The word “mortgage” itself means the purchase of real estate as collateral for real estate - either the one that was purchased as a result of receiving a loan, or the one that the borrower owned before contacting the bank. Buying real estate is, first of all, a transfer of ownership rights, registered in Rosreestr. When a new right arises (the owner of the property changes), then the transaction is considered completed. But the order in which property rights are transferred and what is pledged is the answer to the question of what a mortgage means by force of law.

In simple terms, a mortgage, by virtue of the law under the Civil Code of the Russian Federation, is a transfer of ownership rights to real estate as a result of receiving a loan from a bank. That is, the bank issued a loan and the money was used to buy housing. Legally, this means that registration of a new home owner is carried out in accordance with Article 77 of the Federal Law of July 16, 1998 No. 102-FZ “On Mortgage (Pledge of Real Estate" or Article 488, paragraph 5, Article 587, paragraph 1 of the Civil Code Russian Federation. A transaction by force of law is not only the most common scheme of action among all banking organizations in Russia, but also the safest, as well as legally verified. As a rule, by default, a transaction for the purchase and sale of housing through a bank is carried out precisely according to the format " by force of law."

When does such a mortgage arise?

A mortgage, by operation of law, occurs when an individual obtains title to any real property as a result of the signing and execution of a contract of sale, rent, exchange, or any other agreement where borrowed money is used. It follows from this that the transaction becomes completed after registration with Rosreestr, but not before this stage. In general, the term “mortgage by force of law” is rarely used, because its main purpose is to secure encumbrances on certain real estate. Depending on which method of obtaining a mortgage was chosen, a specific piece of real estate is established, on which an encumbrance (collateral obligation) is then placed.

Is it possible to sell an encumbrance?

No , transfer of rights becomes possible only after all restrictions are removed, but there are different options for repaying the loan.

Either you pay off the remaining debt yourself and deal with the issue of removing restrictions, or the buyer helps with this. In such a transaction, instead of two parties, three will participate: the buyer, the seller and the bank from which the loan was received. All conditions will be determined tripartitely.

If you need to sell an apartment, you need the bank's consent to this operation.

It is important to determine what part of the debt has already been paid; most often, the buyer pays the remaining amount himself, and you receive the difference between the original amount and part of the loan.

However, from January 1, 2021, a ban on the sale and transfer of ownership rights without removing the encumbrance appeared in the Unified State Register.

How to avoid encumbrances when buying and selling real estate:

| If you are a buyer | If you are a seller | |

| Choice of purchase market: primary or secondary | Appraisal of the apartment (independently) | |

| Choosing a new building | Choosing an apartment | Demonstration of an apartment for sale |

| Meet the developer | Preliminary inspection of the apartment | Receiving an advance for an apartment |

| Getting to know the next project | Making an advance payment for an apartment | Preparation of all documents for the apartment |

| Agreement with the developer | Checking all documents for the apartment, checking for mortgages and encumbrances | Preparation of purchase and sale calculations |

| Payment under the contract | Seller Identity Verification | Conclusion of an agreement, certified by a notary |

| Periodic inspection of construction | Drawing up a purchase and sale agreement | Registration of a purchase and sale transaction |

| Acceptance of an apartment from the developer | Registration of ownership of an apartment | Receiving the remaining money |

| Independent registration of property rights | Signing documents for acceptance and transfer of apartments | Transfer of apartment to buyer |

What properties does it apply to?

Such a mortgage can be issued for: - A residential property in exploitable condition - a house or apartment purchased partially or fully with loan funds from the bank; — Any product, including commercial and residential real estate (it does not matter what operating status the product has), for which an installment plan or loan was issued. Such goods remain pledged to the seller until the last payment for the property is made; — Any piece of real estate obtained as a result of the execution of a rental agreement. But for the following types of real estate, it will no longer be possible to obtain a mortgage by virtue of the law: - If housing or real estate cannot be privatized - or, on the contrary, are subject to mandatory privatization by law; — If the objects were withdrawn from circulation (excluded from the list of operating buildings due to emergency conditions or for other reasons); — If the real estate property cannot be recovered in any way due to the restrictions in force in relation to it.

Collection of necessary documents

It is necessary to obtain a sample application for removal of the encumbrance from the apartment from the FSGR office.

Sample application for removal of encumbrance from an apartment

After this, the bank should provide you with:

- A power of attorney from the bank, according to which the borrower receives the right to represent his interests in the registration authority;

- A mortgage note indicating that the mortgage has been paid in full;

- Letter from the bank regarding the fulfillment of obligations under the agreement.

