Quite a lot of judicial practice has already shown that in bankruptcy proceedings, managers with some regularity cause damage to the parties in the form of large-scale losses.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

This can happen through oversight, from the carelessness of a specialist, or from a number of other reasons, leading to such fatal errors that entrepreneurs or legal entities suffer from it.

That is why today almost any arbitration manager seeks to insure his activities so that during the occurrence of an insured event, he could cover the damage to the injured parties.

What features does it have?

According to the rules of Article 15 of the Civil Code of the Russian Federation, no matter what the losses, they are all subject to recovery. A person who has suffered losses has every right to demand compensation from the culprit for their losses in full. The amount of repayment of these payments to the victim may also be established in the contract.

And if the actual amount of loss exceeds that specified in the contract, then the victim is entitled to payment exclusively of the amount specified in the document. In addition, the amount of compensation may in some cases also be specified in legislation.

An arbitration manager is a person who manages a company, enterprise with the aim of applying methods and methods aimed at reducing the risks of losses and reducing the growth of business, production or any other business in an economic crisis.

Such a manager performs his function strictly under the control of the arbitration court. The arbitration manager controls the activities of the debtor with the maximum positive outcome of these activities and the sale of the debtor’s property in favor of satisfying the requests of his creditors.

In Russia, an arbitration manager must be a citizen who has the citizenship of the Russian Federation and is a member of a self-regulatory organization (SRO) of arbitration managers.

In the process of checking the quality of work of these members of the SRO, any violations are always revealed, which, one way or another, fall under the responsibility of the arbitration manager himself.

It is he, in accordance with Federal Law No. 127-FZ, Article 20.4, clause 4, who must compensate for all losses that arose due to non-fulfillment or improper performance of his duties.

Therefore, the conclusion of compulsory insurance contracts for civil liability of managers with insurance companies serves as a form of a kind of full-fledged financial security in the event of damage to the debtor enterprise due to the fault of the arbitration manager.

The contract is concluded with an insurance company, firm or organization and an arbitration manager.

Management companies and their responsibilities

A management company (MC) (most often created in the form of an LLC) is a legal entity that, under an agreement with the owners of apartments in an apartment building, maintains all communications and common property.

Management company is not an entirely correct name; according to the law, a management company is a company that manages investments , but in practice it is used very widely.

CC is one of three alternatives that apartment owners can choose. You can also monitor the condition of the house and communications with the help of an HOA (homeowners' association) or direct management (a real option if there are few owners).

The management company is responsible for the quality of the services it provides. First of all, this is civil liability under a contract, which must specify specific criteria for the quality of the organization’s work and liability for violation of obligations .

Also, the Criminal Code bears civil liability under the Civil Code of the Russian Federation in case of harm, for example, when ice falls from the roof onto the property of third parties or a person . Additional liability may arise when the management company violates the standards for the maintenance and repair of an apartment building.

According to Art. 7.22 of the Code of Administrative Offenses of the Russian Federation, the maximum penalty is a fine in the amount of up to 50 thousand rubles. It can hardly be called significant, so the main tools for influencing the management company are civil liability, market competition and insurance .

there is practically no competition in the housing and communal services market at the moment , so the introduction of compulsory insurance for management companies can become a relatively effective measure .

Legislative framework and terms of the contract

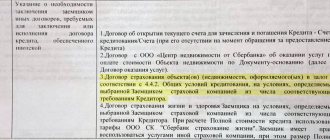

In the new edition of Federal Law No. 127-FZ “On Insolvency (Bankruptcy)”, which entered into force on July 1, 2009, some conditions of the insolvency practitioners’ liability insurance agreement have changed:

- Article 20, paragraph 3 - they cannot be members of a self-regulatory organization (hereinafter referred to as SRO) without concluding an insurance contract due to the risks of causing damage to persons who take part in the bankruptcy case; arbitration managers cannot. Which automatically makes this type of insurance mandatory.

- Article 20 clause 1 – membership in an SRO is mandatory, as is insurance.

- Article 34 reflects information about persons who are involved in a bankruptcy case:

- arbitration manager;

- debtors;

- creditors;

- federal bodies of local self-government and executive power;

- bodies authorized to conduct bankruptcy proceedings;

- a person who provides everything necessary to ensure financial ordering, recovery and alignment.

This Law stipulates that there are four types of insolvency practitioners.

All of them are approved, sent by the arbitration court and are authorized to act exclusively within the framework of Federal Law No. 127-FZ:

| Temporary | its functions include monitoring the bankruptcy process |

| Administrative | carries out financial recovery |

| External | his responsibilities include external management |

| Competitive | operates on the basis of bankruptcy proceedings |

The object of insurance is the property interests of the arbitration manager, which could not in any way contradict the legislation of the Russian Federation, having a connection between the risks of causing losses to debtors due to improper performance of their duties and compensation for these losses by the manager.

