To approve a mortgage, the bank must inspect the apartment being purchased. As a result of the transaction, the financial institution experiences certain risks associated with the fact that the borrower may not return the funds issued. The object of the transaction is registered as collateral. As soon as the borrower stops fulfilling his debt obligations, ownership of the apartment passes to the bank. To close the resulting debt, the bank sells the received property. Therefore, a financial institution is forced to conduct inspections of real estate on the secondary market if it is purchased under a mortgage agreement. This is the only way the lender can be sure that the received object will be able to cover the debt. Every borrower should know how the bank checks a secondary apartment when applying for a mortgage.

What parameters does the bank check?

When considering a mortgage application, the bank checks several parameters that are relevant to the transaction:

- Does the seller legally own the apartment?

- How capable is the seller?

- Power of attorney for revocation.

- Mandatory consent of the spouse that this apartment was not purchased during marriage.

- The presence of other heirs.

- Permission from the guardianship authorities if the transaction is made on behalf of a minor citizen.

- Who is registered in the designated area.

Each of these points is worth considering in more detail in order to understand how the bank checks real estate from the secondary market.

How do banks check a mortgage borrower?

Unlike checking an apartment for a mortgage, potential borrowers are given much more attention.

What does the bank do:

- Checks credit history. If it is not there at all, there is a chance that the mortgage will not be approved, or the minimum amount will be issued. If your credit history is damaged, the likelihood of a positive decision is close to zero. It is optimal when the client already had loans and all of them were repaid on time.

- Examines debt load. If there are outstanding loans, they are taken into account when calculating the total mortgage amount and monthly payments. Banks try to ensure that in total, no more than 50% of their salary is spent on repaying all loans from clients. If there are too many loans, your mortgage may be denied.

- Checks the salary level. It is confirmed by certificates, for individual entrepreneurs – by tax returns. The amount of monthly earnings is important in determining the mortgage amount.

- Client participation in bankruptcy proceedings. If he is already bankrupt or less than five years have passed since he was declared bankrupt, the mortgage will be denied.

Note! After submitting an application for a mortgage, the client undergoes a scoring check, which takes 5-10 minutes. The system analyzes his credit history and determines his reliability based on the completed questionnaire. After this, the potential borrower receives pre-approval. The final decision is announced only after a check by the security service, which examines not only the credit history, but also the submitted documents.

Legal advice: Some banks offer mortgages without proof of income. You shouldn’t count on this: the creditor will still make a request to the Pension Fund to find out whether the person pays insurance premiums. If not, this indicates that he is not officially employed. This system has been used instead of income verification for several years. But for a large amount they will still require income certificates and a certified copy of the work record book.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

What to do if the apartment is owned by several owners at once

The legislation provides for the option that the sale of an apartment can be carried out not only by the owner, but also by his authorized representative. If there are several owners, then each of them must take part in the transaction. Therefore, the financial institution will require information about the number of owners of the apartment being sold.

Just 5 years ago, a certificate of ownership was provided for this purpose. Now an extract is being made based on data from the Unified State Register. All real estate objects and any actions in relation to them are indicated here. This document will allow the bank to immediately and accurately determine the number of owners. All persons named in the document must participate in the transaction and sign the sales agreement. Also in this document you can find information about when the apartment was purchased.

How does the bank evaluate an apartment for a mortgage?

When assessing a home for a mortgage, property inspectors use 3 approaches:

- Analogue, in which a comparative analysis of similar transactions carried out on the market is carried out.

- Profitable, which takes into account the prospect of growth in the value of a given home.

- Costly, providing for possible costs during the construction of such an object. This approach is decisive in making a decision on issuing a loan.

When assessing housing for a mortgage, only the permanent characteristics of real estate are considered. Good repairs increase the value of real estate, but do not in any way affect its liquidity.

Based on the data collected by the appraisers, a report is made that includes the market price of the home and the market price. Photos and copies of documents are included in it. The legal status of such a report is equivalent to a legal document.

