Most often, applying for a mortgage at a bank entails a lengthy procedure for collecting documents and various certificates, especially if the family has children.

This is understandable; the lender, wanting to protect himself from a reckless transaction, wants to receive the maximum possible amount of information.

Some banks, in an effort to attract customers, have launched a new program that provides a simplified package of documents.

“Victory over formalities” from VTB is just such a program. This offer works throughout the Russian Federation and allows the client to obtain the desired loan with a minimum of documents.

Features of the mortgage “Victory over formalities”

Mortgage is a loan issued by financial institutions for the purchase of real estate. Purchasing an apartment is not a cheap pleasure, which means that the amounts issued for such a loan are considerable.

Due to large amounts and long terms, banks receive considerable income in the form of interest, so they can afford to provide lower interest rates on mortgages compared to standard loans.

What is “Victory over formalities” at VTB? This is a relatively new proposal. Unlike other programs, it does not involve collecting a large package of documents.

Due to the lightweight package of documents, this program received a large number of positive reviews and made this offer quite attractive in the eyes of clients.

The main requirement is that the borrower must provide two documents . Both VTB salary clients and those who have never been a client of the bank can apply for such a mortgage.

“Victory over formalities” does not require the provision of income certificates . But if the client really wants to get a mortgage loan, then it is better to try to confirm his solvency with real documents.

Registration procedure

In order to go through the procedure for obtaining a VTB 24 mortgage loan “Victory over formalities,” a client of a financial institution must provide only 2 documents: SNILS and a passport. Despite the fact that you do not need to carry any other papers with you, the applicant must fill out special forms in which he enters all the necessary information. Bank employees check the information received using a special multi-level program. If false information is received, the bank blacklists the client.

The credit history of the applicant is of great importance when deciding on an application for mortgage lending. It is by this criterion that the capabilities of a citizen who has applied to the bank are assessed.

Among the most common reasons for loan refusal are:

- Complete or partial non-compliance with the stated requirements.

- Insufficient salary level and lack of solvent guarantors.

- Providing false information to the bank or having a negative credit history.

Requirements for the borrower

To get a mortgage under the “Victory over formalities” program, you only need to provide two documents:

- passport;

- SNILS.

If the borrower is a man under the age of 27, he will be required to provide a military ID.

If you are determined to receive a loan under this particular program, it would be a good idea to provide maximum information about the employer.

So, be sure to write down complete information about your employer: TIN, legal address of the organization, landline telephone. A salary certificate will not be superfluous, especially since ordering it will not be difficult. The accounting department can easily provide such information.

Of course, you can provide information about your salary using the bank form by filling out a certificate on the spot. But even in this case, the amount of income will not be the least important.

It is important that the income is at least twice as much as the payment on the future mortgage. In case of low wages, it is allowed to attract co-borrowers from outside, but no more than five people.

After all documents are submitted, the bank checks each potential client for reliability. This is a mandatory procedure.

Absolutely any citizen can apply for a mortgage using two documents, the main thing is that he meets the basic requirements of the bank:

- Age limit - at the time of applying for a mortgage, the borrower must be at least 21 years old, at the time of making the last payment he must be no more than 70 years old;

- Work experience – at least 1 year.

These requirements are relevant not only for the main borrower, but also for co-borrowers and guarantors.

What documents are needed

The mortgage product “Victory over formalities” can be obtained upon presentation of only two documents:

- general passport;

- SNILS.

In addition, men who have not reached the age of 27 will have to present a military ID. All clients who decide to use this service must also fill out and submit an application in the prescribed form.

Reasons for refusal of a mortgage

This turn of events is very undesirable for the borrower, but still quite real. So, for what reasons, most often, does a bank refuse to issue a mortgage:

- Insufficient salary level - just because the bank does not ask for a salary certificate does not mean that it will not pay attention to the low salary. Thus, it is much easier for an officially working citizen with a guaranteed income to get a loan than for an unemployed applicant.

- Lack of collateral - it is very advisable to provide documents for any other expensive property - a car, an apartment - as a guarantee.

- Unreliability of the client - banks can check this point on previously paid loans. If a client has irregularly made payments on loan obligations in other banks, this characterizes him as not very trustworthy. The chance of getting a mortgage drops significantly.

- Availability of other loans - if the borrower is making payments on other loan obligations at the time of application, then income minus these payments will be taken into account. The remaining amount may not be so large, and it may not be enough to apply for a loan.

- If the borrower does not meet the bank's basic requirements, a refusal is inevitable.

