Who concludes the insurance contract

DDU insurance against unfinished construction is a mandatory condition, without which the share participation agreement cannot be registered in the Unified State Register of Real Estate and, accordingly, will not gain legal force.

That is, where and how to insure a residential building against unfinished construction and other risks is a headache for the developer.

Important! A construction company does not have the right to cover its costs through additional contributions from investors. Demands for additional payment above the contract price are illegal.

Although DDU insurance against unfinished construction is carried out in favor of the shareholder, the latter is involved in the conclusion of the contract only as a third party and his signature on the document is not required.

The very existence of insurance and its conditions is important to the shareholder, which the developer must notify him about. Insurance legal relations must arise between the developer and the insurer before the conclusion of the DDU, but they become valid only after the share participation agreement is registered.

Object of insurance

Under a share participation agreement, the developer is obliged to transfer residential premises to shareholders after completion of construction. Insurance covers the property liability of the construction company to the participants in shared construction in the event that this obligation is not fulfilled.

Participants in shared construction - regardless of whether it is a company (except for credit institutions) or an ordinary citizen - invest their money in it. Therefore, insuring the developer is beneficial for them, because if something happens, they will receive an insurance payment.

By the way, according to the current law, the developer can insure both the entire house and each apartment separately . However, insuring a whole house is not practical from a cost-saving perspective.

First of all, it's too expensive. Secondly, some apartments are sold only after the building is put into operation. Thirdly, it is difficult to determine who should receive insurance if an insured event occurs.

Therefore, developers take out insurance for each apartment. This is also more convenient for shareholders, because the insurance contract comes into force from the date of registration of the share participation agreement .

In what cases will insurance not protect?

The purpose of insurance is to protect the personal deposits of shareholders, but, alas, certain risks may still remain. These include:

- misuse of funds;

- bankruptcy of the developer;

- fraud;

- illegally obtaining a permit for construction work;

- lack of professionalism of the developer.

Despite full compensation for losses guaranteed by insurers, upon the occurrence of an insured event, situations are possible in which the participants of the DDU may not receive their money:

— the government agency ordered the cessation of construction;

— the court considered the equity participation agreement invalid;

— the presence of a proven fact of deviation from the agreement by the shareholder,

— the developer has not received a building permit,

— the presence of litigation regarding the ownership of the object.

Insurance coverage applies only to two cases:

- The house under construction will be sold for debts. This is justified by the court decision that has entered into force to foreclose on the subject of the pledge.

- The construction company will go bankrupt. Certified by a decision of the arbitration court.

Important! To receive insurance compensation, the insured event must be proven in court.

The legislator determined that DDU insurance against unfinished construction does not cover other situations. That is, the shareholder will not be reimbursed for expenses, for example, in case of delay in delivery of the object. In this case, the claim for compensation is made directly to the developer.

What can the owner insure on the territory of a residential building being completed?

Domestic insurers offer several options for registration and purchase of a pole for optimal protection:

- Completely all housing that needs to be completed.

- External or internal decoration of premises.

- All available extensions. Their list includes bathhouses, guest houses, garden and country houses, and garages.

- Movable and immovable property located inside long-term construction: household and office equipment, furniture and other utensils.

- Communication systems that ensure comfortable living: water, gas and electricity supply, ventilation, video surveillance, etc.

A separate group is “Title” insurance. Its main feature is that the insurance policy is for a dacha or apartment on the territory of which third parties live.

Important to remember! A timely and correctly executed insurance contract helps protect private property from illegal attacks and illegal transactions.

TO ORDER A POLICY YOU WILL NEED:

restaurant menu Civil passport

document Purchase and sale agreement

bill Transfer and Acceptance Certificate

zip 55 Document confirming ownership

How is insurance protection implemented?

And yet protection against unfinished construction exists. True, compulsory liability insurance began to apply in 2014 and is a right, not an obligation. And if you decide to get involved in shared-equity construction, give your preference to those developers who are not afraid of the DDU insurance against unfinished construction in front of the shareholder.

Make it a rule! Developer liability insurance is a fundamental fact when deciding to enter into a transaction. Otherwise, the company will refuse to pay for the damage.

Insurance is implemented:

- With the help of a mutual insurance company. Here the parties have collective responsibility and the builder must pay membership fees;

- With the participation of the lending institute.

- With the help of an insurance company.

Insurance from a credit authority is rarely used, since it requires meeting much more stringent conditions and involves certain restrictions:

- The activity must be carried out for at least 5 years.

- The bank's capital is no less than a component of a fixed amount of 200 million rubles.

- The value of the credit institution’s total property is at least 1 billion rubles.

Most construction companies give preference to loans with automatic insurance. In this case, it will be quite difficult for the shareholder to receive payment upon the occurrence of an insured event.

For reference! The costs of obtaining and paying for DDU insurance against unfinished construction are borne by the builder. But this does not mean that the shareholder does not have the right to demand information about its conditions.

