The transfer of ownership as a result of the donation of a dacha, in accordance with Article 572 of the Civil Code of the Russian Federation, involves the conclusion of an appropriate agreement, in which the object of the donation is this real estate. At the same time, the main feature of the deed of gift related to civil transactions is its complete gratuitousness, which implies the absence of payment when transferring property from one owner to another.

Let us immediately note that the current legislation of the Russian Federation does not contain a clear definition of the term “dacha” and this object, as a rule, is understood as a non-residential, but suitable for habitation (not necessarily) premises located outside a large populated area, the main purpose of which is the opportunity its owner to spend some time during the warm season.

Most often, a dacha consists of 2 completely independent real estate objects:

- land plot;

- residential and non-residential buildings located on a summer cottage.

And, therefore, transferring, for example, a country house and buildings by deed of gift without transferring ownership of the land plot is impossible and contradicts the letter of the law (according to Article 35 of the Land Code of the Russian Federation)!

To legally conclude a transaction, the gift agreement must also necessarily reflect the will of the recipient and the giving party. That is, the donor must express in writing his desire to transfer the property, and the recipient must confirm his desire to accept the gift by signing.

As a result of the execution of the transaction, any obligations related to the procedure for transferring the dacha can only arise from the owner (donor), since the deed of gift refers to unilaterally binding transactions.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

During the preparation and signing of the contract, both parties must strictly follow the rules and regulations of the current legislation of Russia, which relate to the subjective composition of the transaction (Article 575 of the Civil Code of the Russian Federation), as well as the rights of owners (only in cases where the object being donated is part of the general property, as specified in Article 576 of the Civil Code of the Russian Federation)!

Since a dacha is defined as real estate, the transfer of ownership from the donor to the donee must be officially registered, in accordance with Article 131 of the Civil Code of the Russian Federation. In addition, according to the rules for its implementation, described in Article 13 of Federal Law No. 122, which was adopted on July 21, 1997, this agreement must be drawn up in writing.

Also, it is worth noting the fact that a deed of gift as a method of alienation of real estate significantly expands the rights of the parties. For example, a transaction can be canceled at the request of both the donor and the donee before signing the agreement (in accordance with Articles 573 and 577 of the Civil Code of the Russian Federation). In addition, the donor has the opportunity to cancel it after signing the deed of gift, but only on the basis of the list specified in Article 578 of the Civil Code of the Russian Federation.

Remember that when receiving a dacha as a gift, the new owner actually receives income that is equal to the market value of the gift. At the same time, he does not spend his own funds on the acquisition of property, which is the basis for taxation, the amount of which in 2021 is 13% of personal income tax.

ARTICLE RECOMMENDED FOR YOU:

Donation agreement for household appliances - legal advice in 2021

Legislative regulation

The natural consequence of drawing up a gift agreement will be the transfer of property to the recipient free of charge.

A desire to make a gift to a third party, expressed orally, has no legal force. The contract must be drawn up in writing, this is the requirement of Art. 574 of the Civil Code of the Russian Federation. What requirements must the contract meet:

- Free transaction. Absence of conditions and reservations on the part of the donor and recipient.

- Consent of the recipient to receive the subject of the transaction.

- Delayed transfer of a gift is allowed after certain conditions have been met. Such a condition cannot be the death of the donor, since in this case it is necessary to draw up a will.

In this way, you can donate both the entire dacha plot and part of it. If the donor owns the plot jointly with his spouse under the terms of community property, the written consent of the husband or wife will be required.

The procedure for drawing up a contract for the donation of a dacha in 2021

As we have repeatedly noted in previous articles on the Legal Ambulance website, since an agreement of this type requires mandatory state registration - the agreement must be drawn up in writing! At the same time, the legislator allows the donor and the recipient to notarize the document drawn up by the parties, recommending that transactions be notarized due to their high cost.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Since the deed of gift regulates the conditions and procedure for the actual transfer of a country house and land, the success of the transaction, in general, will depend on the correctness of the agreement. Therefore, the parties must specifically, clearly and unambiguously state each point of the document!

