Developer liability insurance for shared construction is an imperative norm when concluding a transaction with shareholders for registration in Rosreestr. The responsibility that the shareholder bears to the participants can be established in several ways.

The first option is a bank. However, this option is so complicated and disadvantageous for all parties that it is practically not used in practice. The second option is available only for large organizations, and the third method is not as labor-intensive as the first and is suitable for everyone, unlike the second, but it does not provide 100% reliability.

In accordance with Federal Law No. 214, all houses (residential complexes) must be insured by the developer.

Construction organizations have a choice of how they will insure their activities, and they have several ways:

- through a bank;

- POVS;

- insurance with the help of a developer with a good reputation.

Via bank

ATTENTION !!! According to the list of the Central Bank, there are more than 200 banks in the country that can provide loans, but there are no more than 10-15 that actually provide their services to developers.

The main requirements for the bank are:

- 5 years of operation of the organization;

- 200 million capital;

- more than a billion personal money.

Such cooperation is not beneficial for both parties. It is easier for a construction company to take out a loan than to enlist the support of a bank. The amount of funds returned to the bank can reach high limits.

Registration and collection of papers, long signing of the contract do not contribute to the desire of the construction company to insure in this way, and it is not profitable for the bank from the point of view of large risks:

- if payments are necessary, the bank will have to pay for the cost of all premises, as well as fines and penalties;

- After paying compensation, the bank will also need to recover money from the construction organization, which is very difficult in our country.

New reality: measures to ensure developer liability in 2021

However, the fact that the mentioned articles have lost force does not mean that the developer’s liability will no longer be ensured by anything.

The latest amendments to Federal Law 214, signed by the President of the Russian Federation at the end of 2018, involve the introduction of a number of new mechanisms that should ensure the protection of the rights of shareholders. In fact, the changes being introduced, despite their real effectiveness, were initially intended as temporary measures.

The fact is that in 2021 the government decided to abandon shared construction in principle , and within several years to transfer developers to a project financing scheme.

This scheme prohibits the sale of unfinished housing in any form, and involves project financing in the form of bank loans issued as collateral. Thus, buyers will be able to purchase only finished apartments, which can be inspected in a building that has already been put into operation. In this case, for the shareholder, any problems associated with the suspension of construction, delays, or bankruptcy of the developer are excluded.

Perhaps the only risk remains the quality of “hidden” work, which cannot be verified without special expertise.

So, here is the essence of the main legislative changes that will come into force in the summer of 2021:

Introduction of escrow accounts.

The meaning of such accounts is as follows: the funds collected by the developer do not go to his account, but to a special bank escrow account

(opened for each shareholder)

.

Using this money, the bank finances the construction, and the developer receives funds from shareholders only after the house is completed and put into operation. This measure will prevent the developer from misusing money (or, simply put, withdrawing it)

.

Creation of a state compensation fund. All developers will contribute money according to the volume of construction, and if the developer encounters problems, the construction of his building will be completed using funds from this fund.

Insurance Company

Insurance companies are considered the simplest and most convenient way of insurance, since they provide:

- signing a contract in a short time;

- low prices;

- no need to pay a deposit;

- the insurance rate does not change throughout the entire period of cooperation;

- money is paid if there is an insured event.

However, it is worth considering that the number of insurance companies is constantly decreasing. In two years, their number has decreased from 27 to 14 in 2021. Due to the closure of insurance organizations, there are not enough resources to work with many developer organizations.

Alexander Zubets, General Director of New Vatutinki LLC, answers:

In general, for the development industry the initiative to introduce compulsory insurance is justified. This gives shareholders additional confidence in the security of the transaction when purchasing an apartment on the primary market, which is important for maintaining demand in projects. This is especially true in the current economic conditions. However, insurance in companies with a small authorized capital in the event of an insured event may lead to the fact that the insurance amount will not cover all liabilities. There are many shareholders, and the creditor bank also wants to return its funds. Therefore, the outcome of the massive demand for a refund is difficult to predict. Probably, if something can be returned, it will not be the entire amount. Even increasing the minimum authorized capital to 1 billion rubles will not solve the problem radically, since this amount will not cover all the damage when selling, for example, several houses at once.

In my opinion, in addition to increasing the minimum authorized capital of insurance companies, it is worth unifying systems for increasing the liability of developers. Today, a developer can insure liability, receive a bank guarantee in the amount of the project budget, and join the SRO of builders. It is quite difficult for a shareholder to understand what is the criterion of reliability, and it is more difficult for the authorities to control all three areas. In my opinion, the most reliable option is a bank guarantee, since, unlike insurance companies, credit institutions have the resources to cover damage if such a need arises. In addition, today it is difficult to give a clear description of the effectiveness of developer liability insurance. We are not aware of any insured events occurring within a year and a half after the introduction of compulsory insurance (from January 1, 2014).

Agreement conditions

The construction organization is required to make a down payment to activate the insurance. You can pay the entire amount in full or with the condition of installments. It depends on the chosen insurer.

The policy is issued for the entire value of the share under the current agreement. A minimum threshold for the amount of insurance has been established, and it cannot be lower than the average price for an apartment (based on prices in the region).

The validity of the insurance contract is 2 years after signing the agreement, the legal force of the contract extends to the next two years after expiration. If the contract is terminated, the shareholder does not lose the right to appropriate payments.

