To make interaction with clients more convenient, Sberbank has provided Internet banking. The service allows you to remotely make transactions and control accounts. You can also pay for a mortgage through Sberbank Online - just log into your personal account (personal account) using your username and password, transfer the amount of the next installment to the loan account. On the due date, the funds will be used to pay off the debt.

What are the advantages of Internet banking

Clients receive the opportunity to remotely pay for loans from Sberbank after registering on the financial institution’s website. To access the system, you can also use the SberBank Online mobile application.

When developing the LC, Sberbank pursued the following goals:

- facilitating contact with clients;

- attracting public attention to the products offered;

- expansion of the list of additional services, which included online payments and transfers;

- providing clients with the opportunity to conduct banking transactions remotely.

After authorization in Sberbank Online, the user can easily control his finances. To see the status of accounts, cards, deposits and find out which credit products are valid, you need to open the corresponding section on the left side of the screen.

In addition to paying for a mortgage loan, a number of other operations are available to clients in the Sberbank account:

- opening an account, replenishing it or closing it ahead of schedule;

- purchase or sale of currency;

- request for statements of accounts, cards;

- blocking the plastic product if necessary;

- money transfer;

- payment of fines, utilities and more;

- applying for a loan.

- clarification of how much remains to be paid on issued loans;

- View your mortgage payment schedule.

Why do you need Sberbank Online

By logging into Sberbank Online, the user receives information about all his cards, accounts, loans, deposits, etc. Your personal account provides access to a number of operations where you can pay for a mortgage loan from Sberbank, as well as perform the following operations:

- open a deposit, replenish it or terminate a previously concluded agreement early;

- buy or sell currency;

- get a card statement, find out the details or block it;

- make money transfers;

- pay fines, housing and communal services, mobile communications and the Internet;

- order a loan from Sberbank by submitting an online application;

- find out about loan balances.

You can also view the mortgage, mandatory payment and mortgage payment schedule in your personal account.

Using a ready-made electronic form for payment

To pay off your mortgage loan as quickly as possible, it is recommended to create a template. This will allow you not to enter details each time, make transfers or debit accounts. The template will also be available in the application from your cell phone.

In order to pay a mortgage through your Sberbank mobile bank using a template, you must follow the step-by-step instructions:

- after making the next payment, you must click on the “Save as template” option;

- title the template, for example, with the word “Mortgage”;

- Confirm the action using a one-time password sent by the system.

When you next log into your mobile bank or online system, you need to pay your mortgage through the menu on the right. Select the item “My auto payments” or “Templates” if it is a phone. Now all that remains is to find your template using the name previously given to it and make the loan payment.

In the same way, you can set up the debiting of funds from your salary card or deposit and pay off the loan even faster. The amount and date of debit are set. The borrower will not have to pay the loan himself every month, because the automated payment setup system will do it for him.

Control over transactions performed is carried out through a mobile bank and an SMS notification system. Whenever funds are debited or a mortgage payment is made, the client will be notified by sending a corresponding notification to his phone number.

READ Payment by credit card in stores and online, step-by-step instructions

Benefits of using Internet banking

Sberbank is not the only financial organization that allows you to pay your mortgage or make payments and transfers online. Most large financial organizations in the Russian Federation have a similar opportunity. An example is VTB or Alfabank. The client has the right to independently choose which financial organization to start cooperation with.

Features of using a personal account in different financial organizations may vary. But the essence is the same - manual management of personal accounts remotely via the Internet.

To access the system, you can use mobile devices on Android, iOS or Windows Phone. When creating a personal account, Sberbank pursued the following objectives:

- simplifying interaction with clients;

- increasing financial literacy of the population;

- attracting additional attention to the organization’s proposals;

- expansion of the list of available services, the list of which included payment of payments online;

- providing clients with the opportunity to independently perform banking operations, payments and transfers.

