Early repayment of a mortgage at Sberbank is an opportunity that has become commonplace. You can close a loan at any stage, which allows you to save a significant amount of money. Basis - Federal Law FZ-284 of October 19, 2011. but the Civil Code of the Russian Federation (clause 2, article 810) obliges borrowers to notify the lender of their intention to terminate the mortgage agreement at least a month in advance. It is believed that it is difficult to take advantage of the early repayment option. But this is if you do not use the information and recommendations of specialists.

Possible restrictions on early repayment by the bank

There is indeed resistance from creditors. It is really unprofitable for the bank if the money is returned prematurely, since the interest rate is determined based on the maximum repayment period. Therefore, bankers try to protect and preserve the profits generated by the interest paid by borrowers. The conditions for early repayment depend on the requirements of the signed agreement. Sometimes the banking structure provides for the following restrictions:

- Minimum payment amount. In Sberbank it is 15 thousand rubles.

- A written notice is given one month before the loan is repaid.

- The borrower pays a penalty for early repayment of the debt.

- The bank recalculates the interest rate upward.

Sberbank allows all clients to repay the balance of debt at any time without any fines or recalculations.

For the purchase of an apartment (what are the terms and conditions)

If there is the required down payment (from 15% with official confirmation of income or from 50% in its absence), as well as compliance with other bank requirements, the client can take out a housing loan for 10-30 years. The exact number of years for which such a mortgage can be issued at Sberbank depends on the personality of the client. This indicator is calculated individually, taking into account all the collected information about the borrower. As part of the current promotion for the purchase of an apartment in a new building, a maximum loan period is limited to 12 years, if the rate is subsidized by the developer.

Types of mortgage payments

When deciding on early repayment, you should take into account what type of payments is provided for in the loan agreement. Not only expediency depends on this. As a result of the calculation, the benefits will become obvious. Then it is necessary to compare the amount of savings with the costs that will have to be incurred if the mortgage is not issued at Sberbank. The agreement may provide for a penalty for early repayment or recalculation of the interest rate in the event of early termination of the agreement.

Annuity payments

In this case, a specific amount is assigned, consisting of the loan body and interest, distributed in proportion to the number of months allocated for repayment. In the first months, the interest rate reaches 90%, while the last payment includes less than 10% of the overpayment. Therefore, to maximize savings, it makes sense to take advantage of early repayment as early as possible. In recent reporting periods, the loan body is mostly repaid. This means that early repayment does not make sense if you have to disadvantage yourself.

Differentiated payments

With this scheme, the principal of the loan is repaid in priority order, followed by interest. Initially, the payment amounts are large, but over time they decrease. In the last year, paying off your mortgage becomes easier, as the payment amount is reduced significantly. This payment schedule is more profitable for the client. Partial early repayment is possible. Money overpaid in excess of the required amount is counted as an advance payment for the subsequent period. However, such conditions are not offered to everyone. By default, mortgages require annuity payments.

Optimal terms of mortgage lending

The average loan period is 15 years. This period is the most acceptable for the distribution of funds without any special burden for the citizen.

However, depending on a number of conditions, it varies from 1 year to 30 years, and in exceptional cases up to half a century.

There are 3 options for determining a mortgage loan according to its terms:

- short-term (1–10 years);

- medium-term (10–20 years);

- long-term (20 years or more).

Of course, a number of banks are interested in fixed lending periods. Meanwhile, most factors influence the ability to issue a loan within the time frame established by the financial institution.

That is why the time period is so widely stretched both to the upper boundaries and to the lower ones.

Maximum mortgage term

Most banks make it possible to take out a mortgage on an apartment for a maximum period of 30 years. However, many financial institutions seek to protect themselves from all sorts of risks by offering lending terms of up to 25 years and even less than 20 years.

It should also be understood that the longer the mortgage, the higher the overpayment on it will be. But the amount of monthly payments will allow you to repay the loan without much effort, without causing significant blows to the family budget.