- Submitting false information - wanting to make a favorable impression on the bank, the borrower provided incorrect information about himself, for example, submitted incorrect information about employment.

The borrower must understand that the larger the amount he wishes to receive, the more guarantees the bank expects from him.

Insurance

At VTB 24 Bank, only one type of insurance is mandatory - this is the borrower's insurance of risks associated with damage or loss of the loaned property. Other types of insurance can be provided only at the request of the borrower.

Optional types of insurance are:

- insurance against the risks of the borrower's death and loss of ability to work;

- insurance against the risks of restriction or termination of property rights to the real estate object being financed.

If the client does not obtain an insurance policy for these optional types of insurance, the interest rate on the home loan will be increased by 1% of the base rate.

It is recommended to carry out insurance through insurance companies accredited by VTB 24 Bank. A list of such organizations can be found here.

If the borrower does not want to use the services of 24 insurance organizations approved by VTB Bank, he can send information about an insurance company not listed on the list to the bank. VTB 24 will add the insurance company proposed by the client to the appropriate list within 21 days.

A mortgage provided by VTB 24 Bank with just two documents is an excellent opportunity for those who do not want to waste time collecting documentation, but want to quickly and immediately get an apartment or house on a mortgage.

A loan based on two documents is issued on the website - all you need to do is fill out a form and send it for consideration.

You can see reviews about early repayment of a mortgage at VTB 24 in the article: VTB 24 early repayment of a mortgage. Find out how to fill out the application form for a mortgage at VTB 24 here.

Find the conditions for a mortgage without a down payment in VTB 24 in this article.

Mortgage terms

- The minimum loan amount cannot be less than 600 thousand rubles. The maximum limit varies depending on the region where the loan is received, so for residents of Moscow and St. Petersburg this amount reaches 30 million rubles. Borrowers from other regions can count on a limit of 15 million rubles.

- The maximum term for issuing a loan is 20 years; if financial capacity allows, the term may be shorter.

- The rate also varies; the key criterion here is the volume of acquired space. If the property is less than 65 sq. m, then the rate is higher. When purchasing an apartment above the established limit, the rate will decrease by almost a point.

- The down payment on a mortgage directly depends on the type of property purchased. If money is required to purchase an apartment in a new building, the down payment corresponds to 30% of the cost of the property. When purchasing a secondary property, the bank will require a more significant contribution - 40%.

- An important point is that in the “Victory over formalities” program there is no opportunity to use maternity capital to make a down payment. The borrower must provide this amount from his own savings. Maternity capital can be used to repay the principal amount of the debt after receiving approval from the bank for the loan.

These conditions are valid for 2021 . On the bank’s official website you can get all the necessary information on the terms of the “Victory over formalities” program.

Mortgage insurance service

These types of insurance are mandatory, since the apartment will remain in bank ownership until the debt is fully repaid by the borrower. The financial organization will thus protect itself from unforeseen accidents.

The “Victory over formalities” program involves mandatory registration of insurance services, since this is a requirement of the law, but not the bank.

You can use insurance services from both VTB and another accredited organization. A complete list of them is presented on the bank’s website.

How to get a mortgage at a lower interest rate

- Taking out insurance - this item is not mandatory for obtaining a loan, but is highly desirable, therefore, if you refuse it, the rate increases by a point, and this already deprives the offer of its former attractiveness.

- Being a salary client means having additional privileges. The bank sees the client’s income and understands the level of his solvency. Additional savings in bank accounts will also serve as a guarantee of reliability.

- Many banks enter into partnership agreements with construction companies or real estate firms. If you purchase real estate through such partners, you can also count on an additional discount.

Mortgage insurance

Taking out insurance is one of the most reluctant points of a loan agreement. However, as we have already indicated, you can refuse it, but you will have to pay for such a decision with your own ruble.

So what does insurance include, and is it really necessary?

What does insurance include:

- Personal policy - it is a guarantee that the insurance company through which the insurance was issued, in the event of the occurrence of certain conditions specified in the insurance contract, will make a payment for you. In the event of the death of the primary borrower, the insurance will fully cover all mortgage costs, and the relatives of the deceased will not be charged for the remainder of the mortgage.

- A collateral property policy is a mandatory condition provided by law - any housing purchased with a mortgage loan must be insured. This will allow compensation for damage in the event of a fire, earthquake or any other natural disaster. In this case, the insurance company will also compensate for all damage incurred.