Someone else's mortgage

You cannot pay someone else’s loan through the Sberbank Online service form. But there is a way out of this situation - the service allows you to transfer funds to the account of a third party, after which this person will be able to pay independently.

To perform this operation, you will need to do the following:

- go to the “payments and transfers” tab;

- select the item “transfer to Sberbank client”;

- Next, you should fill in the details of the payment card or account of the person to whom the funds will be transferred (last name, first name, patronymic, individual taxpayer number, BIC, and address).

Once the borrower receives the funds into his account, he will be able to make the repayment himself. A small commission is charged for transferring funds; interest is not charged when paying off the loan.

How to start using online banking from Sberbank

If a client wants to start using Sberbank online, he will need to create an account. Access to the system can be obtained by persons with a Sberbank debit or credit card. You can create an account yourself. The procedure can be performed:

- through an ATM;

- during a visit to the organization’s office;

- by calling the hotline;

- through the Internet.

If a citizen decides to create an account using an ATM, then you can acquire an access code yourself.

The procedure is performed according to the following scheme:

- A citizen starts working with an ATM. To do this, insert a card into the receiver and then enter a PIN code.

- In the main menu, you need to select the Sberbank Online section and click on the item that allows you to get a login and password.

- Wait for the device to provide a receipt. Information with the required data will be printed on it.

- When you need to acquire codes to confirm transactions in your personal account, you need to obtain one-time passwords by clicking on the item of the same name in the menu.

An alternative is to self-register online. The procedure is carried out on the official website of the company. You first need to connect your mobile bank.

Application connection

Action plan:

- Insert your credit card into the ATM;

- Select the items “Mobile Bank” - “Connect main card”;

- Select your mobile operator and enter your phone number;

- Save the data specified in the email (login and password can be changed).

The software is connected not only through an ATM, but also using the bank’s official website. To do this, you need to visit the corresponding web page and indicate the card number. After this you will receive an email with your login. Your personal account will be registered automatically. Bank websites are often faked by scammers. Confidential data should be entered exclusively on the bank’s official portal.

How to quickly pay a mortgage through Sberbank Online: step-by-step instructions

Making payments remotely allows you to avoid the need to personally visit the office of a financial institution, which significantly saves time. Instructions on how to pay a mortgage through Sberbank Online will allow you to understand the features of the procedure in advance and avoid difficulties. You must adhere to the following algorithm:

- Go to the official website and log in.

- Top up an account opened with a financial institution. To do this, you need to go to the deposits and accounts section, and then click on the appropriate item. You need to activate the “Top up account” function. Next, you need to click on the “Transfer between accounts” column.

- If you need to pay for a mortgage through Sberbank Online, you will need to indicate the card number and transfer options in the empty fields that appear.

- Click on the “Transfer” button and confirm the operation.

Using the above scheme, you can pay for your mortgage through Sberbank Online within 5 minutes. But you need to make sure that the money has arrived in your account. To do this, you need to select the “Loans” item in the menu, and then go to the “Purchase of housing” section and familiarize yourself with the service that is paid for. Here you will see information about your account status. The financial institution allows you to make payments ahead of schedule. But for this you have to write an application. The debt is paid by transferring money in favor of a credit institution.

Login to Sberbank Online

The transition to Sberbank Online is carried out on the official website in your personal account.

To get into your personal account, you will need to specify your username and password, and then click on the login button. An SMS with a code will be sent to the phone number linked to the card. It works within 5 minutes. The combination must be specified for authorization in the system. If you fail to meet the deadline, you must request the code again.

Login to Sberbank Online can be done from a computer or phone. The authorization procedure is identical. If you are using a mobile device, the system will prompt you to install the application. If the client does not want to perform the procedure, you can go to the browser menu and click on the “Full version” item. The method will allow you to access the authorization window through your personal account.

Sberbank protects clients. During each login, the owner of the payment instrument receives an SMS notification that the authorization procedure has occurred.

From which account are the funds debited?

