What is it and is it considered income?

Rent is a situation when the owner of real estate transfers any property to the payer on the terms of guaranteed payment of remuneration to the owner or maintains the owner in another form (Article 583 of the Civil Code of the Russian Federation). Rent is encumbered by both a land plot and an apartment or other real estate (Part 2 of Chapter 33 of the Civil Code of the Russian Federation).

Rent is one of the types of regular income of the recipient, for which there is no need to conduct work, business or any other type of paid labor. Rent is not income for the payer .

GLAVBUKH-INFO

Question: On personal income tax taxation of income received under an annuity agreement with lifelong maintenance with dependents, in the form of a lump sum - 10% of the market value of the transferred property and monthly rental payments.Answer:

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION LETTER dated January 27, 2015 N 03-04-07/2785

The Department of Tax and Customs Tariff Policy reviewed the letter on the procedure for taxation of income of individuals received under an annuity agreement with lifelong maintenance with dependents, and in accordance with “Article 34.2” of the Tax Code of the Russian Federation (hereinafter referred to as the Code) explains the following. It follows from the letter that under an annuity agreement with lifelong dependent maintenance, the annuity payer pays the annuity recipient a lump sum of 10 percent of the market value of the transferred property and makes monthly cash payments. In accordance with “Article 583” of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code), under a rent agreement, one party (rent recipient) transfers ownership of property to the other party (rent payer), and the rent payer undertakes, in exchange for the received property, to periodically pay rent to the recipient in the form of a certain sum of money or the provision of funds for its maintenance in another form. The provision of funds for the maintenance of the annuity recipient instead of paying sums of money is provided for, in particular, by a lifelong maintenance agreement with dependents, according to which the annuity payer, in accordance with “Article 601” of the Civil Code, undertakes to provide lifelong maintenance with the dependents of a citizen and (or) a third party specified by him ( persons). An annuity contract is an independent type of contract that has its own characteristics. The remuneration of this agreement is determined by the presence of an obligation to pay rent, and not by payment for the property transferred to the rent payer. At the same time, a specific feature of a annuity contract among other contracts aimed at the paid transfer of property into ownership is its risky, and not exchange (not equivalent) nature. This is due to the uncertainty of the counter-provision made by the rent payer in exchange for the property accepted from the rent recipient. In contrast to the size of the purchase price in the purchase and sale obligation that is predetermined or determined according to the rules of “clause 3 of Article 424” of the Civil Code, the parties to the annuity agreement at the time of its conclusion do not know what the total amount of the rental income of the annuitant will be. Since the annuity is paid indefinitely or for life, it may turn out to be more or less than the actual value of the property transferred for annuity payment, depending on the specific duration of the relationship between the parties. “Clause 2 of Article 605” of the Civil Code provides that in the event of a significant violation by the annuity payer of its obligations, the annuity recipient has the right to demand the return of real estate transferred to ensure lifelong maintenance, or payment of the redemption price to him under the conditions established by “Article 594” of the Civil Code. In this case, the rent payer has no right to demand compensation for expenses incurred in connection with the maintenance of the rent recipient. Thus, the monthly rental payments received by the annuity recipient cannot be considered as income from the sale of property transferred under the annuity agreement. Accordingly, the provisions of “clause 17.1 of Article 217” of the Code on the exemption from taxation of income received by individuals who are tax residents of the Russian Federation for the corresponding tax period from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots and shares in the said property that were owned by the taxpayer for three years or more, as well as upon the sale of other property that was owned by the taxpayer for three years or more, and “subparagraphs 1” and “2 of paragraph 2 of Article 220” of the Code on obtaining property tax deductions in respect of income received by the taxpayer from the sale of property or shares in it cannot be applied in respect of income received by the recipient of the rent in the form of periodic rent payments. “Clause 2 of Article 585” of the Civil Code stipulates that in the case when the annuity agreement provides for the transfer of property for a fee, the rules on purchase and sale are applied to the relations of the parties regarding the transfer and payment, and in the case when such property is transferred free of charge, the rules on the agreement donations insofar as otherwise is not established by the rules of Chapter 33 of the Civil Code and does not contradict the essence of the annuity agreement. That is, property that is alienated for the payment of rent can be transferred by the recipient of the rent into the ownership of the rent payer for a fee paid regardless of the payment of rent, or free of charge (“clause 1 of Article 585” of the Civil Code). From the above it follows that in relation to income in the form of payment for property transferred under a rent agreement (in the case under consideration - 10 percent of the market value of the specified property), the relevant provisions of “clause 17.1 of Article 217” of the Code on exemption from taxation of income received by individuals from the sale of property that was owned by the taxpayer for three years or more, as well as “subparagraphs 1” and “2 of paragraph 2 of Article 220” of the Code on obtaining a property tax deduction when selling property.

