The concept and subject of pledge of property

A pledge of property is a unique form of securing the fulfillment of certain obligations, which can be expressed in various material assets, as well as in various civil rights, with the exception of money. But the implementation and enforcement of a specific requirement will be possible only if the pledge of property is carried out in relation to those material assets that are in the legal ownership of the pledgor.

The established procedure and specific provisions of the current Civil Code of the Russian Federation provide that owned property can become the object of collateral only if the total value of this property covers the cost of the loan and guarantees its full repayment and withdrawal.

The procedure and features of the current legislation provide their own explanations regarding the requirements for the subject of property pledge.

The subject of the pledge is a certain property, separated from the general mass, or transferred personally to the pledge holder, the value of which can be used in the event that the other party to these legal relations does not comply with certain requirements, conditions and procedures contained in the property pledge agreement concluded between individuals , or legal entities.

The current requirements establish a certain list and types of property owned by the mortgagor, which can become collateral:

- movable and immovable property, in respect of which a pledge of the acquired property can also be issued;

- property rights secured by real estate owned by an individual or legal entity that have passed all the necessary registration procedures, certificate, power of attorney, notification, etc.;

- securities and documents of a legal entity or individual, which can be transferred after registration personally to the pledgee, or placed on the deposit of a notary, unless the property pledge agreement contains a different procedure, features, conditions and requirements.

Types of collateral

Based on the various conditions established by the parties in the pledge agreement, or other circumstances accompanying the pledge legal relationship, the following types of pledge can be distinguished:

Collateral and mortgage

Typically, the pledged item remains in the possession of the pledgor without any changes in the rules for its use (unless additional requirements arise for insuring the property pledged, ensuring its safety and informing the pledgee about the fate of such property).

The legislator separately identifies a situation in which, by agreement of the pledgee with the pledgor, the subject of the pledge can be left with the pledgor under the lock and seal of the pledgee, and an individually defined thing can be left with the pledgor with the imposition of signs indicating the pledge - the so-called firm pledge.

It happens that the parties agree to transfer the collateral directly to the pledgor (mortgage), which, of course, to a certain extent makes it easier for the creditor to foreclose on such property in the future, although it imposes additional obligations on the latter to ensure its safety.

It is noteworthy that in this case, by agreement of the parties, the pledgee may be given the right to use the pledged item transferred to him, regularly submitting a report on use to the pledgor. Under the agreement, the pledgee may be obligated to extract fruits and income from the pledged property in order to repay the main obligation or in the interests of the pledgor.

Initial and subsequent pledge

The mortgagor, who is left with the pledged property “in hand,” can, of course, try to pledge it again, especially since in the vast majority of cases when it comes to movable property, there are usually no certificates of pledge available to a wide range of people ( which is one of the most serious problems of our time).

The pledge of already pledged property is called subsequent and, according to current legislation, the claims of the subsequent pledgee are satisfied from the value of this property after the claims of the previous pledgeholders.

In this case, a subsequent pledge is allowed if it is not prohibited by previous pledge agreements.

The pledgor is obliged to inform each subsequent pledgee of information about all existing pledges of this property and is responsible for losses caused to pledgees by failure to fulfill this obligation.

In the event of foreclosure on the pledged property on claims secured by a subsequent pledge, early fulfillment of the obligation secured by the pledge may be simultaneously demanded and foreclosure on this property may also be made on claims that are secured by a previous pledge and the deadline for filing for foreclosure has not yet arrived. If the pledgee under the previous pledge agreement has not exercised this right, the property that has been foreclosed on claims secured by the subsequent pledge passes to its acquirer as encumbered by the previous pledge.

Thus, a certain priority of the interests and rights of the original mortgagee is established. At the same time, the lack of unified information databases on pledged movable property creates significant risks in the registration of collateral legal relations, which citizens and microfinance organizations now regularly face when concluding collateral agreements in relation to, for example, cars.

