Tax amount for the second floor of a private

The obligation to make tax contributions does not depend on the citizenship of the owner, his age or period of ownership.

Stateless persons or foreigners must pay tax on personal property located on the territory of the Russian Federation.

If the owner of a residential building is a minor (under 18 years old) or a young child (under 14 years old), he is considered a taxpayer and is obliged to pay fees on a general basis.

There are a number of criteria for determining an entity obligated to pay house tax:

- If the real estate is owned by an enterprise, the taxpayer is a legal entity.

- If a country house has more than one owner, the property is subject to a single fee. The tax fee is calculated depending on the size of the shares.

- A person who is a tenant of a premises does not pay tax if such a clause is not specified in the agreement.

ATTENTION! Real estate owners must pay property taxes on time to avoid penalties and interest.

What is subject to real estate tax?

Among individuals, both a citizen of the Republic of Belarus and a foreigner and a person without citizenship can pay tax in 2021. To make a payment, one condition must be met - legal ownership of a real estate property in the country. The payer can:

Taxpayers

The list of objects for which the property tax rate is not charged also includes buildings, territories of strategic importance or exploitation, as well as agricultural or related to road infrastructure.

When calculating the size of the tax base for a residential building, a tax deduction is applied: it is necessary to subtract the cadastral value of 50 square meters from its full cadastral value. m. When calculating tax on a part of a residential building, a deduction of 20 sq. m. applies. m. From the tax period 2021

an additional deduction is applied for large families (if there are 3 or more children under 18 years old) - 7 sq. m of a residential building or part thereof per each minor child (clauses 3, 5, 6.1 of Article 403 of the Tax Code of the Russian Federation).

The remaining cost after applying deductions will be equal to the tax base, which must be multiplied by the appropriate rate.

Benefits for real estate taxation are provided to persons with the status of Hero of the USSR or the Russian Federation, disabled people, participants in military operations, citizens exposed to radiation during weapons testing or liquidation of the consequences of accidents, military personnel with over 20 years of service, relatives of deceased military personnel, “Afghan” soldiers, etc. .P. (a complete list is given in Article 407 of the Tax Code of the Russian Federation).

Benefits are also provided for pensioners receiving pensions in accordance with the pension legislation of the Russian Federation, as well as for persons who have reached 60 (men) and 55 (women) years of age, receiving lifelong allowance (judges, etc.). The benefit also applies to those persons who, due to changes in the legislation on pensions in 2021, are not yet pensioners, but under the previous rules would have the right to receive a pension (clause

10, 10.1 art. 407 of the Tax Code of the Russian Federation).

Example

Residential buildings on dacha and garden plots also fall into the taxable category - they are equated to residential buildings by analogy with buildings on lands for individual housing construction. If a person owns not only a house, but also a plot of land, he will have to pay land tax annually. The legal regulation of land taxation is carried out by the provisions of Chapter 31 of the Tax Code of the Russian Federation.

What determines the amount of tax paid?

The amount of the contribution depends on a number of parameters:

- location of the property;

- cadastral value of the building;

- type of taxable object;

- type of territorial zone where the building is located.

The amount of payment to the Federal Tax Service also depends on the area and number of floors of the real estate and its technical characteristics. The greater the number of square meters and floors of the building, the higher the tax.

Attic tax 2021

When ordering a project, it is necessary to decide whether part of the current attic space or the entire attic will be used for the attic. In the first case it will be less, but this decision is determined not by financial, but by constructive issues.

Mailing address: 0 Registered: Sep 23, 2021, 11:42 AM Thanks said: 104,132 times in 84 messages Mailing address: 0 Smart people strive to own information, wise people strive to own the result of its processing! Registered: 15 Aug 2021, 10:39 Thank you: 17 71 times in 37 messages Mailing address: 0 This innovation is valid from January 1, 2021. If you want to have something you've never had, start doing something you've never done.

Tax base and rates

The tax collection is based on the rate established by the regulatory legal acts of the Tax Code of the Russian Federation, which depends on the type of construction:

- 0.1% of the cadastral and inventory value of a residential building, parking space or garage;

- 3% if the cost of housing according to the cadastre exceeds 300 million rubles, and the property serves as office or commercial premises;

- 0.5% of the price of other buildings recognized as real estate.

Regional authorities have the right to change tax rates: reduce or increase them. Reducing interest is allowed without restrictions, and can be increased by a maximum of three times.

In a year, the tax on houses and dachas could increase 125 times

“It is for this reason that our company was chosen to carry out the assessment work. The BTI archive stores information about about 10 million capital construction projects in the Moscow region.

The technical passport, which is in the BTI archives, contains much more information than the State Property Committee.

With the help of archives, we supplement the information of the State Property Committee, determine the percentage of wear in order to make the most transparent and honest assessment.

— But in order to use the services of the MFC, you must first register your property, put it on the cadastre, clarify the boundaries of the site, register the house, and “link” it to the site. A lot of fuss. Probably half of the property owners in the Moscow region have not done any of this. And for some - the whole thing.

