Home » Inheritance » Registration of a land share as property by inheritance

2

Registration of a land share as an inheritance is somewhat different from the standard procedures for accepting property received after the death of a relative. This is a long and costly process, accompanied by many bureaucratic operations. There is a special algorithm for legal registration, during which a citizen can obtain the right to dispose of a plot of land assigned to him by inheritance.

Is land share inheritable?

According to the legislation of the Russian Federation (Article 130 of the Civil Code), a land share is considered one of the types of real estate. But formally it is not a land plot, but only the right to claim it in a specific amount. This is an unallocated part of common land, which can be registered in the name of a citizen and transferred to his possession. Only after the execution of the State Act does the share become a land plot with specifically defined boundaries. The owner of the share can partially dispose of it even before its allocation.

The Federal Law “On the Turnover of Agricultural Land” will determine the list of actions that can be carried out with land at the discretion of the owner. They can be used for their intended purpose, sold, donated, rented, or bequeathed. There are some restrictions regarding the unallocated land share. It can be transferred by will, but it cannot be rented or sold until a specific plot is allocated.

The transfer of a land share by inheritance can be carried out by law or by will. The only condition is that the owner of the plot has ownership rights.

A professional lawyer will help you quickly and correctly complete all the necessary steps. He will tell you what actions need to be taken and what documentation to prepare, and can also accompany the heir to meetings with other applicants for shared property. You cannot do without the help of a specialist in cases where the deadline for accepting the inheritance has been missed or there are other circumstances that complicate the procedure.

Legal regulation

Chapter 3 of the Civil Code of the Russian Federation regulates the process of inheriting an agricultural land share. The legislative act establishes the necessary procedure for registration and the list of documents, and also determines all the features of the procedure and deadlines for completion.

In order to receive or inherit a share on your own without the help of lawyers, you will have to carefully study the regulatory framework. This will allow you to complete all the necessary steps correctly. Legal regulation is carried out:

- Art. 1110 of the Civil Code of the Russian Federation - will determine the right of the testator to dispose of his property at his own request.

- Art. 1112 of the Civil Code of the Russian Federation - defines the main components of inherited property, as well as the rights and obligations of the testator.

- Art. 1181 of the Civil Code of the Russian Federation - regulates the process of obtaining a land share by inheritance.

- Art. 1154 of the Civil Code of the Russian Federation - establishes the deadlines for entering into legal inheritance.

How to register a land share as a property by inheritance?

The total amount that the heir will pay to the notary consists of two payments:

- Payment for the technical work of a notary when drawing up an application for acceptance of an inheritance is several hundred rubles. Established according to the prices of the notary's office.

- The state fee for issuing a certificate of the right to inheritance is 0.3% of the value of the inherited property, but not more than 100,000 rubles - for children, including adopted children, spouse, parents, full brothers and sisters of the testator or 0.6% of the value of the inherited property, but no more than 1,000,000 rubles - to all other heirs; is established by clause 22, part 1, art. 333.24 of the Tax Code of the Russian Federation.

This is interesting: Sample inspection report for the local area

Valuation of a share for inheritance Carrying out the valuation procedure is an indispensable condition for transferring a land share as an inheritance.

Methods of transferring land by inheritance

A citizen receives the right to a land share after a meeting of all participants in shared ownership, land surveying procedures, registration of the allotment with the state and registration of ownership. There are two ways to enter into an inheritance: by will and by law.

The first option implies the presence of a testamentary document, which expresses the last will of the deceased in relation to the property that belonged to him.

If the will has been drawn up taking into account all the requirements and signed by a notary, the procedure for transferring land is carried out in the order specified in it, regardless of the order established by law.

Mandatory share

The only exception is the presence of a mandatory share in the inheritance. In accordance with Article 1149 of the Civil Code of the Russian Federation, the following are entitled to it:

- minors or incapacitated children;

- parents or spouse who have lost their ability to work;

- dependents of the deceased.

They are assigned the right to receive part of the property even if they are not mentioned in the will. The legislation established this restriction in order to take care of this category of citizens who may find themselves in a difficult financial situation after the loss of a breadwinner. This condition also protects them from pressure and coercion to transfer their own share. In the absence of a will or if it is declared invalid, inheritance of property occurs according to law.

According to Art. 1141 of the Civil Code, relatives can claim inheritance in a certain order, according to the degree of relationship with the testator.

How to inherit a land share

The heir to a land share must complete a certain legal procedure before registering ownership of it.

First, you need to contact a notary to confirm your right to receive property. In the case of inheritance under a will, this should be handled by the lawyer who drafted it, who can confirm the authenticity of the document.

If there is no testamentary document, you need to contact the notary office at the place of residence of the deceased.

