3.1 / 5 ( 7 votes)

The bulk of housing in Russia is now purchased by families through loans. The process of repaying a debt to a bank is usually designed for ten years. During this period, spouses often manage to divorce without repaying the debt. Therefore, the division of mortgaged apartments is not uncommon. The process takes into account the legal norms set out in the RF IC, the Civil Procedure Code of the Russian Federation, the Tax Code of the Russian Federation, the Civil Code of the Russian Federation and a number of federal laws. The procedure has some differences depending on whether the debt to the bank has been repaid at the time of division or not yet.

Is it possible to divide an apartment taken on a mortgage?

Art. 34 of the RF IC establishes that all property acquired by spouses during marriage is considered joint property. But only on the condition that funds from the general family budget were used to purchase it. This means that if property is divided between spouses, each party must receive an equal share of it.

This rule also applies to the debt obligations of spouses. If the loan received was spent on family needs, liability for it is recognized as general. And each spouse is obliged to repay half of the debt.

Therefore, a mortgaged apartment acquired during marriage can be divided between husband and wife. This rule also applies to real estate for which the debt to the bank has not been fully repaid.

Methods for dividing a mortgaged apartment will depend on many factors:

- whether the debt under the mortgage loan agreement has been fully paid;

- the presence of shares in the apartment of owners other than spouses;

- attracting additional funds in addition to the family budget to pay off the debt;

- the wishes of the spouses themselves;

- the bank’s consent to the division if the debt is not fully repaid, etc.

If the mortgage loan is paid in full, the encumbrance is removed from the apartment, it is divided on a general basis, like private property:

- By concluding a voluntary separation agreement or a prenuptial agreement.

- Through the court.

If the debt is not fully repaid, the mortgaged apartment is divided only with the consent of the bank. It is mandatory to obtain it even when resolving the issue through the court.

Dividing a mortgage during divorce

Who is the owner of the apartment with a mortgage?

Any person, even if not related to the Borrower, can act as a co-borrower of a mortgage. In this case, the purchased real estate can be registered as the property of either one of the Borrowers, or the Borrower and Co-borrower (by their decision and with the consent of the bank). Often, adult members of the Borrower's family (children, parents) act as co-borrowers. The borrower's spouse must become a co-borrower, even if he (she) does not work. More detailed definitions about the co-borrower, the spouse of the title co-borrower, the title co-borrower can be found here.

- It is necessary to provide a complete list of documents for consideration of the application to the bank (if desired, you can contact the partner’s office);

- Wait for a positive decision from the appropriate specialist;

- Select the desired property on the primary market;

- Provide the specialist serving you with the necessary documents on the property;

- Sign the papers required by the bank;

- Register your rights to the property you have chosen with the state registration service (Rosrestr);

- Get a mortgage loan.

Also read: Sample of appealing a traffic police decision about an accident

How is a mortgage divided?

The division of an apartment between spouses is carried out only on the condition that it was purchased during marriage with funds from the common family budget. At the same time, they do not take into account which of the parties actually invested more money in this budget. One of the spouses may not work at all, but run the household. Money will still be considered community property if it was earned during the marriage. An exception is royalties for the results of intellectual activity.

If, when concluding a mortgage agreement, spouses become co-borrowers, or one of them is a guarantor, the parties have equal rights to the apartment and bear equal responsibility for repaying the debt.

Most credit institutions initially include options for dividing the mortgaged apartment in the agreement with borrowers in case the parties decide to divorce before the debt is fully repaid. In this case, the parties can only be guided by the terms of the agreement.

A mortgaged apartment during a divorce (if the debt is not repaid) can be divided in the following ways:

- The spouses together fully pay off the debt and divide the apartment according to the allocated shares after the encumbrance is removed.

- One of the parties waives its rights to real estate. The debt is then repaid by the second spouse, who after the end of payments becomes the owner. He is obliged to pay monetary compensation to the rejected spouse.

- The joint bank account of the co-borrowers is divided into two. Next, everyone independently repays their part of the debt and, upon completion of payments, becomes the owner of a share in the apartment.

If the mortgage is issued and repaid outside of marriage, the apartment is considered personal property and is not subject to division, with rare exceptions.

Registered before marriage

If the mortgage on the apartment was issued before the wedding and the debt for it was fully repaid at the same time, it is not taken into account when dividing the common property. It is the property of only one of the spouses. But there is an exception to this rule, fixed in Art. 37 RF IC. According to the legal norm, if such a mortgaged apartment is significantly improved during the marriage using money belonging to both, it can be recognized as common property.

