The concept of donation and subjects of the procedure

A gift agreement of the Civil Code of the Russian Federation implies a transfer of rights to property without mutual financial interest. It is issued exclusively in written form. The owner acts as the donor, and the new user acts as the donee. When it comes to property worth more than 3,000 rubles, a written agreement must be drawn up.

The document itself is usually called a deed of gift. The Civil Code does not provide for documentary recording of a transaction for an amount less than three thousand.

Who can be a donor?

Individuals and legal entities are allowed to transfer the right to property or donate an object, thing, property share, etc. The law says: ordinary citizens must be legally capable and of full age.

There are some restrictions for certain categories:

- Children under 14 years of age, as well as citizens suffering from mental disorders, cannot give objects and things worth more than 3,000 rubles, since a written agreement is required. Parents and guardians act in their interests, however, according to Article 575 of the Civil Code of the Russian Federation, representatives do not have the right to give anything valuable on behalf of the owner.

- Minors from 14 to 18 years of age and people partially limited in legal capacity can dispose of their property at their discretion. Gifts such as real and personal property are only permitted with the written permission of the legal guardians.

- A married person has free disposal of personal property. To transfer property acquired jointly during marriage, the consent of the second spouse is required, in writing, certified by a notary.

Fact

For organizations, only one condition for such an agreement is determined - the absence of commercial gain. A legal entity does not have the right to make gifts to other legal entities for the purpose of obvious or hidden profit.

Commentary to Art. 572 Civil Code of the Russian Federation

1. Donation is one of the most ancient and widespread transactions between citizens, especially if we are talking about the everyday component of civil transactions. The most successful definition, in our opinion, was given at one time by G.F. Shershenevich: “A gift is a gratuitous agreement aimed directly at increasing the property of the donee in accordance with the decrease in the property of the donor.”

——————————— Shershenevich G.F. Textbook of Russian civil law, 9th ed. M.: Publishing house. Br. Bashmakov, 1911. P. 490.

As a rule, donation occurs between close people (relatives, friends, acquaintances). At the same time, the parties to such an agreement can be individuals and legal entities. The Russian Federation, its constituent entities, as well as cities and other municipalities represented by their bodies can act as the donee. The motives for donation usually do not matter, however, one should remember that there is a prohibition on donation (see Art. 575 of the Civil Code and the commentary thereto) and the existence of the Criminal Code of the Russian Federation (hereinafter referred to as the Criminal Code of the Russian Federation, CC).

Unlike previous legislation, the commented article also recognizes the promise of a donation as a gift agreement and binds the promisee, if it was made in the proper form.

2. The subjects of the agreement are the donor and the donee. In this case, the object can be a thing, a property right, as well as an exemption from property obligations.

3. The most important feature of a gift agreement is gratuitousness. It must be borne in mind that if a donation is made in the presence of a counter-transfer of a thing, right or counter-obligation, then this agreement is not recognized as a donation. In practice, such cases sometimes occur. Often, local governments or organizations make the provision of municipal housing to needy citizens conditional on the obligation to donate their existing apartment to the municipality. When drawing up agreements for the exchange of residential premises of various forms of ownership, in practice one can encounter cases of “exchange of an apartment by way of gift.” Based on clause 2 of Art. 170 of the Civil Code of the Russian Federation, such transactions are recognized as sham. At the same time, reimbursing the donor for expenses incurred in connection with the donation does not turn a donation into a paid contract if, according to the terms of the contract, they are not included in the value of the subject of the donation.

——————————— Makovsky A.L. Donation // Civil Code of the Russian Federation. Part two: Text. Comments. Alphabetical subject index / Ed. O.M. Kozyr, A.L. Makovsky, S.A. Khokhlova. P. 306.

The gratuitousness of a gift agreement does not make it impossible to conclude a gift agreement with a suspensive condition not related to the consideration (Article 157 of the Civil Code). The occurrence of a corresponding circumstance is a necessary prerequisite for the emergence of the donor's obligations to transfer the gift.

