Russia is a unique country. Here, problems are first created, and then ways to solve them are sought. This fully applies to the size of pensions for older people. In developed countries, their size is designed so that old people have a happy old age. In the Russian Federation, the size of pension payments only allows one to make ends meet. The overwhelming majority of elderly Russians do not have the opportunity to think about a vacation or a major purchase.

As a result, the government is forced to develop a complex system of benefits, allowances and discounts for pensioners in various areas. In this case, benefits are provided on an application basis: the pensioner knows about them and has submitted the appropriate documents to the social service or the relevant organization - he will receive discounts, additional payments or compensation. He doesn’t know - the treasury will save some money for each pensioner, which on a Russian scale equals huge amounts of saved budget funds.

Elderly people receive the most significant savings in the family budget through various preferences in housing and communal services. We will tell you in detail what benefits for pensioners to pay for housing and utilities are provided in the Russian Federation in 2021.

Normative base

All subsidies have federal and local funding sources. Naturally, there are two levels in the regulatory framework:

- legislative acts and government regulations adopted in the federal center: Federal Law of the Russian Federation No. 178 of July 17, 1999 “On state social assistance”; Art. 159 and 160 of the Housing Code of the Russian Federation; Government Decrees No. 541 (dated 08/29/2005) and No. 761 (dated 12/14/2005, last revised 12/29/2016); Budget Code of the Russian Federation;

- normative acts of local legislative assemblies.

Who is eligible for benefits

Which pensioners are entitled to housing and communal services benefits? In accordance with the legislative acts of the Russian Federation, all beneficiaries are divided into II categories:

Category I – persons to whom preferences are guaranteed by the state in any case:

- awarded the title of Hero of Russia or the Soviet Union, as well as those awarded the medal “Hero of Socialist Labor”;

- full holders of the Order of Glory;

- blockade survivors;

- family members (parents, widows, children) killed during hostilities in which the Soviet Union and Russia participated (WWII, Afghanistan, Vietnam, Chechen company, etc.);

- family members who became disabled during hostilities;

- disabled people of groups 1-3, as well as parents of disabled children;

- WWII participants;

- relatives (close ones) of those who fought on the fronts of the Second World War, who were dependent on them;

- participants in the liquidation of the Chernobyl accident and service personnel of the Semipalatinsk test site;

- disabled relatives of military personnel who died while serving in the Russian Army (regardless of whether the death occurred as a result of hostilities or service in peacetime);

- persons caring for a visually impaired person;

- minor prisoners of concentration camps.

A special list includes persons who retired from paramilitary or law enforcement agencies:

- Russian Ministry of Defense;

- Ministry of Internal Affairs;

- investigative committee;

- Ministry of Emergency Situations.

Benefits for military pensioners for housing and communal services are provided in the form of a discount.

Difficulties in obtaining category I benefits lie in the regulatory framework - who, how much and for what benefits are provided has to be looked for in a huge number of legislative and regulatory documents.

Category II – utility benefits for pensioners at the local level. They can be issued:

- families with 3 or more children;

- pensioners with a low pension (if the amount of utility bills exceeds 22% of the total family income);

- labor veterans;

- orphans and children whose both parents have been deprived of parental rights;

- Home front workers during the 2nd World War;

- repressed and then acquitted citizens of the Soviet Union;

- public sector workers, etc.

Each federal region may have its own list of beneficiaries. Their list can be found on the website of the government of the region, region, city or district.

However, not all of the listed categories of citizens are automatically included in the list of beneficiaries at the regional level. It is also necessary:

- own an apartment, house or part thereof;

- rent housing under a contract in the private sector;

- live in municipal property.

Pensioners are not provided with benefits for paying utility bills if the person who applied for state support:

- rents an apartment;

- receives a life annuity;

- has debts to pay for housing and communal services;

- actually lives at a different address than where he registered;

- has excess living space: more than 33 m2, if a single pensioner lives; over 42 m2 for a family of 2 people; more than 18 m2 per person for a family of 3 or more people;

- is not a citizen of Russia, etc.

