What is the tax on bathhouses, greenhouses, sheds and toilets?

The Ministry of Finance of the Russian Federation informed that owners of dacha plots must inform the tax authorities about the outbuildings existing on their territory. The media picked up the alert and distributed it online and on television. Therefore, a number of citizens have the impression that there is now a new tax on bathhouses, greenhouses, and sheds.

However, it is not. No such tax was introduced. However, for a number of country houses it is still necessary to pay fees. The fact is that they are equated to real estate objects. As a result, such buildings are subject to property tax. In other words,

The tax on bathhouses, greenhouses, sheds and toilets is a regular property tax on individuals. It has been in effect in Russia since 1992 and applies to real estate owned by citizens.

By the adopted amendments to the Tax Code of Russia in 2021, all buildings for economic purposes on the territory of land plots of gardening, partnerships, and dachas are equated to taxable objects. Therefore, along with houses and residential premises, an annual tax is paid for them.

Outbuildings include:

- Baths,

- Gazebos,

- Garages,

- Protective structures (fences),

- barns,

- Greenhouses,

- Greenhouses,

- Summer kitchens,

- Toilets (toilets),

- Other commercial buildings.

Property tax

Property tax is paid by all garage owners, and is intended for all categories of citizens. Regardless of whether the structure is monumental or temporary, if the ownership of the garage is registered in the prescribed manner, the obligation to pay tax also appears.

In accordance with Art. 402 of the Tax Code, the property tax base is the inventory value of the garage. It is calculated by the engineers of the cadastral agency and marked in the cadastral passport.

Some categories of citizens are exempt from property tax on garages, but benefits are not provided to owners whose garages are operated for business purposes.

We invite you to familiarize yourself with: Tax return 3NDFL sample for deduction for an apartment

What buildings are subject to tax?

In turn, the Federal Tax Service provided a number of clarifications on the taxation of objects on land plots. Mandatory tax must be paid for a building if it meets the following conditions:

The dacha building must have a permanent structure.

In other words, such buildings include those that have a foundation. In this case, moving the outbuilding is not possible without changing the design, disassembling or damaging it. Therefore, only such structures are considered real estate.

The property must be registered.

Based on the fact that the building has a permanent structure and is real estate, it must be owned with a documented right to it by the owner. To do this, the object must be entered into the Unified State Register of Real Estate and assigned a cadastral number.

The total area of the building exceeds 50 square meters.

To be subject to taxation, a fundamental building must have an area of more than 50 square meters. Only in this case is it registered and entered into the register. Smaller structures, even if they have a permanent structure, are not subject to tax in accordance with the law.

Let's look at specific examples of which buildings on the site are subject to tax:

1. Residential building (house).

This type of building is subject to registration and payment of tax, since it is a capital structure. As a rule, houses are built on a fundamental basis.

2. Bathhouse.

Most baths also have a foundation, so they are treated like real estate and are subject to tax. However, if the bathhouse is small in size and does not exceed 50 square meters, then you do not need to pay tax for such a building.

3. Barn.

Sheds come in different types and sizes. The rule is the same here. If the barn has a foundation and its area is more than 50 square meters, then it is registered and taxed. In other cases, it is not necessary to register it.

4. Greenhouse, greenhouse.

Such buildings are usually easily portable and have a simple structure. As a result, they are not taxable items.

5. Garage.

The structure of garages also differs in design. If it meets the conditions listed above, then payment of tax for it is required. Small garages are exempt from contributions to the budget. However, it is worth considering that the land plot on which the garage is located must be located outside of federal cities.

6. Toilet (toilet).

Such structures are classified as auxiliary buildings; their size, as a rule, is quite small, and they are not considered real estate. As a result, you do not need to pay tax on them.

7. Fences.

Fences also belong to other types of structures. They are a fence and have a protective and framing function. Despite the length of the fences, they are not real estate, and no tax is paid for them.

8. Summer kitchens, gazebos and other outbuildings.

Most buildings of this type are also not fundamental. Their area rarely exceeds 50 square meters, and they are not included in the tax base.

