Home / Taxes

Back

Published: 12/12/2019

0

15

- 1 Expensive houses, apartments, cottages and land plots

- 2 Luxury tax on real estate

- 3 Importance of luxury tax

- 4 Calculation of luxury tax percentage rate

- 5 Changes in the tax program in 2021

- 6 Cases of tax exemption

- 7 Luxury real estate tax

- 8 Chapter 25

- 9 Who will pay luxury tax in 2014

Expensive houses, apartments, cottages and land plots

Previously, as a result of purchasing a two-room housing in the city in the central lands, a resident paid 500 rubles to the budget. tax, upon completion of the new reform, the tax amount will increase to 5 thousand rubles. annually (even more). The basis of taxation will be the cadastral value (and not the inventory value), which can bring real estate as close as possible to its market price.

Dimensional parameters of the tax amount are 0.1-2% of the cadastral valuation. This taxation is not uniform for owners of different real estate options; it will be updated over a period of 5 years, taking into account research by independent experts.

This fee applies to the following categories of citizen-owners:

- Unfinished housing (residential);

- Garages, parking spaces;

- Rooms, apartments, other housing;

- Centers containing at least 1 residential premises;

- Domestic buildings up to 50 square meters located on land where dacha work and gardening activities are carried out.

In addition, property owners will be required to provide tax officials with accurate information about the property they own. Otherwise (in a situation of data falsification, etc.) they face penalties of 20% of the tax amount. The list of preferential categories of citizens will remain the same in 2021, there will be no changes in it.

Most citizens have heard the concept of a luxury tax on real estate, cars, even some works of art - all this can be considered the object of such tax relations. However, not every taxpayer understands why such a tax was introduced, what is its peculiarity and fundamental difference from those payments that are made regularly in connection with the presence of a person’s property.

- Facilities financed from the state budget.

- Family-type orphanages.

- Dormitories.

- MAFAS, non-residential buildings in markets.

- Residential/non-residential buildings in the resettlement zone.

- Residential/non-residential real estate in the exclusion zone.

- The property is residential but uninhabitable.

- Real estate owned by orphans.

- Residential property owned by children without parental care.

- Real estate owned by disabled children raised by only one parent, for example, by mothers - no more than one dwelling.

- People living in the capital and various large cities of the Russian Federation will be required to pay higher for their real estate than the rest of the population living in the periphery. For example, the tax amount for Moscow residents will be 5-6 times higher than for people living in the neighboring region.

These include the following citizens:

- persons who, according to the law, are recognized as parents of many children;

- veterans who participated in the Great Patriotic War;

- persons who have any disability group;

- persons who took part in any military operations;

- persons who received the title of Hero of Russia or the Soviet Union.

The collection of various kinds of taxes and fees, which is often associated with the maintenance of an apartment, the receipt of income, and the ownership of property, is a normal and familiar type of relationship in the entire system of society. However, not so long ago such a mandatory payment as a luxury tax was introduced. For some people, this still remains a not entirely clear phenomenon, since the concept of luxury is not clearly defined in the law. Only after some time was it determined which objects would belong to this category.

As stated in the Tax Code, objects subject to luxury tax also include residential and non-residential real estate of citizens located on municipal territory, namely in large settlements and their environs:

- apartment or room in multi-apartment residential buildings;

- house or cottage;

- a single immovable complex structure;

- unfinished objects;

- a garage with one or more spaces;

- as well as other buildings, premises and extensions;

- summer cottages and buildings located on the territory for conducting subsidiary, agricultural, gardening, and homestead activities also fall into the taxable category.

Only those premises that are in the state register and owned by a collective farm are exempt from paying taxes.

Many citizens do not agree with this bill - the market value of real estate is increasing every year, people could buy an apartment in the economy segment 10-15 years ago, but today its value will increase. For example, buying a one-room apartment 10 years ago for 700 thousand rubles. – currently its market value will be at least 1 million rubles.

- Changes of a capital nature after extreme revaluation, for example due to repairs;

- Depreciation of real estate of a physical, natural nature;

- Deterioration of the surrounding space of a natural, physical nature, affecting the condition of the immovable object (for example, the land on which the house was built);

- Various other factors that can influence the value of the property (presence of hazardous enterprises near it, whether the necessary infrastructure is available).

