Utility tariffs

The amount of payment for utilities is determined in accordance with the volume of actual consumption in proportion to the readings of metering devices.

Provided that such devices are not available in a residential apartment, this means that during the calculation the consumption standards preset in Article No. 157 of the Housing Code of the Russian Federation are applied.

What services are included in the tariff?

The user undertakes to pay for the following housing and communal services:

| For the supply of electricity | throughout the entire operational period |

| Delivery services | cold water to the apartment |

| Heating | in the winter season |

At the legislative level, special tariffs have been adopted that are payable for utility services provided to residents.

Tariffs were adopted based on the instructions of the decision of the Federal Tariff Service No. 228-e/4, dated 10/11/2019.

The document specifies the adoption of boundary indices of the maximum permissible change that apply in the field of wastewater disposal and water supply.

The standards of the second resolution predetermine the maximum marginal prices for thermal energy supplied by heat supply structures.

It is noteworthy that all tariffs have an average value for individual constituent entities of the Russian Federation. In particular, the tariff for thermal energy to pay for housing and communal services for heating from 07/01/2019 is 1,621.95 rubles/gcal.

Whereas the cost of 1 kWh is equal to 4.12 rubles.

Quadrature standards

According to the law, there is a standard living space per person. It is 12 square meters. This provision is enshrined in Art. No. 38 Housing Code of the Russian Federation.

The specified standard corresponds to the average value, so in some regions it is permissible to adjust it down or up.

The living space standard directly affects the amount of money that must be transferred for housing and communal services received.

The legislator established that the minimum allowable sanitary living space per citizen can be 6 square meters.

Whereas for a family consisting of 3 persons - 18 sq. m., if the minimum is 16 sq. m.

Provided that the family consists of 2 persons, residents have the right to expect to receive residential premises with an area of 42 sq. m. Moreover, the social norm for one tenant is 33 sq. m.

How can excess living space affect the final rent?

According to the standards of Art. No. 157 of the Housing Code of the Russian Federation, the amount of payment that is transferred by residents for the provided housing and communal services is determined in accordance with the tariff in force in a specific region of the country.

This tariff is established by the executive government structure of the constituent entities of the Federation, local government bodies, if by law they have such powers.

It is important that every residential building or apartment has a flow meter to accurately determine the cost of services.

What categories of people do not pay extra for extra square meters of living space?

Standards Art. No. 159 of the Housing Code of the Russian Federation establishes the legal rights of citizens to receive government subsidies for utility bills.

A subsidy can be provided if the cost of paying for housing and communal services significantly exceeds the maximum possible portion of the cost of the family's needs.

In accordance with current standards, it cannot account for more than 22% of the total family income, this moment is fixed in a government decree.

Provided that the average per capita family income is below the current level of the subsistence minimum, this means that the maximum amount of costs for housing and communal services is determined taking into account a special adjustment factor.

Low-income categories of the population

In accordance with current legislation, citizens who have the right to receive government benefits have the right to pay no more than 50% of the total cost of utilities.

All regions of the country have their own rules for providing benefits.

According to government regulations, the following categories of persons are entitled to benefits:

- Elderly citizens, if they are cared for by a social worker.

- Children with disabilities, orphans.

- Citizens with disabilities.

- Pensioners.

In addition, state benefits can be provided to low-income, large families if their average per capita income per family member is less than the subsistence minimum accepted in the region.

Such citizens are required to systematically confirm their average per capita income using appropriate documentation.

Socially established standard

This is the minimum permissible amount of consumption that ensures normal life support.

The social norm is provided for different types of services. In particular, there is a standard for electricity supply, the main goal of which is to stimulate energy savings.

Each region of the country has its own standard, which depends on the type of building and climatic conditions.

In particular, for the Vladimir region the consumption norm per resident is 50 kWh, while in the Krasnoyarsk Territory the social norm is 75 kWh. At the same time, the excess for the mentioned regions may be 25%, 10%, respectively.

Provided that residents consume in excess of the norm, they must pay for the excess at higher rates.

To calculate the amount of payment for housing and communal services for citizens living in unsafe, old buildings, it is necessary to use special increasing coefficients in addition to the base rate of the social standard.

This measure is applicable if it is not possible to install metering devices in such residential premises.

Read the rent for an apartment where no one is registered here.

Is there a benefit for excess space?

