Let us recall that a gift agreement means the gratuitous transfer by one party of property, securities, jewelry or ownership of real estate to the other party.

Any item can be donated at any cost. Restrictions are imposed on the transfer of a hunting rifle into the possession of another person, which, by law, can only be given to a person who has the appropriate permit (license).

It is recommended to draw up a gift agreement when the value of things exceeds 3,000 rubles.

A deed of gift for any piece of real estate or plot of land must be registered with the federal government and the title of ownership must be transferred from the donor to himself.

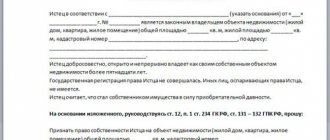

In order for the gift agreement to be registered by law and come into force, the following documents must be prepared:

- application for registration of the agreement (submitted by both parties);

- documents confirming the identity of the donor and the recipient;

- receipt of payment of state duty;

- a gift agreement concluded with a notary in the original;

- notarized written consent to conclude a gift agreement from the wife or husband of the donor, if he is legally married.

Otherwise, the agreement may be declared invalid. The gift agreement implies mutual consent of the two parties.

The recipient must know about the item he is receiving as a gift, its real value or historical significance, and agree to accept it. Otherwise, the fact of donation will not take place.

Reasons for termination of a gift agreement by the donor

But there are situations when the donor himself insists on the return of his former property.

To do this, he must present compelling arguments, which include the following factors:

- bodily harm to the donor by the recipient or an attempt on the life of his family members;

- early death of the donor after the conclusion of the contract, arousing suspicion among law enforcement agencies;

- the recipient is negligent in storing a rare item of cultural and historical significance;

- an unexpected decline in the donor's standard of living, which he can restore with the return of the donated item.

A big disadvantage of concluding a gift agreement in the event of its termination is the return of the gifted item without compensation for the recipient, and it is not taken into account that he, for example, made European-quality renovations in an apartment, furnished a country house, or invested a decent amount of money in tuning a car.

Cancellation for general reasons

The requirement to invalidate an agreement is possible in court if:

- the signature of one of the parties was forged or the party did not realize the significance of its own actions (Article 177 of the Civil Code of the Russian Federation);

- the party was misled (Article 178 of the Civil Code of the Russian Federation);

- the party acted in a situation of difficult circumstances, deception or threat (Article 179 of the Civil Code of the Russian Federation).

In all cases of cancellation, the gift party must be restored to its original (original) state, therefore the donee is obliged to return the gift if it was preserved at the time of cancellation of the agreement. If the donee has alienated the object of donation to another person, then its return becomes unacceptable.

If it is proven that the recipient of the gift alienated/destroyed the gift to avoid returning it to the donor, a lawsuit may be filed for damages.

The profit received by the donor from the use of the gift is not transferred to the donor, since it was received while legally owned by another person. The rules that cancel the agreement apply to gifts worth more than 3 thousand rubles. (Article 575, Article 579 of the Civil Code of the Russian Federation).

A deed of gift may be terminated due to the impossibility of execution if the donor refuses in the event of the destruction of the subject of the gift, or a ban on promised actions due to the entry into force of restrictive state regulations (Articles 416, 417 of the Civil Code of the Russian Federation).

The transaction may not take place for general reasons provided by law:

- in case of non-compliance with legal requirements;

- in the absence of the intention of the parties to create the corresponding legal consequences (imaginary contract);

- when concealing an actual agreement of a different kind;

- in case of recognition of a citizen as incompetent;

- in the case of a commission by a minor child (under 14 years of age) or in the absence of the consent of the guardianship authorities or trustees of a minor citizen;

- if committed by a citizen under the influence of a misconception regarding the nature of the procedure or a malicious agreement between representatives of the parties.

A transaction declared invalid does not entail any legal consequences. The recipient undertakes to return everything received to the donor, and if this is not possible, to reimburse its value in monetary terms (Articles 166-181 of the Civil Code of the Russian Federation).

A gift agreement may be declared invalid due to non-compliance with the letter of the law.

We remind you once again that the gift agreement must be concluded legally, otherwise it may be declared invalid due to non-compliance with legal norms.

