Maintaining tax records for a garage cooperative

Like all organizations, a garage cooperative must submit reports to the tax authorities. This obligation is enshrined in Article 23 of the Tax Code of the Russian Federation. In accordance with established rules, GSK employees are required to provide annual financial statements. The action must be completed no later than 3 months from the end of the calendar year. There is no need to submit quarterly financial statements.

Any GSK has employees. Consequently, specialists of the institution are required to provide information on the average number of personnel for the completed calendar year. The exact composition of the reporting depends on the form of taxation of the State Insurance Company. If the cooperative is on the simplified tax system, has a land plot and a vehicle, then it will have to file the appropriate tax returns.

When reporting to a consumer garage cooperative, you must:

generate and systematize primary documentation;- keep cash records of transactions;

- make payments from bank accounts;

- handle payroll;

- conduct settlements with members of the cooperative and create reports on debtors;

- fill out and submit reporting documentation to regulatory authorities.

Additionally, the accountant is responsible for maintaining site cards and preparing summary information for audit commissions.

How to submit documents to the Federal Tax Service?

The registration process of garage cooperatives is carried out in accordance with the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” and is very similar to the registration of other legal entities.

Registration of a garage cooperative occurs on the basis of an application to the Federal Tax Service. The applicant's signature requires notarization.

The application itself must be submitted along with:

- GSK Charter;

- The minutes of the meeting with the signatures of the founders, which confirmed the decision to form a cooperative;

- A receipt confirming payment of the state duty in the amount of 4 thousand rubles.

To operate a garage cooperative, a large amount of documentation is required. All activities of the garage cooperative must be carried out in accordance with the provisions of the charter. The document regulates the nuances of the functioning of the institution, including the procedure for calculating and paying contributions.

Its approval is carried out at a general meeting of members of the cooperative. All funds of shareholders must be spent only in accordance with the provisions of the document. If spending exceeds the amount of money received as contributions, an additional fee occurs. The action is carried out within 3 months from the date of approval of the annual balance sheet.

If the established conditions are not met, GSK may be liquidated. The reason for starting the procedure may be a creditor's demand. Additional documents that the garage cooperative must have are presented in the table.

| Document types | Scroll |

| Accounting and tax documentation | Annual balance Tax returns Audit reports Tax audit reports Reporting to the Social Insurance Fund |

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

Reporting to the tax authorities can be submitted:

- in person on paper;

- sent by mail with the obligatory execution of an inventory of the attachment;

- in electronic format via the Internet.

Who is responsible for this?

The norms of the Tax Code of the Russian Federation (Article 23, paragraph 1) and the Law “On Accounting” No. 402-FZ, dated December 6, 2011 (Article 6, paragraph 1), oblige all legal entities to keep accounting records and pay taxes and fees on time , submit reports. In Art. 7 of Law No. 402-FZ, responsibility for organizing the accounting system rests with the head of the enterprise. In a garage-building cooperative, his role is played by the chairman.

The chairman is an elected position that forms the basis of the board of the cooperative. The list of his functional responsibilities includes one of two:

- independent accounting;

- selection and hiring of a qualified accountant.

The accuracy of the accounting is assessed by a control commission consisting of independent experts.

Creation of a cooperative

Garage construction cooperatives are called upon to make the dream of every car owner come true - to own a garage, which is a place where you can safely leave your car, store things and carry out maintenance (Civil Code of the Russian Federation, Articles 123.2, 123.3). To register a GSK, it is necessary to create an initiative group, the members of which may be connected by the same place of work, residence or interests.

General meeting of GSK members

The first step is to register the organization with the Federal Tax Service. For this purpose, a general meeting of members is held, which makes a decision on the creation of a cooperative, a board, a chairman, and a controlling body are elected, the Charter of the organization is developed, and a current account is opened.

Registration of an association is carried out at its location address.

Registration certificate

After registering the GSK, a lease agreement for the land plot is concluded and registered, a construction organization is selected that will develop the project, erect boxes and provide communications. When the facility is commissioned, contracts are concluded with operating organizations, and documents are submitted to register shareholders as owners of garage boxes.

Cadastral plan of the land plot

The video in this article will introduce the issue in more detail.

What must be indicated in the chapters of the GSK charter

A garage construction cooperative must have its own charter. This should include basic information about its activities, the purposes of its existence, the property and responsibilities of members, etc. You can find many examples of standard charters on the Internet and write the charter of your GSK in their likeness.