4. The next characteristic of a gift agreement is its real or consensual nature. The Civil Code of the RSFSR of 1964 did not allow the construction of a consensual agreement. According to Art. 256 of the Civil Code of the RSFSR of 1964, under a gift agreement, one party transfers ownership of property free of charge to the other party.

The real contract of gift is a so-called real contract in science. Its peculiarity is that before its conclusion the rights and obligations of the parties cannot arise.

A consensual gift deed (a contract containing a promise of a future gift) requires writing.

5. Important, both for theory and for law enforcement practice, are questions about the relationship between donation and gratuitous assignment of the right of claim, as well as debt forgiveness. It is obvious that these institutions are not identical, but have common features. In paragraph 3 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 N 104 “Review of the practice of application by arbitration courts of the norms of the Civil Code of the Russian Federation on some grounds for termination of obligations” it is explained that debt forgiveness is a gift only if the court establishes the intention of the creditor to relieve the debtor from the obligation to pay the debt as a gift. The absence of the creditor's intention to benefit the debtor may be evidenced, in particular, by the relationship between forgiveness of the debt and the receipt by the creditor of property benefits under any obligation between the same persons. In the dispute under consideration, the cassation court found that the purpose of the debt forgiveness transaction was to ensure the return of the unforgiven portion of the debt without going to court, i.e. the creditor had no intention to benefit the debtor.

It is also necessary to take into account that the gift agreement is bilateral, and debt forgiveness is a unilateral transaction.

As for the relationship between the gift agreement and the assignment of the right (claim), the qualification of the agreement on the assignment of the right (claim) as a gift agreement is possible only if the intention to transfer the right (claim) free of charge is established. The absence in the agreement of a condition on the price of the transferred right (claim) does not in itself indicate the grant of the corresponding right (clause 9 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 30, 2007 N 120 “Review of the practice of application by arbitration courts of the provisions of Chapter 24 of the Civil Code of the Russian Federation "). According to paragraph 4 of Art. 576 of the Civil Code of the Russian Federation, donation through the fulfillment of his obligations to a third party for the donee is carried out in compliance with the rules provided for in paragraph 1 of Art. 313 Civil Code of the Russian Federation. Donation through the transfer by the donor of the donee's debt to a third party is carried out in compliance with the rules provided for in Art. Art. 391 and 392 of the Civil Code of the Russian Federation.

An agreement that provides for the transfer of a gift to the donee after the death of the donor is void. It is necessary to distinguish between a gift agreement and the disposal of property in the event of death, which is only possible by making a will (clause 1 of Article 1118 of the Civil Code).

In the case where a gift agreement and the transfer of ownership of real estate under the agreement were registered after the death of the donor, different consequences take place in judicial practice: from recognition of the agreement as valid if the donor did not withdraw the application for state registration during his lifetime, to the inclusion of the object of the donation into the hereditary mass. Such an agreement should not be recognized as void, since the donor does not have the intention of transferring the gift after death and the agreement does not provide for the transfer of the gift to the donee after the death of the donor. The time gap between the expression of the will of the donor and the donee and the moment of state registration of the agreement is associated with the timing of state registration of rights to real estate and transactions with it, which, in our opinion, require reduction.

This is interesting: Health groups at the military registration and enlistment office

Rights and obligations of the parties

The current version of the Civil Code of the Russian Federation indicates the emergence of legal relations when donating. The transferor of the gift must:

- Take into account the interests of all shared owners of real estate; the share must first be officially allocated;

- Transfer the property to the new owner;

- Hand over title documents or symbolic objects, for example, keys to an apartment, jewelry;

- Compensate for losses or damages, if any.

This is also important to know:

Deed of gift for an apartment between close relatives

The previous owner has the right:

- Refuse the gift;

- Indicate additional conditions, for example, caring for his health, keeping the donor’s pet;

- Expect to live in the living space for life without ownership rights.

