Is it possible to buy a private house with land using a military mortgage?

The savings mortgage system (NMS) has been developed in Russia for quite a long time. Initially, within the framework of this state housing loan program, military personnel could only purchase an apartment in a multi-story building. However, over time, lending conditions for the military have improved and today the answer to the question of whether it is possible to buy a house with a military mortgage is positive.

The sequence of actions for a citizen to purchase a private house with a land plot on a military mortgage:

- A citizen of the Russian Federation signs a contract with the Ministry of Defense for military service and immediately submits a report for registration with the NIS;

- For 3 years, the state annually transfers funds to a special savings account of a system participant (during this entire period, the serviceman cannot use the savings);

- After 3 years, the NIS participant submits a report addressed to the commander of the military unit in which he is serving, with a request for the issuance of a special NIS certificate confirming the presence of a specific amount in the savings account (the validity period of this document is limited - 6 months);

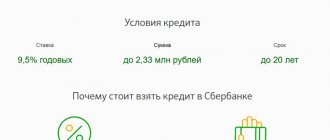

- During the six months during which the certificate is valid, the serviceman must have time to find housing and apply for a mortgage loan in one of the Russian banks that provide funds under this program (for example, Sberbank or Uralsibbank);

- The selected bank is provided with a package of necessary documents to obtain a mortgage loan;

- The buyer must formalize a preliminary agreement with the seller on the purchase/sale of a house under a military mortgage;

- Next, a special bank account is opened to transfer the down payment for housing;

- The next step is for the serviceman to sign a mortgage agreement with the creditor bank, which sets out all the conditions for the provision of borrowed funds;

- All collected documents (certificates, contracts, etc.) are sent for verification to Rosvoenipoteka. If approval is received, the main transaction for the purchase/sale of real estate can be concluded;

- After this, in order to become the legal and sole owner of residential real estate, the serviceman submits all the necessary documents to the Registration Chamber.

It is definitely recommended to immediately insure the purchased property.

How to buy a house or townhouse with a mortgage for military personnel

If personal funds and the size of the subsidy allow, a military man has the right to purchase a private house with a plot under it or a townhouse with 1-2 acres of land. Ready-made townhouses are positioned by developers and banks as new buildings, so purchasing them with a preferential mortgage will not be difficult.

Read also:

Toy store, sale and purchase of ready-made business

However, when buying houses, duplexes and townhouses, there is an increased risk of running into fraud or encountering problems with paperwork. The question may arise about the legality of development on a certain site, legal disputes with suppliers or the city administration. Therefore, before you buy a private house with a small plot, carefully check the documents for the land and building.

The acquisition of a separate land plot within the framework of mortgage lending for military personnel is possible. This procedure will require more time to verify cadastral documents than if you had to buy an apartment from a developer accredited by a bank. The down payment and rate will also be higher, and the lending limit will be lower, since such transactions are characterized by increased risks.

If a military man abandoned construction plans and decided to buy a finished house with a plot of land from a private individual or a developer company, he will need:

- Draw up a report on registration in the NIS system when concluding a contract for service in the RF Armed Forces. After completing the documents during the subsequent years of contract service, a tranche from the Ministry of Defense will be transferred to the employee’s personal account at the beginning of the reporting period, which can only be used to improve living conditions.

- After 3 years, receive a NIS participant certificate. Having served a specified period of time under the contract, a military man has the right to submit a report to the commander of his unit to receive government housing guarantees. The document is valid for 6 months.

- Select an offer and contact the bank. You can start searching for houses on your own or contact a real estate agency. After selecting an option and preliminary checking the documents, contact the financial institution to coordinate the transaction with the Ministry of Defense.

Read also:

Ready business: Water delivery service

Any contract soldier who has served in the Armed Forces for more than 3 years has the right to buy a built house with a land plot and communications within the framework of a military mortgage. In this short period of time, both a warrant officer and an officer who has signed a long-term contract with the Ministry of Defense can improve their living conditions. Participation in the savings system made the purchase of real estate accessible to every military man.

Requirements for a house purchased with a military mortgage

A military man and his family can choose their future residential home on their own or by seeking help from an agency specializing in such services. The main thing is that the property meets the requirements of the credit institution and Rosvoenipoteka.

Purchasing a private home using a military mortgage is practically no different from a similar transaction under standard mortgage lending programs for civilians.

As a rule, any financial and credit organization carefully checks not only the borrower himself, but also the liquidity of the purchased property. Basic requirements for the property:

- A house purchased with a military mortgage should not be in disrepair, i.e. it must have all the conditions for comfortable and safe living;

- The property must not be pledged or have other encumbrances;

- The house must be completely completed, i.e. ready for immediate occupancy and permanent residence;

- The object should not be located far from a nearby populated area; access roads must be accessible to it;

- There should be no additional buildings on the adjacent site;

- The residential building must be connected to all communication systems necessary for comfortable living: electricity, gas, water, sewerage, heating;

- The layout and living space must comply with officially registered technical documentation;

- The land plot on which a residential building is built must have one of the following statuses: dacha non-profit partnership (DNP), gardening non-profit partnership (SNT) or individual housing construction (IHC).