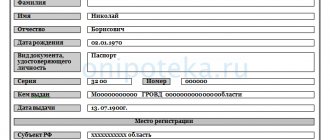

The person submitting the application must prepare:

- Application to the FSGR;

- Passports of all property owners;

- Real estate documents;

- If available, purchase and sale agreement.

How is it different from a contractual mortgage?

Let us now understand where the line lies and what the main differences between a mortgage by force of law and by force of contract are expressed. A mortgage loan by virtue of an agreement means a type of encumbrance that is not fully regulated by legislative acts. This most often happens in atypical situations when it is necessary to introduce many conditions, reservations, mutual requirements, etc. into the rights registration procedure. Relatively speaking, a mortgage by force of law is when everything is extremely simple and all parties to the transaction act according to a scheme pre-established by law, but the same by force of contract is when the classical scheme is not suitable for a very unique case. The basis for such a mortgage is a certain document establishing all the rights and obligations of the parties. Most often this is a purchase and sale agreement, but there may be variations. For example, a mortgage loan by virtue of an agreement is almost always concluded in the following cases:

- When the borrower places an encumbrance not on the property purchased on loan, but on housing that was owned by the citizen even before contacting the bank;

- When the transaction involves several parties that are not typical for lending - for example, the state partially subsidizes the purchase of housing (maternity capital, etc.);

- If the transfer of property rights must occur upon fulfillment of a certain condition - for example, the privatization of housing;

- The same thing, only with regard to the transfer of funds (down payment, first payment, full payment, etc., depending on the chosen loan/installment plan format).

Circumstances in which a pledge of rights is permissible only with the permission of the debtor of the right holder

Part 3 art. 358.2. The Code states exceptions to the basic rule regulated by Part 1 of Art. 358.2. According to the regulations, there are two cases in which the pledge of a right is permissible only with prior permission from the debtor:

— The permission of the debtor is required if, on the basis of law or an agreement between the owner of the right and the debtor, the need to obtain such permission from the debtor is regulated.

Art. 388 regulates the following cases:

- by virtue of Part 2 of Art. 388, the transfer of rights under an obligation in which the identity of the creditor is important for the debtor, without seeking prior permission from the debtor, is prohibited;

- Part 4 Art. 388 states that the assignment of rights to receive non-monetary performance of an obligation is prohibited without obtaining permission from the debtor in the event that making such an assignment will lead to a worsening of the debtor’s position;

- Part 5 Art. 388 establishes that a joint creditor has the right to assign rights to another person only with the permission of other creditors (a different procedure may be established by agreement between such creditors).

— If a legislative act or agreement of the parties stipulates that upon assignment of rights, the transfer of obligations associated with such right also occurs to the acquirer, then obtaining the permission of the debtor is mandatory.

What is best for the borrower?

It cannot be summed up unequivocally that one format brings more benefits to the borrower, and another less. It all depends on the situation. A mortgage loan is legally convenient and beneficial to all parties to the transaction if everything goes “on the beaten path,” i.e. there are no conditions and requirements, only upon the occurrence of which registration or transfer of funds must occur, there are no additional parties to the transaction, or any other difficulties. When everything is standard - a loan is received, a down payment is made and property rights are immediately registered - there is nothing better than a mortgage by force of law, because it gives the greatest legal protection to both the bank, the seller, and the buyer. But these advantages become irrelevant as soon as nuances appear in the transaction that are not regulated by the standard package of legal documents. Then, on the contrary, it is the mortgage loan that, by virtue of the contract, can provide the greatest protection to both the borrower and the other parties, because the agreement will further clarify and legitimize those very nuances not regulated by law.

Moment of occurrence of the lien right

The general rule regarding the moment at which a pledge is considered as having arisen is regulated by Part 1 of Art. 341 of the Code.

According to the provisions of this article, the right of pledge arises at the moment of concluding a pledge agreement.

However, other grounds for the emergence of a pledge may be provided:

- Civil Code of the Russian Federation;

- directly by the pledge agreement itself;

- other regulations.

In addition to the general rule, Art. 341 of the Code also defines additional grounds for the emergence of a pledge, applicable in some situations.

Situation No. 1.

The collateral can be not only property existing at the time of conclusion of the agreement. These may include real estate or movable property that will be created or acquired by the mortgagor in future periods. In such cases, the following rules apply:

- general procedure - the rights of the pledgee arise at the moment of creation or acquisition of ownership by the pledgor of the corresponding thing;

- a different procedure - the pledge agreement between the parties to the process and by force of law may establish other terms for the emergence of the right of pledge in cases where the acquisition of ownership or creation of a thing by the pledgor is planned in future periods.