First chapter

It should be devoted to general provisions relating to the cooperative. It is there that you must indicate the exact address and its full name.

Also, this chapter must contain an indication that this organization is a legal entity, and therefore has the right to carry out transactions on its own behalf, to acquire rights and bear responsibilities. In addition, the first chapter should list all the founders of the cooperative.

Chapter two

Serves to determine the goals, activities and rights of the GSK. For example, a cooperative can legally enter into contracts for construction work, installation of communications, garage maintenance, etc.

Chapter Three

Here it is necessary to list the property that belongs to the cooperative. The property of the cooperative will be considered shares in the form of cash or property of its participants. Also in this chapter, mention should be made of all the sources that can be used in the process of forming the property of the cooperative.

Then it is necessary to determine the funds that are formed on the basis of property - share, indivisible, reserve, etc. In addition, it is necessary to indicate the total amount and frequency of payment of membership fees, as well as the amount of penalties in case of late payments.

Chapter Four

Dedicated to listing the bodies through which the cooperative is managed.

In most cases, this process is carried out:

- Meeting of members of the cooperative;

- Board of the cooperative;

- Audit Commission.

- Also during the meeting, the election of the GSK board and its auditors, the determination of the volume of contributions and funds, as well as other important issues, including. and related to the reorganization or liquidation of the cooperative.

- The executive body of the garage cooperative is its board, which is headed by the chairman. The main area of activity of the board is to maintain lists of GSK participants, formulate estimates and plans for expenses, organize the collection of contributions, manage the current and planning of the economic activities of the cooperative.

- The role of the control body of the cooperative is played by the audit commission, therefore members of the cooperative cannot be included in its composition. For the activities of the audit commission, one auditor is sufficient, and the duration of his powers is determined by the provisions of the charter.

We invite you to read: Transfer of vacation pay at the request of an employee

Chapter Five

Dedicated to a description of the conditions under which new members are accepted into the cooperative, as well as a listing of their rights and obligations.

Members of the cooperative must:

- Comply with the charter of the cooperative, as well as decisions made by the Assembly, the Board and the Auditor;

- Make contributions on time and pay all necessary taxes and fees;

- Take part in events held by GSK;

- Comply with the rules for maintaining the garage, as well as sanitary, technical and fire safety standards;

- Participate in the costs associated with the maintenance of the common property of the GSK, etc.

Members of the cooperative have the right:

- Take part in the management process of the cooperative;

- Receive the necessary information about the work of the cooperative;

- Use the material and technical resources of the cooperative;

- Receive your share of GSK profits;

- Receive your share of property during the liquidation of the cooperative;

- Alienate the garage;

- Receive cooperative payments.

In addition, this chapter specifies the reasons on the basis of which a member of a cooperative may be excluded from its membership.

This may happen as a result of:

- Refusal to pay the fee;

- Harm to the GSK;

- Violations of the requirements of the charter and rules for maintaining a garage.

Also in the fifth chapter you can find a description of the procedure for leaving the cooperative at your own request.

Chapter Six

- The final chapter describes the procedure in accordance with which reporting and accounting, statistical or operational records are maintained in the cooperative, information on which can be requested at any time by any participant in the cooperative.

- In addition, every year the financial activities of GSK must be audited through the involvement of an independent audit organization.

Membership fees in a garage cooperative

Hello dear lawyers.

Should an owner who is not a member of the GSK pay membership fees and why? Thank you September 19, 2013, 15:44, question No. 212712 Maria,

Vladimir

- , ,

200 cost of the questionquestion resolved Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (4) 1073 answers 460 reviews Chat Free assessment of your situation Mysnik Nina Lawyer, Moscow Free assessment of your situation

- 1073responses

- 460 reviews

Hello Maria!

In accordance with Art. 116 of the Civil Code of the Russian Federation: The charter of a consumer cooperative must contain, in addition to the information specified in paragraph 2 of Article 52 of this Code, conditions on the amount of share contributions of members of the cooperative; on the composition and procedure for making share contributions by members of the cooperative and on their responsibility for violating the obligation to make share contributions; on the composition and competence of the management bodies of the cooperative and the procedure for their decision-making, including on issues on which decisions are made unanimously or by a qualified majority of votes; on the procedure for covering losses incurred by members of the cooperative.

Thus, a member of the GSK is obliged to pay share contributions.

The size and order must be read in the charter. Non-members of the GSK do not pay membership fees.