Thus, owners of land plots must pay taxes only for such economic objects that are included in the Unified State Register of Real Estate, have a foundation and an area of more than 50 square meters.

Explanations from representatives of Rosreestr regarding the registration of dacha buildings on plots

The object of taxation can be a house, apartment, room or garage.

Property tax for garden and dacha land plots is levied only for those buildings that are erected on the territory. Some groups of citizens may be exempt from paying property taxes. Buildings located on a garden or summer cottage plot with an area of up to 50 square meters, including outbuildings of the same size, are not taxed.

The property tax rate is set by the municipality, since this type of tax is local. The value of real estate is taken as the tax base:

- up to 300 thousand rubles - up to 0.1%;

- from 300 thousand rubles to 500 thousand rubles - from 0.1 to 0.3%;

- over 500 thousand rubles - from 0.3 to 2.0%.

The payer of the property tax in respect of plots included in the community is the association. For lands owned by the community, rates are set by the administrative apparatus.

According to ch. 30 of the Tax Code of the Russian Federation, plots that are part of a dacha community or SNT are subject to land tax in the same way as other types of property. The peculiarity of the taxation of such plots is that payments are made by the garden or dacha community at the expense of targeted contributions from the participants of the association.

Tax rates are set by the municipality, since this type of fee is local. Benefits are provided for some groups of citizens.

The amount of the tax is established on the basis of the cadastral value of the territory and taking into account the classification of land by intended use.

For garden and country plots, this rate is a maximum of 0.3% of the cadastral value. The tax base is determined as the cadastral value of the territory at the beginning of the year considered the tax period, minus tax benefits.

The tax rate on land owned by the partnership is determined by the administrative body.

The community of gardeners or summer residents is a non-profit organization, but the association can employ citizens performing various types of work activities. In this regard, like any employer, SNT is obliged to pay all tax obligations that arise for it. These include personal income tax, pension fees and other types of taxation.

Tax benefits

Preferential taxation procedures are established for certain groups of citizens. Owners of plots may be exempt from paying taxes in full, in part, or the accrual base will be reduced due to deductions made. The following have the right to social support:

- heroes of the USSR and the Russian Federation, full holders of the Order of Glory;

- citizens with disabilities;

- disabled since childhood;

- participants in the liquidation of man-made disasters and affected residents (at the Chernobyl nuclear power plant, the Semipalatinsk test site and the Mayak association);

- WWII veterans and combatants.

We suggest you read: How to determine the boundaries of the local area of an apartment building

Conclusion

In conclusion, a number of conclusions can be drawn:

- Property located on land plots of a horticultural or dacha community, like any other, is subject to taxation.

- The payer in this case is SNT, and not the owner of the plot. Payment is made from funds that go to the community treasury in the form of targeted contributions.

- To make a payment, the partnership is required to submit a corresponding declaration to the tax office, indicating the amount to be paid. The declaration is provided quarterly.

- Property tax assessments depend on the value of the property and the corresponding rate.

- Land tax is also obligatory and is calculated at the rate set by the administrative body. A declaration is also provided for land tax.

- The amount of tax is determined taking into account the cadastral value of the site and the established rate, which should not exceed 0.3%.

- Like all legal entities, SNT assumes obligations to pay personal income tax in the amount of 13% of accrued wages. Funds are paid from the salaries of employees who perform essential work activities in the community.

- Not all citizens are required to pay these taxes. Certain groups of partnership participants are exempt from taxation if there are appropriate grounds, for example, a disability certificate or a veteran’s certificate.

List of laws

Still have questions? Ask them to practicing lawyers on land issues right now:

Call right now and resolve your issue - it's fast and free!

The obligation to pay tax on dacha real estate is assigned to citizens by the Tax Code of the Russian Federation. Federal Law No. 284-FZ of October 4, 2014 amended Section X of the Tax Code of the Russian Federation - Chapter 32 was added to it, which included Articles 400-409 on the property tax of citizens.

These articles regulate the main criteria:

- objects subject to taxation;

- the tax base and the procedure for its determination, taking into account the cadastral and inventory value of the object;

- tax rates and the procedure for their calculation in relation to the purpose of the object;

- tax benefits and a list of persons eligible for them;

- tax period and deadlines for payment of accrued amounts.

