Land tax - latest changes for 2021

- If the amount of tax after recalculation turns out to be more than what was paid in previous periods, then the amount of payment will be left the same (Article 52 of the Tax Code of the Russian Federation).

- The tax increase is now limited to 10% per year compared to the previous one. In addition to the lands on which the unfinished construction is located (clause 17 of Article 396 of the Tax Code of the Russian Federation).

- The list of beneficiaries who are entitled to a deduction of 6 acres per plot of land has increased, namely large families with three or more children under 18 years of age.

- In cases of changes in the VRI, land category, as well as area, the new cadastral value is now taken into account from the moment the information is entered into the Unified State Register of Real Estate (Article 391 of the Tax Code of the Russian Federation).

- Now it will be easier to get benefits. To do this, you do not need to submit documents confirming your right to benefits, but simply fill out an application indicating the details of the title document.

- When calculating the tax, new cadastral land valuation data will be applied (not in all regions).

Who needs to pay land tax

Payment of land tax is regulated by Article 388 of the Tax Code of the Russian Federation. Where it is said that land tax is paid by all persons who own the land as property:

- use without expiration date;

- lifelong inheritable ownership.

Land tax is not payable if the plot of land:

- is under the right of free use (Article 24 of the Land Code of the Russian Federation);

- transferred under a lease agreement.

Some categories of citizens are interested in the question: “Do pensioners, disabled people of group 2, minor children, labor veterans pay land tax?” Yes, but for them there are federal and local benefits that help reduce land tax to zero.

Land tax benefits in 2021

Benefits can significantly reduce tax calculations. Since the land tax is local, the list of regional beneficiaries is determined by the authorities of the territories in which the lands are located. The exact list of categories enjoying tax relief and in what amount can be clarified:

- in the territorial tax authority of the municipality where the land plot is registered;

- in the background information on property tax benefits (instructions on how to find them are located below).

Federal benefits include:

- heroes of the Soviet Union and Russia;

- people with disabilities;

- veterans of the Great Patriotic War;

- participants in the Chernobyl disaster;

- pensioners;

- individuals who have the right to social benefits and have 3 or more children.

According to paragraph 7 of Article 395 of the Tax Code of the Russian Federation, the following are exempt from land tax:

- used for the preservation and development of traditional crafts,

- economic management and way of life of the small indigenous peoples of the North, Siberia, as well as the Russian Far East.

To receive the required reduction or exemption from paying tax, you must contact the tax office with an application for a benefit. Along with the application, you will need to provide a package of documents with which you can confirm the benefit (clause 10 of Article 396 of the Tax Code of the Russian Federation).

Payment deadlines

Our service allows you to check and pay land taxes online. To check, just enter the TIN number or Document Index (UIN) in the form below.

Using the TIN of the owner of a land plot, you can only check debts; using the UIN number, you can check current accruals.

The land tax can be calculated using the formula: Land tax = KST * D * ST * KVKST - cadastral value of the land plot; D - size of the share in the right to the land plot; ST - tax rate; KV - land ownership coefficient (applies only in case of ownership land plot for less than a year).

The cadastral value of a land plot is calculated by Rosreestr (Federal Service for State Registration, Cadastre and Cartography). The tax rate is established by regulations of the representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol).

Thus, the tax rate differs in different localities (municipalities). For example, the land tax rate in Moscow is 0.025% for the so-called “dacha land”, while in the Moscow region the prevailing rate is 0.3%. In addition to the differences in the rate depending on the municipality of the site, the rate varies depending on the category of land.

- classified as agricultural lands or lands within agricultural use zones in populated areas and used for agricultural production;

- occupied by the housing stock and objects of engineering infrastructure of the housing and communal complex (except for the share in the right to a land plot attributable to an object not related to the housing stock and objects of engineering infrastructure of the housing and communal complex) or acquired (provided) for housing construction;

- purchased (provided) for personal subsidiary plots, gardening, market gardening or livestock farming, as well as summer cottage farming;

- limited in circulation in accordance with the legislation of the Russian Federation, provided to ensure defense, security and customs needs (Article 27 of the Land Code of the Russian Federation);

1.5% for other land plots. Detailed information about established tax rates and benefits can be found at any tax office or by using the following link.