September 19, 2013, 03:52 pm 0 0 297 replies 107 reviews Chat Free assessment of your situation Lawyer,

St. Petersburg Free assessment of your situation Dear Maria. Apparently in this case you want to know about the advantages and disadvantages of having or not having “membership” in the GSK. Disadvantages of "membership" - fees.

Each member of the GSK is obliged to pay contributions that are provided for by the GSK Charter, regulations on contributions and other documents adopted by the GSK. Civil legislation establishes that the legal status of a consumer cooperative, the rights and obligations of its members are determined by special laws (clause

6 tbsp. 116 of the Civil Code of the Russian Federation). However, for garage and construction cooperatives, unlike housing or gardening cooperatives, a separate law has not been adopted.

Decision No. 2-2876/2015 2-2876/2015~M-703/2015 M-703/2015 dated June 5, 2015 in case No. 2-2876/2015

— Civil Essence of the dispute: Property disputes between members of cooperatives, participants in non-profit partnerships, societies The original of this document is filed in civil case No. 2-2876/2015, stored in the Naberezhnye Chelny City Court of the Republic of Tatarstan. Case No. 2-2876/2015 DECISION in the name of the Russian Federation June 5, 2015.

We recommend reading: How to check the authenticity of a RVP

Naberezhnye Chelny RT Naberezhnye Chelny City Court of the Republic of Tatarstan, composed of presiding judge R.G. Zakirova, under secretary A.F. Shaikhutdinova, with the participation of the representative of the plaintiff - E.V. Ivanova, defendant L.A. Mordovtseva, representative of the defendant - I.V. Mordovtsev, having considered in open court a civil case on the claim of the garage-building cooperative "Domostroitel" against L.A. Mordovtseva.

about the collection of debt on membership fees, ESTABLISHED: GSK "Domostroitel" filed a lawsuit against L.A. Mordovtseva, indicating that the latter is a member of the Domostroitel garage-building cooperative; she owns garage No. in boxing. and garage no. on the street .

in the garage-building cooperative "Domostroitel". According to the Charter of the GSK Domostroitel, each member of the GSK is obliged to pay annual membership fees for the maintenance and operation of garages by November 15 of each year. Despite repeated notifications and demands from GSK Domostroitel, L.A.

Mordovtseva does not fulfill its obligations to pay annual membership fees properly, starting from. year. According to the Minutes of the general meeting of authorized representatives of GSK Domostroitel dated.

years, for . year, the size of membership fees was approved, which amounted to: for a garage measuring 4x6m - 6,300 rubles, 6x6m - 9,450 rubles, 6x12m - 18,900 rubles.

Also at the meeting of commissioners from. year, it was established that members of GSK Domostroitel who have debts for previous years pay membership fees in the amount established by the general meeting of authorized representatives.

year. Based on the above, the plaintiff asks to recover from the defendant the debt on membership fees for garages for the period from .

What are the problems of taxation?

Taxation is an acute and still unresolved problem in Russia. Without organizing taxation within the framework of the Legislation of the Russian Federation, it is impossible to improve the economic situation in the country. The economy is the main conductor of state interests and a natural result of effective tax policy.

When creating garage-building cooperatives and registering them under the Law, the founders encounter problems. They don't know what taxes to pay, how to make payments, what is considered profit and what is not.

It is advisable to consult with a lawyer immediately after registering the GSK in order to subsequently avoid problems with the Law.

The taxes that a garage cooperative is required to pay directly depend on whether the company is engaged in commercial activities or not. If the cooperative's income comes only from the fees paid by its members, the company will protect itself from paying income taxes. Since the tax authorities do not consider such earnings as income. However, payments will have to be made if the company:

- conducts business activities;

- receives profit from renting out property;

- receives income from investing free money in deposit accounts.

If an organization plans to use one of the above methods as an additional source of income, experts advise separating the income and expenses that the cooperative and commercial activities bring. Income received through trade and rental of cooperative property cannot be reduced by expenses that the organization incurred due to non-profit activities.

Taxes that a cooperative engaged in non-profit activities may not pay are presented in the table.

| Name | Condition | Tax |

| GSK is engaged in non-profit activities | You don't have to pay | At a profit VAT Housing maintenance |

| You don't have to pay if there is no transport | For road users |

If a cooperative is engaged in trade or earns money through other non-commercial activities, then the income received must be distributed among all members of the organization. There is such a thing in the law as “cooperative payments”. Income received by a member of a cooperative as a result of the organization's entrepreneurial activities is subject to additional tax. From the profits of individuals, the cooperative transfers 13% to the state.

