What is a legal encumbrance on a mortgage?

Content

A mortgage encumbrance by force of law is a form of real estate collateral in which the borrower’s property acts as an obligation to repay the debt to the bank (the collateral in this case is the property on which the mortgage is taken, i.e. the mortgaged apartment will be pledged to the bank). In most cases, it occurs when taking out a home loan.

The object of a mortgage, by virtue of the law, is residential premises (apartments, rooms, houses), land plots, commercial real estate, garages, shared ownership in a house under construction, and others.

When issuing a loan, the bank issues a mortgage, which the client must provide to Rosreestr (real estate rights registration service) when it registers the purchase and sale transaction. Based on this document, a mark of encumbrance is placed. Currently, a certificate of state registration of rights is not issued; all information about the pledge is stored in an electronic database. You can find out about it by ordering an extract from the Unified Register of Real Estate Rights (USRN).

If the owner does not fulfill his obligations to repay the loan for a long time, the mortgaged apartment can be sold by the mortgagee (the bank - the holder of the lien on the property). The proceeds will be used to pay off the mortgage loan, interest, fines and penalties. In this case, the borrower will receive in his hands only what remains after paying the debt to the bank. It turns out that the sale of mortgaged property is a very unfavorable situation for the owner, because he will overpay the bank a significant amount.

It should be noted that in the case of a mortgage, by force of law, the bank does not become the owner of the apartment. To sell it to repay the loan, you need to obtain a corresponding court decision.

Mortgage by force of law in the public consciousness is firmly associated with housing lending, which is not entirely true. This type of encumbrance also arises when a rental agreement (lifelong maintenance) or sale of an apartment on credit is concluded.

The apartment is pledged to the bank. Is it really possible to sell it? Is it worth buying?

18.03.2011 | 8400

— A man bought an apartment with a mortgage. I paid and paid, repaid some of the loan, but not all. And suddenly I needed to sell this apartment. Are there many such offers on the market? - No, not much - about 3-5 percent of the total. But among them there are interesting options at an attractive price. Therefore, some buyers are willing to take a certain risk. — How big is the risk? - Very differently in different cases. First, let's find out whether this apartment is supposed to be purchased in cash or using a bank loan - this is important. Let's say a person wants to buy an apartment that is pledged for cash. The algorithm here is as follows: we write to the bank an application for full early repayment, the bank sets a deadline when this can be done. On this day we submit the registration agreement to the Rosreestr office, it states that the price of the apartment is this much, the seller received the money before signing this agreement. We also write in the contract that the apartment is pledged to such and such a bank, and that the debt to the bank will be fully repaid by such and such a deadline. The buyer pays the seller, from this amount the seller pays off the debt to the bank, about which the bank provides the corresponding document - a letter confirming the absence of loan debt. Next, the participants in the transaction, with a letter confirming that the debt to the bank has been repaid, immediately go to Rosreestr, where the seller submits an application to remove the pledge in the certificate of state registration of ownership of this apartment, so that it becomes possible to carry out a purchase and sale transaction with it. Since state registration of the contract takes place within 30 days, and the deposit is removed in 3 days, the buyer does not even feel that the apartment is mortgaged. He just knows about this from our words, from an extract from the Unified State Register, from the contract, which states that the apartment is pledged... In this described case, the risks are minimal, because all actions take place almost simultaneously. Another situation is when the apartment is pledged to the bank, which sold the mortgage somewhere - to Moscow or Switzerland, it doesn’t matter. It is important that you need to wait until the mortgage comes - this is a month, or even more. And there is a risk here. The money has already been given to the seller, but we still have to wait a whole month for the mortgage - you never know what can happen during this time. For example, the seller changed his mind... - So, it turns out that the result greatly depends on the integrity of the seller? - Yes. If the amount of loan debt is at least half the cost of the apartment, then the risks can be minimized. When an apartment costs, for example, 2 million rubles, the balance of the loan debt is 1 million and a million is the difference, then by mutual agreement with the seller we leave this million for storage. In the contract we write that the seller receives the money after submitting an application to remove the deposit. He is interested in taking them, and accordingly, when the mortgage comes, he will fulfill the terms of the agreement. Here, too, the risks are not very high. There is a big risk when the balance of the loan debt is equal to the cost of the apartment or even exceeds it. And besides, the mortgage is somewhere in Luxembourg, and according to the bank’s terms, it will arrive in 40 days. During this time, anything can happen. You never know, the seller was hit by a car - that’s all! We do not recommend such transactions. But often buyers, despite all the warnings, say: yes, we agree. —What motivates them in such cases? — It is possible that the mortgaged apartment is being sold below market value. And people are willing to take risks because of the low price. Or you really liked the apartment, and there is no alternative among others. Or this apartment is located exactly in the house (in that entrance, on that floor) that they dreamed of. — We were considering options for purchasing with cash. When does the buyer plan to take out a mortgage loan? — If within the same bank, then such a deal is absolutely real. For example, an apartment with an encumbrance is being sold from VTB 24. A buyer is found, receives a credit decision, then the loan debt from one payer is removed and transferred to another. Even if the seller’s loan balance is higher than the buyer’s down payment, this is a solvable issue within the same bank. Such transactions took place. And if there are different banks, then such a transaction is impossible in any way. If the amount of the down payment is enough to repay the loan debt, then an option is possible when the apartment is pledged to one bank, and the buyer takes out a loan from another. But the risk is colossal. Firstly, everything happens for a very long time, which increases the possibility of unforeseen situations. Secondly, with this scheme we cannot in any way insure ourselves in case the seller personally did not want to go sell the apartment after the debt was repaid. The only way to do this is to go to court. — Do you think the number of mortgaged apartments offered for sale will increase? — The percentage ratio (the number of apartments with encumbrances compared to all others) has not changed for several years, and I do not yet see an upward trend. Although, perhaps, their number will increase, as more apartments are purchased using borrowed funds.

