For most car owners, the garage is not only a room in which the car is parked, but also a place of rest, a mini-workshop. And if paying a fee for square meters of an apartment or house is commonplace, then a garage tax is something new. However, the legislation of our country also provides for a fee for this building, so let’s look at interest rates, categories of citizens who fall under benefits and are also exempt from payment, and the conditions for calculating this fee.

Legislatively, the tax on garages, as on the real estate of citizens, was established in October 2014

What tax will you have to pay for a garage?

Having received a notification by mail from the federal tax service about the need to pay an additional fee for a privatized garage box, citizens begin to find out why the tax is received, what category of fees it belongs to, and from what amount it is calculated. Let's look at all the components of the issue in order to avoid problems with the tax office in the form of fines and penalties in the future.

First of all, it is worth noting that the tax on garages, as on the real estate of citizens, was legislated in October 2014, and came into force at the beginning of 2015. The provisions of the law on property taxation apply to all citizens of the Russian Federation, including citizens of foreign countries, as well as stateless persons. And it doesn’t matter how many people (joint ownership of the building by relatives) own the garage, the tax is paid depending on the share of ownership of the latter. According to legislative norms, this fee is classified as local taxes, and accordingly the entire amount is sent to the city budget.

Please note that the citizen receives the obligation to pay the fee for a garage building (boxing) immediately after registering the latter with Rosreestr and issuing the corresponding certificate of property.

Citizens are often interested in whether taxes are imposed exclusively on the building or only on the land plot? But what if the garage is located in a garage cooperative?

According to current legislation, the duty on a garage building includes, in fact, two separate taxes - a duty on real estate and the land plot on which the specified structure is located.

An important nuance in calculating the amount of tax on a given premises is that the basic indicator for calculations is the inventory value of the building. This is the amount of restoration of real estate (object), taking into account its wear and tear, as well as the jump in pricing for building materials and work. The inventory cost is included in the technical passport of the premises and also includes the regional tax rate.

In this case, the cadastral value of the garage is not calculated.

Earth

The tax for the land on which the garage is located is also subject to mandatory payment.

If the garage is located in a garage cooperative, is registered as a property, but the land is not, then the tax will be paid indirectly: the tax will go to the garage cooperative as a whole, and the accounting department will distribute it among all members of the cooperative.

If the garage is located in a tax-exempt cooperative (for example, the GSK is registered to a society for the disabled), then the owner (a healthy person) also does not have to pay tax, because the tenant is an organization that does not pay tax.

If the land under the garage is registered as a property, then the tax office itself will send a receipt for payment to the owner once a year.

The amount of tax on land under a garage depends on two factors:

- cadastral value of land;

- regional tax rate.

The obligation to pay tax arises from the moment

- beginning of land use (at the start of construction);

- from the moment of registration of land ownership.

The tax rate depends on the region, but on average is 1.5%.

If the garage owner is a pensioner

Until the end of 2014, the tax on real estate that was owned by a citizen who had reached retirement age, including a garage building, was abolished

Since in our country citizens of retirement age have a number of privileges and benefits, the question often arises whether pensioners pay a fee for garage construction. Let's look at this type of taxation, focusing on this category of citizens.

Until the end of 2014, the tax on real estate that was owned by a citizen who had reached retirement age, including a garage building, was abolished. However, starting in 2015, this legislative norm was changed for pensioners. According to the introduced changes, a citizen has the right to choose 1 piece of real estate that will not be subject to the fee, and since the amount of the fee for an apartment or house will be more significant compared to the fee for a garage, the choice falls on them.

Do not forget that the tax on a garage owned by a pensioner also includes payment for the land plot underneath it. As for the land plot under the garage, according to the above legislative acts, payment for it is carried out in full, regardless of the status of the owner of the building.

Only the tax rate on land, which is within the sphere of influence of local authorities, can be different. The percentages for your region must be clarified with the relevant specialists of the federal tax service. If this option is possible, you need to contact the inspectorate with an application, pension certificate (copy), and internal passport.

How is garage tax calculated?

First of all, please note that our country today has a progressive system. What are its features and how much should you pay according to it?

According to this system, the tax is calculated depending on the cost of the garage, that is, the more expensive the building, the higher the duty amount. But how to calculate the tax so as not to contact specialists, what should you pay special attention to in order to definitely find out the tax on this type of real estate.

Let's look at how much it will cost you to own which garage space:

- if the cost of the building is up to 300 thousand rubles, the tax deduction for the garage will be 0.1% of the amount;

- with a cost ranging from 300 thousand to half a million rubles, the tax rate varies from 0.1 to 0.3%;

- for garage buildings costing over half a million rubles, you will have to pay a tax ranging from 0.3 to 2%.

It is worth noting that interest rates may differ in each region of the Russian Federation; for more detailed information, please contact the tax service.

In addition to the interest rate, the difference in garage duty will also differ by the type of garage ownership

In addition to the interest rate, the difference in garage fees will also differ by the type of ownership of the garage. If the garage is privately owned, then the notice will be sent directly to the owner, but if the garage is built on the lands of a garage cooperative, then a receipt from the tax office will be for the total amount. The division of the duty into the shares of the members of the cooperative will be carried out in the accounting department of the latter. If a cooperative has a discount on land tax or is exempt from it, its members are also exempt from paying.