22 Jul 2021 glavurist 6254

Attic floor is subject to tax

3. If the real estate has a basement, then it is taken into account when determining the tax base only if the height from floor to ceiling in the basement is not less than 2 meters.

In this case, when calculating the tax base, the area of such a basement is taken to be equal to 50 percent of the area determined in accordance with Part 2 of this article.

4. If the real estate has an attic, it is taken into account when determining the tax base only if the height from the floor of the attic to the lowest point of the ceiling in the attic is not lower than 2 meters.

Article 329. Tax rate 1. Tax rates on real estate are established in a short amount from the land tax rates in accordance with Articles 266 and 267 of this Code within the following limits: - real estate used as residential premises - from 10 - multiple to 20 - multiple size.

, - real estate used for carrying out trading activities, organizing public catering facilities and consumer services for the population - from 20 to 50 times the size; - real estate used for other purposes not specified in this part - from 15 to 40 times the size.

If the height from the floor to the lowest point of the ceiling on any floor of real estate exceeds 6 meters, when calculating the tax base, the area of such floor is taken equal to 200 percent of the area determined in accordance with Part 2 of this article, adjusted to the number of floors coefficients expressed as a percentage. in accordance with parts 3-7 of this article.

Everything is simple and easy, order or come up with a project yourself, build, arrange it and now - your childhood dream is almost fulfilled. But then questions come to mind from adult life: should I pay for the attic as for redevelopment?

And how will the housing tax increase if I do build an attic? Is there even a tax on the attic?

Everything is simple and easy, order or come up with a project yourself, build, arrange it and now - your childhood dream is almost fulfilled.

But then questions come to mind from adult life: should I pay for the attic as for redevelopment? And how will the housing tax increase if I do build an attic? Is there even a tax on the attic? The question is timely, but not very difficult. Let's figure out what problems you may encounter while implementing this project? First, let's understand the terms.

Our legislation provides for a tax on the attic, but it is more than loyal to this type of superstructure. Firstly, only a room whose ceiling height is higher than two meters can become a taxable attic. If your premises are even 198 centimeters high, the tax office will not consider its declarations.

Secondly, the cost of one square meter of attic

Attic tax

You have a plan: furnishing an attic, thereby expanding the usable living space in your home. We may be talking about an inherited dacha, the family is growing; or about a country house for year-round use.

Should we or should we not be afraid of him? He's quite loyal. You can read about property taxes.

- Yes, if the ceiling height at the maximum point does not exceed 2 m. We built a room under the roof where the ceiling height is a maximum of 195 cm - we do not pay tax, if it is exactly 200 cm - we pay.

- According to the law, the cost per square meter of attic space is lower than in premises inside the building, therefore payments will be lower.

- If, according to the plan, your house is initially one-story and the attic is included, then the tax is not due on it. If the house is two-story, then the average area of the room under the roof is calculated as half the area of the first floor.

- Are you planning to equip an attic in a finished house, the design of which has been approved? Will a partial remodel be required? Then prepare a new project and approval of the development. Calculations are needed, since the weight of the existing structure may not withstand the new load.

- If there are several responsible tenants or owners in your house, you will need to obtain the consent of the majority (2/3 of the total number), plus a document on the transfer of part of the attic space to you for long-term rent or ownership.

We suggest you read: How not to pay a loan, what will happen if you have nothing to pay the loan to the bank

You can avoid the tax on the attic by changing access to this room. The staircase to the attic can be temporary, shaky, or wooden.

The staircase to the attic must be stationary, durable and safe. So think about it. By the way, according to this principle, many cunning people do not pay tax on their house at all, disguising it as temporary housing or unfinished housing. Only you can decide how things will turn out for you.

The main thing is that everyone is comfortable.

Where there is comfort, there is peace of mind.

Consequently, the tax rate for attic premises is much lower compared to second floor premises.

When calculating the tax, the attic is taken into account only if the distance from the attic floor to the lowest point of the ceiling is at least 2 m. If this distance is less than 2 meters, then the attic is not taken into account for tax purposes. When calculating the tax on a house with an attic, the area of the attic is conventionally assumed to be equal to 50% of the area established in accordance with Part 2 of this article.

Technical inventory authorities estimate the cost of a house in accordance with special collections, and then multiply the resulting value by a coefficient established for each region. According to the information contained in these collections, the estimated cost of 1 m³ of a one-story brick house with an attic is 24.5 rubles.

Let the total volume of the house with the attic be 450 m³.

Thus, the inventory value of the house will be equal to: 24.5 x 450 x 56.986 (conversion factor for the Belgorod region) = 628,270 rubles. This cost is multiplied by the tax rate, for example, 0.75%, which will be 4,700 rubles per year.

If the distance from the attic floor to the lowest point of the ceiling is less than 2 meters, then when calculating the tax, such a house is considered simply one-story.

The cost of 1 m³ of a one-story brick house is 20.6 rubles; the cubic capacity of such a house due to the reduction of the attic will also be slightly less, for example 430 m³. Thus, the inventory value of a house with a small attic in the Belgorod region will be: 20.6 x 430 x 56.986 = 504,782 rubles.