Share with friends

Is it possible to sell encumbered real estate?

The encumbrance implies that Rosreestr does not have the right to register any transactions that entail a change of owner. That is, you cannot sell, donate or exchange the apartment. In this case, you can bequeath it, but after the death of the owner, his heirs will have to decide on the removal of the encumbrance (in most cases, the solution will be to pay the balance of the mortgage loan).

Restrictions are also imposed on the registration of third parties in the apartment. Only family members of the borrower can be registered in it. You cannot rent out the premises, unless we are talking about commercial real estate.

Currently, mortgages have become very common, because young families often cannot buy housing in any other way. Many sell maternity capital and government certificates by attracting borrowed funds. With such popularity of mortgage lending, it is not surprising that situations arise when the borrower cannot repay the loan himself.

Understanding the complexity of the issue that has arisen, some banks meet their clients halfway and offer a loan repayment scheme through the sale of an apartment. Even if the lender is ready to give consent to the sale of the property, before this, the mark on the mortgage in the Unified State Register must be removed.

Risks when buying real estate with a mortgage

Table of contents

- Bank requirements

- The bank's risks are insured

- Borrower's risks

- Possible circumstances for challenging a transaction

- Significant risks

- Risks associated with the identity of the Real Estate Seller

- Responsible real estate purchasing process

Bank requirements

The first and main thing that a bank is interested in when issuing a mortgage loan is only your solvency!

Secondly, this is the presence of a complete list of documents and the absence of errors in them.

The bank's risks are insured

Therefore, they will not engage in detailed analysis. Banks have certain internal standards and requirements for the acquired property. They have enough current information about the property, which they draw from the standard package of documents provided by the Borrower-Buyer of real estate. The Buyer, in turn, requests from the Seller only the list of documents that the bank needs.

The bank analyzes documents from the last transaction in which real estate was purchased. Banks do not check the history of the property and the Seller. And this may threaten the Buyer with loss of ownership of the property.