For example, according to Article 173-179 of the Civil Code of the Russian Federation, a gift agreement is invalid and a person does not have the right to accept any items as a gift if:

- the donor is a minor from 14 to 18 years of age without the consent of parents or guardians (the exception is the fact that a minor at 16 years of age is recognized as emancipated, that is, fully capable on the basis of his employment and parental permission);

- the donor is a person declared incompetent, and his guardian did not give consent to this agreement;

- if the contract does not indicate the items of donation and their approximate value;

- the donor is the organization that provided the items as a gift orally;

- the recipient is an employee of a social service or medical organization directly related to the donor;

- if a legal entity or individual entrepreneur is declared bankrupt within 6 months after the conclusion of the gift agreement;

- when the donor puts forward certain conditions under which the recipient can receive the object of the donation;

- the gift agreement is considered invalid if the donor insists on the transfer of items as a gift after his death by his closest relatives;

- the gift agreement was concluded under duress and threats of physical violence;

- the donor was misled about the conclusion of the contract, did not understand the essence of what was happening and could not imagine the consequences as a result of which his immediate relatives would have their rights infringed;

- the legal spouse of the donor did not provide his consent to the agreement;

- the donor was in extremely difficult life circumstances and therefore agreed to conditions that were obviously unfavorable for himself, which the other party took advantage of for their own selfish purposes;

In the event of the death of the former donor, the property is returned to the latter, and the relatives of the recipient do not have rights of inheritance.

This must be taken care of in advance by the one who receives the items as a gift and the fact of inheritance by their closest relatives must be registered in the event of his untimely death.

You will probably be interested in watching the mental map “How to receive an inheritance” with step-by-step instructions for heirs

Or find out HERE about canceling the enslaving deal

Judicial practice of canceling the donation of an apartment

The judicial authority, when deciding the issue of canceling the apartment donation agreement, takes into account the following as significant circumstances :

- Negligent handling of property valuable to the donor by the person receiving the gift.

- The new owner of the property must have an idea of what special meaning the donated object has for the donor.

- The severity and nature of the harm caused to the donor or his family members does not matter. What is important is the fact that violations took place.

- Intentionality of illegal actions.

If the above circumstances exist, the court makes a decision to cancel the apartment donation agreement and return the real estate.

In judicial practice, there are cases when the recipient of a gift sells the gift in order to avoid its return.

Example

Citizen K. filed a lawsuit to cancel the donation agreement and return the apartment transferred to Citizen M. The plaintiff explained that the defendant caused physical harm to his daughter and presented a certificate of injuries inflicted, issued by a medical institution. However, Citizen M. announced in court that the donated housing was sold, and he does not have the opportunity to return the apartment back. Despite the sale of the property, the court in its ruling satisfied the plaintiff’s demands and ordered the defendant to compensate for the damage caused to Citizen D. (Article 1082 of the Civil Code of the Russian Federation).

The judicial authorities in cases of cancellation of a gift agreement do not decide the issue of a person’s guilt; such determinations fall within the competence of criminal proceedings.

Recognition of a gift agreement as invalid if it is a cover for a purchase and sale transaction

A gift agreement can be challenged in court and declared invalid if it is an actual cover for a purchase and sale transaction.

Such situations often arise when dealing with rooms in a communal apartment or selling your share of real estate. This is due to the fact that such sales transactions involve a lot of hassle.

The owner of a share or room in a communal apartment must offer his neighbors or co-owners to buy out his property on a priority basis or ask for permission to sell if they refuse the deal.

It happens that the neighbors are already accustomed to, as they say, living alone (since you are selling the room, it means you have another place to live) and do not want other people to appear in the apartment, but they themselves are not able to buy out your share.

Then they deliberately delay the answer, thereby disrupting all the plans of the co-owner.

To avoid all these difficulties, many people try to cover up the purchase and sale transaction with a gift agreement.

It is not recommended to agree to purchase a room in a communal apartment or a share in any other real estate if you were offered to do this through a gift agreement.

People who have the primary right to purchase this property can challenge your agreement through, and the statute of limitations is 10 years from the date of conclusion of the agreement.

As a result, you may be left without real estate and without money, since it will be very problematic to prove their receipt by the donor.

Think about whether it's worth the risk!