Supervisory authorities

The Central Bank has been chosen as the insurance supervisory body for compliance with insurance legislation in cases of mutual insurance , and regional authorities monitor compliance with the requirements for the participation of construction firms in a mutual insurance society (MIS).

Find out where and how to insure an apartment with maximum benefit for the policyholder.

You can get information about which real estate is subject to title insurance HERE

Read why it is necessary to conclude a life insurance contract when purchasing a home with a mortgage: //dom/n-info/zhizn-pri-ipoteke.html

In general, the procedure for registering insurance for shared participation agreements is a troublesome matter, because if there are 300 apartments in a building under construction, then there should be 300 insurance agreements.

First, the developer will have to decide on the insurance method, then collect a package of documents, conclude agreements with each shareholder and, most importantly, fully and properly fulfill the terms of these agreements.

Otherwise, an insured event will be allowed and shareholders (despite the insurance compensation paid) will be left without an apartment in new buildings .

While there is no excitement in the insurance market, insurance companies are not eager to enter into contracts with developers, since construction is one of the least profitable areas in this regard.

Most experts in this matter believe that insurance of shared participation agreements can significantly increase the cost of housing on the Russian real estate market, since construction companies will certainly shift these costs onto the shoulders of shareholders.

Can a shareholder insure a child-care facility?

The shareholder can voluntarily insure the preschool building against unfinished construction. But you need to remember that there are differences between such insurance compared to the developer. It is more difficult for the shareholder to change the terms of the agreement with the insurer, and the compensation itself will depend on the funds invested by the shareholders.

Shareholders benefit from insurance by the developer not of the entire building, but apartment by apartment, since the insurance contract becomes valid from the moment of registration of the DDU.

It is important to know! The occurrence of an insured event is considered to be non-fulfillment or improper fulfillment of one’s obligations to participants in shared construction. This fact must be confirmed by a court decision.

The right to choose an insurer remains with the developer, but the shareholder must have an insurance contract in hand. The minimum amount of compensation depends on the contract price. At the same time, it should not be less than the cost desired for purchasing an apartment and the average market indicator per square meter of housing in the region of the Russian Federation where the development is taking place.

Construction without risk: how does the insurance system for shareholders work?

Andrey Evstifeev,

Vice President of the European Legal Service

Over the past four years, the government has made its second attempt to reform the developers' liability insurance system. What guarantees will shareholders have this time?

Today, approximately 80% of all residential buildings are built under equity participation agreements (EPA), that is, at the expense of Russians. In absolute figures, this is more than 5 trillion rubles. Imperfect legislation, weak control and regulation in the construction sector have been accompanied by high-profile scandals for many years: according to the authorities, the total number of defrauded shareholders in the country may exceed 81 thousand people, and the share of problem objects is approaching 900 units. According to experts, 131 thousand shareholders have encountered certain violations in Russia. The number of cases initiated by the Prosecutor General's Office in connection with various violations in this area exceeds six thousand.

The above figures demonstrate in the best possible way the futile attempts of the authorities to restore order in this area. In 2014, the previous systemic reform of the industry was undertaken - voluntary liability insurance for developers was introduced. However, it soon became clear that this mechanism also works with reservations - defrauded shareholders faced protracted legal proceedings, cases of developer fraud are not covered by insurance.

At the same time, the law on voluntary insurance was written in such a way that insurers had to bear responsibility for business errors in the normal activities of developers or market fluctuations in demand. But in the proposed model, builders incorrectly interpreted the essence of insurance and believed that the rule “the insurance company will pay for everything” applies.

At the same time, the assets of key insurers operating in this market amount to billions of rubles, and the amount of accepted insurance liability exceeds a trillion rubles. True, it is worth explaining that insurance is built on the theory of probability and the specified capital may be enough for companies, taking into account the fact that insurers use the reinsurance mechanism (often in large Western insurance companies). In addition, there are precedents when insurers, after the bankruptcy of the developer, completed the construction of houses themselves, this allows them to minimize payments. As a result, people received full-fledged apartments, and not insurance compensation.

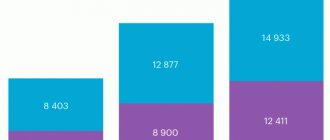

In short, the existing scheme, although with reservations, works, which is confirmed by the growing indicators of insurance payments in this area. As for the new scheme - with the creation of a compensation fund, it has just begun to operate and concerns new construction projects.

So, from the end of October 2021, the Fund for the Protection of the Rights of Citizens Participating in Shared-Share Construction began operating in Russia. The fund, experts believe, should gradually replace the previous voluntary insurance scheme. Previously concluded agreements will continue to be valid.

