Do I need to pay tax on an apartment if it is purchased with a mortgage? On the one hand, the property does not belong to you completely, because the loan has not yet been repaid. On the other hand, this real estate has a special legal status described at the federal level.

According to Russian legislation, paying taxes is an annual obligation of all individuals who own real estate.

Next we will talk about how the tax on an apartment with a mortgage is paid, what is its size, what are the features of fulfilling tax obligations, is it possible to make payments via the Internet, is it possible to avoid paying property tax and who is officially exempt, are there any benefits, pay Is there a tax for pensioners?

Features of apartment tax in a mortgage

The Tax Code of the Russian Federation lists categories of persons exempt from paying taxes . Penalty measures have also been established for those who evade prescribed payments or have debt.

If you are in doubt whether you need to pay property tax if the apartment is mortgaged, read Article 400 of the Tax Code of the Russian Federation. Citizens who purchased real estate under a bank loan program are required to pay tax on an apartment with a mortgage.

Homeowners are required to make a fiscal payment based on the cadastral value of the home. Payment must be received no later than October 1, otherwise the payment will be considered late.

Houses, apartments, garages, rooms, cottages, other buildings and premises, shares in a property acquired with a mortgage are subject to taxation.

Tax and tax deductions when selling an apartment

Citizens buying apartments with a mortgage are legally entitled to a tax benefit called a tax deduction. This is money that is returned to the taxpayer’s account from the amounts of income taxes he paid to the state. The amount of return and the maximum price of the purchased property from which such a return can be made are limited.

- Citizenship of the Russian Federation.

- The benefit is provided only once within the limit; the taxpayer is not entitled to receive it again for another limit.

- Employment in any organization in accordance with the Labor Code of the Russian Federation, confirmed by the presence of an employment contract.

Do retirees have to pay property taxes? Before determining in what cases pensioners should shell out their funds for these payments, you first need to determine in what cases this category of citizens is entitled to this type of tax benefit:

- Apartments;

- Rooms;

- Residential buildings;

- Structures with an area of no more than 50 square meters and located on the territory of country houses,

garden plots or lands designed for individual housing construction, which can be used as residential premises;

Tax benefits when purchasing an apartment for different categories of pensioners Both working and non-working pensioners have every right to certain tax benefits when purchasing residential real estate.

Those who sell their home are also entitled to a property deduction. After all, having sold property, you receive a certain amount of money for it, which forms your income. And personal income tax must be paid on income. But not always.

So, if you are selling housing that was purchased before 01/01/2016 and was in your ownership for 3 years or more, then you do not have to pay tax on its value (clause 17.1, article 217, clause 1, clause 2, art. 220 of the Tax Code of the Russian Federation). Otherwise, you will need to calculate the tax and submit a declaration in form 3-NDFL to your Federal Tax Service at your place of residence (clauses 1, 4 of Article 229 of the Tax Code of the Russian Federation).

We invite you to read: In what cases does an institution have the right to rent out property without bidding?

For housing purchased in 2021 and later, different rules apply. There will be no need to calculate personal income tax on its value if it is sold (clause 1.2 of Article 217.1 of the Tax Code of the Russian Federation):

- 3 years after it became the property by inheritance, on the basis of a gift agreement from a family member or close relative, as a result of privatization, or as a result of the transfer of property under a lifelong maintenance agreement with dependency (clause 3 of Article 217.1 of the Tax Code of the Russian Federation);

- after 5 years of ownership of the property (clause 4 of article 217.1 of the Tax Code of the Russian Federation).

When calculating the tax on the sale of an apartment, you can apply the following deduction:

- or in the amount of actual expenses that were previously spent on the acquisition of the sold apartment. Let's say you bought an apartment in 2015 for 2 million rubles, and sell it in 2021 for 2.4 million rubles. Then, by claiming a deduction for the amount of expenses, you will have to pay personal income tax in the amount of 52 thousand rubles. ((2.4 million rubles – 2 million rubles) x 13%);

- or in the amount of 1 million rubles, if you did not have such expenses or do not have documents with which you can confirm the amount of expenses (clauses 1.2, paragraph 2, article 220 of the Tax Code of the Russian Federation). Returning to our example, when deducting 1 million rubles. the seller will have to pay 182 thousand rubles to the budget. ((2.4 million rubles – 1 million rubles) x 13%).