Insurance contract.

Features of the Roadside Assistance policy are discussed in the article: Roadside Assistance. Read what the professional liability insurance contract says in this article.

Reforms in housing and communal services and insurance

The legislator has long been looking for ways to stimulate the development of the housing and communal services market ; insurance is one of many solutions.

On September 1, 2014, the law on amendments to the Housing Code of the Russian Federation and some other legislative acts came into force, which introduces licensing of management companies in housing and communal services.

The requirements for licensed companies are minimal: registration as a legal entity or individual entrepreneur and the absence of a criminal record, disqualification or a previously revoked license.

But in the future, it is possible that the requirements for obtaining and conditions for deprivation of a license will become more stringent. It is possible that insurance of the housing and communal services management company will become a mandatory condition.

In addition, at the highest level there is talk about the need to tighten responsibility for the improper performance of the Criminal Code of its duties, and this may mean introducing new articles into the Code of Administrative Offenses or streamlining judicial practice.

Housing and communal services insurance is unlikely to ever become a universal solution to the industry’s problems, but it can provide support to consumers and conscientious management companies . The issue of housing and communal services reform has been raised more than once at the level of the government and the president, and in the future it is inevitable that the responsibilities of management companies and additional regulation of the housing and communal services sector .

But even before the introduction of rules on compulsory liability insurance, purchasing a voluntary insurance policy by a housing and communal services management company is a reasonable step both for the service organization itself and for consumers of its services.

Rules

The rules of compulsory liability insurance of the arbitration manager fully represent the risks that are covered under this agreement.

The risks include the following:

- losses caused as a result of the negative result of actions performed by the arbitration manager, as well as his complete inaction, if he was not authorized by a court decision to perform these same actions;

- losses due to cases of force majeure - violation of the safe handling of nuclear fuel, actions resulting in pollution of nature, air, soil, water, etc., due to military actions, rebellion, terrorist operations, states of emergency, exposure of citizens, etc. ;

- the fact of causing moral damage;

- illegality and absence of any legal action of persons other than the arbitration manager.

An insured event must be recognized as a court decision that reflects all the responsibilities and obligations of the arbitration manager to the debtor or other persons participating in the bankruptcy process, and the proven fact of failure to fulfill his duties by the arbitration executor, except for the cases provided for in the Insurance Rules.

In other words, the following is recognized as an insured event under this type of agreement:

- Inadequate performance or complete absence of any performance of duties by the arbitration manager, which are assigned to him by a decision of the arbitration court in a bankruptcy case. These actions, or lack thereof, are sure to result in losses for the debtor or other person involved in the bankruptcy process.

- The fact of identifying liability for losses caused by repeated unauthorized, dishonest actions of the arbitration manager. Several violations or facts of non-fulfillment of obligations are counted as one insured event.

Rules for liability insurance of arbitration managers.

Additional liability insurance of the arbitration manager

A compulsory insurance contract is concluded for a period of 1 year or more, for an amount of at least 3 million rubles . In addition to these basic insurance conditions, there is also additional insurance for insolvency practitioners.

This service is used when the amount of the main insurance contract is higher than the 3 million rubles established by law. This can be practiced if the debtor’s assets, for example, amount to 100 million rubles.

Then the arbitration manager, authorized and approved by the arbitration court, is obliged to insure his liability within 10 days from the moment he was approved by a court decision.

Liability insurance for management companies for housing and communal services

The program was created to protect the interests of management companies when they become obligated to compensate for damage to the life, health, or property of third parties caused as a result of deficiencies in the implementation of a set of works (measures) for the maintenance and operation of residential buildings (including deficiencies that mean untimely elimination of damages that occurred for reasons beyond the control of the Policyholder), namely:

- scheduled maintenance,

- scheduled maintenance of engineering systems and internal communications of the building, its structures and equipment, their adjustment, regulation and monitoring of their technical condition

Free installment payment of the insurance premium is provided (up to 3 payments).

Arbitrage practice

The relationship between the insurance company and the arbitration manager as between the Insurer and the Insured may deteriorate due to a number of reasons.

This includes the company’s unauthorized requirement to renew the insurance contract in a forced form and underpayment of insurance on the part of the Insurer, and deliberate damage to the property of the debtor in a bankruptcy case by the manager (the insured person) himself in order to receive insurance payments and profit from this, as well as much more.

Judicial practice in proceedings between insurance companies and arbitration managers under insurance contracts is based on the following legal positions:

- the bankruptcy trustee is obliged to calculate all costs used to pay for various services to involved persons, only based on a conscientious attitude to the calculation of the debtor’s assets, as well as based on market value;

Particular attention is paid to this point when the company under study does not have a balance sheet or the balance sheet value cannot be confirmed and is very different from the market value.

