Mortgage approval in Sberbank

Content

Getting pre-approved for a mortgage means the bank can lend you a certain amount of money. This indicator is calculated for each client individually depending on the number of guarantors and your level of profitability. The final loan amount is calculated after submitting the required documents. Based on the results of scoring (checking the borrower for compliance with the bank’s requirements), its value may be reduced by Sberbank. This happens when, in the opinion of the loan officer, there is insufficient information provided or income does not allow the loan to be issued on the terms specified by the borrower.

If a home loan is approved, approval is required to disburse mortgage funds. Sberbank gives you 114 days for this, during which you must decide on the choice of real estate and provide the organization’s specialist with the required documents.

Attention! Sberbank approves the mortgage as part of the payment for the selected living space. The maximum limit is 90% of the value of the property. You contribute the remaining money from your personal savings.

How to speed up the application review process?

In our country, when asked about deadlines, they always get the answer “for yesterday.” Russians don't like to wait. In this section, experts offer you several effective ways to speed up the process of mortgage approval by Sberbank:

- Use the DomClick service for selecting new buildings, created by Sberbank, to conveniently search for a property that meets all the criteria of a financial institution.

- On the official website of Sberbank https://www.sberbank.ru you can submit an application online: it will be considered as a priority. And you will be given an answer in 2-3 days. In addition, this method saves your personal time, which would otherwise have to be spent visiting a bank branch.

- One of the most important points by which you can significantly reduce the waiting period is searching for housing in advance. Decide in advance on suitable options, check their cost, and check for compliance with the bank’s requirements. Thus, after preliminary approval, you can begin collecting documents for housing and bring the transaction date closer. All that remains is to wait for Sberbank’s response on the decision regarding the chosen housing.

- There is another way to reduce the waiting time when preparing documents - use the electronic transaction registration service without visiting Rosreestr and the MFC. To do this, all parties to the transaction must issue an electronic digital signature, which will allow all documents to be signed electronically. The manager will send the documents to the authorities via Internet resources, and the potential borrower will receive a purchase and sale agreement and an extract from Rosreestr by email.

How to get approval for a mortgage at Sberbank

The first thing you need to do is decide on the type of property - new building or resale, house or apartment. Then monitor current offers on the market. This is necessary to know exactly how much loan you may need.

Secondly, it’s worth going to the bank to get a preliminary mortgage estimate. At this stage, you will find out how much money the bank can provide you with and under what conditions. You can get advice and apply for mortgage approval from Sberbank online. To do this, open the company’s website and go to the section for private clients. Select the “Loans” tab, then “Mortgage loans”. Here you can find information on housing lending programs, make a preliminary calculation and fill out an application.

An application for a mortgage loan can be submitted in three ways:

- Directly at the Sberbank office.

- Through your personal account – Sberbank Online or the DomClick website.

- By contacting the company's partners - accredited mortgage agencies and developers or credit brokers.

Attention! When submitting the initial application for a mortgage loan, all you need is a passport and SNILS.

What are the steps to take when an application is approved?

After approval of an application for mortgage lending, clients have to complete a large amount of work, for which Sberbank allocates only three months. This period is quite enough to cope with all the nuances. It is installed for a reason. This is due to the fact that many documents become invalid after 3 months, which may result in them being reissued.

Once approval is received, the borrower needs to do the following:

- Find suitable housing to purchase;

- Conduct a housing assessment;

- Insure the property that is planned to be used as collateral;

- Prepare a complete package of documents to complete the transaction with the bank;

- Signing a real estate purchase and sale agreement with the participation of a credit institution;

- Transfer of the required amount to the seller of the residential property;

- Registration of an apartment on the terms and conditions of the mortgage;

- Make a down payment under an agreement concluded with a credit institution;

- Making mortgage payments on time. Sberbank provides the client with a payment schedule, which is used for timely repayment of debt.

How to increase bank trust - current recommendations

- Don't damage your credit history before applying for a mortgage. Pay off loans and borrowings on time. Even a small delay on a trade loan 5 years ago can cause a mortgage refusal.

- Sberbank evaluates the solvency of each client. The monthly mortgage payment should not exceed 50% of your earnings, from which all mandatory expenses will be deducted.

- Be sure to confirm your employment and income, not only the main one, but also the additional one. High earnings are not so important if you change employers every six months. For Sberbank, the main thing is stability.

- In the application, you can indicate the amount of joint income of the spouses, but it must be documented.