Mortgage

Mortgages stand apart when it comes to regulating collateral. And this is not a loan secured by an apartment, as this term has become traditionally understood, but rather a pledge of real estate. Mortgages have become widely known thanks to financing programs for the purchase of residential real estate, which provide for the automatic transfer of such property as collateral to the appropriate credit institution.

Legal relations regarding mortgages are regulated by Federal Law No. 102-FZ of July 16, 1998 “On Mortgage (Pledge of Real Estate),” which establishes many nuances that distinguish a mortgage of real estate from other pledges.

In particular, it provides for a mortgage by force of law (automatic pledge when purchasing real estate using credit funds), state registration of a mortgage (issuance of certificates of registration of ownership of real estate with a note about the encumbrance in the form of a mortgage), the use of a mortgage as a security, and a number others.

At the moment, a mortgage seems to be perhaps one of the most transparent and safe types of collateral.

Pledge of goods in circulation

One of the most interesting types of pledges, which came to us from ancient times, was then known as the “shop pledge.”

A pledge of goods in circulation is recognized as a pledge of goods with their retention by the pledgor and with the provision to the pledgor of the right to change the composition and natural form of the pledged property (inventory, raw materials, materials, semi-finished products, finished products, etc.) provided that their total value is not becomes less than specified in the pledge agreement.

Thus, the pledgor manages to attract borrowed funds by securing the interests of the creditor with the pledge of goods, which the pledgor at the same time has the right to sell and purchase without stopping the work of his enterprise.

The peculiarity of this type of pledge is that it is directly related to the moment of emergence or termination of the pledgee’s ownership of the relevant goods.

Pledge of things in a pawnshop

A previously quite popular type of collateral that many Soviet citizens encountered was the opportunity to receive a certain amount of cash in exchange for a collateral of some value. In the future, the debt could be repaid and the value could be returned.

Otherwise, the pawnshop sold the pledged value. That is, he quite quickly, out of court, foreclosed on the collateral.

Nowadays, the acceptance from citizens of movable property intended for personal consumption as security for short-term loans can also be carried out as a business activity by specialized organizations - pawnshops, whose activities are regulated by Federal Law of July 19, 2007 No. 196-FZ “On Pawnshops” .

Loan agreements and, accordingly, pledge agreements are formalized by the pawnshop issuing a pledge ticket. The pawned items are transferred to the pawnshop.

The pawnshop is obliged to insure in favor of the pledgor at its own expense the things accepted as collateral in the full amount of their valuation, established in accordance with the prices for things of this kind and quality, usually established in trade at the time of their acceptance as collateral.

The pawnshop does not have the right to use and dispose of the pledged items.

In case of failure to repay the loan amount secured by the pledge of things in a pawnshop within the established period, the pawnshop has the right to sell this property after the expiration of a grace period of one month.

As a general rule, foreclosure on pledged property is carried out by pawnshops with a notary's writ of execution, however, an agreement between the pawnshop and the borrower may also provide for the possibility of this operation without such an inscription.

The pawnshop sells the pledged property independently or by organizing a public auction. If the cost of an item exceeds thirty thousand rubles, sale is possible only at public auction.

After this, the pawnshop’s claims against the pledgor (debtor) are repaid, even if the amount received from the sale of the pledged property is insufficient to fully satisfy them.

Types and features of property pledge

The established procedure, features and requirements of the legislation of the Russian Federation provide that existing types of pledge of property can be divided into several categories, depending on additional circumstances and on the agreement concluded between the parties.

Depending on the individual or legal entity who holds the pledged property, the following types and forms of pledge are allowed:

- mortgage - in which the property, after registration, is transferred to the hands of the pledgee - an individual or legal entity;

- pledge without transfer - the property remains with the pledgor, but the fact of the pledge itself is formalized accordingly - by collecting and preparing the necessary documents, which include a certificate, notification, etc., and carrying out the registration procedure.

