The balance in utility bills is the debt of the payer of housing and utility services at the beginning or end of the period for which the receipt was generated. In the previous article, we became familiar with the concept of balance and the algorithm for calculating this indicator. Today we will look in detail at how to calculate the current debt, taking into account the balance in the receipt for housing and communal services and how this balance is calculated. We will also tell you what errors there are in rent calculations and in what cases penalties may be charged.

What is the balance in the receipt for housing and communal services?

Utility payments are a mandatory expense for each month and are taken into account when planning your monthly budget. Often the payer does not understand what the balance on the receipt is and where this strange amount came from. And the main question is how much you need to pay: what is accrued for the billing period, or taking into account the balance?

The opening balance in the housing and communal services receipt is the consumer’s debt as of the 1st day of the billing period, which is included in the payment document regardless of when the payment was made. In the management organization, a personal account is opened for each payer, which is assigned a unique number. This number is usually indicated in the upper right corner of the payment document. For each account, a balance of income and expenses is maintained. So, the opening balance is taken from this balance sheet. Having a debt at the beginning of the month does not mean that it needs to be paid. It is enough just to raise the previous payment and check the amount, payment date and details.

The opening balance in the receipt is the balance of the debt at the end of the period, taking into account the opening balance and accruals. You should not assume that the opening balance is the amount due. You must take into account how much you have already paid this month.

The payment document for housing and communal services contains a list of housing and utility services. The housing service provider can be a management company, a housing cooperative, a homeowners association, or a government organization that manages residential buildings. Housing services include:

- property maintenance;

- cleaning common areas and local areas;

- maintenance and repair of elevator equipment;

- garbage removal, etc.

As a rule, the cost of such services is expressed as a fixed amount, which is periodically indexed. Indexation can occur every six months or year.

Utilities are variable expenses, the cost of which is calculated by multiplying the tariff rate by the expense. Expenses are determined by meter readings. Such testimony must be submitted by the consumer within a certain period. This can be done by phone, through the official website or the management company’s form.

Utility providers are resource organizations that issue bills directly or through a management company. Utilities include electricity, water supply, landline telephone communications and gas supply (if the house is equipped with gas stoves or water heaters).

All of the above organizations keep records of debt at the beginning and end of the current period and include the incoming and outgoing balance of payments in the receipt, which is usually generated in the first days of the month.

What to do to prevent a balance from appearing

To ensure that there are no discrepancies in the amounts in utility bills, the consumer must carefully and conscientiously pay for services:

- Transmit information about meter readings exactly within the specified period.

- Make payment by the date indicated on the invoice.

- Pay for services in the amounts indicated on the receipt, taking into account previous debts or overpayments.

- Correctly use the calculation formula when independently calculating the amount.

- Check the details for transferring funds so as not to send money to the wrong account.

In controversial situations, cash receipts are proof of payment made . In the event of a technical failure in the banking system, or an error by a utility employee, such a document will help resolve the misunderstanding. Therefore, checks cannot be thrown away. It is best to store them in a separate folder along with paid receipts.

If the amount on the payment form is in doubt, the consumer has the right to request an explanation from the utility company and recalculate for the current period.

It is better to send a written request indicating which balance needs to be clarified - for gas, electricity or water supply. In the response letter, the utility service will describe in detail the reason for the balance.

Why enter the balance on the receipt?

The balance in the receipt is indicated in order to inform the consumer about the status of his personal account, including debt at the beginning and end of the period according to the service provider. To calculate how much you need to pay, you need to subtract from the opening balance the amounts you have already paid in the current month.

If, for example, the balance on August 1 is equal to the amount that you paid on August 7, this means that at the time you receive the payment document you have no debt for previous periods. You only need to pay what is accrued for the current month.

Causes

A positive or negative balance appears in the following situations:

- There is arrears in payment of utilities, the amount of which is added to the payment for the current period.

- When creating the account, there were unaccounted contributions - this situation occurs when the receipt is not paid on time.

- The consumer did not transmit the actual meter readings, or sent the information later than required. In the absence of accurate data, the housing and communal services institution will calculate the payment based on average values; their difference from the actual readings, accordingly, forms a balance.

