Types of encumbrances on an apartment

An encumbrance is understood as a certain legal condition that limits the rights of the owner of a property. This means that the owner of the apartment loses the opportunity to dispose of it at his own discretion: transactions with it will require the consent of a third party.

If the apartment is sold, its new owner receives the property with an encumbrance. To prevent concealment of information about existing restrictions, such information is entered into the certificate of ownership and reflected in the extract from the Unified State Register of Real Estate.

Important! Currently, the following types of encumbrances are distinguished:

- mortgage. If a person who owns a mortgaged apartment does not repay the loan under the concluded agreement, he loses the right to dispose of it without the consent of the bank; it is the bank that gets the opportunity to determine the terms of further transactions with the apartment,

- rent. Disposal of the residential premises in which the rent recipient lives is permitted only with his consent; the rent payer cannot dispose of it at his own discretion,

- easement. This encumbrance means the right of third parties to use the property. At the same time, the owner of the property does not have the right to dispose of it without their consent,

- arrest. If utility debts exceed the established limit, the residential premises may be seized. In this case, the owner will not be able to dispose of the housing until the debt is fully repaid,

- emergency condition of the house. It is unacceptable to sell apartments located in such buildings

- hiring The tenant and his family members occupy the residential premises for a certain period of time. During such a period, the owner of the premises has no right to dispose of it without the consent of the tenant and his family members,

- the presence of residents who are registered in the residential premises. If the owner of an apartment intends to sell it, all persons registered in it are required to leave it within the appropriate period. If there is no voluntary deregistration on their part, the owner has the right to go to court to force a compulsory deregistration.

We can come to the conclusion that the sale of residential premises in a house that is recognized as unsafe is unacceptable. If the property is seized, the residential premises can be sold only after the debt is repaid. In other cases, the consent of third parties to carry out transactions will be required.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

How to remove encumbrances from an apartment?

In order to remove the mortgage from your residential premises, you need to fully repay the loan (or loan) taken out, as well as all penalties, interest, and other penalties established by the agreement.

Once your credit obligations are terminated, the pledge also expires. The loan can be repaid either within the terms established by the mortgage agreement or ahead of schedule.

However, the mortgage is not automatically removed when the loan is repaid; for this, the registering authority must make an appropriate note in the register in which the mortgage agreement was previously registered.

Application for removal of encumbrance

If real estate is the subject of a mortgage, then all actions to dispose of it must be agreed upon with the bank. This is due to the fact that the bank has a direct interest in the outcome of the transaction with the mortgaged property. To do this, you need to draw up an application for removal of the encumbrance and submit it to the bank branch.

The application must contain the following information:

- information about each party (full name, passport details, residential address, as well as the name of the credit institution that provided the loan, full name of the relevant employee),

- information about the subject of pledge (real estate),

- details of the mortgage agreement (number and date of signing),

- grounds for removing the mortgage,

- Date and signatures of each party.

An apartment with an encumbrance - what does it mean?

Read here what documents to check when buying an apartment on the secondary market.

When you can sell an apartment after purchase in order to avoid paying tax, read the link: https://novocom.org/nalogi-i-vychety/cherez-skolko-mozhno-prodat-kvartiru-posle-pokupki.html

Sample application for removal of encumbrance on real estate

application for state registration of the established form in accordance with Appendix 3 to this public service standard; 2) an identity card of the authorized representative of the service recipient and a document certifying the authority (the original is provided to identify the identity of the service recipient) to represent the service recipient (if the representative of the service recipient applies);

Legal advice: on the Rosreestr website there is an online service “Reference information on real estate”. By following the link. You can get background information about the apartment you are interested in without leaving your home. The procedure for removing the burden is simple and done quickly. But collecting documents takes a lot of time.

We recommend reading: Sample applications for awards

Letter to the bank

applications for the removal of encumbrances on real estate to the bank for free in word format

At the bank, the process of removing the encumbrance is carried out as quickly as possible.

Important! To do this, do the following:

- contact the bank branch, presenting the employee with an identification document and a copy of the loan agreement,

- with the help of a bank employee, fill out an application,

- within 7 to 14 days you will receive a notification about the need to appear at the MFC to take further actions. At the MFC, fill out an application for mortgage repayment,

- if required, the applicant has the right to obtain a new certificate confirming ownership of the property. Information about the encumbrance will be excluded from it.

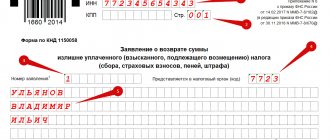

ATTENTION! Look at the completed sample application for the removal of encumbrances on real estate to the bank:

Application to Rosreestr

applications for the removal of encumbrances on real estate in Rosreestr free of charge in word format

There is no strict form for the application. This means that you have the right to present information in the text of the document at your own discretion, adhering to business style. At the same time, certain requirements are imposed on the content of the application, which must be taken into account when drawing it up.