Benefits for excess space are established only for certain categories of citizens, which include the following persons:

- pensioners;

- disabled people;

- military pensioners;

- minor orphans;

- citizens living in an apartment under a social tenancy agreement;

- persons living alone in a communal apartment;

- citizens who live in emergency housing.

Additional preferences for paying utility bills above the housing standard are introduced by regional authorities. As practice shows, there are no regions in Russia where such benefits are provided.

List of required documents

In order to apply for a housing state subsidy to pay for housing and communal services, you must first submit an appropriate application to the social protection structure of citizens.

The document contains personal, contact, passport details, bank account number, as well as registration address.

The plaintiff undertakes to indicate in the application information about family members, incl. metric, passport information.

It is permissible to take the claim form from the SZN structure at your place of residence.

In addition, the application is accompanied by:

| Official statement from personal account | what is required to pay for housing and communal services, certifying the absence of arrears in payments |

| Official documents certifying the rights of the plaintiff or his family members | to apply for subsidies, receive benefits, and other social assistance measures. For example, a certificate confirming the status of a large family |

| Passport of the applicant, as well as all family members | or a birth certificate for each child |

| Certificate of income for each family member | for the past 6 months, for example, tax return 3-personal income tax. It is important that such a document is provided by all able-bodied family members |

| Certificate confirming family composition | (form No. 9) |

| Title documentation for living space | in particular, an extract from the Unified State Register of Real Estate, a sales contract or a certificate of ownership |

| Official document | certifying the relationship of citizens who live together with the plaintiff |

Citizens of other countries who permanently reside in the Russian Federation are required to provide documentation to obtain a housing subsidy.

The standard is valid if there is an international agreement between the Russian Federation and the state from which the foreign citizen arrived.

What difficulties may arise

In the payment slip for payment of housing and communal services for a municipal-type apartment there is such a line as payment for rent of living space.

The law presets the deadline for transferring payments for utility bills, according to which Russians are required to pay them before the 10th day of each month.

In this case, the payment is realized on the basis of payment documentation - receipts issued by the Housing Office.

Such payments are sent to residents no later than the 1st day of the current month. Still, the deadlines can be adjusted in accordance with the terms of the agreement signed with the housing and communal services management office. This standard is specified in Art. No. 153 of the Russian residential complex.

The housing maintenance organization bears full legal responsibility for the provision of housing services of inadequate quality.

In particular, she undertakes to recalculate the payment, taking into account the mistakes made.

What area is used when calculating the amount of payment for housing and communal services?

In accordance with paragraph 2 of Article 154 of the Housing Code of the Russian Federation (hereinafter referred to as the Code), payment for residential premises and utilities for the owner of premises in an apartment building includes:

1) payment for the maintenance of residential premises, including fees for services, work on managing an apartment building, for the maintenance and routine repairs of common property in an apartment building, for utility resources consumed during the use and maintenance of common property in an apartment building;

2) contribution for major repairs;

3) payment for utilities.

According to Article 158 of the Code, the owner of premises in an apartment building is obliged to bear the costs of maintaining the premises belonging to him, as well as to participate in the costs of maintaining common property in an apartment building in proportion to his share in the right of common ownership of this property by paying fees for the maintenance of residential premises, contributions to major renovation.

Paragraph 1 of Article 37 of the Code establishes that the share in the right of common ownership of common property in an apartment building of the owner of the premises in this building is proportional to the size of the total area of the specified premises .

In addition, the calculation of the amount of payment for heating provided in a residential premises and utilities provided for general house needs is made in accordance with the occupied total area of the premises .

In accordance with Article 15 of the Code, the total area of a residential premises consists of the sum of the area of all parts of such premises, including the area of auxiliary premises intended to satisfy citizens' household and other needs related to their residence in residential premises, with the exception of balconies, loggias, verandas and terraces

The total area of your premises, which should be used for calculating fees, is indicated in the technical passport of your apartment, in its extract or in the certificate of ownership .

If the wrong area is used to charge for housing and communal services for your apartment, you need to send a written application to the provider of housing and communal services with a request to change the area, with supporting documents attached.

If you refuse to recalculate, you have the right to contact the prosecutor's office, the housing inspectorate, or challenge the refusal in court.

What is reflected in payments

If you look at the payment receipts that residential property owners receive monthly, you will see that all housing and utility expenses can be divided into two groups of payments:

- utility fees;

- contributions for the maintenance and repair of residential premises.

