How to spend maternity capital in 2021?

Since 2021, the conditions for obtaining maternity capital have changed. The amount of the certificate has also changed after indexation in 2021:

- If the family has not previously registered for maternity capital , and a second or subsequent child appears, then the mother has the right to 639,432 rubles. according to the mother's certificate.

- The mother is entitled to an additional payment in the amount of 155,550 rubles if she has a second child after 2021, and previously she had already received 483,881 rubles. for the first baby. The total amount for two children is 639,432 rubles (that is, 483,881 + additional payment of 155,550).

These funds can be spent for purposes established at the legislative level. 4 main directions have been identified:

- Improving family living conditions. The money can be spent on purchasing an apartment or room in a dorm, on purchasing a private house or its construction, for transferring to the bank as the first or next installment on a mortgage (housing) loan, to reduce debt under an equity participation agreement.

- Receipt of educational services by children under 25 years of age. Funds can be used to pay for kindergarten, school, clubs, vocational education, and to pay for living in a hostel.

- Mom can use all or part of the maternity capital for a funded pension. Once she reaches retirement age, the money will be paid.

- If a family has one or more children with disabilities, then maternity capital funds can be used to purchase services and tools that will facilitate the child’s adaptation in society. There is no need to wait until the baby is 3 years old.

The money on the certificate can be used in whole or in part. It is also allowed to spend funds in several directions at once, established at the legislative level.

This video was recorded in 2021, but it is absolutely just as relevant today. All areas of spending funds up to 3 years are listed very informatively and clearly. We highly recommend viewing!

When can you use maternity capital?

There are two options when you can use maternity capital: immediately after the birth of a child and after the child reaches three years of age. This is stated in the law “On measures to support families with children.” The subsidy can be spent on several purposes at the same time. The procedure for registration and use is as follows:

- The baby was born.

- We submitted the application and documents to the Pension Fund. We have registered the right to payment. We received a certificate.

- We chose what to spend our maternity capital on.

- If necessary, wait until the baby’s third birthday.

- We wrote a statement to the Pension Fund about what you want to spend the payment on.

- Received PF approval.

- You have entered into agreements with organizations (people), whose goods (services) you will pay for with a subsidy.

- PF transfers money to the account of the seller (service provider).

After the birth of the child

Maternity capital can be spent immediately for the following purposes:

- pay for preschool education (kindergarten);

- buy things to improve the life of a child with a disability: strollers, special computers, etc. (the entire list of goods);

- buy or build housing with a loan (mat capital can be spent on a down payment or loan repayment);

- receive a monthly payment (for low-income families in which the second child was born after January 1, 2018).

After the child's third birthday

You will have to wait three years to use maternity capital if you decide:

- buy or build housing with your own money (without a loan);

- pay for non-preschool education (school, college, university);

- spend the subsidy on your mother’s funded pension.

To improve living conditions

Legislation allows you to use maternity capital funds without waiting for the child’s 3rd birthday. Money can be transferred to a credit institution to reduce debt or pay off a mortgage (housing) loan. Funds can be used for:

- The first mortgage payment (its amount often ranges from 10 to 30% of the contract amount).

- Reducing the principal debt (next payment).

- Payment of interest on the loan.

The number of banking institutions and loans in them is not limited at the legislative level. That is, maternity capital can be spent to eliminate or reduce debt on several loans in several financial institutions.

The use of certificate funds is not permitted by law to pay off debts on penalties and interest accrued for late payments.

How to use maternity capital for up to 3 years to purchase living space

You can use certificate funds before the child turns 3 years old only if they are used to pay the first (next) installment on a mortgage loan or housing loan. Money received from a financial institution can be used for the following purposes:

- Purchasing an apartment.

- Purchasing an entire home or its share from relatives.

- Purchasing or building a house.

- Buying a room in a communal apartment (dormitory).

The law allows you to purchase housing from relatives, but the right to own the property must pass to the owner of the certificate and his family. If it is determined that the family does not live in the purchased apartment , then the maternal capital funds will have to be returned to the Pension Fund.

Which credit institutions can I get a loan from?

In accordance with the law (Resolution No. 862 of December 12, 2007), MSC funds can be used to repay a loan received to improve living conditions. The loan can be issued to the following organizations:

- Banks operating on the basis of a license issued by the Central Bank of the Russian Federation.

- Credit consumer cooperatives operating for at least 3 years from the date of registration.

- Other institutions authorized to issue mortgage loans.

To borrow money from a cooperative, you will need to become a member. Compared to banks, cooperatives have more lenient conditions for obtaining a loan . Its return is ensured by collateral, surety and other means.

By other financial institutions we often mean microfinance organizations. But this term is not fixed by law and most likely the Pension Fund of the Russian Federation will not approve the conclusion of an agreement with such an organization. Until the debt is repaid, the housing will be under encumbrance.

