Registration of a deed of gift for a house and land: necessary documents

Before carrying out the registration procedure, the donor must first consult with a lawyer, collect a package of documents and proceed step by step:

- The donation procedure is first discussed between the donor and the recipient of the property. The terms of the transaction and all future clauses of the contract are discussed.

- The donor receives a cadastral passport for residential real estate. To do this, you need to contact the cadastral chamber at the place of registration of the object.

- The next stage is drawing up the gift agreement itself. The document can be drawn up either in written or electronic form, then printed on a printer. But, in any version, errors are excluded, in writing - strikethroughs and corrections. If necessary, the agreement is notarized.

- The next step is for each participant in the transaction of donating property to collect their own package of documents.

- Next, the state fee is paid at the registration department of such agreements.

- The collected documents are submitted for consideration to the MFC (registration authority).

The documents will be ready within 2 weeks.

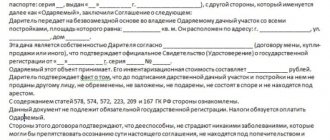

To draw up a gift agreement, you must collect the following documents:

- civil passports identifying the parties to the agreement;

- a document confirming the actual registration of a residential building with adjacent land with a government agency in the name of the donor;

- grounds for registering the rights of ownership of a real estate property to the donor;

- written consent of the second spouse to transfer real estate as a gift to a son or daughter, certified by a notary, if this real estate is the common property of the spouses;

- technical, cadastral passport for residential real estate (issued by the BTI);

- an extract on the property made from the house register;

- agreement on the gratuitous transfer of property in 3 copies;

- a notarized power of attorney for the intermediary of the transaction, if a third party is handling the paperwork;

- If a party to the gift agreement is a minor child, his legal representative issues the appropriate permission.

Each document is drawn up in accordance with the requirements of current Russian legislation. If documentation is lost, it must be restored and resubmitted to all appropriate authorities.

Stage No. 2 - go to the MFC or Registration Chamber to register the donation

If the agreement is drawn up in a simple form (without certification from a notary), then the participants themselves submit documents to register the transaction. Starting from 2021, in many cities it is possible to submit documents for registration of a gift only at the MFC.

Then the MFC employee themselves transfers the documents to the Registration Chamber. Those.

The Registration Chambers no longer accept citizens directly, but only through an intermediary in the form of the MFC. If in your locality you can submit documents directly to Reg.

Chamber, then it’s better to do so.

The process of submitting documents to the MFC or the Registration Chamber is no different, so in the instructions I indicated about the MFC.

- Donors and recipients (parents and adult children) need to contact the MFC, pay the state fee and submit signed gift agreements with documents.

The state fee for registration is 2000 rubles (clause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation). It is paid by the recipients. Payment details can be obtained from an employee. The cash desk is usually located in the MFC building itself. There will be a commission of about 50 rubles.

After paying the state fee, the employee is provided with the following documents in originals, in order of priority:

- Passports of both parties;

- Donation agreements;

If the agreements are in a simple form, then you can sign them in advance or in front of an MFC employee, it makes no difference.

The number of copies of the agreement is equal to the number of participants in the transaction, plus one copy remains in the MFC. For example, if there are two donors and one recipient, then 4 copies are needed.

For example, spouses Ivan Petrovich and Maria Pavlovna bought an apartment while married, but registered it only in Ivan Petrovich’s name. The couple decided to give their apartment to their adult son Andrey, who is also married.

To register a donation, you need the notarized consent of Maria Pavlovna. Because the apartment is considered the joint property of both spouses, even if it is registered only in the name of the husband.

The consent of Andrei's wife is not required.

If donors want to remain living (registered) in the apartment after the donation transaction, then an additional extract from the house register will be required. Other names for the extract are a certificate of registered persons or a certificate of family composition. It is required to prove that the donors actually live/are registered in this apartment. You can get it for free at the passport office, at the MFC or at the Federal Migration Service - instructions. A separate clause in the gift agreement should also be written about accommodation.

- If a trusted person acts for one of the participants in the transaction - a notarized power of attorney. But the donor cannot issue a power of attorney for the donee to sign a gift agreement for him, and vice versa. Because the donor and the donee cannot be the same person - clause 3 of Art. 182 of the Civil Code of the Russian Federation. You can’t just sign a contract. But they can, for example, to submit documents to the MFC.