Deputy Director of the Department of Tax and Customs Tariff Policy R.A. SAHAKYAN

27.01.2015

| Next > |

Taxation

The payer can become the owner of property in two ways: paid and free of charge (Article 585 of the Civil Code of the Russian Federation). We talk about what types of rent there are and under what conditions for obtaining real estate they are concluded here.

Paid transfer of property is carried out through a purchase and sale agreement (Chapter 30 of the Civil Code of the Russian Federation). To officially obtain the status of owner of the transferred property, the payer is required to make a state registration. registration of the concluded agreement. From this moment on, the payer assumes the obligation to pay all utility bills and personal property taxes. faces.

Monthly rent continues to be paid to the owner regardless of the method of transfer of property. In addition, a person who has received real estate can count on receiving a tax deduction equal to the actual value of this property, but in an amount not exceeding one million rubles (2 clause 1 of Article 220 of the Tax Code of the Russian Federation).

The funds received by the owner from the payer for the transfer of ownership rights are classified as income received from the sale of real estate (Clause 5, Clause 1, Article 208 of the Tax Code of the Russian Federation).

The amount received by the owner monthly is classified as income received from renting out property (Clause 4, Clause 1, Article 208). These incomes are subject to 13% tax (Article 1, 224 of the Tax Code of the Russian Federation). If the property was transferred under a gift agreement, tax fees are not applied. You only need to pay the tax on the annuity contract (Article 572 of the Civil Code of the Russian Federation). You can find out more about how an annuity agreement differs from a gift agreement, as well as from a will, in a separate material.

The tax consultant of the financial service “Inkom-real estate” Aina Zaitseva answers:

Taxation upon alienation of an apartment will depend on several conditions. Firstly, on the method of obtaining an apartment by the spouse. So, if an apartment was purchased during marriage in the name of the spouse, then, according to the provisions of the Civil and Family Codes of the Russian Federation, the property acquired by the spouses during the marriage is their joint property. It does not matter in the name of which spouse such property is registered. In connection with this point, the date of emergence of the spouse’s ownership rights is the date of acquisition of the apartment into common joint ownership and registration of it in the name of the spouse.

The owner of the apartment died. What should the heirs do?

Inheriting an apartment

If more than three years have passed from the date of acquisition of an apartment to its alienation under a rental agreement (for property for which ownership rights arose before 2021), then the income received from the alienation of the apartment will not be subject to personal income tax. Otherwise, income from the alienation of an apartment will be subject to personal income tax on a general basis.

Secondly, you need to look at the terms of the annuity agreement. You, as a rent recipient, can receive income on two grounds: from fees for transferring property into ownership and from rental payments. The payment for the transfer of the apartment (if provided for in the agreement) is recognized as income from the sale of property. Therefore, if the apartment was owned for more than the minimum period of ownership, then the fee for transferring the apartment is not subject to personal income tax, otherwise it will be taxed on a general basis. Such income can be reduced by the amount of expenses or a property deduction can be applied. As for rental payments, such payments are not recognized as income from the sale of property, a property deduction cannot be applied to them, they are subject to personal income tax at the rate of 13% on a general basis. For this type of income (rent payments), it is necessary to file a declaration and pay tax annually.

Tax Consequences of a Lifetime Annuity Agreement

A life annuity agreement establishes the procedure for maintaining a needy person at the expense of his or her existing property. Payments are made regularly based on a clearly defined schedule. A life annuity terminates upon the death of the recipient. From the moment of death, all obligations for maintenance or other assistance to the owner are completed. Additional clauses specified in the contract related to the moment of death must be strictly fulfilled.

Personal income tax of 13% is assessed on the entire amount of maintenance ; it is recognized as the income of the individual recipient (clause 1 of Article 224 of the Tax Code of the Russian Federation). The responsibility of the rent payer is to pay for utilities, electricity, gas, etc. – this cost is not included in income. The procedure for payment of tax by the recipient is regulated by Art. 228 of the Tax Code of the Russian Federation, the recipient also has the right to use standard tax deductions.

Upon the death of the beneficiary, all encumbrances placed on the property are released, after which the payer becomes the full owner. In the event of the death of the payer, the law does not provide for termination of the contract, therefore, the heirs of the deceased, receiving his property, also receive responsibilities for maintaining the dependent (read about in which cases termination of the annuity contract is possible in a separate article). If the heirs refuse to accept the rights to the encumbered property, the inheritance becomes escheated and becomes the property of the state. Responsibilities for maintaining a dependent are transferred to the state § 1 Ch. 33 Civil Code.