When choosing a bank, you should take into account that some large financial institutions apply preferential mortgage lending conditions. The annual rate does not exceed 6% if the family has a second baby born after the beginning of 2021.

What compensation can you use maternity capital for without waiting 3 years?

Families have the right to use maternity capital for up to 3 years to compensate for expenses associated with the upbringing and social adaptation of children.

Recommended article: Early repayment of a mortgage with maternity capital

Providing for disabled children

Basic Rules ():

- expenses are compensated upon their occurrence;

- You can reimburse expenses for any of the children in the family (the one in connection with whose birth the certificate was received, or any other);

- the list of goods and services that can be compensated has been approved and contains 48 items of goods and services for social adaptation;

- the list does not include services, special equipment, and events that are guaranteed by Federal Law No. 181 of November 24, 1995;

- To receive compensation, you must submit an application to the Pension Fund/MFC.

Package of documents submitted along with the application:

- passport of the certificate recipient;

- representative's passport and notarized power of attorney (if submitted through a representative);

- rehabilitation/habilitation program that was in effect on the date of payment for the reimbursed purchase;

- documentary evidence of the fact of acquisition and the amount of payment (agreements, checks, acts, etc.);

- inspection report - drawn up by the social service authority at the place of application to the Pension Fund - the period for providing the service is 5 days from the date of application;

- account details for crediting compensation - the owner of the account and the certificate must be the same.

After submitting your application, it will be reviewed within a month. If the requirement complies with the law, a positive decision will be made. After this, the money will be credited to your account within 2 weeks.

Preschool education

From 2021, you can use maternity capital for up to 3 years to pay for services provided to any of the family’s children within the framework of preschool education, maintenance, supervision (). The main condition is that the institution has a license. The certificate holder fills out an application to the Pension Fund or MFC in the prescribed form. Attached to it:

- the agreement on the basis of which the services are provided;

- additional agreement - if necessary, stipulate some conditions in accordance with the requirements of the Pension Fund;

- calculation of the cost of payment.

The Pension Fund will review the application within a month. If the decision on compensation is positive, the money will be transferred within 10 working days for the periods specified in the application. When clarifying the amount of payment, the certificate holder sends a corresponding application to the Pension Fund.

Payment for kindergarten with maternity capital for up to 3 years

We told you how to use maternity capital for up to 3 years to pay for supervision and maintenance. Please note that when using state money for these purposes, the parent loses the right to receive compensation:

- 20% for 1st child;

- 50% for the 2nd;

- 70% for the 3rd.

Purchasing housing with maternity capital up to 3 years

You can use maternity capital before 3 years for credit/loan payments ():

- as a down payment;

- according to schedule (principal + interest).

You can buy an apartment on the secondary market, take part in shared construction, build or buy a house with maternity capital for up to 3 years. The fundamental condition is the participation of the organization that will issue the loan (usually a bank). To transfer money directly to the seller, you must wait until the child is 3 years old.

Using maternity capital for up to 3 years for a down payment

The money is allowed to be spent for this purpose in whole or in part. If they are not enough for the down payment, you will need to add your own. Approximate order:

Recommended article: Maternity capital for the first child in 2020

- Start choosing a home to purchase - this can be done as the first stage or in parallel with the next two.

- Receive a certificate from the Pension Fund of Russia.

- Apply for a loan. It would be appropriate to contact several banks at the same time to compare offers.

- Get approval for the amount, select a lender if necessary.

- Submit an application to the Pension Fund to use the funds.

- Wait for consent.

- Submit to the bank the documents for the purchased housing and the notification received from the Pension Fund about the balance of financial capital.

- Get the transaction approved by the bank.

- Sign contracts for the purchase of real estate and for a loan.

- Execute with a notary an obligation to allocate a share to everyone in your family after repaying the debt and removing the encumbrance.

- Submit your registration documents to the Registrar's Office. Many people find it convenient to contact the MFC for this.

- Having received the agreement with a registration mark, submit an application to the Pension Fund for the transfer.

- Provide the lender with the registered agreement, consent to the transfer from the Pension Fund and other documents in accordance with the loan agreement.

- Make sure the calculations are completed successfully.

Receive maternity capital for up to 3 years to repay the existing mortgage

The law allows the use of maternity capital if the child is under 3 years old for early repayment of the mortgage loan - principal and/or interest. The loan can be issued to either spouse at any time, including before the birth of a child and before marriage. After attracting state support, an obligation comes to allocate a share to each family member (). Registration procedure:

- Get a certificate.

- Submit an application to the bank for early repayment.

- Get information from the bank about the balance of the debt.

- Execute a notarial obligation to allocate a share to each family member after the encumbrance is removed.

- Submit an application to the Pension Fund for disposal of the money due to you.

