Today in the primary real estate market, the most common ways to purchase housing are the conclusion of an agreement for participation in shared construction (DDU)

between the developer company and the shareholder, and the buyer’s entry into a housing construction cooperative

(HBC)

. In today’s article, we will talk about the advantages and disadvantages of each of these methods of buying a home, and we will try to figure out which one is better to give preference to.

Each of the methods mentioned is absolutely legal and is accompanied by relevant legislation. In the first case, the relationship between the shareholder and the developer is regulated by Federal Law-214, and in the second case, when the buyer joins the cooperative, Federal Law-215 is in effect.

By the way, today the vast majority of transactions on the Moscow primary real estate market

(about 90%)

are concluded precisely under the DDU, however, housing cooperatives have also not lost their relevance, although such transactions account for only about 8%.

What is the idea of shared and cooperative construction?

The idea of shared construction (within the framework of preschool education)

lies in the fact that the company attracts money from shareholders

(funds that, in essence, are an interest-free loan)

, builds apartments with this money and makes a profit. Shareholders, in turn, receive housing below market value for the funds provided.

The relationship between the shareholder and the developer is regulated by the provisions of Federal Law 214, which impose rather strict restrictions on the developer.

If the developer violates the rights of the shareholder in any way, he can defend his interests in court.

The idea of building cooperative housing (within the framework of housing cooperatives)

lies in the fact that citizens collect funds and organize construction work themselves

(hire a contractor, entrust him with the purchase of building materials, control quality, etc.)

.

On the one hand, participants can receive their apartments at a lower price (than under the DDU)

, since there is no profit for a third party, payment is made for work performed and construction materials purchased.

But, on the other hand, the law (FZ-215)

cannot protect citizens from them, because they themselves build housing and decide for themselves how and in what order this should be done.

Relations between the cooperative and the members of this cooperative are regulated by internal documents - the Charter on the one hand, and the Participation Agreement on the other.

At the same time, the Participation Agreement can be changed at any time, and if the participant’s relationship with the cooperative does not develop as the cooperative participant initially intended, then it will be difficult to defend his case in court.

What is housing cooperative

This form of cooperation involves the creation of a voluntary community, whose participants buy apartments in the building being built and become shareholders. They receive ownership of the new living space on the basis of a certificate from the housing cooperative about full payment of the share contribution. By concluding a housing-construction cooperative agreement, people independently collect money and organize construction work. This allows them to save on the cost of living space, paying in fact only for the purchased building materials and work performed. All relationships between the housing cooperative and the members of the cooperative are determined accordingly by the Charter and the Participation Agreement.

A housing cooperative is created for the construction of a specific building. To pay for construction work, shareholders can use both their own funds and a bank loan. Unlike shared housing cooperatives, housing cooperatives are a more cost-effective way to purchase new housing. To pay for construction, housing cooperative participants create a mutual fund, into which they undertake to contribute a certain amount every month. At least a year is allotted for fundraising.

Price component

Housing in a housing cooperative can be purchased cheaper than from a developer under the DDU. Within the framework of shared construction, there are certain restrictions that cause a higher cost of real estate compared to cooperative housing:

Firstly,

the developer must not only recoup expenses, but also make a profit, otherwise his activities become meaningless. Construction by a cooperative has different priorities; participants need housing, so the primary task is to cover construction costs;

Secondly,

The developer, when selling housing, is forced to include VAT in the price.

Self-construction (by a cooperative)

is not subject to value added tax;

Third,

the developer cannot avoid the costs that arise when insuring his liability to shareholders; the law obliges to insure risks, and the costs are also included in the price of housing. There are no such requirements for housing cooperatives; however, the lack of transaction insurance significantly increases the risks of cooperative members.

Differences

So, how does a housing cooperative differ from a preschool building? The difference between these two concepts is really significant and it lies in the following:

- state registration. A DDU agreement must be registered, whereas a transaction with a housing cooperative is not registered. This procedure ensures that the apartment will not be resold several times, and therefore housing cooperative participants often risk their property.

- Property value. DDU guarantees that the price of the apartment will not change. The contract with the housing cooperative in this case seriously loses, since it provides for a change in the cost of living space. In addition, shareholders are often forced to incur additional expenses.

- Deadlines. Again, if construction is delayed, then under the DDU the developer will be forced to pay a penalty. Based on the agreement with the housing cooperative, the deadlines can easily be postponed.