To obtain property tax deductions both for the sale and purchase of an apartment, the Seller or Buyer, respectively, must fill out and submit to their Federal Tax Service (at their place of registration) a tax return in form 3-NDFL.

This is a rather voluminous document with a lot of formalized points and empty fields for calculations and data substitution (see link to the sample below). In order not to rack your brains over tax puzzles, you can order the preparation of a 3-NDFL declaration to special commercial services for a small fee.

Sample tax return form 3-NDFL - on the official website of the Federal Tax Service -

Here

.

Addresses of tax inspectorates (IFNS) of Moscow are here (if you change the region there, you will receive the addresses of inspections of any region of Russia).

Consultation and assistance in filing a 3-NDFL declaration and obtaining a tax deduction can be obtained HERE (SERVICES).

When selling an apartment, a declaration (on income received and applicable deductions) is submitted from January 1 to April 30 of the year following the year of registration of the transaction (and receipt of income, respectively). This period is specified in clause 1, article 229, Tax Code of the Russian Federation.

The tax itself must be paid after filing the declaration, maximum until July 15 of the same year. This is indicated in clause 6, article 227, Tax Code of the Russian Federation.

In the case of the sale of an apartment, to which, by law, a tax deduction is applied in the amount of the full cost of housing (see above about this), a declaration on the income received is still submitted, but the obligation to pay tax does NOT arise.

When purchasing an apartment, a declaration (indicating the expenses incurred and an application for a personal income tax refund) can be submitted in any year and in any month, starting from January of the year following the purchase. This discretion is provided here because the Buyer's use of this tax benefit is a right and not an obligation. At the same time, the tax deduction for the purchase of housing will be calculated only for the 3 years preceding the submission of the application (see above about this).

The return of personal income tax paid from the Buyer's salary occurs after the end of the tax period (year), it is calculated for the expired tax period, provided that the tax payer (i.e., the Buyer of the apartment) had income (salary, etc.) during this period. ), from which personal income tax was paid to the budget.

The personal income tax is refunded until the entire amount due for refund has been returned.

Collecting and submitting documents to receive a tax deduction (including filling out a declaration in Form 3-NDFL) can be done either independently or with the help of tax consultants (see the link to them above).

How is a personal income tax refund processed for the purchase of housing? The procedure for the Buyer of an apartment to apply for a tax deduction, and the list of documents for returning personal income tax, see the link.

What if you sold one apartment and bought another at the same time? Will there be a netting of tax and deduction here - see the link.

And individual, special cases of applying tax deductions can be found in the comments to this article.

Transaction support by an experienced lawyer ALWAYS reduces risks (especially for the Buyer of an apartment). The services of specialized real estate lawyers can be found HERE.

Rules for preparing and conducting an apartment purchase and sale transaction are on the interactive map “STEP-BY-STEP INSTRUCTIONS” (will open in a pop-up window).

Tax and mortgage According to Russian legislation, paying taxes is the annual obligation of every individual who owns real estate. The Tax Code of the Russian Federation contains a description of the category of persons who are exempt from paying it. He also established penalties for those who evade payments and debtors.

Thus, a citizen who has purchased real estate, according to Article 400 of the Tax Code of the Russian Federation, is obliged to pay tax on the acquired property to the state. Each individual who is a home owner is recommended to make a fiscal payment based on the cadastral value of the existing property within the established time frame, namely, no later than October 1 of the current year, to pay a visit to the tax office.

If you do this later, the payment will be considered overdue. It is better to pay off tax debts before May 1. Otherwise, potential and existing counterparties will see information about what the company owes to the budget for a whole year. {amp}lt; ... Personal income tax on lottery winnings: who pays Who should transfer personal income tax from winnings to the budget (the lottery distributor or the winning citizen) depends on the amount of the prize won. {amp}lt;

… Home → Accounting consultations → Personal Income Tax Current as of: February 21, 2021 Tax benefits when purchasing an apartment usually mean property deductions for personal income tax provided to home buyers. In this case, the deduction is provided only to those persons who have income subject to personal income tax at a rate of 13% (clause 3, clause 1, article 220, clause 3, article 210, clause 1, article 224 of the Tax Code of the Russian Federation).

