Contents of the agreement

Issuing a home loan is a rather lengthy and complex process. At stake is a large amount of money that the borrower will need to repay for decades. In order not to buy a “pig in a poke”, you need to carefully read the VTB 24 mortgage agreement. It is concluded between two parties - the lender and the borrower. It is this document that determines all the provisions of the loan issued: amount, repayment terms, interest rate, insurance, rights and obligations of the parties.

The VTB 24 mortgage agreement consists of two main parts: individual conditions, rules for granting and repaying the loan. They contain vital information for the borrower.

The individual terms of the mortgage agreement indicate:

- Details of both parties. The name of the bank and full name of the client, their registration addresses, details, and passport details are written down.

- The subject of the agreement is the intended purpose, the amount of the loan issued, the date of its repayment, the amount of the monthly payment, the interest rate.

- Procedure for calculating interest.

- The subject of the mortgage is a detailed description of the property that serves as collateral. This section indicates the number of the real estate purchase and sale agreement and the details of its former owners.

- Loan collateral – guarantor details and collateral information. The value of the property and the duration of the mortgage are indicated.

- Insurance – the client is obliged to insure the property annually; all possible risks and the amount of the insured amount are listed.

- The procedure for provision is the scheme of settlements between VTB and the borrower, the list of requested documents.

- Other conditions - information on forming a request to the BKI, processing personal data, the procedure for writing off funds to pay off debt.

It is necessary not only to familiarize yourself with the individual conditions, but also to check whether the data and information about the purchased property are correct. There should be no inaccuracies or errors in the mortgage agreement.

The “Rules” indicate precise definitions of all terms, detailed information on the process and servicing of the loan. There is quite a lot of information. It is better to study them at home, rather than at a bank branch. The borrower can ask for a sample document and read it in a calm atmosphere, thinking about all the nuances.

Important! The VTB mortgage agreement must indicate the full cost of the loan issued, taking into account all additional costs. The client must also remember about the insurance, which he pays at his own expense.

List of additional documentation

VTB 24 Bank has the right to request additional documents from a client who does not take out a military mortgage and refuses to take part in the “Victory over formalities” program:

- certificates of unclosed loans that were taken out from other financial institutions indicating their amount;

- statements from savings and savings bank accounts;

- marriage contract.

It is not necessary to show the following documents, but their presence may increase the chance of getting approved for a home loan:

- diplomas confirming successful completion of educational institutions;

- an employment contract concluded with the main employer;

- extracts from Rosreestr for real estate owned by the borrower;

- documents for the car.

Essential conditions

The main indicator that is taken into account when obtaining a loan is the interest rate. If for consumer loans it is fixed, then for housing loans the rate can be variable. In the first part of the VTB 24 mortgage agreement, in the “Individual conditions” section, detailed information on the amount of accrued interest is specified. The borrower must pay attention to this information:

- Interest rate type.

- The minimum and maximum interest rate for the entire loan term.

- The date of revision of the interest rate and the frequency of this procedure.

- The amount of the monthly payment and the date of its payment.

- The amount of the penalty for violation of repayment terms and the procedure for its calculation.

- The amount of commission charged for the loan issued.

Only after analyzing this information does the applicant decide whether to take out a mortgage from VTB or not. The monthly loan payment should not exceed half of the borrower's net income. Otherwise, it will be very difficult for him to repay the loan, and there is a high risk of overdue debt.

It must be remembered that VTB has the right to confiscate acquired property if there is a large amount of debt. If you can no longer pay your mortgage, you must immediately apply for restructuring. This article describes in detail the procedure for providing it.

Applying for a mortgage at VTB 24

Applying for a mortgage at VTB 24, as in all banks, involves several procedures, the specifics of which you need to know in order to simplify and speed up the process.

Applying for a loan

To begin, the borrower must contact VTB 24 Bank to apply for a mortgage.

This can be done either in person at the nearest bank branch or by filling out an online application.

The questionnaire includes personal information about the borrower, which must subsequently be confirmed by relevant documents, and the proposed mortgage program.

Visit to the bank

If the borrower submitted the application online, the first visit to the bank will occur after the response to his application.

