How to find out why the bank refused a mortgage?

If your mortgage is rejected, find the reason. There are several ways to find out why the bank did not give a mortgage.

- manager at the bank. Lenders usually don't talk about this. Therefore, you will have to analyze the reason for the refusal yourself. But there are exceptions, and bank employees tell you exactly why they did not issue a loan.

- Check your credit history. Make a request to BKI. If there are delays in the CI, then this is the reason.

- Compare income and expenses on loans. If current loans take more than 40-50% of your income, then they are denied because of this.

Refusal, refusal again

Some real-life examples of how bank underwriting works.

Example 1. The Ivanovs applied for a loan. The wife is on maternity leave and her income is not taken into account; citizen Ivanov has been employed in a very large company for more than a year. According to the standards of a mortgage calculator, the family’s income is sufficient to take out a loan for 20 years and buy a two-room apartment in St. Petersburg. But at the stage of submitting documents, something went wrong: first the refusal came from Sberbank, then from VTB, then from a third credit organization. The reason turned out to be the following: a foreign employer company does not have the right to directly hire workers in Russia according to our legislation. Therefore, every 9 months the employee is forced to sign a new employment contract with an intermediary company. The banks considered that the borrower was unreliable and left the young family without the opportunity to take out a loan.

Example 2. Citizen Petrov received a mortgage refusal from his native salary bank. The bank manager never told the client the reason. The most obvious reason was that the potential borrower had two open credit cards, the limit on which exceeded 300,000 rubles. Although Petrov did not use these cards, the bank considered them as a potential threat to the financial stability of the payer.

Example 3. The Stepanovs planned to purchase an apartment in a new building. Everything was going as well as possible:

- preliminary approval of the application has been received from the bank;

- there was an opportunity to get a loan at 6% under the state program (the couple had a second child in 2021);

- the husband had a constant and sufficient income to repay the loan;

- Borrowers had a down payment of 20% of the cost of the selected home.

The couple signed a reservation agreement with the developer, for which they had to pay 20,000 rubles. The non-refundable booking amount was 200,000 rubles. Since the bank, after checking all the clients’ documents, assured them that the mortgage had been approved, the couple calmly prepared for the move. They paid 5,000 rubles for the assessment of the property and submitted documents for the apartment to the bank. After this, a notification of refusal came from the bank without explaining the reason. The creditor referred to the complexity of the case, but the refusal remained in force. The total financial losses of failed borrowers amounted to 225,000 rubles, and this does not take into account the wasted time and nerves.

As you can see, refusal can not only be a cause for disappointment, but also hit your wallet. The bank can refuse a client even when the person is 100% confident in his own reliability and creditworthiness. And often it is impossible to find out the reason for a negative answer.

What to do if you are denied a mortgage - expert advice

If the bank refuses your mortgage, don’t give up. Prepare the next application taking into account the errors. Let's look at what you need to do to increase your chances of approval.

Option 1: Check your credit history

You can do this once a year for free. You need to find out your subject code in the old loan agreement and send a request to the Central Bank of the Russian Federation on the official website at the link: https://www.cbr.ru/ckki/zh/subject . In 5 minutes you will receive an email. It will indicate in which bank accounts your credit history is stored. To view your CI, you must send a request to each bureau.

Expert opinion

Alexander Nikolaevich Grigoriev

Mortgage expert with 10 years of experience. He is the head of the mortgage department in a large bank, with more than 500 successfully approved mortgage loans.

There may be errors in your credit history due to the fault of the bank. In such cases, provide evidence of repayment of previous loans and demand that the CI be corrected. If your credit history has been damaged due to your fault, read the article on how to get a mortgage with a bad credit history.

Option 2: Try to improve your credit history

If your credit history is damaged, try to improve it before reapplying. Take out a consumer loan and repay it on time without delays. Then take another bigger one. And again pay it on time.

Expert opinion

Alexander Nikolaevich Grigoriev

Mortgage expert with 10 years of experience. He is the head of the mortgage department in a large bank, with more than 500 successfully approved mortgage loans.

Do not take out small commodity loans with a service period of less than 6 months. They will not be taken into account when taking out a mortgage. The presence of such loans, on the contrary, will arouse suspicion among analysts. For a loan to be eligible for a mortgage, its size must be at least 30% of the size of the future mortgage loan.