However, lawyers note that an agreement can be challenged in 95% of cases if its content does not contain the following information:

- The intention expressed by the donor to transfer the dacha free of charge into the ownership of the donee or group of persons;

- the expressed consent of the recipient to accept the gift and assume all responsibilities associated with it;

- information about the parties to the transaction, including their passport details and actual residential addresses at the time of drawing up the dacha donation agreement;

- a detailed description of the properties and characteristics of the object of the donation, including data on the land plot, the address of the dacha, cadastral numbers of the house and plot, as well as the technical characteristics of all premises that distinguish the gift from among similar objects;

- list of grounds for termination of the deed of gift;

- instructions on the current legal capacity of the donee and the donor;

- indicating the period for transferring the object into ownership of the new owner;

- a list of obligations and rights of the parties, as well as their responsibility for violating the terms of the agreement;

- information about the absence of encumbrances or similar restrictions on the use of real estate;

- signatures of the parties.

ARTICLE RECOMMENDED FOR YOU:

Registration of a deed of gift for a house and land

The next step in concluding a dacha donation agreement after drawing up and proofreading the main agreement is its mandatory state registration, or more precisely, the re-registration of ownership from the donor to the donee. All the parties need to do is go together to the registration authority, where they will have to write a corresponding application (from both the donor and the donee), hand over a package of necessary documents and receive a receipt from the organization’s employees with an approximate completion date of the procedure.

Registration at the MFC

To register a deed of gift for a dacha through the MFC, the donor must prepare in advance a list of documents confirming ownership of the object.

The procedure is as follows:

- Drawing up a draft gift agreement in 3 copies, a standard sample will do.

- Preparation and collection of documentation.

- Personal appearance of the parties to the transaction at the nearest MFC (at the place of registration of one of the parties to the transaction, or at the location of the property). Submitting documents to the center employee, signing the application for registration of the gift, receiving a receipt for the submission of documentation. The applicant is informed of the expected date of document readiness.

- Waiting for the deadline for registering the right (no more than 10 days from the date of receipt of the documentation at Rosreestr).

- Repeated appearance at the center. Receive an extract from the Unified State Register of Registered Rights to the property.

What documents are required

By the time you appear at the MFC, the following documents must be prepared:

- confirmation of the donor's ownership of the dacha plot;

- passports of the parties to the transaction;

- receipt for payment of state duty;

- consent of the donor’s marriage partner, notarized (if the dacha was acquired during marriage);

- certificate of inventory value;

- a certificate of family ties between the parties to the transaction, if any;

- consent of the recipient's representative if he is a minor.

Reference! In the MFC, when drawing up a deed of gift, the presence of both the giver and the recipient of the gift is required. When concluding a gift transaction, you should check the availability of all necessary documents and their relevance. Since any inaccuracies may lead to its recognition as invalid. This can happen if other relatives are interested in the property.

What documents are needed to donate a dacha?

To carry out all the above-described stages of drawing up a contract for the donation of a dacha from one person to another, the parties (for the most part, the donor of the property) must have these 5 types of documents on hand:

- original passports of the parties involved in the registration of the deed of gift;

- papers confirming state registration of the land plot and buildings on it;

- all title documents for the land plot and buildings on it, confirming the donor’s right to dispose of this object;

- technical and cadastral passports and plans (for the site and buildings);

- other available land and legal documentation.

ARTICLE RECOMMENDED FOR YOU:

Donation agreement after the death of the donor - is gifting possible?

And, in order to register the ownership of the new owner of the property, you need to add to the existing papers:

- original deed of gift;

- transfer deed (if it was concluded);

- a receipt confirming successful payment of the state duty established by current legislation.

Gift deed between close relatives

Close relatives are:

- brothers and sisters;

- relatives in ascending and descending lines.

If the donor and the recipient are related (as confirmed by a document), the transaction is exempt from tax, in accordance with Art. 217 Tax Code of the Russian Federation.

At the same time, participants in the transaction who are relatives do not pay only the 13% tax, but are not exempt from paying state duty, as well as other related payments.

If the parties are not related, they are required to pay 13% of the cost of the plot. In addition, they still have the obligation to pay state fees.

Agreement for donating an apartment between close relatives in 2019

How to gift an apartment to a relative? Concluding a gift agreement is the simplest and least expensive way to transfer square meters. However, in order to avoid misunderstandings and litigation, it is worth understanding some of the nuances of the agreement for donating an apartment between close relatives in the year, which will be discussed in this article. A fairly simple procedure allows you to resolve all issues with minimal costs.

You only need to pay the state fee and, if necessary, notary services. Forward-thinking parents often prefer to issue a deed of gift for children, understanding that officially donated housing is not involved in the division of property during a divorce and the interests of the child will definitely not be harmed. True, real estate received as a gift is taken into account when calculating alimony if the donee pays it.