Learn more about real estate valuation for obtaining a mortgage loan in the video:

How is the legal capacity of the person selling the apartment verified?

This parameter is assessed by a bank employee during a personal conversation with the real estate seller. Sometimes doubts arise about the adequacy of a person, so additional certificates may be required, which are issued after an examination at a psychoneurological dispensary. This institution has information about the registration of a specific person. If a citizen is not registered on such a register, then he is legally capable.

Please note that the provision of such a certificate is made on a voluntary basis. However, it can increase the chances of a successful outcome of the transaction.

Power of attorney to conduct a transaction

Often the sale of an apartment is not carried out by the owner, but by his authorized representative. To carry out such activities, you will need to issue a general power of attorney. This document will be checked by the lender when purchasing and selling an apartment from the secondary market. It is worth considering that the power of attorney has its own expiration date, so at the time of the transaction you should check its relevance.

Situations arise when the apartment owner can revoke the power of attorney. This aspect is also checked by the bank. This can be done on the special website reestr-dover.ru. To check you will need to enter:

- Registry number.

- Certificate date.

- Who signed the document?

After entering the necessary data, a message should appear stating that the power of attorney being verified has not been revoked. Otherwise, the document has no legal force.

Buying an apartment while married

The current legislation of the Russian Federation calls real estate purchased during marriage jointly acquired property. This means that the property belongs to both parties. At the time of the transaction, the bank checks the apartment to determine whether it was purchased during marriage.

If such information is discovered, written consent from the second spouse will be required.

Information about heirs

The property being sold may come to the seller as an inheritance. If such information is discovered, the financial institution may require you to purchase title insurance. This is relevant for situations where less than three years have passed since the date of acquisition of the property. During this period, disputes regarding inheritance may arise.

A will may be provided as evidence. This will allow the bank to verify all the conditions for entering into an inheritance. Sometimes the bank may require a certificate of family composition at the time the inheritance was received.

Legal check

And last but not least, this is legal. Bank employees pay the most attention to it in order to protect themselves from financial losses. The credit institution must check the legal purity of both the apartment itself and its owner, that is, the seller.

- Verification of the owner (the person has ownership rights to the apartment)

First of all, the bank must make sure that the seller is really the owner and is not selling someone else’s apartment. If there are several owners (the apartment is in shared ownership ), they all must participate in the transaction. This can be checked using an extract from the USRN database. The document can confirm ownership of the home.

- Presence of encumbrances

This information can also be found in the extract from the Unified State Register of Real Estate. The apartment must not have any encumbrances : be the subject of a pledge, seizure, lease or rent. Otherwise, the transaction may not be registered.

- Sale by proxy

When the apartment is not sold by the owner, but his interests are represented by another person with a power of attorney. The owner issues the document for a certain period. But the seller may revoke the document ahead of time, for example, if he changes his mind about selling the apartment. If the representative turns out to be a fraudster, he can arrange everything in his own interests and, having received the money, disappear. Therefore, banks must check whether the power of attorney has been revoked.

- Consent of spouses

If the apartment is owned by a family and the seller is alone, in this case the bank may ask for the consent of the other party. Because according to the law, if property was acquired during marriage, one of the spouses can dispose of it only with mutual consent.

- Real estate by inheritance

For bank employees, as well as for customers, this is a risk area. Since undetected heirs may appear at any moment. Especially if the period for challenging the inheritance has not yet passed - three years.

“Transactions with apartments received by inheritance are considered the most risky. In order to exclude future claims from uncalled heirs, the bank may require a certificate of family composition at the time of opening of the inheritance or insist on title insurance (the risk of loss of real estate as a result of termination of ownership of it),” emphasizes lawyer Nikolai Kandiranda.

- Minor owners

If the buyer finds such an apartment, the lender may require permission to sell from the guardianship authorities. Because children cannot be deprived of their property rights if there is no information about their future housing, and they also cannot be discharged to nowhere. Therefore, the bank may ask for information about all registered people. The seller must deregister all those registered at the time of the transaction. Otherwise, you will have to deal with uninvited guests later.