Please note! In particular, you will need to indicate the following information:

- information about the applicant (who is the owner of the property): full name, registration address,

- information about the mortgagee,

- information about loan obligations (debt amount, dates of deposit, contract term),

- please remove the burden,

- indicate that there are no mutual claims or obligations.

ATTENTION! Look at the completed sample application for the removal of encumbrances on real estate in Rosreestr:

How to check whether a land plot has been seized?

Removal of encumbrance from an apartment in 2021 application

A writing sample, its form is available in any department of the Rosreestr authority, so anyone can familiarize themselves with it. The owner is deprived of the opportunity to fully own, use and dispose of it, so he will not be able to carry out any transaction with the property. .

This service is not available everywhere, so you often have to wait in line. Stages of buying an apartment with a mortgage in a new building in 2019 As a rule, an application for removal of the encumbrance is filled out directly at the registration chamber. the price of such an apartment is even lower, and finding a buyer is not so easy.

Required documents

In order for Rosreestr to pay off the mortgage record, you will only need an application to remove the mortgage.

It should be noted that the application must be accompanied by the presentation of a passport. If a representative submits an application on your behalf, he must present an appropriate power of attorney certified by a notary. For his part, the bank employee presents a passport and the corresponding power of attorney.

Watch the video. We remove the encumbrance from the property:

Is it possible to remove the encumbrance by power of attorney?

powers of attorney to remove encumbrances from real estate free of charge in word format

If a person who is the owner of real estate cannot personally decide on the issue of removing the encumbrance, he has the right to transfer the corresponding powers to his representative by drawing up a power of attorney.

In accordance with Article 185.1 of the Civil Code of the Russian Federation, a power of attorney giving the authority to carry out transactions for registering property rights must be certified by a notary.

Consequently, current legislation allows the removal of encumbrances from real estate by power of attorney.

Power of attorney to remove encumbrances from real estate under mortgage and in other situations

A power of attorney is a document whose format and content are subject to strict requirements. If they are violated, the document may be declared invalid.

According to the provisions of the law, a power of attorney is required to carry out actions to interact with government bodies and participate in the procedure for registering property rights as a representative.

Remember! Actions for which a representative receives authority through a power of attorney are associated with material values. For this reason, the power of attorney must be certified by a notary.

When carrying out the procedure for certifying a power of attorney, the presence of the owner of real estate (principal) and the person to whom he transfers the authority to complete the transaction (trustee) will be required.

The principal and the authorized representative will have to present to the notary documents proving their identity and the relevant documents for the property.

ATTENTION! Look at the completed sample power of attorney to remove encumbrances from real estate:

Removal of mortgage encumbrance - documents to Rosreestr

- A mortgage that states that there is no debt. Issued by the bank upon application (if previously issued).

- Papers confirming actions regarding the mortgage: deed of transfer, explanatory letter regarding the mark made.

- Certificate of loan repayment. It contains data on the terms and amount of the contract, the date of repayment and account closure.

- Power of attorney to represent the interests of the bank.

It is mandatory that the owner and bank employee submit a general application for the removal of the mortgage encumbrance, a sample of which is available at Rosreestr or at the institution itself. In this case, the owner can carry out the operation independently, having secured a power of attorney, or the bank. This procedure should be clarified with the lender. Many banks exempt clients from such a procedure and perform it themselves, almost automatically.

We recommend reading: Minimum subsistence level 2019

Removal by court order

If the parties have disagreements regarding the fulfillment of contractual obligations, and attempts to reach a compromise are unsuccessful, the encumbrance can only be lifted in court.

Attention! To do this, carry out a number of actions of the following nature:

- file a claim, indicating in it the grounds for removing the encumbrance,

- collect the necessary documents that constitute the evidence base, confirming the facts you have stated, attach them to your claim,

- wait for the court's decision. If the court satisfies your requirements, proceed to the next step,

- After receiving the court decision, send the necessary documents to Rosreestr. Within three days you will receive a new certificate of ownership, which will indicate the absence of encumbrances imposed on the property.

How to find out if the encumbrance on an apartment has been removed?

Statement of claim

It is permissible to draw up a statement of claim in free form, but there are a number of requirements for its content.

claim to the court to remove the encumbrance from the property free of charge in word format

The document must contain the following information:

- the name of the court in which you are filing the claim,

- details of the applicant and mortgagee, contact information,

- information about the property,

- information about the repayment of the debt (the date of payment of funds) and its amount,

- documents confirming rights to real estate,

- grounds for filing a claim, demands put forward.

ATTENTION! Look at the completed sample claim to the court to remove the encumbrance from the property:

Where can I get an extract from the Unified State Register for an apartment?

