Home / Housing disputes / Donation of a share in a mortgaged apartment

A person has the right to dispose of property at his own discretion. However, if we are talking about a mortgaged apartment, the borrower is limited in the rights of the owner - donation, sale, inheritance and exchange occur only with the consent of the lender.

Imagine that you want to donate a share in a mortgaged apartment. In part, this means that you will have to negotiate with the bank - it is the bank that owns the collateral in the form of an apartment. This means the donation will differ from the standard procedure. What exactly? Read about this in our article.

Is it possible to donate a share in a mortgaged apartment?

Entering into a mortgage means concluding a mortgage agreement with a bank, under the terms of which the lender provides a loan to purchase a home. The borrower continues to live in the apartment, but undertakes to transfer the rights to the mortgaged property to the bank. Then comes the loan repayment period - all this time the apartment is pledged to the bank.

If the borrower has not yet repaid the mortgage, but wants to donate a share, he will have to obtain the consent of the lender (Article 37 of the Federal Law “On Mortgage”). The permission may be specified in the mortgage agreement. But this happens extremely rarely - it is not profitable for banks to change the loan payer, which means their consent is very rare. However, in fact, there is no need to worry - even if you have received a refusal to donate a share in a mortgaged apartment, no one forbids you to wait until the loan is repaid. Immediately after payment of the entire amount, the owner will be able to dispose of the property at his own discretion (clause 1, clause 1, article 352 of the Civil Code of the Russian Federation).

Thus, if the bank does not allow the alienation of property under a mortgage agreement, donation of a share is possible only when the loan is repaid.

Nuances and pitfalls

In a situation where the bank does not give you its consent, but you still carry out a transaction to donate real estate, then we want to warn you.

The bank can cancel your transaction at any stage by simply filing a lawsuit.

However, you will have already spent significant money, and both the credit institution itself and the donee may be charged for material damages. Be sure to remember this, because your desire to deceive the bank may backfire on you.

Terms of a transaction

Registration of a deed of gift with a current mortgage on an apartment is not an easy procedure. Before entering into a deal, you need to study your life circumstances.

Conditions for donating a share in mortgaged living space:

- clause on the possibility of donation during the mortgage repayment period;

- consent of the donor and the donee, for example, to the transfer of rights and obligations under the pledge agreement;

- re-registration of a mortgage agreement at the request of the borrower.

A mandatory condition of the transaction is registration of changes with the Rosreestr authority. The new owner (donee) will assume legal rights only after registration with government agencies.

Please note that banks do not agree to donate shares in favor of children, pensioners, the poor and orphans, i.e. those who are unable to meet mortgage payment obligations. The only option is to donate the share to such persons, but retain the obligation to repay the loan (clause 38 of the Federal Law “On Mortgage”).

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Question:

Can we give a share to a child if the living space was purchased with maternity capital? The mortgage has already been repaid by ⅔, but we have not yet contacted the bank.

Answer:

Registration of a deed of gift for a share in an apartment is considered an alienation of property. According to paragraph 1 of Article 37 of Federal Law No. 102 “On Mortgage (Pledge of Real Estate)”, donation is possible only with the permission of the holder of the pledge, i.e. banking institution. Read the mortgage loan agreement. If it contains a clause about donating a share before the mortgage is repaid, then you will be able to complete the deal. The absence of such a clause makes it difficult to donate a share. You will have to write an application to the bank and apply for permission to complete a transaction with an encumbrance.

One more point: If you plan to donate a share to a child using maternity capital, the parents must draw up a preliminary gift agreement or formalize an agreement on allocating the share to the children.

Who will be allowed to donate an apartment?

Is it possible to donate a house with a mortgage? What about an apartment? For a bank, changing a borrower is a troublesome process. Donating living space for which the debt has not yet been repaid implies that not only square meters, but also loan obligations are transferred to the new owner. He will have to make monthly payments in the future, pay for insurance, etc.

The likelihood of approval of the transaction increases if the original borrower has paid more than 50% of the total amount under the agreement.

Accordingly, the recipient's candidacy is subject to careful consideration and study. The new borrower must be solvent and within the age limits established by the specific lender. And the “old” debtor will definitely be required to prove the reasonableness and necessity of such a transfer of obligations.

