In what cases is apartment insurance required?

Insurance will be useful in many cases, for example, the insurance policy will fully compensate for damage caused to housing by third parties due to flooding, arson, theft and other intentional illegal actions.

The share of insured real estate in Russia is small - only a few percent. Today, at the legislative level, compulsory insurance is provided for only a few types of services (for example, insurance for military personnel or “MTPL”). Similar products do not apply to residential and property objects; they relate exclusively to voluntary types of insurance, and therefore are not included in this list.

Insurance of real estate, in particular apartments, is mandatory only when concluding a mortgage insurance agreement. If a person takes out a loan to purchase an apartment, then banks oblige these square meters to be insured, forcing them to buy a residential property insurance policy. In this case, the residential premises act as a guarantee for the execution of the loan agreement and are registered as collateral.

Accredited insurance companies:

- Sberbank - accredited insurance companies (link).

- "VTB" - accredited insurance companies (link to PDF).

- "RosBank" group "Societe Generale" - accredited insurance companies (link).

- "Raiffeisen BANK" - insurance companies that meet the bank's requirements (link).

You can find a list of insurance companies that meet the requirements of your bank on the website, or inquire at a bank branch.

Voluntary apartment insurance

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(the call is free for all regions of Russia)

Home insurance in the Russian Federation is still voluntary. Almost any owner or tenant of housing in an apartment building can insure their apartment. There is only one exception: you cannot insure an apartment or room if this premises is recognized as unfit for habitation or in emergency condition.

What else to read:

- Apartment insurance against fire and flooding

- How to insure civil liability for apartment owners

- Concept and types of property insurance

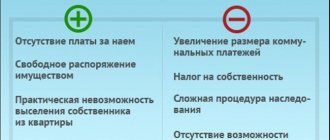

The features and benefits of voluntary insurance are obvious. It consists of receiving payments under the policy without additional rates (when damage/damage is estimated at less than 15,000 rubles), a contract for any period (from 1 month to 1 year), fairly reasonable prices, the opportunity to purchase a comprehensive policy, as well as insure only individual elements (finishing, liability to neighbors, doors, structural elements, furniture, appliances, etc.), the possibility of concluding an insurance contract without an inventory of property, protection from illegal actions of third parties.

Emergency is not a decree for the law

The All-Russian Union of Insurers (VUS) has identified 16 pilot regions where voluntary home insurance programs against emergencies could be launched first in 2021. These are the Moscow region, St. Petersburg, Leningrad, Tver, Sverdlovsk, Tyumen, Novosibirsk, Belgorod, Omsk, Pskov and Saratov regions, as well as Transbaikal, Perm, Krasnoyarsk, Krasnodar and Khabarovsk territories.

The VSS noted that a home insurance policy under the regional program, which includes the risk of destruction or damage by the elements, as well as the risks of fire, explosion, flooding, will cost approximately 150-200 rubles per month, or 1800-2400 rubles per year. A policy with a minimum set of risks - insurance exclusively against emergencies - will cost less, 350-450 rubles per year.

So far, regions are in no hurry to develop their own programs. Some of them are experimenting with including insurance fees in the receipt for payment of housing and communal services - as a separate line, as has been the case in Moscow for many years.

At the beginning of September, such a column appeared in the paychecks of Crimean residents. The monthly fee is 100 rubles, and the maximum amount of insurance payment is 150 thousand rubles.

Previously, an experiment on mass home insurance through utility bills was carried out in Yekaterinburg. Over the course of six months, 7,400 residents' receipts included a line about voluntary insurance of interior decoration and engineering equipment, as well as civil liability of the owner of the premises. The monthly fee was 230 rubles, and the maximum payment amount was 450 thousand rubles (in the event of a fire, flood, explosion, lightning strike or natural disaster). However, the majority of homeowners did not want to pay even 230 rubles per month. Only ten percent of residents were interested in the proposal.

In most regions, the share of insured housing does not exceed 10 percent

Currently, regional authorities are still deciding on the development of home insurance programs. Thus, in the Novosibirsk region, the question of whether a regional voluntary home insurance program is needed is under discussion. This was reported by the Ministry of Housing, Communal Services and Energy of the region.

