Military Mortgage Review

Since 2004, in order to obtain ownership of housing, a serviceman must become a participant in the savings-mortgage system. During his service, in accordance with Law No. 117-FZ of August 20, 2004 “On the savings and mortgage system of housing for military personnel,” funds regularly allocated from the federal budget accumulate in the account.

A serviceman has the right to use mortgage funds to fully pay for the purchase of a home or the down payment on a mortgage. The area of real estate exceeding the limit established by the state is paid for by him from his own funds. They also compensate for the overpayment for the purchase of luxury housing located in large cities.

ATTENTION!

You can participate in the NIS both if there is no residential premises owned by a serviceman, and when the property already has housing or improvement of living conditions is required.

Changes in legislation regarding military mortgages

Over the past years, some changes have arisen in the issues of preferential subsidies for the category of citizens undergoing military service.

Many of them are of fundamental importance:

- the law in 2011 finally approved the mechanism for purchasing housing in the primary markets;

- in 2013, changes appeared regarding contract workers - now they were included in the program list as soon as they signed the first contract;

- in 2014, it is possible to purchase apartments in new buildings that must be accredited by Rosvoenipoteka and meet the requirements of Federal Law No. 214;

Since the same year, insurance of the developer's obligations was introduced, and the insured can be a bank, a private insurance company or an insurance company directly for developers.

Indexation of contributions

Every year, the mortgage loan amount for military personnel is set at the federal level. Based on it, the monthly contribution is calculated, which will be transferred by the state during this year to pay for the mortgage.

REFERENCE!

The payment received annually to the serviceman's account from the federal budget consists of the main part established by the state for the current year and interest received by investing the funds accumulated in the account. Money comes in monthly equal installments.

Pros and cons of military mortgages

As soon as the first 3 years of contract service expire, the serviceman is faced with the question of whether to take out a mortgage or wait until the required amount accumulates in the account. The following arguments speak in favor of taking out a loan:

- You can buy your own home after 3 years of registration.

- It is possible to purchase not only an apartment on the secondary market, but also a new building, a house with land, or several real estate properties, as long as the cost does not exceed the threshold established by law (banks may not approve an additional mortgage, or you will have to pay extra).

- Although it is difficult, it is possible to sell an apartment before its service life expires.

There are also disadvantages:

- If you leave service before the end of 10 years, you will have to return all money received to the state.

- Upon dismissal, federal benefits stop. If the length of service is less than 20 years, the right to additional payments upon dismissal does not mean that they will be enough to fully repay the loan debt. Refinancing will not solve the problem.

- If a serviceman has a large family, it is more profitable to receive a subsidy.

Military mortgage: requirements for an apartment

Here are the requirements the state imposes for the purchase of this type of real estate through the NIS program:

- The apartment must have a separate kitchen, bathroom, toilet.

- The apartment must have connections to the heating system, water supply and electrical networks.

- The condition of the apartment must meet certain quality standards: there should be no wooden partitions in the apartment (to reduce the risk of fires);

- the apartment should not be mortgaged and free from the claims of other persons;

- The roof of the house must be in good condition (this requirement is relevant for apartments on the upper floors);

- windows and doors must be functional (checked during the apartment assessment).

- the foundation of the house must be built of brick, reinforced concrete or stone;

Differences between a military mortgage and a regular one

- Before the borrower is transferred to reserve, his mortgage debt is paid by the Ministry of Defense.

- A loan cannot be issued without concluding a targeted loan agreement with Rosvoenipoteka.

- The amount of the down payment cannot exceed 1.4 million rubles. And the loan itself should not be more than 3.5 million rubles.

- The mortgage is issued to a military personnel between 21 and 45 years of age.

- The average area of purchased housing cannot exceed 54 m2.

- When applying for a military mortgage, a tax deduction is received only from the amount that the serviceman paid from personal funds.

- Due to the addition to the list of authorities involved in resolving the issue, the terms for the military are longer than with a regular mortgage.

- When purchasing housing with a military mortgage, the property can only be registered in the name of a military personnel.

- When taking out a military mortgage for a share in construction, you will have to take into account restrictions on the choice of developer and house.

- Not every bank works with military mortgages.

- The loan rate for military personnel is in most cases lower than that of a conventional mortgage.

- When applying for a military mortgage, banks pay little attention to the borrower’s credit history.

