Home / Real estate / Purchasing real estate / Buying an apartment

Back

Published: 12/19/2017

Reading time: 8 min

0

634

Russian legislation allows the possibility of purchasing an apartment in installments from an individual. In this case, the property will be pledged until the debt to the seller is fully repaid.

- Buying an apartment in installments: definition and features Is installment profitable?

- Registration of the contract

Often, buyers do not have enough money to purchase an apartment, and the seller does not want to waste time searching for another buyer. In this case, the seller may offer to conclude a purchase and sale agreement with installment payment.

Such transactions have not yet become widespread in the real estate market due to insufficient awareness of them. Many Russians mistakenly believe that only a bank issuing a mortgage loan can act as a lender.

Circumstances under which it is possible to obtain an installment plan

Basically, the developer company offers potential buyers installment plans in order to attract attention to the new residential property. The company takes such measures only if the deal can justify itself, that is, be profitable.

ATTENTION !!! It is worth noting that if a company offers clients to enter into an installment plan agreement, then this entails an increase in the final cost of the apartment by no less than 10-15%.

Features and conditions when the developer offers installment plans:

- You can get an installment plan only if the proposed apartment is located in a building under construction or a newly built one;

- The initial installment payment is quite large. But in today's economic situation, companies are making concessions and reducing it. In some cases, large companies may not require a down payment. If an apartment is purchased in a highly liquid new building, then in this case, the installment plan is issued for a period not exceeding 12 months, and the down payment can be more than 50% of the total cost of housing.

Why developers willingly provide installment plans:

- if housing in a new building takes a very long time to be sold out, then companies take a similar step so as not to remain at a loss after completion of construction;

- if the company that built the housing has just appeared on the market, then in order to attract attention it offers installment plans;

- if the company has an unsatisfactory financial condition and additional funds are needed to complete construction, for example, shareholders.

Options for agreements to purchase an apartment in installments

There are two options for purchasing a home with deferred payment:

- Apartment in installments from the developer under an equity participation agreement. This option is often offered by construction companies at different stages of construction. It is most profitable to buy an apartment in installments in a building that has already been erected and is at the completion stage. Typically, a DDU is concluded for a period of up to 3 years, during which the developer manages to put the building into operation, and the buyer manages to fully pay for the housing in the new building.

- Secondary housing in installments under a purchase and sale agreement with deferred payment. You can buy an apartment in installments not only from a development company, but also from a private person selling his own property. With this type of installment plan, the purchase and sale agreement records the encumbrance on the apartment. This means that the buyer has the right to use and live in the apartment, but cannot sell it until the debt is fully repaid.

When buying an apartment in installments in a new building, there are two types of transaction execution - a shared construction agreement or a sales and purchase agreement. It is important that the legal requirements are taken into account:

- You cannot enter into an equity participation agreement when the house has already been put into operation. In this case, the developer has the right to offer to draw up a preliminary purchase and sale agreement with installments.

- It is illegal to enter into purchase and sale agreements if construction of the property has not yet begun.

- When concluding an equity participation agreement, the developer is obliged to provide the buyer with the organization’s constituent documents - a certificate from the Unified State Register of Legal Entities, a report on economic and financial activities, a balance sheet, an auditor’s report (Law No. 214-FZ).

If housing is purchased in installments on the secondary market from the owner, there is only one option for executing the transaction - a purchase and sale agreement.

What is required to apply for an installment plan?

It is worth noting that applying for an installment plan will not require a lot of time from a citizen; the process is extremely simple and understandable.

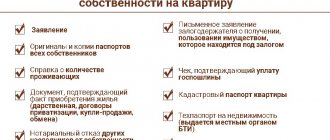

In order to execute an installment agreement, you must provide the following documents:

- it is necessary to provide identification documents of one of the buyers;

- further, it is necessary to provide the consent of the spouse to conclude such an agreement. Consent must be certified by a notary office.

After the necessary package of documents has been collected, you need to request information about the property directly from the developer company.

How does the purchase and sale of an apartment in installments work?

The process of purchasing a home is divided into two stages. Initially, the parties enter into a contract of agreement. It indicates all the technical information and completeness expected at the time of delivery, as well as the specifics of transferring the apartment to the investor. The transaction is considered signed after the contract is certified by a notary. The document has legal force and can be used in court if disputes arise between the parties.

At the construction stage, the investor does not buy the property itself, but the property right to it. Property law does not give ownership, but is a waiting stage. The property right passes completely to the investor only after 100% payment and execution of the transfer and acceptance certificate. The second stage is the transfer of ownership rights. It occurs when construction is completed and the new building is commissioned. Ownership can be transferred to the investor only after state registration of the new building is completed through the issuance of title papers.