After the transfer of ownership of real estate to the payer due to the death of the recipient, the tax for receiving the property by the payer is not paid, since this property, which became the property during the transfer, is not classified as income. The new owner of the property must pay land and property taxes.

Our website has many useful publications on various types of annuities. We also talk about whether it is possible to challenge a rental agreement and how to do it correctly.

Lifetime Annuity Agreement: Taxes on Regular Payments

Such income is treated similarly to rental payments for real estate and is taxed at a rate of 13%.

A feature of tax relations under an annuity agreement between citizens is that the source of payment is not a tax agent. Consequently, he does not have the right to withhold tax from the recipient’s income and transfer it to the budget. The responsibility to calculate personal income tax, submit the declaration to the tax authority and pay the tax lies with the recipient.

When preparing your return, standard tax deductions are applied - for children, disaster relief workers, and others.

Payment of utility costs becomes the responsibility of the rent payer from the date the apartment is transferred to him. Payments for charges for water, heating, gas, electricity and the like are not included in the income of the citizen receiving the rent.

A special feature of a dependency agreement is the obligation of the payer to provide for the needs of the recipient citizen in kind, not limited to the transfer of funds. Moreover, money transfers may not be included in the contractual terms at all. At the same time, the contract for lifelong maintenance with dependents indicates the cost of the entire volume of compulsory assistance, which is subsequently used in calculating personal income tax.

Due to advanced age, the recipient may not be able to independently fulfill tax obligations. He has the right to instruct the payer to transfer the tax and submit the declaration to the Federal Tax Service. To do this, you need to include the appropriate condition in the annuity agreement, prepare a notarized power of attorney in the name of the responsible person and sign the agency agreement.

If there are two or more recipients, each of them separately fulfills the responsibility for tax reports and payments to the budget.

Payment terms and amount of monthly payments

Permanent and lifetime annuity

How much does a permanent annuity cost? Civil Code of the Russian Federation, clause 2, art. 590 determines the amount of permanent rent established by the contract not less than the subsistence minimum per capita in the region where the property is located. The amount of this amount may change in proportion to changes in the cost of living. It is possible to pay rent by providing things, performing work or providing services corresponding to an established monetary value. For life annuity everything is the same, but its value is regulated by clause 2 of Art. 597 of the Civil Code of the Russian Federation and does not involve replacing cash payments with other services.

Dependent until the end of days

How much to pay for a dependent life annuity? Civil Code of the Russian Federation, clause 2, art. 602 determines the amount of payments of at least two subsistence minimums per capita in the region where the property is located. The amount of this amount may change in proportion to changes in the cost of living.

Redemption and redemption price constant

Redemption of annuity is a situation in which the payer, instead of constant regular payments, must pay the recipient a one-time payment established in accordance with the agreement (Article 592, Article 593 of the Civil Code of the Russian Federation). If there is no clause in the contract on the amount of the redemption price, the redemption must be carried out at a price equal to the amount of annual payments for rent (clauses 2 and 3 of Article 594 of the Civil Code of the Russian Federation). If there is no clause on the amount of the redemption value of the property transferred free of charge, the price for the redemption is formed taking into account the price of the property and the annual rent payment (clause 2 of Article 594 of the Civil Code of the Russian Federation).

Cost of document registration by a notary

Each rental agreement must be notarized. The service is provided for a fee and its cost is 0.5% of the contract price, but not less than three hundred rubles and not more than twenty thousand rubles. This price is fixed for all regions of the country.

Differences in price are reflected in fees for technical services. The amount of this payment depends on the regions of the country.

For example, in Moscow, technical services cost 7,000 rubles, in Orenburg from 4,000 rubles, in Ryazan 7,000 rubles, in Surgut from 6,000 rubles, in Omsk from 5,000 rubles, in Samara from 7,000 rubles, in Kazan from 7,000 rubles, in Krasnodar from 7,000 rubles, in Chelyabinsk from 7,000 rubles, in Yekaterinburg from 6,000 rubles. Payment for notary services is carried out by the payer.

Formulas and procedure for calculating ground rent

The difference between land plots lies in their location. Some are located in favorable and fertile territories, others in territories unsuitable for agriculture. Land rent is divided into two types: differential and absolute.

- differential I – represents additional net income received from conducting activities on fertile lands;

- differential II - represents the net income received as a result of active economic investments in economic activity;

- absolute - one of the mechanisms of the economy, entailing a careful attitude towards land. This type is formed due to the meager supply of land.