Income tax and deductions when purchasing an apartment with a mortgage

The law provides for tax deductions when purchasing housing, but not all citizens of our country can take advantage of this right.

The maximum deduction in 2021 is set at 13% of 2 million rubles . At the same time, it is allowed to purchase one premises from 2 million rubles, or several at a lower cost.

Homeowners must be employed and receive official income, since tax preferences in the form of deductions are formed from income payments that citizens transferred for the previous period.

If the salary is less than 2 million rubles. per year, you cannot receive a deduction in a single payment . A citizen can only return the amount that he paid earlier.

Apartment owners have the right to submit documents each year to claim payments as part of the tax deduction. To receive larger amounts, it is recommended to submit documents once every 3 years.

What is a tax deduction when purchasing real estate?

In essence, this is a specific “cashback” from the state. You spend money on your mortgage during the year - at the end of the year the state partially compensates for it (returns 13%).

This program was introduced to stimulate real estate purchases. We'll tell you exactly how it works using clients as an example.

Irina and Vladimir are married, both work. They decided to take out a mortgage on an apartment in the Moscow region worth 10 million rubles. We bought an apartment with a rough finish from the developer, then ordered a comprehensive renovation from our company. Repairs cost another 1.5 million.

At the end of the year, the spouses submitted an application and received the following payment:

13% + 13% - on the cost of the apartment and the amount of overpayments to the bank.

Important information!

The maximum amount for which you can receive a tax deduction is 2 million.

Additionally, they requested a tax deduction for repairs (it is impossible to return 13% of the entire amount, “cashback” only applies to finishing).

The result was a good amount, which became a good bonus for the holidays and allowed the couple to go on vacation.

Features of property tax

Despite the fact that an apartment purchased with a mortgage is collateral, the owner is obliged to pay the state and municipal fees accrued on it.

In fact, such an apartment is considered the property of an individual, and the tax authorities impose certain obligations on such property.

Property tax is calculated depending on its value . These requirements are determined by the current provisions of the Tax Code of the Russian Federation.

The Federal Tax Service must send notifications about the need to pay taxes. It is not necessary to make a payment until you receive the document.

If the notification was not received or arrived late, there should be no negative consequences . In this case, it must be indicated that the absence of a notification is due to the fact that tax officials did not send it, and it was not lost in the mail or was removed from the mailbox.

But citizens themselves should not treat this responsibility negligently, otherwise fines will be imposed . The amount of the first fine will be 20% of the original amount of property tax; a repeated violation will entail a penalty of 40%. Fines are imposed for missed payments - this is a month from the date of receipt of the notification.

Preparation

To receive a deduction when purchasing an apartment with a mortgage, you need to prepare in advance. The government agency responsible for payments reviews applications if certain documents are available. There is no need to submit originals - copies are sufficient. Documents for tax deduction on mortgage:

- property deed;

- agreement with a financial institution;

- payment repayment schedule;

- certificate confirming income.

Sequencing:

- You are writing a statement about your desire to receive a property deduction for mortgage interest.

- Attach a declaration and salary certificate.

- Copy other papers, including the agreement with the bank and the payment repayment schedule.

With all these documents, you go to the tax office and claim the right to deduct mortgage interest. Making a decision does not take much time - usually you can receive a payment within a few days.

Interesting fact! In the USA, the Tax Code consists of 250 volumes.

Tax status of an apartment with a mortgage

Housing purchased under the mortgage program has a special legal status. This is due to the specifics of the mechanism for regulating legal relations in the field of mortgage lending.

An apartment with a mortgage has the following features:

- this housing has not been fully paid for by the buyer, therefore it has an intermediate status of collateral;

- Despite the mortgaged status, the apartment is considered the property of the person who purchased it on credit. It can be used and, to some extent, disposed of;

- if you miss the deadline for paying the next mortgage payment, the apartment will be transferred to the lender to pay off the debt;

- the apartment is the property of the borrower, so tax on it is paid in accordance with the general procedure.

Who can receive a deduction?