How to properly receive a land share by inheritance in 2021

In addition, the adopted children of the deceased can claim the inheritance if the adoption procedure was officially carried out, as well as persons who were his dependents. The law establishes eight lines of heirs depending on the degree of relationship and the presence of dependents. The heirs of the first stage are the closest blood relatives of the testator and spouse, as well as persons who were his full dependents. The absence of heirs of the first priority gives the right to inheritance to persons included in the second priority. If there are no heirs of the second stage, or if there are heirs, but refuse, the property of the deceased passes to the heirs of the third stage, and so on. In this case, the property of the deceased within one line is distributed among the heirs in equal shares. Read the article “Order of Inheritance” for details.

This is interesting: Who owns public lands in SNT

Documentation

To receive an agricultural share, you need to collect the following package of documents:

- Death certificate of the previous owner.

- Certificate from the place of registration of the testator.

- Passport of the heir.

- Documents for land (cadastral plan, certificate of allotment of land, property rights).

- Evidence of a family relationship with the testator (birth, marriage, etc.).

- Certificate of ownership of the plot, issued in accordance with the request of the notary authorities.

Grade

To receive a share as an inheritance, a land valuation is required. This procedure is carried out by the Land Committee of the area where the share is located. To determine the price of a plot, a special commission is appointed, which collects and analyzes documents, selects a valuation method and calculates the cost. Based on the results of the work carried out, the commission draws up a report indicating the cost of the site.

Valuation of a land share is a mandatory document for the heir to obtain ownership rights.

Certificates from the tax office

The heir must contact the tax office to obtain two documents:

- A certificate confirming the absence of restrictive measures on the use of the allocated plot - arrests or other prohibitions limiting the right to dispose of the share.

- A certificate confirming that there are no delays or arrears in paying taxes for the plot. If such debts exist, they must be paid off in order to enter into an inheritance.

The issuance of documents to the tax office is carried out on the basis of an application from the heir and does not require a notarized request.

Procedure

The procedure for entering into inheritance rights takes place on generally accepted grounds, since land is an integral part of the entire inheritance (as is a house registered as property). The process of opening an inheritance must be completed within six months from the date of death of the owner. If the heir missed the specified period for valid reasons, the right to inheritance can be restored through the court.

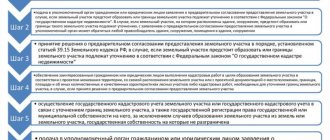

When inheriting a land share under a will, you must:

- contact a notary organization;

- collect the necessary documentation package;

- hold a general meeting and approve the boundary marking procedure.

In order to obtain a certificate of inheritance , special checks are carried out, namely:

- fact of death;

- the legality of the rights claimed;

- checking other possible heirs.

The legal successor receives full ownership rights to the land share by inheritance only if compulsory shares are not allocated from it.

Set up an inheritance after the death of parents

Re-registration of a land share into ownership after the death of parents is divided into two categories - by will and without a will. In the first case, the testator draws up a document in which he indicates his will regarding the plot, that is, who will get it after his death.

To re-register a land share received by inheritance, the heir contacts a notary office and provides the death certificate of the parents and documents confirming the relationship. Under the supervision of a professional, an application for opening an inheritance is drawn up.

This is interesting: NTO in the local area in Perm

The application must indicate:

- reasons for obtaining property rights;

- details of the applicant, his current address of residence;

- details of the former owner, date of death confirmed by a death certificate;

- information about the share - total area, boundaries, information about the land surveying procedure);

- date and signature.

Next, a state fee of 350 rubles is paid, the receipt is saved and attached to the package of documents. After which the interested person must receive extracts from the land cadastre, based on the results of which the land is assessed.

Required documents

To receive a land share by inheritance, the following documents are provided:

- death certificate;

- a certificate drawn up at the place of current residence of the testator;

- passport information of the citizen applying for the corresponding plot by inheritance;

- document on the allocation of a share;

- card index plan;

- documents that confirm ownership rights;

- documentation proving relationship (birth certificate, marriage registration certificate);

- a copy of the judge's decision confirming family ties;

- conclusion of the commission that assessed the land share;

- an official document that will prove the absence of limited rights in the area of disposal of the transferred real estate;

- certificate of absence of payment debts.

Important! To obtain an assessment and certificates from the tax service, only an application from the successor is required; a special request from a notary is not needed.

Application deadlines

You should contact a notary within 6 months from the date of death of the testator or from the moment the court makes a decision declaring him dead. However, if this deadline was missed for a good reason, the citizen has the right to restore it through the court. To do this, you will need to prepare an appropriate statement of claim and support the stated facts with evidence.

If during the judicial review it is established that the heir did not know about the death of the relative, the decision will be made in favor of the applicant.

There is also a mechanism for registering an inheritance after missing a deadline without trial. A prerequisite is the consent of all heirs of the property who previously assumed their rights. The procedure consists of the following steps:

- In the presence of a notary, all heirs confirm in writing their consent to the entry into the inheritance of a person who has missed the deadline allotted by law. If the simultaneous presence of all heirs is impossible, it is allowed for their signatures to be certified by a notary separately.

- The property is re-divided.

- New certificates of inheritance rights are issued.

Property, the rights to which were not claimed within 6 months from the date of death of the owner, is considered escheated and becomes the property of the state.

