Currency mortgage holders are as shameful a page in the history of the Russian real estate market as defrauded equity holders. In the mid-2000s, rates on foreign currency loans were noticeably lower than those in rubles, and the banks themselves were more willing to issue housing loans to Russians in dollars and francs. With the fall in the ruble exchange rate, these borrowers fell into debt bondage. They did everything they could to attract attention: they spent the night under the door of the Minister of Finance, blocked the streets, handcuffed themselves in the offices of creditor banks, dressed in prison clothes and threatened suicide. But the activism of foreign currency mortgage holders has not solved the problem: thousands of Russians are still paying off unaffordable loans. One of these borrowers, Daria, told her story to a Lenta.ru correspondent (the name has been changed at the request of the heroine - note from Lenta.ru

), which has been paying foreign currency mortgages since 2006.

It all started at the end of 2006. I was 29, I worked in the PR department of one of the development companies - by the way, it has long ceased to exist. I received a good salary, traveled a lot on business trips and lived in my parents’ apartment - they have a spacious “Stalinist” three-room apartment in the Oktyabrsky Pole area. I started thinking about my own apartment when my parents and I received an inheritance from our grandfather - a one-room apartment in the same area. She and my grandmother divorced and separated in the late 1990s, now they are both gone, and my grandmother’s apartment went to my older brother, they live there with their wife and child.

Photo: Asya Dobrovolskaya / TASS

I don’t remember now what my parents spent their part of the inheritance on, but I finally decided to buy my own home. Of course, the amount would not be enough for a separate apartment, even for a new building in the suburbs, and if so, I decided not to waste money on small things and look for housing closer to my area. You still have to take out a mortgage. To be honest, I didn’t know how to save, either then or now, so I relied only on the money I inherited, and on a loan. I chose a one-room apartment in a brick house on Skhodnenskaya; at that time it cost a little less than 200 thousand dollars - then prices were set in foreign currency - and I had about half of this amount in my hands.

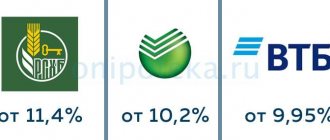

I made good money - but there was a nuance: most of the money was given in an envelope, and the “white” part was about 12 thousand rubles. Less than $500 even at that time. As a result, I visited several banks - none of them were ready to give a mortgage in rubles. And in dollars they gave it for 20 years. Nowadays there is a lot of talk that foreign currency mortgage holders are people without brains, that they should have thought that a loan should always be taken in the currency of income... They say a lot.

Related materials

00:22 — January 29, 2016

“They betrayed the ruble. The ruble betrayed them"

Reaction of social networks to the protests of currency mortgage holders

But where were all these “mother’s experts” in 2006, when every iron was advertising mortgages in francs, yens and what the hell? I worked with journalists in the real estate industry, I was aware of the agenda, so to speak - there were too many smart columns and expert comments about the benefits of foreign currency mortgages that were published in the media at that time. The currency of my income, and that of many of my friends, was dollars in an envelope. In general, before smartly judging those who took out a loan in foreign currency, study what is called the materiel.

The next year and a half was spent on renovations - I lived in a concrete box, slept on a folding bed and ate almost from a box lined with newspaper, and spent all my earnings on a loan, building materials, workers and furniture. And by 2008, I was the happy owner of a brand new apartment, the best employee of the department and a foreign currency mortgage holder with exemplary credit behavior.

At the beginning of the year, I received job offers from two companies, I took a long time to decide, and as a result I was able to agree with both - to work for them without registration and with a flexible schedule. So I became a “servant of two masters”: each of the companies was sure that I worked only with them. I slept about four hours a day, but I had more money, I bought a car and even managed to go on vacation.

Photo: Vasily Kuzmichenok / TASS

Before the start of the 2008 crisis, I had no doubt at all that I was doing everything right. And in November-December, in fact, there were no real problems: everyone in the industry became nervous, layoffs began, but both of my employers paid regularly. Until the new year, 2009, in January both cut their salaries (it was a short month, low season), and in February, one after the other, they refused to cooperate. Somehow, by April, I got a job in a company with my friends - they also fired their PR person, but then they decided to hire a new one (at half the salary).