In other situations, one should not count on the fact that tax collection will stop. The only thing that will allow you to be exempt from payments is the termination of ownership of specific property. However, all fraud with property may ultimately lead to prosecution and the application of coercive measures by the state.

We suggest you read: Non-refund of money on receipt

As such, the luxury tax was supposed to appear in Russia in April 2014. But the bill was rejected in the first reading: the State Duma opposed the oppression of the financial interests of the elites. Nevertheless, already this year and next year, in a slightly modified form, it will come into force.

This bill was first discussed back in 2012, when deputies from A Just Russia first started talking about it. But that original bill had serious differences compared to the one that will now begin to be implemented. At that time, luxury goods meant real estate whose market value was above thirty million rubles. In addition, vehicles whose market value would be more than three million rubles. This bill was rejected.

was also not adopted, but was returned to again in 2015, simply identifying a number of “luxury” vehicles and real estate as subject to increased tax payments. But what actually happened? What will the luxury tax be in 2021 and who will be affected by increases in car and real estate taxes?

In 2015, certain amendments were made to the Tax Code of the Russian Federation regarding the calculation of tax on real estate. The goal of the reform is to gradually increase the tax to 20% annually, the duration of this tax program is 5 years. Reduction coefficients should limit the growth of tax payments.

Features of taxation

Among the important objectives of this legislative act were the following:

- fight against corruption;

- increasing contributions to the state budget;

- regulation of financial flows within the country, directing them to support the real economic sector.

The tax program affecting luxury items consists of 2 parts:

- 1 – applies to owners of expensive vehicles;

- 2 – affects property owners.

Many experts note the main feature of this taxation - it concerns almost the entire population of Russia, acting as an additional tax on land and property.

Until 2015, the tax on a property was determined taking into account its inventory assessment. Today, one more value has been added to these indicators:

- Cadastral value.

Therefore, even a run-down apartment can become a luxury if it is located in a good location, for example, in the central areas of the city.

In 2015, certain amendments were made to the Tax Code of the Russian Federation regarding the calculation of tax on real estate. The goal of the reform is to gradually increase the tax to 20% annually, the duration of this tax program is 5 years. Reduction coefficients should limit the growth of tax payments. This five-year time period is intended to ensure a smooth change in taxation - according to various experts, the value of the cadastral value exceeds the inventory value by 10 times.

Luxury real estate tax

The first indicator that will be needed to calculate the tax is cost. You should always remember that the tax is calculated as a percentage, that is, certain rates that will determine the amount of tax based on the price of the object of the relationship. In addition, the rate in the case of luxury tax will also depend on what value is set for a particular item.

The luxury tax will be calculated based on the value of not only the property that is owned by a person, but also for those objects that he uses by right of inheritable ownership or lifetime use. This rule applies only to apartments and houses. With cars, everything is much simpler; it is enough to save data on what the price was at the time of purchase according to market indicators.

When making calculations, it is also necessary to take into account the specifics of the object. Depending on whether a person owns an apartment or a car, their rates will be determined. This division is due to the fact that these luxury goods inherently have different characteristics. In a car, it is enough to know its market value.

In the case of an apartment, market and cadastral prices, as well as their ratio, must be taken into account. And when there are several objects and they belong to the same category, the cost will be added up. In addition, the owner must report all objects independently and in advance, including indicating their cost.

The tax rate in the case of luxury goods always varies within certain limits, namely from half to ten percent. The Tax Code does not provide for large indicators.

So, first of all, it should be said about the tax rate that will apply to apartments, houses and other real estate.

The rate will increase as the price of the property increases:

- when the object has a value ranging from fifty to one hundred million rubles, the rate will be equal to 0.7% of the specific determined value;

- if the price of the object is from one hundred to one hundred and fifty million rubles, then the rate is equal to one percent;

- when real estate has a value of over one hundred and fifty million rubles, the tax rate will be ten percent.

There are some benefits and privileges, but this is an exception to the rule, which requires full regulation and factual confirmation.

As for cars, there is a little more variation in rates, but they will also be determined depending on the established value of the car. What’s interesting is that for cars of different brands and those costing from three to twenty million rubles, there is no exact rate; it will be determined in each specific case depending on the brand and year of manufacture. For aircraft, as well as sea and river vehicles, the rate is ten percent of the cost.