The recipient under the gift agreement has the rights and obligations:

- The donee may accept or refuse a gift in the form of real estate;

- Has grounds to demand performance of the contract in the future if there is a clause on the time of transfer of the object;

- May demand compensation for damage if it was caused by the donor’s refusal to fulfill his duties;

- Obliged to pay taxes and make payments as a law-abiding owner of the property.

Commentary to Art. 572 Civil Code of the Russian Federation

Under a gift agreement, one party - the donor - intentionally provides property benefits at his own expense to the other party - the donee with the consent of the latter.

- can be real (the donor transfers a thing or property right or releases him from a property obligation);

- can be consensual (the donor undertakes to transfer the thing or property right in the future or to release him from the property obligation).

In acts of donation, it is not legal, but purely ethical considerations that come to the fore” (O.S. Ioffe). It is the special (friendly, family) relationship that binds the donor and the recipient that requires legal regulation that is fundamentally different from the strict rules of paid contracts. From this point of view, a gift agreement is a completely unique legal structure with very specific features.

2. Uniqueness of the legal structure. A real gift agreement is an example of a property agreement - before its conclusion, the rights and obligations of the parties cannot arise, and by transfer of property, i.e. By transferring the property right to the gift, the relationship between the parties is exhausted (after fulfillment, the parties do not have rights and obligations). “A property contract, in principle, does not imply any obligatory legal relationship. Its function is limited to the fact that it is a contract-transaction.”

It is difficult to characterize a consensual gift agreement as bilaterally binding. The donee has no obligation to accept the gift: only consent is required from him, his right - paradoxically - is to refuse the gift (see Article 573 of the Civil Code of the Russian Federation). Perhaps in a gift agreement we are dealing with a combination of two counter unilateral transactions: actions to provide property benefits on the part of the donor and consent to accept the gift on the part of the donee (the theory of unilaterally binding and unilaterally authorizing transactions developed by B.B. Cherepakhin). This design optimally explains the features of the gift agreement, in particular its termination (Article 573 of the Civil Code of the Russian Federation), refusal to perform (Article 577 of the Civil Code of the Russian Federation), cancellation of the donation (Article 578 of the Civil Code of the Russian Federation).

3. Features. An external qualifying feature of a gift is its gratuitousness (part 1, paragraph 2 of the commented article).

Compensation or gratuitousness depends solely on whether the action of one person is in a certain legal dependence on the action of another person or not. A legal relationship will be gratuitous if it consists of an obligation of only one subject, which is neither conditionally nor causally dependent on the actions of another counterparty or at least on the obligations of both parties, but if the obligation of one party is, in its content, only defining or limiting the obligation the other side.

As a result of donation, the turnover of property benefits occurs. Despite the breadth of the subject of the gift agreement and the peculiarities of this agreement, with its help only property relations are regulated, ultimately aimed at receiving material benefits by the donee or saving the donee’s property.

A donation is a contract, therefore, the gratuitous provision of property benefits due to the imposition of obligations (payment of alimony, compensation for non-contractual harm, etc.) is not considered a donation.

Donation forms its own contractual model, which is not mixed with other contractual models from which the element of remuneration has been removed. Donation also differs from hidden charity, when they want to help a person without hurting his pride, and at a disproportionately high price they buy things from him, pay for services, etc.

There is a difference between donating property and receiving it by inheritance (clause 3 of the commented article). The specificity is that a document providing for the transfer of a gift to the donee after the death of the donor can be recognized as a will if the conditions of its validity under inheritance law are met.

4. The subject of the gift agreement is understood very broadly. As follows from part 2, paragraph 2 of the commented article, the subject of a donation is a thing, a right or an exemption from an obligation. There are five options for the donor to act in providing property benefits to the donee; determining the specific content of two of them is the subject of debate.

As follows from paragraph 1 of the commented article, the donor can:

4.1. Transfer your property to the donee.

4.2. Transfer to the donee his obligatory right of claim against a third party. In this option, the donor makes an assignment in favor of the donee of his right to claim against a third party under any obligation (Article 382 of the Civil Code of the Russian Federation).

