Tax on a privatized apartment

The procedure for paying tax is regulated by the Tax Code of the Russian Federation.

In addition to its provisions, issues of tax payment are regulated by the Civil and Land Codes of the Russian Federation, laws No. 218 (on the procedure for state registration of real estate), No. 135 (on the peculiarities of assessment), No. 1541-1 (on how privatization occurs). Important! The maximum tax rate for a privatized apartment is 0.1% of its price and is regulated by Art. 406 NK. The final amount is obtained after multiplying the cadastral value by the specified rate. The owner makes payments to the state fund annually.

Download for viewing and printing:

Article 406 of the Tax Code of the Russian Federation “Tax rates”

Federal Law of the Russian Federation dated July 13, 2015 No. 218 “On state registration of real estate”

Federal Law of the Russian Federation of July 29, 1998 No. 135-FZ “On valuation activities in the Russian Federation”

Federal Law of the Russian Federation dated July 4, 1991 No. 1541-1 “On the privatization of housing stock in the Russian Federation”

Owner categories

The value of the tax paid on the apartment you privatized depends on the type of property:

- individual owner - is the only person who owns real estate;

- shared owners - have shares, the ratio and distribution of which is indicated in the privatization agreement;

- joint owners - have a percentage share of the housing, but by agreement one person can pay the tax.

Important! With shared ownership, all citizens are payers, and the amount of tax depends on the percentage of the share.

What housing do you need to pay for?

The text of Article 401 of the Tax Code states that tax is paid on:

- private houses or parts thereof;

- apartments or shares in them.

There is no requirement to pay tax for the common place of use of an apartment building owned by all owners.

Important! Art. 401 also recognizes non-residential real estate, as well as ancillary premises on the territory of a dacha, gardening or vegetable farming partnership, individual housing construction, as full-fledged residential buildings, for which tax is also paid. Download for viewing and printing:

Article 401 of the Tax Code of the Russian Federation “Object of taxation”

Types of taxation

When paying personal income tax, you should know about property tax:

- payments to the state fund for the property of individuals have been changed since 2015. In Art. The Tax Code noted that the tax is calculated based on the cadastral value;

- for a privatized apartment at a rate of 0.1%;

- For a real estate purchase and sale transaction, a tax of 13% is also charged.

On a note!

The new property tax will be finally implemented in all constituent entities of the Russian Federation only at the beginning of 2021. Download for viewing and printing: Article 32 of the Tax Code of the Russian Federation “Responsibilities of tax authorities”

Which relatives are required to pay?

The following categories of relatives are not exempt from taxation by law for a donated apartment:

- Uncles;

- Nephewsnieces

- Son/daughter-in-law

- Any cousins (brothers, sisters, grandparents, grandchildren, etc.);

- Close people without family ties.

Read about who is entitled to property tax benefits here.

Attention!

Pensioners are deprived of benefits in this matter. Accordingly, if a pensioner received a gift of real estate not from a close relative, then he must pay a stable gift tax of 13%.

Read here what taxes pensioners can expect when paying property taxes.

Tax on the sale of a privatized apartment

Simply selling your privatized private real estate or apartment will not work - you need to pay tax for it. You should know that the purchase and sale transaction of such property is clearly stated in the Tax Code of the Russian Federation. The owner of the property pays personal income tax in the amount of 13% of its sale price. Since the sale of an apartment results in a significant amount, you need to understand in detail the intricacies of taxation.

When can you sell an apartment after privatization?

Privatized real estate is allowed to be sold only after taking ownership. This period at the beginning of 2021 is 6 years, i.e. After this period, you can take advantage of the tax deduction.

Property registration was 3 years ago

The profit received is subject to personal income tax at a rate of 13%. To make the amount smaller, use:

- property deduction - by 1 million rubles. sellers-owners of housing pay less for 3-5 years (clause 1, clause 2, article 220 of the Tax Code of the Russian Federation). Benefits are valid only for 1 object in 1 tax period;

- compensation for purchase expenses - tax is paid on the difference between the starting cost of real estate and the income from the sale. At the same time, when selling housing acquired through renovation, you can deduct the costs of purchasing both an old and a new apartment (clause 2, clause 2, article 220 of the Tax Code of the Russian Federation).

Advice! Use a property deduction if the acquisition costs are less than 1 million rubles.

The privatization deal took place after January 2021

If you privatized an apartment after January 1, 2021, then you can sell it immediately as soon as it becomes your property (from the moment of state registration), but you will have to pay the tax in full (13%) only after 60 months.