From October 20, 2021, any developer who attracts public funds under the DDU is required to make contributions to the Fund. The tariff for developers for deductions today is 1.2% of the amount of the DDU. In the future, the authorities and the professional community will have to decide whether it will remain flat - the same for everyone - or whether it will be differentiated depending on the size of the developer, his financial situation and, possibly, rating. Developers will not be able to avoid paying fees, otherwise they will not be able to register a child-care facility with Rosreestr.

As of today, 746 developers from 78 regions have insured their DDUs with the Fund for the Protection of the Rights of Shareholders. In total, there are about six thousand developers in Russia, but there is no goal of “driving” them all into the Fund - after all, the Fund will grow with each foundation laid.

What amount of payments should you expect “if something happens”? In this situation, the shareholder has the right to monetary compensation, which is equivalent to a maximum of 120 square meters. An exception is made for large families. The restriction is aimed at guaranteeing housing for those who cannot afford to buy large and expensive apartments. The same principle applies here as in the Bank Deposit Insurance System, when the state insures deposits up to 1.4 million rubles. An important nuance: the cost of compensated meters will not be calculated based on the amount of the DDU, but on the basis of average market values - based on the coefficients determined by Rosstat in each specific region. Shareholders will have a choice: either use compensation from the Fund to complete the construction of the house, or receive the money owed. This will have to be decided at a general meeting of shareholders.

The authorities have provided mechanisms for monitoring the financial condition of developers. Rosfinmonitoring will transmit to DOM.RF (formerly the Agency for Housing Mortgage Lending - AHML) information about the risk level of developers. In addition, DOM.RF launched an information portal on which each shareholder will be able to quickly find out about the state of construction of his facility, compare the completion date and the actual readiness of the building

Let’s hope that both the insurance system, which continues to operate, and the compensation fund will together be an effective mechanism for protecting the rights of shareholders, and the information portal will be a timely channel for monitoring the condition of construction projects. And the confrontation “defrauded shareholders against everyone” will finally move from a street hype format to a constructive format. After all, effective solutions should always be sought through negotiations with representatives of the Ministry of Construction and Housing and Communal Services, insurers and developers.

In conclusion, I would like to give simple but effective advice to all shareholders: you should never panic or give in to emotions. Today, the topic of defrauded shareholders has begun to attract a huge number of provocateurs who are trying to use this topic to their advantage. If problems arise, you should not make rash decisions - going to the insurance company for compensation is always associated with the refusal of the apartment. It is worth weighing the plan set out in the road map, which should be available for each problematic facility on the Ministry of Construction website; sometimes it is better to wait until the house is completed. Finding new options will cost more.

Are there insurance supervisory authorities?

The Central Bank is authorized to monitor compliance with legal canons in cases of mutual insurance. Regional authorities monitor compliance with the conditions for participation of construction enterprises in a mutual insurance society. In the latter case, when the developer uses insurance to secure his obligations, he is obliged to notify shareholders about this very company.

Attention! An insurance company is obliged to conclude an agreement with another insurer or a guarantee with a bank within 15 days if its license is revoked, or participate in a mutual insurance company.

It often happens that shareholders attempt to solve a specific problem without having the necessary knowledge or skills to do so. And then the problem is solved either at great expense or not solved at all. A belated contact with a lawyer, even a highly qualified one, does not always save the situation.

If you want to have guarantees that the shared construction project will be protected from possible risks, contact a legal specialist at the stage of concluding the DDU.

Author: Bogdanova Irina Mikhailovna.

Lawyer for shared construction matters. Leading lawyer of the consumer rights protection society “Legal Supervision” on real estate and shared-equity construction issues. A lawyer with more than 15 years of experience, most of which involved resolving complex issues with real estate, as well as problematic developers. Provides legal support both in court and pre-trial on issues of equity participation. Thanks to his work, several thousand legal conflicts were resolved, many of which were resolved without resorting to litigation.

Insurance of equity participation agreements. What is this?

There are three mechanisms for insuring equity participation contracts in construction, which, according to experts, are very similar to compulsory insurance.

- Through any insurance company that must have the appropriate license.

- Bank guarantee. Its presence during the execution of equity participation agreements is checked by the Rosreestr authorities. However, not all banks will agree to act as guarantors in the field of construction, because for them it involves high risks.

- Non-profit insurance through the Developers Insurance Society (OVS). OBC must be licensed and engage only in insurance of equity participation agreements. The most successful developers will be selected as founders of such societies by order of the Ministry of Regional Development.

OVS appeared in our country in August 2013 and began operating on January 1, 2014. Perhaps you would like to learn more about the mutual insurance company for developers.

Read about what compulsory civil liability insurance for a developer is HERE

The developer is obliged to submit either an insurance certificate or a bank guarantee to the Rosreestr branch - only then will he be able to enter into agreements with shareholders.

Why is this done? This is an attempt by the Russian government to nullify cases of numerous deceptions of shareholders by developers who, for one reason or another, stop construction.

If the developer fails to fulfill his responsibilities, shareholders through special insurance companies have the right to insurance compensation.