Utility bills include:

- hot and cold water;

- drainage;

- sewerage;

- electricity;

- gas;

- heating;

- garbage removal.

Utility bills are paid:

- based on the readings of meters installed in residential premises;

- based on the standards and tariffs established in the region.

Calculations for:

- heating;

- maintenance of the common property of the house.

The maintenance of the common property of the house includes:

- organization and management of the house;

- current repairs of the common property of the house;

- elevator maintenance;

- removal of solid waste;

- waste disposal.

Their payment, with the exception of the last one, is made depending on the area of the apartment owned by the owner. Solid waste removal can be calculated in two ways:

- taking into account the number of registered persons in the residential premises;

- depending on the area of the living space.

For citizens living in municipal apartments under a social tenancy agreement, the same rules apply.

Legislative norms

The rules and procedure for calculating the cost of utility services and the timing of their payment are established by such regulations as:

- Housing Code. Articles 153-154 of the Housing Code of the Russian Federation determine the deadlines for making payments and establish the obligations of the owner to make payments.

- The Civil Code establishes the procedure for concluding an agreement with the Management Company on whose balance sheet the apartment is placed in order to supply resources to ensure life in the premises and provide utilities.

- Government Decree No. 857 of 08/27/12. rules for the provision of utility services to owners and users in apartment buildings were approved. It also outlines the types of utility services, the rules for calculating and depositing funds by users and homeowners.

The Housing Code regulates payment issues:

- housing maintenance;

- rental of living space from municipal, official and state funds;

- utilities;

- contributions for major repairs.

The obligation to timely pay for utilities is assigned by law to the following subjects of housing relations:

- owners;

- employers;

- members of housing cooperatives;

- tenants.

Payment for utilities for residential areas built as part of shared construction is assigned to the developer before the purchase of the apartment by the buyer.

From what point is rent charged in a new building? The law clearly defines this date: the moment of signing the transfer and acceptance certificate by the owner. There are exceptions when the buyer is offered to sign an additional agreement obliging him to pay for housing and communal services 2-3 months before signing the acceptance certificate.

Property owners and tenants are required to make all payments by the 10th day of each month based on payment receipts.

The responsibility to inform citizens about accrued payments and the amount of debt is assigned to:

- organizations managing apartment buildings;

- settlement centers;

- resource supply organizations.

Housing and communal services tariffs and standards are regulated by local legislation, so the amounts in receipts for residents of different cities may differ even if the residential premises are completely identical.

The payment invoice contains a list of services that the user needs to pay for . Recommendations for calculating rent are approved by local authorities.

Regardless of whether the owner/tenant of the premises agrees with the amount presented for payment or not, he has the responsibility to pay the receipts on time.

Legislative regulation

In Russia, the obligation of residential property owners to pay for utilities is prescribed by law. Rent in an apartment is the amount transferred to Russians to housing and communal services enterprises for services rendered: housing maintenance, repair work and the provision of other housing and communal services.

The owner or responsible tenant is always required to pay for utilities; the availability of income does not matter. This norm is prescribed in the Housing Code. The obligation to pay for an apartment arises from the moment of re-registration of ownership rights or the conclusion of an agreement on the rental of housing.

Article 154 of the Housing Code establishes the structure of payment for an apartment. The rent for the apartment is payment for:

- rental (for housing belonging to the state or city housing stock);

- use of housing by tenants;

- housing maintenance - payment for the apartment;

- maintaining property considered public in good condition: paying fees for routine repairs and paying for utilities that were consumed during the maintenance of common property (water and electrical energy).

The owners pay a separate fee for future major repairs. Housing and communal services provided to residents are paid separately.

Article 155 of the Housing Code of the Russian Federation determines that you pay for an apartment in Russia on the basis of the payment documents provided, or, in their absence, the information posted in the system.

The amount of payment for an apartment is established by a meeting of co-owners if a partnership of co-owners or a cooperative is organized. In the absence of a decision on the choice of method of managing the house, rent rates are set by the municipality or other regional authorities.

If you decide to pay for housing and services later, you will have to pay the accrued penalty separately. When faced with financial difficulties, you should ask for a deferment or installment payment. Make a written request to the management company.

How is rent calculated and what does it consist of?

Utility payments include:

- Housing maintenance . This service applies only to apartment buildings and involves residents paying for the costs of caring for common areas in the house (basements, attics, entrances), which are connected to heating systems, lighting, require cleaning, etc. Residents of high-rise buildings are also required to pay for major repairs of the house and the labor of the people who manage this farm.