Borrower's risks

One of the first risks of the Buyer - Borrower is the risk of losing the amount of the deposit that he makes to the Seller of the Real Estate in order to secure the Object and the price for it before the transaction. At the time of transfer of the deposit, the Buyer does not yet know about the bank’s decision on the property. There is a possibility that the bank will not approve the apartment and the mortgage agreement will not be concluded, then the deposit amount remains with the Seller. Only a professional realtor who is familiar with all the nuances of transferring partial payments for the purchased property knows how to avoid losing money and time.

Possible circumstances for challenging a transaction

If the bank nevertheless approved the property you found and issued a loan, then there are circumstances when, after canceling the transaction, the buyer will not receive the funds in full or will not be able to return them at all. After all, the seller could spend it. Of course, he is responsible for returning the money, but due to his insolvency, he will not do this quickly or soon. And it can be even worse if the Seller got sick, disappeared or died.

Significant risks

- purchase of real estate in which minor children were registered, left without guardians and parents

- purchase of real estate that was purchased with the participation of maternity capital, but the shares for minor children were never registered

- purchase of real estate that was inherited by the Seller and the heirs were identified who missed and restored the deadline for accepting the inheritance

- purchase of real estate that was acquired in a joint marriage and for the sale of which the consent of the spouse was not obtained, etc.

Risks associated with the personality of the Real Estate Seller

In addition to the invalidity of the seller’s passport, there are risks associated with the financial condition of the real estate Seller. Enforcement proceedings may be initiated against him and, in the process of registering the transfer of rights, the Buyer may be subject to arrest for registration actions on the property. If the seller has no debts, then another legal proceeding or bankruptcy case may be initiated against him.

Responsible process

Buying real estate with a mortgage is a responsible process that is associated with a huge number of risks. A large number of buyers treat this issue negligently, naively believing that by purchasing real estate with the help of a bank, they have completely protected themselves from all sorts of problems.

This article does not describe all the risks associated with purchasing real estate with a mortgage. To check the deal, get comprehensive information about the real estate seller and protect yourself from negative consequences, you need to contact real estate market professionals.

Professional realtors work for their reputation, which they earn over the years and are not ready to say goodbye to it overnight, losing the client and his recommendations in the future.

Only the help of a professional realtor will turn your process of buying a home into a mortgage into the pleasure that you will get by settling in the House of your Dreams!

The procedure for selling an apartment with a mortgage

In addition to paying off the debt in full, there is another way to get rid of loan property. We need to find a buyer who will agree to pay the balance of the mortgage loan with a deposit for the apartment. After closing the loan, the buyer and seller, together with a bank representative, go to Rosreestr to remove the encumbrance. At the same time, documents for the purchase and sale transaction are submitted. The main problem is to find a buyer who agrees to wait until the bank completely closes the loan and issues all documents for registration.

If the buyer himself does not have enough money to buy the home he likes, he can take out a mortgage for it from the same bank. In this case, the transaction will be accompanied from start to finish by a credit specialist. It is a pity that few creditors are willing to agree to such a scheme for selling mortgaged property.

Since the buyer will be a borrower after the transaction, he should obtain the bank’s consent to issue him a home loan. He must apply on a general basis, and the maximum amount of the approved loan cannot be less than the balance of the buyer's debt.

If it turns out to be less, the future owner will have to raise his own funds. Essentially, the bank transfers loan funds from the buyer's account to the seller's loan account, repaying his loan.

In general terms, the scheme for repaying collateral using a new mortgage loan is as follows:

- The buyer submits an application for a home loan from the primary lender (the bank where the mortgage is issued).

- After approval, the bank prepares papers for a new encumbrance (loan agreement, mortgage).

- The buyer, seller, and bank representative go to Rosreestr and submit documents for the transaction.

- Next, the loan is issued to the buyer and the money is immediately transferred to repay the seller’s debt.

- The bank issues the seller a certificate of fulfillment of obligations and a mortgage note. He removes the encumbrance in Rosreestr.

- The buyer receives an extract from the Unified State Register of Real Estate for the purchased apartment with a note about the mortgage by force of law. He only has the loan agreement in his hands; the original mortgage note is kept in the bank. He becomes a borrower and pays monthly installments on the loan until it is fully repaid.