- if the arbitration manager uses prices higher than market prices or those established by law for payment for the services of attracted specialists, then such an action must be confirmed by a judicial act;

- after the sale of the debtor's pledged property, the proceeds are distributed by the bankruptcy trustee in accordance with the rules prescribed in Article 134, Article 138 of the Bankruptcy Law. The manager has no right to withhold VAT repayment amounts;

- The creditor's claims must be included in the register of creditors' claims, which is also regulated by a judicial act. Except for cases where payment for hired labor appears under an employment contract or payment of severance pay in the second stage;

- when the arbitration manager notices that the expenditure of the bankruptcy money or property assets of the debtor will inevitably lead to the absence of justification for this state of affairs, then he must carefully and very carefully try to take all measures to terminate the relevant agreements previously concluded by the debtor’s director;

- a meeting of the debtor’s creditors on the initiative, regulations and agenda of the arbitration manager cannot comply with the norms of those meetings that are organized under the leadership of the creditors’ committee;

However, such a meeting is possible, but only within 3 weeks from the moment the manager receives the authority by a court decision to fulfill his duties in relation to a specific debtor.

- the arbitration manager is obliged to provide reports to the meeting of creditors on his performance of duties in relation to their debtor;

- In order for the debtor’s property values to be assessed correctly and reliably, the bankruptcy trustee is obliged to involve an appraisal examination with the involvement of expert appraisers within the framework of the requirements of the legislation of the Russian Federation.

In addition to these frequently encountered points, there are countless other cases and nuances in judicial practice.

Thus, forensic specialists can review all the documents of the arbitration manager, up to his retraining and checking his compliance, to the extent he is competent.

All documentation of the insurance company is also checked. Particular attention is paid to the fact of the presence or absence of accreditation of the Insurer with the SRO.

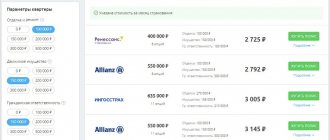

Price

The insured amount is determined when taking out a policy or concluding an agreement between the Insurer (insurance organization) and the Insured (any type of arbitration manager).

The contract amount is a maximum and is strictly regulated by Article 24.1, paragraph 2 of Federal Law No. 127-FZ.

So, for example, for the main contract it will always be at least 3 million rubles . – this is if the value of the balance sheet of the debtor’s assets is not higher than 100 million rubles .

But there is also additional insurance, so everything can be considered together in the table:

| Type of insurance | Book value of assets of the person who is the debtor, rub. | Percentage of the excess of the book value of the assets of the person who turned out to be the debtor, % | Insurance cost |

| Under the main insurance contract of the arbitration manager | Less than 100,000,000 | — | 3 000 000 |

| Under the additional insurance contract of the arbitration manager | From 100,000,000 to 300,000,000 | 3% | 3% of the book value of the debtor's assets |

| From 300,000,000 to 1 billion. | 2% | 2%+6 000 000 | |

| More than 1 billion | 1% | 1%+20 000 000 |

In addition, insurance companies charge an interest rate on the contract amount for their work. Thus, under the main agreement, most often, 0.15-0.3% per annum is applied, under an additional agreement - 0.08-1.5% per annum.

In order to avoid causing any losses to persons in a bankruptcy case, it is very important for the insolvency administrator to perform their duties carefully, carefully and conscientiously.

Otherwise, by a court decision, disputes regarding non-payment or delay of insurance payment to the arbitration manager upon the occurrence of an insured event can be resolved in favor of the insurance company.

About the contract of insurance of civil liability to third parties is described in the article: contract of civil liability insurance. You can find information about developer liability insurance here.

Find out what renter's liability insurance is on this page.

Tariffs and benefits

Insurance rates are determined for each policyholder individually.

They are calculated based on several basic factors:

- condition of the property, how long ago the last repair was carried out;

- qualifications of contractors and employees of the company itself;

- statistical data on accidents and cases of damage;

- term and additional conditions of insurance.

The cost of the policy can be reduced very significantly if the management company additionally complies with a number of conditions that reduce the likelihood of an insured event occurring:

- The management company and all contractors involved in maintaining the house are insured;

- the management company manages a large housing stock (usually from 500 thousand m2);

- there is a well-developed plan for repair work and a good reputation of the management company (working on the market for many years, a small number of accidents).

But insurers are well aware that the financial condition of many management companies is not very stable and they simply cannot pay much for insurance.

Therefore, many insurance companies offer a number of benefits when concluding a contract for comprehensive insurance of a management company. First of all, these are installment plans for paying insurance premiums - for 3-4 payments.

Also, if the above additional conditions are met, the cost of insurance can be reduced very significantly.

Find out what insurance is for shared participation agreements (PDA). Read about the mutual liability insurance company for developers in THIS article. All about insurance of antiques and antiques: //dom/estate/antikvariat.html