- There was an error in the bank transfer system and the company did not receive the previous payment.

For 2021, in most Russian regions, utility services recommend that consumers submit individual meter readings for the current month on the 23rd–26th. Deviations from these deadlines may cause discrepancies in issued invoices.

According to general rules, utility organizations provide consumers with receipts on the 1st day of the month, indicating the specific service and its cost. Homeowners are required to pay by the 10th.

Due date

The payment document always indicates the due date for payment. Most often, this period is set on the 10th day of the month following the billing month. In some cases it may be the 20th or 25th. It should be noted that the payment deadline is the date of the actual transfer of funds, and not their crediting to the supplier’s details.

Example. The payment deadline for the payment document is no later than the 10th. The payment was made on the 10th at 23.59, the money will be credited on the next banking day, but the payment deadline will not be violated.

How to pay the balance on your electricity bill

The opening balance for electricity services is as follows: you need to add accruals (the cost of consumed electricity) to the debt balance at the beginning of the month and subtract the amount of payments in the current period.

Usually the receipt is paid the following month. If you have already paid some amounts this month, they must be deducted from the opening balance.

Example. The balance at the end of April in the electricity receipt was 750 rubles. ($10 or 290 UAH). On May 7, a payment was made in the amount of 300 rubles. ($4 or 116 UAH). Therefore, you still have to pay another 450 rubles. ($6 or 174 UAH).

Sometimes a consumer wonders: is a balance with a minus an overpayment or a debt? Returning to theory, let us remember: for the service provider we are a debtor, i.e. debtor Receipts for payment are always generated “on behalf of” the supplier. A negative debit balance means you overpaid. Perhaps some payment was made twice, for example: you paid the amount of charges for the month and in the same period the balance on the electricity receipt was paid. Or you had an automatic payment set up, the bank wrote off the payment yourself, and you forgot about it and paid again. Sometimes the consumer pays for utilities in advance, i.e. pays the amount several months in advance. This happens, for example, when you need to leave for a long period. This creates an overpayment that can be offset against future payments.

Meanings of the word balance. What is a balance?

Balance

Balance (Italian: saldo - calculation, balance) - the difference between income and expenses for a certain period of time. Balance in accounting is the balance of an accounting account, the difference between the sum of the debit and credit entries of the accounts.

BALANCE - the difference between cash receipts and expenses for a certain period of time; in international trade and payment settlements - the difference between the value of a country’s exports and imports (trade balance) or between its foreign...

Great Accounting Dictionary

Balance (from the Latin saldare - to equalize). — Between persons (or institutions) who are in a relationship of trust with each other, when one party has to spend their own and other people’s money at the same time, there is a mutual account.

Encyclopedic Dictionary F.A. Brockhaus and I.A. Efron. — 1890-1907

BALANCE – remainder.

Methods of paying for utilities to avoid differences

Ideally, the debt at the beginning of the period should be equal to the accruals for the previous period, and the ending debt should be equal to the accruals for the current period. If you pay exactly what was charged and do not violate the payment deadline, then you will not have problems with the balance.

If in any period you violate the payment deadline, the service provider may charge a penalty. On the receipt, the amount of the penalty is usually highlighted as a separate line, and is sometimes not paid attention to. The penalty is calculated for each day of delay, is included in the opening balance and must be paid as soon as it is charged to you.

Many banks offer mobile applications for paying for housing and communal services, where you can set up automatic payment. This will be useful for those who are not used to remembering payment terms. However, even if you have such a function configured and use it, it would be a good idea to check your opening balance every time.

Types of balances, their characteristics

In accounting, the term “balance” carries a specific functional load and is divided into several types. The meaning of each of them is very important when preparing various reports and documentation, therefore, when calculating such a balance, it is very important to avoid mistakes.

Each type of balance is calculated in the same way; to do this, the first thing you need to do is create a balance sheet (all transactions are entered into it), arm yourself with a calculator and some mathematical knowledge that absolutely every accountant has.

Debit balance

A debit balance is formed when the debit indicators are higher than the credit indicators. In this case, the resulting value is displayed in the asset column.