- Title policy - this type of insurance allows you to protect the rights of a co-owner to this property, even if third parties try to claim any rights to this area, they will not succeed.

Many banks, including VTB, work with certain insurance companies, but the borrower can refuse to take out insurance with the bank and enter into an agreement with any other company.

The main thing is that the insurance policy covers all possible risks and gives the bank guarantees for payments in the event of an insured event.

When choosing an insurance company, it is better to turn to those companies that are accredited by the bank. Their list is available on the official VTB website.

However, you can insure yourself with another company. To do this, after issuing an insurance policy, you must submit it to the bank, the latter will check the selected company.

If it meets all the necessary characteristics, the bank accepts this insurance policy. But be prepared for the fact that this procedure may take time, and the company may not be accredited by the bank.

When purchasing insurance externally, you will have to purchase at least two policies . The first is insurance against damage and loss, the second policy is your choice, this can be a title policy or protection of property rights.

All this is necessary, since while the loan is being repaid, the property is pledged to the bank. Bank insurance is a reliable guarantee.

Documentation

The list of basic documents is small. According to the terms of the program, at the application stage, the applicant must provide:

- a completed application form, which must indicate the SNILS and TIN of the borrower;

- passport of a citizen of the Russian Federation or passport of a citizen of another state;

- SNILS;

- military ID if the client is a man under 27 years of age.

A similar package is submitted by the guarantor if he is involved in a credit relationship.

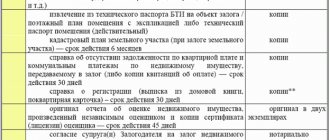

After approval of the loan, additional documents will be required to formalize the agreement and transaction, the list of which will vary depending on the type of housing being purchased.

For example, when purchasing an apartment in a new building, in some cases you may need an assessment report. And this document is required to be provided when the client applies for loan refinancing or when purchasing housing on the secondary market.

In addition to the report, the following documents are provided as part of the “ready housing” program:

- A title document for a real estate property, for example, a purchase and sale agreement, an exchange or gift agreement, an agreement for shared participation in construction, a certificate of inheritance, a document confirming the fact of the transfer of municipal housing for privatization.

- A copy of the passport of the apartment seller (all sellers, if there are several);

- Extract from the house register;

- Permission from the guardianship authorities to sell the property, if there are minors among the owners of the apartment being sold, as well as a document confirming that the child has another home (if permission to sell has been obtained).

A more detailed package of documents is required when the seller of the apartment is a legal entity.

In such cases, the bank asks to provide:

- A copy of the certificate of registration of the organization with the tax authorities or a copy of the notification from the Federal Tax Service on the registration of a legal entity, issued no later than 2 months before the conclusion of the transaction;

- A copy of the constituent documents;

- A power of attorney issued in the name of a representative of the seller acting in the interests of a legal entity.

In general, the list of additional documents provided after approval of the application does not differ from any other, for example, the list of documents requested from Sberbank. Other information relevant to the potential borrower is provided in the application form filled out by the applicant.

It might be interesting!

Is it possible to get a mortgage in another city?

Mortgage calculator

Even without contacting the bank for advice, you can get preliminary information about the size of the down payment, the loan term and the amount of the monthly payment. All this can be calculated using a mortgage calculator. Here you can see how the interest rate and monthly payment will change with changes in the size of the down payment and the mortgage term.

To use the service, you need to go to the official page of the program, here are the fields that need to be filled out . After setting all the necessary parameters, you will see what monthly payment and interest rate will be provided by the bank under these conditions.

But you need to understand that these are only preliminary calculations. During a personal visit to the bank, a specialist will be able to make a more detailed calculation based on your personal capabilities.

Is it worth taking a mortgage from VTB?

Before making your final choice of lender, it is a good idea to get acquainted with the opinions of their clients. Reviews from borrowers, including those who took out mortgages under this program quite a long time ago, vary greatly. However, upon careful analysis, it is possible to identify the main positive and negative aspects associated with the “Victory over formalities” program.

Here are some of them:

- Despite the optional confirmation of income, which can be indicated approximately, the bank pays attention to factors such as the client’s work experience and education. This means that confirmation of employment by the lender itself and the provision by the borrower of documents on education (higher education in priority) significantly increases the chances of loan approval.

- The possibility of obtaining a mortgage remotely is limited to submitting an online application. According to borrowers' feedback, subsequent actions require a personal visit to the bank's office.

- Some clients are perplexed about the question of why they do not call and notify about the decision, which can be explained by the individual disorganization and insufficient competence of individual bank employees.