- Wait for notification from the Pension Fund about the results of the application review. Application review period is 1 month.

- If the result is positive, the money will be sent to the bank to repay the loan within 10 days after consideration.

- If the result is negative, you will be told the reason for the refusal.

List of documents for the bank

The exact list of documentation can be found in the financial institution, since it is established by banks independently and may change depending on the life situation of the borrower. But you must provide:

- Passport.

- Certificate for maternal capital.

- Certificate in form 2-NDFL and other information about income.

- An extract from the Pension Fund of the Russian Federation on the balance of the capital amount.

It is no longer necessary to provide an undertaking certified by a notary to allocate shares to each family member in the purchased real estate. The use of maternal capital funds imposes such obligations on its owner.

Procedure for early repayment of a mortgage with maternity capital

We will describe step by step where to apply, with what documents, in what order.

Obtaining a certificate

Apply to the pension fund. You will fill it out on site with the help of a staff member. You will definitely need:

- passport;

- birth certificates of children in your family;

- confirmation of citizenship of family members.

If events such as the death of a mother, a crime against a child/children, or deprivation of parental rights occur, documentary evidence will be required.

Applying for a mortgage loan

According to current legislation, a loan can be obtained before or after the certificate is issued. To register you will have to:

- confirm financial security to the bank (2-NDFL, income certificate in the bank form, copy of employment, 3-NDFL, account statements), more details about the requirements for documents in another article: Requirements for documents for an online mortgage

- obtain approval for the loan amount;

- provide documents for the purchased property (seller's title documents, assessment report, cadastral passport, in rare cases, technical passport);

- obtain site approval;

- sign a loan agreement;

- conclude an agreement for the purchase of real estate; more details about the purchase and sale agreement with a mortgage and important points for the buyer and seller are in another article;

- register the transaction in Rosreestr;

- provide the agreement and an extract from the Unified State Register to the bank.

Application for early repayment of mortgage with maternal capital

You have the right to pay off the mortgage principal or interest with maternity capital. In the vast majority of cases, families pay off the principal debt. The second option is attractive if further early repayments are not planned.

Recommended article: Maternity capital if the child is under 3 years old

In the bank:

- present your passport and maternity capital certificate;

- Based on your words, the employee will fill out the application, check and sign it;

- Receive notification of the outstanding balance.

Obligation to allocate shares

(The notarial obligation has been canceled since 2021 - more details - The notarial obligation to allocate shares in maternity capital has been cancelled)

The document is drawn up by a notary. Take with you:

- passport;

- birth and marriage certificates;

- agreement for the purchase of an apartment;

- an extract from the Unified State Register of Real Estate confirming the registration of ownership rights

- a certificate from the bank about the balance of debt under the loan agreement.

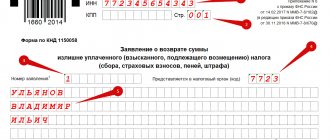

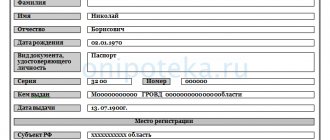

Obtaining the consent of the Pension Fund for the transfer of funds

- Submit an application to the pension fund to dispose of the money. The form to fill out is available at the institution and is also available on its website for downloading.

- Submit the following documents:

- passport;

- SNILS;

- certificate;

- a copy of the loan agreement;

- bank certificate about the balance of debt;

- a copy of the agreement registered in Rosreestr;

- extract from the Unified State Register of Real Estate;

- documentary evidence of non-cash receipt of credit funds by the borrower from the bank;

- obligation to allocate shares (cancelled from 2021 - link above);

- marriage certificate if the borrower/co-borrower is a spouse;

- a copy of the refinanced or restructured loan agreement, if any;

- confirmation of participation in the cooperative, if entry was credited.

- Get a receipt, check the list of documents you are transferring.

- Wait for the decision. The notification will be sent by mail.

If the Pension Fund has granted the application

The money will be transferred to the credit institution. Partial repayment of the mortgage with maternal capital at Sberbank provides for a subsequent reduction in the monthly amount while maintaining the total loan term. But clients can choose which parameter of the repayment schedule to leave unchanged: the total term or the size of payments.

Recommended article: Division of an apartment in a mortgage with maternity capital during a divorce

After the mortgage is fully repaid, the debt under the loan agreement is closed and the encumbrance on the real estate is removed.

If the Pension Fund refuses

The notice will indicate the reason for the refusal. The most common are typographical errors, as well as an incomplete set of documents. Resubmit your application taking into account the indicated inaccuracies.

The reason may be legal in nature. For example, a house is recognized as unsafe and does not meet the requirements for premises to participate in the maternity capital program. If you think you can prove your case, appeal the refusal in court.

General questions regarding mortgages and maternity capital in another article: Mortgages and maternity capital