When deciding the height and shape of the second tier, it is worth remembering that we do not have a dilemma - an estate or a “cube”.

The area of the building also separately includes the area of the open unheated planning elements of the building (including the area of the usable roof, open external galleries, open loggias, etc.). The traditional second floor consists of straight vertical wall structures and has parallel planes of the floor and ceiling.

The area of the attic is less square meters than the underlying premises due to the bevels of the enclosing structures.

When calculating the tax, the attic is taken into account only if the distance from the attic floor to the lowest point of the ceiling is at least 2 m. If this distance is less than 2 meters, then the attic is not taken into account for tax purposes.

When calculating the tax on a house with an attic, the area of the attic is conventionally assumed to be equal to 50% of the area established in accordance with Part 2 of this article. Thus, to reduce property taxes, it is more profitable to build a one-story house with a low attic.

Thus, the inventory value of the house will be equal to: 24.5 x 450 x 56.986 (conversion factor for the Belgorod region) = 628,270 rubles.

This cost is multiplied by the tax rate, for example, 0.75%, which will be 4,700 rubles per year.

If the distance from the attic floor to the lowest point of the ceiling is less than 2 meters, then when calculating the tax, such a house is considered simply one-story.

We invite you to familiarize yourself with: Tax deduction for pensioners: registration, documents, amount

Info The cost of 1 m³ of a one-story brick house is 20.6 rubles, the cubic capacity of such a house due to the reduction of the attic will also be slightly less, for example 430 m³.

The area under the first floor of real estate is determined in accordance with the external measurement of the size of the real estate

A separate tax on the attic is not established. Naturally, when calculating the amount of tax, the inventory value of the building itself is taken into account, and then the tax rate is calculated from this value. It should be noted that local governments can change the rate established by law. It all starts with obtaining permission to build an attic.

It’s good if you are the only owner in a one-story house, otherwise you should obtain the consent of all homeowners.

Only after this can you order a project and draw up an estimate for construction. In this case, it is necessary to coordinate many issues. Be patient, because this process can take a whole year. When ordering a project, you need to decide whether part of the current attic space or the entire attic will be used for the attic.

In the first case, the tax will be less, but this

Collegium of Advocates

The staircase to the attic can be temporary, shaky, or wooden.

Taxes » Property » Is the attic floor of a private house subject to tax

- What is the difference in tax on a house with an attic or a two-story house?

- I am interested in the tax on a two-story house and a house with an attic. There will be a big difference.

- What is the difference in tax for a one-story house with an attic and a two-story house in the city of Kurgan.

- Is there a big difference in the tax on a one-story house with an attic or a two-story house?

- Please) what is the tax amount for a two-story house.

- What is the difference in paying tax on a one-story and two-story house? how to proceed?

- There is a difference in the tax on a two-story house and a house with a mansard roof of 14 m * 15 m.

- House taxes

- Land and house tax

- Residential house tax

- House tax for pensioners

- Private house tax

Apartment taxes in 2021 - what has changed and who now does not have to pay tax?

The obligation of real estate owners is to annually pay the appropriate tax to the country's budget. Let's look at what's new in property taxation in 2021. Have there been categories of persons exempt from paying taxes on apartments, houses and other real estate?

What is property tax?

This concept, of course, is defined in the Tax Code. But descriptions created in poor clerical language are unlikely to give the user a simple and understandable picture. Therefore, we will make a “translation”.

Property tax is the amount that is payable for each piece of property registered to a person. If there are several owners, then the tax is calculated in proportion to the share of each. For minor owners, parents pay.

Elevators and entrances are classified as common property, no tax is charged on them, residents only pay for maintenance.

What applies to real estate

Now you need to figure out what exactly is considered real estate, according to Russian law. In accordance with the Tax Code, real estate is considered :

- apartment, room in a communal apartment, dormitory;

- a private house;

- residential buildings in areas allocated for individual housing construction, private plots, as well as in the territories of garden plots;

- unfinished buildings;

- garages, boxes, premises, buildings (shops, offices - any stationary objects;

- shares in the above objects.

How is tax calculated?

Pexels Photos

Until 2014, there was a tax calculation system in which the inventory value of the object was considered the base unit. It differed significantly from the market price and cadastral value.

As a result, for an object worth several million rubles, the owner could pay at the inventory price, as for a building worth 100-200 thousand. Naturally, the state lost huge amounts of money every year.

The transition to a new payment system began back in 2015. Then there was a decision to switch to cadastral value as the base unit. It took more than five years to compile a database of cadastral prices.

Over these years, the state maintained a policy of a smooth transition: so that tax increases would not hit citizens’ wallets sharply. In 2021, relief in the form of reducing coefficients is reserved only for residents of Sevastopol; other citizens of the Russian Federation have successfully completed adaptation and now pay tax at the full cadastral value of property objects.

Calculating cadastral value is a rather complicated process. It involves assessing many parameters, including:

- Address of the object;

- infrastructure of the location area,

- age of the building;

- market value of similar objects, etc.

That is, when assessing, many factors are taken into account, and a house in a remote village without amenities, but with an area of 100 square meters, will definitely not cost more than a room in a communal apartment, but in the city center. The frequency of revaluation will be determined by municipalities. For large cities, recalculation of cadastral value is recommended at least once every five years.

