Taking out a mortgage for a foreign citizen in Russia seems to be a difficult task. The fact is that most banks issue housing loans only if you have Russian citizenship. This is explained by increased risks that the lender does not want to take on. If a mortgage debt is not paid, it will be more difficult to collect it from a non-resident than from a Russian. However, mortgages are still available for foreign citizens in Russia.

Can a foreigner take out a mortgage in Russia?

If we look at Russian legislation, it does not impose any restrictions on housing lending to foreigners. But in practice, it turns out to be difficult for a foreign citizen to take out a mortgage, because banks put forward strict requirements for such borrowers. The reason is that a non-resident can leave Russia at any time, then the bank will suffer losses that are unlikely to be compensated.

Even the presence of collateral slightly reduces possible risks. Credit organizations try not to initiate legal collection unless unnecessarily necessary, because this is a serious expense. The natural conditions of banks providing mortgages to foreign citizens will be an increase in the interest rate, the down payment, the application of additional commissions and stricter issuance requirements.

Under what circumstances is it easier to obtain a mortgage for an apartment for foreign citizens:

- having a permanent job and paying taxes to the Russian budget;

- belonging to the CIS countries;

- Russian citizenship of the borrower's spouse;

- high income and lack of loans;

- increased down payment with your own funds;

- attraction of guarantors and additional collateral;

- registration of life and health insurance;

- excellent credit history.

For foreign citizens, you can even apply for a mortgage from banks with state participation, for example, VTB. It all depends on the internal policy of the financial organization and interest in attracting new clients, even representatives of other countries. It is also worth paying attention to commercial credit structures that are loyal to potential borrowers.

Having a residence permit in Russia allows foreign citizens to enjoy the same rights as Russians, including obtaining a mortgage. The loan is issued on standard terms. True, not all banks, for example, do not provide Sberbank mortgages for foreign citizens with a residence permit.

Who can receive

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Many foreign citizens understand that obtaining a mortgage in Russia is fraught with large overpayments for them, and it is much more profitable to first obtain citizenship and only then think about housing. Persons who do not have permanent registration are not issued a mortgage without a down payment.

Both those who have recently arrived in Russia and have not yet obtained citizenship, as well as those who have collected a package of documents and registered themselves, can get a mortgage. In this case, different conditions will be offered.

For foreign citizens, a mortgage is issued at a high interest rate, and a mandatory condition, without which buying an apartment with credit money is not possible, is the availability of additional insurance for the purchased object.

The reluctance of banks to get involved with stateless persons is largely explained by the fact that the risks increase several times, and a person who is not tied to the country by any obligations or citizenship can leave it at any time without repaying the mortgage.

At VTB Bank, all risks are minimized; there is a well-thought-out and effective scheme.

Which banks issue mortgages to foreigners?

The most favorable conditions for housing loans in Russia are offered by large banks. It is a pity that very few of them are ready to see representatives of other states as their borrowers. Probably, both Rosselkhozbank and Sberbank will offer mortgages for foreign citizens someday, but right now they are not available. The question arises: which banks issue mortgages to foreign citizens? Below we will describe in detail where housing loans are currently available to foreigners in Russia.

Which banks provide mortgages to foreign citizens? The first on our list is a large credit institution, more than half owned by the state - VTB. There are several housing programs () available to foreigners:

- Housing loan based on two documents (). Issued for the purchase of finished or under construction housing. Amount from 600 thousand to 30 million rubles, rate from 8.4% (calculated individually), payment period up to 20 years, down payment from 30%.

- Loan for finished housing. Amount from 600 thousand to 60 million rubles, interest from 8.4%, repayment period up to 30 years, down payment from 10%.

- Loan for investment in apartment construction. Amount from 600 thousand to 60 million rubles, rate from 8.4%, down payment from 10%, payment period up to 30 years.

Of course, social mortgages are not available to foreign citizens at VTB. Programs such as the Far Eastern Mortgage or a Loan with state support for families with children are issued only to Russians. This is understandable, because they are subsidized by the Russian budget.