A working group has been created under the Ministry of Finance and Tax Policy of the Novosibirsk Region, which includes representatives of large insurance companies. Its participants will have to assess the feasibility of such a program and the conditions under which citizens will be willing to participate in it.

The department noted that in any case, the decision on home insurance is made by the owner of the residential premises independently. The amount of the insurance premium payment under a voluntary insurance contract will be determined for each constituent entity of the Russian Federation individually.

“The inclusion in a single payment document of fees for services that are not housing and communal services is allowed only if there is an agreement previously concluded between the owners of the premises and the contractor,” the ministry explained.

Thus, the inclusion of the line “voluntary insurance” in a single payment document without a corresponding decision of the general meeting of owners of premises in an apartment building is not allowed. Despite this, some management companies include payment for housing maintenance and insurance in receipts.

In St. Petersburg, the share of insured housing does not exceed 10 percent. Moreover, the bulk are mortgaged apartments, where insurance is the basis for issuing a loan. Despite the fact that St. Petersburg is among the regions where a voluntary home insurance program will be implemented in pilot mode, there is no mass introduction of such products in the city.

In some new residential complexes, management companies often include a line about voluntary insurance in the receipt for payment of utility services, and then the residents themselves decide whether to pay or not pay.

For example, one of the city management companies offers residents an additional 250 rubles every month, the maximum payment amount is 800 thousand rubles. Interior decoration is insured for up to half a million rubles, movable property is insured for up to 150 thousand, and civil liability is insured for up to 150 thousand. The insurance is valid in case of explosions, fires, short circuits, natural disasters, thefts or floods from neighbors.

In St. Petersburg, voluntary insurance services can be included in the receipt in any home, not necessarily in a new building. To do this, residents must make an appropriate decision at a general meeting.

In the Leningrad region they took a different route. Here, the voluntary insurance program has been implemented since 2021. The local unified clearinghouse includes insurance payments as a separate line on utility bills. When the program first launched, 6 percent of residents paid for this service, but every year the number of residents who decide to get insurance is growing.

As RG was informed by the Unified Settlement Center of the Leningrad Region, this year an average of 12.5 percent of residents of high-rise buildings pay for insurance, which is about 107.5 thousand families. Last year, 11.42 percent of residents were insured.

For an apartment building, the insurance premium is 3.75 rubles per month per square meter. In case of an insured event, compensation will be up to 30 thousand rubles per square meter. In the private sector the system is slightly different. If the receipt contains the area of the house, then 6.75 rubles are taken from one “square”, and the amount of insurance coverage is 20 thousand rubles per square meter. If the area of the house is not indicated, then the resident pays 252 rubles per month; in the event of an emergency, he can count on an insurance payment of up to 600 thousand rubles.

What risks are insured?

If the apartment is insured, the insurance policy will cover damage from various insured events that may occur, for example:

- Flooding of an apartment due to an emergency in the water supply, sewerage, heating, or internal drainage systems, even if the accident did not happen in your apartment.

- Fire and consequences caused by fire extinguishing (an insured event is considered, even if the fire did not occur in your apartment).

- Wind over 20 m/sec – tornado, hurricane, tornado and accompanying rain, hail or snow.

- A gas explosion for any reason, with the exception of a terrorist attack (cases are considered even when the explosion occurred in a neighbor’s apartment).

If, as a result of an insured event, the apartment becomes uninhabitable or is destroyed, the insurance company will compensate for all losses in accordance with the property insurance policy.

Property or sociality?

Compared to the previous version of the law, the legal status of housing, which can be obtained to replace lost property, has changed. Previously, owners who lost property due to an emergency situation received a new apartment from the state not as their own, but on social rental terms. Disputes on this issue lasted for three years (the law was adopted in the first reading back in February 2015). The final version of the document states that citizens who lost their housing as a result of an emergency will receive ownership of real estate.

Package apartment insurance

This kind of insurance is one of the most popular and affordable today and makes it possible to insure an apartment and the property located in it at a low price. This form of insurance is quite convenient because it allows the client to maintain profitability at low costs.

