From whom should I demand payment of debt for housing and communal services?

If a debt has arisen, then payment can be demanded from all owners, registered owners and tenants jointly and severally.

Important! Collection of debt on utility bills, with the exception of major repairs and maintenance of residential premises, is allowed from all owners and those registered jointly (clause 29 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated June 27, 2017 No. 22). Each of them can be presented with a separate demand for payment of the accumulated debt in full.

If the owner (tenant, tenant) has changed, collection of debt for utilities is allowed from both the former and the new owner. The old one owns all the debts for housing and communal services, except for the debt for major repairs - it passes to the new owner (clause 3 of Article 158 of the Housing Code of the Russian Federation).

Important! The debt “hangs” not on the apartment, but on a specific person with whom the management company entered into an agreement.

An exception is if the apartment was inherited. Then we demand payment of all debts for housing and communal services from the heir.

The procedure for collecting utility bills

Let us immediately note that this procedure is not too complicated and has three stages: pre-trial, judicial and enforcement proceedings:

- The pre-trial procedure for collecting utility bills involves filing a claim against the defaulter. Such collection of utility bills cannot be called effective, since no more than 30% of debtors respond to it. A notice of disconnection from a utility service gives the greatest result in working with debtors (follow the link for more details on the procedure for disconnecting utilities for non-payment).

- Court. Mostly housing and communal services resort to judicial proceedings. Since it takes a long time to wait for payment during a peaceful settlement of the conflict, moreover, issues of quality of services provided by the service organization or recalculation constantly arise between the parties. As a rule, all controversial issues cannot be resolved without a trial.

- Execution of a court decision. Next, the court receives a writ of execution or a court order, submits an application to initiate enforcement proceedings at the bailiff service, and begins enforcement of collection of amounts collected from the debtor.

ATTENTION: do not miss the opportunity to consult a lawyer for free without a phone through commenting - by subscribing to our YouTube channel.

Extrajudicial methods of collecting utility debts

The following methods of collection are considered extrajudicial:

Calculation of penalties and reflection of these amounts in receipts for payment

Interest on the debt amount is accrued from the 31st day of delay in the amount of 1/300 of the Central Bank rate for each day until the debt is repaid in full. From the 91st day of delay, the penalty increases to 1/130 of the Central Bank rate.

Disabling services

Light, hot water, gas can be turned off if the debtor does not pay for more than 3 months. But first, send the appropriate notice (hand over the notice against receipt). The debtor will have time (as a general rule, 20 days) for voluntary repayment.

Important! If at least some amounts are received to pay off the debt, it could even be 100 rubles a month; utilities cannot be turned off.

In addition to complete shutdown, it is possible to suspend at certain hours during the day or limit the supply by quantitative indicators per day, month, etc. Such gentle measures are desirable, especially when there are young children in the family.

It is prohibited to turn off heating, cold water, or shut off water drainage.

Calls, visits and psychological impact

A polite call with a request to partially pay the debt, personal visits to the debtor without an aggressive attitude often help to get at least some amount per month.

A rather controversial technique is the placement of a list of debtors with the amounts of debt and apartment numbers at the entrance to the entrance or in the entrance on a special announcement stand.

Important! You cannot post personal data - last names, first names. Apartment numbers and debt amounts are allowed to be posted (confirmed by judicial practice).

Why is this method controversial? It will have a negative impact on many payers.

How is the statute of limitations for utility bills calculated?

The initial stage of the process after a claim is the issuance of a court order. In this case, one should also take into account such a term as the statute of limitations, according to which debts are collected for services already provided exclusively without fail within a certain time period.

Please note that the time frame for collecting utility bills is provided as a general one (it is set for 3 years for claims from the moment the debt was incurred for the current month).

The debt is collected for payments within an indefinite payment period, a uniform period of 3 years is applied. During this period, a person has the right to pay off the debt, distributing it at his discretion over the entire period, but at the same time he risks receiving penalties for using the money.

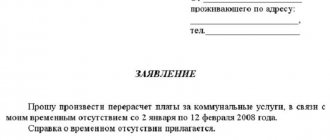

Pre-trial collection methods: claim

Collection of debts for utility services does not imply a mandatory pre-trial procedure in relation to individuals. That is, the management company, homeowners association (TSN, housing cooperative) or the supplier can immediately go to court.

If the debtor is a legal entity, then it is necessary to write a claim.

In any case, we recommend filing a claim. Requirements with calculation of the amount of the debt, penalties and a warning about going to court with the subsequent recovery of additional legal costs from the debtor encourage the debtor to pay at least in parts and gradually pay off the debt.

Calculation of debt for collecting utilities

Debt occurs when a person is 30 calendar days late. From the 31st day the calculation of the debt for collecting utility bills begins. A penalty of 1/300 of the refinancing rate is charged on the amount of debt for all days of delay. Moreover, if the debtor ignores this fact within 3 months, more stringent measures are applied.

If a claim for payment of utility bills needs to be drawn up professionally, then the management company can contact us for help. If, on the contrary, a citizen requires protection, then an objection to a court order for the collection of debts on utility bills or a counterclaim for recalculation will maximally defend the interests of the debtor.