Who else is entitled to housing and communal services benefits and how to get them

Much depends on the status of a citizen and subject:

- Benefit amount;

- Possibility to apply for a subsidy only;

- Possibility to pay at a discount only for certain housing and communal services.

In any case, the right to a benefit or subsidy will have to be regularly proven by updating the necessary documents and social security certificates. If a citizen has several reasons to receive a housing and communal services benefit, he can choose the one that is most beneficial to him (for example, apply for the benefit of an honorary citizen, not a pensioner).

- Large families. All subjects of the Russian Federation must take care of the growth of the country's population, therefore large families are encouraged in every possible way. Different regions have different rules for benefits and subsidies for housing and communal services. They are influenced by:

- Family size (number of children);

- Family wealth;

- The amount of housing and communal services payments in relation to the total family budget, etc. As a rule, they subsidize 30% of the total payment for housing and communal services.

- Single mothers. In order to support vulnerable segments of the population, mothers raising children alone are entitled to financial subsidies when their standard of living is too low.

- Children left without parental care, orphans.

- Combat veterans who have not retired and honorary citizens (holders of orders, heroes of the Russian Federation and the USSR) have the right to receive a subsidy or benefit from the day they acquire special status.

- Disabled people of groups I and II also have the right to a discount on utilities, even if they are officially employed and have not reached retirement age;

- Honorary donors.

List of available benefits

The state is gradually striving to move to full payment for housing and communal services by the population, without providing subsidies to public utilities from the budget. Under these conditions, the growth of tariffs for services significantly outstrips the growth of pension payments. To maintain the standard of living of pensioners, the state introduced subsidies to pay for:

- heating;

- water supply (hot and cold water);

- gas;

- sewerage;

- electricity for lighting;

- maintenance of general areas;

- housing maintenance: major repairs and removal of solid household waste.

How are they calculated?

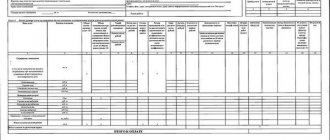

For category I beneficiaries, as well as persons who have reached 70 and 80 years of age, fixed amounts of compensation are established. For clarity, let's summarize these benefits in a table.

| Amount of subsidy, % | Category of beneficiaries | Regulations |

| 100% for utilities | Heroes of Labor, USSR and Russia, full holders of the Order of Glory and families living with them. | Federal Law “On Veterans” dated January 12, 1995 No. 5-FZ (last edition) |

| 50 (for utilities) | participants, disabled people of the Second World War, home front workers, blockade survivors, labor veterans, pensioners exposed to radiation during the accident in Chernobyl and Semipalatinsk | Federal Law “On Veterans” dated January 12, 1995 No. 5-FZ (last edition) |

| 50 (for utilities) | disabled people | Federal Law “On social protection of disabled people in the Russian Federation” dated November 24, 1995 No. 181-FZ (last edition) |

| 50% for major repairs | upon reaching 70 years of age | Art. 169 Housing Code of the Russian Federation |

| 100% for major repairs | pensioners after 80 years | Art. 169 Housing Code of the Russian Federation |

For regional beneficiaries, the amount of compensation is set at the local level. Their sizes can be viewed on the regional government website.

Subsidies are calculated completely differently for pensioners, whose housing and communal services costs exceed more than 22%.

Important: the share of utility costs is set at 22% for Russia as a whole. When paying subsidies from the local budget, in each region or territory it may be less, but not exceed the given figure.

Here social security workers apply the formula:

C = A – T x 22/100 , where:

- C is the amount of the subsidy;

- A – the normatively established minimum cost of housing and communal services in the region;

- T – total family income for the month;

- 22 – the maximum possible share of the family budget in paying for housing and communal services.

Types of additional benefits

What benefits are additionally issued in the field of apartment housing services for pensioners depends on the availability of merit and age. Subsidies are allocated at the regional level in the amount of:

- 100% for major repairs for citizens over 80 years of age. There is simply no accrual for this service; the pensioner will not receive a receipt for payment.