In a situation where ownership of a land plot was for less than a full year, for example, when selling or buying a plot, the ownership coefficient is used to calculate the tax. The land plot ownership coefficient is the ratio of the number of full months during which this land plot was owned (permanent (perpetual) use, lifelong inheritable ownership) by the taxpayer to the number of calendar months in the tax (reporting) period - 12 months.

When purchasing a land plot, the month is considered complete if ownership arose before the 15th (inclusive) of the month of purchase. In the case of a sale, a month is considered complete if ownership is terminated after the 15th of the relevant month. In other cases, the month is considered incomplete and is not taken into account when determining the ownership ratio.

type, cadastral number, status, address, category of land, form of ownership, cadastral value, area, etc. Searching for a plot of land is possible using GPS coordinates, but this functionality does not always work correctly. All information about the land plot is available free of charge and without registration.

In 2021, the President of the Russian Federation signed Federal Law No. 436-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation.” In accordance with this law, a tax deduction is introduced that reduces land tax by the amount of the cadastral value 600 sq.

m of land area. In fact, we are talking about the so-called 6 acres. This benefit applies to all pensioners, as well as the following categories of citizens: Heroes of the Soviet Union, the Russian Federation, disabled people of groups I and II, disabled people since childhood, veterans of the Great Patriotic War and military operations, etc.

The tax for 2021, which will need to be paid in 2018, will be calculated based on this benefit. The tax deduction is provided only for the cadastral value of 6 acres. If the area of the land plot is larger, then the tax will be calculated for the remaining area.

For example, if the area of a land plot owned by a pensioner is 20 acres, then the tax will be charged only for 14 acres. Another feature of this law is that the deduction is applied only to one plot of land at the choice of the “beneficiary”, regardless of the category of land, type of permitted use and location of the land plot.

In order to independently select a land plot to which the benefit will be applied, you must contact any Federal Tax Service Inspectorate with a Notification of the selected plot. If the notification is not received from the taxpayer, the deduction will be automatically applied to one plot of land with the maximum calculated tax amount.

The general procedure and deadlines for paying land tax are defined in Art. 396–397 Tax Code of the Russian Federation.

Specific deadlines for payment of advance payments (if there is a decision to pay them) and the land tax itself are established by representative municipal bodies by adopting relevant regulations. For example, in Moscow this is the last day of the month following the reporting quarter (Clause 2, Article 3 of the Moscow Law “On Land Tax” dated November 24, 2004 No. 74).

IMPORTANT! From 01/01/2021, the deadline for payment of land tax by legal entities will become uniform: March 1 for tax and the last day of the month following the reporting period for advance payments. The new rules will apply from the annual payment for the 2021 tax year. See here for details.

Legal entity taxpayers independently calculate the amounts of advance payments and tax for 2021 based on the rates and rules adopted in the region. Municipal authorities have the right to approve tax rates for certain categories of land plots, without violating the maximum values established in Art. 394 Tax Code of the Russian Federation.

Also, local authorities may establish an obligation for taxpayer organizations to pay tax in the form of advance payments. If it is determined, then the legal entity must pay quarterly ¼ of the amount equal to the product of the rate established in the region multiplied by the cadastral value of the land.

We invite you to read: Tax penalties in 2021: calculation formula - penalty calculator

The tax at the end of the year is paid as the remaining unpaid tax amount (i.e., minus advances). It must be included in the local budget within the deadline established in the region.

ATTENTION! Starting from 2021, legal entities no longer need to calculate the amount of land tax. Tax authorities will independently calculate the amount of advance payments and tax payable and notify the taxpayer about this. See here for details. If the notification is not received, legal entities are required to independently inform the tax authorities about taxable property. Read about the nuances in the material “Organizations will have to report transport and land plots to the tax authorities.”

For an example of calculating land tax, see the material “How to calculate land tax for 2021 in 2021 (example).”

About algorithms for calculating tax when cadastral value changes, read the material “Calculation of land tax when cadastral value changes.”

Legal entities can transfer money through a bank using a payment order, or other persons can pay tax for it.

For the procedure for filling out a payment order and an example of its execution for paying land tax in Moscow, see here.

Tax rates are established by Article 394 of the Tax Code of the Russian Federation.

Municipal authorities may introduce reduced rates that do not exceed the basic ones.

A rate of 0.3% applies to land plots that are used for:

- vegetable gardening, own subsidiary farming, gardening or livestock farming;

- dacha farming;

- agricultural production;

- housing construction;

- public utility facilities.