- Installment plan. If the construction is carried out by a housing cooperative, then the shareholder has the right to live in the apartment, paying his share. With a DDU, construction participants do not have such a right, so they can dispose of real estate only after payment of the entire amount.

- Termination of an agreement. Participants of the DDU can count not only on the return of the deposited amount, but also on the payment of a penalty. When cooperating with housing cooperatives, no penalty is paid.

- Access to the information. Shareholders receive all the necessary documentation before concluding an agreement, whereas in a housing cooperative this requires the personal initiative of the shareholder.

Information: despite the fact that when leaving a housing cooperative, shareholders do not receive the same payments as with a shared-income cooperative, the contributed share contributions are returned to them.

Quality guarantees

The quality of construction is one of the most important parameters by which potential equity holders/shareholders often choose a new building.

Purchasing under the DDU presupposes that the shareholder is a consumer, therefore he is protected by the Consumer Rights Law.

In turn, a member of the cooperative (housing cooperative)

it is not, because a member of a voluntary association, in fact, consumes his own services. Thus, the court will not help protect the rights of the cooperative participant regarding the quality of housing and other construction parameters.

According to the DDU, the developer bears warranty obligations to the shareholder for five years. That is, if, after a certain time after accepting the apartment, the shareholder identifies shortcomings, the presence of which could not be determined at the time of transfer of housing, the developer is obliged to eliminate these shortcomings. Warranty period, which must be specified in the DDU (according to Federal Law-14)

is 5 years. In turn, housing cooperatives cannot be forced to eliminate shortcomings, since Federal Law-215 does not say anything about the warranty period.

Double sale protection

The DDU must be registered with Rosreestr, thus eliminating the possibility of multiple sales of the same apartment. Technically, something similar can happen, for example, an apartment will be sold once under the DDU, and the developer will sell it to several more clients under the Preliminary Sale and Purchase Agreement. But the shareholder who signed the DDU will be unconditionally recognized by a court decision as the sole owner of the property, and the remaining “applicants” will search for the truth for a very long time.

Joining a cooperative does not require mandatory registration of an agreement, so it is quite possible to sell an apartment to an unlimited number of buyers, although this is impossible to verify.

It is necessary to understand that the housing cooperative does not provide protection against fraud on the part of the cooperative management.

What to choose in the end? Based on what reasons?

So what to choose: shared construction or housing cooperatives? None of the above agreements can protect the participant from various circumstances. This could be a lack of funds, changes in legislation, or fraudulent actions of the developers themselves.

That is why, when choosing a method of purchasing housing, it is necessary to pay attention to the construction company that manages the process of constructing an apartment building. She must have a certain positive reputation and extensive work experience. It is desirable that there be a large turnover of funds, which will allow her to pay off creditors if necessary.

It is also important to study all submitted documentation. You shouldn’t think that DDUs or housing cooperatives cannot, for example, miss deadlines. Therefore, it is quite difficult to guarantee complete security of the transaction. Therefore, you need to choose between DDU and housing cooperative, based on your preferences and financial capabilities.

Protection against changes in the contract

A powerful argument

The shareholder may refuse changes to the DDU, and then the developer, in court, will have to return to the shareholder the amount paid at the time of conclusion of the agreement or pay a penalty (offer other ways to resolve the problem).

Federal Law-214 obliges the developer to indicate in the DDU all the parameters of the future apartment - the number of square meters, the cost per square, the total cost of living space, layout, type and quality of building materials, utilities, etc. If during the construction process there is a desire or need to change anything (for example , replace expanded clay block with cinder concrete, double-glazed windows with wooden frames)

, changes can only be made with the consent of the shareholder.

In the Participation Agreement (HCS)

making changes is much easier; it does not require the consent of each of the participants; the board of the cooperative only needs to obtain the consent of the majority.

Various methods can be used to achieve this, and often the proposal looks like an ultimatum (for example, if a decision is not made to make changes, additional funds will have to be raised, since the existing ones are no longer enough)

.

That is, a cooperative participant may, upon completion of construction, receive something that is not exactly what he originally expected (for example, less square footage, a different quality of housing, etc.)

and no one will be held responsible for this, the cooperative will not compensate for either moral or material damage.

If a participant wants to leave the housing cooperative before the house is built, he can do this in the manner prescribed in the charter. At the same time, the cooperative must transfer the paid amount to the participant’s account, and problems often arise with this that have to be resolved in court. Thus, the provisions of the charter may change by the time the participant leaves, and, according to the agreement, the return of money may take an indefinite period. The best option in this case would be the help of a qualified lawyer who will represent your interests in court.