Such insurance is called “boxed” and provides for certain risks, criteria and prices. These include different types of insurance, but in general they directly depend on the needs and requirements of the client. Most often, companies offer insurance against risks such as fire, natural disasters, theft with damage and burglary, illegal actions of third parties, etc.

The main advantages of package offers are simplicity and accessibility. There is no need to conduct an expert assessment of the insured property, inspection, or calculate the tariff and cost of the insurance policy. Boxed products, as a rule, are designed for mass insurance, since it is an inexpensive policy, and its coverage includes the most highly probable and relevant risks. “Package” insurance costs less than purchasing each policy separately.

In addition, this form of insurance has a number of advantages:

- It’s quick and easy to complete. As a rule, this process takes no more than 15 minutes, and the registration requires few documents, which ensures their clear content.

- A representative of the insurance company may not visit the client to inspect and evaluate the property. That is why this procedure is also called “express insurance”.

In addition, it includes civil liability insurance in the event that the client lives in an apartment.

How much does apartment insurance cost?

Apartment insurance (comprehensive) costs from 1 thousand rubles. It is quite difficult to give a more precise figure, since the cost of an insurance policy depends on many parameters. In most cases, the property owner independently determines all the nuances and conditions of insurance. Alternatively, the contract includes various additional risks: for example, breakage of mirrors, glass, etc. In addition, apartment insurance provides compensation for additional expenses: search for stolen or lost luxury items, restoration of locks and keys, documents, etc.

The cost of insurance of property and finishing of the apartment is 0.5% -0.8% of the insured amount. Home insurance – from 0.3% to 0.9%.

Search form for best offers

Using the search form you can find the best property insurance offers. Always current offers and best prices. See for yourself!

If you are looking for property insurance programs for a mortgage loan, before choosing any company, make sure that it is on your bank's list of accredited organizations.

FAQ

Insurance of structural elements of an apartment, what is it?

This is protection of the box of the apartment itself: walls, balcony, front door, window opening. That is, the main elements.

Is it possible to protect both the structure and the finish?

The policyholder is free to choose the option of home protection. You can protect only the structure, or you can add finishing to it and even everything that is in the home. It is clear that the price of the issue will be higher.

Mortgage constructive insurance, what is it?

This is compulsory property insurance, which the borrower leaves as collateral. Without purchasing this policy, concluding a contract is impossible.

What happens if an insured event occurs?

If the property was damaged by an event specified in the contract, the client contacts the insurance company and, after inspection and assessment, receives the compensation required under the contract.

What determines the cost of the policy?

First of all, the insured amount is the price of the property or another amount specified by the client. The price is also influenced by the type of object, its location and additional elements of protection, for example, if in addition to the design, finishing is also specified.

Sources:

- Sberbank: Mortgage insurance for real estate.

- VSK: Insurance policy “Constructive”.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What affects the cost

The cost of an insurance policy cannot be determined initially. When it comes to the form of individual insurance, a representative of the insurance company comes to the insurance object and conducts a detailed inspection, after which he gives an assessment and conclusion, on which the final price of the policy will depend. The tariff itself is determined taking into account several criteria: the year the apartment was built, the number of storeys of the building and the floor of the insured apartment, the material, whether the building has a basement, an elevator, security, etc.

In general, the cost of home insurance depends on the risk of damage. For example, what is the difference between insuring a wooden house and an apartment? The fact is that the risk of damage to a wooden structure is much higher. Accordingly, the payment for it will be much higher.

If the owner rents out the apartment, then the price will also be higher, since the owner of the apartment is less interested in its integrity. The cost is reduced if there is an alarm system, security guards, and iron entrance doors. Insurers call “risks” everything, even minor nuances, from which it is recommended to protect the apartment.

The main risks include:

- Fire.

- Gas problems.

- Natural disasters.

- Flooding.

- Entering a premises with damage and theft of property.

Insurance that includes the above parameters is called comprehensive. Most often, in addition to apartment insurance, it also provides for civil liability to all neighbors.

To summarize, we can conclude that the cost of insurance is calculated taking into account separate criteria:

- The interior of the room (wall decoration, renovation, flooring, interior, etc.).

- Engineering communications (plumbing, heating, electrical, sewerage, etc.).