To put it more simply, this is when the amount of revenue is greater than the amount of expenses/expenses.

REFERENCE!

If a debit balance arose on a passive account, then this can only mean that the accountant made a mistake.

Credit balance

A credit balance is when a credit exceeds a debit, that is, the sum of the credit indicators is greater than the debit (or expenses are greater than receipts). In this case, the value is displayed in liabilities.

Moreover, credit values should be displayed only on passive or active-passive accounts.

REFERENCE!

Receiving a credit balance on an active account means an error was made by the accountant.

Active balance

Active means the excess of income over expenses in the balance of payments or trade.

Passive balance

The passive balance has the exact opposite definition to the “active” one, that is, it is the excess of income over expenses.

REFERENCE!

Despite the fact that this value, like the previous one, can turn out to be positive or negative, it is always written with a “+” sign.

Opening balance

The opening balance (or opening balance) is the account balance at the beginning of the period or the result of the company’s economic activities for the previous period of time. When calculating, transactions that were performed before the current period are used.

In other words, this is the total amount at the end of the calculated period.

Closing balance

Closing balance (outgoing) - the balance at the end of a certain period (month, year or quarter) or the result of account transactions at the end of the calculated period.

To get this balance, you need to add the turnover indicator, which is located in the same part of the account, to its initial value, and then subtract the turnover indicator from the resulting number.

Balance for a period of time

Balance for a period of time is the result of transactions for a certain period. This period is determined in each specific case:

- month;

- quarter;

- six months;

- year or the entire period of operation of the enterprise.

Trade balance

The term "trade balance" is used in trade relations between countries and refers to the difference between the value of goods that are exported and imported. This indicator can take on both positive and negative values, the calculation of which is carried out within a specified time.

- A positive balance occurs when a country sells more than it buys, that is, exports exceed imports. This value usually arises if the state does not need the quantity of goods it produces, but on the world market, on the contrary, they are interested in its products.

- A negative balance occurs when imports are greater than exports, that is, the state acquires more than it sells, which means that there are practically no products from domestic producers in the state itself. Most often, this situation is considered unfavorable for the country, because it indicates that it is not able to provide for itself and is dependent on its neighbors. In addition, a negative balance indicates that the local manufacturer is in a deplorable state, which means that it has various limitations in capabilities and is uncompetitive.

A negative balance may trigger a depreciation of the local currency. Therefore, even the International Monetary Fund recommends maintaining a positive trade balance, because this factor is a prerequisite for a country to receive loans.

But in some highly developed countries, a negative balance is not a problem, because it prevents the growth of inflation in the United States of America and in some other European countries. It also makes it possible to move complex production to developing countries.

Balance of payments balance

Another term widely used in trade relations between countries. Today, almost all states trade with each other, that is, they carry out monetary transactions. Therefore, the concept in the balance of payments means the difference between the amount of payments abroad and the amount received from abroad.

The balance of payments can be positive or negative, each of them has its own characteristics. A positive value is obtained when the amount of payments received from other countries exceeds the amount of payments sent to other countries. A negative balance occurs when payments to other countries exceed payments received from other countries.

The type of balance is also determined by deducting expenses from income.

REFERENCE!

The resulting negative value has a negative impact on the local currency, so absolutely every state is interested in achieving a positive balance at the end of a certain period.

Balance in foreign trade relations

The term in question in foreign trade relations relates to the field of economic theory and means the difference between the cost of goods and services that are exported and imported over a specific period of time.

This indicator is calculated only for relationships with foreign companies. When calculating, the following must be taken into account:

- export indicators;

- import amount;

- payments made to foreign companies;

- cash receipts from foreign companies.

How to calculate the fee taking into account the balance

The amount to be paid is calculated using the formula:

Ref. balance = accruals for the period +/- input. balance – payment.

If the opening balance in the payment order (receipt) is positive, then it must be added to the accruals, if negative, it must be subtracted.

Example. At the end of May, the balance in the gas receipt is 225 rubles. ($3 or 87 UAH) with a minus sign. This indicates that an overpayment occurred in April or earlier. Accruals for May amounted to 300 rubles. ($4 or 116 UAH), there was no payment. Thus, 75 rubles remain for payment. ($1 or 29 UAH) (4-3).

