The happy time when taxes had virtually no impact on our budget has passed forever. Nowadays, tax payments are a significant expense item, and it is always important for owners of country houses to understand how much and what they need to pay, what they don’t have to pay for, and how to structure their tax behavior so that there are no unpleasant consequences in the form of huge fines and lawsuits.

In this article we will cover:

— What taxes need to be paid, and which ones are optional — What loopholes are there for summer residents in tax legislation — Will the tax on a house increase if a veranda is added to it? — Do I have to pay taxes on outbuildings?

How to calculate the amount of land tax?

The tax on land plots intended for gardening, individual housing construction or personal subsidiary plots is calculated based on their cadastral value. In some regions there is a difference in the amount of tax on a plot for individual housing construction and a garden plot, in others there is no: local legislative bodies can set different or the same rates for each type of permitted use of land.

Important: The Tax Code establishes a marginal land tax rate of 0.3%.

It cannot be exceeded - in any case, your tax on land cannot be more than 0.3% of its cadastral value.

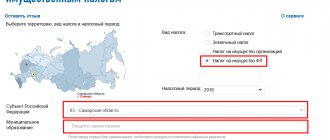

You can find out the cadastral value of your plot at the Rosreestr branch or on the official website of Rosreestr. There is a special calculator on the tax website for calculating land tax.

AndreichPForumHouse Member

I got 7`188`144 rubles * 0.3%= 21`564.43 rubles for all PDOs.

House tax

Many owners are interested in what size house is not subject to tax, and how to calculate the tax on the house? Some citizens confuse taxes on a dacha or a country house, since they need to pay for outbuildings on the plots, including summer kitchens and toilets. But these structures are already subject to taxation, according to Art. 401 of the Tax Code of the Russian Federation.

It is necessary to pay even for unfinished objects . But since Rosreestr or the Federal Tax Service do not have the ability to take into account all objects under construction, owners often do not report them.

If information about an unregistered property reaches the Federal Tax Service, the owner will not only be assessed taxes, but will also be assessed a fine and penalty for evasion of payments and late payments. Therefore, it is better to promptly inform the tax office about existing objects on the site.

According to Art. 407 of the Tax Code of the Russian Federation, the owner can receive benefits for outbuildings that are used for gardening, truck farming and other non-economic activities.

If the area of these objects is less than 50 square meters. m, then this benefit exempts the person from paying tax for them. This does not apply to a residential building on the site.

A special coefficient is used for the inventory base. For the cadastral base, tax is not taken on a house if its area is less than 50 square meters. m. If higher, then tax is required.

You don’t have to pay for the house if the owner falls under the category of beneficiaries, in accordance with Art. 407 of the Tax Code of the Russian Federation.

Property tax is imposed on residential or non-residential real estate. The calculation is carried out as follows:

- Object – residential building (country house, garden, vegetable garden);

- Rate – from 0% to 2% (depending on the region and type of object);

- The tax base is the cadastral or inventory value of the property.

For calculations, use the formula H = (Kst – Nv) x St x Pkf, where:

- N – tax;

- Kst – cadastral value;

- Nb – tax deduction;

- St – rate;

- Pkf – reduction factor.

When calculating based on cadastral value, the base rates for residential buildings are:

- 0.1%, but possible reduction to 0% or increase to 0.3% at the discretion of the municipality;

- 2% for objects worth more than 300 million rubles.

The basic rates for inventory value are based on the price of real estate:

- up to 300 thousand rubles. – up to 0.1%;

- 300 – 500 thousand rubles. – 0.1 – 0.3%;

- more than 500 thousand rubles. – 0.3 – 2.0%.

The calculation takes into account the rate set at the local level by municipal authorities, deductions, benefits and coefficients.

The area of the house does not include:

- unused attic;

- porch;

- underground;

- external open stairs;

- the usable attic is equal to the area of the terrace.

The tax is paid for each month of home ownership. A full month is counted if the residential property was purchased before the 15th.

Privileges

Homeowners may qualify for local and federal benefits. The following are eligible for federal benefits:

- pensioners or persons aged 60 and 65 (women and men);

- disabled people of group 1 or 2;

- participants of the Second World War and Heroes of Russia and the Soviet Union;

- persons affected by the Chernobyl disaster or nuclear accidents;

- military personnel discharged from service and members of their families.

Benefits also depend on the type of property, for example, if residential and outbuildings up to 50 square meters are considered. m, located in gardening and summer cottage areas.

Owners of private houses have the right to deduct the price of 50 square meters. m of the total cost of housing. Tax is paid on the amount remaining after deduction.

Number of floors of the house

During construction, many are interested in whether the tax increases as the number of floors of the building increases . The house tax does not depend on the area and number of floors, but only on the cadastral value.

The tax on a one-story house with an attic or a three-story building will depend on the engineers’ assessment of the cadastral amount. Also an important parameter is the rate in a specific region.

For example, the tax on a house with an area of 600 square meters. m will be less than for a house with an area of 200 square meters. m, located in another region with a low rate.