The price of the car used to determine the tax may differ significantly from the one paid at the time of purchase.

In order to pay the tax in question, it is enough to collect documentation reflecting the availability of property in a person and its value, and then fill out the appropriate samples. It is better to do this with the help of a specialist. Payment of the tax will take place through the bank branch, and the details for this must be provided directly to the tax authority.

When will a luxury tax on real estate be introduced and what conditions will this tax have, the portal’s expert explains in a special article about luxury taxes in 2013: the real estate aspect. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

When will a luxury tax on real estate be introduced and what conditions will this tax have, the portal’s expert explains in a special article about luxury taxes in 2013: the real estate aspect.

Discussions that Russia plans to introduce new taxes “on the rich” or taxes on luxury in order to “correct” social inequality have been going on for a long time. And the point is not even that these arguments are part of the political rhetoric of individual political movements against the background of the general ideological poverty of state building.

We invite you to read: How to account for the sale and other disposal of shares (interests) of other organizations

Discussions about how good it is to have a flat, progressive or regressive tax scale on a national scale will be postponed for more abstract discussions. Let us only note that under any tax regime, citizens learn to find ways to survive and save what they earn. A purchased apartment, a purchased cottage or a summer cottage in the Leningrad region or in St. Petersburg is considered by citizens as inalienable property.

And if for the part of the population who received an apartment during privatization or by inheritance from their parents, real estate is given “for free,” which means that the property tax is not perceived as something completely prohibitive and unfair. For those who built their own house with their own hands or were in the process of buying a country cottage for the last 10-15 years, finishing the purchased apartment at night, saving from their obviously modest income, the state tax on real estate is perceived as an unfair phenomenon.

Indeed, with whom does the state treat more fairly: with those who “spent, skipped, ate and drank” their ten-year earnings, or with those who invested their funds in the country’s economy and created a new property, thereby provoking the formation of new workers places and financial, and therefore tax turnover.

In world practice, there are two opinions on how rich citizens and their property should be treated. One of them justifies the principle “let the rich pay for luxury”, the other assumes that “the rich must be protected” and not subject to increased taxes. The first opinion argues that the main function of the state is to distribute the funds received by society to ensure an even picture of justice.

Another believes that attracting the rich to society leads to the fact that the rich “share” their income with the rest of society, participate in both philanthropy and consumption in society, thereby paying indirect taxes and provoking an increase in the turnover of funds and an increase in the well-being of citizens.

At the same time, despite the fundamental differences, both of these points of view operate with the same key criteria, the main of which is, of course, the criterion for dividing the middle class, the rich class and the super-rich class, characterized by ostentatious consumption and ostentatious spending (more details, read about conspicuous over-consumption in Thorstein Veblen's 1899 book The Idle Class).

There is an opinion that Russian reality excludes the possibility of adequately establishing these criteria. The reason for this is said to be, on the one hand, a very unbalanced picture of income distribution with very low productivity, and on the other hand, an equally unbalanced ownership structure.

Add to this total corruption, legalized methods of extortion at state institutions - for example, the structure of the Unified Document Center in St. Petersburg. The overall picture is such that in today’s reality there is no hope for the adequacy of legislators and government officials.

But let's get back to practice.

Discussions about the advisability of introducing an additional luxury tax in the real estate sector began in February 2012, after the speech of Prime Minister V.V. Putin and his election campaign “Building Justice” published in Komsomolskaya Pravda. Social policy for Russia". Later, speaking at the 19th Congress of the Russian Union of Industrialists and Entrepreneurs, Putin said that this tax could be extremely important from a psychological point of view, since it would be perceived as “a kind of publicly recognized payment for refusing investment in development - in favor of overconsumption and vanity.” .

Later, Anton Siluanov, Russia's Minister of Finance, shared his thoughts on the possibility of imposing a super tax on wealthy car owners. At the same time, the minister will introduce tax levies through increased rates of property tax and transport tax. At the same time, it was decided that a progressive tax on expensive real estate will be levied on the basis of cadastral value; for this purpose, certification of real estate objects and the formation of a national real estate register are being carried out at an urgent pace throughout the country.