The main principle of such an agreement is gratuitousness, and all parties to the transaction should remember this. By gratuitousness we mean that the recipient does not pay anything to the donor in any way for the apartment, and does not provide him with any valuables in return. If this condition is not met and there are supporting facts, the transaction is imaginary, since it conceals, for example, the intention to conduct a purchase and sale transaction while avoiding taxation.

Even the slightest hint of any compensation can lead to the transaction being considered void. An agreement for the donation of an apartment between close relatives, expressed only in the form of an oral intention, is not considered concluded even if there are hundreds of witnesses - the intentions of the parties must be written down, and all the parameters of the transaction must be precisely indicated. Likewise, the recipient’s consent to accept the housing as a gift is also required; if this condition is not met, the transaction will not take place.

A donation agreement is considered legitimate only if all the territorial, address and technical characteristics of the apartment or allocated share are set out with utmost precision, if not all of the real estate is alienated in this way, but only a certain part of it.

If the property is encumbered at the time of drawing up the deed of gift, this fact must also be reflected in the contract. The real estate is described in every detail - from the location of the house, floor and apartment number to an indication of the area of each transferred premises. It is important not to forget cadastral information and the state registration number of property rights. As for the cost of housing, the cadastral value is specified in the contract. Signatures under the document confirm that both parties agree to each point.

In most cases, notarization of a deed of gift is voluntary, but many still prefer to take care of the purity of the transaction. Moreover, if we are talking about the free transfer of real estate to relatives, the services of a specialist are inexpensive.

It is definitely worth having a donation agreement certified by a notary in cases where there is a suspicion that in the future a third party will want to challenge the agreement or, for example, the donor may want to return the property. A notarized document has evidentiary force, which means that it will be difficult to invalidate an agreement through a court without serious and clearly stated grounds in the law.

But if only part of the housing is donated, you must contact a notary. When drawing up a contract yourself, using ready-made templates, you should carefully consider each clause. Both parties must be present when signing the contract; it is impossible to make someone happy with a gift in the form of housing without their consent. All nuances related to property issues must be taken into account. If, under a gift agreement, an apartment is promised to a person, but not re-registered, for example, the transfer of ownership must take place after a certain time, his rights do not pass to his heirs and assigns in the event of death.

If this is desirable, it is worthwhile to include a corresponding clause in the contract. Legal representatives of children, minors, and incapacitated persons do not have the right to draw up deeds of gift on their behalf.

This applies not only to parents, guardians, and adoptive parents; such transactions cannot be overlooked by the guardianship authorities. However, a deed of gift can be issued to persons of the listed categories. If minor children or incapacitated people are registered in the apartment that is being donated, permission from the guardianship and trusteeship authority will also be required to draw up an agreement for Rosreestr to accept it. The person who received the apartment as a gift becomes its full owner after registration.

If he is already 18 years old, he can rent out the apartment, donate it or, for example, sell part of it. To alienate the donated property, the child must wait until he reaches adulthood.

His legal representatives are obliged to keep the donated apartment intact, but they do not have the right to dispose of it at their own discretion without obtaining permission from the guardianship authorities. An apartment cannot be donated by any organization that has operational management or economic control of the property without the consent of the owner. A gift agreement is not concluded between commercial organizations, even if they are owned by close relatives.

Not everyone can be gifted either. Thus, doctors and social service employees cannot count on receiving real estate as a gift if the donor or his relatives are clients of such organizations.

There are also many restrictions for state and municipal employees; they cannot accept housing as a gift from strangers, only from relatives, but they can act as a donor. Actually, the recipient cannot be someone in relation to whom the donor is dependent, for example, a superior subordinate, a soldier-officer, a chief physician-nurse, etc. If a dwelling that is jointly owned is being donated, it is necessary to obtain permission from the second owner. For example, such permission must be obtained from the spouse of the spouse.

Many citizens, wanting an apartment to be guaranteed to be inherited by a certain relative, choose between a deed of gift and a will. An apartment donation agreement drawn up in accordance with all the rules is much more difficult to challenge, because third parties have no relation to this transaction. While a person is alive, he can change his will, this can be done quite easily and without any reason. The deed of gift, in turn, can be revoked only through the court in very serious cases - for example, if the recipient made an attempt on the life of the donor or intentionally caused him bodily harm, and this fact is proven.