Formula for calculating tax

A simplified calculation formula looks like this:

N = (B-NV)*D*S.

N – direct tax; NV – tax deduction; B – base value (cadastral value of the object); D – share of ownership; C – rate.

Tax deduction is tax-free square meters of residential property. It applies to all categories of owners and amounts to:

- 50 sq. meters for private houses;

- 20 sq. meters for apartments;

- 10 sq. meters for rooms.

Pexels Photos

That is, for example , if the area of the house is 100 square meters. meters, and its cadastral value is 1 million rubles, then the tax for payment is calculated as follows:

1. The cadastral value is divided by the number of square meters. This is how we get the price per square meter. m. In our case, it is equal to 10 thousand rubles. 2. Now we apply the tax deduction: 100 – 50 = 50.

3. We calculate the cost of the taxable area: 50 * 10,000 rubles, we get 500 thousand.

The specified amount is multiplied by the ownership share and the stake. As a result, we get the amount of tax to be paid.

IMPORTANT! If the house is less than 50 sq. meters , property tax is not charged on it AT ALL!

The same principle is used to calculate the tax on apartments, rooms and other premises. If you own several objects, the tax deduction applies to only one of them.

Pexels Photos

Families with three or more children have the right to reduce the tax base by the cost of:

- 5 sq. m of apartment, unit, room for each child;

- 7 sq. m of a private house or part of it for each child.

Tax on shared ownership

When owning a premises in shared ownership, the deduction is applied to the total cadastral value of the housing. In this case, the tax is charged to everyone in proportion to their share. For example, if we take the above case: a house of 100 square meters, two owners who own in equal shares, the cadastral value is 1 million.

In this case, the taxable square meters are divided in half and multiplied by the rate. This is how the tax of each owner is calculated.

What is the rate and who sets it

The basic tax rate is established by the Tax Code. It can be increased or decreased by the municipality.

Rates valid in 2021

| Object type | Bid, % |

| Residential buildings, apartments, parts thereof, as well as garages | 0,1 |

| “Luxury” objects with a cadastral value of more than 300 million rubles | 2 |

| Other immovable property objects | 0,5 |

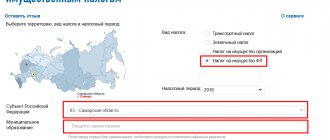

The calculator for calculating property tax for individuals works on the official website of the Federal Tax Service.

To work with it you will need the cadastral number of the property.

Who can avoid paying property taxes?

Pexels Photos

An exhaustive list of citizens who are fully or partially exempt from paying property taxes is given in the Tax Code of the Russian Federation. According to official documents, the following categories of owners have the right to benefits:

- pension recipients (pensions assigned for any reason are taken into account);

- disabled people, except for disabled people of the 3rd working group;

- veterans of the Great Patriotic War, the Afghan War;

- military personnel with more than 20 years of service;

- "Chernobyl";

- spouses and parents of military personnel killed in action.

The benefit is of a declarative nature and is provided only for 1 selected object, provided that no business activity is carried out in relation to it.

You may also like

Calculate total area

The design of individual houses is carried out in accordance with SP 55.13330.2011 “SINGLE APARTMENT RESIDENTIAL HOUSES”. According to SP 55.13330.2011, clause 4.7, the Rules for calculating the area of premises, determining the volume and number of floors of a building and the number of floors are adopted according to SP 54.13330 “Residential multi-apartment buildings”. Let's look there. Appendix B (mandatory) paragraph B.1.1 The area of a residential building should be determined as the sum of the areas of the floors of the building, measured within the internal surfaces of the external walls. The floor area includes the area of balconies, loggias, terraces and verandas, as well as landings and steps, taking into account their area at the level of a given floor.

B.2.1 The area of apartments is determined as the sum of the areas of all heated premises (living rooms and auxiliary premises intended to meet household and other needs) without taking into account unheated premises (loggias, balconies, verandas, terraces, cold storage rooms and vestibules). The area occupied by a stove and (or) fireplace, which are part of the heating system of the building (and are not decorative), is not included in the area of the apartment premises. The area under the flight of an internal staircase in an area with a height from the floor to the bottom of the protruding staircase structures is 1.6 m or less is not included in the area of the room in which the staircase is located. When determining the area of rooms or premises located in the attic floor, it is recommended to apply a reduction factor of 0.7 for the area of parts of the room with a ceiling height of 1.6 m - at ceiling angles of up to 45°, and for the area of parts of the room with a ceiling height of 1.6 m. 9 m – from 45° or more. The areas of parts of the room with a height of less than 1.6 m and 1.9 m at the corresponding ceiling angles are not taken into account. A room height of less than 2.5 m is allowed for no more than 50% of the area of this room. B.2.2 The total area of the apartment is the sum of the areas of its heated rooms and premises, built-in closets, as well as unheated rooms, calculated with reduction factors established by the rules of technical inventory.

Interesting: How long does it take for traffic police fines to be cancelled?