VTB 24 Bank employees will advise you on the chosen program and the necessary documents that should be provided to confirm the information.

It is best to choose a VTB 24 bank branch that is as close as possible to your place of actual residence or purchased property, since in the future you will have to visit the bank more than once.

Preparation of a case of documents

To apply for a mortgage at VTB 24, you will need the following documents, the collection of which is best started in advance so as not to delay the procedure for concluding an agreement:

- A copy of all pages of the Russian citizen’s passport, as well as an additional identification document (foreign passport, driver’s license);

- A copy of the employment contract or work record book, certified by the employer or notarized;

- Certificate of income in the established form for the last six months;

- Taxpayer identification code;

- For pensioners - a copy of the Pension Certificate;

- For those liable for military service - a copy of the military ID.

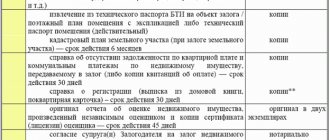

Depending on the chosen program and individual situation, VTB 24 Bank may require additional documents, and then you must provide those related to the real estate purchased with a mortgage.

Review of documents and bank decision

After submitting a complete package of documents, VTB 24 Bank specialists review them to confirm all the requirements that are established for the borrower.

After this, the compliance of the real estate purchased with a mortgage with the liquidity market and living conditions is also checked.

After this, an affirmative decision is made, which is valid for 4 months .

This procedure can take from a week to a month, depending on the speed and completeness of submission of all necessary information.

Registration of insurance

Pledged real estate is subject to mandatory insurance against the risks of loss or destruction of property.

The client is also invited to insure his life and health.

Personal insurance is optional but reduces your interest rate by 1% .

The insurance contract is concluded together with the mortgage; the insurer is a company accredited by VTB 24.

Conclusion of an agreement

The agreement is signed by the borrower personally after its final text has been prepared by specialists from VTB 24 Bank.

All conditions are taken into account, as well as possible changes and sanctions.

After this, the borrower is given money to purchase real estate on a mortgage with its further transfer being secured by VTB 24 Bank.

The procedure for issuing and servicing a mortgage

According to the terms of lending at VTB, funds are provided to the current account. It opens before completing a transaction in Russian rubles. It is also necessary to insure the purchased property. But this can only be done in an accredited company. Their list is indicated on the VTB website.

Once all the papers are ready, you can set the day of the transaction. The borrower signs a mortgage contract and a purchase and sale agreement, a mortgage deed from a notary. After this, settlements are made with the seller of the property. The new owner must register ownership of the property within 30 days.

The first mortgage payment is due in a month. Its size and date of payment are indicated in the repayment schedule. A mortgage loan from VTB is repaid in equal payments. The client chooses a convenient payment option: cash at the cash desk, at terminals, or by bank transfer from an account. The main thing is that the funds are transferred on time.

Attention! Before confirming a payment order, you must carefully check all the details. Responsibility for the correctness of the specified data lies solely with the payer.

Consequences of signing the agreement

Once the borrower has read the contents, the parties move on to the stage of concluding an agreement. This procedure is carried out directly at the VTB 24 branch, where the borrower and an authorized representative of the credit institution sign the document, after which the agreement is stamped. In total, the lender prepares two copies of the agreement, one of which is handed over to the borrower, and the second remains in storage at the bank.

Let's move on to an equally important issue regarding the issuance and servicing of a loan issued by VTB 24. According to the terms of the agreement, borrowed funds are transferred to an account previously opened for this purpose. In this case, the loan is provided in rubles.

At the same time, an agreement is signed with the seller and the insurer. Moreover, the latter is allowed to be concluded exclusively with a company accredited by the bank. A complete list of insurers can be found on the credit institution’s website.

Download the terms and conditions for providing a VTB 24 loan

Following the completion of the transaction and the signing of all contracts, the procedure for transferring the property as collateral is carried out by registering a mortgage in a notary’s office.

The final stage is calculations. Moreover, from the moment the funds are transferred to the seller, the borrower is given a thirty-day period to register ownership, and after another month, the borrower must make the first payment according to the schedule established by the lender.