4.3. Release the donee from his obligation to a third party. In this option, the donor fulfills the latter’s obligation to third parties for the donee (see Article 313 of the Civil Code of the Russian Federation) or organizes the transfer of the donee’s debt to a third party (see Article 391 of the Civil Code of the Russian Federation).

4.4. Transfer to the donee the obligatory right of claim against himself. This is not about establishing the obligation of the donee, but about transferring an already existing right. However, it is only theoretically possible to imagine that the donor organizes the transfer of his debt from any obligation to a third party to the donee.

4.5. Release the recipient from his responsibility to himself. Many modern scientists believe that in this case we are talking about debt forgiveness (Article 415 of the Civil Code of the Russian Federation). However, the opinion of O.Yu. deserves attention. Pintail that debt forgiveness is a one-sided transaction and, accordingly, is not regulated at all by the rules on the gift agreement. Most likely, in this option we are talking about the creation of special contractual models, when the donor undertakes to perform work for the donee, provide him with a service, and at the same time knowingly exempts the donee from payment. Accordingly, the relationship between the parties will initially be built on the model of a gift agreement, and not a contract or paid provision of services.

Conditions for canceling a transaction

Both parties to the transaction may refuse to fulfill the terms of the contract when making a gift. The owner may change his mind or the transaction may not be recognized as valid:

- If the owner is under pressure, there is a threat to his health and life;

- If the physical condition of the testator has sharply deteriorated (Article 577 of the Civil Code of the Russian Federation);

- In case of failure to fulfill counter obligations on the part of the recipient of the gift.

Important

The recipient has the right not to accept the gift, and also to demand cancellation of the transaction or compensation if this agreement was violated by the previous owner of the object. If a minor or a disabled person claims the property, and the interests were not taken into account, then such a transaction is considered invalid. The prohibition on donation also applies to works of art of special value without established ownership, for example, a found relic, ancient coins, etc.

Possibility of canceling a gift

In accordance with Article 578 of the Civil Code of the Russian Federation, a deed of gift can be canceled within three years from the date of conclusion of the agreement, if there are grounds for this. Reasons for canceling an agreement in court may be:

- An attempt on the life of the donor by the recipient of the property. The same clause also applies if bodily injury was caused not only to the donor himself, but also to members of his family and close relatives.

- The new owner handles the transferred value in such a way that there is a risk of its complete loss.

- The presence in the deed of gift of a clause on the return of property in the event of the death of the recipient.

Third parties can file a claim if the donor was an individual entrepreneur or a legal entity, and the transaction itself was carried out on the eve of the announcement of its bankruptcy.

If the court satisfies the request, the recipient is obliged to return the specified property, if it is still preserved.

To whom can a deed of gift not be issued?

The Russian Civil Code establishes the circle of both individuals and legal entities who are prohibited from delivering a deed of gift. These include:

- Social workers providing municipal medical services, employees of boarding homes, palliative centers and hospices, and their close relatives;

- Officials in the public service at all levels, employees of the Bank of Russia and government bodies;

- Commercial organizations.

An exception for officials are gifts given by order of higher authorities on the occasion of celebrations, events, or business trips. The object is transferred to the balance sheet of the government agency in which the donee works.

Rules for drawing up a document

What is a deed of gift and how to formalize it correctly worries both the giver and the recipient of the gift. The form of the agreement is written only. Donation does not oblige contracts to be certified by third parties. However, the legal force of the document is fully ensured by the services of a notary office. Registration of papers by a notary is paid, but it guarantees assistance in correctly drawing up a gift agreement. The process consists of several stages:

- Drawing up an agreement with details;

- Collection of additional documents and evidence;

- Contacting a notary office;

- For real estate – re-registration of ownership rights.

This is also important to know:

How much does a deed of gift cost?

There is a generally accepted sample document, contract form.

Free legal consultation

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

We will answer your question in 5 minutes!