Tax on the second floor of a private house 2021

As always, we will try to answer the question “Tax on the second floor of a private house 2021”. You can also consult with lawyers for free online directly on the website without leaving your home.

In order to prevent a sharp increase in the tax burden, over the past four years the cadastral valuation has been consistently adjusted by an adjustment factor, starting from 0.2 in 2021 to 0.8 in 2021. In 2021, the tax will be calculated without adjustment factors, based on the full cost of each object.

Property tax rates in 2021

Since 2021, our country has been experiencing a smooth transition from inventory valuation of real estate to cadastral valuation. Before this, all citizens' property was valued significantly lower than its real market value. This was due to the imperfection of the technical inventory system.

How is the value of a property determined?

A garden house located on a gardening or summer cottage plot and not suitable for permanent residence may be referred to in registration documents as a non-residential house. According to the latest amendments to the Tax Code of the Russian Federation, they are equal to residential buildings in terms of calculating property taxes.

- The cadastral value of the property must be multiplied by the tax rate.

- The next step is to multiply the inventory price by the same rate.

- You need to subtract the second from the first result.

- The resulting amount must be multiplied by a reduction factor.

- The amount of tax payment calculated based on the inventory value is added to the final indicator.

- WWII veterans.

- Pensioners who retired due to age and other reasons.

- Heroes of the Russian Federation and the USSR.

- Afghan warriors.

- Liquidators of the accident at the Chernobyl nuclear power plant.

- Members of military families who have lost their breadwinner.

- Representatives of creative professions (sculptors, artists, designers) using the premises as a studio.

Procedure for calculating tax on a private house

Sometimes owners of private houses equip gyms, dressing rooms and even swimming pools in their basements. Such premises are considered non-residential, but they are noted in the technical plans. Accordingly, these square meters are included in the tax base, although they are unlikely to greatly affect the amount on the receipt.

But there is also a 2021 property tax for legal entities. Therefore, organizations, corporations, various enterprises, industries, companies, firms are also subject to fulfillment of the obligation. This category of taxpayers also includes representatives of medium and small businesses - individual entrepreneurs (IP).

Calculation example

The taxpayer owns an apartment with an area of 60 square meters. As for the cadastral price, it is 5 million rubles. The total amount of mandatory payment to the treasury for this property will be determined as follows:

- Taxable area = 60 – 20 (mandatory deduction) = 40 square meters

- Cadastral value 40 sq. meters = 5,000,000*40/60 = 3,333,333 rubles

- Real estate tax = 3,333,333 * 0.001 = 3,333 rubles per year.

It turns out that the owner of such an apartment will pay only 277 rubles per month to the treasury, which is not much different from the property tax calculated based on the inventory value.

Tax on Two-Story House 2021

The obligation to make tax contributions does not depend on the citizenship of the owner, his age or period of ownership.

Stateless persons or foreigners must pay tax on personal property located on the territory of the Russian Federation.

If the owner of a residential building is a minor (under 18 years old) or a young child (under 14 years old), he is considered a taxpayer and is obliged to pay fees on a general basis.

There are a number of criteria for determining an entity obligated to pay house tax:

- If the real estate is owned by an enterprise, the taxpayer is a legal entity.

- If a country house has more than one owner, the property is subject to a single fee. The tax fee is calculated depending on the size of the shares.

- A person who is a tenant of a premises does not pay tax if such a clause is not specified in the agreement.

ATTENTION! Real estate owners must pay property taxes on time to avoid penalties and interest.

Tax amount for the second floor of a private

If you do neither one nor the other, you will not have to pay anything from the foundation, but if the tax office discovers this object, for example, during cadastral work, which is carried out at the initiative of the state, the inspectorate will immediately charge you fiscal payments.

The same thing happens with the tax on a built house.

And if you report real estate to the Federal Tax Service, but without registering it in the Unified State Register of Real Estate, then for 10 years or until the year of its registration in Rosreestr you will pay increased land tax, which compensates for the lack of information about the cost of the house.

Results

- , a house area of 50 sq.m. is not taxed.

- The law on tax on houses and other real estate also applies to unfinished buildings, incl.

In popular videos on this topic, the authors make one serious mistake. In their tables, they compare not the average cost of building a cottage, but the volume of basic work.

As a result, it is concluded that it is more profitable to build a one-story or two-story house. We propose a more accurate estimation methodology based on the total amount of expected expenses.

So, let’s compare the costs of building two cottages of the same area (160 m2): a one-story one measuring 10x16m and a two-story one measuring 10x8m.

We use strip monolithic reinforced concrete foundations of the same height (from the base to the top mark of the base 1.6 meters, width 0.5 m).

Walls (height 3 m, thickness 0.43 m) - aerated concrete blocks + facing bricks.

The ceilings of the first and second floors are wooden beams.

The benefit exempts from payment for all such objects with an area of less than 50 sq.m.

You can notify the inspection using a special form:

You can download it from the link . But a residential building on the site will be taxed. If an inventory base is used, a special coefficient is applied.

If cadastral, the house tax is taken from an area over 50 sq.m., and the tax on a residential building up to 50 sq.m. is zero according to Article 403 of the Tax Code of the Russian Federation. And if you fall under the category of beneficiaries from Art.