Alfa Bank offers mortgages for foreign citizens

is issued for all current programs. They are available only to residents of Russia, Belarus and Ukraine. You can get a home loan here on the following conditions ():

- amount from 600 thousand to 50 million rubles;

- interest rate from 8.49% for new buildings, from 9.19% for secondary housing;

- repayment period up to 30 years;

- down payment from 15% for a finished property, from 10% for a property under construction.

Recommended article: Is it possible to gift an apartment with a mortgage to a relative or co-borrower?

At Rosbank, mortgages are available to foreign citizens in many areas:

- A loan for the purchase of an apartment in a finished building or for part of it. Interest from 6.99%, down payment from 15%, repayment up to 25 years, amount from 300 thousand rubles.

- To purchase an apartment in a new building. The rate starts from 6.99%, the first installment is from 15%, the payment period is up to 25 years, the amount is from 300 thousand rubles.

- To buy a house. Interest from 8.49%, down payment from 40%, repayment time up to 25 years, amount from 300 thousand rubles.

- Loan for a room. Interest rate from 7.49%, down payment from 25%, term up to 25 years, amount from 300 thousand rubles.

- Loan to improve housing conditions. The first payment under this program must be 50% of the value of the property sold by the client. Rate from 10.49%, loan repayment period 3-15 years, amount from 300 thousand to 10 million rubles.

- Loan for building a house. Interest from 7.49%, repayment time up to 25 years, amount from 300 thousand rubles, contribution with your own funds from 30%.

- For the purchase of apartments. The rate starts from 6.99%, down payment from 20%, term up to 25 years, amount from 300 thousand rubles.

- Loan for the purchase of a garage or parking space. Interest from 6.99%, down payment from 25%, payment time up to 10 years, amount from 300 thousand rubles.

Next on our list is Raiffeisenbank, which issues mortgages to both Russians and foreigners. Here you can get a housing loan for the purchase of a finished or under construction property under the following conditions:

- interest rate from 8.39%;

- amount from 500 thousand to 26 million rubles;

- Debt repayment period is up to 30 years.

A foreigner living in Russia has the right to contact any of the listed banks and apply for a mortgage. However, you need to remember that the decision rests with the lender. A potential borrower can only increase the likelihood of approval by showing significant income () or providing additional collateral ().

Also among the banks working with foreign citizens are:

- UniCredit Bank;

- Absolut Bank;

- Transcapital Bank.

Advantages and disadvantages

Mortgages from VTB for foreigners are a controversial banking product. On the one hand, it has many advantages, on the other hand, it is burdened with significant disadvantages. There are several reasons to get a mortgage from VTB:

- Thanks to a mortgage, a foreigner has the opportunity to acquire his own home in the shortest possible time. Therefore, he will not have to save long to buy his own apartment or house, or rent a home.

- The interest rate at VTB starts at 12.5%, which is significantly lower than in other banks. At the same time, rates vary up to 17% per annum.

- If the borrower makes a large down payment, he will be able to get more favorable loan conditions.

The main disadvantage of this type of lending is the high requirements for borrowers, which not everyone can meet, and unfavorable conditions. It is many times more difficult for a non-resident of the Russian Federation to obtain a mortgage than for a Russian citizen. A potential borrower must meet the bank's requirements 100%, otherwise they will be refused.

Is it possible for a foreign citizen to get a mortgage without initial capital?

Applying for a loan without depositing your own funds is extremely rarely available to Russians, so foreigners should not count on it. True, a mortgage without a down payment for foreign citizens can be replaced by maternal capital. If the Russian wife of a foreigner has a certificate in her hands, it is allowed to be used instead of paying for part of the apartment in cash.

It turns out that it is easier for foreign citizens to take out a mortgage in Moscow than for residents of the regions, because the head offices of large foreign companies are concentrated in the capital. And the choice of banks is much more extensive, so foreigners living here are a little luckier.