The recipient must register the housing in his or her name during the lifetime of the person who donated it, otherwise it will be inherited in accordance with the procedure defined by law. All procedures for re-registration of property must be completed during the life of the donor, otherwise the transaction is canceled, as it takes the form of a camouflaged will in favor of the only relative.

The recipient must keep the donated housing intact, pay utility bills on time and not cause harm to the previous owner. In general, canceling a gift agreement is very difficult; to do this, it is necessary to collect evidence of fraudulent or other unlawful actions of the relative to whom the apartment was donated.

You can also indicate the date of conclusion of the agreement and the period of transfer of ownership of the property; in some cases, the agreement states that in the event of the death of the recipient, the donor has the right to cancel the transaction. It is important to know that the donee does not officially receive ownership rights immediately after signing the agreement, but only from the moment of its registration in Rosreestr.

Before submitting documents, you must pay the state fee. According to current regulations, the obligation to pay this mandatory fee falls on the recipient, since in this case he is the beneficiary.

It is his data that must be indicated on the receipt. Of course, nothing prevents the donor from actually contributing this amount himself, but everything must be documented correctly. If a child under 14 years of age receives real estate as a gift, the fee for it is paid by parents or other legal representatives, indicating their data in the payment document.

Upon reaching the age of fourteen, the fee is paid in full on his behalf. By and large, you don’t have to provide a receipt - the information will appear in the state payment information system, but this may take time, which means that for reliability and speeding up the process, it is better to attach a payment document to the general package.

Apart from a receipt for payment of the fee, originals and copies of passports, as well as three copies of the signed gift agreement, nothing else is needed for registration.

The procedure itself takes about ten days, however, as practice shows, if the contract is drawn up with errors, it is returned after about a month and you have to do everything again. Until the contract is registered, ownership remains with the previous owner of the property. Thus, a gift agreement is a good option for those who want to transfer housing to relatives without high costs and unnecessary bureaucracy. But it must be concluded only after thoroughly considering the possible consequences, since annulment may require lengthy and costly litigation.

In judicial practice, challenging deeds of gift by a third party or donors under pressure from other relatives occurs quite often, but if the document is drawn up correctly and certified by a notary, it is almost impossible to cancel it. By the way, all costs of litigation in such cases are borne by the losing party.

A selection of the most profitable offers from developers in Moscow and the region! Our channel “About New Buildings” received the Joy Award from Repa in the “Best Interview of the Year” category. Agreement on donating an apartment between close relatives. Contents Basic principles of transferring housing under a gift agreement What should be specified in the deed of gift? Do I need to have the contract certified by a notary? Important details and restrictions Donation agreement or will?

Registration is the final step in transferring ownership of real estate. Conclusion. Igor Vasilenko. Donation of an apartment. Read more Secondary: what is it? Read on topic All articles. How to donate a share in an apartment: features of partial donation of real estate. All articles. Leave your comment.

By date. Nobody has left a review yet, be the first! Leave a comment. I agree with the rules of publication on the site. See useful tips at. Standard for integrated development of territories, review of the seminar. How and for what you can receive compensation from the developer. Results on the real estate market. Forecast for the Most Affordable New Buildings in Moscow.

Overview of the Odintsovo district, Trekhgorka and Skolkovo. New buildings in industrial zones. To live or not to live? Overview of the area. Khimki vs Krasnogorsk. How to choose a reliable developer. What to choose - panel or monolith?

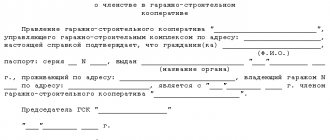

Deed of gift for a summer cottage

The donation agreement for a dacha must contain the following mandatory sections:

- Passport details, full name and addresses of the parties.

- The subject of the contract, its distinctive features and characteristics (address, type, area, cadastral number).

- Confirmation of the donor's property rights.

- Presence of encumbrance.

- Rights and obligations of the parties to the transaction.

- Signatures and date.

Attention! If the parties to the transaction are related, for example, a deed of gift for a dacha is being drawn up for a daughter, this must be indicated in the agreement. Since this circumstance entails exemption of the parties from paying personal income tax.

In order for property rights to be transferred to the daughter, it is necessary to register the transfer of rights in Rosreestr. To do this, you can contact the MFC at the place of registration of the donor or recipient, or the location of the site.