- capital changes that occurred after the last revaluation (repairs, etc.);

- natural and physical wear and tear of the real estate itself;

- natural and physical wear and tear of the surrounding area, which affects the condition of the property (a multi-apartment building in which an apartment is located, or a plot of land on which a house is built);

- other external factors that can affect the cost (presence of hazardous enterprises nearby, proximity to infrastructure, geographical location, etc.)

- Tax calculation

- Results of this tax program

- Odds valid in Moscow

- Changes to the tax program in 2021

- Features of taxation Among the important objectives of this legislative act were the following:

- fight against corruption;

- increasing contributions to the state budget;

- regulation of financial flows within the country, directing them to support the real economic sector.

We invite you to familiarize yourself with: All the intricacies of leasing commercial real estate

Cadastral value

This category is a certain indicator - the actual cost of the property. It is established during professional inspections, taking into account the following points:

- Changes of a capital nature after extreme revaluation, for example due to repairs;

- Depreciation of real estate of a physical, natural nature;

- Deterioration of the surrounding space of a natural, physical nature, affecting the condition of the immovable object (for example, the land on which the house was built);

- Various other factors that can influence the value of the property (presence of hazardous enterprises near it, whether the necessary infrastructure is available).

Regional characteristics play an important role - in the city center the cost of housing will be higher than in remote areas (for example, in the region). In Moscow, real estate costs more than in other cities of the Russian Federation.

The meaning of luxury tax

The main goal of this method of legal regulation is to streamline the situation of society, that is, some stabilization of the social component. This leads to the logical conclusion that the luxury tax implies completely different rates and amounts to be paid than taxes on property or income. Therefore, the introduction of such a tax creates in society an atmosphere of equality of rights and responsibilities for everyone.

Separately, it should be said about objects that are subject to this type of tax. It was this question that caused the most misunderstanding on the part of citizens, since the concept of luxury is not always clear for different categories of people.

The law offers an exhaustive list, that is, theoretically, only these items can be subject to taxation. However, the third group is not very clear, since it can include a large number of items that have a price of several million rubles and are of some value.

Special mention should be made about cars. The legislator does not apply the luxury tax rule to every make of car. The point is that there are the most expensive car manufacturers, and the list of them is enshrined in law. Today, about two hundred and seventy-nine brands of cars are offered, which will certainly be taxed, but not if the price of such a car is less than the established limits.

There are often cases when citizens try to avoid paying taxes. This may apply not only to the luxury tax, but also to other types of similar payments. But fraud is especially common in this part, since the tax is calculated based on the value of the objects, and, as we know, it is quite high.

After the signing of the resolution and the introduction of changes to the Tax Code of the Russian Federation, a large replenishment of the federal budget was noted. Luxury funds will be used to implement various social programs. Citizens felt equality of rights and interests, which was the beginning of the settlement of many social conflicts and disputes.

The luxury tax according to the Tax Code is established in relation to:

- cars whose cost exceeds 3 million rubles;

- real estate with a price of 30 million rubles;

- objects of art and other things that ordinary citizens cannot afford to purchase.

Every year, the government will establish a list of items and brands of vehicles the purchase of which will be considered a luxury. Today, the list of car brands subject to taxation consists of 279 models. They are divided into several price categories: from 3 to 5, from 5 to 10, and from 10 above millions of rubles.

Today, many residents are developing illegal schemes to circumvent the luxury tax. It is worth considering that these actions are illegal and may result in administrative or criminal liability.

Luxury Tax Interest Rate Calculation

What will the 2021 luxury tax look like and who will be affected by the new fees? A bill on such a tax was submitted for consideration in the State Duma several years ago - in 2013. It provided for the creation of a reserve based on tax payments accrued on the following types of property: luxury goods, including vehicles and real estate, tobacco and alcohol products.

- Mercedes;

- Cadillac;

- Jaguar;

- Hyundai Equus;

- Range Rover Sport/Discovery/Vogue/Evoque;

- Volkswagen Touareg/Multivan/Phaeton;

- Nissan Patrol/GT-R;

- Rolls-Royce;

- Aston Martin;

- BMW;

- Lexus;

- Audi;

- Lamborghini;

- Bugatti;

- Ferrari.

Luxury by example

You can calculate the luxury tax for a car using the following formula: L * R * K = N. Where:

- L – number of horsepower;

- R – transport tax taking into account the regional rate;

- K – increased coefficient;

- N – total amount.