State duty

Entering information about mortgage repayment into the Unified State Register is not subject to state duty. For an extract from the Unified State Register of Real Estate, confirming the absence of encumbrances on the property, a fee of 400 rubles is charged.

If you took out a loan to buy an apartment, after repaying it in full, you should remove the mortgage encumbrance.

This can be done by contacting the branch of the bank that issued the loan to you and submitting an appropriate application to Rosreestr. A credit institution employee will help you fill out an application.

This procedure does not require payment of a state fee; the procedure itself is not complicated. This means that it needs to be implemented as quickly as possible in order to avoid a bank bankruptcy situation. If a bank is declared bankrupt, the encumbrance can only be lifted through a court order.

Watch the video. Apartment with encumbrance:

Procedure for removing the encumbrance

/ 0

Redemption of a mortgage registration record in favor of the Russian Federation is carried out by Rosreestr within 3 working days from the date of receipt of the corresponding electronic application from the Federal State Institution “Rosvoenipoteka” (hereinafter referred to as the Institution).

The grounds for the Institution to send an electronic application to Rosreestr for repayment of the mortgage registration record in favor of the Russian Federation are:

1. If a participant in the savings and mortgage housing system for military personnel (hereinafter referred to as NIS) undergoes military service:

1.1. Refund in full by the NIS participant, if he does not have the right to use savings for housing, funds from a targeted housing loan (hereinafter referred to as the TLC) on the basis of an application (Form 1) according to the details that will be contained in the Institution’s response to this application , and submitting to the Institution an application (Form 2) with a copy of the NIS participant’s passport (2-3 pages and a page with current registration) and the original certificate of continued military service, dated later than the date of return of funds to the Central Housing Authority.

or

1.2. Receipt by the Institution from the registration body of the federal executive body or the federal state body in which the NIS participant is currently undergoing military service, information about NIS participants who have reached 20 years or more of the total duration of military service, including in preferential terms, who have paid off the debt on mortgage loan in full, and who have expressed a desire to repay the registration record of the mortgage in favor of the Russian Federation.

The procedure for submitting a report on the provision of information to pay off the registration record of a mortgage in connection with the achievement of 20 years or more of the total duration of military service, including in preferential terms, and the absence of debt to the Institution, NIS participants must be clarified with the responsible official at the place of military service services.

2. In case of dismissal of a NIS participant from military service and exclusion from the register of NIS participants:

2.1. Until January 1, 2021: submission to the Institution of an application (Form 3) of a former NIS participant who has no debt to the Institution under the CZL agreement, formed after the closure of his personal savings account (hereinafter referred to as the INS).

2.2. After January 1, 2021: the Institution receives from the registration body of the federal executive body or the federal state body in which the NIS participant served in military service, information about his exclusion from the register of NIS participants and his repayment of debt under the CZL agreement.

3. In the event of the sale of residential premises acquired by a NIS participant using the funds of a mortgage loan and a mortgage loan, by a court decision to collect the debt and/or declaring the NIS participant insolvent (bankrupt):

3.1. An application (in any form) from the creditor bank to accept residential premises that were not sold at public/electronic auctions as payment for the fulfillment of obligations under a mortgage loan, with supporting documents attached.

3.2. Documents for consideration of the issue of repayment of a mortgage registration record in favor of the Russian Federation at the request of a person who has entered into a purchase and sale agreement for the acquisition of residential premises at public/electronic auctions (when selling property within the framework of a court decision on foreclosure or introducing a procedure for the sale of property within the framework of the case about bankruptcy):

Providing documents in paper form.

1. Application for cancellation of the mortgage registration record in favor of the Russian Federation in connection with the acquisition of residential premises at public/electronic auctions, signed by the buyer. 2. Original or notarized copy of the residential purchase and sale agreement. 3. A copy of the minutes of meetings and the results of the commission of the organizer of the first and subsequent auctions, certified by the organizer of the auction. 4. A copy of the act of acceptance and transfer of property acquired at a public/electronic auction, certified by the auction organizer.

Providing documents in electronic form.

1. A scanned copy of the application for repayment of the mortgage registration record in favor of the Russian Federation in connection with the acquisition of residential premises at public/electronic auctions, signed by the buyer. 2. File of the purchase and sale agreement for residential premises, signed with an enhanced qualified electronic digital signature. The file must provide the ability to verify the electronic signature in any open sources, and also contain the “time stamp” requisite. 3. A scanned copy of the minutes of meetings and the results of the commission of the organizer of the first and subsequent auctions, certified by the organizer of the auction. 4. A scanned copy of the transfer and acceptance certificate of property purchased at a public/electronic auction, certified by the auction organizer.

Consideration of applicants' applications and submission to Rosreestr of an application for repayment of a mortgage registration record in favor of the Russian Federation is carried out by the Institution within 30 working days from the date of receipt by the Institution of an application, a complete set of documents, information or funds to pay off the debt under the CJL.