Almost everything! If a person works, receives a regular salary, and the employer regularly deducts the duty, it will not be difficult to obtain a property deduction when purchasing an apartment with a mortgage. But before you apply, you need to make sure you meet the strict conditions:

- The applicant is a citizen of the Russian Federation.

- The bank is registered in the state.

- The purchased housing is located in Russia.

- The borrower has income subject to personal activity tax.

But a citizen who has not received a stable salary for two years cannot receive a tax deduction for an apartment with a mortgage.

Interesting fact! In the twentieth century, there were about 2 thousand duties in Tibet. The most unusual one is on the ears.

Notice of payment of property tax

A notification from the tax authorities about payment of property tax must be drawn up in the form approved by Order of the Federal Tax Service dated September 7, 2021 No. ММВ-7-11/477. By Order of the Federal Tax Service No. ММВ-7-21/8 dated January 15, 2021, adjustments were made to it.

The main innovation in the new form of notification of the calculation of property contributions is changes in the procedure for generating the form in the event of a need to recalculate the previously established contribution amount.

Preparation and distribution of notifications is carried out only for those addressees affected by the recalculation, and not for all taxpayers living in a given region.

When recalculating, the notification form shall indicate the following information:

- the amount of the previously accrued amount;

- amount of reduction or additional payment.

Options for delivering notifications have also been added. The document can be sent in the following ways:

- at the taxpayer's postal address;

- by email - for individuals with a personal taxpayer account.

Deadlines for paying taxes on an apartment with a mortgage

Property tax must be paid at the location of the taxable property . Every year, the Federal Tax Service sets deadlines for payment of contributions to individuals and legal entities. Previously, property contributions were made before October 1 based on accruals for the previous year.

In 2021, the deadlines for transport and property taxes were shifted. Now you need to pay off received notices before December 1. The specified period is valid for all subjects of the Russian Federation.

Legislative provisions allow the payment deadline to be postponed if the taxpayer promptly sends an application to the regional inspector with such a request. For a positive decision, the application must indicate the reasons for postponing the payment deadline. The maximum transfer period is also set at 1 year.

If the deadline for paying property tax is violated without sufficient grounds, the property owner will also have to pay a penalty for the entire amount of the arrears.

Mortgage apartment tax

The apartment, which has a mortgage, is pledged to the bank. Does this mean that the buyer must pay property taxes on the property in question? How is tax calculated in this case? Do I need to pay property tax for an apartment with a mortgage? Paying property taxes if the apartment is under mortgage is the legal obligation of its owner. The property belongs to him by right of ownership.

Info

The fact that an encumbrance is placed on the apartment before the mortgage is repaid does not matter.

The tax on an apartment with a mortgage is paid in full - as if the apartment were without encumbrance.

Likewise, the owner of such real estate has the right to enjoy various benefits.

The tax is paid regardless of the citizenship and age of the apartment owner.

Property tax amount

In accordance with Article 32 of the Tax Code of the Russian Federation, property tax is calculated based on cadastral value. Its value is approved at the local level of each region.

Tax laws have undergone many significant changes in 2021. The procedure for calculating property tax has also changed. By 2021, the new order and the transition to a new payment system will have to be implemented throughout the Russian Federation.

The tax amount based on the cadastral value is calculated using the following formula: (Cadastral value – Tax deduction) × Share size × Tax rate.

You can obtain information on the cadastral value of property on the Internet. To do this, you need to know the cadastral number of the object or its actual address.

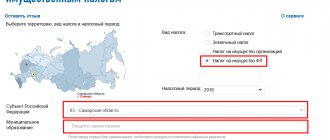

Next, go to the Federal Tax Service website https://www.nalog.ru, select property tax, your region, enter the number and get information about the value of the property.

In the same way, you can clarify the amount of tax for the previous tax period and find out how it was calculated: according to inventory or cadastral value. If according to the inventory, the program will prompt you to enter not the cadastral number, but the inventory value.

You can find out the cadastral number on the Rosreestr website https://rosreestr.ru in the reference information section at the registration address of the property.

The tax amount varies from 0.1 to 2% depending on the region, owner status, and type of property. The exact cost can be clarified at the regional tax office.

Calculation of the final amount involves the following steps:

- Calculating the cadastral value of the property by dividing the total amount by the taxable area.