If we are talking about the presence of a serious illness, an extract from the medical record and a certificate from a specialized doctor will be useful. If the financial situation worsens - a dismissal order, a copy of the work record book or a 2-NDFL certificate.

Important! If the lender's security service decides that the risks of non-repayment of funds increase with a change of owner, the transaction will be prohibited.

Below we consider the attitude of credit structures to different categories of persons - apartment recipients.

Recommended article: How and where to buy a repossessed apartment for debts

How to re-issue a mortgage to another person: procedure and conditions is detailed in another article.

The apartment is transferred to a minor or relative

Is it possible to give an apartment with a mortgage to your daughter or son? The option is unlikely if he is not yet 18 years old. He is considered incompetent and does not yet have his own income sufficient to pay off the debt. In 99% of cases, the bank will not agree to a change of owner.

Assuring parents that they will take over the loan payments themselves or going to court to recognize the recipient as legally competent will not help. Banks insure against such risks and in most cases stipulate in the agreement a ban on transferring property to a minor.

If, for various reasons, the borrower wants the apartment or house to go to a specific son/daughter/nephew, he can draw up a will and have it certified by a notary. This procedure is not prohibited by law.

Is it possible to gift an apartment with a mortgage to a relative? Yes, provided that he meets the bank's requirements, is solvent, has not reached the upper age limit set by the lender, and does not have his own credit obligations.

Lenders do not approve the procedure of gifting real estate to elderly people, regardless of the degree of relationship. It is believed that the only stable income is a pension, but it will not be enough to pay off the debt. An exception is the provision of additional collateral, guarantors or co-borrowers.

Gift recipient - spouse

In accordance with current legislation, spouses automatically become co-borrowers under the Credit (Mortgage) Agreement and co-owners of the purchased property.

Important! Banks strongly “recommend” registering living space not as shared ownership, but as common joint ownership.

There are only two cases when a spouse is not included in the list of co-borrowers:

- he/she is not a citizen of Russia. Some banks refuse such restrictions and issue loans to residents of the Russian Federation. But most of the creditors are conservative, not wanting to cooperate with those who can leave the country at any time and never return here;

- The spouses entered into a prenuptial agreement providing for separate ownership of real estate. In this case, the husband/wife does not become co-borrowers and cannot claim a share in the purchased apartment.

The process of donating a mortgaged apartment to a spouse is considered inappropriate and is not practiced. Initially, the contract implies a community of ownership, and therefore responsibility. There may be exceptions, but in a very limited number of cases, for example:

- the loan agreement was signed by the husband/wife before marriage;

- The apartment was purchased during marriage, but the union broke up. One of the spouses wants to get rid of unnecessary property and transfer it to the other.

Recommended article: Mortgage transaction during quarantine - ways to process the purchase and sale of real estate during coronavirus

Regardless of the reason for the transfer of square meters, the bank will assess the recipient’s solvency, taking into account all the requirements and rules in force in the credit institution.

Donating an apartment to a co-borrower

Co-borrowers are special people in the relationship between mortgagees and title borrowers. They are fully liable for debts to the creditor, but do not always claim square meters. Is it possible to gift an apartment with a mortgage to a co-borrower (not husband or wife)? The issue requires separate consideration.

The relationship between the main debtor and each co-borrower is governed by additional agreements. For example, he is allocated a share in an apartment in the amount of 25-30-40-50%, provided that he deposits the required amount into the lender’s account. If the main debtor, for various reasons, stops paying under the agreement, the bank automatically switches its attention to the co-borrower. He won't even have to go to court for this.

Transferring the debt to a co-borrower is possible (the situation when a husband/wife becomes a co-borrower was discussed earlier). For example, the main debtor wants to transfer both obligations and property to a second person specified in the contract due to health reasons, due to the inability to make payments in the future.

Important! Regardless of who the borrower wants to give his property to, the lender will calculate his risks. If, based on the results of the analysis, it is decided that the likelihood of non-return of money increases, the transaction will be prohibited.