- Public utilities . This includes the supply of gas, water, heating.

- Payment of hire . This service is paid for by persons living in a municipal apartment that belongs to the state or a certain department.

Not everyone knows how rent is calculated: according to regulations or by area? So, according to the number of persons registered in the apartment, only part of the services is paid, namely:

For example, there are 4 people registered in an apartment. If you did not have time to install metering devices (meters), then for the use of gas, water, sewerage, electricity and for garbage removal, you will be charged the amount according to the tariff and the accepted standard, multiplied by 4.

Amounts for other items (heating and maintenance of apartment buildings) are calculated based on the area of the apartment and the general consumption of services. Total consumption is calculated for all residential premises in the house, and then distributed to each apartment in proportion to the share of square footage in the total area.

On what area is rent calculated? Utility payments are calculated only from the area that is in use. Balconies, loggias, terraces and verandas are not subject to payment. The area of the premises involved in calculating payments for maintenance and repairs is taken from the technical passport of the residential premises.

How is rent calculated if no one is registered in the apartment and there are no meters? The absence of registered persons in the apartment does not exempt the owner from paying utility bills. If no one is registered in the apartment and no meters are installed, then the calculation is made for 1 person.

To avoid paying for unused utilities, install meters for gas, electricity and water. But you will still have to pay for housing maintenance services and general household needs.

What to do if a person is registered but lives at a different address? In order not to pay for it, take a certificate from the place of residence of this person confirming the fact that he paid for utilities at another address.

Special cases if no one is registered or registered, but no one lives

Quite often, parents purchase real estate for their growing child. For a long time it stands empty and waits for its owner.

What can you do with payments in this situation? The answer is clear and simple. Not paying at all is unlikely to work.

Again, heating and housing maintenance must be paid in any case. As for water, gas and electricity, it is better to install meters.

There will be no resource consumption, and therefore no payment needs to be made. Thus, it will be possible to minimize costs as much as possible.

You will still have to pay bills for an apartment in which no one lives, in order to reduce the amount of payments to a minimum - it is recommended to install meters

How are utility bills calculated if no one lives in the premises? Rent is still calculated and receipts are issued to this address.

In accordance with Art. 153 LCD owner is obliged to pay payments that are provided by the utility company.

This does not relieve him of the obligation to pay for services. However, there are ways in which you can reduce your housing costs.

When a person is registered at one address, but actually lives in another premises, then bills will still arrive.

In order to pay for utilities for people actually living, you will need to take a certificate from the location. It must be about where the person lives, then the payment will be increased at the place of his actual residence.

Along with the certificate, you need to write a corresponding application to the management companies. However, this is only beneficial when meters are not installed on the territory of registration.

After writing the application, payments will arrive edited. You should know that providing a certificate once will not be enough; this must be done once every six months.

Every person who purchases real estate for the future or wants to make money by registering people in their premises should understand the principle by which utility bills increase. He should also know ways to save on utilities.

Installing special metering devices for some types of services will help save a lot of money, regardless of the number of registered people.

For more information about the procedure for charging utility bills, see the video:

See also Phone numbers for consultation Oct 20, 2021 Yulia Yuryevna 1250

Share this post

Discussion: 7 comments

- Alexey Igorevich says:

11/14/2016 at 03:48I advise everyone who has not yet installed water meters to do so as quickly as possible. The authorities have taken a course towards increasing prices for apartments without meters. For example, in the Sakhalin region, the fee for cold water in a one-room apartment where one person is registered already exceeds 400 rubles, how much in cubic meters you can calculate for yourself.

Answer

- Irina says:

12/14/2016 at 00:46

My children and I are registered in my grandmother’s apartment, but I don’t actually live there, but for the three of us, me and two children, she pays extra for water, because there is no meter, but electricity is metered.

Answer

- Anna says:

06/11/2017 at 03:47

I know from personal experience that it is pointless to sue housing and communal services and get anything from them. In any case, even if a person is registered and does not live there, you will have to pay for him. Of course, in this case, it is profitable to install meters and not worry about overpayment in the future.

Answer

- Evgeniya says:

07/14/2017 at 23:17

In our building, they began to take into account the number of people registered in the apartment when calculating the electricity spent on lighting the entrances quite recently. Previously, they only counted the total number of square meters in all apartments in the entrance and divided it into your “squares”.