We suggest you read: How to find out the cadastral number of a land plot

Despite the fact that the ratification of the above Federal Law took place in 2014, owners must pay the tax on summer cottages for the first time in 2021. Until March 1, 2021, the so-called “dacha amnesty” was in effect, which enabled owners to register rights to previously unlegalized dacha plots and buildings on them in a simplified manner (Law No. 93-FZ dated June 30, 2006).

In fact, from 2021, owners of summer cottages will be required to pay two types of taxes:

- land - based on the area of the land plot;

- property - for objects erected on a summer cottage.

The dacha tax is based on changes that occurred in the legislation in 2021. This concerns the law on dachas, which provides for the formation of state fees related to the category that includes owners of land and garden plots.

Despite the fact that the changes were supposed to simplify the system for generating amounts, experts say that there are currently a sufficient number of problems and outstanding issues that require attention.

Despite the fact that previously established legislative norms were approved about two decades ago, by the time of the latest innovations there were significant problems related to changes in legal norms that had been developing all this time.

What the innovations affected:

- preferential categories;

- period of continuous ownership;

- interest rates;

- other conditions for owning a dacha building.

The new law is designed to reduce the number of questions that arise and simplify the process of administering this area. However, given the attempts to make life easier for owners of land plots and owners of country houses, some questions still remain regarding the formation of the amount.

Starting from 2021, taxes will be imposed not only on summer cottages and garden plots, but also on the buildings located on them:

- garages;

- extensions to the house;

- residential real estate;

- as well as buildings under construction.

This norm is regulated by Art. 401 of the Tax Code of the Russian Federation. All objects located within the boundaries of a land plot or subsidiary farm fall under the criteria of the law.

The tax on garden buildings was introduced in order to bring the tariffs for summer houses and summer cottages closer to the tariffs for full-fledged country cottages. The following are also subject to taxation:

- built real estate complexes;

- a house with an attached garage or summer kitchen, including communications;

- any residential complexes (if the object is identified as a residential complex, then it is subject to one tax).

READ ON THE TOPIC: Tax on owners of bathhouses and country sheds from 2018 - clarifications from the Ministry of Finance

Deputy Head of the Department of State Registration of Real Estate of the Rosreestr Office for the Omsk Region, Elena Kobets, dispelled these rumors. In short, summer residents have become victims of some misinformation.

READ ON THE TOPIC: Who will be charged the tax on sheds and greenhouses on their summer cottage?

Private greenhouses on the plots of Russians, which were built without a permanent foundation and have an area of less than 50 square meters. m, are not subject to property tax, reports the press service of the Federal Cadastral Chamber of Rosreestr.

We suggest you read: How to Get Money Back for Credit Insurance

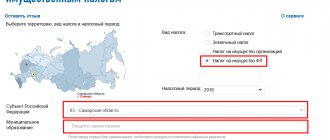

Percentage tax rate for baths, greenhouses, sheds.

Since the tax on bathhouses, greenhouses, sheds is a property tax, the interest rates on it are similar.

Thus, in accordance with the norms of tax legislation, rates for dacha buildings range from 0.1% to 0.5%. However, personal property tax is a local tax. Therefore, in each specific municipality, local authorities have the right to determine their own tax amount, but not exceeding the federal rate.

In most regions of Russia there is a tax rate of 0.3%.

The tax service should be notified of the presence of outbuildings and their area. This will eliminate the emergence of controversial issues and erroneous assessment of taxes.

Property tax is mandatory for all individuals. As a result, every citizen must notify the Federal Tax Service about the objects they own by the end of the year. Failure to comply with these requirements may be interpreted as tax evasion and is subject to penalties in the form of a fine, as well as tax accrual at a higher interest rate.

Taxation of land plots

By purchasing a country house, the buyer receives at his disposal a plot of land (adjacent territory). The tax services already have data on it; it has a cadastral number and certain boundaries.

At the same time, the new owner is required to pay land tax in the following cases:

- if the site is privatized;

- received on the basis of perpetual use rights;

- is in lifelong possession.