407 of the Tax Code of the Russian Federation, then you won’t have to pay for the house.

How is the tax calculated for a one-story, two-story and three-story house?

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region. +7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

— an experienced lawyer will take care of solving all your problems!

Many people are interested in the tax on the number of floors of a house, especially during construction - which house is better to build: one-story with an attic or two-story, two-story with basement premises or three-story, etc.

Attention

On the remaining amount, if the house is valued higher, personal income tax is paid.

If the value of the house is one million or less, then even if you have owned it for less than three years, you do not need to pay tax. Tax deductions can also be obtained for purchased building materials and paid services during the construction of a house. At the same time, the tax when buying your own home allows you to return the previously paid personal income tax.

When selling part of the house, each owner will receive a deduction in the total amount of 1 million, but in proportion to their shares. This rule is applicable if one agreement is concluded, where all property owners and the size of their parts of the property are indicated.

The main thing is that he lives on the territory of the Russian Federation.

It follows from this that, as already noted, the payers of the payment under study are only able-bodied adult citizens. Children and pensioners do not pay this tax in any way.

Every citizen should take this fact into account.

Changes in calculations

Nevertheless, many are interested in what house tax is due in a particular case. Indeed, in 2015, new changes regarding the payment under study came into force.

They caused a lot of problems for the owners. In particular, due to calculations.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 ext. 987

(Moscow)

+7 ext. 133

(Saint Petersburg)

+8 ext.

Previously, there was a toilet in its place, and when all the residents of this house had already built a toilet in their own home, this place was abandoned and they unauthorizedly erected house construction, and the residents of this house erected various kinds of buildings in the places where storage sheds were built firewood when there was no gas. Now I want to legitimize it. I contacted lawyers, each one gives different advice. Some say that so that the judge does not take a lot of money from me, it is better for me to first write to the city architecture an application for the allocation of a plot of land located under this house, and then they will allegedly refuse me this in writing and then, on the basis of this refusal, file a lawsuit and buy it out land at cadastral value in the cadastral chamber. I am a disabled person of the 1st group, I have no housing, the only thing I was given was land. plot in 2012 and it’s far from the house where I live with my mother. I was born in 1956.

https://www..com/watch?v=WBR1wnD1ttg

If the basement is used as a garage and is so documented, then it is a property tax item other than a house - a garage or parking space - and is taxed according to the general rules, but in most municipalities, garage owners are exempt from paying this payment.

If the ground floor is used as a gym, swimming pool, storage room and other similar purposes, then it will be considered simply non-residential and thus will be marked in technical terms, but will fall into the area of the house, although it will not affect the cost so much.

Tax on a house with an attic

The attic, as a rule, is part of the living area of the house, and therefore will affect the price of the object, approved by cadastral engineers when putting the house into operation.

For comparative calculation, we will take the average cost - 120 thousand rubles .

Second bathroom, heating and electrical wiring

The need to equip a toilet and shower in a two-story building is beyond doubt. Going up and down from the bedroom to the first floor, especially at night, is a dubious pleasure. Costs for plumbing, finishing materials and work in the budget version are at least 50,000 rubles. In a one-story cottage, a second bathroom is not needed.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 ext. 987

(Moscow)

+7 ext. 133

(Saint Petersburg)

+8 ext.

N., 10756 answers, 4029 reviews, on the site since 12/09/2015 14.1. Hello! It depends not on the number of floors, but on the value of the property.

15.

Important

Is there a difference in the tax amount for a two-story house and a one-story house with an attic floor? Please write to Sincerely, Alexandra.

All about garage taxes for individuals: general information, who does not pay

However, it is worth understanding that although a benefit is possible for a garage for pensioners in 2021 and 2021, you will still have to pay money for the land. Therefore, when calculating the amount, this point should be taken into account. In addition to this, there are other nuances that may require you to give money even to beneficiaries.

We recommend reading: According to the Labor Code of the Russian Federation, dismissal at the initiative of the employee

Separately, we note that in 2021 new rules regarding tax contributions were already in effect. In particular, previously the amount was calculated from the inventory value, and now from the cadastral value.

Moreover, such a reform did not please people, because due to the change they have to pay more money for owning a garage.

This is due to the fact that the above-described values differ from each other, and it is the cadastral value that turns out to be higher.

Tax on private house and land for individuals

The cadastral value is determined according to the methodology of cadastral engineers, which is not published on external resources. Among the determining factors are the area of the object, location, distance or proximity to the central infrastructure of the settlement, etc.

d. In the case of BTI assessment, the so-called cost of the object. But in any case, the size of the house affects the property tax more than any other factor, and if the home has an attic or basement that is unsuitable for living, the price will be lower than with an attic and a residential basement.

How is apartment tax calculated correctly and what data is used?

Living area is the total size of living rooms; in documents they are taken into account as rooms intended for permanent residence of people.

They must have similar technical parameters, and the same factors must influence the determination of their prices. Next, entire groups are assessed. This valuation method is considered simplified and is also carried out quickly, so it often turns out that the price is determined with low accuracy and does not correspond to reality.