Registration by a notary

Registration by a notary is not a requirement.

This entails additional expenses. But this item is desirable for those who want to further secure the transaction. Completing a transaction in the presence of a notary is an additional guarantee of the legality and voluntariness of the donation. The contract will be stored in the archive, and if lost, it can be restored. In addition to the mandatory expenses associated with the registration of a deed of gift (state duty, tax, if necessary), you will have to additionally pay for the services of a notary. Depending on the region, the cost starts from 2000 rubles.

A state fee is also paid for notary services; their amount is tied to the estimated value of the dacha with land, as well as the degree of relationship.

For example, when issuing a deed of gift for a daughter who is a close relative, the rate will be 0.3% of the value of the gift.

For distant relatives, the rate is 1% if the value of the gift is no more than 1,000,000 rubles. If more, then the rate will be 0.75%, in addition to which you must pay another 10,000 rubles.

The parties can independently agree on who pays the obligatory payments.

Taxation of a dacha donation agreement in 2021

Based on the information contained in Article 207 of the Tax Code of the Russian Federation, real estate donation transactions are subject to tax, the amount of which currently amounts to 13% of the total value of the transaction, that is, the cost of the dacha.

The cadastral value of real estate, in accordance with paragraph 1 of Article 402 of the Tax Code of the Russian Federation, is included in the tax base for the mandatory payment of personal income tax. At the same time, this value cannot differ greatly from the real market value of the same object (or the gift itself after an appropriate assessment) and be lower than it by more than 20%!

ARTICLE RECOMMENDED FOR YOU:

Gift of property to a nephew or niece

Also, it is worth noting that if a close relative, exempt from taxation, decides to sell the dacha within three years from the date of transfer of ownership to him, he will have to pay 13% of the cost of the property .

Donees who are distant relatives, like strangers acting in this role, must pay personal income tax in full, without any special deductions. The Tax Code of the Russian Federation establishes the deadlines within which such recipients should prepare and submit a declaration to the tax office (until April 30 and until July 15 of the following year, which follows the year of the donation transaction).

An example from the practice of lawyers on the website “Legal Ambulance”

Citizen Ryzhikova O. wanted to give her nephew a dacha - a small house with a plot of land, the cadastral value of which was 1,500,000 Russian rubles . Since the aunt and nephew, according to the above rule, are not considered close relatives, the donee had to pay income tax according to the following formula:

1,500,000 Russian rubles x 13% = 195 Russian rubles

Moreover, if these citizens formalize the purchase and sale (provided that the dacha has been owned by the donor for more than 3 years), there will be no need to pay personal income tax. If this property was owned by Ryzhikova for less than three years, you will have to pay an amount that will still be less than when registering a deed of gift:

1,500,000 Russian rubles - 1,000,000 Russian rubles (tax deduction) = 500,000 Russian rubles x 13% = 65,000 Russian rubles

Nuances

The following situations may lead to recognition of the invalidity of a transaction:

- Identification of facts of exerting pressure on the donor in order to force the transaction.

- Attempt on the donor's life.

- Incapacity of the donor, poor understanding of the consequences of his actions. Relatives who have claims to the disputed property may try to prove these facts in court. But they will have to provide significant evidence of incapacity: certificates, photos, videos.

- Errors and lack of specificity in the contract. For example, the inability to identify a gift based on the characteristics specified in the document.

- Bankruptcy of a legal entity within six months after the donation. In this case, creditors can go to court.

There are situations when the recipient dies as soon as he takes possession. In order for the donor to receive the donated property back, it is necessary to provide for such a situation and mention in the contract the possibility of return in exceptional cases.

How to properly formalize the donation of a garden plot with and without a garden house

- gift agreement (you can draw up a preliminary one or fill out a ready-made sample obtained from a notary);

- extract from the Unified State Register of Real Estate (this document replaces the cadastral passport for the plot and the technical passport for the house, as well as a certificate of cadastral value);

- title documentation for the garden plot and building (purchase and sale agreement, deed of gift or certificate of inheritance);

- passports of the parties.

When going to court, relatives try to prove that the gift agreement was fictitious or was signed by misleading the donor or under pressure. The presence of notarization significantly reduces the chances of challenging and canceling the contract, as it confirms that the parties are of sound mind and are aware of the actions being taken at the time of execution of the transaction.

We recommend reading: Law on Rehabilitated Benefits