In order for the lender to treat the procedure favorably, the recipient must have an income higher than that of the current payer. He should not have debts in banking structures or negative entries in his credit history.

Is it possible for a co-borrower to take out a mortgage and how to increase the chance of approval - is described in detail in another article on our website.

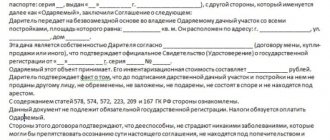

Draft agreement for the donation of a share of an apartment in a mortgage

Contents of the deed of gift for a share in a mortgaged apartment:

- locality and date (in words);

- Full name, passport details, addresses of the parties;

- legal details of the lender - the banking institution that issued the mortgage loan;

- permission from the lender to donate a share of the apartment;

- address, building, building, floor, square meters, technical characteristics of mortgage housing;

- title documents for the property - indicate that the property is pledged to the bank;

- a clause on the voluntary and free transfer of part of the housing;

- rights and obligations of the parties to the agreement (donor and donee);

- information about the encumbrance (collateral);

- details of who bears the costs;

- number of copies of the agreement;

- signatures and names of the parties.

Compilers draw up one gift agreement and make several copies - they will be needed to apply to the MFC, Rosreestr and a banking institution.

Registration of ownership

Having settled all the issues with the credit institution, you need to contact Rosreestr to register ownership of the mortgaged property. To do this, a new mandatory package of documents is collected, which consists of:

- Identity cards of both parties to the transaction.

- Applications for registration.

- Title papers for property.

- Technical certificates of the premises.

- Extracts from the house register.

- If the donor's spouse has a notarized consent to donate the property.

In addition to the above, you will have to pay a state fee for re-registration of property under a gift agreement.

Deadlines

The entire donation procedure is carried out within a strictly established time frame; the credit institution will monitor this, so there is no need to delay the submission of documentation. The banking institution reviews its part of the documentation for a minimum of three working days, and a maximum of five. In Rosreestr, the process of re-registration of ownership will also take no more than five working days. If we talk about the duration of the procedure from start to finish, it takes about four weeks.

Donation procedure

The main difference from the usual donation of a share is permission from the third party to the legal relationship (the bank). The applicant will have to contact a notary, since we are talking about the alienation of shares in the apartment. But first things first.

Where to contact?

The first step towards donating a share of a mortgaged apartment is obtaining consent from the lender (creditor). If the bank does not approve the transaction, further steps make no sense.

The donor approaches the bank to obtain permission to transfer the share to a third party . The application is submitted to the lending department that processed the original loan application. Immediately after processing the request, the bank convenes a commission, where the final verdict is made - to approve the donation of the share or to refuse the borrower.

Keep in mind that the failure rate is a clear majority. But this does not mean that you need to fold your arms and not try to reach an agreement with creditors. There are cases where payers still managed to include a donation clause in the initial agreement with the bank.

Step-by-step instruction

The procedure for donating a share of an apartment in a mortgage has its own specifics.

Follow this algorithm:

- Decide on a candidate (it is advisable that he is not a child, a pensioner, a disabled person or a low-income person - the percentage of refusals from the bank will increase).

- Re-read the mortgage agreement with the bank - look for a clause allowing/prohibiting the alienation of property.

- Go to the bank for advice on the issue.

- Ask the lender to agree to donate a share of the apartment encumbered with a mortgage.

- Prepare documents to complete the transaction.

- Make an appointment with a notary.

- Draw up a draft deed of donation, pay the state fee, and hand over the collected documents.

- Submit the documents for registration of the transaction to the “My Documents” MFC.

- The donee takes an extract from the Unified State Register of Property Rights.

- Notify the bank that the housing transaction has completed.

Contact the bank only if there is a clause in the mortgage agreement. It is also appropriate to ask the lender for permission if you have paid off the principal of your mortgage. Other cases, alas, are not in favor of the borrower.

Documentation

Preparation of documents takes a lot of time - below we will talk about the documents that need to be submitted to government agencies.

Contacting the bank for consent:

- sample application;

- passport of the donor (borrower);

- income certificate in the bank form - 2-NDFL;

- legal documents for other housing.

If necessary, the bank may request a marriage certificate and children's birth certificates.