Land tax must be paid annually. The amount is calculated individually, depending on the cadastral value of the site. The Tax Code sets the maximum permissible rates. You can find restrictions in Art. 394.

If you buy a house on land that does not fall under the categories of agricultural land, private household plots, peasant farms, then the rate for annual payment will be a maximum of 0.3% of the cadastral value of the plot. You can find it out on the website: pkk5.rosreestr.ru.

Tax benefits for baths, greenhouses, sheds.

So, capital structures with an area of less than 50 square meters are exempt from tax contributions. As well as outbuildings not included in the Unified State Register of Real Estate.

It is worth noting that this benefit applies to buildings for personal use. If they are used in the course of business activities, they are not exempt from paying annual contributions.

At the same time, the regulations of the Russian Federation define groups of persons who are granted tax benefits. These include:

- Heroes of Russia or the Soviet Union;

- Disabled people;

- Participants in hostilities

- Veterans of the Civil, Great Patriotic and Afghan Wars;

- Pensioners;

- Victims of the Chernobyl disaster, as well as victims of nuclear tests and other nuclear accidents.

- Retired military personnel;

- Family members of military personnel killed while performing military service duties;

- And other groups of citizens.

A more detailed list of preferential categories of taxpayers is contained in Article 407 of the Tax Code of the Russian Federation.

What is subject to tax?

According to paragraph 1 of Art. 401 of the Tax Code of the Russian Federation (TC RF), in addition to the land plot, tax must be paid for the following objects located within the boundaries of this plot:

- Residential premises and buildings;

- Garage and/or place for a car;

- Facilities under construction;

- Unified real estate complexes;

- Other buildings.

Residential buildings actually used as houses, from 2021, are subject to taxes according to uniform rules if they are located on dacha and garden plots, as well as plots for subsidiary farming, in accordance with clause 2 of Art. 401 of the Tax Code of the Russian Federation.

This measure is intended to combine into one category garden houses that do not fit the definition of “residential building” according to technical standards, with full-fledged houses on individual housing construction plots.

A single real estate complex is usually understood as a set of residential, non-residential and linear buildings, united by an inextricable infrastructure and communications and intended for joint use. Such a complex may include a residential building with a garage and an electrical distribution box. All buildings in the complex are subject to one general tax.

In 2021, it is planned to double the land tax for owners of the following types of built but unregistered buildings:

- Residential buildings and buildings;

- Unified real estate complexes;

- Outbuildings with an area exceeding 50 square meters. m.

This measure was taken to compensate the budget for lost tax from unregistered houses.

Income tax

Such a tax is provided for purchase and sale transactions, regardless of how the ownership was formalized.

Income tax on the sale of a garage is 13% of the established value of the property.

Deed of gift: a garage can be issued as a gift, in which case it is also subject to tax, which is established by the state, except in the situation where the donation occurs within the family circle. In this case of acquisition, there is simply no tax. The following close relatives are included in the family circle:

- husband and wife;

- children and their parents, both natural and adopted;

- brothers and sisters with common parents.

The tax inspector calculates the amount right on the spot. All owners are obliged to pay the full amount of tax annually, regardless of citizenship and place of residence.

Lifetime Property: Citizens who own a property in perpetuity or by right of inheritance are also required to pay a garage tax under current code provisions. Such tax exemption is carried out according to the same preferential groups stated above.

• the cost of a garage is below 250 thousand rubles;

• ownership of the garage is three years or more.

According to Part 4 of Art. 218 of the Civil Code of the Russian Federation, a member of a garage cooperative becomes the full owner of the garage after full payment of the share, and not from the moment of its registration.

As for the tax on a gift transaction, it is paid to the budget by the donee in the amount of 13% of the cost of the garage. Only close relatives of the donor - parents and spouses, children and grandchildren, brothers and sisters, grandparents - are exempt from the contribution.

When inheriting, the first-priority heirs will pay 0.3% of the garage value, but not more than 100 thousand rubles, the remaining heirs will pay 0.6% of the garage value, but not more than 1,000,000 rubles.