The bank does not make any special requirements regarding the mortgage repayment procedure. The main thing is that payments are made on time and in an amount corresponding to the amount of the contribution specified in the loan agreement.

In this case, the client is allowed to repay the loan:

- through the cash desk of a bank branch in cash;

- through bank terminals;

- non-cash transfer from the account.

Calculate the mortgage amount using a calculator

Calculate your mortgage.

Sample contract 2021

You can get an example of a loan agreement with VTB Bank in a couple of minutes. The “Rules” are an integral part of it. We also offer you their current version - download from this link. All information is reliable. Study the tariffs you need and make the right decision.

What kind of income certificate does the bank request?

A bank certificate is a form for an official income statement approved by a financial institution. The bank requests it if the borrower cannot bring form 2-NDFL.

What should be reflected in it, where can I get it?

VTB 24 Bank requests from its clients a certificate of income for the current and past calendar years.

The paper should reflect the following data:

- Full name and position of the client;

- information about the employer;

- salary after taxes;

- Full name of the company director and chief accountant, as well as the phone number of the accounting department.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 302-76-94

Pitfalls you need to be aware of

The volume of documents is quite large. If you have no experience working with banks, then it is quite difficult to study all the material. The client may not understand all of its provisions and miss important information. To avoid any unpleasant surprises later, you need to pay attention to the following points:

- Insurance – you must pay for the policy throughout the entire loan term. If this condition is not met, then the bank increases the rate by 1%.

- Without the bank's permission, only close relatives can be registered in the purchased apartment.

- In order to rent out an apartment or carry out redevelopment in it, you need to obtain permission from the mortgagee.

- If all the terms of the agreement are not met, the bank may demand early repayment of the entire debt amount.

- Every year, the client must provide documents on his income, papers on payment of utilities, mandatory payments and taxes. The lender must ensure that the individual does not have any debts. Their presence may lead to the seizure of the collateral by third parties.

If the applicant still has any questions, they can be asked to a bank employee. But the manager is a stakeholder, so his answer may be biased. It is advisable to consult with an experienced lawyer. This way, the client will be confident that there are no pitfalls in the agreement.

You can also get a free online consultation from our qualified specialists. Ask questions and get answers instantly.

We wrote a lot of useful information about mortgage lending in this article.

Important terms of the contract

When drawing up a mortgage agreement, you should carefully read it and especially pay attention to the following conditions:

- Insurance. Depending on the bank, insurance requirements can be completely different. Among the obligatory conditions, VTB Bank puts forward insurance of the real estate itself, as well as the life and health of the borrower. This condition applies to VTB for each mortgage program. The law does not provide for compulsory insurance, but often it is the refusal of insurance that is the reason for the refusal to grant a mortgage. In fact, insurance is a pretty good deal. You must carefully read the list of insured events and other conditions.

- Other requirements. It is especially important to provide for the right to early (partially early) loan repayment. Thanks to early repayment, the borrower can significantly save his money.

- Responsibilities of the borrower. This point should be studied with special attention. All terms of interaction with the lender during the period of use of borrowed funds are reflected here. Violation of any obligation entails the imposition of penalties.

Filling process: step by step

In principle, in order not to mislead readers and confuse them, it is worth immediately noting that all loan agreements are the same.

Mortgage agreement

If we talk about what a mortgage agreement at VTB Bank consists of, then, according to its sample, we can outline the following list of information that must be included in it.

- The full name of the lender company, in this case, VTB Bank, and the borrower - full name of the individual.

- Conditions of a contract:

- personal data of the debtor (registration, actual address of residence, bank card number, passport series and number);

- information about the loan (mortgage loan size, term of use of loan funds, interest rates, monthly payment amount, intended purpose);

- security (if any: pledge, surety);

- information about the subject of the loan (name of the company selling the real estate or his full name, address, description and type of real estate, documents about the current owners of the subject of the mortgage);

- insurance risks.

- The date of entry into force of the loan agreement, the lender's current account number, according to which the borrower will have to make monthly payments.

- Warning agreement on the transfer of information about the loan to the Credit History Bureau.