Situation No. 2.

The main obligation, which is guaranteed by the corresponding pledge, may arise in a future period - after the conclusion of the pledge agreement. In these cases, the following rules apply:

- the moment of emergence of the rights of the pledgee is determined by the pledge agreement;

- the main obligation must arise later than the date determined by the agreement of the parties.

Regardless of the date of origin of the pledge and the main obligation secured by it, from the moment of concluding the pledge agreement, in these cases the parties will be subject to the rules provided for in Art. 343 and art. 346 of the Code, that is, on the proper maintenance and security of the pledged property, as well as on compliance with the rules for the use and disposal of the pledged item.

The procedure for registering a mortgage by force of law

This happens in several stages:

- Registration of a loan and purchase and sale agreement;

- A package of documents is being prepared for submission to Rosreestr. The papers must include a receipt for payment of the state duty;

- After contacting Rosreestr to submit documents and an application, no more than five days will pass - during this period you will either be asked to supplement or adjust the package of documents, or registration and encumbrance will already be issued;

- Finally, the apartment will become yours along with the removal of the encumbrance, and this will happen only after full payment of the debt.

We remove the burden ourselves

This procedure is necessary to return the right to dispose of real estate under collateral.

This is done only after the mortgage has been paid off. If you don’t know where to get the application, you can look it up on the MFC website or come to the branch in person and take a sample. There you can also ask for a list of required documents.

List of steps to independently remove the burden:

- Receive a document from the bank confirming full payment of the mortgage and pick up the mortgage on the apartment (if any).

- You need to write an application to remove the encumbrance; you can get a sample from the bank. Such a statement is signed by two parties - the bank and the owner of the apartment.

- Collect all necessary documents.

- Come to the registry office or MFC - in person or, alternatively, through an intermediary (brokerage firms) to submit the entire package of documents.

- Come back in three to five days for an extract.

Termination of mortgage by operation of law

In essence, termination of a mortgage is the cancellation of an encumbrance. From this moment on, the bank will no longer have any rights to your property, even if it has any claims. But the question of how to remove the encumbrance is another matter. First of all, you need to remember that termination of a mortgage is impossible without full satisfaction of the lender's requirements. This means that the debt must be fully repaid without any balance and without claims from the bank. If the debt is simply transferred to a third party by assignment of the rights of claim, then the encumbrance is not removed - it will simply be re-registered to the person who received the debt from the original creditor. As soon as everything is over with the debt, you need to get a certificate from the bank office about the absence of debt and claims. You must come to the Rosreestr branch with this paper, as well as a payment schedule to the bank, a loan agreement and other documents. There the papers will be checked and if everything is in order, the encumbrance on the apartment will be removed.

Mortgage encumbrance through government services

In order to become the owner of real estate after repaying the mortgage, you must submit an application to Rosreestr.

The law allows you to do this in one of the following ways:

- In person - come to the FSGR office yourself and submit the necessary documents;

- By mail - it is possible to send documents by valuable letter, it is important to note that an inventory of the attachment is required and all papers must first be certified by a notary;

- Via the Internet - you can submit an application for removal of the encumbrance, but the remaining documents will have to be submitted in person;

- Through the MFC - most often this is relevant for residents of small towns, this method allows you to avoid huge queues.

Recommended viewing:

After some time, you receive an extract from the unified state register of rights without a mark on the encumbrance.

You also need to decide whether you want to get a new certificate or not. If you need it, you will have to pay a fee to the government agency and wait a month.

How is a mortgage issued and terminated by virtue of an agreement?

Everything stated about a legal mortgage is also applicable to a mortgage loan by virtue of the contract. The main difference in the registration procedure is that with a legal mortgage, the application must be submitted by either the buyer (mortgagor) or the bank (mortgagee), and when registering a contractual mortgage, both parties, the mortgagor and the mortgagee, must complete a joint application. If the transaction is carried out by a notary, then you can only get by with a statement from his side - it will be accepted for consideration. Moreover, applications from notaries are usually processed at a faster pace.

How long does it take to remove the encumbrance from an apartment?

The duration of the procedure depends on how quickly you prepare all the necessary documents, contact the bank to issue the necessary papers and write an application to the FSGR.

If you want to speed up the waiting time, you can contact the bank, which will submit and collect all the papers for you for an additional fee.

Five days after submitting the application, you will receive a certificate of removal of the encumbrance.

If you want to receive an extract from the Unified State Register stating that you have gotten rid of the mortgage encumbrance or want to receive a completely clean certificate, you will have to wait a month.