- The employee will check the list of documents and draw up applications for registration of rights, which the parties need to sign . Everyone has their own statement.

- After signing the applications, the employee will take away all the originals of the submitted documents. In addition to passports, they will make copies of them. Then he will give each participant a receipt/inventory of receipt of documents.

- The MFC employee will hand over the documents to the registrar. The registrar will check the documents and the correctness of the contract. If everything is correct, the registrar will register the transfer of rights and make an entry in the Unified State Register of Real Estate.

Registration period for a donation transaction: 9 working days if documents are submitted to the MFC; 7 working days if documents are submitted directly to the Rosreestr office - Art. 16 of the Registration Law.Expert opinion

Zakharov Stanislav Vasilievich

Legal consultant with 7 years of experience. Specializes in family law. Has experience in defense in court.

In practice, they do not always meet the deadline. The receipt will indicate the phone number.

You can use it to find out if registration is ready if you provide the case number and PIN. They are also indicated in the receipt.

- On the appointed day, participants must pick up their copies of the agreement with a state registration mark. It is not necessary for everyone to come to the MFC at the same time. You can do it separately at different times and days. The adult child or children will also be given an extract from the Unified State Register of Real Estate (for the apartment). It will not be written that he is now the owner of the apartment. Certificates of ownership have been canceled and will not be issued as of July 2021. Have your passports and receipts with you.

Above I wrote the main list of documents. You can find out the full list in the help window from an MFC/Registration Chamber consultant. The consultant will check the documents and tell you which ones are still missing. You can also consult a website legal consultant for free. Ask your question in the online consultant window at the bottom right of the screen or in the comments.

Children, as new owners, can register in the apartment. Instructions on how to register in your apartment. If the former owners want to check out, here are the instructions on how to check out of the apartment.

Since the son/daughter is a close relative of his parents, they do not need to pay tax when receiving an apartment as a gift - clause 18.1 of Art. 217 Tax Code of the Russian Federation. Donors also do not pay any tax.

If the gift deed was certified by a notary

If the gift agreement was certified by a notary (in notarial form), then the notary is obliged to submit the agreement for registration HIMSELF, FREE OF CHARGE AND ON THE SAME DAY - Art. 1 of the Federal Law of August 3, 2018 N 338-FZ and clause 2 of Art. 22.1 Basics about notaries. This is already included in the transaction certification service.

Typically, notaries submit documents electronically. Then the transaction must be registered within one business day.

If the notary does not have the opportunity to submit electronically, then he or his assistant must submit the documents in person to the Rosreestr office and within a maximum of 2 business days. The registration period will be 3 working days after submission.

All this is indicated in paragraph 9 of Art.

16 of the Federal Law on Real Estate Registration of July 13, 2015 N 218-FZ.

The parties to the transaction must pay the notary only the state fee for registering the transaction - 2000 rubles (clause 22 clause.

1 tbsp. 333.33 Tax Code of the Russian Federation).

If a notary submits documents electronically, Rosreestr has set a discount of 30% - you only need to pay 1,400 rubles. According to the law, the state duty is paid by the donee, because

they are beneficiaries, but in practice the notary doesn’t care who gives the money.

After the transaction is registered in Rosreestr, the documents can be collected from the notary. Some notaries notify you about this by phone, while others will have to call you yourself.

A gift agreement is a convenient way to transfer property into the ownership of another person. By deed of gift, real estate is most often transferred to close relatives, whom the donor infinitely trusts and wants to secure their future.

This usually happens when parents want to transfer residential property free of charge to their children. Let's consider how to draw up a deed of gift for your son, what payments are required when drawing up a gift agreement and the advantages of this method of alienating property to your loved ones over other transaction options.

How to register a donation of land

Before you issue a deed of gift for a plot of land in the name of your son or daughter, you need to understand the registration procedure itself. Land is an object of special regulation by the state. When making transactions with this property, many factors are taken into account, for example, the intended purpose of the land plot (for development, agricultural activities, etc.), shared ownership and other nuances.

According to the current Russian legislation (Civil Code, Art. No. 260), only entities that are its legal owners have the right to donate land. At the same time, the land plot should not be limited in civil circulation or seized.