Answer

- Aigul says:

08/09/2017 at 07:39

Hello, please tell me. If the social rental agreement and the decision of the housing commission indicate 3 people, but only 1 person is registered at the housing department’s passport office. For how many people should housing and communal services be accrued? The tenant submitted a request to the housing and communal services suppliers so that the accrual would be made for 3 people. How legal is this and is it necessary to register the remaining two family members in order to indicate the number of people as 3 instead of 1 in the Unified Payment Document.

Answer

- Vasya says:

02.11.2020 at 10:02

That is, if I am registered and do not live, then I have to pay, but if I am not registered and I pour tons of water, then I don’t have to pay. As a last resort, you can buy a fictitious temporary registration. A country of morons, the United States would sooner smash it into logs with tanks and shoot every Russian with a bullet.

Answer

- Julia says:

01/25/2021 at 14:09

The brother is registered with his son at the parents' apartment, but does not actually live in it, does this fact affect the payment of rent?

Answer

How to calculate your own rent?

Citizens can calculate their costs for electricity, gas and water supply independently, based on meter readings. To determine the exact consumption of these resources, it is necessary to record current instrument readings on a monthly basis.

By subtracting the previous indicator from it, it is easy to find out the volume of consumption for the month. The resulting figure must be multiplied by the established tariff. Residents who do not have meters pay for utilities according to standards multiplied by the number of persons registered in the apartment.

Standards can be set:

- Per 1 m² of total living space;

- For each person registered (permanently or temporarily) in the apartment.

The final payment amount is determined by multiplying the tariff by:

- the volume of resources used during the billing period according to the meter;

- standard for general living space (heating);

- standard and for the number of persons living in the apartment (water supply, gas supply, sewerage).

If the apartment building is equipped with a common building meter, then payment for utilities is calculated in the following way: the total volume of services consumed by all residents of the high-rise building is multiplied by the tariff and by the area of the apartment; the resulting value is divided by the total area of all premises of the apartment building.

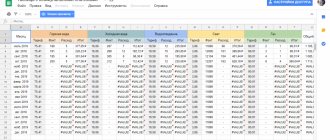

You can calculate the amount of rent using modern programs. The most current software products include:

All these programs allow you to make calculations for free. They take into account discounts, rent benefits, debts and other nuances.

The penalty is calculated based on the refinancing rate (10%), converted from a percentage value to shares, i.e. 0.10.

Many owners are interested in the date from which rent penalties are calculated . We answer: according to the norms of the Housing Code of the Russian Federation, penalties are not charged for the first month of late rent. For the 2nd and 3rd months they are calculated using the formula: amount of debt * refinancing rate / 300 * number of overdue days.

For subsequent months, instead of 300, 130 is taken. The debt count starts from the 11th day and ends on the day of its repayment.

Rules for calculating rent

The resource standard is taken to be a specific amount of consumption of utilities by one person. In such a calculation, the actual amount of electricity or water used is not taken into account - the footage of the residential property and the number of registered citizens are important.

In other words, the standards will depend on the following:

- of the total area;

- on the number of people legally residing in the apartment;

- from the presence of specialized household devices, for example, electric stoves or heating boilers.

The procedure for calculating rent is fully regulated in accordance with Decree of the Government of the Russian Federation No. 354 on the provision of public utility services for the benefit of the population.

How to check whether rent is calculated correctly?

To avoid unreasonable overpayments, carefully check the data contained in the receipt, namely:

- correspondence of information on the number of registered persons and the area of residential real estate;

- the validity of changes in tariffs for services and consumption standards;

- introduction of new payment points;

- charging for services not provided.

The correctness of the charges indicated on the receipt can be checked using the “Utility Payments Calculator for Citizens of the Russian Federation,” which is posted on the website of the Federal Tariff Service.

Let's say you identify errors in your receipt. Where to go if the rent is charged incorrectly? First of all, contact the Management Company, which is obliged on the basis of Art. 10 of the Housing Code of the Russian Federation to provide residents with unhindered access to information about payments. Information is provided based on written and electronic requests within 10 days.

If a response is not received from the Criminal Code or the applicant is not satisfied with the result of the consideration of the application, then a complaint can be filed with the Housing Inspectorate or the Prosecutor's Office.

The Housing Code also provides for the possibility of reducing payments for housing and communal services in the event of poor-quality provision of services. The consumer must record this fact in a special act, then submit an application for recalculation of payments for utility services.

