List of papers to remove the encumbrance from an apartment or house with land

The main condition for removing all restrictions on real estate is the full repayment of the mortgage loan. After the borrower makes the last payment on the loan, it is necessary to obtain a certificate from the lender confirming that there is no debt on the mortgage and no claims against the borrower.

This document is optional, but it is recommended to obtain it, since due to frequent incorrect calculations, a minor debt may remain on the borrower’s mortgage account, which will not allow the operation to remove the encumbrance from the real estate.

Having closed the mortgage and received a certificate of no debt, the owner can begin to collect the necessary package of documents to remove restrictions on the property.

The main documents required to remove encumbrances from real estate are:

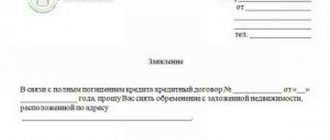

- An application from a credit institution to the state registration service about the absence of debt of the borrower on a mortgage loan, as well as about the absence of claims against it. As a rule, the application is accompanied by an extract on the current status of the mortgage account.

- An application for the removal of restrictions on mortgage real estate from both parties to the transaction (lender and borrower), signed by authorized employees of the credit institution. The form of this document can be obtained either from a bank or from the state registration service Rosreestr.

- Mortgage agreement in two copies.

- Mortgage note (original and copy of the document) obtained from a credit institution. The document must necessarily contain the date of the last mortgage payment, as well as a note about full repayment of loan obligations (you can find out how to return the mortgage after repaying the mortgage here).

- Property owner's passport. If several citizens own real estate, a passport is provided by each of them. Also, each owner must be present at the registration office during the procedure.

- Extract from the Unified State Register of Real Estate on the ownership of property.

- A receipt confirming payment of the state fee for making changes to the Unified State Register of Real Estate, as well as for issuing a new extract on the removal of the encumbrance from the property.

- A court order, if the mortgage lending was closed by its decision.

This list of documents needed to remove restrictions is the same for any type of real estate. Moreover, if the mortgage encumbrance is removed from a secondary home or a house with land, then the borrower will additionally need to submit a real estate purchase and sale agreement to the registration authority.

Sample power of attorney to remove encumbrance from an apartment

A mortgage is by far the most common type of encumbrance on real estate, as banks actively sell housing on these terms. This means that until the loan that was taken out to purchase a home is fully repaid, you are the full owner of the property, but this same property is pledged to the creditor bank. Since the housing belongs to you, you have every right to dispose of it at your own discretion: you can register in this apartment yourself or register someone else, unless otherwise stated in the agreement with the bank. When issuing a mortgage, some banks additionally stipulate your rights in the contract (if you want to make repairs or register Uncle Vasya, you will have to apply for permission from the bank). A mortgaged apartment can be rented out or even sold, but all these transactions must be carried out with the consent of the bank that issued the mortgage loan. This is de jure. De facto, even if you manage to agree on a purchase and sale transaction with the bank, it will look like this: the buyer will pay the bank the loan debt with all interest, and you will only be paid the difference between the amount you agreed on and the amount paid to the bank.

Nowadays, a large number of elderly people, especially those who do not have heirs, agree to bequeath their apartment to complete strangers. In return, these citizens undertake to financially support elderly property owners until the end of their days. Such apartments are considered encumbered until the death of the legal owner.

Where should the assembled package be submitted?

Citizens can submit an application and all necessary documents to remove the encumbrance on their mortgaged property using 3 different options:

- The most reliable way is to contact the Federal Service for State Registration, Cadastre and Cartography (Rosreestr) directly. However, this option may not be convenient for many citizens due to the limited number of territorial branches of this body.

- The second popular option for submitting documents is to contact the Multifunctional Center. Currently, this method is the most relevant, since citizens can contact any nearest branch of the MFC to submit papers.

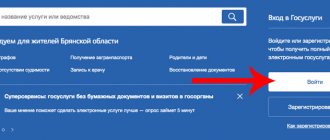

- The third way to submit an application is to use the Government Services portal.