The main features of a pledge are, first of all, that the right of direct pledge of an individual or legal entity can arise both as a result of the direct transfer of certain property to another individual or legal entity - a possessory pledge, and as a result of the execution of documents in the established form - an agreement on right of pledge – not a possessory pledge.

In this case, the role of mortgagor can be played either by the debtor himself for certain obligations, or by another person who has the appropriate certificate - then this form of pledge between persons will be a pledge for other people’s debts.

Do you need help from a tax lawyer?

Sign up for a consultation with a specialist

+7

Concept and grounds for the emergence of collateral

A pledge is one of the ways to ensure the fulfillment of obligations, the essence of which is that the creditor under the obligation secured by the pledge (pledgee) has the right, in the event of failure of the debtor to fulfill this obligation, to receive satisfaction from the value of the pledged property and preferentially before other creditors of the person who owns this property (mortgagor), with the exceptions established by law (clause 1 of article 334 of the Civil Code).

In modern conditions, collateral occupies a special place among the methods of ensuring the fulfillment of civil obligations and has undoubted advantages. Firstly, a property pledge agreement ensures the availability and safety of this property at the time when the debtor has to pay off the creditor. Moreover, the value of the pledged property will increase in proportion to the level of inflation. Secondly, a pledge of the debtor’s property provides the creditor-pledgee with the opportunity to satisfy his claims at the expense of the pledged property, preferentially before other creditors. Thirdly, the real danger of losing property in kind (and the subject of pledge is, as a rule, especially valuable, so-called quick-liquid property) is a good incentive for the debtor to fulfill his obligations properly.

Despite all its advantages, collateral has not yet become widespread in business relations. This is explained primarily by the absence of a system of unified state registration of property rights and transactions with real estate, which, as a subject of collateral (mortgage), is the most attractive for lenders. As a result, it often happens that the same property is pledged more than once. Moreover, each subsequent creditor-mortgagor has no idea that his obligation is secured by the pledge of property already encumbered by previously concluded agreements.

According to modern Russian civil legislation, the right of pledge is a right of obligation. The current Civil Code has allocated the pledge to a separate legal institution and recognized for it the meaning of a security obligation (Chapter 23 “Securing the fulfillment of obligations”).

There are two ways for a pledged legal relationship to arise - by virtue of an agreement and on the basis of the law upon the occurrence of the circumstances specified in it, that is, if the law stipulates what property and to secure what obligation is recognized as property that is pledged.

The right of pledge, as a general rule, arises from the moment of conclusion of the agreement, if the subject of the agreement is not subject to transfer to the pledgee. In relation to the pledge of property that is subject to transfer to the pledgee, the right of pledge arises from the moment of transfer of this property to the pledgee. But the moment when the right of pledge arises also depends on the terms of the contract.

The pledge agreement can be independent, i.e. separate from the agreement under which the obligation secured by the pledge arises, but the pledge clause may also be included in the main agreement.

The essential terms of the pledge agreement are the subject of the pledge and its valuation, the essence, size and period of fulfillment of the obligation secured by the pledge, as well as the condition regarding which of the parties, the pledgor or the pledgee, has the pledged property. If the parties do not reach an agreement on at least one of these conditions or the corresponding condition is absent in the agreement, the pledge agreement cannot be considered concluded.

The pledge agreement must be concluded in writing. A mortgage agreement, as well as an agreement on the pledge of movable property or the right to property to secure an obligation under an agreement, which must be notarized, is subject to notarization (clause 2 of Article 339 of the Civil Code). In some cases, the pledge agreement must be registered in accordance with the established procedure.

Failure to comply with the notarial form of the agreement, as well as the rules for registration, entails the invalidity of the pledge agreement (clause 4 of Article 339 of the Civil Code).