Mortgage refinancing for foreigners

Mortgage refinancing for foreign citizens is available under the same conditions as obtaining a new home loan. It is worth paying attention to the same banks that we talked about in the previous section. What refinancing conditions do they offer:

- VTB will refinance the existing mortgage at an interest rate of 8.8% for a period of up to 30 years (if according to a simplified package of documents - up to 20 years), the amount is up to 30 million rubles;

- Alfa Bank issues a loan for refinancing in the amount of up to 50 million rubles, interest from 8.69%, repayment period up to 30 years;

- Rosbank will refinance housing loans at a rate of 6.99%, for a period of up to 25 years, for an amount starting from 3 million rubles;

- Raiffeisenbank refinances mortgages from 8.39%, in the amount of up to 26 million rubles, payment period up to 30 years.

Some of the most favorable rates for refinancing housing loans are offered by Gazprombank. However, unlike VTB, Gazprombank does not issue mortgages for foreign citizens. You should not look for similar programs in Rosselkhozbank, Sberbank, Otkritie, Sovcombank, Tinkoff Bank, etc.

Recommended article: Gazprombank mortgage terms

There will be costs associated with refinancing your mortgage. You will also have to insure the mortgaged property annually. To approve the application, you must provide real estate documents to the bank; most often, the lender requires a recent appraisal report. So the costs of the new loan will not decrease.

Please note that in addition to mortgages and refinancing, in the banks we list, foreigners can take out a loan secured by existing real estate. To obtain it, the borrower's property must be pledged. You can spend the funds received at your own discretion, that is, you do not have to report to the creditor.

Requirements for borrowers

Mortgage conditions for foreign citizens are more stringent than for other borrowers. In this way, credit institutions minimize their own risks. Clients should be prepared for the following loan parameters:

- high interest rate;

- short payment period;

- increased down payment;

- requirement to strengthen security.

The easiest way to get a mortgage is for citizens of the Republic of Belarus, Uzbekistan, Tajikistan and Kazakhstan; for Ukrainians, obtaining a loan is now difficult.

Usual requirements of banks when obtaining a mortgage by foreign citizens:

- the person is a tax resident (), that is, pays taxes to the budget;

- residence in Russia for at least 190 days;

- permanent employment;

- experience in the current position from six months, but some banks raise the bar to 2-3 years;

- having a good credit history and no current debt obligations;

- making a down payment of 20% of the cost of housing, but this value can reach even 70%.

These measures are designed to reduce the risks of banks issuing mortgages to foreign citizens. If the potential borrower has a residence permit, this greatly simplifies the task. But the likelihood of approval is still lower than when applying from a Russian.

What documents will be required

The list of documents for obtaining a mortgage by foreign citizens with a residence permit is almost no different from the standard one. The package of securities is formed depending on the selected bank. It usually looks like this:

- foreign passport and its notarized translation;

- a document confirming the right to stay in the Russian Federation;

- A completed application form;

- other identification documents of your choice (for example, driver's license);

- income certificate in the form or sample of the bank;

- confirmation of employment;

- additional papers if necessary (diploma, document on marital status, birth certificates of children, etc.).

A similar package of documents will be required from guarantors and co-borrowers.

Important to know: Mortgage without a credit history – chances of getting approval

How does a mortgage transaction work - frequently asked questions

How to confirm a down payment on a mortgage

Is it worth getting a mortgage through realtors - pros and cons

After the initial approval of the loan application, it is necessary to select a property that meets the bank’s requirements. These again can vary greatly depending on the lender. But as a standard, it is required to confirm the absence of encumbrances and legal claims of other persons, the house should not be in disrepair, etc.

Are mortgages issued to foreign citizens for properties other than apartments? Yes, it is possible to purchase a residential building with land outside the city, a dacha, a garage, apartments, etc. If the bank’s lending program provides for any of the listed real estate options, a foreigner will be able to purchase it.

For finished housing you should provide:

- extract from the register of real estate rights;

- a copy of the seller's passport;

- technical documentation;

- document establishing the right of ownership;

- draft purchase agreement;

- evaluation report;

- certificate of registration and other papers depending on the situation.

When purchasing an apartment in a new building, foreign citizens must provide a draft construction contract and documents for the developer to the bank for a mortgage. If a loan transaction for finished housing involves the simultaneous registration of collateral, then an apartment under construction requires additional collateral.