Ask a Question

Fact

Model form of gift agreement

Contents of the deed of gift

The document must contain the following information:

- Name;

- Date and place of compilation;

- Data of the parties to the agreement;

- Subject of the agreement with a full description;

- Rights and obligations of the parties;

- Transfer procedure;

- Date or entry into rights of the donee;

- Other conditions for the alienated apartment;

- Details and signatures;

- "Visa" of a notary.

When transferring real estate, indicate the data and dimensions from the cadastral passport.

Related documentation package

The transaction is completed with the provision of the following documents:

- Copies of the donation agreement;

- Participants' passports;

- Evidence indicating the relationship of the donor and recipient;

- Consent of the spouse to the alienation of joint property or shared owners;

- Technical documentation from the BTI, cadastral passport, certificate of owner, if real estate is donated;

- With the participation of minors or incapacitated persons - consent of legal representatives or guardians.

Re-registration of property rights

If real estate is donated, then the ownership rights are re-registered. This can be done for the recipient at the Multifunctional Center or the Rosreestr authority. Registration takes about 10 days. Only after this the recipient is recognized as the owner.

Costs for the donation procedure

According to the current edition of the Civil Code of the Russian Federation, the process of gratuitous transfer to the donee is accompanied by the payment of taxes and duties. However, under some conditions the procedure is carried out without costs. This applies to the transfer of donated property worth up to 3,000 rubles without legal registration of papers. All expenses are divided into:

- Document drafting services;

- Notary support;

- Gift tax;

- Re-registration of property rights.

The services of lawyers are required if the owner does not have sufficient legal literacy and the gift is of high value. It's worth thinking about this before donating. Notarization is popular when transferring ownership between legal entities or unrelated people. The current version of the Civil Code does not require mandatory contact with a notary. Costs for this part of the signing can reach up to 50,000 rubles. The service is valued at 3,000 rubles +0.2% of the cost of the gift for relatives. Tariffs depend on the price of the property and the status of the parties.

This is also important to know:

How and where you can issue a power of attorney for donation

Movable property requires a deposit of 0.3% for close people and 1% if the signing is between strangers.

The transfer of an object to the donee requires payment of a tax of 13%. However, if the agreement is concluded between relatives, then the participants in the deed of gift are exempt from such tax. The new owner must make annual contributions to the tax authorities as the new owner.

Fact

Re-registration and receipt of a property certificate for an individual costs 2,000 rubles. Legal entities are required to pay 22,000 rubles.

State registration

State registration should be completed only if the subject of the gift is real estate. This procedure allows you to secure the assignment of rights at the state level and enter information about the new owner into the general register of information on ownership rights to the property. You can live in a donated apartment without registration, but you will not be able to dispose of unregistered square meters.

To register the rights of the new owner, you must contact the territorial body of Rosreestr or the MFC. In both cases, both parties collect the required package of documents and fill out an application for registration of property rights.

The assignment of property rights is carried out on a paid basis. The state duty is 2000 rubles. Rosreestr has 10 days to verify documents and re-register. You can confirm the changes made by requesting an extract from the Unified State Register.

Rules for refusal of donation and conditions for invalidation

Canceling a deal is often an unpleasant surprise, and sometimes an objective necessity. The owner can draw up a waiver of the transaction if the obligations specified in the document are not fulfilled by the donee. For example, repairs that have not been made or conditions for caring for a pet. The recipient himself may also not accept the gift if the terms of the transaction do not suit him. In addition, there are clauses in the law under which the transaction is unacceptable or will be considered invalid. These include:

- Drawing up an agreement through pressure or threats against the donor, there was an attempt on the life of the benefactor by the recipient, etc.;

- Deterioration of health before the actual transfer of rights;

- Carrying out a procedure on behalf of an incapacitated person or a minor;

- Lack of consent of other owners, shareholders;

- Discrepancies in the contract: textual, factual errors, data inconsistencies;

- Lack of documents;

- The recipient is a civil servant or an employee of a social or medical organization;

- The transfer is made between commercial organizations;

- The fact of using the gift for commercial purposes has been proven.

- The donor dies before the legal documents are re-registered and the property is actually transferred.