How to minimize risks when buying an apartment with encumbrances

Buying an apartment with an encumbrance is always a big risk. If the loan is taken from a large, reputable bank, there is no need to worry about the purity of the transaction. If the transaction takes place in another financial institution, it is better to involve a qualified lawyer or realtor. There is a high risk of running into scammers and, as a result, being left without an apartment and without money.

What advice can be given to those wishing to purchase real estate encumbered with a mortgage:

- All the nuances of the transaction must be spelled out in detail in the purchase and sale agreement, indicating the loan, current accounts and the procedure for the parties.

- Before the transaction, request from the seller an official document from the bank, which contains all the information about the mortgage loan (number and date of the loan agreement, loan amount, object of acquisition and collateral, current debt and amount for full repayment).

- Visit the bank together with the owner of the apartment and personally make sure that he has a housing loan for it.

- If you decide to take out a mortgage from the same bank, transfer the deposit only after the loan application has been approved.

- Repay the loan balance by bank transfer together with the seller, do not give him the money in his hands, ask for a copy of the supporting document.

- After repaying the loan and canceling the collateral, order a USRN extract. If there is no encumbrance there will be an o.

- Request a certificate that all residents have checked out of the apartment.

- Check with the tax office that the property is not for rent.

Selling an apartment from a bank where there is an unpaid mortgage is not as scary as it might seem at first glance. Of course, it will be difficult to understand the intricacies of the issue without an experienced realtor. However, such apartments usually cost an order of magnitude cheaper, so the buyer receives an undoubted benefit as a result of the transaction. The downside is the duration of the procedure, sometimes it lasts more than a month.

Double encumbrance on an apartment with a mortgage

Double encumbrance on an apartment with a mortgage occurs quite rarely, but you need to know about this detail. This term means that, in addition to the bank, the pledge holder is another person. For example, an apartment was purchased in a building under construction and a mortgage was issued on it by virtue of the law. But at some point the construction was frozen due to lack of money. The developer will have to mortgage the entire house to the bank that issued him the construction loan, as stipulated in the agreement between them.

This creates a double burden. It’s definitely not worth getting involved with such apartments, or you need to deeply understand all the nuances of this issue.

What is real estate encumbered with a mortgage?

There are several types of encumbrances, but let's consider mortgage encumbrances. This means that the apartment was previously purchased on credit. For some personal reasons, the owner was unable to pay his debt and the only way out of the situation was to sell the apartment with a mortgage encumbrance to another individual. The bank must provide all the conditions for such a transaction.

Without these conditions being met, the sale of the apartment simply cannot take place. Most often, the financial institution issuing the loan will ask for 50% of the loan from the original owner.

Mortgage repaid: how to remove the encumbrance, procedure, documents

How to terminate the encumbrance of real estate in the form of a mortgage:

- The debt is repaid in full with any interest, penalties and fines due, if any.

- The bank requests a certificate of the loan being paid and consent to remove the collateral.

- The time of the visit to Rosreestr is agreed upon with the lender’s representative. Typically, employees of large banks have allocated time to visit this government agency, so you do not have to make an appointment yourself.

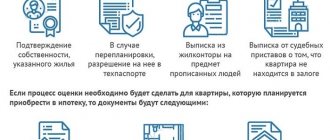

- A visit to Rosreestr or MFC (multifunctional), where papers are submitted from the lender (original mortgage) and from the former borrower (loan agreement, loan repayment certificate). It is better to request a current list of required documents from the bank.

- The employee receiving the papers will issue a receipt indicating the date of receipt of the USRN extract without a note about the pledge. He will also tell you how long it will take to remove the mortgage encumbrance from the apartment.

When the loan is repaid in full, the encumbrance should be removed automatically. However, you should not completely rely on the consciousness of the lender and Rosreestr. It is better to control the process and personally make sure that all the papers are completed properly. To do this, you need to request a certificate from the bank about the removal of the encumbrance from the apartment, and from Rosreestr - an extract from the Unified State Register. If they are not there, proceed as described above.