Consequences of non-payment

If the receipt accumulates a positive balance, in case of non-payment, the owner may be subject to administrative liability in the form of a warning or a fine.

The accrual of penalties depends on the duration of the debt and the rate of the Central Bank of the Russian Federation:

- in the period 31–90 days, penalties are calculated as 1/300 of the Central Bank key rate;

- for a longer debt period - 1/130 of the Central Bank rate.

On all receipts, penalties are indicated in a separate column. Fines are not included in the balance calculation.

When the surplus increases to certain limits, the provision of utility services is suspended, which means the supply of electricity, water or gas is stopped. Renewal is possible only upon full repayment of the debt and payment of a fine.

If the owner pays receipts on time in the exact amount and submits meter readings on time, the risk of a balance appearing on the receipt is close to zero.

Errors in receipts for housing and communal services payments - what to do

The appearance of errors in payment documents for housing and communal services is a fairly common phenomenon. Almost every consumer has encountered a situation where amounts were charged for non-existent services or the cost of utilities was greatly inflated. Such errors occur for several reasons:

- Dishonesty or incompetence of management company employees. Unfortunately, there are cases when the receipt includes services that were not actually provided. For example, you pay for cleaning common areas, but there is not even a cleaner on staff. Or the receipt contains the line “payment for the maintenance and operation of the waste collection chamber,” but in fact the room allocated for the waste collection chamber is closed and not in use. Or you live on the ground floor and are charged for the elevator.

Here are the most common reasons for overcharges on receipts:

- In almost every apartment building there are residents who do not consider it necessary to pay bills. Often, management companies, instead of going to court to collect debts, “scatter” them according to receipts from bona fide payers. Therefore, you need to know the rates for each service. Thus, tariffs for electricity, gas and water can be found on the official websites of resource supply organizations. There are services for which tariffs depend on the area of the residential premises or on the number of registered residents;

- It is impossible to check metering devices for common areas. For example, in winter there are temperatures above zero from time to time, and the heating in apartments can be regulated independently. At the same time, radiators in elevator halls operate at full capacity. As a result, residents pay for energy that is actually wasted;

- paid services are not provided at all or are provided improperly: premises are cleaned or garbage is removed rarely, elevators do not work for several days, while charges for these days are made as usual.

- Technical glitches. Sometimes the programs that generate receipts crash. Here's an example: residents moved into a new house in June. By that time, there was already a certain number on the heating meter that should not be included in the receipt. However, heating for June was charged due to a failure in the system.

- Human factor. An operator or accountant is a person who can make a mistake: set the tariff incorrectly or incorrectly reflect your expenses.

Thus, you should not rely on the honesty and correctness of the actions of the management company’s employees. Each line on the receipt must be checked carefully. If you do not agree with the charges, submit a statement to the Criminal Code, and they should recalculate you. If refused, go to court. It is also possible to resolve issues of charging fees for housing and communal services at a general meeting of owners.

Balance - what is it in simple words

On the website If you make a Reconciliation Report with your customers, then shipments will be made according to Debit 62 of the account, and payment for the goods according to Credit 62. If for suppliers (60 account) there is a debit balance, this means you are owed, you transferred an advance and the goods were not shipped to you , if the balance is on credit, then you owe for goods supplied and services rendered.

Login to the site Reconciliation reportAnd forgive us our debts: at what point can a company write off its debt to counterparties? What “other grounds,” along with the expiration of the statute of limitations, exist for writing off? The Tax Code of the Russian Federation does not contain an answer to this question. In this case, let us turn to official explanations to officials and arbitration practice. It is difficult to disagree with them, because in accordance with Article 419 of the Civil Code of the Russian Federation, the obligation is terminated by the liquidation of the legal entity.