For example, before the wedding, a woman completely repaid her mortgage loan and became the owner of a one-room apartment in a new building. After the wedding, her husband sold his personal car, purchased before marriage, plus the couple added funds from the general family budget and used the resulting amount to make renovations in the apartment.

After the divorce, the apartment was recognized in court as common property. It was transferred to the ownership of the woman, and she was ordered to pay compensation to her husband.

There is another option, when a mortgage apartment issued before marriage will be recognized as common. This is possible if the loan debt to the bank was repaid during marriage using common money or funds provided by a spouse who is not the official owner.

Dividing a mortgage taken out during marriage

Married

A mortgaged apartment issued during a marriage under an agreement under which the spouses act as co-borrowers is automatically considered community property. The same applies to contracts under which one of the spouses acts as a guarantor. Therefore, when dividing an apartment, each spouse receives an equal share, unless otherwise provided by the terms of the agreement.

But there are situations when one of the spouses, being in an official marriage, applies for a loan without obtaining the consent of the other party. In this case, the division of the mortgaged apartment and the unpaid debt will depend on a number of factors.

If the parties provide evidence that the loan was repaid by both, the apartment will be divided between them. When the procedure is carried out in court, the burden of proof lies with the plaintiff.

If one of the spouses took out a mortgage loan without approval and wants to share the debt burden between both, he will need to prove that the entire family is using the apartment received and, of course, allocate a share in it to the second spouse.

Taken in a civil marriage

In Russian society, it is customary to call civil marriage the cohabitation of a man and a woman running a joint household without registering the marriage in the registry office. Such cohabitation has one significant disadvantage. In the event of separation, the rules for dividing the common property of spouses, enshrined in the RF IC, do not apply to cohabitants.

Therefore, you will have to be guided by the norms of the Civil Code on joint transactions. If in the loan agreement a man and a woman are indicated as co-borrowers, each of them becomes the owner of a share in the apartment.

When the mortgage was issued to one person, and both provided money to repay it, it will be very difficult to divide the property. But it is possible if the interested party is able to collect enough evidence of joint residence and common household management. Plus, document that her personal funds were also used to pay off the debt. For this purpose, you will need all kinds of payment documents, bank statements, etc.

When concluding a marriage contract

Spouses, in accordance with Article 40 of the RF IC, can establish any regime of ownership of property. To do this, they should sign a marriage contract. This can be done before the wedding or during marriage. The terms of the document allow the delineation of ownership rights to the common or personal property of the spouses in any shares.

If they document that the mortgaged apartment becomes the property of one person after repayment of the loan, then they will have to adhere to the terms of the agreement, unless this contradicts Russian law. For example, it is prohibited in a marriage contract to distribute property belonging to the couple’s minor children, etc.

If the terms of the agreement the parties differentiate the rights to a mortgaged apartment for which the debt has not yet been paid, this issue must be agreed upon with the lender. Otherwise, the marriage contract loses legal force.

Here, if you wish, you can familiarize yourself with an example of a marriage contract and a sample.

Selling spouses' property during bankruptcy - will the creditor take everything?

If the arbitration manager indicates in the report that the debtor does not have personal property or its value is scanty and does not cover even the minimum part of the loan obligations, then the court decides to include the joint property of the spouses in the bankruptcy estate.

The Family Code of the Russian Federation recognizes as joint property that which was acquired during marriage. Moreover, after the sale, the debtor’s spouse receives a payment equal to 50% of the proceeds from the sale.

If the spouses took out a mortgage together or one of the spouses acted as a guarantor, then no compensation is due - the entire amount of the bankruptcy estate goes to pay off the debts.

Spouses also need to be concerned about joint property in the event of bankruptcy of legal entities if they are co-founders. This is possible if during the trial their guilt in the financial collapse is revealed, and they are held vicariously liable.

How is property divided when there are children?

The presence of minor children in a couple is practically not taken into account when dividing common property. This also applies to mortgaged housing. It’s another matter if children have their own shares in this property. In this case, parents will not be able to dispose of them simply at their own discretion. For each transaction you will have to obtain the consent of the guardianship authorities.

Particularly difficult is the division of mortgaged housing if minors are registered in its area, and the loan has not been fully repaid. In this case, parents have only one choice. They will have to pay off the entire debt, remove the encumbrance from the apartment and then divide the property on a general basis.

If the mortgaged housing belongs to both spouses and the loan for it is repaid, when dividing property through the court, the presence of minor children can be taken into account in the following cases:

- Children have their shares.

- After a divorce, children remain to live with a parent who has no other home, plus his income does not exceed the income of the former spouse. In this case, the parent with whom the children remain may get most of the apartment. But the issue is resolved at the discretion of the judge (Article 39 of the RF IC).

