Thanks to the funded mortgage system, contract military personnel have an excellent opportunity to resolve the issue of purchasing housing. Federal Law 117 describes the rules applicable to the savings mortgage system for military personnel. The required amount of funds for the purchase of housing is provided by the state. Participants in mortgage lending perform military service to pay off the debt. This scheme helps you choose the right housing anywhere in Russia. The state also has advantages from this - there are no long queues for purchasing real estate. The mortgage loan will be paid by the political organization, so the possibility of delays will be excluded.

Features of the savings-mortgage system (NIS)

The NIS mortgage lending scheme was developed in 2004, after which the state introduced Federal Law 117. All powers for the activity of the adopted system were assigned to the Federal State Institution Rosvoenipoteka. Military personnel can apply for a housing loan to purchase property until the end of their service life after 3 years of participation in the NIS.

There are two main ways to buy your home:

- A citizen undergoing military service has the opportunity to obtain a mortgage to purchase real estate with a land plot by contacting an NIS partner lender.

- On the personal account of a contract serviceman, savings are increased until he needs them. The entire amount from the account can be spent on purchasing your own property. If necessary, you are allowed to add personal money.

Military personnel who comply with the following list of requirements can use the capabilities of the NIS:

- Employed for 3 years.

- They send an official document addressed to the commander regarding the addition to the NIS membership.

- They accept a notification document about the inclusion of a candidate on the list of military personnel.

- The new candidate is assigned an individual registration number, which cannot be changed even if he is transferred to another region to perform his duty of service.

- Each participant must receive a Certificate granting the right to purchase property under the state program.

- A current account is opened in a banking institution, owned by the NIS participant himself for the subsequent transfer of the financial part.

- Conducting a purchase and sale transaction for the acquired property.

Important! It takes approximately 2 months to fulfill all these requirements.

Participation in the NIS is provided only for contract military personnel

Only military personnel performing military service under a contract can become participants in the NIS.

Military service, and therefore military mortgage, is provided for in the following government bodies:

⭐ Ministry of Defense of the Russian Federation (Ministry of Defense of Russia, code 10) ⭐ Federal Agency for Special Construction (Spetsstroy of Russia, code 14) ⭐ Federal Service of the National Guard Troops of the Russian Federation (Rosgvardia, code 20) ⭐ Ministry of the Russian Federation for Civil Defense, Emergency Situations and disaster response (EMERCOM of Russia, code 30) ⭐ Federal Security Service of the Russian Federation (FSB of Russia, code 40) ⭐ Federal Security Service of the Russian Federation (FSO of Russia, code 50) ⭐ Foreign Intelligence Service of the Russian Federation (SVR of Russia, code 60) ⭐ Main Directorate of Special Programs of the President of the Russian Federation (GUSP, code 80) ⭐ General Prosecutor's Office of the Russian Federation (Prosecutor General's Office, code 81) ⭐ Investigative Committee of the Russian Federation (IC of Russia, code 82)

List of restrictions in NIS

Unfortunately, not all candidates can be included in the register of participants in the savings and mortgage system, as there are certain restrictions:

- Today, the largest amount that a participant can use to purchase housing is 2,465,000 rubles. If the purchased property costs more, the difference in cost is paid by the serviceman himself with his own funds. In addition, it is very important that the lender does not oppose the acquisition of this property.

- On the date of full settlement of loan obligations, the military personnel must be no more than 45 years old. The loan term starts from the date of conclusion of the financial agreement and ends at the age of 45 years.

- The acquired property is subject to encumbrance on the part of the creditor and the state. As you know, only after the full payment of the loan is completed, a person becomes the full owner of the property. The security for the mortgage agreement is the property.

Important! If a serviceman has his own home, the right to be included in the NIS is not lost.