Debt in favor of LLC - IU What is the receivables of an enterprise? In addition to customer debts for products shipped or services provided, accounts receivable may include advances that were paid to contractors and material suppliers, debts on loans issued, for example, to employees of the enterprise, and funds provided to accountable persons for the purchase of raw materials. What are the types of accounts receivable? debt in favor of Ivanov - that means you owe him, someone owes him IU LLC. If you don’t know, think logically: you are not IU LLC, but the debt is IN FAVOR of IU LLC, which means they OWE it! ))) Debt in favor of the company, what does it mean? They sent me a statement of reconciliation of mutual settlements, in the columns of this company: payment of xxx rubles, receipt of xxx rubles, turnover for the period in debit and credit are the same.

What is the liability for non-payment of the balance?

For late payment of housing and communal services, a penalty is charged. The calculation is made based on the Central Bank refinancing rate:

- for debt with a period of overdue from 30 to 90 days - in the amount of 1/300 of the refinancing rate;

- for debt overdue over 90 days – 1/130 of the refinancing rate.

In addition, the organization making the accruals may go to court. After this, the bailiff service sends a resolution to collect the debt to the defendant’s place of work, and the accounting department makes deductions from wages. The amount of withholding can range from 25 to 50% of the debtor's income. To determine the place of work, the bailiff sends a request to the Pension Fund and tax authorities, where deductions from wages are made.

If the debtor has no income or it is impossible to determine the place of work, then foreclosure can be applied to other property that is owned: a car, real estate, shares in a business, etc.

If the debt for housing and communal services exceeds 500 thousand rubles, collection is possible only through the bankruptcy procedure of an individual. Such a procedure can be initiated by the management company or resource supply organization.

Sometimes the consumer pays only the charges on the receipt, and the opening balance (debt at the beginning of the month) remains. In this case, the payment amounts of the current period are transferred to previous periods, and the delay is counted from the day following the due date of the last receipt. Therefore, check that the opening balance does not exceed the accrual of the previous period.

Debt balance in favor of who owes whom

On the website If you make a Reconciliation Report with your customers, then shipments will be made according to Debit 62 of the account, and payment for the goods according to Credit 62. If for suppliers (60 account) there is a debit balance, this means you are owed, you transferred an advance and the goods were not shipped to you , if the balance is on credit, then you owe for goods supplied and services rendered. Login to the site You can add a topic to your favorites list and subscribe to email notifications. - does this mean that we DO NOT owe it, is it our overpayment, or should we pay an additional 200 rubles? - Nobody asks us whether we agree or not. We don't even remember how we got here. We're just driving, that's all. Nothing remains. — The most difficult thing in life remains. This is especially true in cases where the accounting department processes a large amount of incoming documentation. To check the level of debt that the opponent shows, a reconciliation report is usually used. This is information that is produced by “its” program or algorithm. Experienced accountants usually cautiously use the second method of verification due to the fact that data can be distorted (decreased) by the amount of value added tax. The coincidence of the final balance, accordingly, indicates that the past and current periods in both organizations were carried out correctly, there are no complaints. The discrepancy in the information directs the accountant to check each payment and shipment that is recorded in the period for which the report is generated. Help please! In progress 1 law 4 years ago 0 Replies 308 wordpress, question, developer Share Similar questions

- How to enter an address in the form?… (1)

- Recourse claim. Urgently!… (1)

- alimony debt how to refuse... (3)

- how to file a second lawsuit in court against a debtor if one lawsuit has already been filed?... (1)

- what is the balance at the beginning of the period... (4)

- How to terminate a contract with an individual entrepreneur if he dies... (1)

- What kind of debt to a mobile operator can be prosecuted for?… (5)

- How to find out debt on the Internet by personal account... (0)

- how to correctly enter a Moscow address... (1)

- How to correctly translate the specialty “furniture assembler” into Ukrainian?...

An example of calculating the balance in a receipt for housing and communal services

Let's consider an example of calculating the balance in a receipt for water with a payment due date of July 10.

As of July 1, the payer's debt is 600 rubles. ($8 or 232 UAH). This debt includes:

- accruals for June - 450 rubles. ($6 or 174 UAH);

- debt for previous periods - 113 rubles. ($1.50 or 44 UAH);

- penalty – 38 rub. ($0.50 or 15 UAH).

On July 9, a payment was made in the amount of 450 rubles. ($6 or 174 UAH). The meter readings were submitted on time - July 20.

