Why insure your apartment?

There are a lot of options for insurance cases when real estate may suffer serious damage or even be destroyed. A correctly drawn up insurance contract can cover most of the probable insured events applicable to a private house or apartment.

Fire insurance is a very terrible threat, since not only property can be damaged, but also the very life of the property owner. At the same time, when a fire occurs, not only the ignition source itself is at risk, but also its neighbors.

It is enough to look at the news reports to see with your own eyes: household gas explosions are a reality of our days. In this case, the apartment or house risks being completely destroyed without the possibility of subsequent restoration.

Flood insurance is a risk that all home owners bear. In this case, you may be flooded or you yourself may flood your neighbors. In this case, household items and decoration suffer. Given the state of communications in most apartment buildings, the risk of flooding is another reality of the property owner.

Not everyone understands the risk a robbery poses to real estate. But burglary is a threat of damage to decoration, destruction of windows or doors, and thieves often set fire to robbed apartments to hide traces of the crime.

A risk that does not appear so often in insurance contracts, but at the same time is very common, is the risk of mechanical damage. When carrying out repairs in a neighboring apartment, damage may be caused to load-bearing structures, adjacent partitions, and communications. At the same time, not only the apartment can suffer from unfortunate neighbors, but also a private house. For example, neighbors may “drop” a cut tree on your roof or damage your fence.

Unintentionally, the apartment owner or tenants can cause damage to neighbors, which in insurance practice has a special name: insurance of the risk of civil liability for causing harm to third parties. The cause of damage in this case can be anything, the main thing is the amount of compensation under the contract.

Natural disasters can cause a lot of trouble: cause a short circuit and subsequent fire, damage to the roof, cracks in the walls or destruction of the building due to an earthquake, and so on. An apartment building or a private one can suffer, since everyone is equal before the elements.

The realities of our lives are such that we have to seriously think about such things as terrorist attacks, because of which the entrance to an apartment building can be destroyed or an entire residential block can burn down.

What is title insurance

Title insurance is insurance against the risk of loss of title to real estate.

Title insurance when purchasing a home is recommended for many reasons. But in itself it is not a panacea for all possible cases when former owners and others make claims against a purchased apartment. However, in combination with a competent inspection of real estate, with the help of title insurance, you can significantly reduce the risk of losing both the purchased residential property and the money for it.

A scenario for which the buyer is not ready

When choosing an apartment, pay attention to its location, layout, cost, and neighbors. Of course, all this is important. But as practice shows, buyers check the legal purity of previous alienation transactions superficially. The worst option is to take the seller or his realtor/representative’s word for it (we encounter this approach from buyers almost every day in practice).

A typical situation is that a family buys an apartment, manages to renovate it and move in. Six months to a year after the purchase and sale, a relative of the seller appears, who at the time of the transaction was serving a sentence in prison. You won’t see this in a classic registration certificate, because the law on the protection of personal data allows you not to disseminate information about such persons...

For reference! Deprivation of liberty gives the right to the relatives and friends of the convicted person to forcibly discharge him from the apartment. In addition, he may miss the deadline for entering into inheritance for valid reasons.

A situation arises where a released relative demands reinstatement of his rights. The reasons are different, but in practice, the claims of such persons are often satisfied, and the purchase and sale transaction is declared invalid. Buyers find themselves in a difficult situation: they are obliged to return the apartment, but the seller, for various reasons, does not return the money (he simply no longer has it).

It is in such cases that title insurance will help you get your money back . It is especially relevant for transactions on the secondary real estate market.

Well, of course, it is important to check real estate before purchasing from experts , and not from a “familiar realtor” who will promise that everything is in order, but in case of claims it will not matter.

Transaction support by SPIC specialists

Transaction support by SPIC specialists

Guarantees you

security of the transaction and preparation of all documents

Where can I insure my apartment?

Few people are willing to make risky deals that could result in them losing their home. Therefore, you should not experiment in choosing an insurance company. You can only entrust apartment insurance in St. Petersburg to a responsible company with an impeccable reputation. At the same time, you don’t need to have connections in high circles to recognize a reliable insurance company. A reliable company does not hide information about itself. All information is presented on the official website, including contact information and a list of services provided.

Request a call back

Choosing an apartment insurance program

When choosing an insurance program for your own apartment in St. Petersburg, you need to correctly determine the object of insurance:

- Supporting structure (frame) of the apartment;

- Engineering equipment, interior decoration, heating, ventilation, power supply systems, etc.;

- Movable property: furniture, equipment, valuable items, etc.;

- Civil liability to third parties, in particular for damage to property, as well as the life or health of neighbors;

- "All inclusive".

The cost of the contract directly depends on the selected object. However, if the insured event does not coincide with those listed in the contract, compensation will not be paid. The choice is yours what exactly to insure. Only an all-inclusive agreement will help protect yourself from all risks.

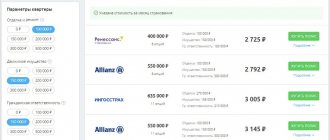

What is the price?

The value of the insurance contract is influenced by the price of the insured object and the length of the list of risks. The calculation is performed according to a certain formula, which necessarily takes into account the following components:

- Area of the property;

- Age of the house or apartment;

- Availability of security alarm;

- Deterioration of utility networks;

- Age of repair and current technical condition of the property.