Every year, state money is transferred to the participant’s bank account in the amount prescribed in the law on the budget of the federation. A serviceman who has taken out a mortgage and purchased real estate with loan funds must ensure a monthly receipt of funds from his bank account. The amount should be 1/12 of the annual savings. This money is transferred to the lender to pay for the mortgage. The accumulation of money occurs only after timely compensation of monetary obligations to the bank.

Accumulation system

You can get a military mortgage only after the serviceman becomes a full member of the NIS.

From the moment a report is submitted to include the applicant in the list of recipients of budget funds for the purchase of housing, the process is considered to have begun. Rosvoenipoteka specialists create a current account in the name of the report submitter and funds begin to be credited to it. Receipts are made once a year, and the amount is determined by government officials, taking into account indexation over the past period.

From the moment of initial registration with Rosvoenipoteka, at least three years must pass before a contractor can begin processing a military mortgage in the chosen bank. But the maximum period of savings is determined only by the NIS participant himself and the time of his retirement.

The state program provides for a strictly developed savings system. Their amount does not depend on the time of service, military rank and the amount of allowance; it is the same for all NIS participants.

Annual contribution amount

In 2005, for the functioning of the new state program to provide housing for military personnel, the amount of subsidies per participant was established. Subsequently, the amount of state aid was annually revised and increased due to inflation. If we present the past years in full, the increasing trend looked like this:

- 2005 – 37,000 rubles.

- 2006 – 40 600.

- 2007 – 82 800.

- 2008 – 89 900.

- 2009 – 168 000.

- 2010 – 175 600.

- 2011 – 189 800.

- 2012 – 205 200.

- 2013 – 222 000.

- 2014 – 233 100.

- 2015 – 245 800.

- 2016 – 245 800.

- 2017 – 260 141.

- 2018 – 268 465,6.

Subsequently, amounts will be indexed as necessary. Part of the savings is used as a down payment, and the rest is used to pay off monthly loan installments.

Methods for checking savings

The amount of savings of a serviceman depends on two factors:

- The size of budget transfers.

- Duration of participation in the program.

The start of the countdown for enrollment in the ranks of NIS participants is an individual date. Budget funds are transferred not in a single amount, but every month in the amount of 1/12 of the established annual transfer. All together, this does not allow you to offhand determine the amount of accumulated funds in the account yourself.

A serviceman has the right to check at any time exactly how much is in his account. This can be done in several ways, but each of them assumes that the participant knows the individual number assigned to him. This information is provided by Rosvoenipoteka in writing. If for some reason the letter is lost or not received, you can look up the number from the head of the unit, since the data on the assigned numbering is attached to the serviceman’s personal file and is stored throughout the entire period of service and even after retirement.

Having the registration number in hand, the contract soldier can submit a report to the head of the unit with a request to provide him with data on existing savings. This method takes too long, since the answer comes within a month. There is an option that allows you to obtain information much faster and without the participation of your superiors in this process. To do this you need:

- Register on the Rosvoenipoteka website. Registration involves creating a personal account with entering the personal data of the NIS participant.

- In your account, select the “Requests” tab, and fill in all the lines in the field that appears.

Once the required data has been entered and the request has been sent, a response regarding the accrual amount will be received within 10 calendar days. It will be delivered by email and to your personal account on the Rosvoenipoteka website.

Basic rules of Federal Law 117 on military mortgages

117-FZ “On the NIS of housing provision for military personnel” indicates the permissible categories of persons who are members of the NIS. The law also limits the time limits for exercising their rights. Typically, the time frame takes 3 years from the date the service member joined the NIS. Departments that have sufficient authority to properly regulate the functions of military mortgages are also noted.

Federal Law 117 describes the regulations for spending the budget allocated under the state program. According to the law, there are certain sources that serve as the basis for the formation of savings in a personal account. The law explains the list of rights and obligations of the full membership of the NIS, including relatives from the family of deceased participants.

Military personnel who are members of the NIS have the following advantages:

- the likelihood of approval for a military mortgage is much higher than a regular long-term loan;

- the amount of overpayment on a loan for military personnel is much lower;

- the participant can purchase residential property under the NIS in any region of Russia, despite the place of military service;

- While the service life continues, the loan is paid from the state account.