Any decisions regarding real estate, if they concern the interests of minor children, must be agreed upon with the guardianship and trusteeship authorities.

If maternity capital is invested

Based on Federal Law of the Russian Federation No. 256 (dated December 29, 2006), families with two children have the right to receive maternity capital. Most families spend this targeted payment on improving their living conditions, including paying off a mortgage loan.

According to Art. 10, if maternity capital was spent on the purchase or reconstruction of housing, all family members in it receive equal shares in the property. This rule also applies to mortgage housing. After repaying the debt, equal shares in the apartment are allocated to parents and children.

If at the time of the divorce the mortgage debt has not been repaid, and the capital was previously spent on it, the parents will have to pay the creditor in full, remove the encumbrance, allocate shares and divide the property. In this case, other methods of dividing the property of spouses will not be available to them.

Divide an apartment in court

How to buy an apartment while married and register it in the name of one of the spouses

Another important factor is the down payment. Interest rates may vary depending on the bank. The average contribution ranges from 10 to 30 percent. Purchased and registered with a mortgage, it remains under the bank’s encumbrance until the end of the debt payment.

You can use the deduction once in your life. The owner of a housing, apartment, or other property under construction can receive a cash payment. If the property is owned by both spouses, each of them has the right to receive

How to divide an apartment with a mortgage during a divorce in court

An apartment that is mortgaged during a divorce can be divided by court. This method is resorted to if the borrowers and the bank fail to reach an amicable agreement. Either spouse can file a claim. You must contact the district (city) court of general jurisdiction at the location of the defendant or the divided apartment. If the loan has already been repaid, then the rules for filing a claim are identical.

Required documents

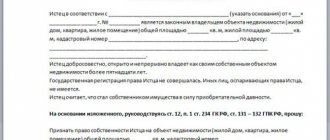

When going to court, first of all, you will need to draw up a statement of claim (Article 131 of the Code of Civil Procedure of the Russian Federation). It should include the following information:

- Information about the court (name, address).

- Details of the plaintiff and defendant (full name, place of residence, date of birth, passport details).

- Information about civil status, i.e. whether the plaintiff and defendant are married or divorced with reference to evidence and dates.

- What does the plaintiff see as a violation of his rights?

- Proposal for division of property.

- Calculation of the cost of a divisible apartment.

- List of documents attached to the application.

- Date of preparation.

- Signature with transcript.

The claim can be filed in person at the court office or sent by registered mail. It must be accompanied by copies of documents, the list of which may vary slightly depending on the situation:

- General passports of both parties.

- Receipt for payment of state duty.

- Title documents for real estate (purchase and sale agreement or DSA).

- Extract from Rosreestr.

- Loan agreement with the bank, if the apartment is still under mortgage during the divorce.

Depending on the situation, you may need birth certificates of children, an extract from the Pension Fund of the Russian Federation on the expenditure of maternity capital, etc.

Here, if you wish, you can familiarize yourself with an example of a statement of claim and a sample.

State duty

The amount of state duty when considering cases of division of property of spouses is not a constant value. It depends on the value of the property being divided (Article 333.19 of the Tax Code of the Russian Federation). Its minimum size is set at 400 rubles, and the maximum – 60 thousand rubles.

The state fee must be paid before filing a claim, otherwise it will not be accepted for consideration. If the plaintiff has a difficult financial situation, he has the right to ask for a deferment or installment payment of the duty (Article 333. 41 of the Tax Code of the Russian Federation).

Section order

After filing a claim, the judge makes a decision within five days whether to accept it for consideration, reject it, or return it to the plaintiff. If the application is submitted to judicial proceedings, it must be considered within two months after filing.

As a rule, such trials do not last more than a month, unless they are consolidated with other claims.

The court's decision will be made after hearings and debates between the parties. The losing party is given a month to challenge it. This is done by filing an appeal to the court in which the claim was heard (Article 321 of the Code of Civil Procedure of the Russian Federation).

After the decision enters into legal force, the executive documents should be taken from the court office and taken to Rosreestr for property registration.

As judicial practice shows, spouses often now divide apartments for which the mortgage loan has not yet been repaid through the courts. Most banks stipulate the terms of mortgage repayment in case of divorce. If the parties turn to the court for help, the judges make a decision based on the principle of equality of shares both in relation to the mortgaged apartment and in relation to the remaining debt. It must be agreed upon with the creditor bank.