- You should not provide false information to a bank employee or falsify certificates.

- It is better to remain silent about personal plans for the near future; you should not tell the bank about your imminent pregnancy or your desire to go diving.

There is no clear answer to the question of how to get a positive decision after applying for a mortgage. But know that Sberbank will take into account all possible risks. Therefore, if you are going to take a trip or engage in a dangerous sport, it is better to keep silent about it.

Who is approved for a mortgage at Sberbank

Each bank sets its own minimum requirements for a potential borrower. Before you apply for a mortgage, find out if you qualify. This will be the first step on how to get approved for a home loan. Sberbank has them as follows:

- The borrower must reside in the territory of the Russian Federation and be its citizen.

- Registration by registration must be in the region where the bank operates.

- Age restrictions are from 21 to 75 years at the time of loan closure.

- Work experience of more than 1 year, with the last employer - at least 6 months.

- Availability of co-borrowers – Sberbank allows you to attract up to 3 people, primarily spouses and parents. In relation to citizens free from marriage, this is a desirable requirement. For married people it is mandatory; the spouse always acts as a co-borrower.

- Positive credit history.

Ways to find out the solution and possible reasons for refusal

We have figured out how applications for mortgage loans are reviewed at Sberbank, who meets the minimum requirements and what documents need to be provided to fill out the application. Half the battle is done. All that remains is to wait for a preliminary decision from the bank.

Where will the response from Sberbank come?

At the end of the mortgage application decision-making process, you can receive the results as follows:

- The credit officer will receive an SMS or call to the phone number specified in the application form. Will tell you about the parameters approved by the bank.

- Through Sberbank Online, if the application was submitted remotely.

- Information can be obtained from the credit broker with whose help the mortgage application was completed.

Why does Sberbank refuse

Let's look at the reasons why Sberbank may not approve a submitted application for a home loan. These include:

- Damaged credit history – there were arrears on previous loans.

- There are unpaid trade or consumer loans.

- Profitability that does not meet the bank's requirements.

The monthly mortgage payment should not exceed 30-40% of the borrower's salary. Solvency is determined based on the total family income, which is calculated as the sum of the earnings of all members for 3 to 6 months, minus all expenses. The resulting value is divided by 3 or 6 and the number of people, including children. The result should not be below the subsistence level.

- Falsification (forgery) of documentation submitted to the credit manager.

- Indication of erroneous information in the application form.

- The employer cannot officially confirm the fact of your employment.

- The borrower does not comply with the Hunter system (a special system for checking loan applications created to detect fraud).

- Refusal after checking the data by a credit expert in the underwriting service (the department where a detailed check of the borrower is carried out) of the bank.

If Sberbank has not currently approved the mortgage, citing certain technical reasons, then you have the right to re-submit the application after eliminating the shortcomings. These include:

- Lack of required salary transfers to a Sberbank debit card.

- Incorrect entry of information related to full name and passport data when issuing a salary card.

- Based on the FMS data, the identity card is invalid.

- Low income.

If you find out why Sberbank does not approve a housing loan for you, then after a while you can try to submit your application again. This information can be obtained from the loan officer handling your mortgage. If Sberbank’s refusal is categorical, then re-application is possible only after 2 months.

How many days does it take to approve a mortgage at Sberbank?

The speed of consideration of applications is influenced by how the overall approval process takes place at Sberbank and the workload of loan specialists. After all, conducting a complete check of each potential borrower is not as easy as it seems. On average, you will receive a decision on a standard application within 2-3 days. Questionnaires of salary clients and pensioners, whose income is reflected in Sberbank current accounts, are processed more quickly.

What to do after your mortgage is approved by Sberbank

Let us consider in detail what needs to be done so that the mortgage is not only approved, but also provided with assistance in registering real estate and collecting documents, the registration period of which can be lengthy. The period allocated for this is limited and is 3 months.

- First of all, after receiving a positive response from Sberbank, read the terms of the loan and the approved amount.

- After which you can begin to choose a future home that suits the requirements of the banking organization and your personal preferences.

- The choice has been made. The next step is to collect information about the property subject to a mortgage, on the basis of which Sberbank checks the future collateral. At the same time, it is worthwhile to evaluate the property being purchased. This is only relevant for finished housing; with the borrower’s participation in shared construction, the document is drawn up after the house is put into operation. Your credit manager will provide you with a list of accredited appraisers.