Also, an oral promise to donate any thing or things in the future, especially those worth more than 3,000 rubles, is not a full-fledged and legal gift agreement under the Civil Code. The revocation of oral promises is an area that the law does not regulate, but is a property of the individual moral qualities of the donor.

Refusal of donation: procedure

The contract can be terminated at the stage of oral promise before the re-registration or transfer of the offering. After fulfilling the obligations specified in the contract, the parties will not be able to cancel the deed of gift, say, for an apartment, except in certain cases. These include unforeseen circumstances, such as deterioration in the health or financial situation of the donor. The owner only needs to write an application to suspend the registration of the rights of the new owner with government agencies. The Civil Code provides for compensation for the recipient in the form of a requirement to repay the losses that he incurred in the process of acquiring rights. But such damages cannot be claimed if the actual performance of the gratuitous gesture has not taken place.

Important

It is practically impossible to cancel an already completed assignment of rights if the new owner transferred the rights to a third party or sold the property, unless this contradicted the terms of the deed of gift. Cancellation will require compelling reasons, which may result in a claim for compensation for material damages for the recipient.

Article 572 of the Civil Code of the Russian Federation

- Car insurance

- Housing disputes

- Land disputes

- Administrative law

- Participation in shared construction

- Family disputes

- Civil law, Civil Code of the Russian Federation

- Consumer rights Protection

- Labor disputes, pensions

- home

- Article 572 of the Civil Code of the Russian Federation. Donation agreement

Civil Code of the Russian Federation:

Article 572 of the Civil Code of the Russian Federation. Donation agreement

1. Under a gift agreement, one party (the donor) gratuitously transfers or undertakes to transfer to the other party (the donee) an item of ownership or a property right (claim) to himself or to a third party, or releases or undertakes to release it from a property obligation to himself or to a third party .

If there is a counter transfer of a thing or right or a counter obligation, the contract is not recognized as a donation. The rules provided for in paragraph 2 of Article 170 of this Code apply to such an agreement.

2. A promise to transfer a thing or property right to someone free of charge or to release someone from a property obligation (promise of donation) is recognized as a gift agreement and binds the promisee if the promise is made in the proper form (clause 2 of Article 574) and contains a clearly expressed intention to commit future gratuitous transfer of a thing or right to a specific person or release him from property obligations.

A promise to donate all of one’s property or part of one’s entire property without indicating a specific object of donation in the form of a thing, right or release from an obligation is void.

3. An agreement providing for the transfer of a gift to the donee after the death of the donor is void.

The rules of civil inheritance law apply to this type of gift.

Return to the table of contents of the document: Civil Code of the Russian Federation Part 2 in the current edition

Features of drawing up a deed of gift with the participation of legal entities

Donation of property, where the parties are a legal entity, may be limited in scope or prohibited. According to Article of the Civil Code of the Russian Federation No. 572, the gratuitousness of the procedure excludes any mutual financial claims and the use of the gift for the purpose of obtaining benefits. Therefore, such transactions are prohibited.

This is also important to know:

Is it possible to issue a deed of gift for a minor child?

When transferring goods to a legal entity, which is a non-profit form of ownership, a public organization, a charitable foundation, etc., it is possible to dispose of the gift in order to obtain benefits. It will be difficult for the donor to refute the transaction if the funds received from the use of the gift go to the maintenance of a public organization and comply with the Charter.

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

The donation procedure is permitted between a parent and subsidiary organization, but does not exempt from tax.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

If property worth more than 3,000 rubles is donated on behalf of a company, then the donation agreement of the Civil Code of the Russian Federation is concluded with the permission of the owner - founder of the company.

The agreement on the alienation of property can be canceled if the donor company goes bankrupt in the next six months. In this case, the alienated property will be used to pay off debt obligations.

Another comment on Article 572 of the Civil Code of the Russian Federation

1. A donation is a provision through which one person (the donor) enriches another person (the donee) from his property and which, by the will of both parties, is done free of charge. In this definition, three signs of donation are fixed:

Do you have any questions regarding Article 572 of the Civil Code of the Russian Federation?