Having secured the approval of the lender, you can begin to draw up a deed of gift from a notary and register the transaction with Rosreestr.

Documents for the MFC and Rosreestr:

- written consent of the bank;

- civil passports of the donor (borrower) and the donee;

- legal document for the apartment (for example, a purchase and sale agreement);

- registration certificate for residential premises;

- a current extract from the Unified State Register of Real Estate with cadastral data - you can request it from the MFC yourself;

- consent of the second spouse or co-owners - in case of shared or joint ownership of living space (read, “Is it possible to donate a share in an apartment without the consent of other owners?”);

- certificate of family composition - now this is an extract from the house register;

- confirmation of family relationships (marriage certificate, adoption certificate, etc.);

- approval of the guardianship and trusteeship authority (if necessary).

Expenses, cost

Registration of a deed of gift for a part of the apartment is paid according to the price list. Be prepared to pay for specialist services.

Main expense items:

- state fee at the notary - 0.5% of the cost of the donated share of housing (300 rubles - minimum; 20,000 rubles - maximum);

- state duty in Rosreestr – 2,000 rubles per donee;

- technical and legal work of a notary – from 2,000 to 5,000 rubles;

- estimate of the cost of the apartment - from 3,000 to 15,000 rubles;

- request for certificates and statements – from 1,000 rubles.

However, there are also free procedures:

- bank permission to donate a share of the apartment;

- drawing up an act of acceptance and transfer of real estate.

For more information about notary fees, read the article “How much does a contract for donating a share of an apartment cost from a notary?”

Taxes

Legal transactions with real estate are subject to tax. Donating a share of an apartment in a mortgage is not an exception.

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

Alienation of part of the housing in favor of strangers obliges the donee to pay income tax - 13% of the cadastral value of the share (Article 220 of the Tax Code of the Russian Federation). Concluding a transaction with close relatives exempts you from tax obligations - you do not need to pay personal income tax. However, you will have to confirm the fact of relationship - for example, using a birth certificate.

Deadlines

Applying to the bank for a permit takes 3-7 business days . This is exactly how much is given to the commission to consider the borrower’s application. If the decision is positive, the bank will issue written consent. If negative, an official refusal indicating the reason.

Registration by a notary usually takes from a day to a week , depending on the nature of the document and the office’s work schedule.

Approval of the transaction at the MFC or Rosreestr will take another 3-14 working days , and in some cases up to a month.

The general period for donating a share of an apartment in a mortgage is from 2-3 weeks or longer.

Detailed instructions for the procedure

In order to donate real estate that is under a mortgage, you need to comply with a number of simple conditions.

- For example, the first thing you should do is discuss with the bank all possible variations on the topic of donation. If the bank approves your endeavors, you must receive the relevant agreement documents from it.

- Then you need to discuss all the details of the transaction with the recipient, because it is possible that in addition to real estate, you will also transfer your debt on it.

- Then you need to prepare the apartment, sign out all strangers and pay utility debts.

- Then you must write a gift agreement, and you can do this either yourself or with the help of a notary.

- Then, you must register the gift deed, having first collected a package of documents. Treat this process as responsibly as possible, because an incorrectly formed package of documents is grounds for refusal.

- After the registration authority accepts your package of documents, the gift agreement and registers it, the donee becomes the full owner of the property.

What is needed to obtain bank approval?

In order to obtain permission from the bank, you must make a written request. After you have drawn it up in any form and attached a copy of your mortgage loan agreement, you must take it to the bank office or give it to an employee.

It will take 1 to 2 weeks for your request to be processed. In response, you will receive either a positive decision or a refusal.

If you refuse, you can try your luck again. If the bank responded positively to your request, then you can come to the office to discuss the details. For example, you can discuss with an employee the details of the transfer of encumbrances for payment of real estate.

Then, after all the nuances have been settled, you must receive an agreement from the bank that it grants you the right to make a donation. This completes the procedure for obtaining consent from the bank.

Necessary actions to complete the procedure

- In order for your request to make a donation to be approved, you must create a package of documents. It will include your mortgage agreement, or rather a copy of it.