Taking into account all these factors, the amount of the annual premium under the insurance contract is calculated. The client, at his own discretion, chooses the repayment method - in installments (monthly payments), or one-time - the entire amount for the year is paid upon signing the contract.

Special programs

Typically, an insurance contract is concluded for a long period of 1 year. But you can also conclude a short-term insurance contract:

- During vacation (during the departure of residents);

- During repairs or reconstruction.

“Boxed products” – insurance allows you to sign a contract without the otherwise obligatory inspection of the property. In this case, everything is as simple as possible for the client. All you have to do is come to the office, select an agreement, fill it out and sign it. This method saves the client’s time.

>>> Cost of apartment insurance <<

Who has the right to insure an apartment?

Not only the owner of the apartment, but also the tenant can sign an insurance contract. The owner is required to provide documents confirming the fact of ownership of the property, and the tenant is required to submit a lease agreement.

Nuances of the agreement

To avoid unpleasant proceedings related to the discrepancy between the amounts paid under the insurance contract and the amount of actual damage, you must pay very close attention to each clause of the contract.

For example, when indemnifying damage under an insurance contract for kitchen decoration, it is important to know that in general the insurer is obliged to compensate the cost of damage from an average calculation. This means that the amount of damage will be calculated based on the average prices for the given region for the work of the master and the cost of materials. No allowance will be made for the client's desire to use expensive materials and highly qualified repair specialists. If the client wishes, all this can be specially formalized in the insurance contract as a special clause. Property insurance is necessarily accompanied by the preparation of a list in which this property is accurately described. All new acquisitions must be additionally included in the contract, otherwise they will not be insured.

Similarly, the risk of flooding to neighbors can be clearly stated. For example, the cause of flooding can be a breakdown of a washing machine, a forgotten faucet, or a break in the water supply network. All these cases must be spelled out in the contract.

How to receive insurance compensation?

- Don't be late in submitting your application. The deadline for its submission is always specified in the contract.

- You must have with you documentary evidence of the occurrence of an insured event: paper from the housing office, a statement from neighbors, etc.

Special cases when apartment insurance is necessary

Insurance is a voluntary transaction between the apartment owner, but in some cases it is an urgent necessity:

- Uncertainty of the property owner regarding the quality of construction or repairs;

- Antisocial neighbors;

- Risk of damage to neighbors' expensive property;

- Renting out real estate.

In each case, a balanced approach to drawing up a real estate insurance contract is required. ExpressPolis company offers the services of qualified insurance agents who will help you choose the best insurance option for an apartment in St. Petersburg!

One number for all questions +7 (812) 971-71-21

Life insurance when buying an apartment with a mortgage

Bank requirements are not limited to a mandatory insurance policy for mortgage housing. Lenders strive to minimize their own risks.

The reasons are quite clear:

- Paying off mortgage debt is a long process. Sometimes it stretches on for decades.

- Loan rates have minimum values.

Therefore, clients are offered life insurance with the following insured events indicated in the policy:

- Departure from life.

- Accident resulting in disability.

- Lost opportunity to work (temporary) due to illness or accident.

Attention . Owners of new homes may be required to have another type of insurance within a three-year period - a title insurance policy. It is this period that is defined by law as the period for challenging a transaction, that is, it is necessary to insure against termination and restriction of the owner’s rights.

As a rule, borrowers do not refuse additional insurance. Firstly, they are interested in reducing personal risks (you never know what surprise life will bring), and secondly, refuseniks are assigned higher rates.

What to do if you have property in a new building?

When taking out a policy for apartments in new buildings, a property assessment is required, since in 8/10 cases this is related to the mortgage agreement. If the client insures housing purchased with his own funds, then he must indicate whether his area is favorable for living in terms of infrastructure (bus stops, schools, kindergartens, shops).

Additionally, information about the delivery of the house is specified: when the property was transferred into ownership, whether the developer is reliable, in order to take into account possible risks for the insurance company.

REFERENCE: sometimes the paperwork process can be delayed through no fault of the client. In this case, it is possible that the insurance contract will be specified “retroactively.”

It is recommended to check with the agent the exact validity period of the policy and its renewal if there are discrepancies with the actual receipt of the document in hand.

If the client insures an apartment in another region (city), then an assessment of the property and a detailed description may be a necessary condition, since the insurers are not local residents and will not know all the nuances of the residence.

Documents for issuing a policy

Clients can protect their home at the insurer’s office or via the Internet. When applying for a policy with the company, you should take with you:

- Passport. If the property owner is not the buyer, the insurance agent will also need his information.

- Housing assessment. It spells out the main points that affect the cost of the apartment, including within the framework of the mortgage agreement.

- Loan agreement (if it is collateral insurance).

- Property documents . If there are several owners, and the insurer wants to protect only part of the property, the contract will allow you to calculate the insurance premium and coverage.

REFERENCE: You should check with the company managers about the need to take additional documents. You can leave a request by phone, making an appointment in advance and clarifying the details of purchasing the policy.

When applying for insurance via the Internet, a minimum of documents is required: the buyer’s passport, details of the owner of the home (if the buyer is not the owner), as well as the address where the property is located. Additional information is provided in the form to fill out. There may be information about the area and a description of living conditions.

We talked in detail about what documents are needed to insure an apartment in a separate article.