Important! The credit institution will conduct an audit primarily for its own benefit. And bank employees will not necessarily pay equal attention to all the points listed above. Therefore, it is important to conduct an independent check without the participation of the bank.

“When checking an apartment and its owners, the bank, first of all, takes care of its safety. It is worth understanding that the bank is a counterparty in relation to the borrower, and if something goes wrong, it is unlikely to be interested in whose fault it happened. Therefore, I think that the assistance of a realtor in checking security will definitely not be superfluous,” comments Nikolai Kandiranda.

Sale of an apartment whose owner is a minor citizen

Transactions involving minor citizens are often carried out. This category has the same rights as adult owners. During the inspection of the apartment, the bank will ask you to provide permission issued by the guardianship authorities. This government body regulates the observance of the rights of owners who have not yet reached 18 years of age.

You can obtain such a decision from the guardianship authorities after certain procedures. Representatives of this organization must check the housing where it is planned to register minor citizens. You can count on an approving response only if the interests of the children are not infringed.

How is housing valued on the secondary market?

When issuing a mortgage for the purchase of real estate on the secondary market, the bank looks at the condition of not only the housing itself, but also the building in which it is located. A positive decision will be made if the house has a strong foundation and ceilings made of metal or reinforced concrete. Some commercial banks can issue a loan for the purchase of an apartment and a wooden house, but the percentage of payments on such a loan will be higher.

The number of floors also matters. If we are not talking about a separate house, but about an apartment, then it must be located in a building at least 3 floors high.

It will be more difficult to get a loan for housing in panel houses that were built in the 70s of the twentieth century. Cases where loans are issued for individual old private houses are isolated.

Often the bank asks to provide proof that the house will not be demolished or completely reconstructed in the next couple of decades. Banks do not take houses that are in disrepair or have more than 60% wear and tear according to the standards established by the BTI as collateral for a mortgage.

When evaluating an apartment, its location matters. Accommodation in the city center would be preferable. Repairs, layout, general living space - bank employees pay attention to all this. And the better the condition of the apartment, the more likely it is that the borrower will receive money to purchase it.

They do not give out money for the purchase of individual rooms in communal apartments or hotel-type apartments.

Legal aspects of the process

When providing housing with collateral, the bank pays attention to ensuring that the apartment is ready for registration of a new owner. If there is an encumbrance, for example, former residents are wanted or less than 6 months have passed since the death of the last owner, it will create difficulties in the positive assessment of this property.

In cases where the apartment owners include minor children, the bank may also refuse to provide a loan in order to avoid future problems with the guardianship authorities. The same applies to retired owners or persons who have temporarily canceled registration on a given living space due to their stay in places of detention, etc.

Before selling, apartment owners must make full payments to all utility services and tax authorities.

A situation in which the property was subject to frequent resale, especially more than once a year, would be suspicious for the bank. This may be a reason for refusal.

How do banks evaluate redevelopment?

The question of whether Sberbank checks an apartment that is given a mortgage in this institution for changes in layout has a positive answer. The more changes have been made to the apartment, the less likely it is to get a loan to purchase it. This is explained by the fact that redevelopments are often done without permission, without being legalized by the relevant authorities.

If the bank agrees to provide a loan for the purchase of such a home, it will set the condition that changes be agreed upon within 6 months or that everything be restored to its original condition. Redevelopments that the borrower decides to make in the apartment, already being its owner, must also be considered and approved by the bank. Repair work can reduce the price of an apartment or worsen its quality. For example, turning a 2-room apartment into a 3-room apartment by moving the kitchen to the balcony will most likely not be approved by bank representatives.

Unauthorized reconstruction without the consent of the bank may threaten the borrower with legal proceedings, in which the judicial authorities will decide to restore everything to its previous state.