The main disadvantage of the program is that upon dismissal, a serviceman without the right to spend the accumulated amount will be required to repay in full the entire amount of the mortgage debt.

Important conditions of the savings-mortgage system

There are a number of characteristic features of NIS that every candidate wishing to become a participant in the program should become familiar with:

- Based on the explanations of Federal Law 117, a serviceman is obliged to register the acquired property in his name.

- Military mortgages are allowed to be paid for with maternity capital savings.

- If both spouses in a family serve in the military, they have the right to combine their parts of savings and purchase real estate as shared ownership.

- An NIS participant can buy property from a relative if there is the consent of the creditor.

- The serviceman retains the right to official property when the apartment was purchased outside the locality where he served.

- When a participant has used personal funds to pay off a military mortgage, he retains the right to file a return for a tax deduction.

- The NIS entity must enter into a risk insurance agreement. Thanks to this, it will be possible to prevent troubles in the event of deprivation of the right to receive a funded amount or dismissal for any reason, with the exception of deteriorating health.

- Military mortgage funds are not allowed to be spent on building a house or carrying out renovation work. The solution to this situation will be to receive the entire accumulated amount at the end of the service life and its further use.

- In the case where a military man began his service at the age of more than 25 years, upon reaching 45 years of age, an additional payment of funds is due. Its calculation is made based on the number of months that are not enough to reach 20 years of military service. The number of months must be multiplied by the amount credited monthly to the serviceman’s bank account.

Using savings

The Law clearly addresses the procedure for using accumulated funds. According to legislative wording, they are allowed to be used only for the following purposes:

- Purchase of residential real estate;

- Acquisition of land with a residential building;

- Payment of the first loan installment in accordance with the terms of the military mortgage law;

- Payment of some part of the money during shared construction;

- Closing a mortgage.

These are the purposes of using gradual savings. In addition to them, the law provides for additional certain conditions. Military personnel are allowed to use available funds only 3 years after being enrolled as participants in the NIS. You also need to know that the purchased real estate will certainly become the subject of bank collateral.

At the same time, the Law regulates situations when members of the NIS are registered in an official marriage. Then they are allowed to separately enter into an agreement for a targeted loan. Each spouse is required to participate in the NIS for at least 3 years. Real estate acquired in this way becomes joint property.

The standard form of lending and the procedure for its execution are provided for by a separate government legislative act. The authorized body from the state provides a targeted loan for the entire period of military service of the applicant. During this period of time, such a loan is considered interest-free.

At the same time, the Law provides for the procedure for repayment of a targeted loan. Its repayment is made by a state authorized body if the grounds described by current legislation arise. For them, the main requirements are the following parameters:

- The duration of service must be more than 20 years;

- If the military personnel is discharged after serving at least 10 years;

- When a military man has already reached the maximum age limit for further service;

- If he is unable to perform professional duties due to illness.

Look at the same topic: Mortgage in RosEvroBank: conditions and interest rates in [y] year

When a soldier dies or is declared missing, his relatives receive the accumulated amount. If a serviceman leaves service early without valid reasons provided for by law, he is obliged to return the money previously paid by the authorized body for the monthly payments made. Then a clear repayment schedule is drawn up; the repayment period cannot last longer than 10 years.

How to get a military mortgage

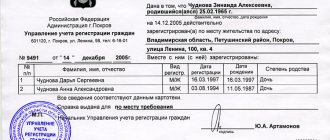

To receive credit funds, a person must provide a personal Russian passport, as well as a Certificate of Entitlement to a Housing Loan. Let's consider the sequence of actions to obtain a military mortgage:

- The participant in military service independently selects the property, as well as the lender. The real estate can be different types of housing: an apartment in a new building, secondary property, a house on land or a townhouse.