The garage cooperative must pay property taxes. However, funds are charged only for those objects that are on the balance sheet of the institution. The tax on parking spaces that are listed on the balance sheet of the State Insurance Company must be paid by their owners.

A garage construction cooperative has a peculiarity of functioning - the presence of share payments, which are the basis for the formation of the organization’s property. Contributions act as a form of targeted financing; all GCS participants are required to pay them.

Accounting for share payments is carried out according to several types of contributions:

Share, the amount of which is determined at the general meeting. It can be not only in cash, but also in kind.- Introductory, contributed by new members of the cooperative. The justification for its necessity is to cover the costs of registration of membership.

- Membership - is spent on the salaries of employees of the State Construction Service and payment of utility bills, carrying out repairs.

- Targeted – implemented for the purpose of making a specific purchase or to provide material support for repair work.

- Additional – appears in the settlement system upon the occurrence of force majeure or unprofitable activities.

ATTENTION! Collection of payments and their subsequent recording in accounting is included in the list of responsibilities of the chairman, who can partially delegate this function to a hired accountant.

Among other features of the SCS accounting department are:

- the need to create an estimate of income and expenses, strictly monitor its implementation, and calculate the amount of share payments based on it;

- the possibility of carrying out two types of activities by the cooperative - non-profit and commercial.

The last factor entails the separation of accounting to eliminate additional tax burden. If this is not done, then targeted payments by members of the association (share, introductory and regular membership) will be taxed (the requirement is set out in clause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

Garage cooperatives can operate according to one of the taxation systems (clause 4, article 6 of Law No. 402-FZ):

- general;

- simplified (USN);

- UTII.

The general system is the most complex and time-consuming, requiring the payment of a large list of taxes. The transition to the simplified tax system is possible using income as an object of taxation (the rate is 6%) or income minus expenses (the rate reaches 15%). If you want to work for UTII you must:

- the presence of services provided by the association in the list of types of activities;

- compliance with the limit on the number of hired employees (Article 346.26 of the Tax Code).

REFERENCE! The most common among the GKS is the simplified tax system, which allows you to be exempt from paying taxes on profits, property and value added.