Forecasts

Some deputies propose to completely prohibit financial institutions from issuing loans in foreign currency. However, such bills are clearly non-market in nature and are unlikely to be adopted. There is only a recommendation from the Central Bank not to issue such loans, but banks decide for themselves whether to listen to it or not.

Financiers predict further strengthening of the Russian currency, which should reduce the size of monthly payments to banks in ruble equivalent. Experts also expect a significant increase in bankruptcy procedures among individuals, including those who have taken out foreign currency mortgages. This opportunity became available to citizens in October 2015. After a debtor is declared bankrupt, it will no longer be the bank that will restructure his loan, but the court.

Foreign currency mortgages remain a very risky solution to the housing issue, and the overwhelming number of experts do not recommend that Russians get involved in this unreliable business today.

Related materials

17:03 — June 29, 2018

"These are the real slave owners"

Thousands of Russians became hostages of banks.

Some manage to escape. By that time I was already in serious arrears: if in January 2009 I still found money for payment, then in February-March there was simply no money. This was a serious test of my nerves: first the phone was cut off by employees of the bank’s collection department, then either collectors or “security guards” were involved - threats were made, they left messages on my front door, they cut the upholstery, some people were sitting under the door. As soon as I found a job, I sold the car for almost nothing and paid off my debts. Why didn't you do this right away? The shock probably took its toll - after the layoffs, I probably didn’t leave the house for a month, I didn’t let my friends and parents in. I lost about 15 kilograms, probably. This, by the way, is the only advantage of the situation at that time - if you set out to find them after all. Before that, I suffered from excess weight for years and was always on diets.

Then, for about six months, I lived from hand to mouth - I quickly ate up the remaining money from the sale of the car, and my earnings were barely enough for the monthly payment, which then increased by almost a third with the rise in the dollar. And they paid in rubles. Gradually I found part-time work, but it was still something like churning milk into butter so as not to drown.

The year became normal by 2012. I got a job at a PR agency, and at the same time I worked part-time wherever I could. To be honest, each of the employers did not pay very much, but in general the earnings were decent, definitely more than one hundred thousand a month - I received about two-thirds of this money at my main job, the rest was earned through “hack work.” I paid a little over 30 thousand for the mortgage, about 15 more went on a car loan (I paid it off in three years, and I’m still happy that I managed to do it), and I spent the rest on myself. It was possible to live. Plus, a couple of times a year some large sums “fall”—either they’ll give me a bonus, or I’ll organize some kind of event by taking a vacation from my main job.

Photo: Alexander Kryazhev / Kommersant

Now they will ask me again why I didn’t restructure the mortgage then. I didn’t think about it at all - I had a clear feeling that the worst was over, now everything would be fine. This was somehow felt in business, in the mood of management, colleagues, contractors, and in general there was some kind of positive mood in the city. In addition, I was so tired of counting every penny and literally making ends meet (in 2009 and early 2010, I took all my gold to a pawnshop, regularly borrowed money from my retired mother, wore only darned tights for a year and that’s all in that spirit), which just “let go” here. Moreover, in our contracting company, one colleague in 2011 still took out a mortgage loan in dollars. I then briefly, without details, spoke about my experience, but he was full of optimism. They say it won't happen again. Such were the moods. I relaxed, lived more or less for my own pleasure, got a dog - picked it up on the street and went out.

Related materials

08:19 — September 5, 2016

“Sometimes I drive past my former house and look at the windows.”

The story of a mortgagee who lost both her apartment and her husband in 2014.

I don’t even want to talk about the end of 2014 (on December 16, 2014, “Black Tuesday” occurred: the exchange rate of the ruble against the dollar fell sharply and at peak moments reached 80 rubles per dollar - approx. "Lenty.ru"

). I looked and didn’t believe my eyes, and my head was spinning: “...” [this is the end]. This was the first reaction, then I immediately sat down to draw up a practical plan. Actually, his main point was to keep his job. It is clear that not everything in this world depends on our desire, but it seems to me that we simply did not have a more proactive employee in our office at the beginning of 2015. Just like in the film about Shurik, I was ready for both a sand pit and street cleaning. In fact, stress greatly stimulates creativity; we then ran an excellent campaign, received a client from a completely new field for us, and won a complex tender. But old clients, as usual in a crisis, left - in the end, there was still just enough money. Part-time jobs came to naught, and only 15 thousand remained from my salary after paying off the loan.