- 50% will be reimbursed to a retired veteran for paying for a landline phone.

- 50% of the utilities will be returned to the veteran and pensioner who was able to live until 80 years old, regardless of the amount of income.

Interesting information: Benefits for major repairs for pensioners after 70 and 80 years of age

When using the last two privileges, the pensioner pays the receipt in full, after which the discount comes to his bank account monthly in the form of compensation.

Many regions approve for pensioners a discount on TV antennas in the following amounts:

- heroes of labor and Russia - 30% (thirty percent);

- single pensioners, disabled people and those with a discount on utilities - 50% (fifty percent).

These subsidies are issued at the social protection office upon presentation of a certain package of documentation.

It is recommended to find out the full list of benefits at your place of residence, since many subsidies are determined by regional authorities.

Required documents

The folder of documents that must be submitted to the social security authorities must contain:

- application for granting a benefit in the established form (and sample filling);

- a photocopy of the personal passport of a citizen of the Russian Federation, as well as copies of the passports of all persons registered in the apartment (house), for whose utility payments benefits are issued;

- photocopies of SNILS of all those registered in this residential area;

- certificate of family composition;

- an extract from the BTI on the size of the living space;

- photocopies of documents confirming the relationship of family members (birth or marriage certificate, etc.);

- a copy of the certificate of ownership of the residential space or the rental agreement for social housing;

- extract from the Pension Fund on the amount of pension;

- income certificates of all working family members for the last 6 months;

- personal account number for transferring compensation (issued by the bank);

- copies of bills for housing and communal services for the last 6 months.

Under what conditions are benefits provided to pensioners for housing and communal services?

State and regional rent preferences are provided exclusively for the following citizens:

- Owners of living space, as well as family members living with them;

- Those renting state or municipal apartments under social tenancy agreements;

- Participants in housing construction cooperatives.

A reduced rate for utility bills is provided for the following persons:

- Citizens of the Russian Federation who have reached retirement age and have issued the appropriate certificate;

- Registered at the address of the living space for which the application for the benefit is being made;

- Those who do not have arrears in paying rent and utility bills . If you have debts, you are given the opportunity to receive a preference by drawing up an agreement on the timing of debt repayment and strictly complying with the terms of the agreements.

In addition, a candidate for a utility payment benefit must spend more than the limit established in the region. This indicator is applied to the total officially registered monthly income of the pensioner.

The final amount of the discount or subsidy provided is calculated by municipal authorities on an individual basis.

Also, regional authorities can issue their own types of benefits, which apply only to residents of a certain district.

As an example, pensioners living in Moscow who are seventy years of age or older are given a 50% discount on utility bills.

Full exemption from payment of tariff contributions for utility bills for citizens who have reached the age of eighty is provided subject to certain conditions.

These are:

- The pensioner has his own living space;

- A pensioner living alone does not have an official place of work, or lives with other citizens of retirement age who have a source of income.

For pensioners, preferential rates are issued for the following housing and utility payments:

- Gas;

- Water supply;

- Drainage;

- Electricity;

- Heating.

How to apply for benefits

As noted above, compensation from the state is provided only after the pensioner applies to the social security authorities. There are several ways to apply for rent benefits for pensioners:

- open a personal account at the Savings Bank, and then submit the application and the entire package of documents in person or through an authorized representative (a power of attorney certified by a notary is required) directly to the social security authorities;

- do the same procedure through the multifunctional center (MFC);

- registration is possible remotely, through the State Services portal (https://www.gosuslugi.ru/). Here all documents are scanned and forwarded to the MFC or social security.

Important: submitting documents before the 15th allows you to receive compensation in the current month. Being late by 1 day (from the 16th) advances the payment deadline by a month, but does not cancel the subsidy for the current month - payment will be made immediately for 2 months.

Duration of benefits

Benefits for paying for housing and communal services for category I persons (federal level) are established either for life or until a certain time, for example, until the youngest child of a large family turns 18 years old.