- Together with the home appraisal, you should take out an insurance policy for the property. Life and performance insurance for the borrower is not required by law, but having it will increase your chances of getting a mortgage loan approved by Sberbank.

Sberbank mortgage for secondary housing: conditions and interest rates

Secondary market properties are purchased through Sberbank using a mortgage for finished housing. The secondary market refers to used properties, i.e. not sold by the developer. The latter are implemented under the program for new buildings. Despite the large-scale construction of new high-rise buildings, secondary housing still occupies a leading position in terms of prevalence.

Conditions:

- The down payment is from 10%. But when this limit is raised to just over 20%, the rate decreases by 0.3 points.

- The base rate is 9.2%. It can be reduced to 8.8% and increased to 11.3%.

- The loan term ranges from 1 year to 30 years.

- The mortgage amount starts at RUB 300,000. The maximum is calculated as 85-90% of the housing being financed.

Collateral for this mortgage is required. For the period before the desired collateral is issued, another form of guarantee resource must be implemented. It is mandatory to take out insurance for the property being purchased, because this is a legal requirement. Additional life insurance is characterized as voluntary.

Procedure for obtaining a mortgage

Drawing up a mortgage agreement involves several stages:

- The down payment is made, the purchase and sale transaction is completed and the mortgage agreement is signed. During the same period, the final agreement on the monthly payment schedule takes place.

- Property registration is carried out during a personal visit to the Rosreestr authorities or remotely through a special service of Sberbank. The latter option will allow you to reduce your mortgage interest rate.

The property will be registered after paying the state fee and providing the necessary documentation - 4 copies of the purchase and sale agreement, one for each participant in the transaction, the seller’s title documents and the application for registration.

- After 10 working days from the date of submitting the documents, you receive an extract from the Unified State Register and become the proud owner of your own home, and the lender transfers the funds to the seller.

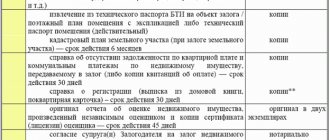

List of required documents

At each stage of applying for a mortgage loan, the borrower is required to provide various documents. At the time of submitting your preliminary application you will need:

- A questionnaire that can be filled out on paper at a Sberbank branch or via the Internet.

- Passport of a citizen of the Russian Federation.

- Documents confirming the borrower's real income and employment. This category includes copies of work books and contracts, 2-NDFL certificates or bank forms, and bank account statements. The information provided in them must be true. There are criminal penalties for falsifying documents. This is why you should not provide false information to the bank.

After receiving approval for a mortgage loan, you need to submit documents to Sberbank on the basis of which the valuation and insurance of the purchased property will be made, proof of payment of the down payment - a receipt from the seller or an extract from the client's account.

When participating in family mortgage programs, you are additionally provided with marriage and birth certificates, a MK certificate and a certificate of the balance of maternity capital. Depending on the situation, the loan officer may request other documents.

An initial fee

After approval of the mortgage loan and signing of the necessary documentation, a pre-agreed down payment is made to the Sberbank cash desk. This can be done as follows:

- Cash to the bank's cash desk.

- By non-cash payment.

- Crediting maternity capital funds.

After approval

So, the happy moment has come - the mortgage has been approved, what next? Let’s look at this issue in great detail, since the positive outcome of the entire event depends on these actions. Next, we will tell you how many times a mortgage is approved by Sberbank after providing a full package of real estate documents.

Selection of object

Both the client’s prosperous future and the positive outcome of the purchase transaction depend on the choice of real estate. The choice of future housing must be taken very seriously and responsibly. It is better to use the services of specialists in this field who will help you quickly take all the necessary steps.

Collection of necessary documents

After the specialist selects the best housing option, he will also help collect the necessary package of documents for this property so that bank specialists can check the future collateral.

You can find out what documents are needed for a mortgage at Sberbank from the previous post.

Grade

It is also necessary to undertake an assessment of future housing, which should be carried out by a company accredited by Sberbank. This document is required only for finished housing or land. If you are purchasing a construction project, you will need this document only after the housing has been commissioned.

A mortgage specialist will tell you the list of appraisal companies, or you can look it up yourself on the bank’s website.

Insurance

Just like appraisals, home insurance must be obtained from an insurance company that partners with a financial institution. At Sberbank, the structure itself is required to be insured if it is a finished home.

Life insurance at Sberbank is expensive and optional, but refusal entails an increase in the loan rate by 1%. To save money, you need to choose another insurance company from the list of accredited ones.