- List of rights and obligations of the borrower.

- List of rights and obligations of VTB Bank.

- Information about the responsibilities of the parties in the event of failure of one of them to comply with the terms of the mortgage agreement.

- Signatures of the parties.

Also, it should be noted that by agreement of both parties, additional points can be added:

- Expiration date (validity) of the agreement.

- Procedure for making changes due to certain changes.

- The procedure for resolving controversial situations, as well as the definition of this, that is, a list of situations that can be considered controversial.

Contract of sale

An agreement for the purchase of real estate within the framework of the use of credit funds, according to a sample agreement for the purchase and sale of an apartment under a mortgage from VTB Bank, must include the following information.

- Personal data of the buyer-borrower (standard list of information).

- Information about the subject of the agreement - the apartment (where it is located, how much it costs, who the seller is).

- Seller's personal information:

- VTB Bank as an intermediary;

- an individual or legal entity as the direct owner;

- Indicate what the property consists of (how many rooms, what building material is used, indicate the type of property).

- Information about the cost of the apartment.

- Warranties given by the seller to the buyer.

- Payment procedure between the parties.

- Rights and obligations of the parties.

- Responsibility of the parties.

- Contract time.

- Signatures of the parties.

Loan agreement

If we are talking about a regular, standard loan agreement, then the process of filling it out requires, oddly enough, significantly less data from the borrower and the lender.

- Personal data of the borrower;

- Information about the lender;

- Information about consumer cash loans:

- sum;

- deadlines;

- interest rates;

- fines and penalties for late payments;

- monthly payment amount.

- Data on the expiration date of the agreement;

- List of rights and obligations of the parties;

- Responsibility of the parties and cases in which it occurs;

- Signatures of the parties.

Example of a VTB Bank loan agreement:

Rules for provision and repayment

The second part of the agreement is the general rules for the provision and repayment of debt. This document explains the meaning of all financial concepts that are used in the agreement, and also talks about all the main points of the transaction. This document consists of the following sections:

- General provisions - it is stated here that the rules are an integral part of the loan agreement.

- Designation of main terms – this section explains the meanings of the main terms that appear in the loan agreement.

- The procedure for granting a loan - describes the mechanism for issuing a loan to the borrower.

- Lending conditions - this section contains the client’s procedure depending on the transaction scheme.

- Conditions for the onset of the title period (if the property is purchased on the secondary market) - the mechanism for concluding a title insurance contract is explained.

- Risk insurance conditions - this contains information about what risks property, life and health must be insured against, as well as a description of the insurance mechanism.

- The procedure for using a loan and its repayment - this tells how the borrower can service the loan, pay interest, and the order of debt repayment

- Rights and obligations of the parties - this section describes what the borrower must do during the entire term of the agreement, as well as what rights he has. The rights and obligations of the creditor are similarly indicated.

- Responsibility of the parties - here we are talking about the consequences that await the borrower for failure to fulfill obligations.

- Other conditions are the final section of the rules. It contains important legal information that was not included in the previous paragraphs of the rules.

rules, you can familiarize yourself with them before concluding a transaction by following the link.

Rules and recommendations for filling out a mortgage loan application

When filling out an application, you must be guided by several principles:

- Credibility. Each question must be answered honestly. There is no point in deceiving the bank, since false information will be revealed in the first stages of verification.

- Attentiveness. If you mistakenly indicated the wrong phone number or made inaccuracies in writing information about yourself, your employer and relatives, this may cause the bank to refuse.

- Objectivity. Before entering information about the requested loan amount, calculate the payment and repayment period in advance. The bank may reject your application if your income is not commensurate with the required loan amount.

In addition to these recommendations, you need to adhere to formal rules: The borrower himself must fill out the form. If a bank employee does this for him, then before you sign, you need to carefully check what is written:

- All fields of the form must be completed. The exception is the “Job Information” section. When applying for a mortgage for the military, this block remains empty.

- If you fill out the document by hand, you need to use blue or black ink. It is advisable to write in legible handwriting and block letters. Corrections and blots are not allowed. If they exist, they must be certified by your signature.