- Calculation of deductions due to a citizen by law.

The amount of the second point is subtracted from the amount of the first point . Contributions are calculated based on the inventory price of the property. The amount of the tax fee is calculated in accordance with three main indicators: this allows you to determine the amount of payment as accurately as possible.

The final indicator is reduced by the size of the correction factor: this allows for a gradual increase in property collection. In 2021, the coefficient was 0.6, in 2021 - 0.8, from 2021 citizens will have to pay 100% of accrued fees.

Procedure for fulfilling tax obligations

The tax amount is determined in accordance with the cadastral value of the property. If you have not received a notification or the indicated amount seems too high, contact the cadastral service and clarify the cost of the object.

Knowing the amount of the tax fee, you can pay it at a bank, tax office, via the Internet, a payment terminal or private specialists.

Upon receipt of a notice at home, you must pay the amount indicated on the form at the nearest bank branch. Payment is accepted in cash or by transfer.

When contacting the tax authority, a specialist will calculate the required amount and issue a receipt for payment. It is recommended to keep the receipt to avoid misunderstandings in case of penalties.

Payment via the Internet

Payment of property taxes online is available to all citizens . However, a number of conditions must be met. Upon receipt of a notification from the tax service, payment is made through online banking, if your bank offers this option.

The procedure for fulfilling tax obligations via the Internet begins with registration on the tax service portal . To do this, you must enter your passport data and taxpayer identification number. Your personal account indicates the amount of tax collection that the tax service specialists made for you.

If you do not know the exact amount, you can send a request through the Internet portal to the tax office, and you will be given an answer regarding your tax obligations.

On the website of the tax service, you can independently calculate the amount of tax - a service with the appropriate algorithm is available.

Is it possible not to pay tax on an apartment with a mortgage?

There is no legal mechanism to avoid property tax. Within the framework of tax legislation at the federal level and regional regulations, certain categories of citizens have tax benefits or are completely exempt from them:

- disabled since childhood, groups I and II;

- pensioners;

- Knights of the Order of Glory;

- military personnel who retired due to age with at least 20 years of service;

- heroes of the country;

- military families who have lost their breadwinner;

- WWII veterans;

- spouses and parents of military personnel killed in the line of duty;

- victims of the consequences of the accident at the Chernobyl nuclear power plant or at the Mayak nuclear power plant;

- owners of outbuildings with an area of no more than 50 m² located in areas of vegetable gardening, horticulture, summer cottage farming, and personal farmsteads;

- citizens using property for creative activities and as a cultural object.

Benefits at the local level are usually provided to large families and needy individuals . The exact list can be clarified at the regional tax service.

Benefits apply to only one property. Citizens of the Russian Federation are provided with tax deductions for apartments purchased with a mortgage.

Tax benefits for military mortgages

Military personnel serving under contract or with at least 20 years of service are eligible to receive a fiscal benefit equal to the amount of tax on a military mortgage loan.

To receive the benefit, you must provide the tax service with a certificate from a military unit indicating your personal data. If you do not contact the tax service in a timely manner, the right to a fiscal benefit is still retained, but recalculation is made for no more than 3 years.

Pension benefits

In accordance with Article 407 of the Tax Code of the Russian Federation, pensioners also have certain benefits and privileges when paying state duties on real estate. The right to reduced payments is granted only for one object.

If a pensioner owns several equivalent residential premises, which of them will be given a benefit can choose independently. Preferences are assigned upon availability of an application and title documents.

Got a mortgage? Claim your personal property tax benefit!

If real estate is acquired as shared ownership by several citizens at the same time, according to the new rules, each taxpayer can exercise their right to deduction until they use the entire tax “limit” provided for by law. In this case, the spouses have the right to distribute the property deduction among themselves, without focusing on the size of the shares in the purchased apartment (Letter of the Federal Tax Service of Russia dated March 30, 2016 N BS-3-11/1367).

Important

Regardless of the share in property, the deduction for each person cannot exceed 2 million rubles. Important: The new rules apply if documents confirming the emergence of ownership of an object were issued after January 1, 2014 and the taxpayer has not previously received a property deduction.

For this reason, eligibility must be verified with your local tax office. If there are grounds to receive preferential tax conditions, you must:

- submit an application using a special prescribed form provided by the tax service itself;

- present documents that certify the grounds on which the benefit is issued.