Let's look at the calculation formula in action. As an example, let's take the BMW 535d x Drive, with 313 hp. With. Based on engine power, economic safety class and fuel type, the tax amount for such a car is about 47,000 rubles. Considering that the car falls under the price category of 3-5 million, the increasing factor will be 1.5%. After recalculation, we receive an amount of 70,500 rubles.

For the BMW X5 M, the amount of transport tax will be noticeably higher, despite the fact that the cars are in the same price category. An engine is installed here, therefore, the basic transport tax will be 86,000 rubles, which, taking into account the increasing rate, turns into 130,000.

The situation in the secondary car sales market is ambiguous. Used cars are often sold at reduced prices, which should save the new owner from paying luxury tax. For example, the Mercedes-Benz CL 65 AMG can be found on sale for a “modest” 2,500,000-4,000,000 rubles. However, in the register of the Ministry of Industry and Trade it is estimated at 10 to 15 million, which means a 3% tax rate coefficient for the owner.

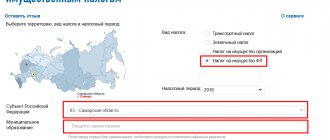

To find out the exact tax, you can contact

to the Federal Tax Service website

Therefore, it is better to play it safe and check the car according to the lists of the Ministry of Industry and Trade. This will help avoid unpleasant surprises when paying taxes.

- 0.7% for the value of the object in the range of 50-100 million rubles;

- 1% if the price of real estate varies in the range of 100-150 million rubles;

- 10% for cadastral valuation of housing worth over 150 million rubles.

The Federal Tax Service calculates the tax on expensive cars and real estate in 2021 independently, and taxpayers are notified of the amount of deductions before August 1 of the current tax period. A declaration of income and a list of documents for real estate and its owner must be completed by March 1 of the following year.

The list of papers can be prepared personally or you can entrust this process to a qualified expert. A professional will help you avoid mistakes when calculating and filling out documents. Tax payment is carried out at the bank branch according to the details received from the Federal Tax Service. It is worth noting that depositing funds can be divided into several equal parts. For property received as a result of gift or inheritance, the tax is paid by the new owner after registration of rights to the property.

If the property is damaged, sold or given away, then no tax will be charged on it, starting from the next month.

Luxury tax (increased transport tax) = Number of horsepower X Regional transport tax rate X Increasing factor;

Changes to the tax program in 2019

The luxury real estate tax in 2021 is a mandatory fee that is paid by a certain category of citizens subject to specific conditions. Benefit groups are insured against this tax, but you should take a closer look at some of the features in order to understand how to avoid such payments.

How is property tax calculated?

Taking into account the amendments made, apartments with an area of over 200 m2 and a cost of more than 30,000,000 rubles can be considered luxury housing. The minimum tax rate is 0.1% of the market value of housing. The maximum threshold is set at 300,000,000 rubles; the owners of such apartments will annually contribute about 3,000,000 to the state treasury based on a rate of 1%.

The innovations affect residential and commercial real estate, including unfinished areas, land plots and buildings. The payment system is quite flexible and is calculated individually for each property. However, residents of the capital and other large cities will pay more for housing than citizens living in the periphery. In particular, the tax amount for Muscovites will be approximately 5 times higher than in neighboring regions.

In addition, people who invested in the purchase of real estate in new buildings with subsequent rental of housing will be at a disadvantage. If the total area of square meters exceeds the established norm (200 m2), annual tax deductions will amount to about 30,000 rubles. This minimizes the profits of such entrepreneurs.

What is not subject to tax?

The luxury tax on real estate is calculated as follows:

- If the market value of the property does not exceed the established threshold, the tax rate is 0.1%.

- For industrial buildings, office premises and tax centers the rate is 0.5%.

- Land for personal subsidiary plots and agricultural purposes is taxed at a rate of 0.3%.

- For other land plots the rate will be 1.5%.

Closer and closer to the end of 2012, the fear of the opposition among the state authorities began to decrease, so officials began to talk about other options for “withdrawing all arrears without a trace.” The concepts of “social” and “over-consumption” have come into circulation. Now officials are proposing differential taxes on homeowners and consumers of state monopoly services.