To make a payment, you need to specify an account. When applying for a mortgage at Sberbank, a citizen signs an agreement to open a loan. The account will be used to calculate the total amount and then write off the debt. To complete the procedure, open one of the following deposits:

- universal;

- poste restante;

- savings account.

All of them are designed for calculations. Therefore, the interest rate on offers is minimal. To find out to which account the mortgage payment should be made in Sberbank Online, you need to read the loan agreement or request data via the Internet.

In the second case, you need to go to the Loans tab. In the list that appears, you need to select the offer you are interested in and click on it. Complete information about the product will appear on a new page.

Displayed here:

- type of service;

- amount provided;

- methods of closure;

- dates of loan and moment of repayment;

- information about the borrower;

- contract number;

- place of registration;

- loan account number.

The required attribute is the last parameter.

How to save a template for payment

In order not to enter data every time, you need to save the completed payment as a template. To do this, you need to click on the button of the same name, which appears after the transfer of funds. The system will prompt you to specify a name for the template. Then you have to confirm the operation by entering a one-time SMS password.

The template will appear in your personal menu. This is where you need to go in the future to pay your mortgage. You can also use the template through the mobile application. It will be located in the payments section in the sub-item of the same name.

Methods

There are a lot of options for paying for a bank loan; we list the features of the most common ones:

- Bank operating cash desk. One of the simple and accessible, and most importantly, reliable methods used by older people. On the day of payment, or better yet in advance, visit the branch with a loan agreement, personal passport and the required amount. Tell the operator your personal information and contract number and make the payment. The advantages of this option are undeniable: money is credited to the account accurately, without commission, but you need to calculate the time, since there may be a line at the cash desk.

- ATM/terminal. Payment through remote access devices is carried out in two ways - using a card or cash, for which you select the appropriate menu item. But please note that the operating hours of ATMs and terminals may depend on the work schedule of the premises in which they are installed.

- Sberbank online , including a version for mobile phones. The most comfortable methods, since payment can be made from any locality, 24/7, but require access to the Internet and some skills in using software applications.

The borrower, depending on technical capabilities and experience, chooses the most comfortable method for himself. But, unfortunately, mistakes made can lead to the formation of debt on obligations, which is associated with the accrual of penalties. To avoid miscalculations, we will present an algorithm of actions on how to pay for a Sberbank mortgage in different ways.

Recommended article: Mortgage for families with a disabled child from Uralsib Bank

Connecting the Sberbank Online application and paying your mortgage through mobile banking

We recommend installing the Sberbank application on mobile devices. This will allow you to make payments without access to a computer. You can download it for iOS on the AppStore, for Android in the Play Market, and for Windows Phone in the marketplace or Windows Phone Store.

The client just needs to find the program and start downloading. The application will be installed on your mobile device automatically. To use it to pay your mortgage, you must follow the following instructions:

- A citizen enters the application and selects the payments tab.

- You must give preference to one of two points - between your accounts or to a Sberbank client. The difference is that the account details belonging to the client are immediately displayed in the application. Then it will be enough to choose where the funds will be debited from and where they will go. If the “Sberbank Client” option is selected, you will need to enter the data yourself and confirm the transfer using a short SMS message.

- Specify the debit amount and confirm the transfer.

Required documents

Compliance with the bank's mandatory requirements for its clients is confirmed by a package of documents. The specific list directly depends on the selected program. Regardless of the specific conditions of the banking offer, the borrower provides employees with an application form, as well as:

- passport;

- identification document of your choice (driver’s license, SNILS, international passport, etc.);

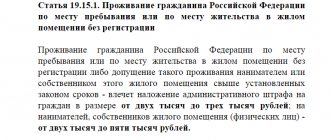

- confirmation of registration or temporary registration;

- confirmation of official employment and stable income (at the client’s request);

- documents for the residential premises being financed (if the borrower has chosen a Sberbank mortgage loan);

- documents for collateral real estate (if it differs from the loaned object);

- confirming information about the availability of money to make the down payment (for example, a bank account statement).