Tax deduction for land

It is possible not to pay tax if the area of the land plot is equal to or less than 600 square meters. meters. This benefit does not apply to everyone; the tax base of the land tax can be reduced by 6 acres for everyone included in the list of categories of persons, according to clause 5 of Art. 391 Tax Code of the Russian Federation.

The benefit must be documented. Submission deadlines are regulated by regional legislation.

How is the tax base for land tax determined?

The calculation of land tax is based on the cadastral value of the plot, taken as of the beginning of the year of payment. For ordinary citizens, the tax office calculates the amount of tax. In the notification we see the name of the object, the cadastral value, the tax rate and the total amount to be paid.

You can find out the cadastral valuation on the official website of Rosreestr using the cadastral number of the plot or the exact address from the step-by-step instructions.

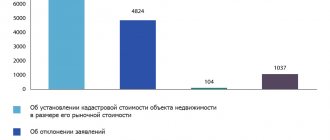

What has changed with the onset of 2021? A significant change was the establishment and increase in the cadastral value of land, approaching the market value, which affected the growth of taxes.

Learn how to reduce the cadastral value of real estate from step-by-step instructions.

How is the tax calculated for a one-, two- and three-story house?

The total amount to be paid depends entirely on the tax base. For a private house, this will be the cost of the property. It is the price of the home , which was established by the state cadastral authority, that determines the final amount of the tax. No other parameters (height, number of floors, presence of an attic, etc.) affect it.

However, the specific calculation will depend on the region in which the house is located. This is not just about a specific rate. The calculation algorithm is determined by the calculation system used in a specific constituent entity of the Russian Federation - based on the cadastral or inventory value.

By 2021, all regions of the country must switch to a cadastral tax calculation system. However, at the moment, 11 constituent entities of the Russian Federation continue to calculate property duties on the basis of inventory value.

Tax calculation based on cadastral value

It happens according to the formula:

N = (Kst - Nv) x St x Pkf , where

- N - tax.

- Nv - tax deduction.

- Cst - cadastral value.

- St - rate.

- Pkf - reduction factor (set for the transition period from the calculation system based on inventory value to cadastral value, ranges from 0.2 to 0.6 depending on the region).

Tax calculation based on inventory value

When calculating tax according to the old system, the tax base will be the inventory value of the apartment (you can find it out in the BTI, on the Federal Tax Service website, on the Rosreestr website).

We recommend: Registration of a deed of gift for a private house and land. Step-by-step algorithm for the donation procedure

Calculation formula:

H = East x St x Kfd , where

- N - tax.

- East - inventory value.

- St - rate.

- KFD - Deflator coefficient (For 2021, set at 1.518) (Order of the Ministry of Economic Development dated October 30, 2018 No. 595).

Calculation of tax using the “transitional” formula

In accordance with paragraph 8 of Article 408 of the Tax Code of the Russian Federation, during the transition to new rules, in addition to the reduction coefficient, regions may apply a special formula for real estate tax. Its essence is to pay a tax rate on the difference between the cadastral and inventory values .

The formula looks like this:

H = (Hk - Ni) x K + Ni , where

- N - tax payable.

- NK – tax calculated from the cadastral value.

- Neither – tax calculated according to the previous system (inventory value).

- K – reduction factor.

Land tax rate for individuals in 2021

The land tax rate is determined by regulations of local authorities or the laws of Moscow, St. Petersburg, Sevastopol and cannot be higher:

0,3 % For:

- gardening and vegetable gardening plots, except those used for commercial purposes;

- agricultural lands;

- plots under an apartment building, divided among all residents in shares, in proportion to the area of the apartment to the total area of the house;

- areas with utility networks, as well as for government needs.

1,5 % - for others.

How can I view the tax rate and benefits in my region when calculating real estate taxes?

Go to the official website of the Federal Tax Service and follow the instructions:

The Tax Code allows for the use of a differentiated rate depending on the category of land and its permitted use.

Land tax rates

Tax rate

cannot exceed

0.3%

of the cadastral value of the plots:

- located on agricultural lands or as part of agricultural use zones in populated areas and used for agricultural production;

- occupied by housing stock and utility infrastructure facilities and acquired for housing construction, except for plots used in business activities (the exception is valid from the tax period of 2021);

- purchased for personal farming, gardening, vegetable gardening. Starting from the 2021 tax period, the rate applies to plots of this group if they are not used in business activities;

- from the tax period of 2021 - general purpose land plots intended for citizens to carry out gardening and vegetable gardening or intended for the placement of other public property.