Minimum mortgage term

The shortest mortgage period is 1 year. However, some financial institutions have set the lower limit at 3 years or even 5 years, since it is extremely unprofitable for banks to issue loans on a short-term basis.

As a result, there are extremely few approvals for minimum mortgage terms. Most often, in this case, the interest rate is inflated so that the financial institution receives a decent profit from the transaction.

Mortgage loan early repayment schemes

The balance of the debt can be repaid at any time from the moment the mortgage agreement is signed until the last day of its validity. If early partial repayment is expected, Sberbank will offer two options. In accordance with the first, the amount of the mandatory payment is reduced. The second involves reducing the loan repayment period. To make the right choice in favor of one method or another, you need to understand their differences and know all the features.

Reducing the monthly payment amount

In case of partial early repayment, the amount of mandatory payments is reduced. This reduces the debt burden, allowing you to leave more money in the family budget and spend it on yourself, family, and friends. The number of months allotted before termination of the mortgage agreement remains unchanged. This reduces the risk of delays in the event of a worsening financial situation, if you leave part of the amount as an emergency reserve (financial buffer).

Reducing the loan term

In such circumstances, after depositing more than the required amount, regular payments remain the same. The return period is changing. This means that you will be able to dispose of the apartment as an owner earlier than planned when signing the contract. All changes in the payment schedule are reflected in the additional agreement and in your Sberbank Online personal account. It should be understood that in the future you will have to pay the same amount as before the partial early repayment.

Conditions for early repayment of mortgage

The main thing is to notify the bank of your intention to “close” the loan a month before paying the balance of the debt. The main conditions are the following statements:

- Applications for early repayment are accepted only from the borrower (co-borrowers).

- Applications are accepted in writing in person or online.

- If applying in person, contact the office that issued the mortgage loan.

- The minimum one-time payment is at least 15,000 rubles.

Any changes to the schedule of further payments are reflected in the document - an additional agreement to the loan agreement. It is an integral part of the latter, and is signed by a Sberbank employee and the borrower.

Methods for early repayment of a mortgage loan

It is allowed to repay the debt to the bank six months after purchasing the apartment. Amounts can be deposited into the account through a cash register, at an ATM (terminal), or in the personal account of a Sberbank client. Loan repayment is made according to schedules. When repaying early, a number of rules should be followed to avoid unnecessary costs and save time. After all, interest on the loan is calculated for each day of use of funds provided by the bank.

Rules for early partial repayment

You will have to contact the branch that issued the mortgage. An alternative is to submit an application remotely using the functionality of your personal account. This requires that:

- The amount of mandatory payment and overpayment exceeded 15,000 rubles.

- The application was submitted a month in advance in person or via the Internet.

- The document is signed personally. The electronic request is confirmed by a code from SMS.

It is advisable to immediately contact Sberbank after the transaction to negotiate new terms for repaying the remaining debt.

Action plan

The step-by-step algorithm involves the following actions by the borrower:

- Submitting an application indicating the repayment amount.

- Waiting for bank approval (arrives within a month).

- Depositing banknotes into the account (crediting).

After this, contact the branch of the bank that issued the loan, receive a new payment schedule, and sign an addendum to the main agreement. You must have a valid (not expired) passport with you. It is advisable to take a second ID with you. A driver's license, photo pass, military ID, etc. will do.

How to pay off a mortgage loan in full early?

You must strictly follow the step-by-step instructions, which include the following steps:

- Find out the balance amount - contact the bank office or call the hotline number-0.

- Deposit funds into the account provided by Sberbank for monthly payments. Payment must match the amount requested.

- Receive a receipt, contact the operator, make sure that after crediting the account balance becomes zero.

Be sure to obtain a certificate confirming that there are no more debts and the agreement has been terminated due to the return of the loan funds in full. Contact your local Rosreestr office, submit an application, and remove the encumbrance. Then you can dispose of real estate without restrictions.