Applicants for a mortgage from Sberbank of Russia under special programs (military, with state support, etc.) submit additional documents along with the above: marriage certificate, birth certificate of children, certificate for the right to receive maternity capital, NIS participant, etc.

A bank employee will provide the client with a detailed list of required documentation after preliminary approval of the application.

Is it possible to pay off a mortgage at Sberbank Online ahead of schedule?

Payment for a mortgage through Sberbank Online can be made before the end of the contract. Obligations will be able to be closed in whole or in part. The financial organization has canceled the deadlines that act as restrictions for making payments. Previously, it was necessary to wait three months after the loan was issued. There is also no minimum payment amount.

Contacting a bank branch will theoretically speed up the crediting of funds to your account. You must obtain a certificate of no debt from a bank branch. Then the mortgage account is closed. The citizen will have to remove the encumbrance from the property and cancel the insurance.

How to calculate the early payment date

If you make a partial early repayment of a loan through Sberbank Online, the amount does not immediately go toward the debt. The operation will take place at the time when the next payment is due according to the schedule. On the next day after early repayment, a new scheme for closing obligations is drawn up.

Early settlement entails a reduction in the amount of the principal debt and the amount of accrued interest. But the last day of payment remains the same. Only the size of the monthly payments changes. If you regularly pay your debt ahead of schedule, you can significantly reduce the amount of overpayment. As a result, it can be paid off in one go.

A mortgage with Sberbank Online is paid in the same way as any other type of loan.

You can use a mortgage calculator to calculate.

Conditions for partial loan repayment

In order for a client to repay a Sberbank mortgage ahead of schedule, it is enough to have the required amount of money in the account. It is credited to the card or deposited through the terminal. Then you have to write a statement to close the obligations before the expiration of the contract.

Partial early repayment at Sberbank is carried out only by reducing the size of the monthly payment. It will not be possible to reduce the deadline for closing obligations.

Conditions for partial loan repayment

When using a system of both annuity (when the mortgage debt is paid in equal installments, regardless of the remaining amount of the loan) and differentiated (when the size of the monthly payment constantly decreases with a decrease in the amount of the principal debt) payments, early repayment of the loan is unprofitable for the bank, since it loses its interest . Therefore, this point is always discussed separately under the terms of the loan agreement.

Previously, a Sberbank loan could contain penalties for the client’s early repayment of the principal amount of the debt. This was a kind of insurance against loss of profit. Now this practice is no longer used, and clients can repay their loans early without restrictions. The only thing is that the contract specifies a specific period when the client is prohibited from making payments ahead of schedule (usually, no more than a few months).

Since early repayment has a negative impact on the bank, the client worsens his credit history when using this payment method, thereby increasing the risk of future loan refusal.

Is it possible to pay off a mortgage early? Previously, if the loan was repaid in full, then at least 30 days before making the payment it was necessary to write an application to the bank requesting repayment.

Now both partial and full repayment of a mortgage is much easier. To do this, the client can submit an application to Sberbank Online just one day before he plans to pay. But applications are accepted only on weekdays. That is, if you submit an application on Sunday, it will be accepted and processed on Monday. At the time of making the payment, there must be a sufficient amount of funds in the account.

How to partially repay a loan through Sberbank Online?

- Using a Sberbank card, gain access to your personal account in the Sberbank Online system.

- Go to the “Credits” tab. The page will display all loans opened in Sberbank in the user’s name.

- Select the “Early repayment” section and “Partial early repayment” there.

- On the page that appears, you need to provide basic payment information: the bank card used to repay the loans; desired date of payment; if a weekend is specified, payment will occur on the first working day following the weekend; amount of payment. Please note that the required amount must be in the account on the date of payment. That is, you can fill out the application itself with a zero balance.

Funds are debited automatically on the day selected by the user when placing an application.