The tax rate for other areas should not exceed 1,5%

from the cadastral value.

How to calculate land tax: formula and examples

To calculate land tax based on cadastral value, a single formula is used (Article 396 of the Tax Code):

ZN = NB × D × NS × K, where

- NB - tax base, determined based on the cadastral value of land plots;

- D - size of the share, with shared ownership;

- NS - tax rate;

- K is the coefficient of time of ownership of the plot (in this case, the full month will be taken as the one in which the right arose before the 15th day or was terminated after the 15th day. And the month in which the right arose after the 15th day or was terminated before the 15th day is not taken into account at all).

Important! Article 52 of the Tax Code of the Russian Federation establishes that the tax is calculated to the nearest whole number, applying the rounding rule.

Example 1. Calculation of land tax for 12 months

Owned by Sokolenko Yu.V. There is a plot of land in the Leningrad region, Priozersk. Its cadastral value is 867,459 rubles.

Calculation of land tax:

The tax rate for this piece of land is 0.3.

ZN = 867,459 × 0.3% = 2602 rubles.

Example 2. Calculation of land tax for one and ten months

Citizen K. bought and registered ownership of a plot of land for gardening on March 13, 2021 in the Moscow region. Then the months of ownership will be taken from March to December, that is, 10 months. The cadastral value of the plot is 1,244,000 rubles.

Calculation of land tax:

The tax rate for the region is 0.3.

Plot ownership coefficient: K = 10 /12 = 0.8333

ZN = 1,244,000 × 0.3% × 0.8333 = 3110 rubles.

Citizen F. sold a plot of land on February 10, 2021 for 385,000 rubles. Since the alienation transaction occurred before the 15th day of the month, it will not participate in the calculation of the tax due. Therefore, only 1 month (January) can be taken into account.

Tax calculation:

Tax rate - 0.3. Plot ownership coefficient: K = 1 /12 = 0.083

ZN = 385,000 × 0.3% × 0.083 = 96 rubles.

Land tax calculator

The correctness of land tax calculations can be checked on the official website of the Federal Tax Service. Among the electronic services there is a very convenient online land tax calculator.

The result of your calculation may not always coincide with the opinion of the tax office. This situation may arise when an error is made or benefits are not taken into account. To restore justice, you must contact the Federal Tax Service with an application drawn up in two copies. Be sure to attach documents to your application that will make your position clear.

The tax authority is obliged to review the application and documents and make a decision to refuse or change the tax amount. The refusal must be reasoned and issued in writing. If you persist in your position, go to court.

Calculation examples

Example 1. Calculation of land tax for a full calendar year

Object of taxation

Petrov I.A.

owns a plot of land in the Moscow region. The cadastral value of the plot is 2,400,385 rubles

.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%.

The land tax in this case will be equal to: 7,201 rubles.

(RUB 2,400,385 x 0.3/100).

Example 2. Calculation of land tax for an incomplete calendar year

Object of taxation

In October 2021 Petrov I.A.

registered the rights to a land plot located in the Moscow region. Its cadastral value is 2,400,385 rubles.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%

.

Land tax for three months of 2021 in this case will be equal to: 1,801 rubles.

(RUB 2,400,385 x 0.3 / 100 x 0.25),

Where, 0,25

– coefficient of time of land ownership (3 months / 12 months).

Example 3. Calculation of land tax for a share of land

Object of taxation

Petrov I.A.

owns ¾ of a land plot located in the Moscow region. Its cadastral value in 2021 is 2,400,385 rubles

.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%

.

The land tax in this case will be equal to: 5,401 rubles.

(RUB 2,400,385 x ¾ x 0.3 / 100).

Example 4. Calculation of land tax taking into account benefits

Object of taxation

Combat veteran Petrov I.A.

owns a plot of land in the Moscow region. The cadastral value of the plot in 2021 is 2,400,385 rubles

.

Tax calculation

The tax rate for this land plot is provided in the amount 0,3%

.

The land tax in this case will be equal to: 7,172 rubles.

((RUB 2,400,385 – RUB 10,000) x 0.3 / 100),

where, 10,000 rub.

– a benefit that is provided to Petrov I.A. due to the fact that he is a combat veteran.