The concepts of renunciation of inheritance in favor of other persons and renunciation of part of the inheritance

Acceptance of property is not an obligation under the law, so citizens can formalize a refusal of inheritance in favor of other persons, for example, children or a married couple. A sample waiver can be viewed on the Internet. The notary will also provide a sample application. The sample is not difficult to fill out: all you need is care and literacy in writing. Sample - refusal of inheritance is written concisely on A4 paper. Its content is divided into types:

- complete failure;

- in favor of other persons.

Refusal procedure:

- the sample is drawn up no later than 6 months after the opening of the inheritance;

- the refusal is real only in favor of persons from the circle of heirs. Refusal in relation to unauthorized persons, as well as in favor of heirs recognized as unworthy, is prohibited;

- It is prohibited to renounce certain parts of the inherited mass of property. This type includes property inherited by will, if the entire estate is bequeathed to heirs appointed by the testator. If an heir is assigned to an heir, the obligatory share cannot be waived;

- a person recognized as having limited legal capacity or not responsible for his actions cannot write a statement. The notary controls the person’s condition when writing the application.

The difference between refusal and non-acceptance of inheritance

You can renounce the inheritance in favor of another applicant to whom the person wishes to transfer his share, or make an unconditional refusal - in this case, his share is divided among other successors. Such will of the person submitting the refusal must be stated in the application.

An heir cannot always transfer his own share to another successor.

It will not be possible to refuse in favor of unworthy heirs who are deprived of the opportunity to accept the inheritance by the will of the testator or in accordance with a court decision.

After opening an inheritance, the law gives the heirs 6 months to accept the inheritance or refuse it. Not accepting an inheritance for a person means that he does not have any rights to the property. If the reasons why this happened are valid, you can begin to restore the deadline for accepting the inheritance.

Refusal of inheritance is a one-sided transaction. It may be declared invalid or may be carried out in favor of a certain person or persons. A renunciation of an inheritance cannot be taken back, nor can it be changed. Moreover, such a procedure is permissible even after the acceptance of the inheritance, but before the expiration of the period provided for the exercise of such a right. Or by a court decision when filing a claim and the court recognizes that the reasons for missing the deadline are valid (only the actual acceptance of the property).

Refusal of inheritance in favor of another heir

Based on the fact that accepting property (debts) from the testator is a citizen’s right, but not an obligation, he can refuse in favor of other persons: heirs in line or those specified in the will. To write a refusal, a citizen must submit an application to a notary, bringing with him an identity card. In addition, originals of papers that are evidence of a blood connection with the testator.

This is necessary if the refusal is formalized by a lawyer handling the inheritance case. If the refusal is written by another specialist, then the original and photocopy of the testator’s death certificate are added to the papers.

In the text of the application, the heir can indicate the list and value of things (property).

A citizen has the right to make a refusal in favor of other entities claiming the inheritance, in the mode of transmission or upon presentation. You cannot write a statement in the direction of unworthy heirs. And also to renounce part of the inheritance. The law prohibits doing this.

The application for refusal must be submitted in person, by post or through an authorized representative. In terms of timing - you must try to submit an application within 6 months: after that it will not be possible to do this. In the case of a proxy, a document is required to authorize the right to act on behalf of another person. The application is certified by a notary.

It is possible to renounce the inheritance even if you have entered into inheritance rights. But this issue is resolved through the court, which will consider the circumstances of the case. He does not always make a decision in favor of the heir. In addition, there is another option: do not take actions aimed at accepting the inheritance for 6 months.

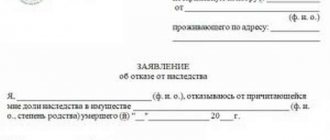

Application form

The application does not have a mandatory form, but must contain the following information:

- In the upper right part of the sheet - the full name of the notary and the address of the notary's office, the full name and contact information of the heir, the authorized representative.

- Indication of the date of death of the testator with reference to the death certificate; information on the basis of which a person claimed property (by law or will); an expression of reluctance to accept an inheritance.

- List of documents offered for the application. As a rule, this is a copy of the death certificate, proof of relationship, power of attorney (if necessary).

- Date and signature.

During the process of distributing the property of the deceased, the heir may wish to transfer his share in favor of another on his own initiative or agreement.

A waiver in favor of other persons is drawn up taking into account a number of rules. An heir who does not want to inherit property chooses the person to whom his share will be transferred. The choice is made only from the circle of heirs by law, will, inheritors by transmission or by right of representation. You cannot transfer your share to relatives or other applicants who have been found unworthy in court. It is also impossible to transfer a testamentary refusal, since this type of obligation is of a personal nature of the relationship with the deceased.

Refusal of inheritance in favor of others

In this case, a statement is written at the notary's office. It indicates the citizen in whose favor the refusal is taking place. For example, it could be someone from a married couple: one spouse refuses in favor of the other. The heir can renounce the inheritance in favor of other persons, not only the married couple.