As a general rule, the benefit applies to only one property from each category. Thus, if a person owns more than one apartment, then only one of them is exempt from tax. You will have to pay for other real estate. As for an apartment with a mortgage, citizens of the Russian Federation are provided with a certain tax deduction. This does not mean that the person is exempt from tax, but a certain portion of the mortgage tax may be refunded.

Important

What is required from the employer? Is it necessary to submit to the Pension Fund in advance lists of future pensioners and documents necessary for assigning a pension? Or are the organization’s responsibilities limited to submitting the requested SZV-STAGE form to the Pension Fund for the future pensioner? Representatives of the Pension Fund Branch for Moscow and the Moscow Region told us what the role of the employer is in the process of applying for a pension by an employee. {amp}lt; ... Compensation for unused vacation: ten and a half months go in a year When dismissing an employee who has worked in the organization for 11 months, compensation for unused vacation must be paid to him as for a full working year (clause 28 of the Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169 ). But sometimes these 11 months are not so spent.

Two weeks left

It is better to protect yourself to avoid fines and penalties. It is worth visiting the tax office and getting a notice. It’s another matter if you never received notifications from the tax office about paying taxes. In this case, you are obliged to independently report by the end of this year about your existing real estate and vehicles.

Akylas. “One of the key property taxes is the tax on the increase in the value of housing. If an apartment was purchased and sold in the same year, then a 10% tax must be paid on the positive difference between the sale and purchase price. — says partner of the law firm Mars Legal Alibi Akylas. “For example, an apartment was bought for 1 million tenge, and six months later it was sold for 2 million tenge.

Thus, on the part of the state, a mortgage is a kind of “Affordable Housing” program, but among the population this term only evokes fear, under which lies a “hopeless debt hole.” In the new year 2021, the conditions for mortgages with state support have been significantly simplified, but what percentage will Russians now have to pay and, most importantly, what is hidden behind them?

a person can return this amount in the form of reduced monthly tax payments from his salary. In simple words, you will not be charged personal income tax until the total amount of monthly tax left to you is equal to the amount you paid in the form of 13% of the property value when completing the apartment purchase and sale transaction. The possibility and procedure for property tax refunds is approved by the Tax Code of Russia.

We invite you to familiarize yourself with: The average monthly amount of personal income tax

The cadastral valuation practically corresponds to the market value, which allows increasing local budget revenues. Considering the difficult financial situation of the regions, this innovation is especially relevant. At the same time, property owners will have to significantly increase their costs. To avoid negative consequences, legislators have provided for a phased transition to cadastral valuation.

During the registration of an apartment purchased with a mortgage, an entry is made in the Unified State Register that this property is collateral, but is the property of the borrower. Such a right of ownership restricts the owner from performing actions with this object. It cannot be sold without the lender's permission. But according to the law, the owner of the mortgaged property is the borrower; he must bear the financial burden in connection with the existence of such property rights, including payment of property taxes for individuals.

In this type of taxation of citizens, a system of preferential categories is used. Borrowers who pay off a mortgage are not exempt and are not exempt from paying property taxes to the state.

But you can not contribute money to the treasury at all for this type of tax or take advantage of a discount if you have such a right established by the federal and regional authorities.

Federal beneficiaries exempt from such payments are:

- citizens who participated in wars;

- those involved in the liquidation of the Chernobyl accident;

- persons with disabilities, etc.

Benefits for the amount of taxation of real estate or its share are applied directly to the citizen who has the right to use the benefits in accordance with the law.

Liability for non-payment

The absence of property transfers after the end of the established period entails the adoption of retaliatory measures:

- accrual of penalties on the entire amount of debt - each day of delay is calculated based on 1/300 of the National Bank's refinancing rate;

- a fine of 20% of the untransferred amount; in case of intentional and prolonged non-payment, the amount increases to 40%;

- if there is no response from the taxpayer within 6 months and the debt exceeds the threshold of 3 thousand rubles. The Federal Tax Service files a claim with the court in order to forcibly collect the debt.

Failure to comply with a court decision may lead to the seizure of money savings and property, and the sending of a notice to the place of work.