A gift agreement covering a purchase and sale transaction is recognized as a void transaction on the basis of Article 170, paragraph 2 of the Civil Code of the Russian Federation.

The agreement to transfer items as a gift must be absolutely free of charge, which is regulated by Article 572 of the Civil Code of the Russian Federation.

Judicial practice of recognizing a transaction as imaginary (feigned)

A donation concluded to cover up is a sham transaction, an agreement that does not create legal consequences is an imaginary contract (Article 170 of the Civil Code of the Russian Federation). Based on the analysis of judicial practice, most often, with the help of registration of a gift, they cover up the exchange of residential premises or the purchase and sale of real estate.

The types of evidence that can be provided to the court include:

- Receipt for receipt of funds from the parties to the agreement.

- Testimony of those persons who did not participate in the transaction, but have information important for the court.

- Testimony of a notary, employees of law firms, if the parties sought help from such, etc.

When concluding imaginary or feigned transactions, the parties may pursue specific legal goals , for example, non-compliance with the pre-emptive right of purchase, which other property owners have if a share in the common property is sold (Article 250 of the Civil Code of the Russian Federation) or the desire to avoid confiscation of an apartment.

Judicial practice shows that when considering cases related to feigned and imaginary transactions, the following facts are especially taken into account:

- Has there been actual execution of the donation, that is, state registration of the transfer of rights?

- Does the donor continue to reside at the address where the apartment is located?

- Has the agreement for the provision of housing and communal services been reissued in the name of the new owner, and does the owner bear the costs of their consumption?

- Does the donee pay property tax?

Imaginary and feigned transactions are void from the moment of their completion.

Risks of purchasing an apartment under a gift agreement

Donation allows you to sell an apartment bypassing certain provisions of the current legislation of the Russian Federation, but when deciding on such a transaction, the parties must be aware of the risks associated with the desire to circumvent the rules of law:

- Giving is characterized by gratuitousness. In this case, the donor, concluding a fictitious transaction, may not receive payment , since the corresponding agreement does not provide for monetary compensation for the transfer of ownership.

- If the parties are not close relatives, the recipient of the gift bears the risk of non-payment of tax in the amount of 13% on the income received due to the purchase of the apartment.

- When completing a purchase and sale, the seller has the right to specify in the document the conditions for penalties, penalties , in the event of failure to fulfill obligations by the buyer. Penalties cannot be specified in the deed of gift.

- A person who received an apartment under an imaginary (feigned) gift agreement, in a situation where the transaction is declared invalid by the court, may lose the funds that were contributed under the actual and concealed purchase and sale transaction.

It is the interested citizen who filed a claim in court who will have to prove the fictitiousness of the completed gift agreement.

Challenging the gift agreement in court by the donor's heirs after his death

If the donor gave certain valuable things as a gift during his lifetime, and his wife or husband agreed to this, then other even close relatives have to come to terms with this situation.

But after the death of the donor, the question of challenging the deed of gift in court often arises.

The heirs of the first stage believe that their rights have been infringed and are trying to challenge the gift agreement made by their close relative in court.

According to Article 196 of the Civil Code of the Russian Federation, the heirs of the donor are given this right, but it is quite problematic to prove that the deed of gift was drawn up illegally.

After all, the donor is no longer alive. Therefore, it is impossible to conduct a medical examination of his legal capacity, and it is also impossible to present evidence of coercion on the part of the recipient.

In addition, the heirs must apply to the court within 3 years from the date of death of the donor, otherwise the statute of limitations will expire.

There is a chance to challenge the deed of gift if the agreement was concluded with any violations that were listed earlier.

PRO new building 7 (499) 703-51-68 (Moscow)

An apartment donation agreement often replaces a will and is drawn up by citizens in favor of heirs and other persons with the intention of disposing of acquired property during their lifetime.

In other cases, a gratuitous transfer is issued to close relatives for their use. In addition, donation can serve as an act of goodwill, a donation to the recipient. The agreement can be challenged within 1 year after the donation is made, but the plaintiff can also rely on the general statute of limitations. In some cases, when the interested party did not know about the transaction, and also should not have received this information on his own initiative, the countdown of time begins from the moment of receipt of the relevant information.