Otherwise, the impression is favorable, because few financial and credit organizations are ready to approve a mortgage without a 2-NDFL certificate and a huge number of documents. On a pleasant note, mortgage interest rates from VTB in 2021 have decreased significantly since the beginning of the year. For example, as part of the “Victory over formalities” program, a reduced rate of only 8.4% per annum has been established until February 29 of this year.

What other documents may be needed to complete the application?

The terms of the program state that only two documents are enough to apply for a mortgage, but it is worth clarifying that this package is only enough to fill out an application for the bank to consider your candidacy as a borrower.

If you receive approval for a mortgage loan, be prepared to provide another package of papers . Without it, you will not be able to get credit:

- Cadastral and technical passport for the purchased housing;

- Extract from Rosreestr - in case of rent arrears, this information will be reflected here;

- Extract from Rosreestr about property - indicating the owners of this property;

- The document on the basis of which the transfer of ownership of the property takes place;

- Assessment of the market value of the apartment.

Also attached to the package of documents is an applicant’s application form, which contains information about the employer and the borrower’s income . The bank does not require you to provide official data, but do not let this mislead you. All information will be checked carefully.

The advantage of this program is that the client is spared the need to spend time preparing certificates and collecting official information about his employment. But this does not mean that the bank will not check the information provided.

Victory over formalities from VTB: conditions for 2021, calculator and reviews

Mortgage “Victory over formalities” from VTB is a new program in the field of mortgage lending to the population. It has fairly comfortable and loyal conditions and not the most stringent requirements for potential borrowers.

Features of the mortgage “Victory over formalities”

A mortgage is a type of loan issued by a bank for the purchase of housing. A mortgage is more profitable than a consumer loan, as it has lower interest rates and favorable conditions. But VTB does not issue mortgage loans to all clients. Reasons for refusal may include:

- Insufficient wages of the borrower.

- Lack of collateral.

- Client unreliability.

- Availability of current debt obligations.

There can be many reasons, but most often people are refused due to a lack of documents confirming their solvency. With the “Victory over formalities” program from VTB, difficulties in this regard will not arise, because a person is required to provide only the following documents:

- Passport with Russian citizenship.

- SNILS.

- For men aged 21 to 27 years - military ID.

Just two basic documents and a mortgage is already in a person’s pocket. VTB issues a mortgage loan without formalities, since people who apply to this bank are most often already its paid clients and have a good status. But this does not mean that a complete stranger cannot apply for a mortgage at VTB.

If the client really wants to get borrowed funds to purchase a home, then he must try to prove to the bank his solvency.

Mortgage insurance

VTB can offer the borrower two types of insurance:

- Insurance of property pledged (purchased real estate) against the risk of loss or damage. It is mandatory and if insurance is refused, the borrower will be denied a mortgage.

- Personal insurance of the borrower against various risks such as disability, life, restrictions on ownership of property, etc.

If a person refuses any form of personal insurance, then VTB automatically increases the mortgage interest rate by one point.

The interest rate may increase for other reasons (large amount, but short term, low salary, etc.), but these are special cases.

What documents may be needed?

VTB will actually issue the mortgage itself using two documents. But he will formalize it - this means he will agree to the issuance of funds. But for the further process you cannot do without:

- Cadastral and technical passport for the purchased housing.

- Extracts from Rosreestr confirming the absence of debts on utility bills.

- Extracts from the same register about the ownership of this property.

- A document confirming the transfer of ownership of housing to the borrower.

- Purchase and sale agreements.

- Specialist estimates of housing costs.

All these documents will definitely be needed when VTB begins to calculate the possible amount of the mortgage. It will also be mandatory to fill out a mortgage application form. It is in it that you will need to indicate all the information about your place of work and earnings. You should not think that VTB does not check this information - it focuses on it when making a decision on issuing a loan.

The advantage of the “Victory over formalities” program is that you do not need to provide a certificate of income and employment, which is good, because this is not always possible. But you still have to indicate your income and place of work.

How can I repay the loan?

Most often, VTB offers clients an annuity scheme for repaying mortgage debt. The entire loan amount, together with interest, is divided into equal parts over the entire loan period.

This scheme is convenient, since there is no need to monitor the payment amount and you can set up automatic payment in your VTB personal account. But the overpayment of interest is a significant part, which would not be the case in a differentiated payment scheme. It involves unequal but pre-agreed payments on set dates.