When submitting an application through the State Services website, the borrower will still have to appear in person at the government agency to receive a new extract from the Unified State Register.

Power of Attorney for Encumbrance of an Apartment

- statement

- a document confirming the identity of the owner of the premises encumbered with a mortgage (that is, a passport)

- mortgage or mortgage agreement, that is, a document that confirms that the borrower has fulfilled his obligations to the bank

- a letter from the bank about the fulfillment of the assumed conditions for providing mortgage lending to the borrower.

We recommend reading: Mom Made a Deed of Gift to Me for the House that We Purchased A Little Less Than a Year Ago. Do I Need to Pay Tax on the Deed of Gift - statement

- title documents for the apartment (sale and purchase agreement, certificate of ownership, etc.)

- mortgage

- a letter from the bank confirming your fulfillment of obligations under the mortgage agreement

- copies of the constituent documents of the creditor bank, certified by a notary.

Differences in the list of papers when submitted through the MFC, Rosreestr and State Services

The package of documents required to remove the encumbrance is no different, regardless of the method of submission - through the MFC, Rosreestr or the State Services portal. However, when submitting papers through the State Services website, certain nuances may arise.

So, when submitting an application through the State Services portal, a citizen must register in advance and confirm his account at the MFC branch, otherwise he will not be able to submit documents. also fill out an electronic application on the State Services website.

In other words, the borrower needs to enter all the necessary information on the application in the fields specially designated on the website, and there is no need to attach a scan of the paper application. All other points remain the same.

Removal of mortgage encumbrance in the Rosreestr and what documents are needed

Example: a bank sells an apartment that it took ownership of due to the debt of the previous owner. Before choosing an encumbered apartment in this case, it is necessary to check the apartment for the presence of legal or any other obligations. This can be done by ordering an extract from the Unified State Register, where information of this kind will be available when paying the state fee.

- Sell this property;

- Rent it out;

- Carry out any actions that entail a decrease in the market value of real estate (for example, redevelopment);

- Transfer housing as collateral to another bank or financial institution in order, for example, to buy a better apartment on credit using the security of an existing one.

How to make an application?

You can obtain an application form to remove the encumbrance from a mortgaged property directly at the Rosreestr branch, at the credit institution where the mortgage was taken out, or on the State Services website.

There is no strict application form. A citizen has the right to independently draw up a document, adhering to business style.

The text of the document must include the following information:

- Details of the authority to which the document is sent.

- Personal and passport details of the borrower.

- Data of the credit institution (name, legal address, details).

- Information about the loan agreement (loan term, mortgage loan size, mortgage closing date).

- Address of the encumbered real estate.

- Request to remove restrictions on the property.

- Information about the absence of mutual claims on the part of the credit institution and the borrower.

- Date and signature of the applicant.

An application for removal of encumbrance is drawn up according to one sample , regardless of the type of encumbered property. In this case, only the content of the document text will differ.

For example, if a restriction is being lifted from an apartment, then the text must indicate: “I request that the encumbrance be removed from the apartment located at the address...”. When removing restrictions from a house with land, the relevant information must be indicated in the text.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 302-76-94

Power of attorney to remove the encumbrance

To complete the process as quickly as possible, you must:. The letter to the bank has an approved form. Letters to remove the encumbrance are possible. When writing an application to Rosreestr, it is necessary to take into account the mandatory requirements for the text of the document. So, it must contain the following data:.

Despite the fact that banks now have an automatic system that completely closes the loan agreement, it is still better to contact the bank yourself and request the appropriate document, because some bank employees are deliberately in no hurry to carry out the withdrawal procedure, which makes life very difficult for their borrowers. In other words, in order for the apartment to be free of encumbrances and the mortgage record to be paid off, you need to submit documents to make changes to the State Register of Rights and receive a new certificate of registration of the apartment, but without any encumbrances.