Only a valid claim can be secured by collateral. If there is no primary obligation, then the creditor does not have the right to priority satisfaction of his claims at the expense of the pledged property. This rule follows from the fact that the pledge agreement does not have an independent character, since it only ensures the fulfillment of another, main obligation. If the main obligation is terminated for any reason, then the collateral obligation also terminates. At the same time, while maintaining the validity of the main obligation, the pledge remains valid in cases where the right of ownership or economic management is no longer valid. the pledged item passes to a third party, as well as when the pledgee legally assigns the claim secured by the pledge to a third party or when the pledgor transfers the debt arising from the obligation secured by the pledge to another person.

Current legislation allows re-pledge (subsequent pledge) of already pledged property. The introduction of the re-pledge rule is due to the fact that the value of the pledged property may significantly exceed the amount of debt under the obligation already secured by the pledge.

If the original pledgee objects to the pledgor's exercise of the right to re-pledge, he has the right to stipulate in the pledge agreement that subsequent pledges in respect of the pledged property are not permitted.

Agreement on pledge of property

A pledge of property, as a fact and form of direct legal action, must be formalized in accordance with the requirements, a list of which is specified in the Civil Code of the Russian Federation.

The property pledge agreement is the most important document for the further emergence of the right of pledge between the parties.

It also establishes the grounds, features, requirements, notification procedure and enforcement of obligations between individuals - participants in these legal relations.

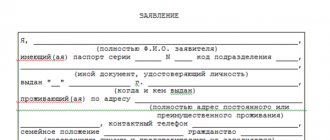

The form of this legal document must be in writing. The requirements established by the civil legislation of the Russian Federation stipulate that the following information must be included in the contract:

- the direct subject of the pledge - a list and types of property that is included in the pledge, information about this property, as well as its value and registration;

- the essence, form and grounds for the occurrence of a pledge obligation, as well as the period within which it must be fulfilled;

- information and notification about who exactly will have the property that is the subject of the pledge;

- other information, grounds, requirements, conditions and notices that may be important when registering these legal relations, for example, the period within which the sale of the pledged property must be carried out, its types, form, necessary documents, etc.

Article 334. Concept of pledge

Article 334. Concept of pledge

[Civil Code] [Civil Code of the Russian Federation, Part 1] [Section III] [Subsection 1] [Chapter 23] [§ 3] [Subparagraph 1]

. By virtue of the pledge, the creditor under the obligation secured by the pledge (pledgee) has the right, in the event of non-fulfillment or improper performance by the debtor of this obligation, to receive satisfaction from the value of the pledged property (the subject of the pledge) preferentially before other creditors of the person who owns the pledged property (the pledgor).

In cases and in the manner provided by law, the pledgee's demand may be satisfied by transferring the pledged item to the pledgee (retaining it with the pledgee).

. The pledgee has the right, in preference to other creditors of the pledgor, to obtain satisfaction of the claim secured by the pledge also at the expense of:

- insurance compensation for loss or damage to the pledged property, regardless of whose benefit it is insured, unless the loss or damage did not occur for reasons for which the pledgee is responsible;

- compensation due to the pledgor provided in exchange for the pledged property, in particular if the pledgor's ownership of the property that is the subject of the pledge is terminated on the grounds and in the manner established by law, due to seizure (redemption) for state or municipal needs, requisition or nationalization, as well as in other cases provided by law;

- income due to the pledgor or pledgee from the use of the pledged property by third parties;

- property due to the pledgor upon the fulfillment by a third party of an obligation, the right to demand the fulfillment of which is the subject of the pledge.

In the cases specified in paragraphs two through five of this paragraph, the pledgee has the right to demand the amount of money or other property due to him directly from the obligated person, unless otherwise provided by law or agreement.

. Unless otherwise provided by law or contract, if the amount received as a result of foreclosure on the pledged property is insufficient to repay the claim, the pledgee has the right to satisfy his claim in the outstanding part at the expense of the debtor’s other property, without taking advantage of the advantage based on the pledge.