Search for new buildings and apartments with military mortgage

According to a military mortgage, there are significant requirements for an apartment:

- It must be located on the territory of the Russian Federation, but is not tied to either the region of registration or the place of service.

- Apartments in dilapidated, unsafe, or demolished buildings will not be approved.

- This cannot be housing with an encumbrance (arrest, pledge, etc.).

- New buildings are purchased only under an equity participation agreement.

You can choose housing on the secondary market or in a house under construction. There is a restriction for new buildings - it can only be a house from the approved list, where the apartments meet all the requirements of the bank and Rosvoenipoteka. With a military mortgage in a house under construction, ready-made apartments can be purchased with finishing or at the excavation stage, it does not matter.

Is it possible to use a military mortgage to build a house yourself?

The legislation does not provide for the construction of private houses with a preferential military mortgage, even if the land plot for development meets the required status. This ban is due to the fact that the financial institution and Rosvoenipoteka are not able to track the actual consumption of building materials for construction.

The only option to independently build your own house using government funds transferred to a special savings account under the NIS program is to reach retirement age.

According to the terms of the program, if a serviceman has served for 20 years or more, i.e. has reached retirement age and retires from the reserves due to length of service, he has the right to withdraw money from the savings account, incl. in cash.

Accordingly, he can spend them on any needs, incl. for private housing construction. The former serviceman will no longer need to report to anyone for the expenditure of these funds.

Is it possible to purchase just a plot of land using a military mortgage?

The goal of the state program of mortgage lending to military personnel on preferential terms is to provide military families with housing ready for living. Therefore, a military mortgage does not allow you to take out money to build a house yourself or just buy land. There must be a ready-made private house or townhouse on the site.

If a serviceman plans to build a house with his own funds, he can use the funds accumulated under the NIS program to purchase a plot of land with a small and inexpensive house, and then engage in independent construction. But, the main thing is that such a building fully complies with the requirements of Rosvoenipoteka.

No regulatory document specifies requirements for the size of a residential building. Therefore, you can buy a small house with a large plot, build a large residential cottage nearby, and then simply demolish the old building.

Possible difficulties when buying a country house with a plot of land using a military mortgage

A military mortgage for the construction of a private house has certain features.

Every serviceman who decides to take advantage of a preferential mortgage program to purchase a private house with land must be prepared for certain difficulties of this procedure.

What difficulties await you when buying a private home with a plot of land:

- Interest rates on such real estate are higher than on a mortgaged apartment;

- All additional costs accompanying the procedure for buying/selling real estate increase, as a rule, by 2 times. This is due to the fact that two different objects (house and land) are acquired at the same time;

- The serviceman will have to collect a separate package of necessary documents for a residential building and a plot of land. An expert assessment of the value is also carried out separately for each property;

- To complete such transactions, financial institutions require mandatory insurance of residential real estate. Moreover, the amount of insurance for a private house is much higher than the insurance premiums for an apartment. This is associated with high risks of damage or loss of property in private homes.

Despite all the difficulties listed above, it is quite possible to purchase a private house with a military mortgage. The main thing is that the property meets the requirements of the credit institution and Rosvoenipoteka, and after purchasing and registering ownership of the property, the serviceman will be able to repair the house, remodel, complete the premises, etc. at our own discretion.

How to build a house with a military mortgage

Individual construction of private households using credit loans is impossible for employees of the Ministry of Defense. The requirements of current legislation limit the targeted spending of funds. The contractor has the right to buy residential real estate of the following type:

- Secondary market apartments in multi-storey buildings;

- Apartments from developers at the construction stage;

- Finished private houses, townhouses, duplexes with a plot.

Read also:

Own mini bakery. Profitable business from scratch

The option of spending government funds on the construction of private housing is excluded. There are several reasons for this decision by legislators. To avoid corruption and misappropriation of public funds, the Ministry of Defense controls every penny of transferred money. With the interaction of a bank, NIS and a military man, this is easier to do than with the participation of additional parties: contractors and subcontractors involved in building a house, suppliers of building materials and other organizations.

It is important to know! You should not consider the paragraphs of Federal Law No. 117 as a limitation of your rights. Understanding the unstable financial situation in the real estate market, the state limits the risks of freezing private construction. Such an object cannot be used as collateral when issuing a mortgage from a bank, since the owner will only have documents for the land plot, the cost of which does not cover the size of the loan.

Also, the law does not allow military personnel to build private houses on relatives’ plots, or to arrange their purchase with a mortgage or at an inflated price. The purchase of real estate from relatives may be regarded by the NIS as an attempt at fraud, and therefore government assistance to the military will be denied.

Important to remember! However, the law provides for one exception. For contract soldiers of the Ministry of Defense, whose service lasts more than 20 years, taking into account benefits, savings can be spent entirely at the personal discretion of the military man. In this case, individual construction is possible.