Consumer garage cooperative. Postings

Good day, dear colleagues! Currently I am understanding the issue of accounting in a consumer cooperative. I have read all the topics on the forum that relate to this issue. At the same time, I studied materials on other sites. I believe that the material from the ATP “Garant”, which I will post below, will help accountants (and not only) who have asked themselves the question: “And yet, in which account should the costs of paying for bank services be taken into account - 91 or 26?” “Question: A non-profit organization uses the simplified tax system. The organization has no other income other than charitable donations and bank interest on the balance in the current account. According to the accounting policy, account 91 “Other income and expenses” reflects only interest received from the bank. Based on the results of the audit, a discrepancy was noted in the methodology for accounting for expenses for bank services (settlement and cash services). Can a non-profit organization account for bank services on account 26? July 19, 2011 Answer: Having considered the question, we came to the following conclusion: In our opinion, a non-profit organization can take into account the costs of paying for bank services for cash management services as part of expenses for ordinary activities and reflect them on account 26 “General business expenses”. Rationale for the conclusion: Clause 4 of PBU “Expenses of the organization” (hereinafter referred to as PBU 10/99) stipulates that the expenses of the organization, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into: - expenses for ordinary activities; - other expenses. Expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses also include expenses the implementation of which is associated with the performance of work or provision of services. Based on expenses for ordinary activities, the cost of goods, products, works, services sold is determined (clauses 5 and 9 of PBU 10/99). All other expenses are miscellaneous. And formally, expenses associated with payment for services provided by credit institutions are other expenses (clause 11 of PBU 10/99). In accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of an organization, approved by order of the Ministry of Finance of Russia dated December 02, 2000 N 94n (hereinafter referred to as the Instructions for the application of the Chart of Accounts), other income and expenses are reflected in account 91 “Other income and expenses " To record expenses for ordinary activities, the corresponding cost accounts are intended (20, 25, 26, 44). At the same time, this option for accounting for expenses for bank services is general; in the case under consideration, it is necessary to take into account the specifics of the activities of non-profit organizations. According to paragraph 1 of Art. 2 of Federal Law No. 7-FZ of January 12, 1996 “On Non-Profit Organizations” (hereinafter referred to as Law No. 7-FZ), a non-profit organization is an organization that does not have profit as the main goal of its activities and does not distribute the profits received among participants. Clause 1 of Art. 24 of Law No. 7-FZ establishes that a non-profit organization can carry out one or more types of activities that are not prohibited by the legislation of the Russian Federation and correspond to the goals of the non-profit organization, which are provided for by its constituent documents. According to paragraph 2 of Art. 24 of Law No. 7-FZ, a non-profit organization can carry out entrepreneurial activities only insofar as it serves to achieve the goals for which it was created. Such activities include the profit-generating production of goods and services that meet the goals of creating a non-profit organization, as well as the acquisition and sale of securities, property and non-property rights, participation in business companies and participation in limited partnerships as an investor. At the same time, the non-profit organization keeps records of income and expenses for business activities (clause 3 of Article 24 of Law No. 7-FZ). And since, by virtue of paragraph 1 of Art. 26 of Law No. 7-FZ, the sources of formation of property of a non-profit organization are, in particular, regular and one-time receipts from the founders, voluntary property contributions and donations, etc., then the organization’s expenses associated with the implementation of the main statutory activities are covered in full by account of targeted funds received by the organization for the implementation of such activities. Taking this into account, we believe that the norms of PBU 10/99 “Expenses of the organization” in relation to statutory activities do not apply. A certain specificity is that the accounting system of a non-profit organization must contain information not only about the state of assets and liabilities, the presence and volume of the organization’s property, but also, unlike a commercial organization, about how the received target funds were used. The basis for reflecting this type of information is the estimate. By virtue of paragraph 1 of Art. 3 of Law No. 7-FZ, each non-profit organization must have an independent balance sheet and (or) budget. Taking this into account, the direction of use of received funds and their accounting often depends on the budget items (separately for each area, program or project). “The organization’s expenses associated with the implementation of management and coordinating functions, and other expenses associated with the implementation of the main statutory activities of the organization (expenses for remuneration of its administrative and management personnel, maintenance of buildings, cars, telephone services, etc.), in the full amount is covered by targeted contributions received by the organization for the implementation of its main statutory activities" (letter of the Ministry of Finance of Russia dated August 21, 2001 N 04-02-05/3/56). According to the explanations of the 3rd rank adviser to the Tax Service of the Russian Federation O. Emysheva, presented in response to the taxpayer’s question (“Financial Gazette”, No. 34, August 2003), covering the costs of maintaining the organization and conducting statutory activities (including remuneration of the staff management, rent for premises, payment for bank services, etc.) is carried out by non-profit organizations at the expense of targeted revenues. We also believe that a non-profit organization carrying out statutory activities can include the costs of paying for bank services for settlement and cash services as expenses for the maintenance of a non-profit organization. In accordance with the Instructions for the use of the Chart of Accounts in accounting, expenses for the maintenance of a non-profit organization can be reflected, in particular, in the debit of account 26 “General business expenses” with their subsequent write-off from targeted financing funds, i.e. when directing funds of targeted financing for the maintenance of a non-profit organization, the use of targeted financing is reflected in the debit of account 86 “Targeted financing” in correspondence, in particular, with account 26 “General business expenses”. Thus, we believe that a non-profit organization carrying out statutory activities has the right to take into account in account 26 the costs of bank services for cash management services. If a non-profit organization carries out not only statutory, but also entrepreneurial activities, and taking into account the fact that the method of maintaining separate accounting of income and expenses of a non-profit organization for entrepreneurial and statutory activities is not established by law, the non-profit organization must consolidate the method chosen by it in its accounting policy for accounting purposes (clause 3 of article 5 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”, clauses 2 and 7 of PBU 1/2008 “Accounting Policy of the Organization”).

The answer was prepared by: Expert of the Legal Consulting Service GARANT Olga Volkova Quality control of the response: Reviewer of the Legal Consulting Service GARANT Myagkova Svetlana

Vehicle storage is a problem that worries many car owners. The issue is most acute in big cities. Experts believe that the most effective way out of this situation is to create a garage cooperative. In this article we will talk about accounting in a garage cooperative and give examples of postings.

The organization is designed to resolve issues of concern to all motorists who have left their vehicle under its care. To ensure that no questions arise during the management of money and property, the garage cooperative, like any other company, must keep records. However, the operation has a number of differences from the usual procedure.