The difference between DDU and housing cooperative

In order to clearly determine the difference between housing cooperatives and preschool cooperatives, it is very important to know the features of each system for selling apartments in new buildings. Only after this will it be obvious exactly what the difference is between housing cooperatives and preschool cooperatives.

The differences between these two options for purchasing housing are presented in the table:

| Housing cooperative | DDU |

| The law regulating the activities of housing cooperatives, as already noted, is the Housing Code. Unfortunately, this law cannot affect the situation with double sales. Moreover, apartment purchase and sale agreements signed with housing cooperatives are not subject to mandatory registration. | As for shared construction, the Federal Law on shared construction obliges all signed agreements to be registered in Rosreestr. Only then accept funds from shareholders, which is much safer. |

| Due to the fact that the agreement with the housing cooperative does not require mandatory registration at the very beginning, problems may arise in the future, due to either incorrectly formalized ownership of the land under the object, or the fact that it is completely absent; this is a fairly common situation. | For DDU, on the contrary, registration is not only recommended, but it is mandatory, and the developer is obliged, together with the DDU, to submit a full package of documents for the object, including paper confirming the validity of land rights and design documentation. |

| The cost of housing during the construction process when joining a housing cooperative may change depending on prices, the state of the construction services market, and such fluctuations are possible several times. | For DDU, this state of affairs is unacceptable, that is, the price is set once, until the end of construction work. |

| Completion dates for construction work are not clearly indicated, as they depend on many factors. | The date of completion of work and transfer to the owner for use is known at the time of signing the DDU. |

| For housing cooperatives, risk insurance is optional, which can cover expenses and possible losses of shareholders. | When signing a DDU with a shareholder, the developer is simply obliged to insure him against possible risks, which are clearly stated in the Federal Law regulating this market. In addition to compulsory insurance, a new law was adopted in 2021, according to which the developer is obliged to contribute 1 percent of the cost of the DDU to the fund for the protection of shareholders, similar to the deposit insurance system. |

| Unfortunately, as such, penalties for non-compliance with obligations during the construction and delivery of a house are not specified in the law. | In a situation of violation of the terms of the DDU, the shareholder has the right to: terminate the contract with the recovery of the full purchase amount and a penalty. Or simply demand a penalty. We recommend that you read: Is it possible to terminate an equity participation agreement with a mortgage and get the money back? We recommend that you read: The difference between a HOA and a housing cooperative |

Having studied these differences, we can conclude that housing cooperatives have only disadvantages, unlike preschool cooperatives. However, not everything is so simple, because each model has its own pros and cons.

Pros and cons of preschool education

In order to choose between DDUs and housing cooperatives, it is necessary to consider not only the features of each housing sales system, but also study what the pros and cons of DDUs and housing cooperatives are.

When considering a DDU as a way to purchase a home, a potential shareholder must be aware of the advantages that he will receive.

These include:

- The signing of the DDU and its registration are possible only if the developer has complete documentation, which gives him the right to build and sell his properties.

- The DDU is signed for a specifically agreed price, which cannot increase at the request of the developer.

- The DDU clearly states all the parameters of the object as a whole, namely the number of floors, entrances and other characteristics.

- If the contract is terminated, the shareholder is guaranteed a refund of the amounts paid. The same applies to insurance situations.

- When purchasing real estate under a DDU, it can be assigned or sold under a special agreement called an assignment agreement. According to it, the rights of claim to the subject of the DDU are transferred.

- Each type of work has specific deadlines, compliance with which is guaranteed by the developer.

These advantages play a significant role when choosing a housing purchase option.

However, DDU transactions also have disadvantages, that is:

- the most important disadvantage is the high cost of the object, in which the developer includes more than one parameter, including the actual cost of the object and payments to various funds;

- the process of registering a preschool educational institution is very lengthy and requires patience from the shareholder;

- the grounds for termination of the contract are usually spelled out very clearly and strictly, so problems may arise with this issue as well, as a consequence of the difficult process of returning the invested amounts;

- Quite often, installment payment is not provided for under the DDU, or its conditions are difficult to fulfill; as a result, a mortgage is often taken out, which further increases the cost of the final cost of the property.

The listed disadvantages make you think about the correctness of the choice if it is made in favor of the preschool education system.

In addition to the disadvantages, it should be noted that if the shareholder, without apparent grounds, demands termination of the contract, then he is obliged to pay a penalty to the developer, and this, in fact, can result in a round sum.