- You will then need to photocopy the main pages of your ID document.

- Next, you must submit requests that describe the terms under which you want to receive the gift agreement.

The bank will consider your requests within 7-14 business days. After this, you will receive a response to your request. We hope it meets your expectations.

How to correctly draw up a deed of gift for real estate on credit?

When drawing up a deed of gift for real estate under mortgage lending, it is important to follow the structure.

For this you will need a sheet of A4 paper. There should be no marks or extraneous notes on it. We recommend that you use a computer to print the contract.

- In the first paragraph, you indicate information about the parties to the donation. Country information must be provided based on the identity document. If a proxy is present in the case, it is necessary to indicate the details of the power of attorney.

- The second paragraph provides information about the subject of the agreement. Namely, information from the technical documentation, as well as a certificate of ownership, must be listed. If the property has any nuances that the donee should know about, they should also be indicated.

- And the third paragraph indicates the rights and obligations assigned to the parties. This point should be taken as carefully as possible. If you are transferring not only real estate, but also encumbrances on it, then be sure to clarify this.

- The fourth paragraph states the responsibility of the parties. But this is far from the last point. In addition, the possibility of changing the contract and termination is prescribed.

The attached documents are listed, dated and signed by the parties.

Registration of ownership

In order to register ownership it is necessary to take the contract and documents to the registration chamber. The Registration Chamber will review the package of documents you submitted.

However, you need to remember that in order to register ownership, you must take the agreement and documents to it to the registration chamber. The Registration Chamber will review the package of documents you submitted. However, you need to remember that there must be papers that will work in your favor.

Be sure to attach to the package of documents a document that represents the bank’s consent to make the donation. Without it, the mortgaged property will not be subject to the transaction, which means it simply will not be registered.

What to do if the bank does not give consent?

Refusal to donate a share by a bank is not such a rare practice. Rather, on the contrary, the lender will not approve the application if the mortgage agreement initially contained a prohibition on the alienation of property in the mortgage.

In what cases does the bank refuse to donate a share of housing?

- The borrower (donor) violated the mortgage payment schedule.

- The unpaid portion of the loan is too large.

- An explicit ban on the alienation of shares in an apartment as collateral.

- The borrower is experiencing financial difficulties (loss of job, decreased income, expensive treatment...).

- Frequent change of place of residence.

There is only one option left - to pay off the mortgage debt and then donate a share of the apartment. If savings are not enough, you can use a consumer loan from a bank . You need to choose the same lender that issued the mortgage loan.

When the loan is approved, the bank will transfer funds from one account to another. The borrower will have the opportunity to remove the encumbrance from the apartment. All that remains is to submit documents through the MFC to Rosreestr - employees will check the fact of repayment of the mortgage and issue an extract on the removal of the encumbrance from the apartment.

Bank consent

The consent of the lender is decisive in the question of whether an apartment can be donated as collateral. If the bank agrees to change the borrower, there will be no problems with drawing up the deed of gift. Therefore, its receipt is a determining factor in the possibility of donating mortgage real estate.

How to get

In order to avoid problems with drawing up a deed of gift, you should take care to reduce the risk of obstacles from the bank. To do this, at the stage of drawing up the loan agreement, it is necessary to include the text of a clause about the possibility of performing legal actions with the collateral real estate, including transferring it as a gift.

Financial institutions are extremely reluctant to take such a step, so you need to be prepared for a negative reaction to such a requirement.

But even if it was possible to include this clause in the loan agreement, this does not eliminate the need to obtain the bank’s consent to the transaction. And it will be given only if the solvency of the new borrower is beyond doubt. This takes into account not only his income, but also the number of dependents, as well as the amount of financial resources that will remain with him after making the monthly payment.

Is it possible to donate a share bypassing the bank?

Don’t even think about donating a share of a mortgaged apartment, bypassing the bank. It should be remembered that everything secret becomes clear. Moreover, with the introduction of a unified state register - the Unified State Register of Real Estate, where all information about encumbrances on real estate is entered.