Who is registered in the apartment

The question regarding the people registered in the apartment is also subject to mandatory study. At the legislative level, the sale of apartments where people are registered is not prohibited. To confirm this information, you must provide the bank with an apartment accounting document from the HOA. An alternative option would be to provide information from the house register.

Such documentation will be able to indicate information about registered persons who must check out of the apartment being sold on the eve of the sale.

Property check

The bank checks not only the seller, but also the property itself. The lender is interested in the purchased property becoming collateral under the mortgage agreement. In this regard, it is necessary to evaluate several parameters at once:

- Is there an encumbrance on the apartment?

- Presence of illegal redevelopment.

- Age of the building, quality of materials used.

- Market price.

Technical check

First of all, this concerns the secondary market. It is necessary that the premises be habitable and suitable for living. The age of the house, floor materials, structural safety and operation of utility networks - all this must comply with the technical plan and be in good condition. It is not profitable for a lender to take real estate as collateral, which will then be difficult to sell. In addition, if the home does not require large additional costs for major repairs, the bank will have confidence that the buyer will cope with the mortgage without delays.

In addition, financial institutions do not like unauthorized redevelopment. If such an apartment comes across, creditors may ask the owners to return everything to its rightful place or agree on changes. If it is impossible to legitimize, the bank may refuse to issue a loan for such housing.

Presence of illegal redevelopment

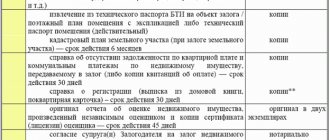

To consider this issue, you need to study the technical passport for the apartment. This document can be obtained from the technical inventory office.

To evaluate the premises, it is necessary to compare the original diagram with the arrangement of the premises. There are cases when facts of illegal redevelopment are discovered. Of course, a bank employee will not go to the site to clarify such data. However, such a fact must be verified and indicated by the appraiser. He will come to evaluate the apartment.

Important! The fact of legal or illegal redevelopment must be stated in the appraisal report.

The bank may approve the purchase of such an apartment. It all depends on the scale of the redevelopment itself. As practice shows, banks often do not pay attention to making such changes in the layout of the premises. However, in the future, illegal redevelopment should be legalized. This issue will have to be dealt with by the buyer. The period for completing this procedure is 6 months.

Market price

Large financial organizations have an appraiser on their staff. If a small bank acts as a lender, you can contact an independent appraiser.

The apartment assessment procedure is mandatory. This allows the bank to know how much the collateral is worth. You must contact an accredited appraiser who can conduct a competent assessment. If the borrower contacts an appraiser who draws up the documents incorrectly, the bank may insist on re-appraisal.

Time to consider a mortgage at Sberbank by stages

The entire mortgage transaction is a sequence of logical stages or steps, each of which requires a certain time. In its standard form, obtaining a mortgage includes the following steps:

- collecting documents and submitting a loan application;

- searching for a property to purchase;

- approval of housing with the bank;

- conclusion of credit documentation;

- transaction registration;

- full settlement with the seller.

Let's look at each stage in more detail in terms of the time that will be spent on it.

Filing an application

Having prepared the necessary package of papers for a mortgage, the client can submit an application. This can be done in two ways: online on the bank’s website or at a Sberbank branch that deals with mortgage lending.

The online application is completed in the borrower’s personal account or through the Sberbank-online service. In order to create such an account, you will need to indicate your full name, date of birth, telephone number and e-mail. The first thing the system will offer is filling in the data for a preliminary calculation on the calculator (real estate cost, term, amount of the down payment). You can learn how to properly apply for a mortgage from Sberbank online from a special post.

After filling out such information, the application with the specified parameters will be recorded in the account in the status “Waiting to be sent.” To send an application to Sberbank you will need to fill out:

- passport details;

- contacts;

- information about marital status, presence of children, education;

- employer information;

- employment and income information;

- availability of additional income;

- data on current expenses.