- The structure of the room (walls, balconies, windows, doors, ceilings, etc.).

- Furniture and appliances.

In addition, the duration of the policy is taken into account.

Who needs compulsory property insurance

At the end of 2021, the government developed a bill, according to which the state, insurance companies and citizens are assumed to be collectively responsible for the financial security of property interests in real estate. The purpose of the regulatory act is to increase people's responsibility for the maintenance of their own and rented apartments, houses and other residential properties. In addition, the planned introduction of a new insurance system will help stimulate this market segment and increase the revenue side of the country's budget.

Article on the topic: Features of the federal law “On compulsory health insurance in the Russian Federation”

Today the principle of voluntariness still applies, but citizens living in the following conditions should insure their property:

- seismically dangerous regions;

- old and dilapidated houses;

- an area where natural fires often occur;

- areas located near bodies of water that cause catastrophic floods.

In addition, when deciding on real estate insurance, you should pay attention to the list of risks included in the agreement. The latest law gave regions the right to draw it up independently, not limited only to the consequences of natural disasters.

Important! To attract a larger number of citizens, the contract may include such risks as man-made disasters, terrorist attacks, military operations, riots, local destruction on the scale of an individual apartment - flooding, fire, household gas explosion. In preparation for the transition to compulsory home insurance, a gradual reduction in the amount of compensation is being carried out for citizens who refused to join the current program voluntarily.

If there are luxury items in the apartment, are they covered by insurance?

All valuable items in the apartment are subject to insurance together with the apartment or separately. The form of insurance depends solely on the preferences and desires of the property owner. Moreover, the criteria may be different in different rooms. Thus, it is possible to include in the insurance contract only jewelry located in the apartment or an antique set that is in the living room.

An example of calculating apartment insurance

Each insurance company has its own price, so it is worth considering approximate methods and figures that are as close as possible to real ones.

For example, a client purchased a fixed box package of a policy with certain risks (fire, gas explosion, theft with damage, flooding, terrorism, natural disasters, glass damage, actions of intruders, damage to electrical equipment), and such a package already initially has a set tariff, which depends on the insurance company itself, the number of risks and is depicted as a percentage.

The price of an insurance policy for an apartment in a multi-storey building (structural elements) at the established rate of 0.11% per year of its value. Accordingly, if the price of an apartment is 2 million rubles, then insurance for a year will cost 2,200 rubles. (0.11% of these 2 million).

The price of insurance for furniture and equipment is from 0.5% per year of their value (determined by an expert during inspection). Let's assume this amount is 250 thousand rubles, which means the cost will be 1,250 rubles.

The price of interior decoration insurance is 0.4% per year of the value determined as a result of the inspection. Let's say the insurer valued it at 600 thousand rubles. Therefore, the price will be 2,400 rubles.

The price of civil liability insurance starts from 0.5% per year (this is the amount of insurance desired by the client). Let's say it is 200 thousand, therefore, the price will be 1,000 rubles.

As a result, the total amount is 6,850 rubles. per year (total 2,200 + 1,250 + 2,400 + 1,000).

How much will it cost

Since the new law has a number of shortcomings and does not have a perfect implementation mechanism, its implementation is quite slow, especially in the periphery. Today, compulsory home insurance is carried out on a large scale only in Moscow and Krasnodar. In these cities, the tariff is set at 1.87 rubles per square meter of total housing area. Approximately this figure should be expected for central Russia, where the risk of natural disasters is minimal.

As for areas where there is a high probability of floods, fires, landslides, and accidents at industrial facilities, the price there can vary between 2-5 rubles per square meter. The same applies to wooden houses and buildings with an expiring resource or in a pre-emergency condition.

Thus, in prosperous areas, the payment of the owner of a two-room apartment will be about 100 rubles per month or 1200 per year. Those living in risk areas will have to pay up to 250 rubles under the contract. per month and up to 3000 per year. The amounts are small and quite affordable even for pensioners.

Related article: Description of the rights of citizens of the Russian Federation in the health insurance system

Note! You can familiarize yourself with the terms of the contract on the website created by local authorities together with insurance companies. There are no general rules for all, since each entity develops its own list of risks.

What compensation can you expect?