The landowner demands an inflated rent for each plot of property, regardless of its location and soil characteristics.

Tenants are forced to increase prices for agricultural products in order to pay rent. Differential rent is calculated using the formula:

DFi = (A0 – Ai)•Oi , where DFi is the differential rent in the i area, A0 and Ai are the level of social and individual production prices, Oi are the output volumes in the i area.

Absolute rent is calculated using the formula:

ABi = (I – I0)•Pi , where ABi is the value of absolute rent from plot i, I is the market price of the product.

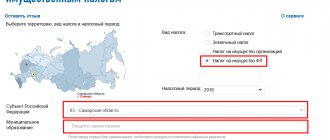

Taxation for rent, how much taxes to pay under a rent agreement

Article 585 of the Civil Code of the Russian Federation provides that property that is alienated for the payment of rent may be transferred by the recipient of the rent into the ownership of the rent payer for a fee or free of charge. If property is transferred for a fee, then the rules of purchase and sale (Chapter 30 of the Civil Code of the Russian Federation) apply to the relations of the parties regarding transfer and payment.The rent payer acquires ownership of the real estate transferred to him by the rent recipient from the moment of state registration of the transfer of ownership under the rent agreement. From that moment on, he assumes responsibility for paying land tax, property tax for individuals, as well as the cost of utilities. In this case, the rent is paid to its recipient regardless of whether the property is transferred to the rent payer in ownership for a fee or free of charge. For late payment of annuity, the annuity payer pays the annuity recipient interest, the amount of which is determined by the annuity agreement. If the amount of interest is not established by the annuity agreement, then it is determined in the manner prescribed by Art. 395 of the Civil Code of the Russian Federation.

If property is transferred to the rent payer for a fee, then in the case when a residential building, apartment or share(s) in them is transferred into the ownership of the rent payer for the payment of rent, such taxpayer has the right at the end of the tax period to receive a property tax deduction provided for in paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, in the amount actually spent by the taxpayer on the acquisition of a residential building, apartment or share(s) in them on the territory of the Russian Federation. In this case, such a property tax deduction can be provided by the tax authority at the taxpayer’s place of residence in the amount of a documented (for example, receipt) amount of money transferred by the rent payer for the transfer of ownership of a residential building, apartment or share(s) in them to the rent recipient , but not exceeding 1 million rubles. In this case, the amount paid to the rent recipient for the transfer of ownership of the property to the rent payer, in accordance with paragraphs. 5 p. 1 art. 208 of the Tax Code of the Russian Federation refers to income from the sale of real estate located in the Russian Federation, and the monthly maintenance rent received by him in accordance with paragraphs. 4 paragraphs 1 art. 208 refers to income received from the rental or other use of property located in the Russian Federation.

The indicated income in accordance with paragraph 1 of Art. 224 of the Tax Code of the Russian Federation are subject to personal income tax (hereinafter - personal income tax) at a rate of 13%. Clause 3 of Art. 210 of the Tax Code of the Russian Federation establishes that for income for which a tax rate of 13% is provided, the tax base is determined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions due to the taxpayer, provided for in Art. Art. 218 - 221 Tax Code of the Russian Federation. In this case, such deductions include, in particular, standard tax deductions and property tax deductions. Thus, when determining the size of the tax base for income received monthly in the form of rent, the rent recipient has the right to take advantage of standard tax deductions in the manner established by Art. 218 Tax Code of the Russian Federation.

Accordingly, when determining the size of the tax base for income received by the taxpayer - the recipient of the rent as a one-time payment for the transfer of ownership of property from the rent payer immediately after the conclusion of the rent agreement, such a taxpayer has the right, at the end of the tax period, to take advantage of the property tax deduction provided for in paragraphs. 1 clause 1 art. 220 of the Tax Code of the Russian Federation in connection with the sale of a taxpayer-owned residential building, apartment, including privatized residential premises, dacha, garden house and land plot and shares in the said property. If such property at the time of its sale was owned by the taxpayer for less than three years, then a property tax deduction can be provided in an amount not exceeding 1 million rubles.

Instead of a property tax deduction from the sale of real estate within the specified standard, the taxpayer has the right to reduce the income received from the sale of such property by the amount of expenses actually incurred by him and documented in connection with the receipt of this income, i.e. for the amount of documented costs for the acquisition of sold property. If the rent recipient transfers to the rent payer the ownership rights to a residential house, apartment (including privatized residential premises), dacha, garden house or land plot or share(s) in the specified property, which were in the ownership of the rent recipient for three years or more, then the property tax the deduction is provided to the annuity recipient in the full amount received by him upon the sale of the specified property to the annuity payer.