Land also refers to real estate. Therefore, after concluding a gift transaction (Civil Code, Art. No. 131), the land plot must be registered in the State Register. At the same time, the state collects a tax, which amounts to 350 rubles for the whole plot, and 100 rubles for a share. ( NC, Art. No. 333, paragraph 33).

Real estate located on a land plot (residential building, garage, other buildings), which is the property of the donor, also becomes the property of the donee (Law, Art. No. 35) . At the same time, relatives who receive land with a house as a gift are exempt from paying income tax on this property (Tax Code, Art. No. 217, clause 18, clause 1).

The procedure for donating land shares is somewhat different. A share is a share of land that is in agricultural use. A deed of gift for a share can only be issued in the name of another shareholder (Federal Law No. 101, Art. No. 12 – 07/24/2002).

Advantages of a gift agreement for a close relative

When drawing up a deed of gift for an apartment or house for a close relative, it is wiser to do without a notary and draw up the document yourself, because Between close people the likelihood of controversial situations arising is minimal.

A notary is needed to confirm the legality of the transaction and the sanity of the donor when drawing up a deed of gift. This is important when the deed of gift is drawn up not for a relative, but for a stranger.

When the donor draws up the contract himself, he can save on notary costs.

In our version, the son is exempt from paying tax. And this is an advantage of such a deal over other agreements.

Compared to a sale agreement, when registering a deed of gift, fewer documents will be required, and he will have ownership rights a month after registering the gift, in contrast to the transfer of property under a will, when the son will receive the inheritance only six months later.

We draw up a contract for a minor

Donations can also be made to minor children. In this case, the procedure involves obtaining permission from parents (guardians).

In the agreement, it can be noted that the property begins to belong to the child only after he reaches the age of eighteen. Until this moment, the property is managed by official representatives.

In order to prevent the sale of real estate given to a daughter or son before they come of age, the agreement must include such a condition as a separate clause. Then the object cannot be sold until the child turns 18 and becomes the full owner.

If the party to the transaction is a minor, the agreement must include the following information:

- Passport information of the parties to the transaction, place of official registration and residence.

- The subject of the agreement is described: the cadastral number of the property, its registration address. When donating a plot of land, its intended purpose and the building structures erected on it must be indicated.

- The donor indicates what documents he has confirming his ownership rights to the object of donation: inheritance, purchase/sale agreement, etc.

The contract is additionally accompanied by extracts and certificates confirming that the object of donation has not been seized, has been pledged for any financial transaction, or has other encumbrances.

Gift agreement for a minor child

- If a child is under 14 years old, then he cannot enter into transactions requiring state registration. registration. In such situations, the parents do this for him (Article 28), and they also apply to Rosreestr to register their son’s right to the donated property.

- A son between the ages of 14 and 18 has the right to enter into transactions himself with the written consent of his parents , including receiving property as a gift under an agreement (Article 26). Such consent need not be formalized in a separate document , but indicated in the deed of gift. The presence of the son when concluding the contract and when applying to Rosreestr is necessary .

Contract of sale

The document of purchase/sale of a house with a land plot is one of the main documents when registering a deed of gift. This document confirms the fact that the property is owned by the donor.

The purchase/sale agreement for the donated object must include the following information:

- real estate registration address (land plot with a house);

- the size of the land plot and its purpose;

- cadastral number of the property;

- living area of the house;

- the value of real estate in total and separately, if the object of the donation is a plot of land and a residential building built on it.

In this case, the contractual purchase/sale agreement must be certified by a notary.

Features of registration of deed of gift

The requirements for drawing up a gift agreement do not depend on to whom the donor’s property is transferred as a gift. Its design and content must not contradict the law.

In a general sense, such an agreement means a documented desire of a citizen to donate his property to the person named in the document. Its difference is the gratuitous transfer of the object of donation, i.e. in return for it, the donor should not demand anything from the recipient of the gift.

An agreement can be drawn up:

Expert opinion

Zakharov Stanislav Vasilievich

Legal consultant with 7 years of experience. Specializes in family law. Has experience in defense in court.

In any embodiment, the document must contain information about the parties to the gift transaction, indicating their last name, first name and patronymic, as well as detailed information about the transferred object itself.