So soon electricity will be calculated at a double tariff - about 70 kWh. per month according to “social” and the rest - according to the increased “super-consumer”. In November-December 2012, the most discussed issue in the real estate sector was the general increase in the tax burden with elements of differentiation.

In December 2012, officials announced other executive characteristics: real estate with an area exceeding 1000 sq.m. and a cost of 15 million rubles will fall under special tax accounting.

Certain categories of citizens are not subject to property taxation for the ownership of apartments, dachas, residential buildings, and garages. According to available data, this list is planned to be preserved (see Tax Code).

- Persons of retirement age;

- Military personnel fulfilling their international duty in Afghanistan;

- Spouses and parents of government employees and military personnel who died in the line of duty;

- Owners of gardening and dacha buildings, if the structures on these plots do not exceed an area of 50 sq.m., as well as owners of residential buildings, if their buildings are also less than 50 sq.m. meters;

- Owners of creative workshops, studios, ateliers, libraries, galleries, museums and other cultural organizations open to the general public, the owners of which are artists and cultural figures, people's artists.

- Employees of the courts of the Russian Federation are exempt from paying property taxes, and the tax rate for members of their families is reduced to 50%.

A couple of tax calculation examples. Let us remind you that a person who owns real estate is obliged to pay two types of taxes annually: land tax and property tax.

Example 1: calculating tax on a piece of land.

There is also a land tax on horticultural land, which pays for gardening. The amount of such tax is calculated by gardening itself based on the area and tariffs of the local municipality. In 2012, the rate for a specific plot varied from 100 to 500 rubles, in 2013 it will range from 200 to 1100 rubles.

Example 2: Calculation of tax on a plot with a house.

But the property tax will be quite large. If the house is valued at 5 million rubles, then, according to the law “On taxes on property of individuals”, for 2012, with a property value of up to 300,000 rubles. the tax will be no more than 0.1%, from 300,000 to 500,000 - from 0.1 to 0.3% and up to 2% for a higher value.

We have to pay “at the rate” of 0.1%. For 2012 we will pay based on the cadastral value of 700 thousand *0.1% = 700 rubles. For 2013, our tax payment for property will be 5 million * 0.1% = 5,000 rubles. There will also be a tax on the land of our gardening or individual housing construction plot and it will be about 200 - 1200 rubles.

A total of about one and a half thousand rubles in 2012 and a little more than 8,000 in 2013. And the Tax Ministry promised an average increase in the burden of only 2 times... Eight thousand rubles is, of course, not a reason to sell a cottage and immigrate, but an increase in taxes from 1,500 to 8,000 rubles under the auspices of introducing taxes on the rich is a reason to once again think about how many times in proportion to tax revenues should the quality of government care for residents of country cottages improve?

About the article “Luxury Tax 2013: Real Estate”

There are also some types of loyalty for owners of summer cottages and buildings, which by law belong to the housing stock, requiring payment of a luxury tax. Twenty square meters are subtracted from the total area of the country house and the tax amount is calculated from the remaining area. If the area is equal to the specified twenty meters or less, there is no need to make deductions to the tax service.

Tax calculation

The scheme for calculating the tax amount is based on the following provisions:

- If the cadastral value of real estate does not exceed the limit adopted by law, then the tax coefficient is 0.1%;

- Office premises, tax centers, industrial buildings - the rate will be 0.5%;

- Agricultural land, plots of personal subsidiary plots - tax coefficient 0.3%;

- Other land plots – 1.5%.

A deliberate reduction in the price of real estate is not possible - all information is checked in Rosreestr, and tax is collected without fail.

In addition, legislative acts indicate:

- Luxury housing is apartments with an area of more than 200 square meters, the price is over 30 million rubles;

- Real estate with a value of more than 300 million rubles. is recognized as a luxury object, the tax amount on it is determined in the amount of 2% of the cadastral value of this housing.

Cases of tax exemption

According to the law, the following categories of people are recognized as taxpayers:

- Organizations;

- Individual entrepreneurs;

- Individuals who own a taxable object from the list specified in Article 333.44 of the Tax Code of the Russian Federation.

The following citizens are not recognized as taxpayers:

- Disabled people of WWII, various combat operations;

- Heroes of the Russian Federation/USSR, full holders of the Order of Glory;

- Laureates of Russian state awards in various fields (science, technology, art, literature, etc.), Nobel Prize.