Which commercial organizations issue mortgage loans to former military personnel?

Military pensions begin at 40-45 years of age. Not all banking institutions offer a military pensioner to take out a mortgage. Here are the most popular institutions where those formerly liable for military service apply.

WE RECOMMEND: How to get a tax deduction when buying an apartment with a mortgage for a pensioner

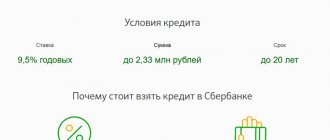

Mortgage for military pensioners in Sberbank

The rate is at 9.2% (). There are no age restrictions. You can take out a loan up to 85% of the final cost of housing. Then the down payment amount will be 15%. It is almost identical to other banks.

Rosselkhozbank

The interest rate is lower than in Sberbank - 8.75% per annum. But there are age restrictions. The borrower must be no more than 75 years old at the time of obtaining the mortgage. The maximum borrowing limit is up to 2.4 million rubles. The down payment is 10%. This bank considers housing options mainly in the primary market ().

Sovcombank

Military pensioners who contact this organization will receive the lowest rate compared to similar banks - from 7.9% per annum (). The age threshold has been increased to 85 years. But the loan amount should not exceed 30 million rubles. Down payment - 10%.

Alfa Bank

Interest rate - from 9.69%. There are no age restrictions for obtaining a mortgage. You can request from the bank an amount of no more than 50 million rubles by paying a down payment of 20%.

VTB Bank

The borrower is issued a loan of up to 2.84 million rubles at 8.8%. The first payment will be 15%. The loan is available to military pensioners of any age category ().

Promsvyazbank

You can get loan approval in this structure at 8.85% (). The organization will provide a loan in the amount of no more than 2.815 million rubles, upon making an initial payment of 10%. The age of a pensioner must not exceed 65 years.

WE RECOMMEND: The procedure for obtaining a mortgage for pensioners at Gazprombank

Terms of military mortgage

- The maximum loan amount is 3.5 million rubles. With the consent of the lending bank, a serviceman can take out a mortgage for a larger amount, but will have to repay it at his own expense.

- Housing can be purchased in any city.

- The serviceman must repay the loan before he turns 45 years old.

- According to the terms of the lending bank, the housing becomes the property of the military man after he repays the loan. According to the conditions of the state, you can become the owner of the purchased housing after receiving the right to own a subsidy.

The loan is fully repaid by the state regardless of the amount of the remaining amount in the following cases:

- 20 or more years of service;

- dismissal after 10 years of service upon reaching the maximum age allowed for the position;

- in the event of the death of a serviceman (ownership rights pass to members of his family);

- upon dismissal after 10 years of service due to health reasons, layoffs or family reasons.

How to get a military mortgage loan?

- Military personnel who have served 3 years under a contract in the RF Armed Forces from the moment of registration in the NIS are eligible to receive a loan.

- The maximum loan size is regularly adjusted by Rosvoenipoteka.

- To receive a targeted housing loan, a serviceman must submit a report to the headquarters of his unit to receive a certificate of the right of a participant in the savings-mortgage system to provide a targeted housing loan. The maximum period for which targeted loans and credits are issued is determined by the moment the military personnel reaches their 45th birthday. The rate cannot be more than 12%.

- Having selected housing in accordance with the requirements of the Ministry of Defense, the borrower must contact the selected bank and obtain approval of the application.

- The mortgage is issued after concluding a targeted loan agreement with Rosvoenipoteka.

- The purchased property becomes collateral.

A package of documents for purchasing real estate on the primary market

After selecting an object, an application for a mortgage loan is completed at the bank using the documents provided. After the mortgage loan is approved by the bank, a personal account is opened in the bank to transfer funds to the TSL (Targeted Housing Loan - money accumulated on the NIS Certificate).

The bank may require additional documents that must be collected to conclude a mortgage loan agreement.

Contracts are concluded:

1. Loan agreement between the bank and the military man

2. TsZHZ (targeted housing loan) agreement between the military personnel and Rosvoenipoteka

3. Real estate insurance contract

4. Preliminary agreement for participation in shared construction

There is also a mandatory assessment of the property by an independent insurance company - a report on the assessment of the property is provided to the bank.