Going to court

Rent debts can be “adjudicated” in the magistrate’s court by filing an application for a writ of injunction in the magistrate’s court. This is the fastest way. Within 5 days you will receive a court order (if you pick it up in person).

If within 10 days from the date of receipt of the letter with the court order, the debtor does not go to court to cancel it, then you will already have a writ of execution in your hands to present to the banks and the FSSP.

If the order is cancelled, you will need to file the claim again: in the magistrate’s court, if the debt with interest (penalties) is up to 100,000 rubles; to the city (district) court, if the amount is greater.

We draw up a claim according to the general rules of Art. 131 Code of Civil Procedure. The state duty can be calculated using an online calculator.

At any stage of debt collection, you can enter into a settlement agreement with the debtor (agree on a convenient payment procedure). For example, if you filed a lawsuit, and the debtor got a job and wants to pay.

Claim for collection of utility bills or court order

Collection of utility payments by court order or through litigation in the event of an obvious dispute is beneficial for both the debtor and housing and communal services. The court for the collection of debts on utility bills makes it possible for utility companies to obtain a writ of execution and begin proceedings to force the debt to be closed, and helps citizens understand the correctness of the accrual.

Why is a court order for utilities more profitable?

If the debtor has not responded to the pre-trial claim, we begin to go to court. In any case, if there is no particular dispute regarding charges, it is advantageous to start with an application to the magistrate for the issuance of a court order for the amount of utility debt.

IMPORTANT: during writ proceedings, the management company saves on state fees by receiving a 50% discount on it, and there is also a reduced period of time spent on judicial consideration of the application.

When is a claim for collection of utility bills required?

If the debtor has sent an objection to the court order to the magistrate or there is a clear dispute over charges, then the housing and communal services service files a claim for collection of utility payments. After which, meetings will be scheduled, for which the utility service must have strong evidence and present it in the form of:

- debt period;

- amounts;

- the entire period of late payments;

- the amount of penalties accrued for late payments;

- the amount of expenses for initiating legal proceedings.

If the service wins, the debtor is obliged to pay the court collection of utility payments in the form of the principal debt for services, accrued penalties and all legal costs.

A court order for the collection of utility bills from registered persons automatically comes into force if the debtor refuses to receive it or does not send an objection to the judge. In this case, housing and communal services have the opportunity to submit an order to the bailiff service.

IMPORTANT: watch the video on the topic of recalculation of utility bills, disputes with management companies: advice from a lawyer on housing issues

Collection through the bailiff service

Bailiffs can prohibit the debtor from traveling abroad, seize accounts and property, write off money from accounts (no more than 50% of any income), sell property to pay off the debt and use other collection methods as part of enforcement proceedings.

If the bailiffs do not receive anything from the debtor for a long time (more than six months), they will issue a decision to end the enforcement proceedings and return the writ of execution.

However, utility services have the right to contact the bailiffs again after 6 months. And if there is evidence of a change in the financial situation of the debtor, then at any time (Clause 5, Article 46 of Law No. 229-FZ) until the statute of limitations expires - 3 years from the date of entry into force of the judicial act (Article 21 No. 229-FZ).

The procedure for collecting debts for housing and communal services

- Voluntary order . At this stage, the management company issues the debt to you and indicates penalties for late payment. Sometimes, even in order to speed up the receipt of money from debtors, it is practiced to post a list of apartments and the amount of debt in order to spur the conscience of a malicious payer and encourage him to quickly pay for utilities. This method is good, but not always fair from the point of view of the law, because certain information is disclosed and made available to the public without the consent of the debtor.

- Claim procedure in the procedure for collecting utility payments. We are ready to file a claim for you on favorable terms (follow the link you will find details of the promotion). The essence of this method of resolving a housing conflict is to present all objections regarding charges in writing. We recommend that you dwell not only on the text with the legal basis for your claim, but also provide a calculation, with a calculation of certain controversial positions.

- Judicial order. If the first two stages in the problem remain unsuccessful, then the utility court will put everything in its place. The judge, by his decision, will determine which side of the dispute is wrong, and most importantly, what and how to do now to correct the situation. Our housing and communal services lawyer helps in these matters with consultation or representation of your interests in court.

How to write off debts for housing and communal services?

Every citizen and organization is obliged to pay debts for housing and communal services according to receipts that come to them monthly, but there are situations when they can no longer pay debts, for example:

- Death of a citizen (owner of the premises), in this case the management company or housing and communal services can write off the debt for a legal reason.

- Liquidation of the organization (in fact, the organization no longer exists, so the debt can also be written off legally).

- Bankruptcy of a citizen (here you can try to go to court as a creditor, however, if the citizen has nothing, neither property nor money, then it is unlikely that it will be possible to recover, so write-offs often occur).

- Expiration of the statute of limitations for utility bills

- Insolvency of the citizen (in this case, the debt may not be written off, but the citizen may be restructured).

It is important to remember that writing off payment debts occurs only on a legal basis, so if a citizen or organization deliberately evades paying debts, then it will not be possible to write them off. If you evade, the situation can only get worse, the matter can go to court, then the debts will be collected in court.