Insurance premiums and deductions

To record transactions with membership fees, the accountant uses account 86 “Targeted financing” (in accordance with the Chart of Accounts approved by Order of the Ministry of Finance dated October 31, 2000 N 94n). For the convenience of systematizing contributions, you can open additional sub-accounts:

current needs;- organizational expenses;

- capital investments.

We invite you to familiarize yourself with: Contract for the manufacture of a cabin sample

The following entries will prevail in accounting:

- D 76 - K 86 - is formed at the time of accrual of the share contribution, which was received by the GKS fund.

- D 50 (51) – K 76 when reflecting the payment of a contribution by a member of the association.

- D 86 – K 26 when using funds to pay for utilities and other current expenses.

- D 86 - K 91.1 - used to record non-operating income.

If the debit balance of account 26 exceeds the credit balance of account 86, then the resulting loss is transferred to account 91.2.

As mentioned above, the common property of a cooperative is formed by receiving contributions from members of this cooperative. However, in cooperatives there are not only share contributions, but also other types of contributions that may be specified in the charter.

Let's take a closer look at them:

- A share contribution refers to cash, securities, property rights or property contributed by a member of the cooperative. The total amount of the contribution is determined during the General Meeting.

- Newly arrived members of the cooperative must make an entrance fee, which will be used for its registration, as well as payment of expenses associated with the preparation of a package of documents.

- Shareholders set a certain amount of membership dues, which are used to pay salaries to the members of the cooperative, as well as to cover its operating expenses.

- Targeted contributions mean funds contributed by members of the cooperative, which are subsequently used to repair existing garage property or purchase new garage property.

- The need for additional contributions is determined by the fact that the cooperative needs to cover its losses. Therefore, the chairman of the GSK is responsible for collecting and accounting for each contribution.

- In order to determine the size of the share contribution, it is necessary to divide the costs associated with the formation of a garage cooperative and divide them by the total number of garages. It is also recommended that the charter indicate that it is possible to increase the total estimate of work before completion.

- Each member of the garage cooperative receives ownership of the garage immediately after making a share contribution. It is worth noting that state registration of the right to a garage is not required in this case. It will be necessary only if the owner wants to carry out some operation with his garage.

- If GSK begins to conduct business activities, separate accounting is required. Otherwise, legislatively targeted contributions from GSK participants will be considered as those that are subject to taxation.

- Chapter 25, Article 251 of the Tax Code of the Russian Federation “Organizational Income Tax” states that targeted contributions should not be taken into account when calculating the tax base. Targeted revenues will be those that are collected from individuals and legal entities and spent on specific needs. According to clause 2 of clause 1 of Article 251 of the Tax Code of the Russian Federation, among such fees one can distinguish entrance, membership and share.

- The profit of the GSK is considered to be the funds contributed by its participants to pay for utilities, repairs, etc. Therefore, such income must be taken into account when determining income tax.

- Clause 5 of Article 116 of the Civil Code of the Russian Federation states that income received as a result of commercial activities must be distributed in equal shares among its shareholders. In addition, it must be subject to personal income tax of 13%. Before leaving the cooperative, each member has the right to receive such a payment for the year.

- GSK also has the right to switch to a simplified taxation option.

The garage cooperative's responsibilities include paying insurance premiums. However, deductions can be made at reduced rates if:

- The garage and construction cooperative is located on the simplified tax system;

- The institution chose OKVED code 63.21.24;

- The cooperative complies with the conditions regarding the amount of income for this type of activity.

In order to reduce the amount of insurance premiums, activities in accordance with OKVED 63.21.24 should be the main one for the cooperative. The rule is considered fulfilled if the institution receives 70% of its income from this type of activity. The profit that GSK receives from contributions is taken into account when calculating the share of income from the main activity.

How are contributions determined?

To record transactions with membership fees, the accountant uses account 86 “Targeted financing” (in accordance with the Chart of Accounts approved by Order of the Ministry of Finance dated October 31, 2000 N 94n). For the convenience of systematizing contributions, you can open additional sub-accounts:

- current needs;

- organizational expenses;

- capital investments.

The following entries will prevail in accounting:

- D 76 - K 86 - is formed at the time of accrual of the share contribution, which was received by the GKS fund.

- D 50 (51) – K 76 when reflecting the payment of a contribution by a member of the association.

- D 86 – K 26 when using funds to pay for utilities and other current expenses.