After receiving the registered share participation agreement, a copy of the agreement is transferred to the bank, the bank transfers the approved loan amount and the funds of the central housing estate to the developer’s account.

Documents regarding the transaction are sent to the Federal State Public Institution Rosvoenipoteka. After completion of construction, an extract from the Unified State Register is sent to the Federal State Public Institution Rosvoenipoteka, confirming ownership of the apartment.

The package of documents for purchasing an apartment with a military mortgage on the secondary market is much broader.

After approval of the loan from the bank, for the selected property you must provide:

• A copy of the certificate of ownership or an extract from the Unified State Register

• Cadastral passport for real estate

• Technical passport containing information about the condition of the house - year of construction, wall material, degree of wear, number of storeys

• Extract from the house register or certificate of registered persons

• Certificates of absence of debt on utility bills

• Property valuation report

• Notarized copies of passports of sellers - participants in the transaction

• Consent of the seller's spouse to sell the home or a notarized statement from the seller about the absence of a registered marriage;

a copy of the consent of the guardianship authorities (in cases provided for by law);

• Certificate of absence of property tax debts;

Each bank's required package of documents may be slightly different.

Buying an apartment with a military mortgage

- After serving 3 years under a contract, a serviceman has the right to submit a report with a request to provide him with a targeted housing loan.

- After familiarizing yourself with the conditions for military mortgages in different banks and receiving a certificate of entitlement to a housing loan (valid for six months), you can choose an apartment, taking into account the requirements of the Ministry of Defense.

- After receiving approval from the selected financial institution for a loan application, an agreement is concluded between Rosvoenipoteka (it will pay the loan from the transferred funds from the federal budget) and the military personnel.

- A serviceman must immediately pay at least 10–20% of the cost of housing using a targeted housing loan (no more than 1 million 400 thousand rubles).

- Having signed the mortgage loan agreement, they complete the purchase and sale transaction of the selected apartment.

- Since the home becomes the subject of collateral, insurance is taken out for it.

Mortgage for military pensioners in Sberbank

If for some reason a serviceman did not purchase real estate, but participated in the NIS program, he can use the accumulated funds after retirement. To do this, you need to simultaneously submit an application for a mortgage to Sberbank and a report on the transfer of savings to the commander of the military unit where your last duty station was located. In this situation, the loan will be approved fairly quickly, and the money can be used for the down payment, monthly payments and repayment of loan debt. A military mortgage with Sberbank online can be issued using the DomClick service.

Recommended article: Family military mortgage in 2021 – conditions and banks

Rate the author

Share on social networks

Author:

Maria Yurievna Sokhan

Date of publicationDecember 26, 2018February 25, 2019

Conditions upon dismissal

After retirement, government payments on the mortgage loan stop. But if the right to a mortgage during the service was not used or part of the funds accumulated during the service remained in the account (a military man can take out more than one mortgage loan), then after submitting the report, the mortgage amount will be transferred to the soldier’s account within 3 months.

This is possible in the following cases:

- length of service of 20 years;

- transfer to the reserve after 10 years of service if the serviceman and his family members do not own any real estate;

- in connection with decisions made at the place of duty (transfer), for health reasons or family circumstances.

What is (general provisions)

The program has been in operation for more than ten years. In accordance with it, each military man is offered an individual mortgage lending program. When forming it, various benefits are taken into account.

In essence, a military mortgage is the conclusion of a classic mortgage agreement with one of the banks. A special feature is that the initial payment is financed from budget funds. The following payment periods are paid monthly by the Ministry of Defense of the Russian Federation.

Stages of registration:

- Submitting a report to participate in the savings system. Information about the applicant is entered into a special register. Officers do not have to file a report. The command creates lists of applicants and creates a personal card for each. The decision to provide housing does not depend on the presence of children in the family or other real estate. The main condition for obtaining it is long-term service.

- The lists are submitted to a higher authority, where all information is carefully checked. The lists are then forwarded to the Housing Department.

- Each participant receives written notification with an individual registration number within three months. An account is opened in the name of the applicant to which funds are credited.

The government transfers money to the account every year for twenty years. Savings can only be used after three years of continuous participation in the program.

It should be noted that the money accumulated over twenty years does not have to be used to purchase housing; at the end of the specified period, the military man can spend it at his own discretion.

The participant has the right to dispose of funds upon dismissal for health reasons or other reasons.