Since this type of taxation is mandatory, it must be paid annually. To do this, you need to pay a receipt, which is sent by the regional office of the Federal Tax Service, in which the amount is calculated and stated. If there is no alert, you have several ways out of this situation:

- you can contact the service department directly to have your tax calculated and issued a receipt;

- An alternative option is to independently calculate and pay the required fee.

Filing a declaration

The declaration must be submitted when paying NFDL. The applicant can calculate the tax amount independently. He has the right to take the amount of income received or take into account the cadastral value of the property, taking into account a reduction factor of 0.7% of its value.

You can also take into account the difference between the income received and the cost of the transaction and, taking into account the resulting difference, calculate personal income tax.

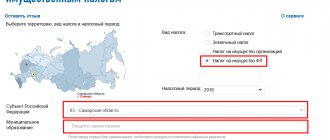

The declaration should be submitted directly at the Federal Tax Service office or through the department’s website, having previously downloaded documents in XML format. The document can be submitted in paper form or typewritten.

We invite you to read: Tax on inheritance

Read,

how to purchase a garage in a garage cooperative

.

How to calculate the cadastral value of a garage? Information here.

Do I need to obtain permission to build a garage on my site? Details in this article.

Types of garage taxes

If we understand more specifically the components of the tax on a garage building, we can see that it essentially consists of 3 separate duties:

- property - this is a payment directly to the building. And it doesn’t matter whether it’s a permanent (brick, block) garage or a prefabricated version made from metal structures and sheets. The building is read by your property;

- land - a separate payment for the land under construction;

- income tax.

The last type is not considered mandatory, unlike the first two. As mentioned above, the fee for a garage building is calculated depending on the cost of the building, its total area, and the region of registration.

Let us note separately that if you officially rent out your garage space, for which a corresponding agreement has been drawn up, then in addition to real estate tax, you will also need to pay income tax. A fee that every citizen pays on their official income. Its current rate is 13% of the amount received. By the way, it will not be possible to transfer the real estate duty to the tenant, since you remain the owner of the premises.

Property tax

Property tax is one of the mandatory types of taxation

According to the legislation of our country, property tax is one of the mandatory types of taxation, which is assessed annually. The list of property that falls under the collection includes: apartments or private houses, separate rooms in communal apartments, country houses, unfinished construction projects, outbuildings, garages. Please note that payment of property tax for individuals is carried out even in the case of shared ownership of property . In this case, each owner pays his part of the tax.

Taxation of a detached garage

The tax is subject to collection only from the garage that is registered with Rosreestr. This includes a separate building, which is a real estate property.

To register a garage, you must have all the title documentation for it. Payments in this case are calculated in accordance with the general procedure.

Find out how to register a garage as your property.

Categories of citizens who are entitled to receive relief

Since the property tax of citizens, both movable and immovable, is considered mandatory, all categories pay it accordingly:

- all owners of garage buildings who are over 18 years old. Recent changes in legislation make it possible to pay a fee to the parents of a minor garage owner;

- legal entities (organizations, firms);

- private entrepreneurs.

As for the category of the population who have the right to receive relief and are included in the list of “Real Estate Tax Beneficiaries”, they include:

- citizens of retirement age;

- disabled people. People often ask, does a disabled person from the Great Patriotic War pay for boxing? It all depends on the disability group; keep in mind that group 3 is not included in the list of beneficiaries of the “garage” fee;

- war veterans. Not only WWII veterans are included, but also those who fought in Afghanistan and Chechnya;

- citizens bearing the title Hero of the USSR and the Russian Federation;

- persons liable for military service with at least 20 years of experience;

- families of those military personnel who died in the line of duty;

- nuclear scientists (citizens who took part in testing weapons that had a nuclear warhead);

- residents who use taxable property for cultural or artistic activities.

Please note that the following categories of citizens are not exempt from paying tax:

- large families;

- families falling into the category of “poor”.

For these categories, a discount is provided in some regions of the country. Information about a possible tax discount must be clarified at the regional office of the Federal Tax Service.

However, please note that the so-called “luxury real estate” does not fall under preferential taxation for the property tax. What is meant? This is the property of individuals, the total value of which exceeds 300 million rubles. Such citizens are not included in the list of beneficiaries for this type of taxation.

As you can see, the garage duty is a completely legal type of taxation with several subtypes, which has a lot of subtleties in the process of its calculation, as well as a separate list of citizens who fall into the category of “beneficiaries”, special conditions for receiving benefits.

Possible difficulties

Neglecting to pay taxes can result in penalties of several thousand rubles. If information about the garage was not transferred to the Federal Tax Service Rosreestr, then the tax notification may not arrive at all. Then everything depends on the behavior of the specialists “on the ground”. In this case, non-payment of tax may not occur for years, which does not formally relieve the payer of responsibility.

It is necessary to calculate and pay taxes in a timely manner so as not to be brought to administrative liability. In difficult situations, it is advisable to seek help from a competent specialist.