So there is no need to talk about a clear choice of preschool education.

Pros and cons of housing cooperatives

Just like the DDU, the housing cooperative has its positive aspects, which cannot be ignored when making a decision about the DDU or the housing cooperative.

The following advantages of housing cooperatives are highlighted:

- possibility of long-term installment payments;

- registration time is much shorter, due to the fact that they are not subject to mandatory registration;

- the opportunity to participate in the construction process and control it;

- the ability to pay for utilities using the profits of the cooperative.

The listed advantages make housing cooperatives an attractive option for purchasing housing.

Along with the advantages, one cannot ignore the disadvantages, namely:

- There is no responsibility for poor performance of their duties by shareholders, which can delay the construction process.

- The cost of housing may vary depending on the prices of building materials and services.

- An entrance fee of 1 to 3% of the cost of housing is required.

- There is no liability or risk insurance.

- High probability of repeat sales.

- There is a risk that land documentation may be received with violations or be completely absent.

- In fact, the shareholder has nothing in his property, since ownership can only be formalized by having a document confirming full payment of the share.

- It is most often not allowed to assign the right to a share or donate it when participating in a housing cooperative.

Thus, the number of shortcomings of housing cooperatives should alert you and force you to be more attentive to the cooperative if a decision has already been made that this particular housing purchase scheme is preferable.

It’s probably still impossible to answer unequivocally for housing cooperatives or public housing cooperatives and which is better. In this matter, every interested person must weigh the pros and cons and only then make a decision. However, even after everything has already been determined, there are nuances that you need to know.

Of course, they relate to agreements, on the basis of which further interaction between the shareholder and the developer, and the shareholder with the cooperative, takes place.

Signing the DDU

When signing a DDU, it is mandatory to carefully study the agreement, from which it should be clear:

- full details of the developer, which include its name, legal address, contact numbers, email address and Taxpayer Identification Number. The latter will help to conduct additional verification of the company using online services. You can also inquire about the constituent documentation and even study it and the size of the authorized capital, which is also available from open sources;

- the contract to be signed must be called DDU;

- the DDU must clearly stipulate all the terms of construction and transfer of the object for the use of the shareholder, the characteristics of the house and the cost of the object, entered in numbers and words.

The shareholder must pay attention to the listed nuances, otherwise he may become a victim of an unscrupulous developer.

The DDU must be drawn up not only taking into account these parameters, it must comply with the general rules and all legal norms without violating it.

The agreement must be drawn up in three copies: one remains with the equity holder, the other with the borrower, and the third copy remains with Rosreestr.

Signing a housing cooperative agreement

Considering the high risk involved in concluding agreements with housing cooperatives, a potential shareholder needs to be especially careful about some clauses of the agreement. It is worth studying it by asking the cooperative for a sample in advance, and immediately before signing it, compare the studied agreement with the one being signed.

Attention should be paid to the following information:

- Are the risks and the procedure for protecting contributions in the event of construction failures spelled out in the contract?

- The full details of the housing cooperative must be indicated, by analogy with the DDU; this will make it possible to further study the founders of the housing cooperative and their previous activities.

- The contract must contain information about all the characteristics of the house and a specific apartment, that is, area and floor.

- The ideal option would be if there is an indication that increasing the cost per 1 m2 is possible only through a meeting of shareholders.

- The agreement must contain information about what specific amount will be deducted from the contribution for the maintenance of the housing cooperative.

- There must be an indication of the documents based on which the site under the future house belongs to the housing cooperative. Additionally, having the details of this document, it will be possible to check all the information on the site.

As you can see, before signing a housing cooperative agreement, a more careful approach is still required, which is not surprising, given the number of defrauded shareholders. If control over developers is tightened every year, the legal regulation of housing cooperatives still leaves much to be desired. In this area, everyone risks being deceived, since among shareholders there may be ordinary scammers, let alone those who work with large sums collected from participants in housing cooperatives.

Refund, penalties, compensation

Housing cooperative: hard facts

Residents of Saratov remember the high-profile case of how the chairman of the Kapitel-2002 housing cooperative left 274 participants without apartments, while about 160 million rubles were stolen, and construction stopped at the level of the eighth floor. Needless to say that the cooperative members never received any compensation?

According to Federal Law-214 (amendments that came into force in 2017)

The development company must be a member of a self-regulatory society, have an authorized capital and pay contributions to the compensation fund

(common for all developers)

.