Option 3. Close loans

If you have a lot of loans, close most of them and reapply. Don't apply for a mortgage until you've reduced your credit load. The bank will not approve the application.

Option 4. Involve co-borrowers

The bank will be more willing to approve a mortgage if you bring a solvent co-borrower with a good credit history. This increases the permissible loan load. The co-borrower can be a spouse or relative. Typically, if one spouse takes out a mortgage, the other becomes a co-borrower without fail.

Option 5: Keep your phone with you

The bank can call at any minute; you must always be in touch and be ready to confidently answer the analyst’s questions. Warn the employer about a possible call.

Option 6: Find another property

If the bank is not happy with the property, find another one. Choose highly liquid housing in a good area. The age of the building is no more than 50 years. Private houses or cottages must be geographically located in the area where the bank operates.

The purchased property must have all the amenities:

- Light.

- Water.

- Sewerage.

- Heating.

- Gas.

- Toilet.

- Bath.

The property must be in good condition with no visible defects. It should not be under arrest or encumbered by other loans.

Option 7. Apply at another bank

Find a small bank that needs clients. Such banks are more loyal and can give a mortgage even with a bad CI. Thus, TransCapitalBank considers mortgage applications from clients even with a bad credit history. You can fill out the online form on the official website at the link: https://www.tkbbank.ru/mortgage

Option 8. Confirm unofficial income

If you have unofficial income, confirm it. For example, you rent out an apartment. Provide documents for it and tell the bank about this source of income.

Option 9. Tell us about unofficial surcharges

If you are paid extra from a gray cash register, tell the bank about it and ask your employer to confirm it.

Option 10: Contact a Mortgage Broker

If you can't get a mortgage on your own, contact a mortgage broker. Describe the whole situation to him. The broker will select a loyal bank and explain how to act in your situation.

How brokers work:

- The client submits an application to the brokerage firm.

- The broker tells you what documents to prepare and tells you how to increase your chances of getting your mortgage approved.

- The broker selects a mortgage loan and sends a request to several banks.

- The bank approves or denies the mortgage.

Contacting brokers does not guarantee 100% mortgage approval. However, the chances of getting a loan increase. Another advantage is that the client does not need to contact the bank personally. He must only submit an application and wait for a decision.

Reasons for refusal of a mortgage at Sberbank. Main Factors

Knowledge of the main reasons that can lead to refusal to receive a loan is simply necessary for all potential borrowers. This is due to the fact that knowledge of the factors influencing the decision of a credit institution will allow the borrower to prepare, and, consequently, increase his own chances of receiving a loan.

The final decision of a credit institution is influenced by a huge number of factors, among which the following deserve special mention:

- Various types of debts to the tax service, as well as alimony debts and unpaid traffic police fines.

- Another good reason for refusal is whether the potential borrower has a criminal record. The fact that if the potential client’s criminal sentence was suspended, then he has a chance to receive a loan deserves special mention. In this case, everything is decided on an individual basis, so there are no guarantees that you will be given a mortgage loan.

- Inability to verify the authenticity of the data provided by a potential borrower.

- Uncertainty when communicating with a loan officer. Uncertainty in the behavior of a potential borrower is interpreted by a bank employee as doubts that he will be able to pay his installments on time.

- The poor health of the client who wishes to obtain a mortgage loan.

- Low level of liquidity of residential real estate, which will act as collateral when receiving a loan.

In fact, there are significantly more factors that can influence the final decision of a credit institution. However, there are several reasons that are an absolute guarantee that a potential client will not receive a mortgage loan. Below we will look at these reasons in more detail.

Can they refuse if the mortgage is approved?

They can. Until the mortgage agreement is signed, the bank is not obliged to issue a loan. In practice, banks sometimes refuse after approving a mortgage.

They justify refusal after approval with the following reasons:

- The economic situation has worsened.

- The Central Bank raised the key rate.

- The collateral property does not meet the bank's requirements.

- The borrower's marital status has changed.

- The client changed jobs.

- A criminal case has been initiated against the loan applicant.

Who won't get a mortgage?

There are unconditional reasons for refusal of a mortgage for certain categories of citizens:

- Persons under 21 years of age. When issuing a mortgage loan, banks give preference to candidates who have certain achievements in life, which a citizen under 21 simply cannot have.