By presidential decree in January 2021, certain changes were made to the mortgage lending system. With the support of a housing lending agency, families with two or more children can qualify for subsidies and preferential loan terms. If there are two minor children, families can qualify for mortgage loans at only 6% per annum.

The remaining interest will be repaid by the state. When a third child appears in the family, citizens can apply for AHML payments, which are used to repay the loan product. In both cases, AHML support is not considered early repayment, and the citizen does not report to the bank for it.

How to find out the balance of debt

To obtain information about the balance of debt, you will need to log into your personal account and go to the Loans tab. It is located in the upper right corner. To find out detailed information about the debt of interest, you have to left-click on the product of interest. The system will display the balance and additional information about the service.

Information can also be requested through the mobile application. The request submission procedure is exactly the same as when using the company’s official website.

Ways to get a housing loan

How to get a mortgage from Sberbank to purchase finished housing? Now this institution occupies a leading position in the Russian lending market. Sberbank of Russia issues more than half of all mortgage loans in the country. Such a high demand for his programs can be explained very simply:

- Firstly, the proposed loan terms are as transparent and accessible as possible.

- Secondly, the interest rates set for mortgages at Sberbank are among the lowest on the market.

- Thirdly, salary card holders can count on a preferential interest rate.

If you are completely satisfied with the conditions for obtaining a mortgage from Sberbank, then you can submit an application. But first you need to calculate the mortgage loan based on monthly payments. Will you be able to pay it without delay? This question can be answered positively if the amount of expected payments does not exceed 30% of your monthly income.

In addition, it would be useful to have an additional source of income - in case the main one unexpectedly stops coming to the budget, for example, as a result of dismissal or a long delay in wages.

Contact the department in person and provide all the necessary documents:

- passport;

- a copy of the work book;

- income certificate;

- all papers for the property being loaned.

To provide a mortgage, Sberbank may require additional documents. If your loan is approved, you have three months to select a property. It is during this period that a truly positive decision is made.

Is it possible to pay for a mortgage from another bank at Sberbank?

Sberbank Online allows you to repay a loan received from another bank. To perform the operation, you only need to know a number of details. You will have to proceed according to the following scheme:

- Log in to your account and go to the transfers and payments section.

- Select the item “Repay a loan from another bank”, and then indicate the region in which the mortgage was issued. You need to have a loan agreement at hand.

- From the list of options that appears, you need to click on the item “Loans and transfers to another bank using BIC”. Then you will need to provide the required information from the loan agreement.

- Select the account from which the funds will be debited, then continue with the operation. The system will automatically display the name of the bank and ask you to provide an account number. This information is indicated in the loan document.

- Display the full name of the credit account owner and “Continue”. Next, indicate the contract number and contact phone information.

- The payment amount is fixed. It should not be less than that reflected in the loan agreement. The transaction is confirmed. To do this, you need to enter the short password from the SMS message.

The operation requires a fee. Its size is 1% of the amount, but not more than 1000 rubles. Funds will be transferred to your account within 3 business days. It is advisable to make payments in advance.

How does a mortgage payment work?

When concluding a mortgage agreement with Sberbank, a savings deposit will also be issued, through which monthly annuity payments will be written off.

You can choose from three deposits:

- "Savings"

- "Universal"

- "Poste restante"

To fulfill your obligations under a loan agreement for the purchase of housing, you must replenish your savings account on time with the required amount. The selected write-off account and the name of the deposit will be specified in the agreement. It is worth considering the features of the “Universal” deposit, which requires a constant positive balance of funds (at least 10 rubles).

Other methods of paying for mortgage loans at Sberbank

Loan obligations must be fulfilled in a timely manner. In other situations, penalties or interest may be assessed. There are alternative payment methods. The client has the right to replenish the account in one of the following ways:

- Online service. The method allows you to transfer money remotely, but it requires paying a commission.