Now you can independently calculate the costs of housing and communal services and, possibly, recalculate in your favor.

From what area is rent calculated?

Rent is calculated in accordance with strict rules and established tariffs. The right to regulate this issue belongs to the executive authorities whose competence includes this type of activity. Tariffs are recalculated periodically, most often in the direction of increasing the payment amount.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Saint Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Questions related to the system for calculating utility bills and their amounts arise periodically for every homeowner in an apartment building. Everyone wants the quality of the services received to be as high as possible, and their cost to be at a minimum level. While some citizens pay without understanding the amounts and the accrual system, others painstakingly try to understand the contents of the bills.

Regardless of whether the owner of the premises agrees with the amount demanded by the management company or not, the obligation to pay receipts on time still lies with him. This requirement applies to both owners and tenants.

The receipt contains a complete list of services to be paid. General recommendations for calculating rent are approved by local authorities. That is why the amounts in receipts for residents of different cities can differ greatly even if the premises are completely identical.

Application form for benefits on utility bills

Do they now charge for excess space when paying for utilities?

According to the norms, the amount of cash subsidy for paying utility bills for housing is determined. The rights of citizens to receive subsidies for utility bills are secured by the provisions of Article 159 of the Housing Code of the Russian Federation

.

It is provided under the condition that utility costs exceed the maximum allowable share of expenses for family needs

.

According to the standards, it should not prevail beyond 22% of the total family income, as noted in the government decree. The act was promulgated on August 29, 2005 under number 541. If the average per capita family income is below the subsistence level, then the maximum amount of utility costs is calculated taking into account the correction factor

. It allows you to significantly reduce the amount of fees that citizens pay for utilities. The following are exempt from 100% payment of utilities and housing maintenance fees:

- single pensioners or disabled people, even if the housing they own or received under a social rental agreement is much higher than the standards;

- minor orphans, for an apartment they own;

- tenants of state apartments on the ground floor (in Moscow);

- families consisting exclusively of pensioners;

- pensioners who care for children under 16 years of age;

- single residents of communal apartments, regardless of age;

- residents of apartments recognized as unsafe;

- owners temporarily deregistered (conscripted into the army, sent on a long business trip, serving a sentence, etc.).

These restrictions apply only to those services whose cost depends on the area of the apartment.

There are the following arguments to support this position. Such concepts as “social norm” are typical exclusively for legal relations regarding social housing rental

.

Such agreements are usually concluded with low-income categories of citizens and housing is allocated from communal property

.

The application of restrictions in the form of social norms for private law relations is contrary to the spirit of the Constitution. In accordance with the latter, the main task of the Russian Federation is to ensure the free development and decent life of its citizens

. In this vein, any restrictions on private property by surplus are not appropriate.

Especially if you take into account the real state of things, for example, in Moscow today you can no longer find one-room apartments of 30 square meters, as provided for by the social norm.

Rent is calculated in accordance with strict rules and established tariffs. The right to regulate this issue belongs to the executive authorities whose competence includes this type of activity.

. Tariffs are recalculated periodically, most often in the direction of increasing the payment amount.

In some regions of the Russian Federation, the local budget determines the amount of additional payments, due to which the size of the utility burden for citizens is reduced. A system of such subsidies is also practiced in the capital.

Questions related to the system for calculating utility bills and their amounts arise periodically for every homeowner in an apartment building. Everyone wants the quality of the services received to be as high as possible, and their cost to be at a minimum level. While some citizens pay without understanding the amounts and the accrual system, others painstakingly try to understand the contents of the bills.

Regardless of whether the owner of the premises agrees with the amount demanded by the management company or not, the obligation to pay receipts on time still lies with him. This requirement applies to both owners and tenants.

The receipt contains a complete list of services to be paid. General recommendations for calculating rent are approved by local authorities

. That is why the amounts in receipts for residents of different cities can differ greatly even if the premises are completely identical.

Application form for benefits on utility bills

Required papers

You can receive a subsidy for utility bills by taking certain actions. First of all, you need to submit an application. The social security authority must accept and process such paper.

The application should indicate:

- passport data;

- personal information;

- contacts;

- home address;

- information about registered residents, as well as about citizens who temporarily reside in the apartment;

- bank account number.

The application is not the only paper on the basis of which the subsidy is calculated.