The rest of the country's citizens receive discounts or compensation for 6 months (with the exception of Moscow, where the period of support for pensioners for reimbursement of housing and communal services costs is 1 year) after submitting an application, after which it is necessary to again collect a package of documents and submit them to the MFC or social security authorities. Let us remind you that the legislative framework does not establish restrictions on the number of applications for state support for paying for housing and communal services.

Payment of subsidies may be suspended in the following situations:

- arrears have arisen for utility services;

- changed place of residence;

- the beneficiary is brought to criminal liability;

- a new source of income has emerged that is not indicated in the documents.

The legislative framework

All nuances regarding the provision of benefits and subsidies to pensioners for housing and communal services are regulated by current regulatory documents.

According to the law, benefits for utility bills are provided for non-working or working pensioners who pay more than twenty-two percent of their total officially registered income for utility bills.

This indicator is the maximum allowed and is valid in each region of the country.

However, municipal authorities have every right to reduce the level of costs for housing and utility services, based on local regulations.

As an example, for pensioners living in Moscow, benefits for utility bills are provided if the citizen’s expenses for housing and communal services payments exceed ten percent.

The main bills regulating the issue of providing benefits for the payment of housing and communal services payments for this category of citizens are:

- Article No. 159 of the Housing Code of the Russian Federation “On the provision of subsidies for the payment of living quarters and utilities”;

- Article No. 160 of the Housing Code of the Russian Federation “On compensation of expenses for payment of residential premises and utilities”;

- Decree of the Government of the Russian Federation No. 761 of December 14, 2005 “On the provision of subsidies for the payment of housing and utilities”;

- Decree of the Government of the Russian Federation No. 541 of August 29, 2005 “On federal standards for payment for residential premises and utilities.”

All benefits for payment for utility services are provided by the Pension Fund of the Russian Federation, which provides partial or full reimbursement of payments from the state budget.

How does the payment work?

For many pensioners, the compensation mechanism is not entirely clear. Let’s fill the gap in knowledge and understand in detail how to receive compensation to your personal account.

Where is it calculated? The subsidy is calculated and awarded monthly by the social protection authorities at the place of registration of the recipient of the benefits.

From what means? Compensations are paid from the regional or federal budget.

Where are they transferred? Social security authorities tend to work mainly with the Savings Bank. Therefore, the recipient of compensation must open a personal account there, where the payment will be sent. The deposited money can be withdrawn at any time and used at your discretion.

When they are listed. Transfer of compensation is carried out after payment of utility bills in full. If there is a 2-month debt for utilities, payments stop until the debt is repaid.

Attention: it is a mistake to believe that social security authorities can independently direct all or part of the compensation to pay off the debt.

Possible reasons for refusal

Everything related to money requires careful verification. Therefore, the overwhelming number of failures is due to two reasons:

- the package of documents provided is either missing some piece of paper, or one of the certificates has expired;

- Inaccuracies were found in filling out the papers.

In this case, the applicant has 10 days to correct errors and omissions. If the package of documents is not corrected within the specified period, with a high degree of probability a refusal will be made for the current grace period (6 months).

There are also options for refusal with semi-criminal reasons:

- deliberately false information has been entered;

- one of the documents is forged;

- the applicant concealed that he has his own business (individual entrepreneur or is the founder (or one of) a legal entity).

The state helps people of retirement age pay for utilities. Here it is important to know about the existence of benefits and timely prepare documents to receive subsidies.

Additional utility benefits

Teachers of urban and rural educational institutions can receive preferences and subsidies for housing and communal services, since their work is socially necessary and difficult.

A retired citizen must have at least twenty-five years of experience in the educational field.

In addition to regular benefits, they can receive free housing if they document poor living conditions.

Persons of retirement age with the title of “Veterans of Labor” who live in the capital, or St. Petersburg, are required to receive benefits for utility bills.

It works:

| To pay for housing and communal services (gas supply, water supply, drainage, heating, electricity) | Fifty percent discount on the total payment amount |

| For tax collection for living space | Fifty percent discount on taxes for an apartment or private house |