The procedure for registering inheritance on land

To acquire an inheritance, it is necessary to express and justify the desire for succession to a notary within a period of 6 months from the date of death of the testator. After the expiration of the period established by law, an employee of the notary office will not be able to help prepare documents.

The law provides for a 3-year period of time for challenging an inheritance and restoring a missed deadline.

The entry into inheritance rights is carried out within the approved time, and the issuance of a completed certificate of ownership and disposal can take from several months to several years.

Despite the fact that the time for registering an inheritance is limited by law, the timing of the issuance of ready-made documents, as well as their number, is not limited in any way. The notary is authorized to issue one general certificate or draw up separate ones for each applicant.

To accept land, it is necessary to transfer documents to a notary at the location of the subject of inheritance.

When drawing up an application for entry into succession, be sure to indicate:

- details of the notary and the company where the application is submitted;

- information about the applicant (full name, residential address);

- information about other applicants for heritage;

- indication of the relationship with the testator;

- expressing a desire to acquire the right of inheritance;

- date of compilation, signature.

Documentary evidence must be attached to the written document, without which the notary officer does not have the right to carry out the procedure for registering an heir. It is impossible to acquire an inheritance on the basis of just one application.

We recommend reading: Inheritance after the death of a husband

After recording the accepted papers, the notary will enter all the information into the database and generate a certificate of inheritance, and all that remains is to register the land share.

If the citizen who is the successor did not know about the death of the testator and it was impossible to submit documents within the allotted time, he will have to apply to the court to restore the deadlines for registration.

The law provides for a pre-trial procedure for resolving the issue of announcing a new successor. If other heirs give written consent to include a new person among the legal successors with a subsequent recalculation of shares, then the notary will re-register the documents.

If there are several heirs

The division of property between heirs can be carried out in one of the following ways:

- If the deceased left a will, the shares are determined based on the will of the owner of the property.

- In cases where the existing will does not indicate the parts of each heir, the land share is divided equally between all applicants.

- In the absence of a testamentary document, the land plot becomes property in accordance with the law, and all heirs receive an equal share of the property.

Registration process

After checking the correctness of all documents and their authenticity, as well as the legality of the rights claimed, the notary opens an inheritance case. In some cases, additional documents may be required, of which the official will notify the applicant.

Upon completion of the checks, but not earlier than 6 months after the death of the relative, the notary issues the heir a certificate of inheritance.

Then the heir will need to start registering the property. To do this, you need to contact the registration service, where, on the basis of a document on the right of inheritance, you can obtain a certificate of ownership of the land.

Conditions for inheriting land

The likelihood of acquiring a land share by right of inheritance is regulated by paragraph 17 of Law No. 122-FZ of July 21, 1997.

A share territory can be inherited only when the testator has managed to complete the process of allocating a share of the common space during his lifetime and has received a certificate of ownership or lifetime leasing.

We recommend reading: Entering into the inheritance of minor children

Confirmation of the grounds for ownership of property by a now deceased citizen is provided for registration in the State Register. If there are erected buildings, a package of documents is provided with a construction permit, an acceptance certificate and other papers for the structures.

It is possible to receive a share in an inheritance on the basis of a will or the right of legal succession according to the order of inheritance.

If the last will of the testator has been drawn up, the notary will notify the heir of the property due to him. The potential successor will have to contact the notary officer who registered the will of the now deceased citizen.

Taxation

Art. 217 of the Tax Code of the Russian Federation establishes that when inheriting property in kind, including a land share, a citizen does not have to pay tax. This reduces costs and simplifies the inheritance procedure.

After registration of the plot, the new owner is obliged to pay land tax once a year on an equal basis with other land users in accordance with the general procedure in accordance with Federal Law No. 141 dated November 29, 2004.

Registering a share as an inheritance is a specific procedure that differs in many ways from accepting other types of property. Without knowledge of the laws and certain skills, it is quite difficult to pass. The procedure can be simplified by the help of professionals who know all the nuances of the process and have extensive experience in solving complex legal problems.

On the portal ros-nasledstvo.ru you can get a free consultation online, as well as order, entrusting specialists with the entire procedure. We will help you prepare documents with a notary, and in case of litigation, we will prepare a statement of claim and provide assistance during meetings.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

20

Does a common-law wife have the right to inherit after the death of her common-law husband?

There is an opinion that the concept of “civil marriage” implies an unregistered...

12

Statement of claim to establish the fact of family relations in 2021

According to Articles 262 and 264 of the Civil Procedure Code of the Russian Federation, an application for...

10

How to find out if there is an inheritance

The sudden death of the testator or lack of contact with other applicants may...

17

Mandatory share in the inheritance by will and by law (without a will)

The legislative act regulating civil law in the field of inheritance (section V...

15

Are loan debts inherited?

The short answer is YES, debts are inherited if the heir accepts the inheritance...

6

Limitation period for inheritance cases

Some people mistakenly correlate the statute of limitations in inheritance cases with...