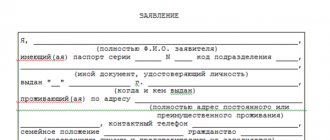

How to withdraw by proxy?

It often happens that the owner of the property cannot be personally present when submitting an application to remove the encumbrance from the property. In this case, on the basis of paragraph 4 of Article 15 of Federal Law of Russia No. 218, the interests of the property owner can be represented by an authorized person if he has a power of attorney to perform these actions.

Requirements for its registration

The power of attorney of the owner's representative to remove the encumbrance from the mortgaged property must be certified by a notary (Article 185.1 of the Civil Code of the Russian Federation).

The text of the document must necessarily reflect the following information:

- City and date of drawing up the power of attorney.

- Personal and passport details of the property owner.

- Personal and passport details of the authorized person.

- Information about the transfer of powers to an authorized person.

- The region and specific address of the institutions where the authorized person will apply.

- Validity of the document and the possibility of entrusting it to third parties.

- At the end of the document, the signature of the authorized representative is affixed, and the details of the notary office and the notary are also indicated.

After the document is officially certified by a notary and entered into the register of notarial acts, the powers of the trustee specified in the document acquire legal force.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 302-76-94

Power of attorney for the sale of an apartment with an encumbrance

- name – “Power of Attorney”;

- date of drawing up the power of attorney (if this date is absent, the power of attorney is void);

- validity period of the power of attorney (if it is not specified, the power of attorney is valid for a year);

- information about the principal and the representative (full name, passport details and place of residence of each);

- personal signature of the principal.

If the mortgaged apartment is sold to pay off the mortgage debt, the owner is obliged to release it, but in accordance with the Mortgage Law, he has the right, by court decision, to delay the sale of the apartment for up to one year and receive temporary housing.

Where can I submit documentation?

There are four main ways to remove a burden.

The most common and well-known is to contact the Federal State Service. registration, cadastre and cartography." Appealing to the Federal authorities can be called the standard option.

Documents can be submitted to the Multifunctional Center (MFC). In such centers, many government services are provided at once, which is why the processing time for papers increases significantly.

Documents, along with a description of the attachment and a notification of delivery, can be sent by mail using the so-called “valuable letter”; in this case, all statements must be notarized. Due to significant efforts and financial expenses, the option is suitable for the most part for those who have no opportunity to appear in person at the Rosreestr authorities.

Reference! Reissued certificates of title are not sent by mail - the applicant will still need to pick them up from the authorities.

Recently, a new method has appeared - submitting an application using the Internet. To do this, the applicant must first register on the government services website and confirm his identity with an electronic signature, after which it will be possible to submit an application and electronic versions of documents remotely.

Read our other materials to learn the important nuances of removing the encumbrance from an apartment or other real estate after repaying the mortgage at VTB 24 Bank and Sberbank.

Legal advice

A power of attorney is always drawn up in writing. She is preparing before going to Rosreestr. The completed sample requires a seal and signature of the head of the enterprise if the business is carried out with legal entities.

In order for a third party to accept all documents to remove the mark of arrest in a government agency, the power of attorney must satisfy 2 conditions:

- the powers of the attorney must be clearly listed;

- The notary must certify the data.

All numbers in the content of the text are written in words that can be added in brackets for decoding. Abbreviations and corrections are not allowed. If necessary, the possibility of reassignment is indicated.

A prerequisite is the presence of a date for signing the document. Without this, the permit will not come into force. The deadline for issuance, as a rule, does not exceed 3 years. But if the period of use of the document has not been determined, then it is considered valid for one year.

Notaries in their office can offer not only a regular power of attorney, but also a general permission to remove the encumbrance mark.

It is also called extended, as it includes a complete list of possible actions with real estate. That is, the representative will be allowed into all government bodies, and even dispose of housing at his own discretion.

05/10/2018 Information about the authors | Category: Mortgage