Maria Litinetskaya, managing partner of Metrium Group, member of the CBRE partner network, answers:

The owner will not be able to re-register the apartment, which is pledged to the bank, to a third party (relative or not - it does not matter) unless the bank gives its consent to this. And approval from a credit institution can be obtained only in one case: if the debt obligations are also transferred to the new owner.

5 options for selling a mortgaged apartment

How to sell an apartment with a mortgage?

When does an apartment become a property with a mortgage?

Registration of ownership of an apartment through the MFC For the convenience of citizens, you can submit documents for registration of mortgage housing not only through Rosreestr, but also through the MFC. By submitting documents to this authority, the applicant saves time because he does not have to stand in line. True, the process of decision-making and preparation of documents here is delayed, since at the MFC employees only accept documents and then send them to Rosreestr. The MFC performs intermediary services. How many days does it take to register ownership of an apartment under a mortgage per year? Dear readers!

According to the law, real estate can be registered as shared ownership with the definition of shares between the parties, regardless of whether it will be purchased for cash or with a mortgage, or whether the parties are in an official or civil marriage. In the loan agreement, the parties will have the status of co-borrowers, obligated to share mortgage payments. Obstacles can only arise from banks that do not want to take on risks in the event of a breakup of a couple that has not officially legalized their relationship, where one of the parties is insolvent and unemployed. It is not recommended to register property and a mortgage loan only in the name of an unofficial spouse. Since in the future he may challenge the rights of the second spouse, who does not officially make contributions to repay the mortgage loan and does not have a common budget with him.

Financial advisor, general director of investment consulting Ksenia Voronina answers:

Theoretically, yes, with the consent of the bank. However, in practice, obtaining such consent is extremely rare for a number of reasons. Firstly, banks really don’t like it when the owner of the apartment and the borrower are not the same person, because if payments are late, it is more difficult for them to foreclose on the apartment. And simply the leverage over you as a borrower becomes smaller. Secondly, if, along with ownership rights, you want to transfer a loan to a relative, then the bank must first check and evaluate his creditworthiness and reliability as a borrower. There is a possibility that your relative will not be satisfied with the bank according to these parameters. But even if your relative fits the profile of a borrower desired by the bank, it is still easier for the bank to refuse you than to approve the re-registration, since this operation does not bring any benefits for the bank, only unnecessary troubles and risks, and the bank has no obligation to approve it . However, you can still contact the bank with a corresponding request: if the application is submitted in writing, you are required to give an answer to it.

Who is the bank?

Many people mistakenly believe that with housing lending, the property belongs to the bank and there is a certain point when the apartment becomes the property of a mortgaged individual. In fact, the buyer is the original owner of the property. Only the owner has all powers of ownership and use of housing. And only if the deadlines for making loan payments are repeatedly violated, the apartment can be foreclosed on.

Having completed mutual settlements with the lender, the property owner must remove the encumbrance and remove the apartment from the mortgage. To do this, you need to obtain a certificate from the bank confirming full repayment of the loan, and a mortgage note with a note on the fulfillment of the obligation. Then you need to go to the registration authority to remove the encumbrance from the apartment. This may be the Rosreestr office at the location of the apartment, but it is more convenient to use the services of the MFC if such a service is provided in your area. To confirm the updates to the register of rights to real estate and transactions with it, you will receive an extract from it with no encumbrance of rights.

The loan agreement and the collateral agreement list the restrictions on apartment ownership. Usually, the owner cannot register persons who are not family members in the apartment without the consent of the bank. It will not be possible to carry out redevelopment or reconstruction of an apartment that is secured by a bank. The fact is that these actions can worsen the consumer properties of the apartment, reducing its market value. If it is necessary to sell such real estate at auction, the mortgagee incurs losses.

Yulia Shchegoleva, mortgage manager of the M16-Real Estate agency, answers:

Until the mortgage loan is fully repaid, re-registration of the apartment in the name of one of the relatives is impossible if initially there is only one person as the mortgage borrower. In this situation, it will be possible to reissue a mortgage only after the loan has been fully repaid. In the meantime, the borrower for whom the mortgage and, accordingly, the housing is issued, continues to bear his obligations, there can be no talk of any re-registration. Even if a first-degree relative acts as a potential owner.

Is it possible to give a mortgaged apartment to a child?

Assignment of rights: features of transactions

In order to have the opportunity in the future to re-register a mortgage for an apartment in the name of one of your relatives, you need to take care in advance. When applying for a loan, indicate such a relative as a co-borrower, even if you plan to bear the mortgage obligations yourself. Only if a relative is already a co-borrower on the mortgage will it be possible to register the apartment as his property. This is the only opportunity to obtain a mortgage for an apartment in the name of a relative; there are no other ways.

Does the bank have the opportunity to seize the living space from the borrower?

In the event that a person who has decided to take advantage of the mortgage lending program ceases to fulfill its obligations to the bank, then this organization has every right to terminate the agreement unilaterally. In most cases, an apartment taken on a mortgage is taken away in favor of the bank for serious arrears and debts.