During the construction of the house and its commissioning, a pledge of existing real estate or a guarantee is required. After registration of ownership of the apartment, the apartment is mortgaged; at this stage, you will need to provide the bank with an appraisal report, an extract from the real estate register and technical documents, as well as insure the property.

When applying for a mortgage to invest in the construction of an apartment, you should choose developers accredited by the bank. It is easier to get such a loan, and cooperation with large lenders is a kind of guarantee of timely delivery of the house and the reliability of the construction company.

How to apply

Having chosen the VTB mortgage program for foreign citizens, apply for a home loan via the Internet or at the company’s office.

Registration online

Submitting documents online takes place in several stages:

- fill out the form on the VTB website;

- wait for the manager to call and make an appointment;

- visit the office to submit documents and fill out an application form;

- receive a decision within 1-5 days;

- choose housing;

- conduct a real estate appraisal;

- obtain approval from the insurance company to issue a policy against the risk of loss;

- collect documents and submit them to the bank to verify the legal purity of the object;

- sign the papers.

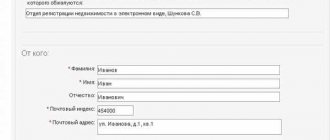

The electronic application form is completed taking into account a number of features:

In the “Personal Information” section you will need to indicate your full name, date of birth (DD.MM.YY) and telephone number used to receive notification of the bank’s decision. You should also enter your e-mail, where a letter with information about the application will be sent. Below, the borrower is asked to consent to the processing of personal information.

In the “Work” category, the user enters the employer’s TIN - 10 digits (12 for individual entrepreneurs) and the size of the monthly family budget. Select work experience from the list: total, at the current place of work.

The “Your loan” block allows you to determine the purpose of financing a real estate property, the region and cost of housing, and the amount of the advance payment.

Section “Documents”: indicate the series and number of the passport, the date of issue of the document. Click the "Submit Application" button. The bank manager will call you back to the specified number, describe the terms of the loan and current promotions, and clarify the missing information.

Registration at a bank branch

Obtaining a mortgage in an office requires a number of actions:

- Fill out the application form and submit the documents to the VTB branch (at your place of work).

- Receive approval within 1-5 days.

- Select an object (new building or secondary housing).

- Sign the loan documentation (loan, mortgage agreement, guarantee and insurance agreement).

Make a down payment in advance to a bank account or at the time of the transaction with the real estate seller. Payments to the property owner are made in cash or by bank transfer. In the first case, the rental of a safe deposit box is provided, in the second - a letter of credit. The transfer of money is carried out after the bank receives the required documentation.

Documents for obtaining a mortgage for foreigners

To apply for a mortgage in 2021, VTB offers to prepare mandatory and additional documents, submitted at the discretion of the credit manager.

| Mandatory documents | Optional documents that increase the chances of loan approval |

| Application form | Education documents of the borrower/guarantor (copies) |

| Identity card: passport of a non-resident of the Russian Federation, its copy and notarized translation; visa, migration card confirming legal stay and employment in Russia. | Employment contract, agreement with the employer. Employment history. |

| Income confirmation (valid for 45 days): certificate of employment; tax return; certificate in the form of the bank. | Confirmation of ownership of real estate (purchase and sale agreement, exchange, gift, property registration certificate) |

| Certificate of temporary registration at the place of residence | Papers for liquid property owned by the borrower (dacha, car, garage, land plot, yacht) |

Papers provided upon request of the bank:

- Agreements of other banks (loan, guarantee), containing information about current obligations.

- Account statements showing the balance of loan debt.

- Marriage certificate, marriage contract.

Guarantor documents:

- Application.

- Passport of a citizen of the Russian Federation or another state.

- SNILS.

- Confirmation of income with a 2NDFL certificate, account statement, annual declaration. If the guarantor is a salary client of VTB, bank employees will independently check the amount of accruals.

- Employment history.

- Military ID for men under 27 years of age.