How to register an apartment as joint ownership

When registering an apartment as common property, participants in this process can independently choose which type of common property - joint or shared - to prefer. Registration of an apartment as joint ownership is somewhat simpler, since this procedure does not require a mandatory application to a notary in order to divide the shares. Moreover, if real estate is acquired through a paid transaction during marriage, then the apartment will in any case be considered the joint property of the spouses, even when it is officially registered in the name of only one of them. That is why, in any subsequent transactions, the consent of the second spouse will be required. But if the apartment was privatized during marriage or gifted to one of the spouses, or received by inheritance, that is, it was acquired as a result of a gratuitous transaction, then it will belong only to the person in whose name it is registered, and he can dispose of it at his own discretion. The consent of the second spouse is not required.

- passports of all future co-owners;

- a title document for an apartment, for example, a purchase and sale agreement, confirming the grounds for the emergence of joint ownership, drawn up in two copies;

- cadastral passport for the apartment;

- application in the prescribed form - written in the presence of the registrar;

- receipt of payment of the state fee for registration of property rights - according to the number of future owners;

- if one of the participants in the transaction, for some reason, cannot come, he will need a notarized power of attorney to register his property rights.

How is property registered with a mortgage during marriage?

The owner will be the one indicated by the buyer in the purchase and sale agreement. But only the so-called "title" owner. According to the norms of the Family Code (Chapter 7), the apartment will be considered jointly acquired property, just like a credit debt. If the money for the down payment is exclusively your own, then it is more advisable to immediately buy an apartment in shares (if the bank does not mind).

Good afternoon ! My husband and I are officially married, we are going to take out a mortgage from a bank to buy an apartment. The borrower will be my husband, because I am temporarily not working (but I will make the down payment on the apartment). The bank told me that I would be a co-borrower without any income. Tell me how the property is registered in this case? Will the bank oblige you to register it in the name of your husband or perhaps in joint ownership?

Registration of an apartment as joint property of spouses

When housing is purchased together during marriage, it is automatically considered joint. However, spouses can, if they wish, then divide it into shares. Interestingly, full-fledged shared ownership can be officially registered between any people. It doesn’t matter whether they are married, relatives, close friends or just acquaintances.

According to the general rule, the deduction amount will be about 2,000,000 rubles. The cost of the purchased apartment will be accordingly divided proportionally, in shares (only the number of people - owners is not important). This is how the amount of deduction for spouses is determined. This is when the cost of the housing they purchase will be up to 2 million. If it is higher, then the amount of the deduction is 2 million multiplied by the share. Of course, the owner of a larger share will receive a larger deduction.

Also read: Types and Limits of Material Responsibility of an Employee Cheat Sheet

Peculiarities of purchasing an apartment in shared ownership by spouses

As for joint common property , it arises most often in marriage. Joint property cannot be split up, divided, part of it sold, etc. It is a single object owned by two people. In this case, on paper the apartment has one owner - for example, one of the spouses, but in fact it is owned by two. And do something with the apartment - sell, exchange, mortgage, etc. – it is impossible without the consent of the other party.

In any family there comes a time to purchase housing - either their own, which did not exist before, or in order to improve living conditions, and for a host of other reasons. Purchasing an apartment during marriage happens everywhere. But, since buying an apartment is a serious step, you should study all the nuances of such a transaction and ask yourself the question of what type of ownership of the property to register, which spouse to register the property in, and what a concluded marriage contract means in this case. So, the topic of our article today is the purchase of an apartment in shared ownership by spouses.

The main aspects of purchasing an apartment in joint ownership

- The apartment has one owner or the apartment is jointly owned by spouses - the purchase and sale agreement is drawn up in simple written form.

- An apartment in common shared ownership requires notarization of the transaction.

- The apartment is purchased with the participation of borrowed funds - before the procedure for concluding a purchase and sale agreement, the bank approves the loan, the purchase and sale agreement is drawn up taking into account the requirements of the bank.

- The apartment is purchased with the participation of maternal (family) capital - approval of the transaction by the guardianship authorities is required. If there is also a mortgage, then a notarial undertaking is provided to the guardianship authorities to allocate shares to the children after the mortgage is repaid.

- Checking the seller's title documents for the apartment.

- If there are several owners of an apartment, all owners must act as sellers.

- If an apartment was purchased in the name of one spouse during marriage, the notarized consent of the second spouse to the transaction with it is required.

- If minors or incompetent citizens are registered in the apartment or are its owners, the consent of the guardianship and trusteeship authorities is required.

27 Jun 2021 stopurist 1824

Share this post

- Related Posts

- The amount of state duty for divorce in 2020

- The car is parked on the lawn where to send a photo

- Do.Veterans.Take.Benefits.On.Gas.Connection

- What is the tax for a house of 200 square meters in Tambov 2019