This is a fairly serious situation that you should beware of, since according to current Russian legislation, the borrower’s consent is not required at all. However, on the second day after the payment is late, no one will take the apartment. In addition, banks often meet their borrowers halfway, providing them with grace periods, imposing minor penalties or small fines. If all these payments are repaid on time, the debtor will continue to repay his loan as before.

An important issue is purchasing an apartment with a mortgage before marriage. In this case, it is not considered jointly acquired property; in the event of a divorce, the apartment remains the full property of the buyer and is not subject to division, regardless of the funds from which the loan was repaid, unless otherwise proven by the other spouse during the divorce process.

In principle, an apartment taken on a mortgage can be rented out, but it is necessary to promptly warn the tenants about this and notify the banking organization. There is some peculiarity - it will be necessary to conclude an agreement on the delivery of property, and its duration should be a maximum of 11 months, so that it does not have to be formalized in the relevant government bodies such as the registration chamber.

Yulia Dymova, director of the Est-a-Tet secondary real estate sales office, answers:

Maybe, but initially you will need to coordinate this issue with the bank. If you do not receive approval from the bank for this alienation of the property, it will be impossible to re-register the property to a relative.

Example: during a purchase and sale, the transaction will look like this: the owner has a loan and rights to the object, but after concluding the purchase and sale agreement, the buyer (relative) transfers money. However, given that the bank has an encumbrance on this property, it will set a condition: the funds must be transferred to the current account (in which the mortgage is opened). The money will be used to pay off the mortgage, and the balance will remain in the current account. It is also possible to replace the collateral. If a person owns two apartments, one of which is pledged, then the loan collateral is transferred to another property.

Mortgage refinancing

Does refinancing a mortgage affect your tax deduction?

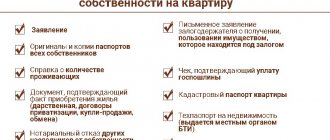

What is needed to register a transaction with collateral

Registration of ownership of an apartment under a mortgage requires the provision of a list of documents established by law (). Their list will be provided by the bank manager or realtor with whom you cooperate. Although it may vary slightly depending on the characteristics of the transaction, the basic list is as follows:

- Passports of the participants in the credit transaction, that is, sellers and buyers.

- Application for registration of ownership. The forms will be printed by the specialist accepting the documents, all you have to do is check the data and sign.

- Receipt of payment of the state fee for registration of property rights. The state duty is divided equally among all future owners. If you are mortgaging your property, you must register the mortgage agreement. The state fee for it is divided equally between all mortgagors and the creditor.

- Agreement with the seller (for resale) or with the developer (for new housing).

- Documents confirming title to housing (extract from the general register of real estate).

- The document in connection with which the right of ownership appeared (privatization, donation, etc.).

- Collateral papers. In case of encumbrance, by force of law, an agreement with the creditor and a mortgage are used; by force of agreement, a special mortgage agreement is used. Some banks do not issue a mortgage, and this also happens within the framework of the law - the restriction of the right is registered only on the basis of the loan and purchase agreement.

- Technical documentation.

- Notarized power of attorney, if the seller is represented by his authorized representative.

- Permission from government agencies to sell living space if there are children among the sellers.

- Notarized permission of the borrower's husband or wife for the encumbrance.

In order to submit documents and not be refused, you should clarify in advance what is required to register ownership of an apartment with a mortgage.

Separately, it is worth mentioning such an important document as a mortgage (). Although many banks neglect its registration, large financial organizations practice registering collateral through a mortgage note. The document must contain:

- data of mortgagors, that is, mortgage borrowers on this loan;

- characteristics of the apartment (location, floor, number of square meters, estimated price, etc.);

- information about the mortgage (amount, details of the loan agreement, rate, etc.);

- features of repayment, date and amount of payment;

- signatures of all borrowers.

Recommended article: How to get a mortgage without proof of income?

A printed and signed mortgage must be submitted for registration. Otherwise, it is not recognized as legal. The original document is stored in the bank archive until the loan is closed. After payment, they will give you the mortgage note, because it will be needed to remove the deposit.

Please note that the mortgage can be transferred to another organization, and not only if payments are late. It all depends on the terms of the loan agreement you signed. By and large, nothing seriously changes for the payer except payment details. The rules for taking away housing are clearly regulated by Russian legislation, so there is no need to worry.

Restrictions on the rights to housing purchased with a mortgage

There are some restrictions:

- You cannot just sell or donate a mortgaged apartment to a third party. This will require written permission from the bank;

- Sometimes credit institutions conduct inspections of the condition of the mortgage collateral. This happens on rare occasions, but they do happen;

- The premises can be rented out only with the consent of the mortgagee. Some owners “get around” this nuance by concluding a lease agreement for 11 months. Then there is no obligation to register it with Rosreestr;

- it is impossible to carry out redevelopment without obtaining permission from the bank and insurance company;

- violation of the rules for using residential premises. You cannot violate the norms of the Housing Code of the Russian Federation (for example, turning an apartment into an office for an individual entrepreneur). If the bank finds out about this, it may terminate cooperation early, requiring the buyer to sell the apartment through auction and repay the credit line.

The mortgage agreement specifies all possible restrictions. Each borrower should carefully review the document before signing it.

Here, more than ever, it is true: measure seven times...