As a rule, it must be accompanied by:

- passports of the applicant and each member of his family;

- a document that will confirm the relationship of persons living in the same apartment (marriage certificate, birth certificate);

- acts confirming the ownership of housing (sale and purchase agreements, donations, certificate of ownership);

- a certificate of income of each able-bodied family member for the last six months;

- a certificate from the housing office confirming that there are no debts in payment of utility bills;

- papers that can confirm the right to receive a subsidy (disability certificate, certificate of a large family and some other types of documents).

The list of required papers can be found on the website of the social protection service or on the government services portal.

When considering applications, social protection officials take an individual approach, so in some situations they may require additional documents confirming the need for a subsidy.

Sample income certificate

Main details

Standards of square meters

The generosity of local governments that provide subsidies for utility bills is not unlimited. A reduction in the payment amount is possible, but only by a certain number of square meters.

These standards are established by law and are:

| No more than 33 meters | For a person who lives alone. |

| No more than 42 meters | For a couple. |

| No more than 18 meters per person | If the family consists of three or more people. |

When calculating rent and subsidies, specialists are guided by these standards, however, local authorities have a number of powers that allow these indicators to be changed upward. So, in Moscow they traditionally add up to 7 meters per person.

Sample certificate of absence of rent arrears

What affects the amount?

Data on the amount of the monthly payment can be found by looking at the receipt for payment of utilities. In 2021, employees of the management organization put it in their mailbox every month.

This paper contains information such as:

- list of provided utilities;

- tariffs for each type of resource;

- the total amount to be paid.

The following may be included in the receipt as additional payments:

- maintenance of common areas;

- renovation of the entrance and other premises;

- performing work as part of a major overhaul;

- a service such as cleaning the local area;

- expenses for servicing various types of equipment (elevator, intercom, lighting).

In some cases, the receipt does not provide detailed calculations based on these criteria, but only indicates the total amount. Apartment owners who are interested in the rent calculation system in such a situation should contact the accounting department at their place of residence.

Sample certificate of disability

Utility tariffs

In accordance with the articles of the Housing Code of the Russian Federation, residential premises are understood as premises that are isolated and suitable for living. A prerequisite is full compliance with sanitary standards, as well as technical rules. Both are established by law.

Residential premises can be of several types:

- part of a residential building or full ownership;

- share in an apartment or ownership of the entire premises;

- room in a communal apartment.

Any registered residential premises consists of several types of territories: living space, auxiliary premises, technical undergrounds, basement floors. It is depending on the size of the area that is in use that utility bills are calculated.

Balconies, terraces, loggias and verandas are not subject to payment. Depending on whether the premises are shared or residential, rent is charged. You should pay for recently consumed resources in accordance with meter readings, but in case of their absence, you should use utility service consumption standards.

Sample certificate of a large family

Features of calculation

First of all, the calculation of utility bills directly depends on the calculation of tariffs in each specific region.

Within this framework, the following strict rules are established:

- the bill payment period is one calendar month;

- the amounts can be evenly distributed over the entire month without violating the final deadlines for accepting funds;

- the actual date of payment is determined by the housing organization or the default deadline is applied - until the 10th day of each new month following the reporting period;

- the payer can carry out a transaction using the details of the management company in cash or non-cash;

- It is allowed to transfer an advance payment for future months;

- the amounts of all payments must necessarily comply with the current tariff standards in the region;

- if the applied tariff provides for the division of payments for the service into several parts, then a calculation must be made for each of them - in this case, the received amounts must be combined, ultimately, into one and presented as a whole;

- calculations for utility services in 2021 are carried out in the vast majority of cases based on the readings of individual reading devices or common meters;

- Payments of benefits or government subsidies in favor of consumers of services do not affect the final amount of utility bills.

Things to keep in mind

Independently calculating the correctness of utility bills is a fairly simple process.

However, to do this, you must have the following set of information:

- current regional tariffs, taking into account changes as of 2021;

- the total footage of the living space, including storage compartments and areas for common use by all residents;

- readings from reading devices;

- the number of citizens living in the apartment on the basis of temporary or permanent registration;

- rules for calculating payment according to individual criteria.

As for the tariff schedule, it is regulated at the state level by executive authorities, including the Federal Tariff Service of the Russian Federation. All accrual rules are established by special regulations of the Government of the Russian Federation. Local government bodies are also directly involved in the process of making relevant decisions.

