What is tax deduction and income tax return?

Tax deductions are submitted by Russian citizens every year.

Every year, citizens of our country are required to file a declaration on payment of personal income tax - personal income tax. Workers and employees pay it monthly through the company’s accounting department. 13% of this tax is withdrawn from wages. Entrepreneurs pay the fee annually. 13% is calculated from annual income. The Tax Code of the Russian Federation has such a concept as a tax deduction. It refers to an amount that is not subject to tax.

In the case of enterprise employees, this amount will be the minimum wage. There is no tax charged on this amount. The tax rate only applies to amounts above the subsistence level. A tax deduction is also called a refund of money for expenses incurred. These include:

- Property deduction is a refund of funds when purchasing a home or taking out a mortgage.

- Social deduction - return of funds invested in treatment, education, life insurance, contributions to charity.

- Standard deduction - it is provided for people with disabilities, full-time students, and parents with minor children.

- Professional deduction - this form of tax deduction is available to certain categories of citizens in connection with their professional activities: military personnel, scientists, employees of the creative field.

What tax deduction can be obtained through government services?

Through the State Services Portal it is possible to issue any tax deduction:

| Type of tax deduction | Explanation | Normative act |

| Property | In the case of purchase of an apartment, room, house, or share of real estate by spouses, the real estate is automatically considered common shared property. To receive a tax deduction, only one of the spouses must submit to the tax authorities an application approved by Letter of the Federal Tax Service of Russia dated November 22, 2012 No. ED-4-3 / [email protected] , which will indicate the joint decision of the spouses on the distribution of the tax deduction. The amount of deduction for expenses is no more than 2,000,000 rubles per person. | Article 220 of the Tax Code of the Russian Federation |

| Social | Training costs: · own training; · education of children under 24 years of age (full-time); · training of current and former wards under the age of 24 (full-time); The amount of deduction for children's education expenses is no more than 50,000 rubles per year. · education of a sibling (full-time). Treatment costs: · own treatment; · treatment of spouses, parents, children under 18 years of age; · medications prescribed by the attending physician to the taxpayer himself, spouses, parents, children under the age of 18; · insurance premiums under voluntary insurance contracts for the taxpayer himself, spouses, parents, children under the age of 18. The amount of deduction for expenses on your own education, education of a brother or sister, in combination with other expenses subject to tax deduction - 120,000 rubles This restriction does not apply to the provision of expensive medical services. | Article 219 of the Tax Code of the Russian Federation |

| Standard | Tax deductions are provided monthly to parents, spouses of parents and adoptive parents: · 1400 rubles – for the first child; · 1400 rubles – for the second child; · 3000 rubles – for the third and subsequent children; · 12,000 rubles – for a disabled child under the age of 18 and for a full-time student (resident, intern, graduate student) under the age of 24 (disability group I or II). A tax deduction is provided monthly to guardians, trustees, adoptive parents, and the spouse of an adoptive parent: · 1400 rubles – for the first child; · 1400 rubles – for the second child; · 3000 rubles – for the third and subsequent children; · 6,000 rubles – for a disabled child under the age of 18 and for a full-time student (resident, intern, graduate student) under the age of 24 (disability group I or II). The tax deduction is provided in double amount to the only parent, guardian, or adoptive parent. A tax deduction for one of the spouses can be provided in double amount, provided that the second spouse has written an application for refusal to receive the tax deduction due to him under the law. The tax deduction is valid until the taxpayer’s annual income exceeds the amount of 350,000 rubles. | Article 218 of the Tax Code of the Russian Federation |

Who gets

Everyone who works officially

applies for tax deductions. The following people apply for tax deductions:

- working officially,

- have no tax debts,

- the invested amounts should not be related to benefits and government payments (maternity capital, material assistance from various funds),

- money should not belong to third parties (relatives, friends, acquaintances),

- A tax deduction is possible between close relatives (children-parents, husband-wife) if the payer is not currently working.

How to prepare documents for applying for a deduction

A declaration, application and certificate are attached to the passport.

To apply for a tax deduction, you will need the following documents:

- Passport of a citizen of the Russian Federation.

- Declaration 3-NDFL with the stamp of the tax authority. The stamp is placed when the tax inspector accepts the declaration.

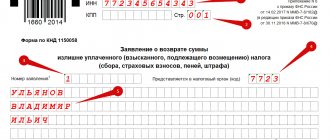

- Application for a tax refund.

- Help 2-NDFL. It confirms payment of income tax.

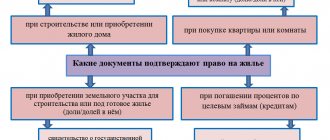

These documents are required in any case. The following are documents confirming the reason for the return request. If this is a home purchase, the following are included:

- contract of sale,

- documents confirming the fact of payment,

- extract from the Unified State Register of Real Estate.

When applying for a tax deduction related to treatment, attach an agreement for the provision of medical services or a payment receipt stamped by the medical institution.

You can claim tax compensation not only for paying for your own treatment, but also for medical expenses for family members

The package of documents when applying for a deduction for training includes an agreement concluded by the student with the educational institution and payment receipts. It is important to know that a tax deduction is provided only if the educational institution has a license for educational services. It can be located both in Russia and abroad.

Why can they refuse to receive a tax deduction?

Tax authorities do not always make positive decisions regarding the provision of tax deductions.