The application form is submitted to the bank branch along with documents. Before contacting the bank, it is recommended to check the details of documents and certificates with what is written in the application form. Remember that misspellings and illegible spelling of words may result in your mortgage being denied.

APPLY FOR A MORTGAGE AND FIND OUT A DECISION QUICKLY A mortgage agreement is the main document that defines all the terms of a loan for an apartment at VTB 24, including the procedure for resolving conflict situations. It contains all the main parameters of the transaction, the rights of the parties, obligations, fines and sanctions that will be applied for failure to comply with the conditions. So, familiarizing yourself with the text of the contract before signing is not a recommendation, but a necessary action of the client. Let's try to figure out what pitfalls the VTB 24 mortgage agreement contains and what to pay attention to before concluding a deal.

Sample filling

The application form can be taken at the branch or on the official VTB website. If you plan to fill out an application at home, download the form from the link.

The entire document is eight pages. Let's consider the order of filling out each of the items.

Introductory information

At this point you need to select your client status - borrower, guarantor or mortgagor. Here you also need to enter your full name and date of birth. If you are a guarantor and a pledgor, then indicate the degree of relationship in relation to the borrower. Source of information about the banking product Select the source of information from which you learned about the VTB 24 mortgage program. You need to tick one of the proposed options: from an advertisement, on the recommendation of friends, on the recommendation of a construction company or realtor, etc. If none of the options are suitable, you can write your answer.

Personal details of the applicant

Fill in the following information:

- Please provide your insurance certificate number and Taxpayer Identification Number. The taxpayer number must be entered if there is no SNILS.

- Next, you need to fill in your residential address: zip code, country, region, locality, district, street, house, apartment. If your place of residence coincides with your registration address, then check the appropriate box. Below you need to indicate on what basis you live in the apartment: rental agreement, by right of ownership, with relatives.

- In the contact information section, you need to enter five phone numbers: mobile, additional number, home number at the address of residence and registration (if the addresses are the same, then the same number is entered), work phone. You also need to enter your email address here.

- In the “marital status” item, your marital status is indicated (single, divorced, married, etc.). If a marriage contract was concluded with your spouse, then you need to indicate its existence. If you changed your last name, first name or patronymic, then write your data (full name) that was valid previously. If you change data multiple times in this column, you must indicate the previous full name before the last change. You can enter previous changes in the additional information section.

- Information about children: you must enter the full name and date of birth of the children. Opposite the information about each child, you need to tick the options: lives with you or not, is dependent or not.

Education information

In this section, you need to mark the appropriate option for the education you have received: secondary, higher, incomplete higher, below secondary, academic degree, etc. If several options suit you, then tick several answers. Please indicate the name of the educational institution below. If you graduated from several educational institutions, then you need to write about the rest on an additional sheet.

Information about work activity

In the first paragraph, indicate whether you are a payroll client of VTB 24. If yes, then write your bank card number. In the paragraph about the place of work, you need to select one of the proposed options for types of employment: hiring, your own business, individual entrepreneur. If you are an employee, indicate the type of employment contract and its duration. Write below:

- job title;

- experience;

- monthly income (after taxes);

- legal name of the enterprise (for example, LLC “Salut” or IP Smirnov);

- address of the actual location of the organization;

- employer's telephone number and tax identification number.

In the next step you need to select the industry of the enterprise. If the company is engaged in services, then you need to clarify the scope of activity. If there is no suitable option among the proposed options, then enter the company’s industry in a separate column. Next, you need to indicate the approximate number of employees, taking into account all departments and the period of existence of the enterprise.

Asset information

Here you need to provide information about your existing property: bank deposits, cars and real estate. In the “Cash” section, write the amount of savings (including funds for the down payment), and the bank in which they are stored. If you have a vehicle, then you need to indicate the make, model, year of manufacture and current market value (according to your personal assessment). In the “Real Estate” column you must enter:

- Address of the object;

- type of property;

- current value;

- the basis for the emergence of the right (purchase, inheritance, privatization, etc.);

- type of ownership (personal or shared);

- your plans for real estate: are you going to sell it, rent it out, or take it out as collateral in the near future?