In the event of bankruptcy of the developer, all payments in favor of shareholders will be compensated with funds from this fund. That is, if at the time of bankruptcy the house is not completed or put into operation, the shareholder can expect that the money will be returned to him or the house will be completed (in such cases, the SRO can transfer the property to another developer)

.

In such cases, achieve something from the cooperative (housing cooperative)

problematic.

The housing cooperative will be able to return the money only if it is in the account (although the fact that construction has stopped in itself indicates a lack of money)

.

Of course, you can’t count on additional payments (penalties, compensation)

, the return procedure is determined by the cooperative itself; if a cooperative member manages to return at least part of it, that will be very good.

To be fair, it is worth noting that the new amendments to the DDU are still only at the implementation stage, but there are already mechanisms that make it possible to ensure payments to shareholders - this is liability insurance and a bank guarantee.

In the case of housing cooperatives, insurance is not a mandatory requirement. So, if the management in organizing construction work turns out to be ineffective (which cannot be ruled out, since members of the board of the cooperative are not necessarily professionals in the construction market)

, and there is not enough money to complete construction, then you will either have to find additional funds or try to somehow realize the unfinished project.

Installment plan, mortgage, state support for mortgages

The advantage of purchasing housing through a housing cooperative is the ability to arrange installment plans for a long period (up to 7 years)

, moreover, money can be paid in installments even after the house is put into operation and occupied.

According to DDU (for Moscow)

The maximum installment period is 2 years.

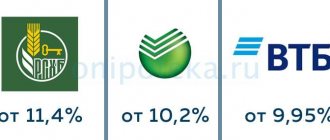

A mortgage loan can be issued both for housing purchased under DDU and for housing constructed by housing cooperatives. Preferential mortgage programs can only be provided when purchasing real estate under the DDU; state support programs do not apply to cooperative construction.

Features of DDU

The published Federal Law 214 is a regulatory act for all developers; the most responsible and professional of them always follow its provisions in their work. The law directly addresses shared construction and protects the interests of buyers who have invested their funds in construction.

Thanks to robust legislation, DDUs are becoming increasingly common as a way to build and purchase homes.

It is important for apartment buyers that, by law, the housing they pay for under the contract must go to them during construction. And go within a certain time frame.

Unfortunately, it is not uncommon for construction to begin to slow down over time or stop altogether; all possible deadlines for putting the house into operation are not met. And the presence of a law adopted at the federal level is a reliable protection that allows you to calmly sign an agreement on shared construction, despite all the risks.

Advantages

Shared construction has already become popular, many have become owners of new, modern, comfortable housing thanks to such invested construction of residential complexes or individual apartment buildings:

- The presence of a federal law has become an important factor for participation in such construction. Not all forms of residential investment offer such strong protections.

- If the developer violates the terms of putting the object into operation or other provisions of the contract, the shareholder has every right to terminate the contract with him.

- If the contract is terminated, all the money must be returned to the shareholder; this is provided for by Law 214. The investor also has the right to receive a penalty and moral compensation in cash. These standards are established at the legislative level only for those who are building an apartment for themselves according to the DDU.

- Reliable protection of the shareholder's funds by Federal Law allows him to receive a loan to pay for housing with virtually no problems. Banks know about the law and its strength, so they do not consider lending to construction under the DDU a risk.

- Another important advantage is that the land under construction and the construction site are pledged to the equity holders. Even if construction stops, the land and the constructed facility can be sold so that the parties to the transaction can return their funds.

A shared construction agreement must be registered in Rosreestr according to the law. And this is an important confirmation of its reliability. What does registration give? It protects against fraudulent double sales schemes, which have led to more than one lawsuit.

Flaws

The federal law was adopted not so long ago; its effect has not yet been sufficiently tested. Basically, developers have a good understanding of the norms of Federal Law 214 and do not want to risk their business and do not create precedents for violating it.

But there are still cases when shareholders went to court due to a delay in putting a building with apartments into operation, due to the developer’s reluctance to pay a penalty.

By law, a construction company can postpone the completion date, but to do this it must notify shareholders in advance, at least 60 days in advance. Unreliable developers sometimes take advantage of this loophole, pushing back the deadline more than once.

As a result, even with serious legislative protection, shareholders suffer, cannot move into new apartments on time and cannot bring the deceiver to court. What to do in such a situation?

ATTENTION! A law has already been passed in St. Petersburg that prohibits builders under the DDU from delaying the completion of construction by more than 9 months.

It is desirable that the same laws be adopted in other cities and regions.