The tax is calculated based on the comparison of the price of the privatization contract and the cadastral valuation of the highest amount. Deductions from the sale of an apartment that has passed from state ownership to private ownership have a number of nuances:

- Individual entrepreneurs are exempt from paying tax;

- Personal income tax is paid by individuals who receive income under a lease agreement;

- on the basis of Article 14 of the Tax Code, tax deductions apply to inherited or donated objects (in this case, the donation comes from an individual recognized as a family member and (or) a close relative of this taxpayer in accordance with the Family Code of the Russian Federation).

Important! A privatization transaction registered earlier, before 2021, does not fall under the innovations.

Is it possible to sell immediately after registration?

You can sell privatized real estate immediately after state registration of the right, but there is a peculiarity if, after the sale of such property, a new one is purchased. For these precedents, offset is applied - its amount depends on the price of the housing sold or purchased. If you bought an apartment for more than you sold it for, the state makes a refund in the form of personal income tax on the purchase.

On a note! For other transactions, except inheritance and gift, a tax of 13% is charged.

What happens if you do not declare the donated real estate?

The Registration Chamber transmits all information about similar real estate transactions to the Federal Tax Service and the latter, in turn, carefully monitors the deadlines for filing the declaration. If for one reason or another you were unable to declare the apartment you received as a gift on time, then do it as soon as possible. The fine for late payment of tax on donated property increases for each month of delay.

Read about the tax system when donating an apartment to a close relative here.

The penalty system in such a case is as follows:

- For failure to submit a declaration, a fine of 1,000 rubles is charged, 5% of a certain amount of tax for each month the declaration is overdue (i.e., starting in May);

- For non-payment of tax, a fine of 20% of personal income tax (Personal Income Tax) is provided for the first time and 40% is charged if the situation happens a second time (moreover, tax evasion is considered intentional);

- There is also a penalty for late tax payment, which is calculated daily after July 16 (inclusive) and is calculated using the following formula: amount of tax debt * 8.25% (refinancing rate) * 1/300 * number of days overdue.

Fines can be levied either voluntarily (i.e. at the request of the tax service) or through the courts.

Who doesn't pay tax

The legislation of the Russian Federation makes exceptions when paying taxes for several categories of the population.

Special categories of taxpayers

The list of persons belonging to special categories includes pensioners and children under 18 years of age.

Preferences for pensioners

According to Art.

407 of the Tax Code of the Russian Federation, pensioners receiving pensions in accordance with the pension legislation, as well as persons who have reached the age of 60 and 55 years (men and women, respectively), who, according to the legislation of the Russian Federation, are paid a monthly lifelong allowance, and pre-retirees after privatization have benefits in the form of a 100% discount on Personal income tax. Benefits can be obtained only for one piece of real estate of each type upon submission of a package of documents to the tax office. It is granted automatically based on age. You can take advantage of the preference if the apartment was privatized and not used for business.

But pensioners pay the full tax on objects whose cadastral value is from 300 million rubles, that is, there is no benefit for an expensive privatized apartment.

A pensioner who owns a home can receive a tax deduction for:

- apartment up to 20 square meters;

- room up to 10 square meters;

- house up to 50 square meters.

Advice! Write an application and submit it to the Federal Tax Service, attaching the necessary documents and a copy of your pension certificate.

Minor citizens

Previously, until 1994, children could not get an apartment based on the principle of privatization. Now, on the basis of Art. 11 Federal Law No. 1541-1 they are full participants in the transaction. The legislation of the Russian Federation protects the rights of the child through several regulations:

- Art. ZhK - full rights of minors when transferring property from state to private;

- Art. and the Civil Code - guardians, parents, trustees cannot, without the permission of the district or city administration, exchange, donate, or take away the property of a citizen under 18 years of age.

A minor owner under 14 years of age does not sign documents. Children from 14 to 18 years old write their own application, but parents and guardianship authorities must give consent.

Children are provided with two benefits - the right to re-privatization after 18 years of age and tax exemption. In this case, personal income tax should be paid to legal representatives.

Important! The child cannot refuse the privatization deal. Download for viewing and printing:

Article 69 of the Housing Code of the Russian Federation “Rights and obligations of family members of the tenant of residential premises under a social tenancy agreement”

Article 28 of the Civil Code of the Russian Federation “The legal capacity of minors”

Article 37 of the Civil Code of the Russian Federation “Article 28 of the Civil Code of the Russian Federation”

Categories of beneficiaries

Benefits for paying property tax at the federal level are:

- pensioners and pre-retirees who are assigned pensions in accordance with the legislation of the Russian Federation in force on December 31, 2018 - based on age or length of service;

- disabled people and categories, childhood;

- heroes of the USSR and RSFSR;

- people who participated in the Patriotic War and the campaign in Afghanistan;

- holders of the Order of Glory 1-3 degrees;

- wives, parents, children, husbands of military personnel who died while serving;

- citizens involved in the liquidation and elimination of the consequences of the Chernobyl disaster.