Before making your final choice, consider whether it would be more profitable for you to refuse insurance altogether. The cost of an insurance policy for a Sberbank mortgage can be calculated using the calculator below.

Important point! The calculator allows you to issue a policy online, which will save not only your time, but also money. An online policy is usually 10% cheaper than a regular one.

Making a down payment

You can make a down payment only after receiving a positive decision on the loan. Today there are several ways to make a down payment:

- In cash;

- Non-cash;

- Certificates from the state.

If you are using a scheme that inflates the cost of the apartment (mortgage without a down payment from Sberbank), then do not forget to prepare a receipt for payment of the down payment.

The first mortgage payment for housing under construction is made only after registration of the DDU.

After making the down payment, the bank prepares directly for the real estate purchase and sale transaction.

After providing a complete package of documents, bank specialists will carefully check and analyze all the information provided. This usually takes no more than two days.

Important point. After submitting real estate documents to the bank, it re-checks the credit history. In this regard, if you take out a loan for a down payment or for other purposes, you risk getting a mortgage refusal. Take out a loan only after final approval of the property and setting a transaction date with the bank.

Deal

Conducting a purchase and sale transaction is the most crucial moment for both the client and the bank. On this day it is important to be as concentrated and attentive as possible. If any questions remain unanswered before, you should ask your credit specialist before making the transaction.

To sign a mortgage agreement, you must already have insurance in hand or you can arrange it on the spot at Sberbank.

In the process of signing all contracts, you do not need to succumb to the general rush and turmoil, read each clause carefully. Particular attention should be paid to additional agreements to contracts, because they indicate special conditions that the client can only learn about during the transaction.

You also need to carefully check the compliance of the current interest rate under the loan agreement, according to which monthly payments will be calculated.

Registration

After the purchase and sale transaction is completed, it is necessary to register the mortgaged property, otherwise the transaction will be considered incomplete.

Since 2021, Sberbank has introduced electronic registration of mortgages. This service allows you not to visit the authorities, but to register the transaction through a special service directly at the bank.

With this registration scheme, you will not have paper documents in your hands, but only an electronic version of the agreement with a digital signature. But this will allow you to lower your interest rate.

Issuance of credit

After registering the transaction, you will need to contact Sberbank again to issue a loan. To do this, you need to provide registered documents for regular registration and documents for paying the first installment if you have a construction project.

Next, the bank will transfer the money to the seller. On average, the transfer time by bank transfer is 2-3 days. Sberbank also has a payment option through a safe deposit box. After the loan is issued, all you have to do is pay the loan on time.

Use our online Sberbank mortgage early repayment calculator to calculate the overpayment on your mortgage and how it will change if you pay it off early.

We are waiting for your questions in the comments.

We will be grateful for rating the post, liking and reposting.

Pitfalls of mortgages at Sberbank

Every lender, including Sberbank, has pitfalls when drawing up a mortgage agreement. These facts include:

- The minimum rate of 7.1% for housing under construction and 8.6% for finished housing is available only to bank employees and salary clients. For everyone else it will increase by 0.5%.

- If you provide a certificate of income in the form of a banking institution, the loan term and the approved amount may be reduced. And the lender’s remuneration percentage will increase.

- Increase in interest rate by 1% upon refusal of life and health insurance of the borrower.

- High cost of obtaining an insurance policy. Sberbank strongly recommends insuring collateral, life and health only through the bank's insurance company. To do this in another organization, you need good reasons.

- Sberbank does not provide time to eliminate minor shortcomings, but immediately refuses the borrower.

These are the conditions for purchasing real estate with a mortgage through Sberbank. Some of the disadvantages of such cooperation can be mitigated by a reduced interest rate. But believe me, there will be many more advantages. First of all, clients note the convenience of loan repayment and the possibility of early repayment without commission.

Sberbank mortgage conditions

Sberbank not only strives for its own benefit, but also sets a course to satisfy the interests of existing and prospective clients. In this way, he manages to constantly replenish the ranks of his clientele requesting mortgages and other services. As part of its customer focus and cooperation with the government, Sberbank is constantly modernizing its service conditions.

Throughout 2021, significant changes have been observed regarding service parameters. Sberbank reduced requirements for applicants and improved mortgage conditions. The adjustments mostly related to interest rates. This has become especially noticeable in programs in which assistance is provided from the state budget.