The preliminary document does not need to be signed, it is not binding and has no force, the DDU is sufficient. Before signing a deal with the developer, it is necessary to discuss all the details and include important points in the document. This will protect yourself from unpleasant surprises. When applying for an installment plan, you do not need to submit documents confirming your financial independence. It is important for the developer that the investor can make a down payment, the amount of which can reach 50-80% of the cost of the apartment, as well as repay the next payments on time. To draw up a DDU you must provide:

- passport;

- taxpayer identification number;

- marriage document, if the client is a member of it.

Here you need to independently calculate your own solvency, and take into account the possible risks of selling an apartment in installments in the document. If the client has financial difficulties, he has the right to terminate the transaction by mutual agreement with a refund of payments. This provision is desirable in the contract. The buyer must be aware of whether he will pay in stages over a regulated period or not. Risks on the part of the developer should be taken into account. If for some reason he is unable to deliver the object, a refund will be provided.

Important! Before signing a deal, it is recommended to check the integrity of the developer in order to exclude situations where the construction becomes unfinished or is frozen for some reason.

It is recommended to familiarize yourself with the history of the developer, ask how many successful projects have been completed, and whether there are any long-term construction or frozen objects. Experience is evidenced by how many years you have been working in the real estate market. A construction company must stand on its own feet. There should be no litigation related to construction that affects its timing. Information about the developer should be obtained not only from reviews on the Internet, but also from the media, as well as from well-known lawyers practicing construction law.

Our lawyers know the answer to your question

Free legal advice by phone: in Moscow and the Moscow region, in St. Petersburg, as well as throughout Russia

The company must provide the following documents for review:

- an extract from the State Register of Real Estate, which contains information about the land plot on which the object is located;

- plan and all necessary technical and operational documentation for the property;

- reports from regulatory agencies. It is required to provide a report that the new building has passed the state examination and the housing meets all requirements and quality standards.

Please pay attention to the agreement

It should be noted that the legislation does not provide clear criteria that would describe the form of drawing up an agreement on installment plans. Therefore, a potential buyer, before giving his consent, needs to know what conditions should be specified in the contract in order to avoid unpleasant consequences. The risks when concluding a contract are quite significant.

The main points that must be strictly stated in the contract:

- First of all, you need to indicate the name of the organization providing the installment plan - the company itself or the credit institution. If the agreement is concluded with a bank, the conditions for providing installment plans will differ significantly;

- It is mandatory to indicate how the down payment must be paid, as well as the order of cash payments. It is also necessary to indicate the dates when payments are required;

- it is also necessary to specify the conditions under which early repayment of the installment plan will be carried out;

- when ownership of the property is transferred to the buyer after he has paid the down payment or paid the installment plan in full. It is mandatory to indicate this item;

- a clause that provides for the liability of the parties. It also requires specifying the measures that will be applied to the buyer if he is unable to fulfill his financial obligations. Additionally, this paragraph may include the conditions under which the contract is terminated and the procedure;

- conditions under which the buyer is given the right to transfer financial obligations to another person. This point may be important when the buyer is not confident that he can cope with the financial burden.

How is it different from a mortgage?

Installment plans are provided by the developer without involving a bank for a short period of time and require full repayment before completion of construction. Usually the period does not exceed 5-7 years. The client pays the mortgage for a maximum of 30 years. The developer develops the provisions of the contract for an apartment in installments independently, so it is possible to discuss the points and adjust them individually. The bank is not involved in signing the transaction.

Depending on the features of the new building, the down payment ranges from 5-80%. Subsequent payments are made in equal installments once a month, quarter, or other short-term period. The apartment in installments remains pledged to the developer until the cost of housing is fully repaid.

The overpayment does not exceed 3-10%. Developers offer a short-term product with a term not exceeding 2 years at 0%. During the construction process, the price per square meter gradually increases. The higher the initial amount paid, the cheaper the housing. A mortgage costs a client much more. The amount of overpayment depends on the annual interest rate and related costs. You can buy an apartment in installments on the secondary market from an individual only by mutual agreement.

The mortgage agreement is developed only by the banking institution. The points are clearly regulated. The bank is reluctant to make changes. Strict requirements are put forward for the selection of real estate. Lending for unfinished projects is not provided. When registering an apartment in installments without a mortgage, the procedure is simplified as much as possible.

Advantages and disadvantages

To summarize, we can name the pros and cons of such a deal, whether it will be justified and whether it will entail negative consequences.

Pros:

- As a rule, the installment procedure is completed over a short period of time;

- The buyer is not required to provide any additional documents. But it is worth noting that if the installment plan is issued through a bank, then some items may be added to the minimum package of documents;

- a fairly large selection of real estate in newly built houses;

- if the buyer had debt obligations to the bank, then they will not be taken into account when deciding whether to grant an installment plan.