It should be understood that the refusal does not have retroactive effect. You cannot, having changed your mind, take away the inheritance from the person in whose favor the refusal was made. For example, in favor of one of a married couple. Disabled persons and citizens under 18 years of age can refuse inheritance with the consent of the authorized bodies. This is guardianship.

Sample application for waiver of claims to property during divorce

In the event of a divorce, a receipt for the waiver of claims to property will also have no legal force, like the previous document.

The paper can be compiled in any form.

The main thing is that the spouses file a divorce in accordance with all the rules and requirements of the law, and then divide the property.

There are several options for the development of events in this situation:

- The spouses file for divorce through the court - and in the same court they divide the property. Since, according to the law, the common property is divided equally, the court cannot award another. The parties can draw up a settlement agreement, but in court, in which one of the spouses will renounce the property.

- The spouses file for divorce by mutual consent through the registry office, and then go to the notary. A lawyer can draw up an agreement according to which one of the spouses will renounce his or her part of the property in favor of the other. The document must be certified by a notary!

A receipt can be written, but in the second case, when the parties go to a notary.

In the case of legal proceedings, the receipt will not help and will not affect anything.

Refusal of inheritance in favor of the state

The law does not contain a special provision that would disclose the procedure for renouncing inheritance in favor of the state, as well as other public entities. This means that a rule applies to the state: it is possible to renounce in its favor if they are called upon to inherit by will.

The limitation to one will is due to the fact that they are not included in the legal heirs.

The Russian Federation has the right to escheat property. It is impossible to refuse it. According to Art. 1151 of the Civil Code of the Russian Federation, escheated property is things that do not have heirs, or the heirs have been removed from their rights, have refused the inheritance without indicating the circle of persons to whom the property is transferred.

Refusal of inheritance with reservations

Refusal of inheritance with reservations or under conditions is not allowed. Reservations and conditions can become an obstacle to the management of inherited property.

In addition, unnecessary interference would be created in activities aimed at taking measures to protect property and fulfilling testamentary orders after the expiration of the period for accepting or refusing an inheritance.

Additionally, conditions and clauses may create obstacles to the participation in legal relations of persons whose right to become heirs arises as a result of non-acceptance or refusal of an inheritance.

Sample waiver of claims for real estate, apartment

A receipt, or waiver of property claims, is not a legally significant document. This paper can be issued at the request of any citizen, but it will not affect anything in the authorities.

You can draw up a sample waiver of claims yourself - no matter what form the document takes. In it, you can indicate that you are waiving your rights to some real estate, including an apartment, but this refusal will not have legal force.

Receipts of this kind are an ordinary piece of paper that will not solve anything - even if the Russian goes to court with such a refusal.

You can issue a receipt using the standard template attached above, in the first subheading.

Waiver of the obligatory share in the inheritance

Refusal of inheritance is not possible if a minor child is in care and is entitled to a mandatory share. As a general rule, the person who has custody of the child cannot waive the obligatory share. However, waiving the obligatory share is not so simple. An unconditional waiver of an obligatory share in the inheritance is possible on the grounds of Art. 1157. Civil Code of the Russian Federation. A number of experts apply a different interpretation of the norm, which leads to infringement of the rights of the compulsory heir. It turns out that they accept the inheritance, regardless of their wishes.

Judicial practice suggests that courts, when considering controversial legal relations concerning the invalidation of refusals of a share in an inheritance (mandatory) for various reasons, assessed the validity and legality of these grounds (reasons).

The possibility of waiving an obligatory share in the inheritance is not questioned by the courts. Thus, due to the ambiguous interpretation of the law, if a notary refuses to certify the waiver of an obligatory share of the inheritance, it can be appealed through judicial proceedings. Thus, refusal of the obligatory share in the inheritance is permitted. A sample waiver of an obligatory share in an inheritance can be viewed on the Internet.

Refusal of part of the inheritance

The law does not allow writing a waiver of part of the property. This is a rule from which there is an exception in accordance with Art. 1158, clause 3 of the Civil Code of the Russian Federation. The article says that if a citizen inherits on several grounds in a simultaneous manner, for example, by will or by law in the transmission mode, he has the right to write a waiver of the property transferred to him on one of the grounds, for some of them.

The procedure for entering into inheritance is established by the Civil Code of the Russian Federation. The law clearly states that heirs can decide within six months in favor of whom to renounce the inheritance if they so desire. As for the refusal of inheritance after the expiration of this period, the refusal is not recorded if the person has not declared his rights during this time. Another question is if the rights have been declared, and there is a legal fact of entry into inheritance rights.

Once a citizen has acquired inheritance rights, he can no longer refuse them.

It happens that a citizen who has actually entered into inheritance rights cannot legitimize them due to certain reasons.

In this case, there is no need to do anything, since the law gives a period of 75 years for registration of rights to acquired property. In this mode, the heir uses the property, but is limited in its disposal. For example, he lives in an apartment, but cannot sell it. If refusal of inheritance after 6 months is a fundamental issue for a citizen, he needs to address this issue to the court.