- An initial agreement is concluded between the parties, confirming the transfer of the finished property from the seller to the buyer. An agreement for equity participation is also drawn up with a construction company when purchasing an apartment in a building under construction.

- The next stage is signing an agreement with a credit institution. A current account is opened for the client.

- Concluding a housing loan agreement with Rosvoenipoteka. As a result, funds from the savings reserve are credited to the current account at the banking institution. This limit of funds will be needed to make the entry fee.

- Registration at the MFC, taking into account the presence of a double pledge in favor of government agencies and a banking institution.

- Providing the bank institution with a registered certificate confirming ownership and an extended extract from the Unified State Register of Real Estate.

- Conclusion of a real estate insurance contract.

- The lender transfers the amount of funds to the seller of the apartment.

- The serviceman transfers documents for real estate and registration of rights to Rosvoenipoteka. In turn, this company transfers monthly funds automatically to the lender’s current account. This is carried out at the expense of funds received by the NIS participant.

The calculation of a mortgage loan is carried out on such a principle that the installments are greater than the monthly payments, and also that the military personnel do not accumulate debt.

Amendments to Federal Law 117 On the savings and mortgage system for military personnel in 2019-2021

In 2021, it was established that members of the private and non-commissioned personnel who entered military service on January 1, 2021, will be included in the mandatory list of NIS participants. Clarifications have also been made regarding military personnel who are not NIS participants and who have received subsidies/housing. These persons do not have the opportunity to join the NIS.

Already in 2021, some amendments were again made to the Federal Law. In the event of the death of a person who is a member of the NIS, his parents (adoptive parents) have the right to savings and additional cash payments in connection with the death of a military man, if he does not have a family. The state pays off loan debt in full in a lump sum payment.

Main reasons for leaving the program

Russian legislation provides for two options for exiting the NIS:

- forced;

- voluntary.

Let's consider the legitimate reasons that entail the exclusion of a participant from the register:

- the military man was fired before he reached retirement age for an unjustifiable reason;

- death due to illness, accident or other reasons not related to military duties;

- in the case where a military man is declared missing or died during a search;

- provision of housing for the entire period of military service from the cash reserves of the state budget;

- secondary entry into service from the reserve list, when previously the military man was removed from the register on the previously stated grounds. If a military man was sent by transfer to another region in active status, he is included in the NIS at the new location.

A military man can refuse to participate in the system of accumulating funds for a mortgage, either voluntarily or through the court.

How to participate in the program

Not everyone is allowed to participate in the benefit program. Military mortgage is targeted, it applies only to certain categories of citizens:

- Career military personnel who began serving in 2005.

- Military personnel who returned from the reserves to serve after 2005.

- Persons serving on long-term contracts.

- Extended conscripts who entered into a re-contract after 2005.

- FSB employees whose status is equal to military personnel.

- Employees of the Ministry of Emergency Situations serving in rescue paramilitary units.

- Military personnel who went into the reserve due to deterioration in health due to injury, occupational disease, or work injury.

- Ministry of Defense employees who were fired during the disbandment of their military unit, after the termination of their contract.

Civil servants of paramilitary units, soldiers and sergeants in conscript service do not fall into the category of beneficiaries. Those who are entitled to it have the right to use it only 3 years after the conclusion of the contract. They need:

- Submit a report notifying your desire to participate in the program;

- Provide a photocopy of your passport and a copy of the contract;

- Expect to be included in the register and receive a personal registration number for an open personal savings account;

- Includes the military personnel in the current register of the housing department;

- After 3 years, the service member can use the funds in his account to pay the down payment of the mortgage.

When a serviceman breaks a contract early, he loses benefits and is removed from the register and his personal account is closed. At the same time, his rights to the already accumulated funds disappear. This rule does not apply to military personnel who served for ten years before breaking their contract. Then they can use the saved money to pay the mortgage.

Look at the same topic: Review of the mortgage lending market in Russia in [y] year