Refusals to provide a tax deduction may be due to a number of reasons:

- not the entire package of documents has been provided;

- documents were submitted to the Federal Tax Service at a location other than the taxpayer’s place of registration;

- there were errors in the documents;

- documents have been provided to pay for the treatment of persons who do not fall into the category of relatives specified in the legislation.

What and how to scan

The following pages are scanned in the passport:

- passport issue information,

- information about the owner,

- registration,

- for men – attitude towards military service.

Persons liable for military service are required to make a scan of their military ID.

For other documents, all completed pages are scanned. The highly compressed format used for scanning is jpg (jpeg). Scanning quality is 200 DPI (dots per inch) or 130 per centimeter. The final file size should be at least 50 KB. Scanned copies are saved on the computer.

How to submit documents through the State Services website

The very first step is registration on. It is standard, but requires confirmation. To confirm, you need to go to the administrator with your login and passport. The process does not take more than 5 minutes. The account is confirmed only once. Then all services become available in your personal account.

We enter your personal account. At the top of the page select “Services”.

In the window that opens, click “Taxes and Finance”.

Click on the inscription. The following window opens. In it we select “Acceptance of tax returns”.

Click on the inscription. In the window that opens, select “Electronic services. Acceptance of tax returns of individuals (3NDFL).”

By clicking on the inscription, we go to a new page. There are two options to choose from here. “Generate a declaration online” is suitable if the declaration has not yet been written. The “Send completed declaration electronically” function is needed when the declaration is ready and scanned. Important! 3NDFL is submitted at the end of the year. You can use the electronic filing service no more than once in 12 months.

Since all documents were scanned, we send them as ready-made files.

Next, click on the “Get service” button. It is blue, located on the right and immediately catches the eye. On the page that opens, select “download declaration”.

Here you can drag and drop the file or upload it. If a file is being dragged, you need to collapse the page, grab the file with the mouse, and drag it to the collapsed page. As soon as the mouse with the file touches the shortcut, the page will unfold and the file will be in place. To download the file, click on “Download manually”. This will open a window with documents stored on the computer. Select the files you need and open them. They are downloaded automatically. Information about the acceptance of the declaration is sent to your personal account in the form of a message.

Before sending documents, do not forget to check the box indicating consent to data processing.

There is a separate link on the website for tax deductions. We return to our personal account. Click on “Services”. Go to “Taxes and Finance”. Move the page down. We find “Life Situations”. In the section, click “Property tax deduction”.

By clicking on this button, you will be taken to a page with complete information on tax deductions. Next, you just have to follow the recommendations. The application is submitted on the website. You can go to it using the link from State Services. The declaration is verified within 3 months. The right to deduction is verified within 30 days. The tax inspector notifies you of the readiness of the notification of the right to deduction by calling the specified telephone number. The received document is handed over to the employer personally by the applicant.

Instructions

After authorization in the user’s personal account, the form required to fill out can be found by following the branches:

- Catalog of services;

- Taxes and finance;

- Acceptance of tax returns;

- Electronic service – provision of a declaration in form 3-NDFL.

You can submit a declaration in several ways, which are listed on the page with the required electronic service. The electronic option is selected by default, so you don’t need to change anything. Just click “Get service” and proceed to filling out the declaration.

Note! The tax deduction declaration is completed for the calendar year. Therefore, the choice “Fill out a new declaration” can be made no more than once a year.

However, it is not necessary to complete the entire application at once. Some of the data can be “save” as a draft, and when the time comes for the final submission of the report, select “Continue filling out”.

A form opens for the user to fill out a report. Here you need to specify:

- FULL NAME;

- Date of birth;

- Place of Birth;

- Passport data (series, number, date of issue, by whom);

- Residence address. Please note that it is not necessary to indicate your residence address in this field. Temporary registration address or place of stay is also suitable);

- Income information. Information about earnings is taken from the 2-NDFL certificate, which is issued to the employee at work upon request. The certificate must be scanned. An electronic copy is uploaded to the main form as an identification document. Please note that this certificate can only be obtained by an employee who is officially employed. This means that income tax is automatically deducted from your salary;

- Type of tax deduction. It is necessary to select the category to which the citizen applying for a tax deduction belongs.

At the end, the declaration is strengthened with a non-qualified electronic signature and generated for sending to the Federal Tax Service.

It is important that after downloading the declaration, it will not be possible to mark it or make adjustments through the State Services portal.

You can submit a declaration in form 3-NDFL not only on the State Services portal, but also on the website of the Federal Tax Service. The service there will not only allow you to enter the necessary data, but will also check it in real time and point out errors and omissions when filling it out.

How to register with the tax office

If you want to visit the tax authority in person, the State Services website will help reduce the time of the visit. We return to our personal account. Click “Services”. Go to “Taxes and Finance”. Select “Acceptance of tax returns of individuals (3NDFL). All these actions have been described above. In receive type. Click “Make an appointment.”

Personal data will appear in the window that opens. Let's go lower. We find “Where will you submit the original documents.”

Choose your region. A new window opens.

Find the desired tax authority and click the select button. Possible recording days and times appear in the window that opens. All you have to do is choose a convenient option and confirm your actions.

What are the advantages of filing a tax deduction through government services?

Thanks to the portal of State Services of the Russian Federation https://www.gosuslugi.ru, the provision of documents to the Federal Tax Service significantly optimizes the time and financial costs of the taxpayer:

- You can fill out the documents yourself - you do not need the help of a specialist, which you will have to pay for;

- To generate and submit documents, you only need a computer with Internet access, which saves time on visiting tax authorities and saves the money needed to travel to the Federal Tax Service (especially in remote areas).