For modern people, a mortgage is one of the most popular ways to acquire their own home...

In the first half of this year, the mortgage market grew by 16%, breaking the 2014 record. Experts expect that by the end of 2021, the volume of issued housing loans will be a record in the entire history of the mortgage market in Russia.

Many Russians are already accustomed to mortgage agreements, as well as the obligations acquired in connection with their conclusion. But the mortgage agreement has its own characteristics - knowing them, the borrower will be able to choose the most favorable conditions for himself.

The real estate portal superrielt.ru found out from lawyer Oleg Sukhov what points you should pay attention to when concluding such an agreement.

Borrower's obligations

The borrower should study all clauses of the contract where his obligations are stated. If you can’t figure it out on your own, use the services of lawyers who can explain any ambiguities and also assess the risks that arise if these conditions are not met.

Many borrowers do not attach importance to the clause requiring them to inform the bank about significant changes in their lives. So, you must immediately notify the bank if your financial situation changes. Otherwise, if a mortgage refinancing is required in the future due to a difficult financial situation, the lender may refuse and even charge the borrower a fine for concealing information.

It is also necessary to evaluate the deadlines for fulfilling obligations and the form in which they need to be fulfilled. If the contract requires notification, then does it need to be in writing, etc. To clearly evaluate and calculate the time for a particular action, write down all the deadlines specified in the contract in a separate table.

When finance sings romances

Among the pitfalls of a mortgage agreement, a special place is occupied by the conditions for unilateral termination of the agreement at the initiative of the bank. Moreover, the most common reason for such an initiative on the part of the creditor is that the borrower has become a debtor or has missed payments several times. There may be a penalty that you will have to pay in addition to the principal debt when parting with the mortgagee.

The mortgage agreement also stipulates penalties and fines that await the debtor if he evades payment of monthly installments.

Theoretically, they can be challenged in court in the future, but it is better not to bring the debt situation to this stage. You should also not avoid contact with bank employees, because this will be interpreted as your unwillingness to comply with the loan agreement and may speed up the process of selling the collateral under the hammer to cover the debt.

An alarming signal for the bank is the presence of more than three late payments per year or arrears in payments for more than a month. If there is such a picture, the bank will offer you to terminate the contract and pay the remaining debt. Moreover, if you did not insure the risk of non-payment of the loan due to unforeseen circumstances, the insurance company in such a situation does not owe you anything, and you will cover the debt through the sale of real estate. There is a chance that even after this you will still owe the bank.

Termination of a mortgage agreement initiated by one of the parties can take place both in court and in pre-trial proceedings. Judicial intervention in terminating a mortgage is mandatory in the following cases:

- if the mortgage was issued using benefits and subsidies from the state (for example, a military mortgage);

- if the spouses are divorcing and they have minor children (the interests of the children must be protected);

- the borrower has become permanently unable to work (disability).

When the borrower has a desire and at least a minimal chance of keeping the mortgaged property, you can use the following financial instruments:

- restructuring;

- credit holidays;

- changing the payment schedule.

However, if your bank does not give you this option, you can switch to another bank. And then you will still have to go through the process of terminating the mortgage agreement.

Financial expenses

Banks often include all sorts of additional services in the contract, which, moreover, are paid. Request a printout from the bank managers, which will indicate all additional costs. Calculate their total cost and evaluate whether this amount is acceptable for you. It is also worth asking whether these costs can be reduced.

Particular attention should be paid to the points where the commission for servicing accounts is indicated. The Central Bank prohibited banks from establishing separate fees for account servicing in mortgage agreements.

In turn, the Housing Mortgage Lending Agency prohibits banks from including so-called hidden payments in the mortgage agreement. For example, legal support of a transaction, which cannot be refused, is paid directly to the bank or an affiliated legal entity. If such violations are detected, you can complain about the credit institution to the regulator.

What features of a mortgage agreement should you pay attention to?

When studying a mortgage loan agreement, experts recommend paying special attention to the following nuances :

- In addition to information about the currency, terms and amount of the loan, the document must indicate a detailed schedule of monthly loan repayments with exact payment dates and a specific amount. The schedule is printed on a separate sheet (attachment), where all parties involved in the mortgage sign and the bank’s seal is affixed, which gives the document legal force.

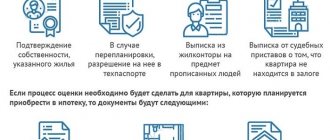

- It is mandatory that the mortgage agreement must contain detailed information about the subject of the mortgage : the location and address of the property, technical passport data, the estimated value of the property, etc. Incorrectly reflected information on the property may lead to the invalidity of the document.

- The collateral for the bank is usually real estate purchased on credit . However, some financial institutions indicate in the agreement that the borrower is responsible for all of his property, which is also worth paying attention to.

- It is believed that the client's main obligation to the bank is to make timely monthly payments on the mortgage loan. But according to the law, the borrower must also coordinate all his actions with the bank regarding the collateral. For example, carrying out redevelopments, leasing, registering family members in the living space, etc.

- When concluding a mortgage agreement, the bank reserves the right to prematurely terminate the document in the event of the debtor's insolvency or late monthly payments. It is advisable that the contract indicate how many times delay can be allowed. An important point is also the column where the right to sell the pledged item and the distribution of funds from its sale are written down.

- The sanctions clause is mandatory for a mortgage loan agreement . It specifies specifically, and not in general phrases, a list of sanctions applied to debtors. There should also be a column where the percentage of fines and the possibility of the bank increasing the interest rate are written down.