However, this requirement does not yet apply to residents of all Russian regions, since the transition to the new system is planned until 2020. But in Moscow and the Moscow region it is already in full force.

If you have a personal account on the tax website, by default you will not receive any notifications by mail. In order for them to arrive by mail, you need a paper delivery application. After registering in your personal account, you can choose whether to continue receiving paper receipts for debt by mail or refuse.

The law requires registration of rights to any real estate, but there is no such requirement for movable objects. Do not confuse it with the registration of vehicles in the traffic police: when issuing a vehicle passport, the car is registered, and the ownership of it is not registered. Due to the title, the owner is “tied” to the car, but this is not an analogue of ownership.

The tax rate is a certain percentage of the base amount. The value of the property is taken as the basis for the calculation. This does not mean that property owners independently indicate the price of their homes for tax purposes. The law establishes a uniform assessment procedure, and the cadastral value of the property serves as the basis for all.

These are unrelated types of duties; each has its own payment procedure and different rates.

For example, if you have three rooms in communal apartments and two houses, you only need to select two properties (one room and one house) to apply the preferential taxation. Notification of the choice must be sent to the Federal Tax Service before December 31.

What awaits property owners in 2021

New tax schemes. Who will save and who will pay more?

Hello everybody!

Next year, a number of changes are planned that will affect all property owners. Some, under certain conditions, will be able to save money.

But some citizens with modest salaries may have to pay a “super-rich tax.”

. But more on that at the end of the article.

So, what's new in 2021?

Firstly, the scheme for calculating property taxes is changing

As you know, the obligation to pay tax falls on all owners of real estate, regardless of its purpose. Currently, the tax is calculated based on the inventory value.

However, from 2021, the tax will be calculated according to a new scheme that involves the use of cadastral value. The cadastral value is close to the market value.

Find out how much your property is currently worth. And in case of disagreement, send comments with the cadastral value through the State Services portal or through the MFC.

What price is set for your apartment or house - see the Rosreestr website https://rosreestr.ru.

In the first three years, the cadastral value is calculated with reducing factors 02, 04, 06

.

And later – from the full cadastral value. At the same time, there should not be a sharp rise, since even if the cadastral value differs significantly from the inventory value, the tax under the new scheme cannot exceed last year’s value by more than 10%.

Secondly, changes are being introduced to the real estate sales tax.

This applies to transactions with residential buildings, apartments, rooms, cottages, garden houses, land plots (or shares in such property).

In 2021, real estate sales tax for individuals depends on several factors:

- how the object was acquired

- what is the period of ownership before sale?

- when the property was registered as ownership.

You will need to pay tax if the real estate (or shares of real estate) was owned for a minimum time.

There are 2 minimum terms established - 3 and 5 years, depending on when and how the property was acquired

3 years is considered a minimum period if:

1) the property for sale is the only residence

2) the right to the property being sold is obtained in the following cases:

- by inheritance or under a gift agreement from a family member or close relative;

these are relatives

in a direct ascending and descending line (parents and children, grandparents and grandchildren), full and half-blooded (that is, having a common father or mother) brothers and sisters, that is, blood

relatives

in one generation, neighboring generations and across a generation.

- as a result of privatization;

- the rent payer as a result of the transfer of property under a lifelong maintenance agreement with dependents.

5 years is considered the minimum period in all other cases not specified in the three-year limits.

If the property is owned for more than the minimum period, then no sales tax is paid.

What about the “super-wealth tax”? And what does this have to do with citizens with modest salaries?

From January 1, 2021, the President proposed changing the income tax rate from 13 to 15 percent for those who earn more than 5 million rubles per year

. Only income that exceeds 5 million rubles will be taxed at an increased rate.

Although the changes are being adopted in order to collect more taxes from the wealthiest, modestly earning citizens may well also fall under their influence. We are talking about apartment sellers.

There is a high probability that an increased tax rate on personal income will be applied when selling real estate if the total income for the year exceeds 5 million rubles

.

That is, the real estate itself may cost less than 5 million, but together with other income, the result is an excess.

Will this initiative affect Russians with modest salaries when selling real estate? While there is no draft law, one can only guess about this.

What do you think, my dear readers? Join us!

Read about how to find a management company for a management company here.

How to avoid major problems when choosing an apartment - written here

subscribe to the channel

and press

“thumbs up”

!

Bye bye. See you again!

House area and real estate tax calculation

Starting from 2021, in a number of regions, apartment owners will receive new property tax receipts. It is calculated based on the cadastral value of housing. This valuation is as close as possible to the market value.

The updated property tax was introduced gradually.

When switching from the inventory value of objects to the cadastral value, up to 2021, the calculation formulas took into account reducing factors to distribute the sharply increased financial burden.

In 2021, the practice of using reducing coefficients ceased to exist, and starting from 2021, the tax is calculated from the full cadastral value of the property.

All taxpayers are required to report to the Federal Tax Service by submitting until March 30, 2020. declaration for the expired tax period (2019). The timing of payment is determined by the regional authorities and informs legal entities officially.