- D 86 - K 91.1 - used to record non-operating income.

If the debit balance of account 26 exceeds the credit balance of account 86, then the resulting loss is transferred to account 91.2.

Privatization of land in GSK

Garage cooperatives receive land for indefinite use, so a member of the GSK does not have the right to the land under the garage, since it is in state ownership.

- Carrying out such actions independently is only possible if the garage is a separate building and also has a separate entrance and foundation.

- In situations where the garage is part of a garage box, the purchase of land for garages should be carried out jointly with other shareholders, since it is not divisible.

- After the redemption, each shareholder will receive a certain share in the common property. To determine the divisibility or indivisibility of land, you should consult the authorities of architecture and land relations.

- The value of land is determined based on the location of the GSK, but in most cases this number does not exceed the cadastral value.

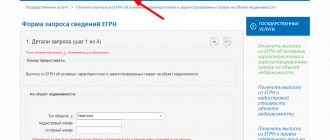

After making a decision, it is necessary to send a corresponding application to the local administration, which must be accompanied by:

- Copies of passports of all participants;

- An extract from the Unified State Register regarding ownership of real estate;

- A lease agreement or an extract from the Unified State Register, which confirms the right to use the land plot;

- Cadastral passport of the plot.

The application is considered for a month, then a decision is made on whether it is possible to purchase or lease the land plot. Then the administration prepares an appropriate project, an agreement is concluded, and it is registered with the justice authorities.

When organizing a garage cooperative, the building codes in the garage cooperative must be taken into account; they must comply with the development plan. The instructions will help you do everything correctly. Only the norms are constantly changing and additions are being made to them. Therefore, before starting work, you should look at photos and videos and collect the latest information.

Contributions to a garage cooperative

- Is there a statute of limitations on membership fees in a garage cooperative?

- How to pay garage co-op dues in 2021.

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel phone If you find it difficult to formulate a question, call a free multi-channel phone, a lawyer will help you 1. How to pay membership fees to a garage cooperative in 2021. Lawyer Samokhin D.S., 2171 answers, 1631 reviews, on the site since November 21, 2017 1.1.

Hello! As a rule, each GSK has a provision that sets out the procedure for paying membership fees. As a rule, the amount of contributions is approved annually by the general meeting. Some cooperatives practice the following: the earlier the payment is made, the smaller its amount.

You should contact a specific GSK with questions of interest, since I have given you a general algorithm. 2. Is there a statute of limitations for membership fees in a garage cooperative?

Lawyer Nemirov O.V., 38194 answers, 15801 reviews, on the site from 08/19/2015 2.1.

Good evening, dear Alexander. If you play with fire, they may exclude you from the cooperative; it will be more expensive. Good luck to you and your loved ones. 3. The situation is this: the father (a member of the Civil Code) gave his son a garage in the cooperative, the son immediately registered the ownership of the garage and the land under the garage.

Does the obligation to pay an entrance fee to a garage cooperative arise when a son becomes a member of the group?

Lawyer Karavaitseva E.A., 56,670 answers, 26,908 reviews, on the site since 03/01/2012 3.1.

This issue is regulated by the GSK Charter. Lawyer Mikhailov A.A., 1577 answers, 678 reviews, on the site from 06/13/2021 3.2. This is property. The owner is no longer a member of the cooperative.

Only taxes to the Federal Tax Service on real estate.

4. Our garage cooperative is being moved to another location. We bought a new place in another group of companies and are moving the garage at our own expense. No dues were paid for 6 months. Can they charge me?

What are the problems of taxation?

According to the law, even though GSK is a non-profit organization, no one prevents the management of the cooperative from engaging in entrepreneurial activities.

Regarding taxation matters, the same rules apply to them as to legal entities, i.e. they pay taxes on commercial and statutory activities.

The list of reports submitted to the Federal Tax Service depends on the taxation system used. Under the common system, the following declarations must be submitted:

- arrived;

- according to VAT;

- on income tax (2-NDFL and 6-NDFL);

- reporting on insurance premiums;

- information about the average number of employees.

We suggest you familiarize yourself with: All remote loans online, take a loan remotely on a card

If there are grounds, you may additionally need to submit a declaration for property tax, land and transport taxes.

When working under a simplified system, the basis for tax reporting will be a declaration according to the simplified tax system. This form replaces profit and VAT declarations. Forms regarding the results of the work of hired employees will have to be submitted (for personal income tax, insurance contributions and average headcount). If the SCS owns land, real estate or cars, then they will also have to report on them. Reports are prepared on paper (if the number of employees allows) or electronically.