If the amount received as a result of foreclosure on the pledged property exceeds the amount of the pledgee's claim secured by the pledge, the difference is returned to the pledgor. The agreement on the mortgagor’s renunciation of the right to receive the specified difference is void.

. The general provisions on pledge apply to certain types of pledge (Articles 357 - 358.17), unless otherwise provided by the rules of this Code on these types of pledge.

The rules of this Code on real rights are applied to the pledge of real estate (mortgage), and to the extent not regulated by these rules and the law on mortgage, the general provisions on pledge.

. Unless otherwise follows from the essence of the pledge relationship, a creditor or other authorized person in whose interests a ban on the disposal of property was imposed (Article 174.1) has the rights and obligations of the pledge holder in relation to this property from the moment the court decision by which the claims of such creditor enter into force or another authorized person were satisfied. The order of satisfaction of these requirements is determined in accordance with the provisions of Article 342.1 of this Code according to the date on which the corresponding prohibition is considered to have arisen.

Ways to ensure the safety of pledged property

A contract of pledge of movable property or real estate between individuals or legal entities entails not only the registration and acquisition of certain rights, but also the emergence of certain obligations, in particular ensuring the safety of all material assets that have become the subject of pledge and mandatory notification of any changes .

A pledge agreement for movable property must necessarily contain information about where the property will be located during the period until the document expires.

At the same time, ensuring the safety of the pledged property will be the responsibility of the individual or legal entity who has this property in storage, and information about which is contained in the corresponding document - an agreement between persons that has undergone the registration procedure.

The pledge of movable property requires the implementation by individuals or legal entities of the following security measures:

- registration of insurance of the pledged property in the amount of its full value within the prescribed period and notification of this fact;

- implementation of the protection of property from attacks on it by third parties, as well as a list of other actions, the types and form of which are aimed at protecting these material assets;

- urgent notification of a legal or natural person - a participant in these legal relations, about the emergence of a threat of loss or damage to property included in the collateral list. The form, requirements, grounds, as well as the permissible period within which this notification must be sent to the second party are established by the provisions of the Civil Code of the Russian Federation;

- provide the other party with all the necessary documents containing information about the pledged property and its registration within the prescribed period.

Foreclosure of pledged property

Imposing a penalty on the property of an individual or legal entity is a fairly serious legal procedure that can only be executed by one authorized person - a bailiff.

The form and implementation of this procedure presuppose mandatory grounds that must be present, as well as special requirements and deadlines. This procedure must have two main grounds - a valid court decision and the absence of any legal obstacles to its implementation.

Execution of this procedure will be possible only if the fact that the debtor lacks funds and other property to cover his debt obligations is confirmed by a set of relevant documents.

This list of documents should also include early notifications of the existence of a debt, which confirm that the legal procedure has been followed and there are legal grounds for the implementation of this procedure.

Before proceeding with the imposition of a penalty, the bailiff must make an inventory of the property of an individual or legal entity - the debtor. Information about property is entered in the presence of third parties, who must assist the debtor in fulfilling his obligations within the prescribed period.

Cases of foreclosure on collateral

Property that is the subject of a pledge between certain persons can also serve as the subject of foreclosure, if this need is present. The implementation of this procedure for foreclosure can only be carried out after an appropriate court decision.

When imposing a foreclosure and subsequent sale of existing property, all interested parties, including the mortgagee and the pledgor, between whom the corresponding agreement was concluded, must take actions to obtain maximum proceeds from the sale of material assets.

A notice of foreclosure must be sent to all persons who took part in this transaction and registration of the agreement between the participants.

Foreclosure of the collateral requires a mandatory court decision in certain cases:

- if the subject of the pledge is the only residential premises owned by the debtor on the basis of ownership and registration;

- if the collateral between persons is property of high cultural or historical value;

- if this property is already encumbered with other pledges and obligations between the pledgee and the pledgor, the removal or change of which is possible only by court decision, etc.