Damage assessments are carried out by specially created local commissions after receiving requests from victims. If the housing is completely destroyed (burnt down, carried away by water or mud flow), then its assessment is carried out on the basis of documents available in the archive or an electronic database.

The maximum amount of payments is 500,000 rubles, it can be reduced by decision of local authorities to 300,000 rubles, if there are appropriate reasons for this. The procedure for determining the amount of compensation was approved by Government Decree No. 433 of April 12, 2019.

The following indicators are taken into account:

- the type of material from which the building is constructed;

- age (degree of deterioration of the structure);

- type of housing (room, apartment, house);

- total area of the room;

- average market value per square meter in the region.

The estimated amount of compensation is up to 20% of the price of the new living space. Victims have the right to choose an apartment from the municipal fund or receive money to purchase new housing.

Is it possible to save money and how?

Discounts for apartment insurance are made; they directly depend on two factors: the insurance company itself, as well as its features. Some insurance organizations quite often provide significant discounts to regular customers, while some prefer to cooperate without discounts at all. In most cases, discounts are provided if the policyholder has special CASCO or OSAGO policies from Ingosstrakh.

In addition, one of the ways to save money is to include an unconditional deductible in the insurance contract. The franchise operates as follows: under the terms of the agreement, a (fixed) amount is established within which the property owner will not contact the insurance company, but will fulfill all obligations under the contract himself (for example, for apartment repairs). In this case, savings can be up to 15-20% of the policy cost.

Provisions and essence of the law

In 2021, funds for restoration and elimination of natural disasters were taken almost entirely from the state budget. However, if the compulsory insurance bill comes into force next year, the number of financial sources will increase. Let's pay attention to them:

- the state budget;

- regional or regional budget;

- payments from insurance companies.

In practice, by combining payments, the new law will increase the amount of compensation to victims of a natural or other disaster. This will allow you to manage funds more efficiently and create fundamentally new programs to protect property.

benefits can the following bring to the regions :

- consolidation of payments from the budget and insurance companies, their rational use for the speedy restoration of housing and property;

- effectively organize the distribution of funds between government and insurance organizations;

- increase the interaction of authorities in eliminating the consequences of a disaster.

An analogue of compulsory insurance has been operating in Moscow for several years. In what situations can you expect compensation? In addition to complete or partial loss of housing, citizens can count on compensation in the following situations :

- in case of gas leak or fire;

- domestic fire;

- damage to real estate by unscrupulous citizens;

- damage to water supply or sewerage areas.

If a law on compulsory insurance is introduced, owners of apartments and buildings can count on 100% compensation . The calculation will be based on the total area of housing and its market value.

Each subject of the Russian Federation can introduce its own insurance programs and a citizen has the right to count on new housing. For example, an apartment in a new building or social housing. Everything will depend on the type of property rights that were in force before the natural disaster.

IMPORTANT! The victim may refuse insurance payments in favor of a regional program in order to receive greater monetary or property compensation.

The victim can also count on compensation from the state, in addition to regional programs and insurance payments.

In the absence of a mandatory one, the citizen can only hope for a government restoration program. Moreover, the calculation will be carried out according to the legislative norms provided for by the liquidation program.

A citizen can count on social housing, which remains the property of the state and no rights or actions (sale, inheritance) are provided.

The bill does not impose any restrictions on the transfer of housing ownership. This suggests that so far only in theory, the victim can receive ownership of an apartment or building. On the contrary, vulnerable segments of the population are provided with certificates or subsidies for obtaining or purchasing new housing.

How is insurance compensation made if an insured event occurs?

Payment of insurance compensation is established according to the amount of damage, but not more than the amount established in the contract. The legal basis for payment is a court decision that has entered into force.

Clients who insure an apartment with a mortgage simultaneously insure their title, so they can additionally insure the risk up to the full cost of the apartment, thereby protecting their down payment.

Before signing an agreement that provides for all the risks regarding the owner’s real estate, it is recommended to read the agreement and ask questions to an employee of the company or bank on any unclear point. In addition, you can get advice from a lawyer who will help you understand all the issues: choose a banking product without any additional overpayments, and also check the insurance contract for compliance with legal requirements.