Mortgage early repayment scheme

The step-by-step procedure was described earlier. The main thing is not to force the steps, and do everything in the following sequence:

- Make sure it is appropriate, make preliminary calculations, and make the final decision.

- Submit your application in a convenient way. Fill out the form correctly, eliminating errors and inaccuracies.

- Specify the amount and make the payment exactly to the ruble. Even a small balance will result in late fees being assessed in the future.

- Receive documentary evidence that the bank no longer has any claims, since the debt has been fully repaid.

Making a mark in the unified state register is the final, mandatory stage. Removal of an encumbrance presupposes the opportunity to use the property right provided for by current legislation.

Calculation of benefits of early repayment

If we consider and compare the consequences of partial early payment, it is easy to see that shortening the payment period is more profitable, since the total overpayment is less. On the other hand, if you reduce your monthly payment, you can spend the money you save now. This is a family vacation, paying for children’s education, purchasing any goods, saving. Everyone chooses for himself what is more acceptable for him under the current circumstances.

Use the mortgage calculator. Enter the initial data in accordance with the loan being paid. Specify the amount of early payment. Then a new graph will appear on the screen, where you can see how much you will have to pay in the near future.

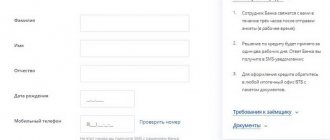

Submitting an application

The application must be submitted at least one day before the date of the mandatory contribution. Otherwise, the money will be credited only after 30 days. You can submit your application in person or remotely. The main thing is to provide all the necessary information. Contractual details, amounts, as well as terms and interest rates are prescribed. Personal and contact information is also entered. In case of refusal, a corresponding message will be sent to the specified phone number and email. Errors and inaccuracies will lead to delays, and the date of early payment will be postponed to the next month.

In the office

You will have to go to the branch that once issued the loan. If you are in another city, but want to pay off your debt immediately upon arrival, use another method. If you have the opportunity to appear in person, take your passport with you. The contract, in fact, is not needed, because the second copy is stored in the bank archive. An electronic copy is stored in a database and is accessible from the computer of the operator accepting the application. Take a second ID just in case. Sometimes this is necessary when signing an agreement to change the terms of your mortgage.

Through Sberbank Online

You can apply for early repayment online. For this:

- Log in to your personal account using your username and one-time password.

- Go to the early repayment loan section.

- Select the card or account from which the money will be debited.

- Enter the amount. The minimum is the same as the regular payment.

- Agree to the transfer by clicking the “Pay” button.

- Double-check the entered data and confirm readiness with the code from the SMS.

This scheme is suitable for cases with partial early repayment. In this case, the amount of monthly payments will automatically decrease, but the repayment period will remain the same. The last option is available only to persons who personally visit a Sberbank office.

Those who wish to pay the bank in full ahead of schedule must use a special service. The amount owed will appear on the monitor. If this does not happen, call support. Remember that the next day the amount will change.

Depositing the amount

It is immediately necessary to make a reservation that Sberbank does not accept cash as an early payment. It is useless to take it to the cashier. If you have a savings account or card, top it up and use the following payment methods:

- Transfer through an ATM or terminal.

- From a card or account when visiting any office.

- Remotely in your Sberbank personal account.

Payments are accepted from cards and accounts of other banks. In this case, a commission is provided, since the transfer is interbank. The next day after enrollment, check that your credit account balance is zero.

Remember that going online can only reduce your recurring payments. To reduce the time required for partial repayment, please contact the branch that provided the loan in person.

results

There are several outcomes of early repayment. In some cases, an additional agreement is signed to shorten the period of validity of the loan agreement. In others, its conditions imply a reduction in the amount of funds that must be deposited each month, but the terms remain the same. If full repayment is made ahead of schedule, a certificate is issued stating from what date the debts were completely written off. Based on this document, Rosreestr will make a corresponding note in the database and cancel the encumbrance.