In cases where the property that is alienated for the payment of rent is transferred by the recipient of the rent into the ownership of the rent payer free of charge, the rules on the gift agreement (Chapter 32 of the Civil Code of the Russian Federation) apply to the relations of the parties to the rent agreement. According to Art. 572 of the Civil Code of the Russian Federation, under a gift agreement, one party (the donor) gratuitously transfers or undertakes to transfer to the other party (the donee) an item of ownership or a property right (claim) to himself or a third party, or releases or undertakes to release it from a property obligation to himself or a third party . Until January 1, 2006, real estate transferred by way of gift was taxed in accordance with the Law of the Russian Federation dated December 12, 1991 N 2020-1 “On the tax on property transferred by inheritance or gift.”

From January 1, 2006, income in kind received from individuals as a gift, in the case of a gift of real estate, is subject to clause 18.1 of Art. 217 of the Tax Code of the Russian Federation is subject to personal income tax at a rate of 13% if the donor and recipient are not close relatives. Income received as a gift is exempt from taxation if the donor and recipient are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half (having a common father or mother) brothers and sisters). At the same time, Art. 572 of the Civil Code of the Russian Federation provides that if there is a counter transfer of a thing or right or a counter obligation, the contract is not recognized as a donation. Based on this rule, in the case of the transfer of real estate for the payment of rent free of charge, the rent agreement for the purpose of taxation of property transferred by way of gift cannot be considered as a gift agreement.

Consequently, income in kind received by rent payers from individuals receiving rent in the form of property alienated free of charge under a rent agreement is not subject to personal income tax, unlike income received as a gift of real estate. Let's look at the procedure for taxing the income of an annuity recipient using a specific example. Under a lifelong maintenance agreement with a dependent, the annuity recipient transfers the rent payer's ownership of the apartment for a monthly fee for the payment of rent. An apartment that is alienated for payment of rent is transferred by the recipient of the rent into the ownership of the rent payer free of charge. The cost of the entire amount of maintenance with dependents per month is determined by the parties in the amount of at least 3 thousand rubles. Additionally, all utilities are paid monthly, as well as the cost of gas, electricity, maintenance, and telephone services.

Essential in a lifelong maintenance agreement with dependents is the condition on determining the cost of the entire amount of dependent maintenance, which depends on the nature of the maintenance provided. If this condition is absent, the contract of lifelong maintenance with dependents is not considered concluded (Articles 432, 433 of the Civil Code of the Russian Federation). For personal income tax purposes, the amount of maintenance specified in the lifelong maintenance agreement with dependents is recognized as the income of the individual receiving the annuity.

The amount of monthly maintenance rent he receives in accordance with paragraphs. 4 paragraphs 1 art. 208 of the Tax Code of the Russian Federation relate to income received from leasing or other use of property located in the Russian Federation. The indicated income in accordance with paragraph 1 of Art. 224 of the Tax Code of the Russian Federation are subject to personal income tax at a rate of 13%. If the agreement for lifelong maintenance with a dependent has passed state registration, payment of utilities, as well as the cost of gas, electricity, maintenance, and telephone services is the responsibility of the annuity payer, and, therefore, their paid cost will not be the income of the annuity recipient.

In accordance with Art. 228 of the Tax Code of the Russian Federation, the annuity recipient, as an individual receiving remuneration from another individual - a annuity payer who is not a tax agent, on the basis of a concluded civil law agreement, is obliged to independently calculate personal income tax amounts in the manner established by Art. 225 Tax Code of the Russian Federation.

When determining the size of the tax base for income received monthly in the form of rent, the rent recipient has the right to take advantage of standard tax deductions in the manner established by Art. 218 Tax Code of the Russian Federation.

In addition, according to Art. 229 of the Tax Code of the Russian Federation, the annuity recipient is obliged to submit a tax return to the tax authority at the place of residence no later than April 30 of the year following the reporting year, and pay personal income tax no later than July 15 of the same year.

Land capitalization and methods used

This is the name of the method in which the income method is directly used in assessing the value of land. There are 2 methods to determine capitalization ratio :

- for a similar plot of land, the price of land rent is calculated and divided by the cost of its sale;

- the risk-free rate of return on capital increases by the amount of the risk premium associated with investing capital in the assessed plot of land.

Rent is a very profitable business. This practice is widespread in Europe; in Russia it is only gaining momentum. A guarantee of obtaining the desired property is care when concluding a contract and compliance with all its conditions.