Tax payment is made for the entire residential property, and not for its individual parts . The tax is calculated based on the cadastral value, according to the formula: N = (Kst - Nv) x St x Pkf.

The total amount payable depends on the tax base. The final tax amount is determined only by the cost of the house, according to the assessment of the state cadastral authority. It is not affected by other parameters, such as number of floors, height, the presence of a terrace or attic.

Dacha: how to calculate property tax?

Property tax (residential building) is equal to 0.1 percent of the cadastral value of this house. More precisely, property tax on a dacha is calculated using the formula:

0.1% - (cadastral value of the house - cadastral value of 50 square meters of this house).

That is, the cadastral value of 50 square meters must be subtracted from the cadastral value of the house. 0.1 percent of the balance will be the tax amount. If there are other buildings on the site that are considered real estate, then the tax amount on them will be 0.1% of their cadastral value (the cadastral value of 50 meters will no longer be deducted).

If calculated according to cadastral value

A person wants to live not in a dusty, smoky city, but in the fresh air, in a village - next to a forest, on the banks of a river or lake. Land in the area is inexpensive, taxes are affordable, and again you do not depend on high city utility bills and taxes. Living in the village and working in the city is the dream of many Cherepovets families. But construction costs and lack of infrastructure are confusing.

Dacha tax in SNT: when, to whom and for what should it be paid?

- And we have some where only one grandmother lives in winter. Or let’s say the village of Kizboy with 60 houses (50 kilometers from Cherepovets), where one family lives all year round and goes to work in the city. The rest are summer residents,” says Valentina Nikitina, head of the Voskresensky settlement. “We have good lands, again mushrooms and berries, rivers.” For example, the village of Romanovo is located on Lake Romanovskoe, and there are vacant plots there. In the village of Ostrov, land plots of 20 acres (approximate cost of 90 thousand rubles) have been formed: only two kilometers away from the Belozersk road. We are only too happy for the arrival of landowners, including residents of Cherepovets. Why should the lands be empty?

Owners of private houses are required to pay 2 taxes at once: property and land . These are unrelated types of duties; each has its own payment procedure and different rates.

You might be interested ==> What a retired labor veteran in Komi is entitled to in 2021

Do I have to pay tax on country houses?

According to (clause 1 of Article 401 of the Tax Code of the Russian Federation), the objects of property tax for individuals are not only residential buildings, but also “other buildings, structures, structures, premises” located on plots (we are talking only about capital buildings). From the point of view of tax legislation, these buildings are equivalent to residential buildings.

At FORUMHOUSE we have already talked about a loophole in tax legislation: until individuals have registered buildings in the Unified State Register of Real Estate, they are not obligated to pay taxes on them.

Only the owner can register a building; the tax department does not have such rights.

There are no penalties for the fact that the building is not registered, and the only thing the tax service can do is recommend registering the building and paying tax for it. But the owner has every legal right to ignore this recommendation and not pay tax on dacha buildings.

If you receive a demand for tax payment or a tax notice regarding unregistered objects, you must appeal it in court. The court will rule in your favor.

Normative base

Social benefits enjoyed by an individual can reduce the state tax payable after the sale of a land plot or dacha. These include different disability groups, veteran documents, participation in armed conflicts, the presence of disabled dependents, etc. Such preferences can reduce the size of the tax base by up to 10,000 rubles.

Documentation

A citizen can independently calculate the amount of duty that he must pay to the budget of the municipality at the location of the property being sold. To do this, you should use a simple formula, which includes the following indicators:

May 15, 2021 semeiadvo 422

Share this post

- Related Posts

- Living wage in the Kostroma region for 2021 for children

- How much do labor veterans in Tula earn?

- Stavropol living wage for children for 2021

- How much does lunch cost in kindergarten?

Who is entitled to tax breaks for country houses and dachas?

The full list of beneficiaries is contained in Article 407 of the Tax Code of the Russian Federation, and it is quite extensive. Pensioners, disabled people, heroes of the USSR and the Russian Federation, military personnel, Chernobyl survivors and many others are eligible for benefits.

According to existing tax legislation, it is provided in relation to ONE object of each choice, and the taxpayer himself can determine the object. If he has a house and an apartment, he is entitled to benefits for both the house and the apartment, and if he has two houses, he can choose which one to choose the benefit for.

To receive the benefit, you need to write an application to the tax authority. Without this, the tax service itself will choose your property for which the deduction will be provided. Or even you simply won’t be given a deduction.

LyudochkaForumHouse Consultant

A land tax deduction of 6 acres is provided to pensioners. If the pensioner did not receive this deduction, he probably did not write a statement to the tax office.

Svetlana153 FORUMHOUSE participant

If you want to apply for tax breaks on 6 acres, you need to go to the tax office, unfortunately they don’t do it automatically. This is of a declarative nature.

Owners of dachas and village houses now have a chance to get rid of the “mess in their heads”

— What did summer residents ask most often?