State assistance

The state is trying in every possible way to support citizens, helping them obtain a mortgage at a minimum rate. There are programs for young families, large families and people in need of social protection. When buying a home, the transaction is subject to tax, but you can apply for a deduction and get some or all of the money back. These measures are aimed at providing the opportunity to quickly repay the loan. Many manage to do this ahead of schedule. With such repayment, mortgage costs are minimal.

Registration of a tax deduction

The procedure involves partial reimbursement of funds spent on the purchase of housing. To be precise, the fee is charged on the amount received from the bank. The maximum tax on the loan amount is two million rubles. From interest - up to three million. Amounts up to 260 and 390 thousand rubles are subject to refund. respectively. Paragraph 3 of Article 210 of the Tax Code states that when determining the amount of the deduction, they are guided by the official earnings of the borrower. To find out how much you can compensate, use a special online calculator.

Maternal capital

Using funds allocated by the state for the birth of a child involves repaying the loan and interest, as well as using the money as a down payment. Fines and penalties cannot be paid off. The certificate is also suitable for early payment. You must contact the Pension Fund and provide a certificate indicating the balance of the mortgage debt and bank details under the home purchase loan agreement. After this, the money will be transferred from the budget to a savings bank account.

State support programs for mortgage lending

Government subsidies are available for:

- Young family. Repayment of up to 35% of the property price is expected.

- Large family. This is a special regional program for parents of two or more children. Paid up to 100 thousand.

- People suffering from force majeure circumstances. Early payment of 10% of the unpaid amount is allowed.

In the latter case, the final repayment figure is determined by the borrower's earnings decreased by 30% compared to the average for the last 12 months.

No down payment

Registration of a mortgage at Sberbank is subject to mandatory payment of a down payment. Its minimum size is 15%. According to the requirements of some programs, it can be increased to 50%. The only opportunity to do without accumulated own funds to pay the down payment is for the holders of a maternity capital certificate. By law, they are allowed to use Social Security benefits to make the first payment.

You might be interested in:

Refer a friend - Sberbank promotion for small businesses

Where can I get money to pay off my mortgage loan early?

Sometimes circumstances arise that require immediate early repayment. This is necessary if, for example, a family is going to move for permanent residence to another region or abroad. Or, say, it is necessary to increase the square footage by moving to a new, larger apartment or house, since twins or triplets were born in the family. Without paying off the debt, it will not be possible to sell or exchange the property. Therefore, paying off debt early becomes a problem. But there is always a way out, and more than one.

Savings

It's not just about cash, which is in short supply in most cases. But people sell unnecessary valuables. This could be a garage, country house, car, etc. The main thing is to collect the required amount. Many borrowers and their relatives who are ready to help have savings in their accounts, which can also be used for early repayment. Relatives have the right to transfer funds directly without giving the banknotes to the debtor. To do this, use the bank client’s personal account.

Consumer loan

There is a plus here - early repayment of the mortgage, and also a minus - the interest on the loan is usually higher. This method is rarely resorted to; Sberbank will not give much money until the main debt is closed. But if you urgently need to remove the encumbrance from real estate, for example, for subsequent sale, the method is suitable. The sequence of actions involves repaying a mortgage loan, receiving money from the sale of a home, and early repayment of a consumer loan.

Borrow money

No one forbids borrowing from friends. Relatives are also ready to support if it comes to early repayment of debt obligations. This method is good because you don't have to pay interest. MFOs offering money before payday charge too much for services. The interest rate on microloans is high, which makes the loan unprofitable. Moreover, you will have to provide security, and an apartment will not be suitable. She herself is the collateral. Therefore, try to achieve understanding from relatives, friends, colleagues, and acquaintances.

Bank offers on mortgage terms

Top Russian banks offer their mortgage products according to terms set by themselves.