Insurance cases

IMPORTANT !!!! Such cases arise as a result of non-fulfillment or dishonest fulfillment by the construction organization of the terms of the contract, as well as when housing is delivered for use of inadequate quality.

Insurance cases include:

- cessation of construction;

- devastation;

- non-compliance with the terms of the agreement;

- no refund or elimination of defects.

The existence of an insured event is confirmed by the arbitration court to which the shareholder applied, or by the court that declared the construction company bankrupt.

All contracts with shareholders are concluded on an individual basis due to the fact that the builder is responsible to them individually. The developer is obliged to complete housing construction on time, according to the approved plan.

The insurance company must pay the due funds upon the occurrence of an appropriate event in which the shareholder becomes a beneficiary. Information about changes to the terms of the contract must be communicated to all members of shared construction.

Managing partner of Metrium Group Maria Litinetskaya answers:

In my opinion, tightening the requirements for the minimum amount of a developer’s authorized capital is truly one of the most necessary measures today.

The current requirements for authorized capital (400 million rubles) will not be able to cover the damage. It would be one thing if developers could only insure themselves with large companies. However, in practice, a situation often arises when a developer makes a choice in favor of the insurer offering the lowest commission percentage - 0.3–0.7%. And it is not a fact that such organizations will be able to compensate for damage in the event of an insured event.

I think that after the requirements for insurance of developers are tightened - the amount of their own funds is increased to 1 billion rubles - the pool of insurance companies that a developer can turn to will shrink. This will certainly lead to an increase in compulsory insurance rates for developers, who will likely pass on this overpayment to the end consumer, which means an increase in the cost per square meter. Otherwise, the developer will be forced to reduce margins, which makes the development business less profitable and again increases the likelihood of financial difficulties. In this regard, in my opinion, it is necessary to limit insurers in the maximum amount of commission, then innovations will not hit buyers’ wallets.

Which company should you choose?

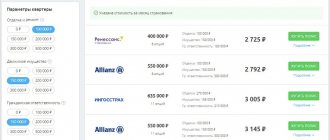

According to the list provided by the Central Bank, the following companies operate in Russia:

- "Regional insurance company."

- Joint Stock Company "VSK".

- Insurance and UralSib Group

- Public Joint Stock Company "Ingosstrakh".

- CJSC Moscow Joint Stock Insurance.

- Joint Stock Company "ENERGOGARANT".

- Open Joint Stock Company "AlfaStrakhovanie".

- Absolut Insurance LLC.

- LLC "VERNA", insurance, LLC "BIN Insurance", "Insurance.

Rates

Any insurer sets the primary tariff on its own terms and certain adjustment factors depending on possible risks.

The chosen tariff depends on the reputation of the construction organization. Today this figure is within the range of 0.6-0.9. For some reputable developers, under certain conditions, it can be reduced to 0.4-0.5.

After calculating the base rate and the validity period of the contract, the insurance payment is calculated. Developer insurance costs are managed using accounting and tax accounting. If the property is delivered earlier than the period specified in the agreement, the amount of the insurance premium may be partially refunded.

IMPORTANT !!!! Risks in mutual cooperation are reduced to a greater extent for shareholders. An agreement with an insurance organization protects the money of citizens who decide to participate in shared construction.

Monitoring the developer’s compliance with obligations

IMPORTANT !!!! The controlling body is Rosreestr, recently renamed Rosnedvizhimost. Refusal to register may be the absence of an insurance agreement, as well as financial insolvency to pay insurance premiums.

In the regions, control over the work of construction organizations is additionally organized by the prosecutor's office and some executive authorities. The compensation fund also helps collect and manage money from builders to equalize payments to shareholders of failed companies.

If the Compensation Fund continues to work in this direction, then it will soon be possible to refuse to work with insurance companies, and Rosnedvizhimost and the local municipality will be at the head of control.

Olga Basova, junior director of RAEX (“Expert RA”), answers:

From October 1, 2015, the minimum amount of equity capital of an insurance company engaged in civil liability insurance for non-fulfillment or improper fulfillment of obligations to transfer residential premises to a participant in shared construction increases from 400 million rubles to 1 billion rubles.

If the insurance company with which the developer has entered into an insurance contract does not meet the new requirements, then the developer, within fifteen days starting from October 1, 2015, is obliged to conclude a new insurance contract with another insurer or mutual insurance company or enter into a guarantee agreement with a credit institution. The same period is given for re-concluding an insurance contract in the event of the revocation of the insurance license from the insurer or the appointment of a temporary administration.

Increasing the requirements for insurance companies involved in insuring developers is justified, since the insurer assumes extremely high risks, and given the fact that there is no high-quality reinsurance in this segment, if even one risk materializes, a small insurer will not be able to cope with the payment of insurance compensation. In addition, with the advent of this type of insurance, a significant part of unscrupulous insurance companies, whose own funds and reserves were filled with “fictitious” assets, began to actively conclude insurance contracts for developers. Of course, such insurance companies will not be able to fulfill their obligations.

In order to select a reliable insurer, you need to focus on reliability ratings - the higher the rating, the more reliable) in its ratings evaluates various parameters of the financial stability of insurers, including the quality of assets and their reality. In addition, the developer has the right to request from the insurer all information confirming the insurer’s compliance with the requirements of the law, and the insurance company can also provide an official letter issued to it by the Central Bank of the Russian Federation confirming the absence of orders for non-compliance with the requirements for ensuring financial stability and solvency during the last six months.