The creditor's retaliatory measures can be very severe:

- Recognition of the transaction as invalid - you will have to cancel the gift agreement and return the donated share back (Article 167 of the Civil Code of the Russian Federation);

- Demand early repayment of the loan (Article 39 of the Federal Law “On Mortgage”);

- Sale of collateral - the apartment will go under the hammer, and the donor risks being left without living space.

Any actions by the borrower without the knowledge of the bank are fraught with trouble. To avoid harmful consequences, try not to go against creditors.

Sample of drawing up a deed of gift for a mortgage apartment

After receiving permission from the bank, you can proceed to drawing up a donation agreement for collateral real estate. The legislation does not put forward clear requirements for the execution of this document. It can be in simple written form. It also does not need to be certified by a notary.

Despite the absence of strict requirements for the design and content of the gift agreement, it must reflect the following information:

- Details of the parties to the transaction.

- Data from documents confirming the donor's ownership.

- Technical parameters of the apartment.

- Subject of the agreement (transfer of ownership rights free of charge).

- Rights and obligations of the parties.

- Terms of a transaction. In this section it is necessary to indicate that the recipient is informed that the real estate is under mortgage collateral and agrees to assume obligations to repay the loan.

- Signatures of the parties.

After drawing up the deed of gift, it must be registered with Rosreestr within 1 year. If this is not done, the transaction will be considered illegal. To do this, you need to follow a certain procedure:

- Collect documents and draw up a deed of gift.

- Submit documentation for registration of the transaction to Rosreestr or MFC.

- Receive documentary evidence of transaction registration.

Registration of a transaction for the donation of living space purchased with a mortgage can take up to 1 month.

Important: if the donor and recipient are not close relatives, then you will additionally need to pay a tax fee, which is 13% of the cost of housing.

Required documents

The following package of documentation must be submitted to Rosreestr:

- Passports of the borrower and recipient.

- Application for registration of the agreement.

- Papers confirming ownership of real estate.

- Technical passport of the home.

- Extract from the house register.

- Consent of the second spouse (if the property was purchased during marriage).

- Permission from the guardianship authorities (if the transaction involves minors or incapacitated persons).

- Bank consent.

Based on the results of state registration, the recipient will receive a certificate of ownership of the apartment encumbered with a mortgage. After this, you need to contact the insurance company to make changes to the insurance contract.

Why might a bank refuse?

As mentioned above, the credit institution, in turn, has the right to refuse to issue you written consent to donate an apartment. On what grounds can a lender refuse a borrower? There are several good reasons:

- The applicant is a persistent defaulter;

- The borrower has paid too little of the total cost of the mortgage;

- The mortgage agreement contains a clause prohibiting the gift of real estate;

- The borrower does not have a permanent job, and therefore, the ability to repay the loan.

Attention!

It is worth noting that if for some reason you decide to donate an apartment without the bank’s consent, you may have serious problems in the future.

So, of course, you will be denied registration of the transaction in Rosreestr, and this will somewhat delay the entire donation procedure. In addition, the lending institution that provided you with a mortgage may sue you. You may also be required to repay the loan early, with all interest paid. If you cannot fulfill this condition, the apartment itself, which served as collateral, will most likely be taken away from you. Share:

Pros and cons of donating a mortgaged apartment

The main advantages of registering such a donation procedure are as follows:

- The main advantage is that the donation procedure is very simple. In this case, the borrower can either have the agreement notarized or draw it up independently.

- It will also not be difficult to find a document form and a sample of how to fill it out.

Unfortunately, there are also some disadvantages - in particular, banks are very reluctant to agree to such transactions, and if they agree to them, then the person receiving housing under a gift agreement is checked for solvency as carefully as the previous borrower.

Deal Features

Before you start donating an apartment or its share that is under a mortgage, remember that you still have financial obligations to the bank. This means that this procedure will have many nuances and limitations. So, its main feature is that a third party will be present in the transaction - a credit institution, since it also has some rights to the apartment, along with its owner. Please note that the borrower’s ability to carry out such transactions must be specified in the loan agreement.

Information!

If the borrower, when purchasing an apartment, knows that he will sell it, he should include this clause in the loan agreement even before it is signed. This will reduce his risk of being rejected by the lender, and will also significantly simplify the procedure for obtaining consent.