Completing the annual report

When compiling the Balance Sheet, the SCS replaces the “Capital and Reserves” section with information about targeted financing. The degree of detail of these items is determined by the enterprise independently; the need for more detailed disclosure of individual indicators is assessed based on the criterion of data materiality. Example of filling out annual financial statements:

- the amount of resources spent on wages, charitable activities and the implementation of targeted activities;

- expenses associated with maintaining the functioning of the cooperative;

- balance of money at the beginning of the reporting period;

- amount of income;

- balance of funds at the end of the year.

Which ones exactly?

Are entrance and membership fees from members of the cooperative subject to value added tax? No, this money has a targeted nature, and therefore VAT is not provided for, which is reflected in subparagraph 1, paragraph 2 of Art. 146 and subparagraph 4, paragraph 3 of Art. 39 of the Tax Code of Russia.

By making a share, a person automatically becomes the owner of the garage, and also owns a share in the GSK.

To minimize its costs, the contractor (founder) includes “input” VAT in the share size.

The same tax is not paid if the cooperative is authorized to collect funds to pay for electricity or water.

These funds in most cases pass through it in “transit”, i.e. after receipt, they are transferred to the account of specialized organizations.

Sometimes GSK provides services: current/overhaul, maintenance, etc. Previously, the cooperative was exempt from paying VAT, but

Federal Law No. 118 of August 5, 2000

. abolished this relief.

What about income tax? In the case of shareholders making share contributions, entrance and membership fees, it is not charged, since they are targeted income and are spent exclusively on the maintenance of the cooperative. This norm is reflected in paragraphs. 1 clause 2 art. 251 Tax Code of the Russian Federation.

In most cases, the owners of GSK are unfamiliar with the intricacies of taxation; they do not separate the funds paid into targeted funds and those that were required for routine repairs, as a result of which the tax is calculated incorrectly.

It should be emphasized that the owner does not pay land and property taxes if the garage in the GSK is registered as a legal entity. In this case, the entire territory on which the garages, utility rooms and access roads are located is the property of the cooperative.

Once a year, the accountant receives receipts for the payment of property and land taxes from the Tax Committee, and divides the amount in them among all co-owners.

Sometimes the garage is located in a co-op, which is tax exempt. In this case, they do not have the right to collect tax from individuals and beneficiaries for using it. If the plot of land under the garage is owned by the owner, then he pays land tax once a year.

Some themselves calculate the amount of mandatory contributions to the budget, knowing the cadastral value of the land and the tax rate in their region (on average 1.5%).

If GSK does not conduct business activities, they do not pay income tax. But this does not exempt the cooperative from paying property taxes. Pay for what? What is recognized as property in this case? Roads are laid to the garages - access roads.

GSK may have its own premises for meeting with owners or collecting funds. All this is taxable. Owners pay taxes for the places where cars are parked.

In most cases, GSK does not pursue the goal of making a profit. Shareholders only operate their garages and that’s all.

Important! If desired, the cooperative can conduct business activities by renting out vacant garages, repairing cars of owners, etc.

In this case, an accountant is hired who takes into account expenses and divides them into non-commercial and commercial activities.

Sometimes they don’t share expenses, and end up paying income tax in accordance with the requirement of clause 14, clause 1 of Art. 251 Tax Code of the Russian Federation. Hired personnel are paid salaries and make contributions for compulsory pension insurance and unified social tax.

When providing services to garage owners, the cooperative receives income, which is distributed among all members of the GSK. There is even such a term as “cooperative payment”.

In this case, you must pay personal income tax at a rate of 13% on the entire amount of income. When calculating income, fines paid by members of the cooperative for late payment of contributions and interest for storing money for unexpected needs in the bank are taken into account.

For example, for July 2021, the accountant received 500 rubles as interest on a bank deposit and 6 thousand rubles as a fine. As a result, an amount of 6.5 thousand rubles appeared on the balance sheet, of which 13% is calculated as personal income tax, and the remaining money is divided among the garage owners.

When conducting business activities, the list of taxes increases, and the following are paid:

- property;

- land;

- personal income tax;

- income tax.

And also when hiring employees the following mandatory contributions:

- social insurance;

- pension contributions;

- health insurance;

- contribution to the employment fund.