Get advice and comments from lawyers on Article 572 of the Civil Code of the Russian Federation for free.

Questions can be asked either by phone or using the form on the website. The service is available from 9:00 to 21:00 daily Moscow time. Questions received at other times will be processed the next day. Only initial consultations are provided free of charge.

Donation

Article 582 of the Civil Code allows a gift to be reclassified as a donation if the item has the following features:

- Intended use determined by the donor;

- Public benefit;

- Inability to spend the donation in other interests without the consent of the owner;

- Exclusion of reciprocal gifts to donors.

Interesting

The donation will not be subject to the laws of gifting. All responsibility for preservation and maintenance will be on those who accepted the gift. In this case, the use will be checked by the contractor. In case of dishonesty, the object may be reclaimed.

Disputes arising under a donation agreement may be considered in court, but the form of the agreement itself will not be identified as a gift

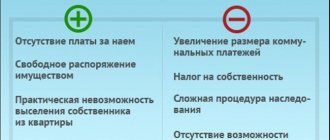

Advantages and disadvantages of deed of gift in comparison with other methods of transferring rights

Considering various forms of assignment of rights, donation may be beneficial in some cases and unacceptable in others. This is due to the amount of the gift, expenses, relationships between participants and other conditions.

Purchase, sale and donation

Advantages of gratuitous alienation:

- Simple format: oral or written;

- Free alienation of shares;

- Speed of the procedure.

This is also important to know:

Donation of real estate between close relatives 2021

Minuses:

- Payment of income tax by the recipient without relationship with the donor;

- Uncertainty about receiving a gift due to the donor’s right to refuse assignment.

Exchange and deed of gift for an apartment

The advantages of deed of gift over exchange are the same as in comparison with purchase and sale. Among the disadvantages, one can note the mandatory transfer of property in exchange for other property at the time of conclusion of the contract. There is also income tax, which is excluded in the exchange procedure. This is my advantage.

Rent and gift agreement

The main disadvantage of the agreement is the lack of monetary compensation that the donor would receive when registering the annuity. The previous owner receives nothing, since gratuitousness is required. There is also a disadvantage for the new owner in the form of paying 13% if he is not a relative of the donor.

Donation or bequest

The most common forms of contractual relations that are considered by citizens. This is usually true for relatives. In a difficult relationship, the donor thinks about the worthiness of his heirs. Difficult relationships will not be an obstacle to receiving an inheritance after death. But the deed of gift can be managed until death and the correctness of the decision can be assessed. In addition, after the transfer of property before death, other owners will not be able to lay claim to the property of the deceased.

Another advantage is the speed of the transaction and the opportunity to obtain rights before the death of the owner. When inheriting, the inheritance begins six months after the funeral. The disadvantage is the impossibility of specifying the conditions for receiving property that are in the will. Also, the sacrament of a will can later bring a “surprise” for the direct heir.

Conclusion

There are many alternative agreements for a gift agreement, which can be financially beneficial, but are complicated by legal conditions. Also, the simplicity and speed of issuing a deed of gift has its pitfalls for both the donor and the donee. Legal relations between relatives are perhaps one of the significant factors in favor of gratuitous transfer. The decisive factors are the value of the gift, the conditions, the relationship between the parties and the legal authorization from the Civil Code.

Free consultation

8 800 511-39-66Ask a question

Another comment on Art. 572 of the Civil Code of the Russian Federation

1. The commented article provides a definition and general characteristics of the gift agreement. A characteristic feature of a gift agreement is that it is gratuitous. Any counter-provision on the part of the donee, be it a counter-transfer of a thing, a right, or the acceptance by the donee of a counter-obligation, makes the gift agreement invalid (the rules on a sham transaction apply to it). In order for a grant to be considered reciprocal, it does not have to be provided for in the same contract as the original gift, but may be the subject of a separate transaction and sometimes even with another person (for example, when, for a gift received or promised, the donee will fulfill the donor’s obligation to third parties). In this case, there must be a causal condition of the gift by a counter-provision on the part of the donee. In this regard, the gift agreement should be distinguished from the so-called sponsorship agreement. In the latter case, the property may not be provided free of charge, but in exchange for advertising by the donee.