Article 157 of the current Housing Code of the Russian Federation contains information that the amount of payments directly depends on the number of services actually consumed or on current standards, if devices for reading information on resources were not installed in the premises. Practice shows that the simplest calculation option is reconciliation with meter readings.

Restructuring of rent arrears is possible if you write a statement of the established type indicating the objective reasons for this. Find out how to pay rent through State Services from this publication.

Special devices are installed for the following resource categories:

- water supply and sanitation;

- supply of electricity;

- gasification;

- heating supply.

To determine the correct payment amount, you need to have detailed information about the current tariff for the type of service. This can be found in the payment document itself. It is also important to obtain data on current and past meter readings. Then you need to multiply the tariff by the difference in data, which will result in the desired value.

It is worth noting that within this framework the number of square meters in the apartment and the number of residents cannot be taken into account. In a similar way, you can calculate expenses for ODN when a common reading device is installed for the entire house.

Payment is made at a branch of any financial organization, for example, through the Bank of Moscow and Sberbank or online via the Internet.

What area is rent usually calculated from?

Not every owner knows for what area rent is charged.

By paying the receipt, the owner pays for:

- Maintenance of the premises and its repair. This amount also usually includes the cost of house management work, as well as the price for current and major repairs.

- Provision of utilities and their actual consumption.

- Maintaining the territory that is used by all apartment owners in an apartment building. Payment for these indicators occurs strictly in proportion to the area of the premises owned. In other words, the more expensive the property, the more the owner will have to pay for maintaining the common area.

If an error occurred when calculating the monthly fee, consisting in incorrect calculation of square meters, you must write an application for recalculation, attaching a copy of the document confirming ownership as proof. If the housing and communal services refuse to make changes, you should contact the courts or the prosecutor's office.

How is rent calculated?

owners have to make the largest payments .

They consist of the following payments:

- Contribution for major repairs;

- ICD fee;

- Payment of utility bills.

Payments for tenants and residential apartment owners differ .

For the owner , the law establishes that the amount charged for living space depends on the square footage of the premises and the number of persons registered in it .

The total volume of payments includes payment for the common resources of an apartment building.

Persons who have entered into a rental agreement are exempt from paying for major repairs , but they must pay funds for the provision of housing for their use .

Other fees, consisting of rent and utility bills , are paid in the same way as for the owners of residential premises.

Related Terms

Impact of surplus

Everyone should know about the rent for incorrectly recorded space. It is possible to determine whether there is a surplus of meters, which are included in the calculation of the subsidy for utility bills, only by taking into account all citizens who are registered in the premises.

Citizens who are visiting or living on the basis of a document of registration at the place of stay do not affect the indicator. The age of the people living in the apartment is also not important.

The subsidy will be calculated taking into account the social norm, according to which each resident cannot have more square meters than is established by law. The difference between the area for which the subsidy is calculated and the actual area is paid in full.

How does the calculation work?

If the actual area of the residential premises is larger than the subsidized one, the difference is paid according to the tariffs established at the legislative level.

It is important to know that the following are exempt from payment at actual cost:

- children who are orphans;

- pensioners living alone, as well as disabled people;

- living under social tenancy agreements in apartments on the ground floor (in Moscow);

- single citizens living in communal premises;

- children of disabled people and pensioners who are dependent on them;

- residents of emergency buildings;

- large families living in low-rise buildings.

Depending on which category the beneficiary belongs to, the subsidy is issued either for the entire living space or for certain social norms. A complete exemption from utility bills is also possible. In this case, the state provides benefits in the entire amount indicated on the receipts.

Standards for the provision and surplus of living space in Moscow

In Moscow, you will have to pay for excess housing. This rule is regulated by the Decree of the Moscow City Government, which was registered under number 1038 in November 2010.

Moreover, this rule does not apply to those who already pay housing and communal services based on their actual cost.

The Moscow government has decided to expand the list of those who may not pay for the surplus. Thus, housing and communal services are not paid in excess of the norm:

- single pensioners and families of pensioners;

- orphans who have full ownership of housing;

- tenants of residential premises from the municipality under a social tenancy agreement;

- citizens living in a communal apartment;

- persons who own an apartment located in a dilapidated building or one not intended for permanent residence, for example, when they are in mobile housing;

- large families who live in low-rise buildings in Moscow.

The standard for one person in Moscow is 33 m2. For a family of two people, the standard increases to 40 m2, and for three – 75 m2.

Important!

Housing and utility services for space in excess of the norm are paid at 2.5 times higher rates.