- Persons with a criminal record. A citizen who has committed a crime once can theoretically decide to relapse. And if he is convicted, he will no longer be able to repay the loan.

- Citizens without a credit history. It’s not worth starting your credit experience with such a serious loan as a mortgage. The bank will not issue a mortgage to a citizen whose reliability it knows nothing about.

conclusions

Getting a mortgage is not easy. Often the bank refuses without explanation. We have described the most common reasons for refusals, but each case is individual.

Let's summarize:

- Most often they are rejected due to bad credit history.

- To improve your credit history for a mortgage, take out and pay off a personal loan. Its amount must be at least 30% of the expected mortgage amount.

- Before applying for a mortgage, try to pay off all debts and close your credit cards.

- Involve co-borrowers.

- Submit a second application no earlier than one month after the first.

Basic requirements for refinancing by the bank

This is a kind of issuance of a new loan, so the requirements of banks are similar. The task of bankers is not to miss the client and to protect themselves as much as possible from the risks of non-return of money. Therefore, the conditions for obtaining a positive decision will be the following:

- Relevant age - the borrower must be at least 21-23 years old at the time of filing an application for mortgage refinancing and no more than 60-65 years old at the time of full repayment of the loan. The presence of guarantors can shift the framework both in one direction and in the other.

- Citizenship and permanent residence.

- No arrears or debt on the current mortgage.

- Good credit history. It is worth noting that it is not only a history of late payments that can reduce the value of a borrower. Banks also really don’t like it if there is no credit history at all (especially if the borrower is a middle-aged person) or if it shows a tendency to repay loans early, since this is unprofitable for the financial institution.

- Having a source of stable income. This may be not only an official place of work, but also additional options. For example, receiving income from renting out an apartment or even a small, but your own business. The main thing is that they can be confirmed.

There may be additional nuances in any bank, but in general they are not very different.

Step by step: what happens when applying for a mortgage

To make this process easier to understand, read the short instructions for the future borrower. As an example, let's look at how this all happens at Sberbank. The procedure consists of the following steps:

- To find a good bank and not overpay, it is better to consult an experienced mortgage broker. He will advise where and how it is more profitable to apply for a loan.

- If you don’t want to overpay for a consultation, you’ll have to look for such a bank yourself.

- Come to the bank and consult with bank employees about the terms of the loan and the list of required documents.

- Collect the required documentation package.

- Submit the papers to the bank and wait for a positive decision on your issue.

- If your application is approved, all you have to do is choose a suitable property on the primary or secondary housing market.

- Discuss all the conditions with the apartment owner or developer, and collect the necessary documents for this property.

- Bring the bank specialist documents regarding the property.

- Conclude an agreement and sign all the necessary papers.

- Register documents with the state registration service (Rosrestr).

- Get money.

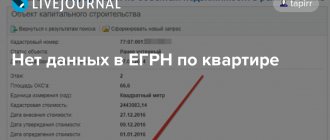

What is your credit history?

When registering a pledge, the bank requires the applicant's credit history. But, due to the large number of credit history bureaus in Russia, there is complete confusion regarding this issue. On the Internet, this information can rarely be obtained for free. As a rule, only the bank that last submitted the request there knows about the BKI where your credit history is stored. How can you find your BKI and get this information for free?

- To do this, go to the website of the Central Bank of the Russian Federation.

- Enter your loan agreement code.

- If you don’t know him, contact the bank where you last took out a loan.

- If you have not applied for loans before, then you do not have a credit history.

- If you know the agreement code, enter it on the CBRF website, and they will tell you for free which BKI your credit history is in.

- After this, contact your BKI. This is done on the website of this bureau on the Internet.

- Then register on the site and receive information about your credit history.

Contacting a credit broker

Do not forget about such financial market participants as credit brokers. They act as intermediaries between the borrower and banks.

They won't give you a mortgage - your credit broker will tell you what to do. He will help you get a positive decision by correctly filling out the application and completing the accompanying documents, but will also offer a loan product under exclusive conditions, with lower interest rates. In this case, the services of the credit broker are paid by the bank from the interest on the loan agreement. This means you won’t have to pay separately for its services.

Contacting a credit broker significantly increases your chance of getting a mortgage loan, so if you receive a refusal, it is wise to contact him.