This is interesting: Legal advice family law

If there is a counter-provision in an agreement, which is formally called a gift agreement, the rule on a sham transaction will apply (see commentary to paragraph 2 of Article 170).

As a general rule, a gift agreement is unilaterally binding. However, it is possible to conclude a gift agreement, according to which the donee has reciprocal obligations and they cannot be considered as a reciprocal grant (a donation with an obligation to use the gift for generally beneficial purposes). The subject of a gift agreement can be things, property rights, as well as release from property obligations to oneself or to third parties.

In practice, sometimes local governments or state organizations and institutions make the provision of municipal or state housing to needy citizens conditional on the obligation to donate their existing apartment or room to the relevant municipal or state organizations. Thus, when exchanging privatized apartments for non-privatized ones, apartment exchange agreements are concluded as a gift. All such contracts must be declared invalid, since they contain consideration and, therefore, cannot be recognized as gratuitous.

Often, instead of a gift agreement, a purchase and sale agreement or a lifelong maintenance agreement with dependents is concluded in order to avoid paying taxes on property transferred by way of donation. The rules on a sham transaction should apply to such an agreement (clause 2 of Article 170 of the Civil Code of the Russian Federation), however, it can be quite difficult to prove that in fact the transaction was gratuitous.

The state, state and municipal entities can act as a donor, for example, when providing free assistance to victims of terrorist attacks and national disasters. At the same time, taking into account the public nature of these entities, as well as the security nature of such assistance, it was obviously necessary to introduce into legislation special legal forms that would mediate such agreements. At the same time, it was possible to take into account the experience of pre-revolutionary Russia, where the donation of state real estate on behalf of the Russian Empire was clothed in a special legal form, which was called a “grant”.

However, it is necessary to distinguish between a gift agreement, in which the state, state and municipal entities act as the donor, and gratuitous grants of a public legal nature (state awards, monetary awards, etc.). The difference is that in the first case, the consent of the donee to accept the gift is required, while in the second case, the donor unilaterally announces a grant of a public law nature. Even if subsequently the person to whom the gratuitous provision of a public law nature was intended refuses to receive it (there are cases when individuals for some reason refused to receive state bonuses), this fact will not affect the validity of such provision.

A gift agreement should also be distinguished from the payment of bonuses or valuable gifts at the place of work, which are similar to a gift agreement. The main difference is that the resulting relations are regulated not by civil law, but by labor law.

The subject of the gift agreement must meet the general requirements of negotiability. This means that things withdrawn from circulation cannot be donated at all, and things with limited negotiability can be transferred to the donee only in compliance with the special regime established for such things. Yes, Art. 20 of the Federal Law of December 13, 1996 “On Weapons” (SZ RF. 1996. N 51. Art. 5681) establishes that the donation and inheritance of civilian weapons registered with the internal affairs bodies are carried out in the manner determined by the legislation of the Russian Federation, with the heir or the person in whose favor the donation is made has a license to purchase civilian weapons (for example, a member of a hunting society).

2. Paragraph 2 of the commented article talks about cases when the gift agreement is consensual and when, accordingly, rights and obligations arise from the moment the agreement is reached. To do this, it is necessary to conclude an agreement in writing (see commentary to paragraph 2 of Article 574) and the text of the agreement must contain a clearly expressed intention to make a gratuitous transfer of a thing or right to a specific person in the future or to release him from a property obligation. In this case, it is mandatory to specify the subject of the gift agreement in the form of a thing, right or exemption from obligation. Without such specification, the contract will be considered absolutely invalid (void).

3. Transactions in which the parties agree to transfer any property free of charge after death are not considered as gift agreements. An order for the transfer of property after death can only be executed with the help of a will certified in a notarial (or equivalent) form.