Despite the fact that the luxury tax is defined as an additional measure for regulating such relations and a way to establish equality of all citizens in the tax sphere, cases are still allowed when preferential procedures can be applied even to owners of expensive things, which completely or partially allow them to be exempted from payment of the tax in question.

The easiest way is to stop paying taxes on your car. Every year it is necessary to check the lists that establish the brands of cars, the years of their manufacture and the value of objects subject to taxation. Accordingly, over time, it is possible to obtain a privilege, that is, to stop paying tax on the car, since due to its characteristics it will simply be removed from the specified list. However, this is not always possible. This raises the question, how else can one free oneself from the obligation in question?

The law determines the circle of people who can be completely exempt from the luxury tax.

Although the proposed actions cannot be considered illegal, the tax authority will conduct a thorough audit, and if fraud is detected, this will lead to some liability.

Thus, the tax on objects that have been recognized as luxury is always levied on everyone who owns such property. This only affirms the principle of equality of every citizen before the law. At the same time, like any other tax, the payment in question will involve some preferential conditions that can terminate the fulfillment of the obligation, but for this you need to provide evidence that would establish the existence of reasons for this.

Preferential group of citizens

There are several social strata of the population that are completely exempt from paying luxury tax.

The following citizens fall under this rule:

- parents of large families;

- disabled people (regardless of the degree awarded);

- veterans of the Great Patriotic War;

- combatants;

- heroes of the Russian Federation and the USSR.

This benefit can only be used if the vehicle’s power does not exceed 200 hp.

Moreover, there are very few vehicles in Russia that meet these requirements and cost more than 3 million rubles.

Luxury real estate tax

Is it possible to avoid paying luxury tax? There are also various tricks that some people use to evade paying taxes. If the vehicle is registered with an organization that is taking part in the preparation of the 2021 FIFA World Cup, vehicles that have been converted to be driven by disabled people. Luxury tax: real estate Our legislation provides for the option of paying a real estate tax.

Thus, the owner of a brick house in Krasnodar with an area of 500 square meters now pays a tax of 100 rubles. After 2014, the tax on such a building will be 4,000 rubles, that is, it will increase 40 times. In addition, such a tax will be noticeable for those who bought apartments in new buildings for rent.

Tax objectivity

Many citizens do not agree with this bill - the market value of real estate is increasing every year, people could buy an apartment in the economy segment 10-15 years ago, but today its value will increase. For example, buying a one-room apartment 10 years ago for 700 thousand rubles. – currently its market value will be at least 1 million rubles.

Chapter 25

2) dachas and other residential buildings, premises and structures located on the territory of the Russian Federation with a value of 30 million rubles and more, as well as land plots on which the specified real estate objects are located, country and garden land plots, land plots (shares in them) allocated for individual housing construction;

4) cars, passenger sea, river and aircraft purchased on the territory of the Russian Federation or registered for the first time in accordance with the established procedure in accordance with the legislation of the Russian Federation to a new owner with a value of 3 million rubles and more: airplanes, helicopters, motor ships, yachts, sailing ships , boats.

Odds valid in Moscow

| Real estate | Tax rate |

| Housing with a cadastral value of less than 10 million rubles. | 0.1 |

| Housing with a cadastral value of 10-20 million rubles. | 0.15 |

| Housing with a cadastral value of 20-50 million rubles. | 0.2 |

| Housing with a cadastral value of 50-300 million rubles. | 0.3 |

| Housing with a cadastral value of over 300 million rubles. | 2 |

| Garages | 0.1 |

| Construction in progress | 0.3 |

| Commercial buildings | 2 |

| Administrative buildings | 2 |

Who will pay the luxury tax in 2014?

According to experts, one of the most significant events in the Russian financial sector in 2014 will be the introduction of a luxury tax. V.V. Putin intended to introduce this project a year ago. According to preliminary forecasts, the luxury tax was supposed to come into force in the first quarter of 2013, but the government was unable to calculate the main criteria for innovation, and the project was postponed indefinitely.

The main goal of the bill under consideration is the ability to regulate the movement of financial flows and redirect them to different sectors of the country’s economy. In addition, the government believes that by introducing additional duties on luxury goods, it will be possible to reduce the level of corruption in the country, thereby increasing state budget revenues.