How much will the deed of gift for my son cost?

As already noted, when you donate your real estate to your son, you will not have to pay tax. But you will have to pay a fee.

In the case of donating real estate to a son, it will be 0.3% of the appraised value of the property, but not less than three hundred rubles. By law, the recipient of the property must pay the fee, but when he is a minor son, then, of course, his parent bears all expenses.

Giving an apartment or house to a son, according to an independent sociological survey, is one of the most common options for transferring this type of real estate within a family in Russia. And this is not surprising, because issuing a deed of gift to close relatives has many advantages!

The simplicity of drawing up a document, the absence of taxation of the transaction and the speed of registration of property rights are what made the gift agreement in favor of close relatives so popular in 2021!

However, this does not mean at all that this method of alienation of property does not have “pitfalls” that can not only create problems in the future for each of the parties, but also act as grounds for declaring the transaction invalid.

A practicing lawyer and one of the authors of the Legal Aid website, Oleg Ustinov, will tell you about all this today.

Pros and cons of deed of gift

Let's consider the main advantages and disadvantages of registering a DD for a child:

| pros | Minuses |

| If the donee is married, the donated property will belong to him | The donor is deprived of rights to the donated property |

| In case of divorce, the property of the apartment is not included in the division - it belongs to the child according to the DD | High cost of notarization |

| No transaction tax | DD with a child is almost impossible to cancel |

| Fast transaction processing - in total, everything takes a maximum of 2 weeks |

Donating real estate to your son in 2021 – features and nuances

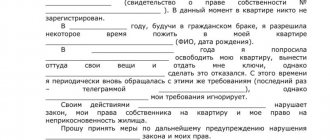

Let us immediately note that all donation agreements whose object/subject is real estate, for the reasons stated above, must be drawn up exclusively in writing! At the same time, notarization of the act remains an optional part of the transaction.

Based on the information established in Part 3 of Article 574 of the Civil Code of the Russian Federation, deeds of gift for real estate are subject to mandatory state registration in Rosreestr!

Expert opinion

Zakharov Stanislav Vasilievich

Legal consultant with 7 years of experience. Specializes in family law. Has experience in defense in court.

That is why, when donating an apartment, the role of the second party (legal representative of a minor son) must be the second parent or employee appointed to carry out the transaction by the guardianship and trusteeship authorities.

How to give your son an apartment

It’s worth noting right away that, according to current Russian legislation, a parent acting as a donor can transfer an apartment to his son not only in full, but also donate a certain part of it by registering a deed of gift and indicating in it the share of the transferred real estate.

When making a donation of an apartment that was acquired during marriage and is part of the joint property of the spouses, written consent to carry out the transaction in 2021 is a prerequisite! Otherwise, the apartment donation agreement may be declared invalid in court.

Also, when donating a part of residential property, the parties must indicate in the agreement the number of square meters being donated (instead, they can indicate the proportional ratio of the donated part of the apartment - for example, 1/2).

When drawing up a deed of gift, be sure to include in its contents all the information relating to the transferred object of donation, especially the following: floor, real address, total size of the property and size of living space, number of rooms, absence/presence of a balcony, cosmetic condition of the premises, cadastral number, etc.

List of documents for donating an apartment to your son in 2021

Since when registering a donated apartment for a son, it is necessary to re-register ownership with the Rosreestr authorities or the nearest branch of the MFC - let's look at what kind of certificates and acts will need to be provided to the employees of this body without fail.

So, before registering property, the donor and donee must have the following papers in hand:

- Passports of the parties or the birth certificate of the donee, if he is a minor citizen of the Russian Federation;

- several (usually three) copies of the deed of gift - one each for the donee and the donor, as well as 1-2 for the registering authority;

- written notarized consent of the spouse, if the apartment being donated free of charge is part of the jointly acquired property;

- title documentation confirming the ownership of the donor’s real estate (inheritance certificate, purchase and sale or gift agreement, etc.);

- certificate about other persons registered in the donated apartment;

- a certificate stating that there are no encumbrances on this apartment (you can obtain this certificate on the State Services online portal);

- a receipt confirming successful payment of the state fee established by the legislator for re-registration of property rights.