- Depositing the amount into the cash register. The method is considered the most reliable. The person can be sure that the money has been credited to the account. The operator will prepare all the documents and make transactions in the presence of the citizen.

- Transfer from cards of other banks. The method is popular. But it comes with a commission. We advise you to withdraw the amount and make the payment through the terminal.

- Using ATMs. They are present in many Sberbank branches and shopping centers. Using an ATM may involve additional risks, especially when you need to deposit a large amount.

Early repayment of mortgage

If the client wants to pay for the mortgage early, he can do this by first agreeing with the bank on a change in the payment schedule. Once approval is received, the mortgage early repayment function is activated. To do this, in the “Loans” section you need:

- ABOUT.

- Select the “Partial early repayment” option.

- Specify the account for withdrawing money.

- Enter the payment amount.

- Click “Submit an application”.

READ How to disable contactless payment from a Sberbank card

After each early repayment, the bank recalculates the schedule and the monthly payment is reduced.

Tips for working safely with software developed by Sberbank

When starting work, it is important to make sure that the connection is established with the official website of the organization. All other resources are informational and auxiliary in nature. If the site has a different design or repeatedly requires you to provide a phone number, it is better to stop working with it and leave the resource. If you switch to an unsecured connection, the computer will issue a warning. The use of such systems should also be abandoned.

We do not recommend saving your login information in a browser or password manager.

It is important to double check the payment details, verify the information received in the SMS and only then confirm the transfer. If the system prompts you to provide a password for the cancellation procedure, most likely there was an interaction with scammers. If you receive an SMS notification about a payment that has not been made, you must immediately contact the contact center.

Using an ATM

Transferring through an ATM does not have any special features. The algorithm of actions is usual:

- The card is inserted into the slot and the PIN code is entered.

- In the menu that opens, in the payments and transfers section, select the “Loan repayment” category.

- On the page that opens, enter information from the loan agreement. In modern devices, you can use a barcode reader - loan data will appear on the screen: monthly payment, passport information and contract number. If everything is correct, you need to click the “Next” button.

- The machine will ask you to choose a payment method (cash or card). If you choose to pay in cash, the amount must be rounded up and take into account that the ATM does not give out change.

- After confirmation and payment, all that remains is to receive a receipt.

Before figuring out how to pay for a Sberbank mortgage through an ATM, you need to consider one technical point: the transfer to the bank can take from a few minutes to three days. Therefore, transfers through an ATM should be made in advance, preferably three days before the due date of the next payment.

conclusions

Using the Sberbank Online system significantly simplifies depositing funds to pay for mortgage loans. The citizen will not have to stand in line. It is important to be vigilant when translating. If the details are incorrect and the citizen has confirmed the payment, the money will not be returned. It is better not to make full early repayment through Sberbank Online. It is safer to deposit money into the cash desk of a financial institution, and then immediately take a certificate confirming that the obligations are completely closed.

Mortgage terms

Mortgage lending from Sberbank is available under four programs for all categories of clients, three special ones (military, preferential for families, and also using maternal capital) and an offer for refinancing existing loans, incl. mortgage For clients who do not want to collect a large package of documents and then report on expenses incurred, a non-targeted program is provided for the security of existing real estate. Today, mortgage rates at Sberbank are considered the lowest. More detailed information about specific offers for the purchase of real estate can be found below:

- Purchase of housing under construction – a loan for the purchase of an apartment under construction or a finished one in a new building from developers cooperating with the bank. Issued for an amount within 85% of the cost of collateral housing for a period of up to 30 years and at an interest rate of 8.7%. When participating in the subsidy program, the maximum period is limited to 12 years, and the rate is reduced to 6.7%. The down payment is from 15%.

- The purchase of finished housing is a Sberbank mortgage on secondary housing in the amount of up to 85% of the value of the collateral, for a period of up to 30 years, at an interest rate of 8.6% per annum. Down payment – at least 25%.