Insurance services

Often, when concluding mortgage agreements, insurance services are imposed on citizens. But the law obliges the borrower to insure only the collateral, and nothing is said about health and life insurance, which some lenders require.

Previously, banks actively imposed life insurance on borrowers. Despite the fact that this practice was recognized as illegal, it can still be encountered today. In addition, do not forget: even if, on the recommendation of the bank, you have additionally entered into a life insurance contract, you can cancel it within five days.

Insurance - what and who do you pay for?

You are studying a mortgage agreement - what should you pay attention to first? Start with the cost and content of the insurance the bank offers. By law, only insurance of the mortgaged property itself is mandatory, but banks diligently impose comprehensive insurance.

On average, insurance costs the borrower 0.5-1.5% of the debt amount per year.

In addition to mandatory insurance, comprehensive insurance includes risks that you will be offered to insure on a voluntary-compulsory basis:

- title (if the property is secondary);

- reliability of the developer (for new buildings);

- your health, loss of ability to work.

On the one hand, given the term of the mortgage loan, such precautions can be very useful. The nuance is that formally you have the right to purchase an insurance policy from any company. But each bank cooperates with the insurer and is interested in you purchasing partner insurance. Often, as sanctions for refusing comprehensive insurance, the already mentioned increase in the interest rate is practiced, so that it is cheaper to buy an imposed policy.

The borrower has the right to choose the insurance company.

Here's what you need to remember about insurance:

- all risks are insured in favor of the bank;

- in order to insure the down payment or the likelihood of non-payment of the loan in your favor, you need to purchase additional insurance, which is not included in the comprehensive offers;

- if you paid for insurance in advance for three years, and a year later paid off the mortgage early, you are unlikely to return the unused insurance payment;

- within five working days (cooling period), you have the right to cancel insurance with minimal losses.

When planning the costs of a mortgage, insurance occupies a very important position among other expenses, so pay special attention to its preparation.

Early loan repayment

Carefully study the clauses of the agreement, which indicate the consequences of early repayment of the loan. Is there such a clause in the contract? According to Article 810 of the Civil Code, the borrower has the right to repay the loan early. Therefore, even if there is such a clause in the document, it cannot become an obstacle to the exercise of this right. But keep in mind: the article says that the borrower must notify the bank about early repayment of the loan at least 30 days in advance.

Also pay attention to the repayment procedure, terms and other existing conditions. The Civil Code leaves this at the discretion of the creditor. Therefore, study all the provisions regarding such issues.

Remember: banks do not have the right to collect a fine for early repayment of a loan, nor to establish permanent or temporary prohibitions in this regard in the agreement.

What should you pay attention to when applying for a mortgage?

When applying for a mortgage, the bank carries out all operations independently. He evaluates the property and approves the loan only after a full legal review. The mortgage agreement and the purchase and sale transaction are concluded simultaneously.

When choosing a mortgage program, pay attention to the following nuances:

Additional expenses

In addition to the interest rate, you need to pay attention to the following additional costs:

- Bank commissions. Some banks don't advertise them, but these payments can significantly increase your monthly mortgage payment. To avoid unpleasant surprises, carefully study the contract.

- Payment terms. Delay results in fines and penalties. It is better to make your monthly payment a couple of days earlier than to make excuses and incur additional expenses later.

- Penalties for early repayment. Unfortunately, this issue has not yet been resolved. Some banks do not allow their clients to pay monthly amounts greater than what is specified in the agreement. Early closure of the mortgage in this case will lead to a significant monetary loss. Even if you do not plan to repay your mortgage early, choose a credit institution that will not fine you for depositing funds “in excess of the limit” (in a few years, your financial situation may change for the better).

- Conditions for increasing payments. Some programs are pegged to the dollar, and when the quotes of this currency increase, the amount of contributions also increases. Often banks tie their long-term programs to the established rates of the Central Bank. If rates are raised by the Central Bank, the credit institution will increase the mortgage interest rate.

- Insurance. Additional costs include property and life insurance of the borrower. If the first option cannot be disputed, then life insurance can be refused. But then you may be denied a loan.

Restriction of rights to real estate

Purchasing an apartment with a mortgage allows the owner to use the property and live in it with his family or third parties. But some banks limit this possibility, allowing only members of your family to move into the apartment. Until the full payment of the cost of the property specified in the contract, the property is pledged to the credit institution.

Complete turnkey apartment renovation

- Everything is included The cost of repairs includes everything: work, materials, documents.

- Without your participation After agreeing on the project, we only bother the owners when the repairs are completed.

- The price is known in advance. The cost of repairs is fixed in the contract.

- Fixed repair period Turnkey apartment renovation in 3.5 months. The term is fixed in the contract.

Read more about Done

The owner cannot dispose of the apartment, which is pledged to the bank. That is, he cannot sell, give or bequeath it. By law, this can be done, but 99.9% of banks do not agree to dispose of their property until the last mortgage payment is made.

Maintaining collateral

You can pay off your mortgage in different ways:

- Fully. After transferring the amount, the bank transfers documents for the property.

- Annuity payments. Interest is paid first, then the principal amount of the loan. The payment amount does not change throughout the loan term.

- Differential payments. The loan body is paid monthly in equal shares, and the interest accrued for the current month is also paid. The payment amount gradually decreases throughout the loan term.

If the borrower plans to pay more than the monthly payment, the bank must be notified about this. In some cases, you can get by with a phone call, in others you will have to visit the department of a credit institution.

Do you need repairs?

We have already renovated more than 500 apartments, we will be happy to help you too

Find out the cost of repairs