Below is a table for visual reference so that everyone can choose the appropriate bank, taking into account the minimum and maximum lending periods determined for themselves.

| Financial organizations | Minimum term (years) | Maximum term (years) |

| Sberbank | 1 | 30 |

| VTB 24 | 1 | 30 |

| Raiffeisenbank | 1 | 25 |

| VTB Bank of Moscow | 1 | 30 |

| Gazprombank | 1 | 30 |

| DeltaCredit Bank | 3 | 25 |

| Rosselkhozbank | 1 | 30 |

| Bank "Saint-Petersburg | 1 | 25 |

| Bank "Revival | 1 | 30 |

| Absolut Bank | 1 | 30 |

| Promsvyazbank | 3 | 25 |

| Bank Uralsib | 3 | 25 |

| Bank Russian Capital | 1 | 25 |

| Bank AK BARS | 1 | 25 |

| Bank Center-Invest | 1 | 20 |

| Transcapitalbank | 1 | 25 |

| Bank FC Otkritie | 5 | 30 |

| Zapsibcombank | 3 | 30 |

| Svyaz-Bank | 3 | 30 |

| Bank Zhilfinance | 1 | 20 |

In truth, judging by the table, there are no special differences in the terms of mortgage lending for the choice to fall on a specific bank.

Those purchasing living space for long-term personal use are in most cases satisfied with a medium-term loan. However, this is not at all true for people who intend to subsequently sell their home or pay off their mortgage early.

Alternative ways to pay off a mortgage in a difficult life situation

It happens that circumstances are such that no one helps, but you need to make early repayment as quickly as possible. Then it makes sense to contact Sberbank directly, which offers to take advantage of restructuring or refinancing. The first service is provided to bank clients, the second is available to persons who have taken out a loan in another banking structure of the Russian Federation. The consequences vary depending on the proposal. In any case, early repayment is a quick way to remove debt obligations.

Mortgage refinancing

If another bank issued money to purchase a home, using refinancing you can transfer the loan to Sberbank, which offers more favorable conditions. Moreover, the currency is rubles, even if the primary loan was paid in dollars or euros. The interest rate is lower and there is the possibility of early repayment. Other banks impose fines on those who try to pay off their debt early. Sberbank does not do this. And when refinancing, the terms of the new agreement are edited in accordance with the wishes and capabilities of the client.

Mortgage loan restructuring

Sberbank does not refinance its own loans, but is ready to restructure them. As a result, conditions change. The payment period increases, payments are made in rubles. If necessary, credit holidays are provided to solve temporary financial difficulties. During this time, you can prepare and collect the amount necessary for early repayment. And when payments resume, close the debt in whole or in part in order to change the amount of the mandatory contribution or shorten the repayment period.

How to calculate the mortgage amount based on income

Even if the amount of income does not differ in cosmic values, you should not despair, considering a mortgage unaffordable. The advantage of a mortgage is the ability to borrow for 20-30 years, which allows you to increase the maximum loan amount with a modest salary.

On the website of each mortgage lender there is an online calculator that will help you correctly calculate your salary mortgage by adjusting the online data according to:

- repayment terms (if it is not possible to repay in 10 years, you can set the loan duration to 25-30 years for calculation);

- the size of the down payment (when the official payment is small, it is worth collecting a larger amount and reducing the requested amount);

- apartment prices (if your income is modest, it makes sense to consider the option of buying housing at more affordable prices).

What must you do after paying off your mortgage?

After early repayment, the funds will be in the account, which means there are no debts to Sberbank. In any case, request a certificate that reflects this fact. If there is a discrepancy in the data, the document will serve as irrefutable evidence in court. To remove an encumbrance from a property, a certificate is presented to Rosreestr. Then the house or apartment can be sold, donated, exchanged, bequeathed, or rented out. Otherwise, the mark is not removed, and disposal of the property is prohibited.

If there is an early termination of the contract, contact the insurance agent with the same certificate to return part of the funds spent on obtaining the policy.