On a note! The full list of persons entitled to preferences is specified in Art. 404 NK.

Regional benefits

Considering that until 2021 the tax on privatized property - from a privatized apartment to a house - was calculated according to the inventory value, regional policy is aimed at reducing its cadastral rate.

In some regions of the Russian Federation, parents with many children, disabled people, and military personnel have benefits. A pensioner who is included in several preferential categories cannot receive all the preferences, even within the region.

Advice! A list of citizens who are eligible for benefits can be found on the website of the local municipality.

List of documents

For example,

The declaration is not the only document that must be provided to the tax service if you receive real estate as a gift. You need to collect the following package of documents:

- Declaration in form 3-NDFL;

- Donation agreement;

- Documents confirming ownership of property;

- Certificate from the BTI and other technical documentation for real estate;

- Passport.

Information!

Help: Even if you are a close relative of the donor and are exempt from tax on gifted property, still check with the tax office at your place of residence about the need to submit a declaration with documents confirming your relationship with the donor (birth certificate, marriage certificate, etc.) . Such details differ in different regions of the country.

We invite you to read: Can a co-borrower receive a tax deduction?

How much does it cost to register a deed of gift with a notary, read here.

about the author

How to pay tax

From 2021, in order to pay tax, you need to follow new rules.

The duty base was previously set by the BTI, but now this issue is regulated by Rosreestr. It is not the technical characteristics of housing that are taken into account, but its regional market value. To pay, persons registered as owners after 2016 act as follows:

- Notify the tax service about the availability of real estate by filling out a form. It is on the Federal Tax Service website;

- Provide notification to the territorial office at the place of residence or property registration;

- Submit an application in your personal account on the Federal Tax Service website.

Important! Documents are provided before the beginning of the new year.

Size

The Tax Code of the Russian Federation does not specify the specific rate. It is set for a specific region. As an example, here is the fee for Moscow residents in 2021:

- less than 10 million rubles. - 0.1%;

- 10-20 million rubles. — 0.15%;

- 20-50 million rubles. - 0.2%;

- 50-300 million rubles. — 0.3%;

- over 300 million rubles. — 2%.

The amount of payments is calculated by tax authorities every year, after receipt and processing of information from Rosreestr.

Calculation of the amount

From 2021, the calculation is carried out according to a new scheme, when the cadastral value is taken as the maximum figure with a coefficient of 0.7. The reduction value is 0.4. To make calculations, you will need to multiply the tax amount by the cost of housing and subtract the coefficient.

Example

The apartment was bought for 8.4 million rubles. The sale price was 10.6 million. The calculation with compensation for purchase costs will be as follows: (8.4 - 1) x 13% = 962,000 rubles. (10.6 - 8.4) x 13% = 286,000 rubles.

The apartment was purchased in 2021 for 5.8 million rubles. In 2021 it was sold for 7.3 million rubles. After the cadastral assessment, the cost became 8.9 million rubles. We multiply the cadastral value by 0.7. We receive 6.2 million rubles, which is less than the contract price. We calculate personal income tax based on the contract price: (7.3 - 5.8) x 13% = 195,000 rubles.

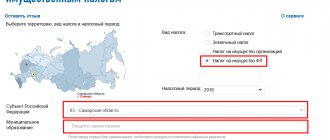

Where to find out the rate

Since the total amount of tax is determined by the region, you can familiarize yourself with the regulations of the authorities in periodicals, on the organization’s website or during a personal visit.

The second point is the cadastral value, which will be calculated on the Rosreestr resource:

- Go to the “Individuals” section;

- Select the tab on obtaining cadastral valuation information;

- Click “Find out more”, enter the registration number and address of the object.

Advice! You can make an appointment with a civil servant - he will need to present a declaration and other documents upon request.

List of documents

To receive a property deduction or pay a duty on a privatization transaction, you will need the following documents:

- declaration 3-NDFL;

- certificate 2-NDFL;

- copy of internal passport;

- application for tax deduction or refund;

- contract of sale;

- payment receipts;

- Declaration of registration of ownership.

Important! Copies of documents must be notarized.

Terms and procedure of payment

To pay the tax, you must contact the territorial department of the Federal Tax Service before January 1, 2021.

If you submit documents later, a fine will be imposed for failure to provide data. To receive the benefit, you must submit papers before November 1, 2021. Payment deadlines are until October 1, 2021. Deductions from the sale of an apartment are made until July 15, 2021, provided that you sold the property in 2021 and submitted the declaration before the end of April 2021.