- Confirmation of the legal stay and employment of foreigners in the Russian Federation.

When refinancing a mortgage from another bank in 2021, provide VTB employees with a certificate of the amount of the outstanding debt and information about the absence of arrears. The document must be certified by the signatures of officials and the seal of the primary creditor.

The set of real estate documents for obtaining a mortgage loan depends on the form of purchase: primary, secondary housing. In the second case, the bank will clarify the legal status of the seller: individual or legal entity.

Papers for secondary housing for individual owners:

- title papers (sale and purchase agreement, exchange, donation, confirmation of inheritance, privatization);

- evaluation report;

- financial and personal account containing information about persons living in the residential premises;

- real estate cadastral passport;

- extracts from the house register;

- evaluation report.

Copies of identification documents are required for all owners. If there are minor owners, you will need permission from the board of trustees, copies of title documentation, and an extract from the house register of the property where the children are planned to move in.

Additional papers for secondary housing for legal entity sellers:

- a copy of the constituent documentation;

- certificate of state registration of a legal entity;

- a certificate from the Federal Tax Service confirming the registration of a legal entity with the tax office (indicating the Taxpayer Identification Number);

- certificate from the Ministry of Taxes on making an entry in the Unified State Register of Legal Entities;

- confirmation of the authority of the representative of the organization.

Documents on primary real estate:

- construction investment agreement, agreement for the assignment of claims or purchase and sale;

- confirmation of the developer’s rights to construct or reconstruct residential properties (permission to conduct construction work, certificate of state registration of ownership or lease of land);

- if a construction permit was obtained after the entry into force of Federal Law No. 214 of December 30, 2004, it will be necessary to publish project declarations in the media and post them on the Internet. It is also possible to provide copies of project declarations.

Transaction scheme

We have already found out whether mortgages are given to foreign citizens, now we will consider the procedure for conducting the transaction. In general, it is no different from the standard algorithm. Let's look at it step by step:

- you must submit a mortgage application to the selected bank and receive approval;

- then, during the period of validity of the positive decision, a property is selected and a package of documents for it is collected;

- papers for the purchased apartment are transferred to the bank for separate verification;

- after the purchase is approved, you can enter into a transaction;

- a purchase agreement (or construction investment) and loan documentation are signed and submitted to the registration authorities;

- at the same time the first payment is transferred to the seller;

- The borrower receives title registration documents, then brings them to the bank to obtain a mortgage and transfer the remaining amount to the seller.

Recommended article: Sberbank again issues rural mortgages

Questions from readers

FAQ

Firuza: “I want to buy a house. Can I take out a mortgage? Since I never took out a loan. I have been working officially for 10 years. I am a foreign citizen. Married and have children. We want our own home. We can’t save money. Since rent, documents, transportation costs are more.”

Hello, I need to try to apply. You just need a down payment of 10-15% of the housing price. This money needs to be saved. And to be able to pay for insurance. Their cost depends on the mortgage amount. From banks to foreign citizens work if the work is in the Russian Federation: VTB Rosbank Unicredit Absolut Transcapital Raiffeisen

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Publication dateJanuary 10, 2020April 28, 2021

How to pay off your mortgage

The loan is repaid in equal monthly (annuity) payments. Choose a convenient method:

| Service | Enrollment deadlines | Commission, rub. |

| Internet bank "VTB" | Instantly | 0 |

| VTB ATMs in Russia (for ease of payment, customers are offered a free card) | 24 hours | 0 |

| Cash desks of VTB Bank | 24 hours | 0 |

| Transfer from another bank | Depends on the policy of the financial company | |

| Branches of Russian Post | The next day | 1.9% (minimum 50 rub.) |

| "Gold Crown" | The next day | 1% (minimum 50 rub.) |

It is possible to partially or fully repay a loan without visiting bank offices using the VTB Online system.

!['Sberbank's requirements for an apartment with a mortgage in [year]: reasons for the "tough](https://2440453.ru/wp-content/uploads/trebovaniya-sberbanka-k-kvartire-po-ipoteke-v-year-godu-prichiny-330x140.jpg)