Accrued for July:

- cost of consumed cold water – 225 rubles. ($3 or 87 UAH);

- the cost of consumed hot water is 300 rubles. ($4 or 116 UAH);

- sewerage fee - 75 rubles. ($1 or 29 UAH)

Total payment is 600 rubles. ($8 or 232 UAH).

So how much should the consumer pay?

The calculation will look like this: from the opening balance we subtract the amount of the payment made in July and add the accruals on the receipt:

8-6+8=750 rub. ($10 or 290 UAH), incl. penalty 38 rub. ($0.50 or 15 UAH).

Origin and meaning of the term

The first printed publication on the accounting of trade operations is considered to be the Treatise on Accounts and Records (1494). It is the work of medieval Italian mathematician, professor and monk Luca Pacioli. He applied his knowledge to commerce.

The scientist is considered the founding father of modern accounting. To reflect business processes in the book, accounts and double entry are used. The concepts of “debit” and “credit” are not named, but are explained.

Saldo translated from Italian means “balance, calculation, balance.” Defined as the difference between revenues and expenses. It became an accounting term at the end of the 19th century.

Payment for housing and communal services

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Moscow)

+7 (Saint Petersburg)

8 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

To avoid possible conflicts with government agencies, citizens need to know how and where they can pay money for the use of public services. For each service, tariffs are set by the executive authority, the energy commission and the local administration.

The latter, in turn, should not go beyond the current Russian legislation. Based on these documents, payment is collected from persons evading this payment.

At this point in time, there are several different ways to pay for housing and communal services. The main ones are:

- postal or bank office;

- ATMs;

- payment terminals;

- electronic resources.

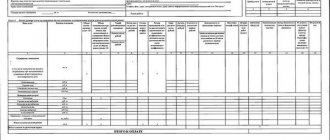

Receipt

Nowadays, a standard receipt for payment of electricity contains information for consumers placed in 18 columns.

It reflects:

- meter readings;

- consumed amount of electricity;

- current tariff;

- balance accrual amount;

- total amount to be paid.

A sample receipt for payment for housing and communal services is here.

This document has two columns indicating the balance:

- No. 3 - balance at the beginning of the previous month;

- No. 11 - balance at the beginning of the current month.

In order to calculate the indicator in column No. 11, you will need to add column No. 3 with No. 8 (accrual of the amount for the previous month) - No. 9 (amount paid in rubles for the previous month) + No. 10 (obtained by recalculating the amount for the previous month).

The resulting value will show how much debt the user has if the result is positive, or how much the citizen overpaid for consumed electricity if the result is negative.

If a person made all the calculations correctly, that is, the amount of money paid for this payment corresponds to the accrued amount, the balance should be equal to zero.

Credit balance

The concept of balance comes from Italy. It became established as an accounting term in the 19th century. Balance is translated from Italian as balance, calculation, payment. In accounting, it meant the difference between the amount of the income account, that is, the debit, and the expense account, the credit. At the beginning of the 20th century, the meaning of this word expanded and went beyond the boundaries of accounting.

Types of balances

Credit balance - in this case, the credit is greater than the debit. This indicator makes it possible to see the state of the source of income that is used to carry out the business affairs of the enterprise. The credit balance is displayed in the liability side of the balance sheet.

On topic: How to pay for water meters via the Internet

Debit balance – debits outweigh credits. It shows the balance status regarding the transactions carried out. In this case, a specific period of time is taken as a basis.

An ongoing transaction account is closed when the difference between credit and debit is zero.

As a rule, in practice, not the entire history of the movement of funds is taken into account, but a selected period of time (month, quarter, year). This period is called the reporting period.

Calculating the account balance is not possible without understanding the following definitions:

- Opening balance. It shows the financial balance in a specific account at the beginning of the reporting period. This indicator is calculated taking into account previous transactions;

- The opening balance shows the balance in the account as of the end date of the period. To calculate, you need to add up the sum of the initial balance and all transactions for a specific period;

- balance for the period - this indicator indicates the result of all previous transactions that were carried out in a certain period.

To determine credit turnover, you need to calculate the result of the accounts by selecting the desired period.