Property tax rates in 2021

The Tax Code of the Russian Federation presents the maximum tax rates; they can be seen in the table:

| 1. | No more than 0.1% of the cadastral value of a property with an area of no more than 50 sq.m. |

|

| 2. | No more than 2% | for the list of taxable objects listed in the Tax Code of the Russian Federation and objects worth more than 300 million rubles. |

| 3. | No more than 0.5% | For other types of property |

Objects of taxation

The Tax Code of the Russian Federation defines a list of property items of individuals that fall under the taxation process. Here he is:

- House;

- Apartment, room;

- Garage, parking space;

- Single real estate complex;

- Unfinished construction project;

- Other buildings, structures, structures, premises.

This list is valid at the present time, and until 2015 it did not include such objects as parking spaces and “work in progress”.

Residential buildings also include dachas, buildings for vegetable gardening, horticulture and private household plots (personal subsidiary plots) - such objects are subject to a 0.1% rate, provided that the area of each object does not exceed 50 square meters. m. The same conditions apply to garages and parking spaces.

But the property of apartment buildings is not subject to this tax.

How to calculate tax

It doesn’t matter what the area of the house is - 100 square meters, 150 or more. When calculating tax based on cadastral value, a reduction is provided for:

- at cadastral value 50 sq. m.

in relation to residential buildings;

- for rooms - at the cadastral value 10 sq. m.

;

- for apartments – 20 sq. m.

As an example, we will determine the amount of tax on a house with an area of 100 square meters. m, an approximate cadastral value of 5 million rubles and a tax rate of 0.1%.

1. Let’s calculate the deduction using the formula: Cadastral value/object area* 50 sq.m. (deduction by type of object)

5 million/100*50=2,500,000 rubles

2. Let’s calculate the tax base: Cadastral value – tax deduction

5 million –2.5 million = 2.5 million rubles

3. Determine the amount of tax based on the cadastral value: (Tax base*tax rate)/100%

2.5 million*0.1/100= 2500 rubles

Thus, the property tax will be 2 thousand 500 rubles.

It is worth noting that it is not so much the area of the property that is important when calculating real estate taxes, but rather the cadastral value. If the cadastral value is up to 10 million rubles, a rate of 0.1% is applied.

You can calculate the property tax yourself by finding out the cadastral value of the property by cadastral number.

As practice shows, with the introduction of this method of calculating real estate taxes, the tax burden on village residents has decreased, in contrast to owners of city apartments.

Attic floor tax – Master of both hands

In accordance with the explanations of the Land Committee No. 39 of July 28, 2004, an attic is the last floor of a residential building in which the ceilings are partially or completely inclined. In this case, the tax is calculated not separately for, but for the entire house with an attic.

When calculating the tax, the inventory value of the house is taken into account, and the tax rate is set depending on this value. Local governments have the right to change the rate established by law.

Let's look at an example of calculating tax on a house with an attic. Technical inventory authorities estimate the cost of a house in accordance with special collections, and then multiply the resulting value by a coefficient established for each region.

According to the information contained in these collections, the estimated cost of 1 m³ of a one-story brick house with an attic is 24.5 rubles. To simplify the calculations, let’s take the area of a one-story house to be 100 m², and the height of the first floor to be 2.5 m. The cubic capacity of the attic floor is calculated individually.

In any case, the volume of the attic will be less than the volume of the first floor.

24.5 x 450 x 56.986 (conversion factor for the Belgorod region) = 628,270 rubles.

20.6 x 430 x 56.986 = 504,782 rubles.

504,782 x 0.75% = 3,785 rubles, i.e.

almost 1000 rubles less compared to a similar house with a full attic.

6. When calculating the tax base, the area of the 4th and 5th floors of real estate is taken to be equal to 90 percent of the area determined in accordance with Part 2 of this article. 7. When calculating the tax base, the area of 6 and higher floors of real estate is assumed to be equal to 80 percent of the area determined in accordance with Part 2 of this article.

9. If the height from the floor to the lowest point of the ceiling on any of the floors of real estate exceeds 6 meters, when calculating the tax base, the area of such floor is taken equal to 200 percent of the area determined in accordance with Part 2 of this article, adjusted by the number of storey coefficients expressed as a percentage in accordance with parts 3-7 of this article.

We invite you to read: Tax on the sale by a citizen of the Russian Federation of an apartment in the Republic of Belarus

The question is timely, but not very difficult.

Let's figure out what problems you may encounter while implementing this project?

First, let's understand the terms.

Our legislation provides for a tax on the attic, but it is more than loyal to this type of superstructure.

Firstly, only a room whose ceiling height is higher than two meters can become a taxable attic.

If your premises are even 198 centimeters high, the tax office will not consider its declarations.

When designing on a finished building, you will have to contact the housing and communal services department, because the weight of the attic may not be supported by the foundation of the house, and any changes in the design of the finished home must be registered.

All other construction and tax conditions are no different from the attic tax in your own home.

single real estate complexes, which include at least one residential premises (residential building); economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary plots, summer cottage farming, vegetable gardening, horticulture or individual housing construction.