But that’s not even the main thing. In mid-2014, I started a holiday romance, rather slow-burning, in Southern Europe. I went there for the weekend and saw each other from time to time. I was fine with that. The last time we saw each other was in November 2014, and in January I realized that I was pregnant. I decided to leave the child, so throughout that crisis winter I thought about how he would feel. This is a different responsibility: I realized that I can’t afford to run away from debt collectors, or sell my car again, or eat fast food. I never made a single loan default, and, despite my pride, I accepted help from everyone who was ready to help: a friend gave me clothes for a baby, my mother brought groceries from retirement... I was aware of all the discounts and promotions in supermarkets .

Photo: Sergey Bobylev / TASS

But what was to be done next? It is clear that in any case I had to go “from the office” to give birth - receiving a salary was important until the last minute. And then? Stay at home with your child, doing odd jobs? But how to pay the mortgage then? Selling the apartment - maybe I would do that if I could close the loan and leave some money for at least six months of a modest life. But in fact, it turned out that not only would I not keep anything for myself, but on the contrary, I would also still owe the bank.

Everything was resolved - here I must say a huge thank you to the company where I still work. I just came to the general - there was nothing to lose - and asked what options were in my situation. He looked at me (my belly was not yet visible), asked when I was giving birth, and calmly said - well, great, you can rest there as long as you need, and then work from home.

As a result, I went “remotely” two weeks before the birth, but I worked until the last minute - even from the maternity ward I sent some comments to the press from my phone and read the general’s interview. This made the process somehow easier to bear. And I “returned” to work in two weeks.

Government measures to help foreign currency mortgage borrowers

About 3 years ago, an anti-crisis commission was created to solve the problems of foreign currency borrowers, headed by First Deputy Prime Minister Igor Ivanovich Shuvalov. The Anti-Crisis Commission discussed pressing problems related to foreign currency mortgages. As a result of the discussions, a general recommendation was given to commercial banks in the country with large foreign exchange portfolios to introduce a system of monthly reporting on the status of these portfolios.

To support borrowers who have real financial difficulties in repaying the loan, the state allocated 4.5 billion rubles of targeted funds. However, these funds were used to help borrowers of not only foreign currency, but also ruble mortgages.

Currently, banks provide an informative report to the government on the number of loans restructured. This significantly helps the authorities to quickly respond to changes in the situation with the foreign currency mortgage market.

General Director of the Agency for Housing Mortgage Lending, Alexander Nikolaevich Semenyaka, states that “More improved mechanisms for assisting foreign currency borrowers will soon be developed.” To create these mechanisms, it will be necessary, first of all, to determine the primary and secondary criteria for providing this assistance.

On April 20, 2015, the Resolution on Mortgage Restructuring No. 373, approved and signed by D.A., came into force. Medvedev. The main entity under whose control this project was to be implemented was the Agency for Housing Mortgage Lending (AHML).

Initially, the project was urgent, but over time, assessing the current situation in the country, the project was extended. Thus, in July 2021, the state allocated an additional 2 billion rubles to support problem borrowers.

A month later, Resolution No. 961 was issued, which fully regulated the new conditions for participation in the borrower assistance program.

In 2021, the Legislative Assembly of St. Petersburg introduced a bill on amendments and additions to certain legislative acts of the Russian Federation. This Draft Law proposed to establish a ban on the conclusion by individuals of loan agreements in foreign currency not for the purpose of carrying out entrepreneurial activities. However, financial experts under the President of the Russian Federation clearly rejected the idea of banning foreign currency mortgages, based on the fact that this action would be contrary to the laws. The Council for the Codification and Improvement of Civil Legislation shared the opinion with the country's main experts and proposed restructuring loans under the Bankruptcy Law.