— The questions they ask are very different, sometimes completely off topic. For example, how to save on electricity. But the majority of those who called the hotline still asked about registering houses and outbuildings, and how to convert a non-residential building into a residential one. Also among the popular questions were: registration in the house, tax deductions and benefits for pensioners.

— Are there many unregistered dachas in the Moscow region?

— The Ministry of Property of the Moscow Region believes that there are about 330 thousand such objects. Considering that 2 million dachas have already been registered, there are not many left.

— The terms of the dacha amnesty were extended many times, and were the conditions somehow different in each of these periods?

— Yes, the most important thing is that now the owners of private houses in rural areas are again subject to the dacha amnesty, and not just those who own dachas in SNT.

- Are there many of these?

- Very. Of the 330 thousand unregistered objects, the majority are located in populated areas - 276 thousand, and only 58 thousand - in SNT.

— What prevents people from registering their real estate, laziness?

— The reasons are varied, including laziness, but most often it is the inability to correctly collect and submit documents. Rural summer residents, especially those who inherited a house, have not registered land ownership rights or have not established the category of the plot or the type of its permitted use. Summer residents from SNT often encounter another problem: they cannot register their house because there are errors in marking the boundaries of the land plot.

— There are probably those who are in no hurry to register a house so as not to pay taxes, especially now, because of the pandemic, many people are having a hard time with money.

— Of course, fear of the tax burden plays an important role. That's why many people call the hotline to find out how much they have to pay. But if we don’t take into account the owners of mansions in the Rublyovka area, then the tax burden on a dacha near Moscow is not so overwhelming. Moreover, our most financially vulnerable - pensioners - are completely exempt from paying tax on 1 house, 1 outbuilding and 1 garage, in addition, from 2021 there is no need to pay tax on 6 acres of land. For everyone else, a tax deduction of 50 sq. m in one residential or country house. So the average tax on a building with an area of 150 square meters. m does not exceed 2 thousand rubles in the Moscow region. in year.

— Where to submit documents?

— At the MFC or directly to Rosreestr. If the house meets the requirements and all documents are completed correctly, then after inspection it will receive an electronic extract from the Unified State Real Estate Register (USRN), confirming its cadastral registration.

— What documents are needed to register a house using a simplified scheme?

— A minimum package of documents will be required: a technical plan for the house, a declaration and the right to a land plot registered with Rosreestr.

— What if it is not registered?

— Then you need to provide title documents for the land plot. For example, a gift or sale agreement, a certificate of inheritance, an act of an authority, a court decision.

— What to do if the land ownership certificate is lost?

— Instead of a lost certificate of ownership of a land plot, you can order an extract from the Unified State Register of Real Estate (through the MFC or electronically, without leaving your home).

— Why are documents most often turned back and registration denied?

— There are many errors in documents, for example, the boundaries of neighboring areas often overlap. Therefore, I advise you to always do land surveying together with your neighbors; it will be cheaper and will protect you from mistakes. As for the technical plan for the house, it should be ordered only from a trusted company, from competent specialists. You can't save money on this. Otherwise, Rosreestr, having discovered errors, may decide to suspend registration for 30 days until everything is corrected.

— In the 90s, they built a lot and often in violation of building codes, is it possible to legalize these towers under the dacha amnesty?

- It depends on what we are talking about. If the owner of the dacha built it outside the boundaries of the site, then it is unlikely, because this is considered squatting. The same applies to those land owners who built a hotel or apartment building on their 6 acres; such buildings cannot be legalized. In general, the dacha amnesty was invented in order to simplify the procedure for registering real estate for law-abiding citizens, and not in order to legalize self-construction.

— Have you received any unusual questions on the hotline?

— Yes, oddly enough, many summer residents are sure that all outbuildings, including greenhouses and wells, also need to be registered.

— Please explain once again to MK readers what country buildings need to be registered?

- Only permanent buildings need to be registered - this is a residential or garden house, a bathhouse, a garage or other outbuildings on a foundation, that is, everything that cannot be moved to another place. Registration is not required for greenhouses, poultry houses, sheds, gazebos, firewood sheds and other temporary buildings.

Who pays property tax in SNT?

If SNT is the owner of roads, buildings and other real estate, then it pays taxes for them itself. SNT takes money for taxes from the fees paid by land owners.

If SNT real estate is in shared ownership of the members of the partnership, then they themselves will pay taxes. But there is a loophole here: ALL owners must vote for this, not the majority.

It is illegal to impose SNT property on the owner of a plot without his consent.

Another possible situation is when the general meeting decides to transfer some SNT property (roads, etc.) to the ownership of the region or region where it is located. With this option, SNT members will no longer pay taxes.

Summarizing

As we can see, Russian tax legislation is not the most friendly to summer residents and owners of country houses, but it has quite a lot of loopholes. The extensive list of categories of people entitled to benefits also inspires optimism. In each specific situation, consultants and FORUMHOUSE participants experienced in tax battles are ready to provide advice - you can share it in the Real Estate Taxes section of the forum.

Also on FORUMHOUSE you can find out how to request a recalculation of property taxes and read an article on how to calculate and dispute property taxes.