Currently, like several centuries ago, the balance is the difference between the final entries according to the debit and credit accounts. But in addition to accounting operations, a specific term is actively used in foreign economic activity.

Source:

Balance

InfoAuthorization I don’t remember Remember Register now Create an account Restore access Forgot your password? Please enter your login and email. We will send a link to create a new password Username* E-Mail*

How to correctly enter the debtor on the balance, specifically in whose favor the debt is? Complaint Question There is a “supplier” and there is a “buyer”. For a certain period, by calculating debit and credit according to the balance, the “buyer” owes money. There is a column: For such and such a period, the debt in favor of XXX is so much... It’s a little confusing who should be on Where is XXX indicated? The one who owes or the one to whom they owe? What causes the confusion: the phrase “in favor” is confusing, :) That is.

This can be interpreted differently...

Application in accounting

Balances on all accounts as of December 31 of the reporting year are needed to generate the enterprise’s annual financial statements (balance sheet and applications). Debit balances are included in the balance sheet assets, credit balances are included in liabilities. For external users (for example, to obtain a loan from a bank), it is necessary to draw up an operating balance using the balances as of the specified date. The term "balance" is also used in macroeconomics.

In the trade balance

Shows the value of a country's exports and imports over a specified period (usually a year). The active part reflects the export of goods produced or processed in the country. Passive - import of goods for domestic consumption or processing.

The trade balance is the difference between exports and imports. Positive when exports exceed imports and negative when imports exceed exports.

The trade balance is part of the balance of payments.

In the balance of payments

All foreign economic transactions of the country are reflected. Shows the ratio of payments made abroad and received in the country. The balance of payments is compiled using the double entry principle. The credit shows transactions that bring currency into the country (recorded with a “+” sign), the debit shows transactions that result in the consumption of currency (reflected with a “-“ sign).

The balance of payments consists of 4 sections:

- current account;

- movement of capital;

- foreign exchange reserves;

- errors and omissions.

Section 1 consists of the trade balance and balances of services, net investment income, and current transfers.

The balance is calculated as the difference between the current account and capital account balances. Positive when foreign exchange receipts exceed expenses (surplus) and negative when foreign exchange expenses exceed earnings (deficit). Covered by changes in foreign exchange reserves.

In international trade

The indicators of foreign trade of different countries are taken into account. They are calculated based on balance of payments data and characterize the country's solvency and its capabilities in international trade.

The result indicators are the balance:

- trade and payments balance;

- balance of services;

- balance of goods and services;

- current account.

How to use a math calculator

| Key | Designation | Explanation |

| numbers 0-9 | Arabic numerals. Entering natural integers, zero. To get a negative integer, you must press the +/- key | |

| semicolon) | Separator to indicate a decimal fraction. If there is no number before the point (comma), the calculator will automatically substitute a zero before the point. For example: .5 - 0.5 will be written | |

| plus sign | Adding numbers (integers, decimals) | |

| minus sign | Subtracting numbers (integers, decimals) | |

| division sign | Dividing numbers (integers, decimals) | |

| multiplication sign | Multiplying numbers (integers, decimals) | |

| root | Extracting the root of a number. When you press the “root” button again, the root of the result is calculated. For example: root of 16 = 4; root of 4 = 2 | |

| squaring | Squaring a number. When you press the “squaring” button again, the result is squared. For example: square 2 = 4; square 4 = 16 | |

| fraction | Output in decimal fractions. The numerator is 1, the denominator is the entered number | |

| percent | Getting a percentage of a number. To work, you need to enter: the number from which the percentage will be calculated, the sign (plus, minus, divide, multiply), how many percent in numerical form, the “%” button | |

| open parenthesis | An open parenthesis to specify the calculation priority. A closed parenthesis is required. Example: (2+3)*2=10 | |

| closed parenthesis | A closed parenthesis to specify the calculation priority. An open parenthesis is required | |

| plus minus | Reverses sign | |

| equals | Displays the result of the solution. Also above the calculator, in the “Solution” field, intermediate calculations and the result are displayed. | |

| deleting a character | Removes the last character | |

| reset | Reset button. Completely resets the calculator to position “0” |