In addition to indicating the above data, you will need to upload an electronic version of the documents. A complete list of documents for Sberbank mortgages is available at this link.

How long Sberbank takes to consider a mortgage application depends on how it was submitted. Sberbank's preliminary decision on the online application will be announced within one, maximum two working days. An application submitted through the service office can be considered from 2 to 5 working days.

Salary clients who have a valid Sberbank debit card have privileges when considering loan applications - the decision is made with minimal time (from two hours to two days).

IMPORTANT! The time it takes to make a decision on a mortgage at Sberbank depends on many factors, including the category of the borrower, the type of housing being purchased, location, and the use of government support instruments. Therefore, in practice, the duration can vary from 2 to 5 days.

Search for housing and the effect of a suspensive decision

After receiving preliminary approval of a mortgage application from Sberbank, the client, if he has not yet decided on the property to purchase, begins searching for it.

NOTE! The bank gives the borrower no more than 90 days from the date of the decision to search for housing and conclude a transaction.

It is during this period that the client must finally decide on the property that will become the subject of the mortgage. There is no need to rush in this matter. It is recommended to carefully read the housing documents and check the legal integrity of the seller and the property.

For non-accredited living space, a certain time is required for approval by Sberbank, which will have to conduct a thorough check and analysis of the upcoming transaction. How many

Property approval

If you purchase a new building that is on the list of objects accredited by Sberbank, then no approval will be required. The client will receive permission for the transaction automatically.

If the purchased housing (both primary and secondary) is chosen by the client independently, then the bank will have to accredit it. If the seller is a legal entity, then it is necessary to provide a package of documents regarding the object and the seller. When purchasing an unapproved new building, you will need a lot of design and permitting documentation, as well as investment plans and reporting from the developer.

On average, it takes Sberbank 1-2 working days to approve real estate if a company is represented as the seller. If the seller is a private client, then 3-5 days.

Electronic transaction registration

This Sberbank service involves remote submission of all documents and applications for registering a mortgage transaction. The bottom line is that after signing the loan agreement and mortgage agreement, the client, through a personal manager, submits a package of papers to Rosreestr for registration. The borrower's personal participation is not required.

The service is paid - from 5,550 to 10,250 rubles.

After a successful registration procedure, the client will receive documents with the appropriate mark to the specified email address.

The duration of electronic registration of a transaction is 5-7 working days from the moment the registration authority accepts the package of papers, but in fact it can take weeks. Read in detail about electronic registration in Sberbank in a special post.

Completing the deal

After the transaction is officially registered with the Registration Chamber or the MFC, and a new certificate is received, Sberbank is obliged to make the final payment to the seller (minus the down payment paid by the borrower).

Practice shows that the lender makes the transfer on the same day. If the seller's account is opened with Sberbank, then the money will arrive immediately. If in a third-party bank, the transaction may take from 1 to 5 business days.

If you have a transaction with safe deposit boxes, then the buyer comes to the bank on his own and makes a disclosure.

When using Sberbank's secure payment service, money is transferred to the seller immediately after registering online without having to go to the bank.

Buyer checking the apartment

Each party is interested in the purity of the transaction and reducing their own risks. Therefore, while the bank is checking the apartment from the point of view of collateral, the borrower can also conduct an independent check.

All necessary documentation regarding operations in the apartment can only be provided to the owner. You can contact the seller with a request to order an extract from the Unified State Register. This document will contain all the information regarding the transfer of ownership rights and information about the previous owners.

Important! The borrower is recommended to study the technical passport of the BTI. If changes have been made to the apartment since the document was updated, the passport loses its relevance. It is recommended to update this documentation every 5 years.

Attention should be paid to information regarding housing and communal services debt. After the transaction is completed, all debts for maintaining the apartment will be transferred to the new owner. However, this can be avoided if you ask the apartment seller to provide all payment certificates.

Buying and selling a home is an important transaction involving a large amount of money. It is necessary to approach this issue responsibly.