Tips for Mortgage Borrowers

Read the contract carefully before approval. Even better, provide the document for professional legal and financial monitoring. This will avoid hidden, unfavorable conditions. When signing, double-check that all items are acceptable. If possible, make early repayments with a shorter loan term. Then the overpayment will be minimal. It makes sense to reduce the monthly contribution if you plan to reduce your income or when you need money for other purposes.

The presence of a deposit increases the level of security of the payer. Use the income generated by interest on the deposit as early payments. Loan repayment using a deposit is not recommended.

Borrower mistakes when repaying early

Some people find it more pleasant to hold money in their hands, and therefore the available amounts are not used for repayment. The result is a big overpayment. Others do not separate the concepts of mandatory payment and early payment. If you deposit 60,000 with a mandatory contribution of 40,000, only 20 thousand go towards early repayment. You don't need to collect a large amount. Extinguish as much as possible. While the desired amount accumulates, the overpayment of interest will increase. However, you shouldn’t take your last money to the bank. Keep an amount in your house or on a card in case of illness, job loss, etc.

Correct borrower steps for early repayment

When making an early repayment, use the instructions below. Make sure that after depositing the funds, the bank shortens the payment period and does not reduce the required payment. As soon as you have liquid 99% of the next installment in your hands, pay off the mortgage by changing the terms of the contract. Don't neglect your tax deduction. Submit your declaration in the first month of the year to get back some of the money spent as early as possible. Take advantage of refinancing, restructuring, credit holidays.

In any unclear situations, seek free advice from specialists. This can be done by phone, email, or online.

What income is required to participate in mortgage programs?

When considering lending options, citizens of certain social categories most often have problems with low earnings, insufficient to issue a mortgage:

- young couples;

- budget employees;

- families with 2 or more children.

The above-mentioned citizens have the right to take advantage of preferential lending conditions with partial financing from the state budget. There is a special lending program for military personnel - a military mortgage with support from the Ministry of Defense.

In such situations, banks have a different attitude towards the borrowers’ income, since participation in the state program gives the right to take compensation from the budget.

Mortgage for a young family

To become a participant in the program for young families, one of the spouses must be no older than 35 years. Income for obtaining a mortgage in this case will be determined taking into account additional support from the state. If the borrower is on the waiting list as someone in need of improved housing conditions, there is a chance of receiving a certificate for compensation of 35-40% of the cost of housing from the state.

Situations when young families with three or more children are registered with the local administration are considered out of turn. In addition to the subsidy, such a family has the right to pay part of the loan additionally at the expense of maternal capital.

Military mortgage

For military personnel, salary for obtaining a mortgage is not as relevant as the number of years of service - at least 3 years.

Participation in a military mortgage involves registration of accumulative capital through the Ministry of Defense, with compensation for part of the cost of housing upon reaching the required period of service.

Mortgage plus maternity capital

The maternity capital program has opened up the opportunity for families raising 2 or more children to become owners of comfortable housing. 453 thousand rubles (as of 2021) can be used for the first payment or to pay off the existing mortgage, which eases the burden of the borrower.

For families in which the second or third child was born after 01/01/2018, they can count on special treatment in banks supporting the state program with a preferential 6% rate. Registration of a mortgage with maternal capital is available in large banks, but it is worth finding out in advance about the availability of a preferential interest rate if it is important to reduce the interest overpayment and, accordingly, the mortgage payment.

Construction of a residential building

Many families prefer a private house built with their own hands to apartments. Construction will take a lot of money, some of which can be financed by the bank and the state.

If the borrower owns a family certificate when taking out a construction mortgage, part of the debt is repaid through a payment from the Pension Fund. Matkapital is paid by the Pension Fund of the Russian Federation in charge of this area, so before contacting the bank it is worth consulting with the Pension Fund of the Russian Federation and discussing the possibilities of receiving tranches from the budget (in addition to construction, the state is ready to finance the reconstruction of a finished house with an expansion of living space).