When signing a mortgage agreement, a person must pay utmost attention to this point and choose the most convenient scheme for himself.

VTB allows early repayment of a mortgage without sanctions or penalties for the borrower. You just need to write an application to the bank a month in advance and indicate the amount and date of payment.

You can repay your mortgage at VTB in many convenient ways:

- Transfers from other banks and accounts.

- Top up your account through VTB payment terminals.

- Using Russian Post.

- Through your VTB personal account from a computer or mobile phone with the VTB Online application installed.

- Through a bank cash desk.

There are many options, and therefore a person can easily and without delay transfer funds to pay off the debt. It is necessary to do this at least five days before the appointed date and always take checks, so that in case of a bank delay in the transfer, you can prove that the payment was made on time and the bank did not charge a penalty for late payment.

Procedure for obtaining a mortgage

How to take out a mortgage using two documents? The algorithm of actions is as follows:

- Primary information can be obtained on the official VTB website, where you can also fill out an application to participate in the program. After receiving a positive response, you need to go to the bank with all the documents.

- You can, bypassing the first point, immediately contact the bank’s specialists and get maximum information from them. Don't forget to bring your documents (passport and SNILS).

- After filling out the questionnaire, you will have to wait a day, during which time bank employees will consider your candidacy as a potential client and make a preliminary decision.

- After receiving a positive decision, you can proceed to the most important step - searching for living space. This process may take a lot of time, but remember, the bank’s decision remains in force for 4 months. Then the application will have to be resubmitted.

- As soon as the object of purchase is found, the second stage of collecting papers begins.

- After discussing all the nuances, a mortgage agreement for this property is signed.

- The time has come to make a down payment.

- The loan funds are credited to the seller's account, and the property under the contract becomes collateral to the bank, where it will remain until the obligations under this loan to the bank are fulfilled in full.

Bonuses from the bank

Individuals who participate in the bonus program from VTB 24 Bank can receive additional bonuses when applying for a mortgage product using two documents:

- if a consumer loan, car loan or housing loan was issued at VTB 24;

- if the application was submitted through the VTB 24 – Online remote service system.

On the bank's website it is possible to exchange accumulated points for various gifts. To do this, just go to the “Bonuses from VTB 24” section.

Mortgage loan payment procedure

Most often, the borrower chooses a mortgage with annuity payments, in which the monthly payment is divided into equal amounts. This scheme is good because the monthly contribution remains the same, and there is no need to look into the payment schedule every month to clarify the contribution amount.

You can set up automatic payment and deposit the required amount in advance on the card from which the debit will be made. Another option for depositing funds is to independently transfer money to your current account. This can be done from another card of the same bank or any other. You can transfer money from accounts. You can top up your card from the bank terminal by depositing the required amount into your account.

VTB Bank offers its users an online personal account through which they can control expenses and receipts of funds.

The bank provides for early repayment; this can be done by depositing a large amount. There are no fines or sanctions in this regard. But to do this, you will need to notify bank employees about your step a month in advance and indicate in advance the amount and date of the extraordinary payment.

Procedure for issuing a loan

According to the assurances of the credit institution and feedback from the borrower, the procedure for obtaining a mortgage using two documents is extremely simple.

- Initially, the client must submit an application by choosing the most convenient method:

- by visiting a VTB office in your own or the nearest city;

- using the online application service on the lender’s official website. In the first case, the borrower will have to fill out a questionnaire, the content of which includes a large amount of information regarding financial and marital status, employment, as well as the parameters of a future loan.

- Despite the large amount of information when filling out a mortgage application form using two documents, the client can indicate the approximate amount of income without confirming it with an official certificate. The completed application is submitted to the bank specialist along with the main documents, after which the applicant must wait the period allotted for consideration of the application, which is no more than 24 hours.

- The online application process is slightly different. The client must go to the VTB website, follow the link that redirects to the application form page, check the box “without proof of income,” and then enter basic information into the fields of the online application.

- If the loan is approved, you can begin choosing a property, which could be housing from the secondary market, an apartment you found on your own in a new building, or residential premises from a developer who is a partner of VTB.

- Next comes the stage of concluding a transaction with the seller and signing an agreement with the lender. At the same time, insurance is taken out for the loaned object from a company accredited by the bank. Moreover, the borrower’s refusal of personal insurance entails an increase in the rate by 1%.

- At the final stage, the bank transfers funds to the seller, and the buyer registers the property in Rosreestr with the simultaneous imposition of an encumbrance in the form of a pledge.