- Construction of a residential building - a loan is provided within 75% of the value of the collateral object, for a period of up to 30 years and at an interest rate of 10% with an initial payment of at least 25%.

- Mortgage from Sberbank with state support for families with children - up to 8 million rubles for a period of up to 30 years and at a preferential rate of 6%. The down payment must be at least 20%.

- Mortgage plus maternity capital - a loan in the amount of 300 thousand rubles up to 30 years and from 8.9% per annum. Down payment – from 15% (partially or wholly paid from maternal capital funds).

- Military mortgage - issued in the amount of up to 2.33 million rubles, for a period of up to 20 years from 9.5%. First payment – from 15%. Only participants in the savings-mortgage system can take out such a mortgage from Sberbank.

- Refinancing of mortgages and other loans - a loan to pay for existing loans in the amount of up to 7 million rubles for a period of up to 30 years and at an interest rate of 9.5%.

- Country real estate - issued for an amount not exceeding 75% of the value of the collateral, for a period of up to 30 years, at an interest rate of 9.5%. The down payment is at least 25%.

- A non-targeted loan secured by real estate is a consumer loan for any purpose in the amount of 500 thousand to 10 million rubles or no more than 60% of the value (contractual or estimated) of the collateral housing. The maximum period is 20 years. Interest rate – from 12%.

In comparison with the latest proposal, the mortgage percentage in Sberbank today seems lower, but only through such a non-targeted program can you get a large amount in a short time. For some borrowers, this option is best suited.

As you can see, the terms of the mortgage at Sberbank make it quite possible to quickly and not too expensively acquire your own real estate. Clients really need to take into account that the provisions of the loan agreement will be developed taking into account his solvency. Therefore, not everyone can count on the upper values under the terms of the chosen banking program.

For what type of loan is payment through Sberbank Online impossible?

Full repayment of a loan through the Sberbank Online service becomes impossible if the loan was taken from Sberbank under an agreement that provides for an annuity loan payment schedule.

REFERENCE!

The annuity payment schedule provides for the borrower to deposit the same amount of funds into the account every month.

That is, according to the agreement, the borrower can deposit the same amount, but repaying the loan in full or depositing a large amount of funds is no longer possible. To do this, the client will need to submit an application to change the loan parameters. Once this transaction is approved, the client can repay the loan as follows:

- In the Sberbank Online application, you need to go to the “Early repayment” tab.

- Select the “Partially repay the loan” option and in the list called “Write-off account” select the account number from which the amount to repay the loan will be written off.

- Then indicate the payment date and the amount to be paid.

- Then click the “Complete application” button and confirm the transaction with the code from SMS.

Loan payment

Payment for a loan not received from Sberbank can also be paid using the Sberbank Online mobile application. The procedure will be as follows:

- In the application, select the “Payments” section and go to the “To an account in another bank” item.

- In the form, enter your Sberbank account number and click on the green arrow to go to the next page. On it we indicate the recipient of the transfer – “Organization”.

- Then, on the page that opens, fill in the fields with the necessary information. We indicate the sender's full name, contract number, bank identification code of the organization and the amount of the monthly payment according to the contract.

- After filling out all the fields, click the “Pay” button and confirm the transaction with the code from the SMS.

Basic requirements for borrowers

Who can get a mortgage from Sberbank? The answer to this question interests many of our fellow citizens.

Only clients who meet the following requirements can purchase an apartment:

- have Russian citizenship;

- age from 21 to 75 years;

- work experience of at least six months;

- having an official place of work and a stable source of income;

- no negative credit history.

Passing the application primarily depends on your level of solvency. The maximum loan amount is calculated taking into account the client’s income and expenses. To obtain the necessary funds, co-borrowers may be involved. Their number cannot exceed three people.

But the borrower must rely only on his own strength, since no one will help him repay the loan. The monthly loan payment should not exceed half of his net income. If an overdue debt arises, the bank has every reason to confiscate the apartment purchased with a mortgage.